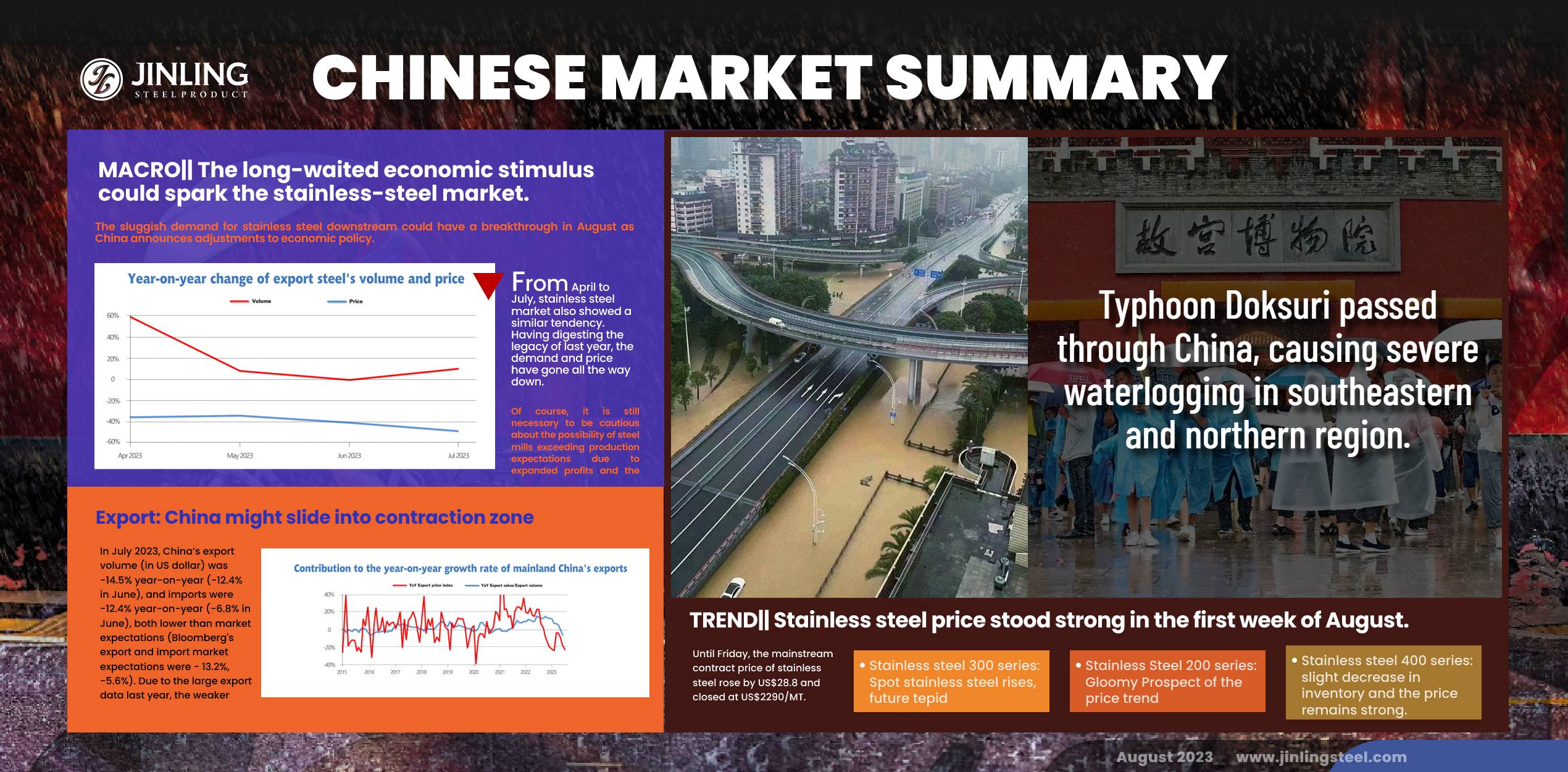

Typhoon Doksuri swept through, leaving chaos behind. The regions around Beijing suffers significant losses, and where Doksuri landed, the Southeastern coastline of China also suspended all the works and almost the whole cities. Influenced by the severe typhoon, many domestic and overseas transportation was delayed. This is one of the reasons why the inventory had a downturn tendency. The supply of stainless steel 400 series will reduce as steel mills have long borne the losses and finally, they decide to cut down the production. About 80,000-100,000 tons of output will be reduced in August. However, it can be sensed that people are getting more worried about the demand. Both China's export and import in July continue to slide down. Both prices and volume of goods had an apparent decreasing trend after April this year. Although Beijing keeps providing more stimulus for the market, and the market will have some rises, we think this year will still be tough for many people. If you want to know more about the market dynamic, just keep going on Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,335 | -23 | -1.01% |

| Foshan | 2,375 | -23 | -0.99% | ||

| Hongwang | Wuxi | 2,270 | -23 | -1.04% | |

| Foshan | 2,265 | -18 | -0.85% | ||

| 304/NO.1 | ESS | Wuxi | 2,175 | -11 | -0.55% |

| Foshan | 2,190 | -8 | -0.41% | ||

| 316L/2B | TISCO | Wuxi | 4,030 | 8 | 0.22% |

| Foshan | 4,065 | 14 | 0.36% | ||

| 316L/NO.1 | ESS | Wuxi | 3,875 | -6 | -0.15% |

| Foshan | 3,905 | 3 | 0.07% | ||

| 201J1/2B | Hongwang | Wuxi | 1,390 | -11 | -0.88% |

| Foshan | 1,385 | -8 | -0.66% | ||

| J5/2B | Hongwang | Wuxi | 1,300 | -8 | -0.71% |

| Foshan | 1,300 | -10 | -0.82% | ||

| 430/2B | TISCO | Wuxi | 1,275 | 7 | 0.61% |

| Foshan | 1,240 | 8 | 0.76% |

TREND|| Stainless steel price stood strong in the first week of August.

Supporting the positive sentiment last week, the stainless-steel market harvested a pass-grade performance. The price overall remained robust, but demand remained sluggish, and the market was being conservative about the price growth. Stainless Steel 201 played on the seesaw, but it was stable overall, stainless steel 304 had an upturn while experiencing a bumpy ride, and stainless steel 430 had a steady growth.

Until Friday, the mainstream contract price of stainless steel rose by US$28.8 and closed at US$2290/MT.

Stainless steel 300 series: Spot stainless steel rises, future tepid

The price of stainless steel 304 experienced a bumpy ride last week: the mainstream price of cold-rolled 4-foot mill-edge stainless steel 304 closed at US$2235/MT with a US$7 growth, the hot-rolled stainless steel 304 was quoted at US$2185/MT with a US$21 increase. The choppy tendency during the week eventually ended up in a weak result, but the trading volume shows a slow ascend.

Stainless Steel 200 series: Gloomy Prospect of the price trend

The spot price of the stainless steel 200 series was stabilized: the mainstream base price of cold-rolled stainless steel 201 fell US$7 to US$1360, the price of cold-rolled stainless steel 201J2 remained flat at US$1275/MT; the price of 5-foot hot-rolled stainless steel also remained unchanged at US$1310/MT.

Starting in a weak beginning, the transaction of 200 series last week was underperformance. The tropical cyclone disrupted the goods delivery and directly worsen the stock outage of the spot goods, but it stabilized the spot price to some extent. While the mainstream contract price of stainless steel 304 spiked last Wednesday, stainless steel 201 also harvested a US$7 growth. The price trend on Thursday, however, was turned upside down.

Stainless steel 400 series: slight decrease in inventory and the price remains strong.

TISCO’s guidance price of 430/2B recorded a US$28 growth to US$1410/MT, JISCO’s quote had a US$7 increase and closed at US$1520/MT.

The quoted price of 430/2B in the Wuxi market rose US$7, landing between US$1275/MT and US$1285/MT. The quoted price of 430/NO.1 remained unchanged at US$1140/MT.

INVENTORY|| Steel mills maintenance to wipe out 100,000 tons of production.

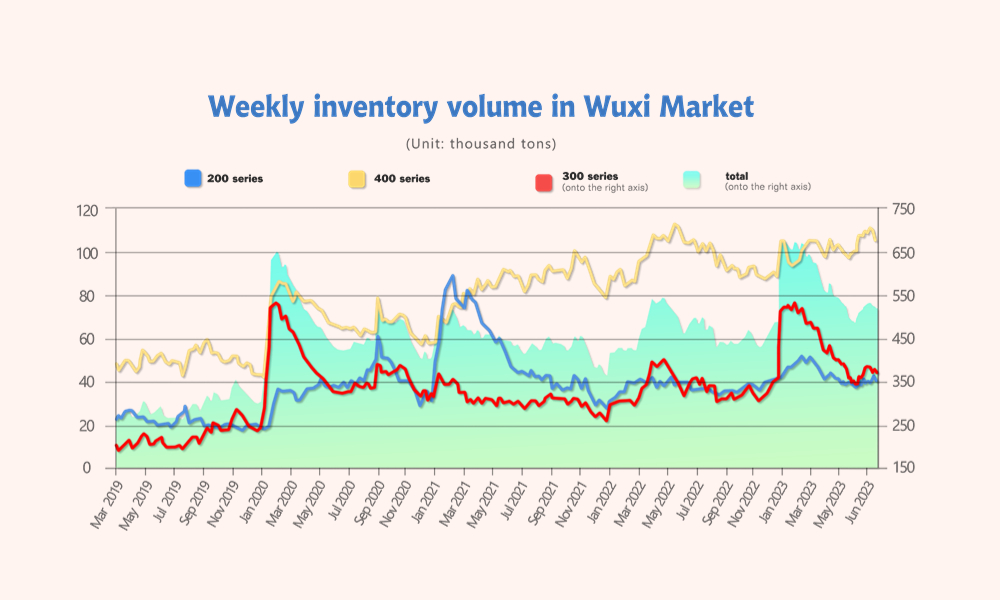

The total inventory at the Wuxi sample warehouse fell by 4308 tons to 516,116 tons (as of 3rd August).

the breakdown is as followed:

200 series: 1,959 tons down to 39,728 tons

300 Series: 1,859 tons up to 372,009 tons

400 series: 4208 tons down to 107,379 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| July 27th | 41,687 | 370,150 | 108,587 | 520,424 |

| August 3rd | 39,728 | 372,009 | 104,379 | 516,116 |

| Difference | -1,959 | 1,859 | -4,208 | -4,308 |

Stainless steel 300 series: half percent increase from the previous week.

The future price and spot price of the 300 series closed with a mixed result last week, there was no significant rebound in market transactions. While two of Delong’s major steel production projects exert their effort on stainless steel supply, the inventory will continue to face pressure from it.

Stainless steel 200 series: Inventory shortage

BaoSteel and Tsingshan continued to water supply to the market, but it failed to compensate for the shortage in inventory due to the late arrival, resulting in the low transaction volume.

Stainless steel 400 series: Destocking accelerated.

The Martensitic stainless steel becoming the least popular kind in the stainless steel market, TISCO halved their production in June, cutting over 20,000 tones of crude steel supply. TISCO is now emphasizing the production in grade 430 while they are conducting annual maintenance. The production of 400 series crude steel is projected to shrink by nearly 60,000 tons.

The supply of stainless steel grade 430 is likely to be reduced in August, and some of the specifications such as 1.2mm and 1.5mm are already ran out.

Summary:

300 Series: The current market is under supply pressure. With the recovery of production at Delong’s bases, the delivery of cold and hot-rolled products from Delong in Wuxi has essentially returned to sufficient levels. Resources from Tsingshan are also expected to arrive in Wuxi soon. Stainless steel prices are fluctuating around the cost line. However, with the support of the peak season expectation, the purchasing sentiment in the market is gradually improving, and the stainless-steel prices is expected to rise in August and September.

200 Series: Currently, steel mill supplies are shorten, and recent arrivals have been interrupted by typhoons, leading to significant shortages in the spot market. This to some extent supports the stability of spot prices. However, downstream demand remains tepid. It is expected that 201 prices will have difficulty breaking through the range in the short term. The market will monitor the advancement of national policies and the actions of steel mills. Next week's market is expected to operate with overall stability and a slightly weaker bias.

400 Series: Last week, the high grade chromium production cost of the main raw material remains high, keeping prices firm and bolstering the stainless steel market. The current steel mill production costs are relatively high, and some steel mills are operating at a loss when producing 430. In the short term, the price of 430 is expected to remain stable. In the medium to long term, due to supply constraints, the arrival of spot goods in Wuxi's market will decrease, potentially leading to stronger price support.

Raw Material|| A possible uptick in cost

The EXW price of high-grade ferronickel was quoted at US$260/Nickel point, while the price of ferrochrome rose US$14 to US$1340/MT (50% chromium).

Nickel: Promising growth in price as more raw materials are needed for production

The demand for raw materials is increasing as steel mills maintain a high level of production. The mainstream tendering price of high-grade ferronickel last week was US$265/nickel point, and it is expected to jump in the short term. The supply of ferronickel, on the other hand, was interrupted by the recent tropical cyclone for about 2 weeks.

Chrome: Chrome ore price will remain strong in August.

The import of Chrome ore in recent 5 years essentially stabilized at 15 million tons annually (about 80% from South Africa). The dispatching of chrome ore from South Africa at the moment rose slightly from June, and the total Chrome ore import in July would be between 1.5 million tons to 1.55 million tons.

Being one of the largest harbors in South Africa, Richards Bay conducted maintenance for berths last week, the Chrome import will drop slightly in August.

China's domestic ferrochrome production has remained at high levels since May, contributing to robust demand for chromite ore. Starting in July, production of ferrochrome has been restarted by the plants, which has to some extent further increased the demand for chromite ore, involving an additional production of around 20,000 tons.

As a whole, the supply-demand reached a balance by a whisker in the begging of August, but the port inventory was seemingly low and that could be the Achilles heel of the constant price growth.

MACRO|| The long-waited economic stimulus could spark the stainless-steel market.

The sluggish demand for stainless steel downstream could have a breakthrough in August as China announces adjustments to economic policy.

Looking ahead to August, some opinions suggest that stainless steel demand will continue to recover, thereby driving overall improvement in the fundamentals. This is based on the market sentiment at the end of July and estimations regarding macroeconomic policies. The price increase at the end of July reflects a market improvement, which can also be observed from macroeconomic data: In July, the domestic manufacturing PMI index continued to rise to 49.3%, an increase of 0.3 percentage points from the previous month. The new orders index also saw a significant rebound, reaching 49.5%, a rise of 0.9 percentage points from the previous month, indicating an improvement in manufacturing market demand.

Another important point is the policy shift. On July 24th, the Central Political Bureau of the Communist Party of China held a meeting and mentioned that the focus of economic work in the second half of the year has shifted from stabilizing production to expanding domestic demand. The meeting also emphasized the importance of the private sector and measures to invigorate the market economy. While the concept of "housing is for living, not for speculation" is missing regarding the real estate sector, recent news about adjustments to real estate interest rates are expected to gradually increase stainless steel consumption in industries like appliances and decoration, thereby potentially increasing stainless steel demand.

Of course, it is still necessary to be cautious about the possibility of steel mills exceeding production expectations due to expanded profits and the possibility of a temporary decline caused by a waning short-term macroeconomic enthusiasm.

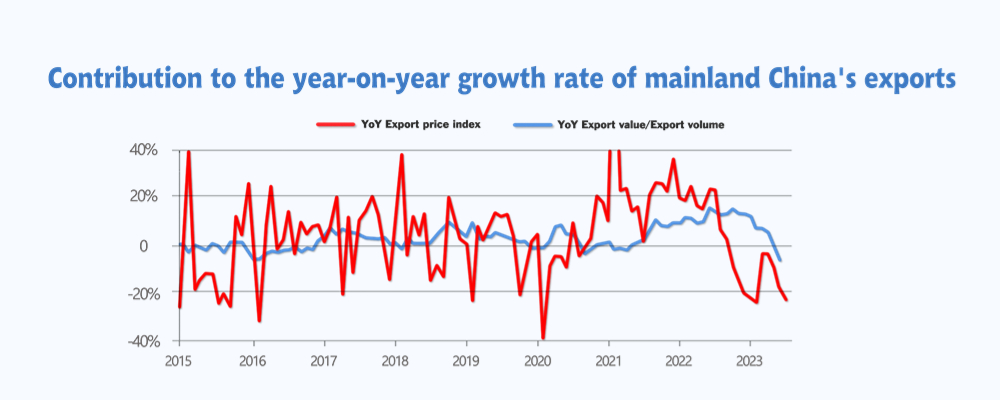

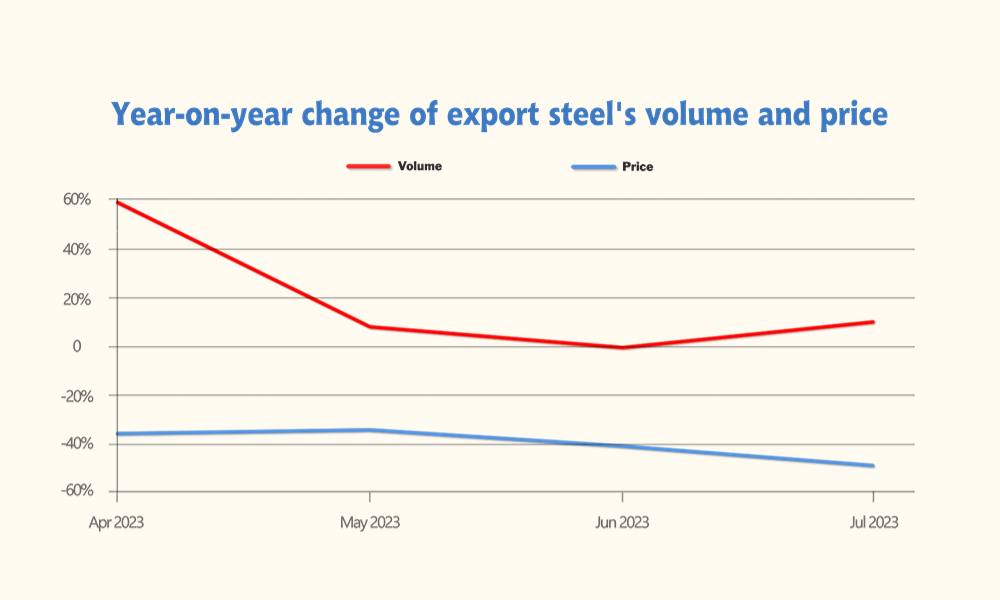

Export: China might slide into contraction zone

Based on the large volume in 2022, the export volume in 2023 comparatively cut down a lot.

In July 2023, China’s export volume (in US dollar) was -14.5% year-on-year (-12.4% in June), and imports were -12.4% year-on-year (-6.8% in June), both lower than market expectations (Bloomberg's export and import market expectations were - 13.2%, -5.6%). Due to the large export data last year, the weaker external demand, and the wider decline in export prices, the year-on-year decline in exports has expanded.

The prices of goods took less advantage in export business.

Steel price and export volume both turn down.

The decline in exports expanded again in July, and there are multiple factors behind it. First, the exports last year performed outstandingly, pushing up the comparative level. The year-on-year growth rates of exports from June to July 2022 will be 16.2% and 17.2% respectively. Second, the overall demand for overseas commodities is still declining month-on-month. In July, the manufacturing PMI of developed countries was 47.1%. Although it was slightly improved from June, it was still within the contraction zone. In particular, the manufacturing PMI in the euro zone further fell by 0.7ppt month-on-month to a historically low level of 42.7%. Third, although the year-on-year decline in PPI in July may have narrowed, the year-on-year decline in export prices may be larger.

Sea Freight|| Diversified freight rate

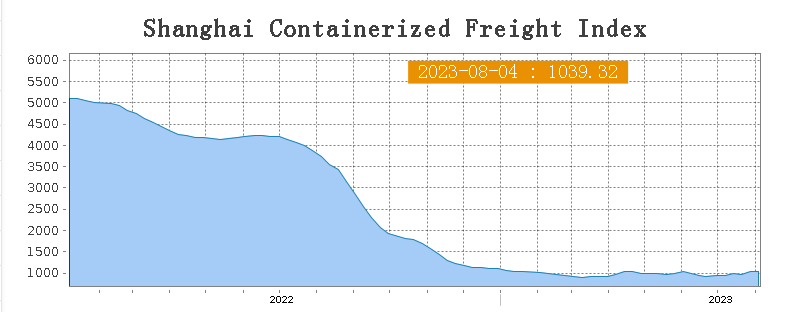

China’s Containerized Freight market was overall stabilized. On 4th August, the Shanghai Containerized Freight Index rose by 1.0% to 1039.32.

Europe/ Mediterranean:

The economic sentiment indicator in the Euro Area declined for a third consecutive month to 94.5 in July 2023, the lowest reading since last October and below market expectations of 95.0. This decline comes as the effects of an aggressive policy tightening delivered by the European Central Bank, coupled with persistently high inflation rates, started to bite.

Until 4th August, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$947/TEU, which fell by 2.9%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1529/TEU, which rose by 1.7%

North America:

Private sector employment increased by 324,000 jobs in July and annual pay was up 6.2 percent year-over-year, according to the National Employment Report produced by the ADP Research Institute.

The shipping demand remained in a high level while the supply-demand is well balanced. Until 4th August, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$2002/FEU and US$3013/FEU, reporting a 3% and 5.6% growth change accordingly.

The Persian Gulf and the Red Sea:

Until 4th August, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 3.6% from last week's posted US$809/TEU.

Australia/ New Zealand:

Until 4th August, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$340/TEU, a 6.9% growth from the previous week.

South America:

The freight market had a slight rebound. on 4th August, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2451/TEU, an 2.5% slide from the previous week.