Last week could be the major plot if the market were a novel. The stainless steel prices last week in China remained weak and downward until Friday when the prices started to rise. Stainless steel suffered consistent loss and was bearish. The continuous drop in nickel price sped up the decrease in stainless steel prices. Market sentiment was at a desperate bottom, but this has made people believe that the worst has come and they should reach out to buy at the lowest prices. The smallest increase in price could spark enormous buying enthusiasm. There was a purchasing peak last Friday, and the increase has lasted until now (the last day of November). If you want to know more about the market dynamics about the stainless steel market, please keep reading our stainless steel market summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,140 | -99 | -4.67% |

| Foshan | 2,180 | -99 | -4.58% | ||

| Hongwang | Wuxi | 2,075 | -89 | -4.36% | |

| Foshan | 2,080 | -71 | -3.48% | ||

| 304/NO.1 | ESS | Wuxi | 1,975 | -89 | -4.58% |

| Foshan | 2,005 | -78 | -3.96% | ||

| 316L/2B | TISCO | Wuxi | 3,540 | -164 | -4.59% |

| Foshan | 3,605 | -181 | -4.95% | ||

| 316L/NO.1 | ESS | Wuxi | 3,365 | -161 | -4.74% |

| Foshan | 3,405 | -178 | -5.16% | ||

| 201J1/2B | Hongwang | Wuxi | 1,370 | -13 | -1.00% |

| Foshan | 1,370 | -14 | -1.11% | ||

| J5/2B | Hongwang | Wuxi | 1,275 | -13 | -1.09% |

| Foshan | 1,285 | -14 | -1.19% | ||

| 430/2B | TISCO | Wuxi | 1,285 | -17 | -1.43% |

| Foshan | 1,270 | -8 | -0.73% |

TREND|| The collapsing spot and future prices might trigger a new round of speculation.

Stainless steel futures prices continued to weaken last week, overall trading was relatively active, and the main contracts continued to reach an all-time low. Affecting by the shift-down cost and wait-and-see attitude, the spot price fell to US$2025/MT. The main contract closed at US$2055/MT this week, a weekly decrease of 1.47%, and the lowest price during the week was US$2020/MT.

Stainless steel 300 series: Prices were shaking in the bottom.

The average market price of stainless steel 304 steepened the down slope last week: Until last Friday, the mainstream price of cold-rolled 4-foot mill-edge stainless steel 304 and cold-rolled stainless steel 304 plunged by US$70/MT to US$2015/MT and US$1955/MT respectively.

However, the downtrend eventually ended up in a promising twist: the spot price and future price had a rebound last Friday which triggered a short bullish trend in the steel market.

Stainless steel 200 series: Tsingshan lightly shook the price of grade 201

The average spot price of stainless steel maintained a bearish trend last week and US$7 was the popular value for quotations to be deducted: cold-rolled stainless steel 201J1 closed at US$1345/MT; stainless steel 201J2/J5 was quoted as US$1245/MT and hot-rolled 5-foot stainless steel was downed to US$1295/MT.

Tsingshan lowered the future price of stainless steel 201 in December to US$14/MT.

Stainless steel 400 series: Supply narrowed

TISCO and JISCO maintained their guidance price of 430/2B steady at US$1450/MT and US$1555/MT respectively.

Ningbo Baoxin remained open for negotiations of the EXW price of cold-rolled stainless steel 304, while they quoted cold-rolled stainless steel 430 for US$1630/MT.

The quotation of 430/2B in the Wuxi market was stable but slightly weak, the mainstream quote price reached at US$1305/MT, and stainless steel 430/No.1 fell by US$21/MT to US$1140/MT.

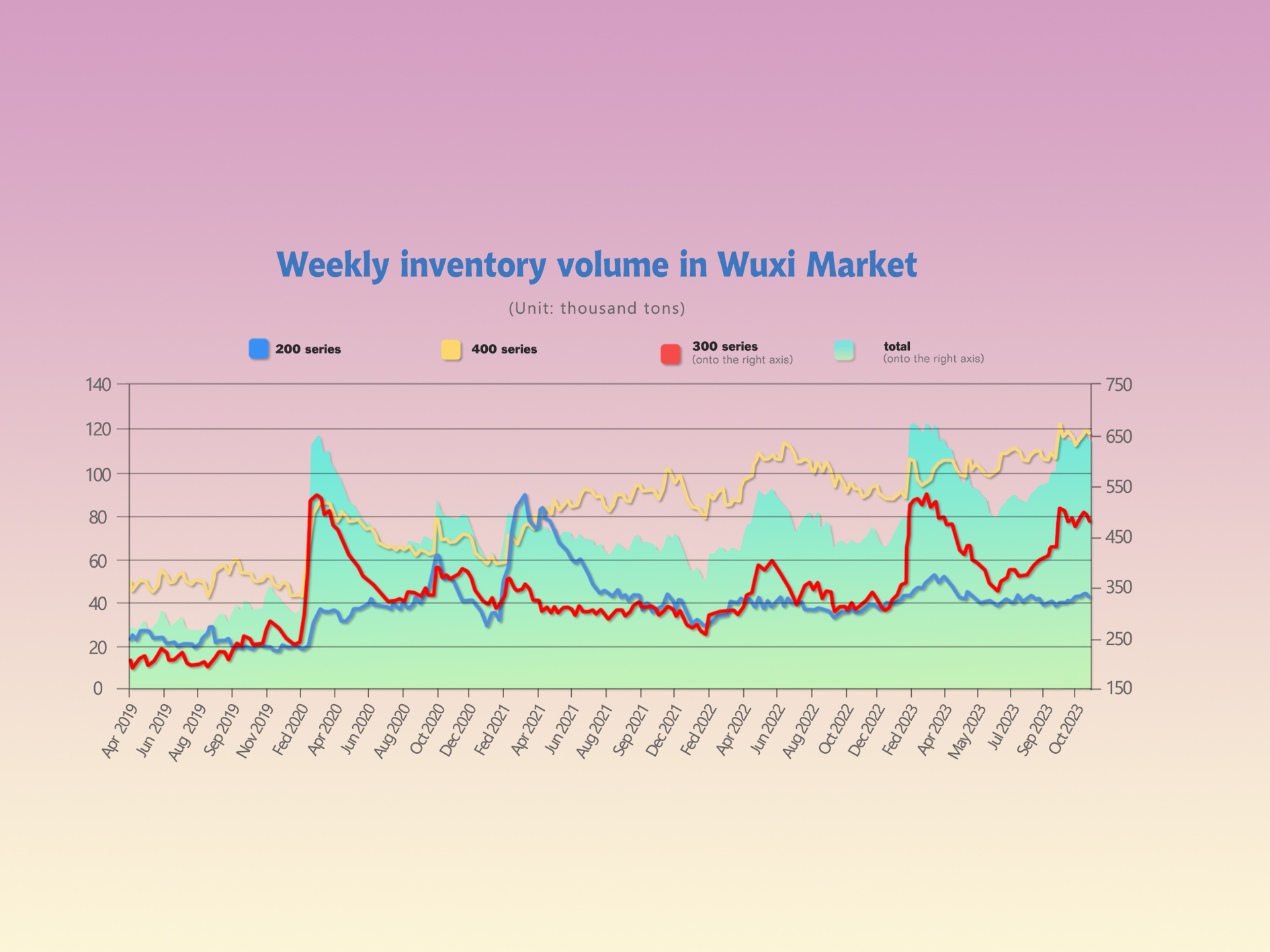

INVENTORY|| The moving average of the cost is broken.

The total inventory at the Wuxi sample warehouse downed by 14,817 tons to 634,077 tons (as of 23rd November).

the breakdown is as followed:

200 series: 1,400 tons down to 40,777 tons

300 Series: 12,091 tons down to 476,878 tons

400 series: 1,326 tons down to 116,422 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| November 16th | 42,177 | 488,969 | 117,748 | 648,894 |

| October 26th | 40,777 | 476,878 | 116.422 | 634,077 |

| Difference | -1,400 | -12,091 | -1,326 | -14,817 |

Stainless steel 300 series: price slump stimulated destocking.

Seemingly the downstream is buying the underselling strategy deployed by traders recently, both cold-rolled and hot-rolled resources had a significant decrease in inventory last week. While the stainless-steel price is having trouble climbing up, the nickel price also reaching its lowest this year.

Stainless steel 200 series: Inventory went down while the price was touching the floor.

There was no notable change in resources arrival last week. Unlike the underselling method adopted by 300 series sellers, traders of 200 series are in favor of “going-rate pricing”. The increasing trading volume of stainless steel 304 activated the trades of 200 series.

Stainless steel 400 series: Seller gave up profit to destock.

The destocking last week was mainly owed to the supply reduction and the effective underselling. The inventory level of the 400 series is likely to fluctuate in the short term as the downstream is still making “Just-in-time purchases”.

RAW Material|| The price of ferronickel joined the queue for deep diving.

The ShFE Nickel closed with a dramatic fall last Thursday, it had dropped by US$1566/MT(7.99%) to US$18,285/MT.

High-nickel iron extended the downtrend from last week. Until last Friday, the mainstream market quotation fell below the thousand CNY mark, which was US$136/Ni, with a US$6/Ni drop. Under this severe situation, the EXW price of China’s domestic also went down rapidly and hit a new low.

In October, China’s domestic ferronickel imports were 906,000 tons, an increase of 6.64% MoM and 68.7% YoY. The import volume of ferronickel from Indonesia was 864,900 tons, an increase of 8.8% MoM and a YoY increase of 77.45%. Steel mills cut production from October to November, leading to an intensification of the ferronickel supply surplus. It is expected that ferronickel prices will remain weak in the short term.

The mainstream EXW quotation of high-chromium has stopped falling and become stable, which made a 0% change from last week for US$1285/Ni to US$1315/Ni. Meanwhile, the quotation of high-carbon ferrochromium remains unchanged at US$1285/Ni. For instance, the price of high-chromium will remain steady.

There was no sign of deceleration in the supply of the high-carbon ferrochrome in October: the total import of chrome ore was 1.48 million tons, which is about a 0.03% decrease MoM and 53.3% YoY. The chrome ore importation until October was summed up as 14.52 million tons with a 15.76% lift from last year. It is understood that the enthusiasm for production in steel mills has been suppressed, in the recent context of continuous weakness in the stainless-steel market. The demand for ferrochrome raw materials in the market has slightly decreased, leading to an increase in supply and a decrease in demand, resulting in continued weak support for prices.

Summary|| Demand is the key to recovering despite the temporary speculation craze.

Until November 23, as the market sentiment hit rock bottom, the most traded futures contract has continuously fallen from US$2170/MT to US$2020/MT, dropping straight down by US$147/MT. The spot price of stainless steel 304 from Hongwang also followed suit, dropping from US$2055/MT to US$2210, falling by US$155/MT in a straight line, and the market trading atmosphere also dropped to freezing point.

Last week, stainless steel prices continued to decline. With prices at a low level, there was a certain bottom-fishing sentiment in the market, and the warming trend in the market on Friday stimulated the demand for replenishing stocks. As raw material prices continued to fall, steel mills were in a state of low profit. It is believed that the policies of steel mills, production plans, and the situation of inventory reduction could be crucial factors in the short term to affect the price trend of the stainless steel market.

300 Series: Nickel iron prices repeatedly hit new lows, leading to a sharp drop in the spot price of stainless steel, approaching the US$1955/MT mark. Steel mills and merchants continue to lower the delivery prices under market pressure. Hence, the low prices have triggered a bottom-fishing sentiment in the market, and after the price rebounded, the order performance was booming. It is expected that the short-term stainless steel prices will fluctuate along the cost line, and attention will be paid to the continued reduction of inventory.

200 Series: Although the market price of 201 was mainly downward last week, overall, there has been no obvious pressure on the inventory of the 200 series recently. The downstream purchasing of grade 201 has not improved significantly. The overall supply and demand situation remains balanced. The attention should be focused on the pricing trends of steel mills in the short term.

400 Series: The raw material, high-chromium market prices, are stable while there is a small amount of destocking in the 400 series. On the one hand, the supply from some steel mills has narrowed this month. On the other hand, market merchants are currently underselling goods, but considering that the spot inventory in the Wuxi market is still high, downstream were mainly making just-in-time orders. It is expected that the market price of 430 cold-rolled products will continue to decline slightly by the end of the month.

MACRO||The RMB exchange rate strengthens against the US dollar, when will stainless steel exports be restored?

The RMB exchange rate against the US dollar has continued to strengthen since November

On November 20, the onshore and offshore RMB exchange rates against the U.S. dollar rose strongly. Data show that the exchange rate of the onshore RMB against the U.S. dollar hit a high of 7.1700, rising more than 600 points during the day; the exchange rate of the offshore RMB against the U.S. dollar hit a high of 7.1703, rising more than 300 points during the day. Looking over a longer period of time, since November, the onshore and offshore RMB exchange rates against the US dollar have increased by approximately 1.91% and 2.20% respectively.The latest CPI and PPI data in the United States have cooled, U.S. inflation data continues to fall, the Federal Reserve announced a pause in interest rate increases, the market's expectations for the Federal Reserve's monetary policy have changed, the Federal Reserve's future interest rate cuts are more likely, U.S. bond interest rates have fallen rapidly, and the U.S. dollar index has also recently A relatively large correction will help international funds flow back into emerging markets, and the RMB exchange rate will also benefit from this.

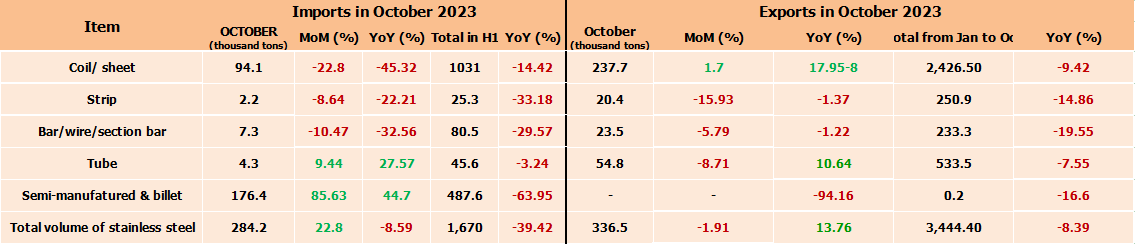

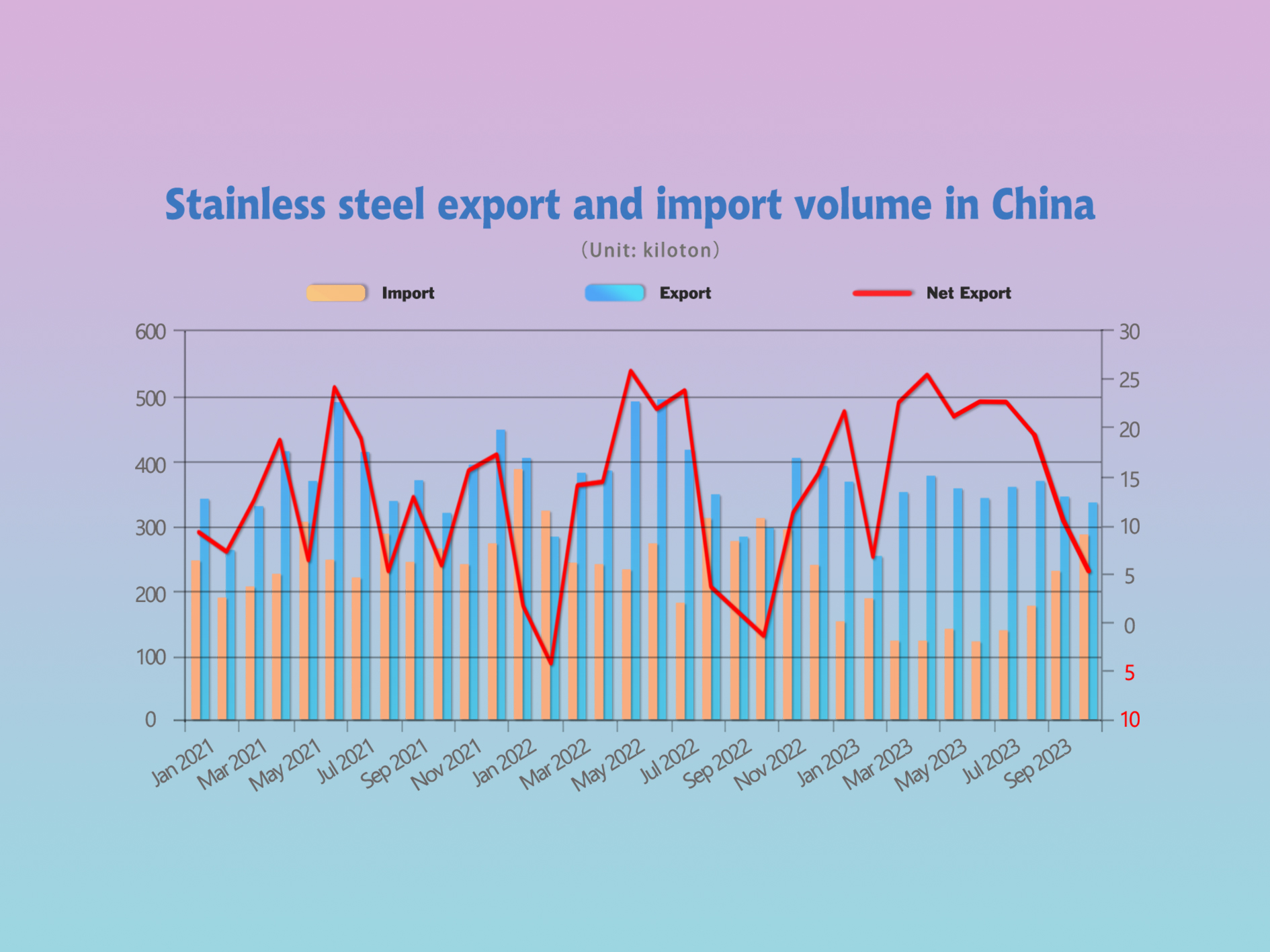

Stainless steel export volume fell 8.4% year-on-year from January to October

According to customs data, in October 2023, domestic stainless steel exports were 336,500 tons, a month-on-month decrease of 1.9%, and a year-on-year increase of 13.76%; stainless steel net exports were 52,300 tons, a month-on-month decrease of 53.09%, and a year-on-year increase of 67,500 tons. The cumulative export volume from January to October reached 3,444,400 tons, down 8.4% year-on-year.

Sea Freight|| Freight market harvest mixed result.

China’s Containerized Freight market was overall stabilized, On 24th November, the Shanghai Containerized Freight Index fell by 0.7% to 993.21.

Europe/ Mediterranean:

HCOB's PMI, compiled by S&P Global and seen as a good guide of overall economic health, ticked up to 47.1 from October's near three-year low of 46.5 but remained firmly below the 50 mark separating growth from contraction.

The demand of European freight line was stable, there was no significant change in the supply-demand. Until 24th November, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$779/TEU, which rose by 10.2%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1182/TEU, which lifted by 3.1%

North America:

The overall freight demand in the market remains stable. On the US West Coast route, most shipping companies continue to adopt a strategy of reducing prices to attract cargo. The overall loading rate on the US East Coast route is “better-looking” than the US West Coast. For some voyages, spot booking prices have fallen, resulting in a slight overall decrease in market rates.

Until 24th November, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1627/FEU and US$2316/FEU, reporting a 4.1% and 1.5% decline accordingly.

The Persian Gulf and the Red Sea:

Until 24th November, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 5.7% from last week's posted US$1198/TEU.

Australia/ New Zealand:

Until 24th November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$927/TEU, a 2.0% decrease from the previous week.

South America:

The freight market had a slight rebound. on 24th November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2700/TEU, an 4% decrease from the previous week.