The stainless steel prices last week slowed down the increasing pace as the previous weeks. Stainless steel 430/2B unexpectedly increased by US$23/MT in regard to the weekly average price. China's stainless steel export volume continued to reduce in May on both a month and yearly basis. The status quo is getting more severe now as China's export businesses are on a downward tendency. The government is taking more stimulations to prop up the manufacturing industry. If you want to know more about the market, please keep reading Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,360 | 6 | 0.25% |

| Foshan | 2,400 | 6 | 0.25% | ||

| Hongwang | Wuxi | 2,305 | 13 | 0.59% | |

| Foshan | 2,280 | 0 | 0% | ||

| 304/NO.1 | ESS | Wuxi | 2,195 | 6 | 0.27% |

| Foshan | 2,210 | -3 | -0.14% | ||

| 316L/2B | TISCO | Wuxi | 4,060 | -11 | -0.29% |

| Foshan | 4,070 | 0 | 0% | ||

| 316L/NO.1 | ESS | Wuxi | 3,820 | -6 | -0.15% |

| Foshan | 3,870 | 0 | 0% | ||

| 201J1/2B | Hongwang | Wuxi | 1,465 | 0 | 0% |

| Foshan | 1,445 | -7 | -0.53% | ||

| J5/2B | Hongwang | Wuxi | 1,380 | 0 | 0% |

| Foshan | 1,375 | 0 | 0% | ||

| 430/2B | TISCO | Wuxi | 1,270 | 23 | 2.01% |

| Foshan | 1,265 | 23 | 2.01% |

TREND|| Seasonal production cuts to disappoint the stainless-steel market.

The future price of stainless steel volatilized and rose slightly. The mainstream contract price hit US$2295 last week then closed at US$2275/MT on Friday, about a US$1.42/MT drop from the previous week.

The spot price of stainless steel was overall stabilized: the price curve of 201 and 304 was flatted while stainless steel 430 harvested a 2% growth.

Stainless steel 300 series: Weak supply-demand produced a mixed result.

The mainstream base price of cold-rolled 4-foot mill-edge stainless steel 304 was reported at US$2240/MT and hot-rolled stainless steel was quoted at US$2180/MT, both had gained US$7 from the previous week.

The price had a bumpy ride expectedly last week while the stock-taking is underway, and there was no dramatic move in spot-taking is underway, most of the downstream users conducted routine purchase.

Stainless steel 200 series: Market performance is still lackluster.

There was no significant movement in the price of the 200 series and the transaction stayed sluggish. As the off-season of stainless steel is drawing near, the downstream enlarge are expanding their supply to the market, but the tide turned quickly after Wednesday when transactions can be rarely seen in the market.

Until Friday, the mainstream base price of cold-rolled stainless steel 201 was reported as US$1425/MT, the cold-rolled stainless steel 201J2 closed at US$1340/MT and hot-rolled 5-foot stainless steel concluded as US$1355/MT.

Stainless steel 400 series: Inventory digestion slowed down, and the price rose slightly.

The guidance price of 430/2B quoted by TISCO rose US$7 to US$1390/MT, and JISCO added US$14 on their previous guidance price to US$1490MT.

The quoted price in the Wuxi market concluded a US$28 growth and landed between US$1265/MT-US$ 1270/MT.

Summary:

Stainless steel prices are expected to remain weak in the short term due to weak supply and demand. However, the ample supply in the future is likely to remains unchanged. The lackluster demand has led to a tendency of inventory accumulation in social warehouses, and the market's wait-and-see attitude persists. Weak transaction volume makes it difficult to support prices, and it is anticipated that stainless steel prices will continue to fluctuate weakly in the future.

300 Series: Currently, stainless steel futures and spot inventories continue to deplete. Steel mills' low profitability limits production in June, and several mills have announced plans for production maintenance and reduction, which support prices. However, with subdued demand, market investors are not optimistic about the future market. Futures prices are fluctuating around US$2240/MT, and market attention will be focused on the pace of arrivals and inventory changes.

200 Series: With the approaching traditional off-season, downstream users and traders have a lower inclination to replenish their inventories. Market sources indicate that a significant amount of steel mill resources will be arriving next month, and traders hold a pessimistic outlook on market trends. However, the production reduction by major steel mills in June and July, which is expected to affect the production volume of the 200 series by 90,000 tons, may partially offset the impact of arrivals. Nonetheless, the weak market situation is unlikely to change in the short term. It is anticipated that the spot price for 201 series will continue to be weak next week, with a range of US$1330/MT-US$1355/MT for 201J2/J5 cold-rolled prices.

400 Series: The mainstream quotation for 430/2B in the Wuxi market has risen to US$1265/MT-US$1270/MT. The market transaction for 400 series stainless steel in the Wuxi market was relatively average during the week, with a slowdown in spot inventory depletion. Combined with the weak trend in the ferrochrome market, the stainless steel market has a strong wait-and-see sentiment. It is expected that the price of 430/2B will remain relatively stable next week.

INVENTORY|| Steel mills cut output regardless of a deeper dive in inventory

The total inventory at the Wuxi sample warehouse fell by 8,461 tons to 485,833 tons (as of 15th June).

the breakdown is as followed:

200 series: 910 tons down to 38,918 tons

300 Series: 8,844 tons down to 348,509 tons

400 series: 1,293 tons up to 98,406 tons

Production cuts: 240,000 tons of production will be affected.

Stainless steel 2000 series and 300 series are very likely to shirk in June and July, it is estimated that there will be 110,000 tons and 70,000 tons lesser than expected.

Stainless steel 300 series: The sixth week of reduction

Due to the pessimistic outlook of some agents on the future market, they have actively reduced their inventory, and significant inventory depletion is evident among large traders. Meanwhile, steel mills have limited arrivals. Delong Hot-rolled has experienced seven consecutive weeks of reduced distribution, and there is limited arrival of resources from the Tsingshan Group. Currently, there is a shortage of specifications in the market for Delong and Hongwang cold-rolled products. According to statistics, the maintenance and production reduction by multiple steel mills in June and July will affect nearly 240,000 tons of production, with an impact of around 70,000 tons on the 300 series production. The market's inventory pressure is relatively limited.

Stainless steel 200 series: A decent transaction harvested a slight decrease.

The stainless steel 200 series also experienced a shortage in some of the specifications, given that the resources were either still en route or cut by the suppliers. Hence, steel mills across China announce their plan for production cut and equipment maintenance successively.

Stainless steel 400 series: Digestion slowed before the maintenance.

While JISCO and Fuxin special steel are commencing maintenance, the likelihood of a price drop of the stainless steel 400 series is minimal. The peaking production cost of the 400 series even made things worse still and the inventory consumption is likely to slow down.

Raw Material || In fear of output reduction

Nickel: volatility brewing

The EXW price of high ferronickel stays unchanged at US$260/nickel point.

ShFE Nickel kept up the growing momentum, going up by US$232/MT (or 0.95%) to US$24740/MT; the stainless steel future price faced up but had a narrower margin.

Recently, nickel import from Russia is start distributing in the Chinese market, ShFE warrants had surged up to 2000 tons, and the inventory level is estimated to climb as more productivity are boosted by new producers. It is believed that the weakly performed stainless steel transaction will add pressure to the nickel price.

China on Thursday announced a nationwide campaign to promote automobile purchases in a major push to shore up demand in the world's largest auto market. The campaign will target multiple car sales categories including both new and secondhand vehicles, it added, and push to replace gasoline cars with new energy vehicles (NEVs) such as battery-driven cars and plug-in petrol-electric hybrids. After the announcement, the order amount of ternary precursor had a sudden increase, and the price of nickel sulfate also rebounded.

Chrome: The market remains sluggish since June

The spot price of concentrated ore (40%~42%) from South Africa last week dropped slightly to around US$8.23/MT. The mainstream EXW price of the high-chrome slide is US$28/MT to around US$1330/MT-US$ 1355/MT (50% chromium).

The tendering-base purchase (July) will commence soon, and sellers in the high-chrome market are now making clearance sales “in panic”. However, the seasonal maintenance of steel mills might raise concerns about purchase volume in the industry.

Macro|| Stainless steel export declined in May

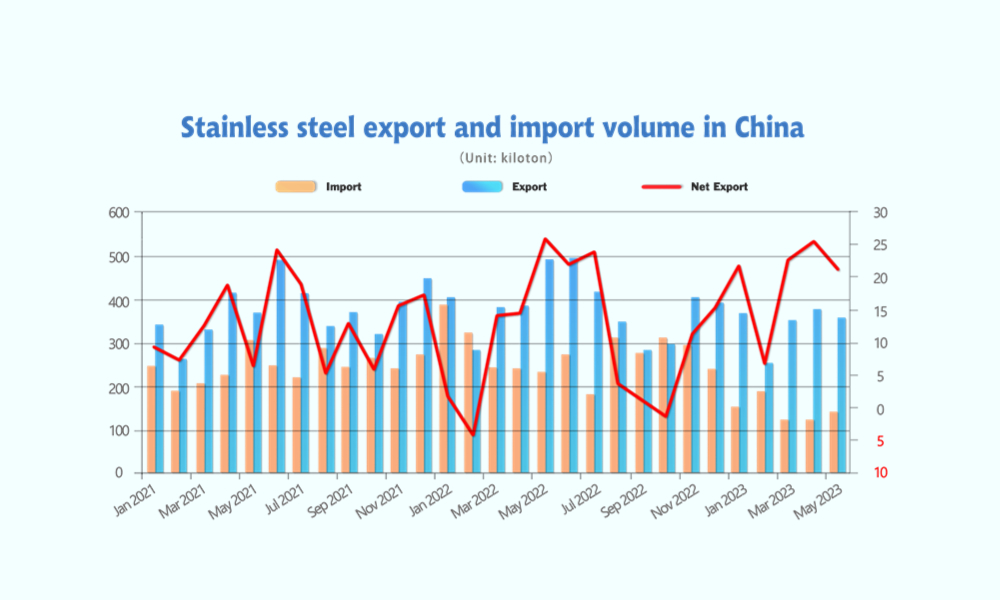

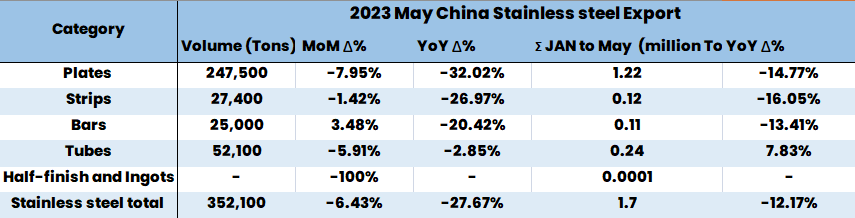

The stainless-steel export in May was reported as 352,100 tons, with a 6.43% descend from last month and a 27.67% drop year-on-year. The stainless-steel import in May gained 16.09% increment and concluded as 141,700 tons, but there is 38.35% drop year on year.

The net export was 210,400 tons, downed 17.25% from April and 18.11% less than same period last year.

The Indonesian Delong had just resume production from equipment maintenance earlier in April, but then the production was ceased, again, dramatically. It is understand that, the import volume of square bar will be shrunken indefinitely.

Sea Freight|| Sea freight market continue to slide.

Freight rates overall on multiple sea routes extended the downtrend from the previous week. On 16th June, the Shanghai Containerized Freight Index fell by 4.6% to 934.31.

Europe/ Mediterranean:

The economy in Euro is still laying low, shipping demand is in urgent needs of recovery. Until 16th June, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$808/TEU, which fell by 2.8%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1601/TEU, which fell by 1.5%

North America:

Hiking interest rate and the strike in ports has once again weakening the US shipping market. Most of the shipping businesses dropped the freight rate to make competition much more fiercer.

Until 16th June, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1,207/FEU and US$2,103/FEU, 13% and 13.6% drop accordingly.

The Persian Gulf and the Red Sea:

Until 16th June, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had a 3.3% fall from last week's posted US$1238/TEU.

Australia/ New Zealand:

Until 16th June, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$269/TEU, a 1.5% slide from the previous week.

South America:

The freight market had a slight rebound. on 16th June, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2375/TEU, an 3% growth from the previous week.