Following the rising prices of ores, all major grades of stainless steel prices increased on a weekly basis last week in China. Cold-rolled stainless steel 304 last week grew by US$49/MT to US$2250/MT. However, although the growth encouraged people to settle down the ourchases, the spot inventory in Wuxi stacked up by over 16,000 tons. The inventory rose, becasue the production was large in July, such as 300 series which hit a historic high in July. According to the latest data, China's stainless steel export voulme month-on-month recovered by 5%. But from January to July, the total export volume was YoY lower by 437,800 tons. Global demand shrinks. Beijing lowers the LPR-1Y by 10bp which is less than experts predicted. Everyone is waiting for more substantial support from Beijing. If you want to know more infomation about Stainless Steel Market Summary in China, please keep reading.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,350 | 45 | 2.04% |

| Foshan | 2,390 | 42 | 1.87% | ||

| Hongwang | Wuxi | 2,280 | 40 | 1.90% | |

| Foshan | 2,290 | 47 | 2.23% | ||

| 304/NO.1 | ESS | Wuxi | 2,195 | 43 | 2.12% |

| Foshan | 2,220 | 43 | 2.10% | ||

| 316L/2B | TISCO | Wuxi | 4,095 | 58 | 1.50% |

| Foshan | 4,165 | 83 | 2.11% | ||

| 316L/NO.1 | ESS | Wuxi | 3,985 | 58 | 1.54% |

| Foshan | 3,990 | 72 | 1.91% | ||

| 201J1/2B | Hongwang | Wuxi | 1,390 | 19 | 1.55% |

| Foshan | 1,395 | 19 | 1.55% | ||

| J5/2B | Hongwang | Wuxi | 1,310 | 18 | 1.53% |

| Foshan | 1,320 | 28 | 2.36% | ||

| 430/2B | TISCO | Wuxi | 1,280 | 10 | 0.84% |

| Foshan | 1,250 | 13 | 1.11% |

TREND|| Stainless steel price flew abreast with inventory level.

The stainless-steel price harvested a flourishing rebound last week, and the price surge in raw materials facilitated the bullish trend. It is obvious that the stainless-steel market is now brewing a positive sentiment for the traditional high season (known as “Gloden September Silver October”), but the downstream buyers so far are having difficulties to response the enthusiasm. The price of stainless steel is likely to be choppy in the short term as the supply and demand are waiting to be matched.

Stainless steel 300 series: Transaction warmed up.

The overall price trend of stainless steel 304 went up but it was a bit shaky last week: the mainstream base price of cold-rolled 4-foot mill-edge stainless steel 304 and hot-rolled stainless steel 304 recorded a US$49/MT growth, quoted US$2250/MT and US$2200/MT accordingly.

While the future price was poking through US$2205/MT recently, steel mills also appreciated their quote price boldly. It is believed that most of the transactions were made between steel mills and metal traders.

Stainless steel 200 series: market trend remains stable

The spot price of stainless steel 201 remained a steady upward momentum, all mainstream prices of cold-rolled stainless steel 201 variations added US$28/MT on the previous level: cold-rolled stainless steel 201 reached $1375/MT, and 201J2 hit US$1290/MT, hot rolled stainless steel rose by US$35 and closed at US$1330/MT.

Stainless steel 400 series: Robust growth in grade 430 price.

TISCO and JISCO decided to hold the guidance price of stainless steel 430/2B at the same position as the previous week, US$1400/MT and US$1515/MT were the result last week.

The quoted price of 430/2B in the Wuxi market had a US$14 jump and closed at between US$1280/MT-US$ 1290/MT. The quoted price of 430/NO.1 has been staying at US$1130/MT.

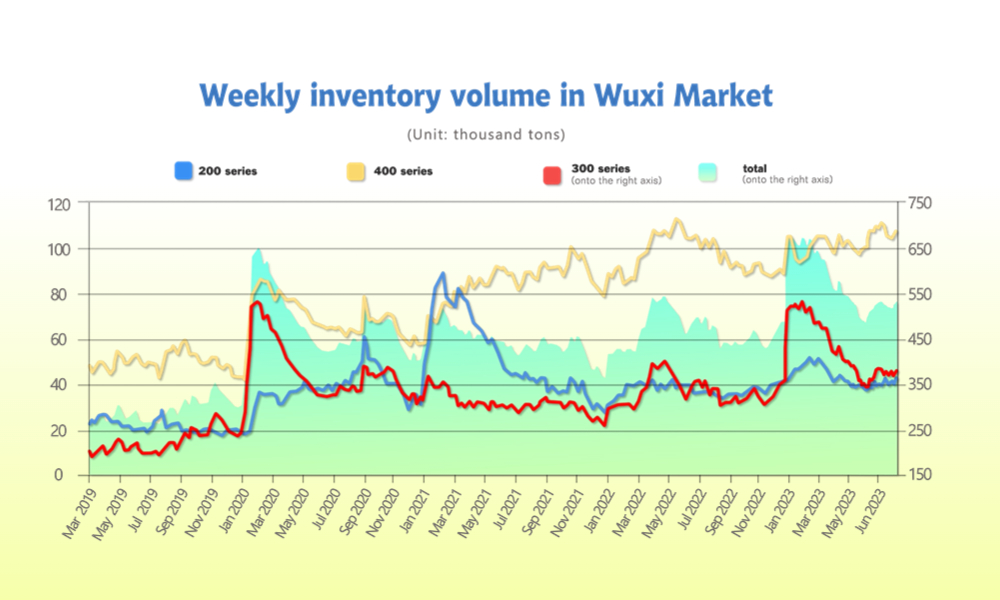

INVENTORY|| Over 15,000-ton increment in inventory.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| August 10th | 40,547 | 369,538 | 103,476 | 513,561 |

| August 17th | 41,940 | 381,121 | 106,793 | 529,854 |

| Difference | 1,393 | 11,583 | 3,317 | 16,293 |

The total inventory at the Wuxi sample warehouse rose by 16,293 tons to 529,854 tons (as of 17th August).

the breakdown is as followed:

200 series: 1,393 tons up to 41,940 tons

300 Series: 11,583 tons up to 381,121 tons

400 series: 3,317 tons up to 106,793 tons

Stainless steel 300 series: high supply to stack up the inventory.

The production of the stainless steel 300 series hit a historic high in July, and it is estimated to receive similar output in August. Tsingshan took a major part in last week’s supply and the digestibility of the inventory will be tested.

Stainless steel 200 series: Accumulation continued

The surprising price surge on Monday lifted the transaction for a bit until the “shopping spree” wore off quickly later last week. It is understandable that the spot inventory of stainless steel 200 series will be shifted from low to high by the weak demand in the short term.Stainless steel 400 series: slight increase in inventory.

The 3,300 tons increment last week recorded a 3% slide compared to the same period last month. The shrunken output affected by the maintenance had finally hit the market, but the buyers in the downstream seemingly are being cautious in purchasing, which resulted in the climbing inventory.Summary:

300 Series: Steel mills have received relatively good orders and maintained high production rates. Coupled with expectations of strong demand in the peak season, the overall market's purchasing sentiment has improved. However, after consecutive price increases, it is necessary to wait for new industry-positive factors to boost enthusiasm. Whether the purchasing enthusiasm can smoothly transmit from the midstream to the downstream still requires further observation. It is expected that in the short term, the price of privately-produced cold-rolled stainless steel will run relatively strong above US$2205. Subsequently, attention will be focused on the market's purchasing.

200 Series: The price of 201 stainless steel has generally been running strong since late July, and market trading conditions have also improved somewhat. However, in recent days, the range of increasing spot prices has narrowed, and there is a growing wait-and-see attitude downstream. The traditional peak season of "Golden September and Silver October" is approaching, and it is expected that in the latter part of September, the overall operation of 201 will be stable. The mainstream base price for 201J2/J5 cold-rolled stainless steel will fluctuate between US$1270/MT-US$1325/MT.

400 Series: The main raw material and high chromium has seen strong EXW prices last week. On the one hand, the price of chromium ore has strengthened, and on the other hand, as September steel tenders gradually approached, factories have increased their willingness to raise prices. The quotation for high-chromium stainless steel is running strong, supported by the production cost of 430 stainless steel, which has boosted market sentiment. Market feedback indicates that businesses face high costs, resulting in an increase in the quotation for 430 cold-rolled stainless steel. Some specifications are in short supply, but downstream procurement is basically on-demand, exerting strong price pressure. In the short term, the quoted price for 430 stainless steel will remain stable. In the medium to long term, due to supply contraction, inventory accumulation has not been significant and the quotation for 430 stainless steel is expected to strengthen.

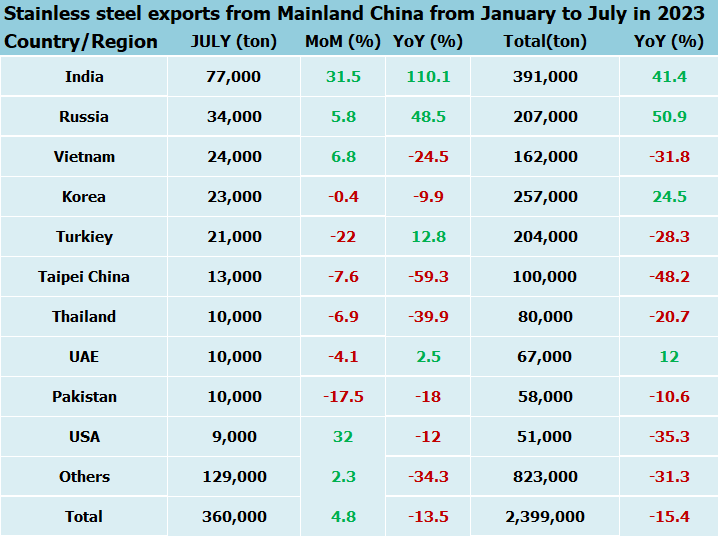

Exports|| In July, China’s stainless steel export volume increased by 5% MoM

In July 2023, China's stainless steel export volume was about 359,800 tons, an increase of 16,500 tons (4.8%), from the previous month, and a decrease of 56,200 tons (13.5%), from the same period last year. From January to July 2023, the total volume in the past 7 months is about 2.3987 million tons, YoY decreasing by 437,800 tons (15.4%).

The increase in exports is mainly reflected in coils with a width ≥ 600mm, rising by 14,000 tons from the previous month (including an increase of 6,000 tons for hot rolling and 8,000 tons for cold rolling).

Top 10 export regions

In July 2023, the export volume of the top ten regions in mainland China was about 230,000 tons, accounting for 64%; from January to July, the total volume was 1.576 million tons, accounting for about 65.7%.

The increase in China's stainless steel exports in July was mainly due to a sharp increase volume to India. 31.5% of rise month-on-month to 77,000 tons hits a new high for the year and is second only to 83,000 tons in November 2022

Raw Material|| The powerhouse of the price soar

Chrome: Supply is expected to expand

The mainstream EXW price of high-grade chrome remained a strong trend after it poked through US$1365/MT (50% chromium) last week, and there was an outliner that had reached US$1420/MT (50% chromium). There were numerous still mills preparing for the purchasing while the price of coke ore is expected to rise US$14/MT in the short term.Featuring 42000 kva of power, a newly built arc furnace is commencing production in inner Mongolia and

The import of ferrochrome and ferronickel from South Africa is expected to go up as the winter is coming to an end in the southern hemisphere. The price of high-grade chrome is expected to stabilize due to the September tendering.

Molybdenum: About US$500 leap down

The market trend of stainless steel 316L is much different from stainless steel 304, the former was already trended down last week and it recorded the first decline accompanied with the price of Molybdenum.Last Wednesday(16th August), the price of Molybdenum closed at US$39905/MT (60% Molybdenum), remained unchanged from Tuesday but recorded a US$525/MT drop from the previous week. The refine molybdenum ore went down by US$7/MT.

In the short term, the market trend of Molybdenum is likely to head down but only in a small range.

Sea Freight|| Freight Index dip down a little.

China’s Containerized Freight market was overall stabilized, but the demand recovery hit a bottleneck. On 18th August, the Shanghai Containerized Freight Index fell by 1.2% to 1031.

Europe/ Mediterranean:

The eurozone registered 0.3 percent GDP growth from March through June and 0% change from same period last year, preliminary data published Monday by Eurostat shows.

Until 18th August, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$852/TEU, which fell by 8%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1500/TEU, which fell by 0.5%

North America:

The ISM Manufacturing PMI in the United States edged higher to 46.4 in July 2023 from a nearly three-year low of 46 in June, but below market expectations of 46.8.

Until 18th August, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$2003/FEU and US$3110/FEU, reporting a 0.7% decline and 1.3% growth accordingly.

The Persian Gulf and the Red Sea:

Until 18th August, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf lifted by 6.4% from last week's posted US$908/TEU.

Australia/ New Zealand:

Until 18th August, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$453/TEU, a 4.1% jump from the previous week.

South America:

The freight market had a slight rebound. on 7th July, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2285/TEU, an 6.5% fall from the previous week.