Stainless steel prices finally start to show a rebound last week! Since March, when the latest round of COVID-19 spread in China, Shanghai locked down, the domestic economy was seriously damaged, and stainless steel prices began to drop. Having experienced a long-term decrease, both Chinese and foreign buyers and sellers were pessimistic about the market. Fortunately, in September, as the peak season comes as people long expected, the stainless steel prices increased steadily. Part of the reason can own to the previous production cut by steel mills, and they still control the delivery volume carefully to avoid the price decline. But from a longer view, the macro economy is not that positive as Powell indicates that cooling down the inflation remains the priority, which implies continuous hawkish actions. Besides, geopolitics is still a threat to the global economy. The energy shortage is intensifying in Europe, pushing up the energy price directly. Undoubtedly, the whole industry will have to supper the high energy cost. Prices will go higher during the inflation time. The solution to inflation means a contractionary policy, such as raising the interest rate. More about the Stainless Steel Market Summary in China, just keep reading.

Stainless steel futures price increased robustly when steel mills and the agents work on raising the prices. Both the spot and the future price of the stainless-steel series at Wuxi were upraising last week, the contract price has US$28 up to $2430/MT.

Both Delong and Tsingshan quoted US$2420/MT to maintain the steady price level. Until 2nd August, 304 cold rolled 4-foot stainless steel also closed at US$2420/MT, a US$15 increase. While hot rolled stainless steel remains at the same level at US$2390/MT. The production cost of 304 stainless steel downed US$36 to US$2465/MT.

Until last Friday, the price of cold rolled 201 stainless sheets of steel was climbing up to US$1485/MT with a $7 increase. Cold rolled stainless steel 201J2 closed at US$1430/MT, a $15 increase. Hot rolled 5 -foot stainless steel 201 reached US$1445/MT with $29 up. The transaction of cold rolled stainless steel was calm and steady as slight upward in the spot price could not stimulate the market. Hot rolled 5-foot stainless steel, on the other hand, the price was high standing, due to the inventory shortage. During the week, the inventory level of hot rolled 5-foot stainless steel 201 had a slight drop.

The quoted price from TISCO and JISCO were landed between US$1280 - US$1285/MT, about a $30 increase compared to a week ago. High chromium mills were partially back on track from the production halt in Sichuan, but then counterparts in Inner Mongolia and Shanxi say otherwise, the production is still laying down and the scale is escalating.

The steady performance of the stainless-steel future is due to:

The production cost is not likely to reach downward after the profit margin was squeezed as narrow as it can be. Therefore, the price of the raw materials such as nickel and chromium was stabilized. Furthermore, the supply-demand was optimizing, owing to the production cut from the mills at the early stage, the pressure on inventory level was relieved.

In short term, the new equilibria on supply and demand have prompted the rebound in the price level. However, it is believed that the tendency of the price could not rapidly grow as the demand is not sustainable.

According to a survey, it indicates that the downstream inventory volume is low. Buyers have stopped waiting when the stainless steel kept decreasing previously and start to purchase and stock up. The high point in sales for the industry, known as “Golden September, Silver October”, is right at the corner when August has come to an end, and the market atmosphere will be turning optimistic.

300 series of stainless steel: The “hot sales” period to some extent could attract terminal customers to purchase in reducing the social inventory level. The base price of 304 cold-rolled stainless steel will be expected to hover between US$2405-$2450/MT.

200 series of stainless steel: Mills are adjusting their price to a higher position, the hot rolled 5-foot stainless steel was back to US$1455/MT level, and some merchants quoted the same price for J2/J5 cold rolled stainless steel. The price for 201J2/J5 cold rolled 4-foot stainless steel is likely to continue growing, it is possible to anchor between US$$1450-$1480/MT.

400 series of stainless steel: The price of 430/2B had a noticeable growth last week. The purchasing price of high chromium is descending in September compared with July’s figure. The price of 430/2B predictably landed between US$1280-$1325/MT.

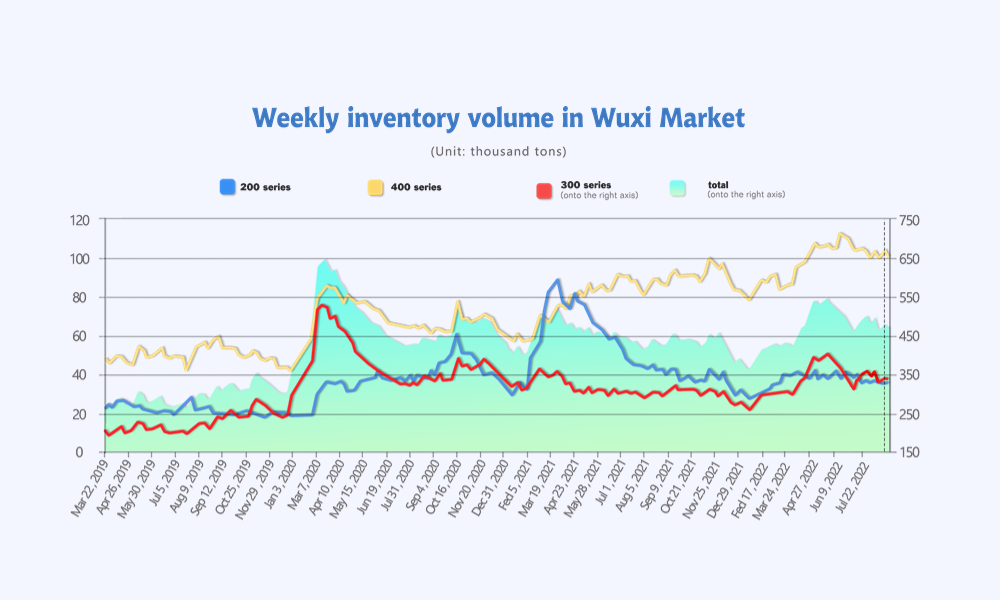

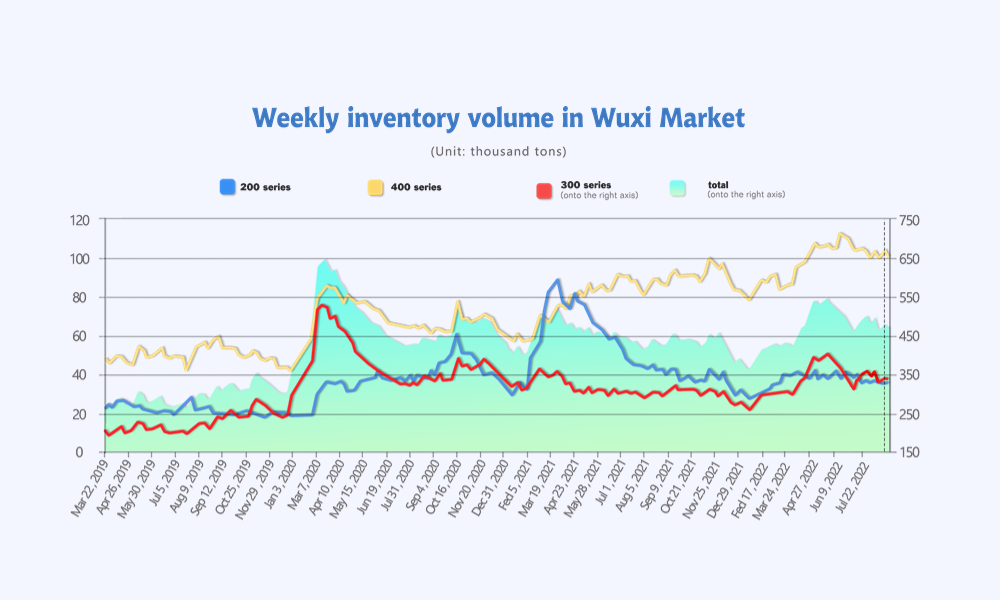

The inventory level at the Wuxi sample warehouse was downed from 7,245 tons to 469,200 tons.

Here is the breakdown:

200 series: 228 tons down to 34,700 tons

300 Series: 3,162 tons down to 335,200 tons

400 series: 3,855 tons down to 99,300 tons

The inventory level only had an insignificant difference from last week, the hot-rolled 5-foot stainless steel had a fraction down and cold-rolled stainless steel had a slight up. 200 Series inventory had created a new low record since March this year, but the shortage was not in severe condition even though the spot market was bearish looking. Driving by the increasing 304 stainless future and spot price, the spot price of 201 stainless steel were also turning green, both cold rolled and hot rolled stainless steel price closed at US$1445/MT level.

The inventory level of the preposition warehouse was volatilizing while there is an obvious reduction in social inventory. Agencies of state-owned mills made settlements at the end of the month also resulting in the decreasing inventory level. The inventory of Delong had a significant growth after recruiting agencies. The market transaction has improved a little, and the inventory shortage of the small and medium-sized traders is somewhat relieved, although the majority of the inventory is still condensing in the mills' agencies and large traders.

In summary, the price of stainless steel is likely to renounce in the coming “hot sales” period in China due to the awakened demand from the terminal customer on the market.

The production of 400 series in JISCO in September is expected to increase slightly after it was halved to 40,000 tons in August. Taishan Steel has changed its production line to plain carbon steel, TISCO is still on production halt and other mills also had low production rates due to the pressure on costs. There is no major issue to address with the supply of the 400 series.

The most-traded contract of ShFE nickel fluctuated to decrease last week and broke down below ¥160,000 (about US$23,529) because the demand and macroeconomy are weak.

The price of ferronickel decreased slightly to US$185/Ni in China. Fearing that Indonesia put a tax on nickel product exports, Chinese imports of nickel products are increasing. The lower-cost products from Indonesia are suppressing the domestic market. In addition, as the profit margin of stainless steel production gets smaller and steel mills reduce production, the supply of high-nickel iron goes above the need.

Although the supply of nickel ore is decreasing, influenced by the current weak situation for ferronickel, the nickel ore price did not change and tends to be weaker in a short term.

About the refine nickel, the decreasing price has attracted some buyers to reach out. However, it was not enough to form a solid and consistent force for the price to rebound. LME nickel inventory dropped down to 54,400 tons, but the low inventory now has less impact on propping up the nickel price. Besides, as the Fed interest rate hike is tending to rise and the US dollar index maintains strong, the prices of non-ferrous metals are more likely to fall.

Broadly speaking, the nickel market is to remain weak.

The bidding price of high chromium (September) was released and it dropped significantly. TISCO reduced the purchasing price to US$1,059/MT(with 50% of chromium content) (tax inclusive, delivered to factory) which was reduced by US$235 compared to the price of July. TSINGSHAN and Baosteel Desheng both decrease the purchasing price of high carbon ferronickel price to US$US$1,088/MT(with 50% of chromium content) (tax inclusive, delivered to factory). Compared to August, Tsingshan’s price is US$88 lower. Baosteel Desheng reduced by US$235 compared to July.

Steel mills not only reduce the price but also the trading volume. Such as TISCO, the bidding volume in September was only set for one month. Due to the low price and deficit, high chromium factories are unwilling to sell.

After a fortnight of suspension of production, on August 29th, the power supply finally returned to normal in Sichuan and high chromium producers have gotten back to work. The power-off period was longer than it was announced which was said to be ended on August 15th. It was predicted that the power-off will cut down 20,000 tons of high chromium production. When the power supply gets stable, some people think that more factories will return to producing, while other people believe that the current low price of high chromium will push the factories to remain the production seized.

The shrinking need for chromium products in Europe has made the export from South Africa increase to China. The lower-cost products further threaten China's domestic prices. Deep down to the root of the low price, is the tepid demand for stainless steel.

Powell said at the annual meeting of global central banks that the size of the U.S. interest rate hike in September depends on the overall data, and emphasized that the priority is to reduce inflation to 2%. The Fed insists on being hawkish in monetary policy. The expectation of a rate hike of 75BP in September is getting stronger, which has boosted the US dollar index to increase rapidly and once hit 109.48. The interest rate hike suppresses the non-ferrous commodity and the nickel price dropped firstly.

According to the market, the bullish commodity market that started in 2020 might have come to an end. From a longer view, the Fed maintains the interest rate high which restraints global demand. But in a short term, due to the political and financial outbreaks such as the Russia-Ukraine war and the broad-based inflation, the commodity is getting scarce and unstable, which makes it hard to decrease in price directly. The commodity prices will more likely to be fluctuating to decline when the policies start to make an effect on the market. But lately, the aggressive interest rate hikes have made the effects obvious. The prices of the commodity are fluctuating and the decline in price is speeding up.

When global liquidity is getting more confined, the influence on the economy will be increasingly greater. The Fed’s interest rate hikes will continue to put pressure on the global commodity price. Based on all signs of the economic indicators, the western economy is stuck in stagnation and the demand will be further prohibited.

The rise and fall of commodity prices are related to the changes on the supply side. Currently, the Russia-Ukraine war remains a vital variety. Europe has been stuck in a shortage of energy. According to Bloomberg, surging European power costs are hurting energy-intensive metal producers on the continent, forcing some to halt output entirely. Previously steelmakers have succeeded in offsetting them through surcharges and price increases, but that may become more difficult if the crisis causes demand to falter. The conflict will continue to affect the market sentiment and prices.Beijing continues to provide more support to the market.

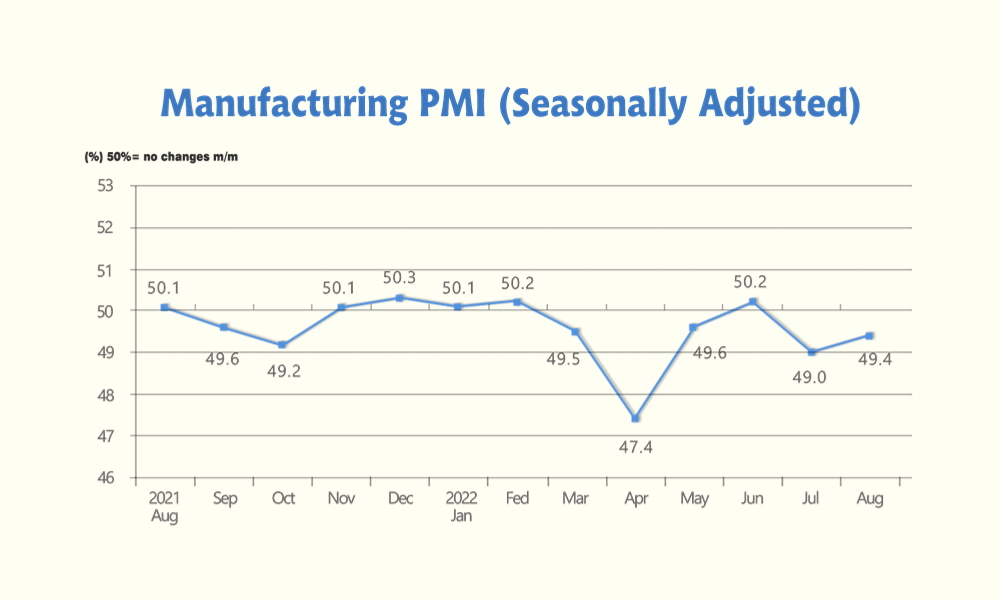

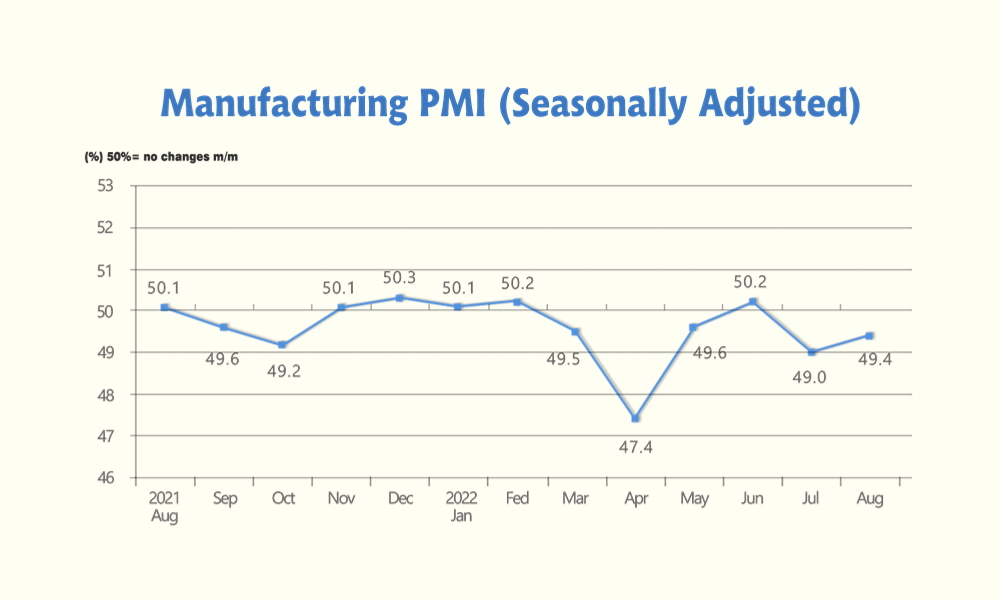

In August, the Caixin China Manufacturing Purchasing Managers Index (PMI) recorded 49.5, down 0.9 percentage points from July, and fell below the line of prosperity and decline, indicating that the manufacturing industry has returned to contraction after two months of expansion.

It is opposite to China’s official tendency which was recorded at 49.4%, 0.4% higher than that of the previous month, showing that the manufacturing industry was recovering.

The PMI in August was still in the contraction range, indicating that Chinese enterprises are facing more difficulties in running their businesses during the sluggish time. Among the surveyed enterprises, 54% reported insufficient market demand, and 48% reported high raw material costs.

On August 31, Prime minister Li Keqiang emphasized strengthening policy support in early September, focusing on expanding effective demand, and consolidating the foundation for economic recovery, including expanding policy-based development financial tools to support areas, and introducing support for manufacturing enterprises, vocational colleges, and other equipment upgrades The policy of guiding commercial banks to provide medium and long-term loans for the construction of key projects and equipment renovation, support rigid and improved housing demand, and promote large-scale consumption such as automobiles.

By providing the preferences, China’s domestic demand for the metal will increase. Hopefully, the domestic needs will activate the steel prices. Besides, as the temperature cools down a bit in China, the power supply is getting stable and most steel factories have returned to work. Although the price of deformed steel bars fell from high, stainless steel prices did not follow suit because the warehouse receipt volume of stainless steel is only over 1,000 tons.

The SCFI on September 2nd slightly decreased to2847.62, declining by 9.7% on-week basis.

Europe/ Mediterranean: CPI of August in Eurozone YoY increases by 9.1% breaking new record high. The Central Bank has to raise the interest rate to constraint the policy On September 2nd, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European base port market was US$4,252/TEU, down by 4.3% from last week. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean base port market was US$4,774/TEU, down by 5.9% from the previous week.

North America: The Employment released by ADP increased by 132,000 but it is still lower than expected. Inflation remains high and the Fed will stay hawkish in the monetary policy. On September 2nd, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East base ports were US$3,959/FEU and US$8,318/FEU, respectively, down by 22.9% and 5.5% from the previous week.

The Persian Gulf and the Red Sea: It lost the rising momentum in demand side. On September 2nd, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the basic port of the Persian Gulf was US$1,767/TEU, decreasing by 14.1% from the last week.

Australia/ New Zealand: On September 2nd, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the basic ports of Australia and New Zealand was US$2,662TEU, down by 4.8% from the previous week.

South America: Sea shipping is now in the end of the traditional peak season. On September 2nd, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American base ports was US$7,981/TEU, decreasing by 9.6% from the previous week.

In the second half of 2022, the macro-economy is getting more complex. The Russia-Ukraine war will continue to crash down the energy and food supply. The stagnation is expanding. The monetary policy in Eurozone, the US and other western countries will remain contractionary. Influenced by the downward economy, such as the tepid consumption, tight energy and food supply, and the changing trading environment, the demand for sea shipping is weakening and the sea freights are fluctuating.

In the international container transportation market, the sluggish global economy will inhibit transportation demand. To maintain the profit margin, the liner companies reduce their transportation capacity to keep the freight rate. In this way, the price won’t fall too quickly. The sea freight is decreasing, but it is still higher than that before the pandemic.

From the perspective of the international dry bulk shipping market, the Russia and Ukraine war still threatens the energy supply. Europe and India have an increasing demand for ore and crude oil. Meanwhile, as China continues to invest in infrastructure, the demand for imported iron ore will increase. Therefore, the bulk shipping demand will maintain stability and it is possible that the sea freight will rise.

WEEKLY AVERAGE PRICES

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

2,555 |

0 |

0% |

|

Foshan |

2,600 |

0 |

0% |

||

|

Hongwang |

Wuxi |

2,465 |

26 |

1.15% |

|

|

Foshan |

2,465 |

7 |

0.32% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,395 |

29 |

1.31% |

|

Foshan |

2,420 |

21 |

0.91% |

||

|

316L/2B |

TISCO |

Wuxi |

3,950 |

0 |

0% |

|

Foshan |

3,995 |

6 |

0.15% |

||

|

316L/NO.1 |

ESS |

Wuxi |

3,780 |

76 |

2.14% |

|

Foshan |

3,810 |

65 |

1.79% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,515 |

13 |

0.96% |

|

Foshan |

1,510 |

13 |

0.96% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,450 |

15 |

1.12% |

|

Foshan |

1,450 |

13 |

1.00% |

||

|

430/2B |

TISCO |

Wuxi |

1,275 |

19 |

1.68% |

|

Foshan |

1,275 |

19 |

1.68% |

TREND|| Demand is recovering as some specifications are out of stock.

Stainless steel futures price increased robustly when steel mills and the agents work on raising the prices. Both the spot and the future price of the stainless-steel series at Wuxi were upraising last week, the contract price has US$28 up to $2430/MT.

300 series of stainless steel: Inventory reduces, prices increase slightly.

Both Delong and Tsingshan quoted US$2420/MT to maintain the steady price level. Until 2nd August, 304 cold rolled 4-foot stainless steel also closed at US$2420/MT, a US$15 increase. While hot rolled stainless steel remains at the same level at US$2390/MT. The production cost of 304 stainless steel downed US$36 to US$2465/MT.

200 series of stainless steel: Market warms up and prices are stably increasing.

Until last Friday, the price of cold rolled 201 stainless sheets of steel was climbing up to US$1485/MT with a $7 increase. Cold rolled stainless steel 201J2 closed at US$1430/MT, a $15 increase. Hot rolled 5 -foot stainless steel 201 reached US$1445/MT with $29 up. The transaction of cold rolled stainless steel was calm and steady as slight upward in the spot price could not stimulate the market. Hot rolled 5-foot stainless steel, on the other hand, the price was high standing, due to the inventory shortage. During the week, the inventory level of hot rolled 5-foot stainless steel 201 had a slight drop.

400 series of stainless steel: Prices continue to rise.

The quoted price from TISCO and JISCO were landed between US$1280 - US$1285/MT, about a $30 increase compared to a week ago. High chromium mills were partially back on track from the production halt in Sichuan, but then counterparts in Inner Mongolia and Shanxi say otherwise, the production is still laying down and the scale is escalating.

Stainless steel Future:

The steady performance of the stainless-steel future is due to:

The production cost is not likely to reach downward after the profit margin was squeezed as narrow as it can be. Therefore, the price of the raw materials such as nickel and chromium was stabilized. Furthermore, the supply-demand was optimizing, owing to the production cut from the mills at the early stage, the pressure on inventory level was relieved.

In short term, the new equilibria on supply and demand have prompted the rebound in the price level. However, it is believed that the tendency of the price could not rapidly grow as the demand is not sustainable.

Stainless steel spot:

According to a survey, it indicates that the downstream inventory volume is low. Buyers have stopped waiting when the stainless steel kept decreasing previously and start to purchase and stock up. The high point in sales for the industry, known as “Golden September, Silver October”, is right at the corner when August has come to an end, and the market atmosphere will be turning optimistic.

300 series of stainless steel: The “hot sales” period to some extent could attract terminal customers to purchase in reducing the social inventory level. The base price of 304 cold-rolled stainless steel will be expected to hover between US$2405-$2450/MT.

200 series of stainless steel: Mills are adjusting their price to a higher position, the hot rolled 5-foot stainless steel was back to US$1455/MT level, and some merchants quoted the same price for J2/J5 cold rolled stainless steel. The price for 201J2/J5 cold rolled 4-foot stainless steel is likely to continue growing, it is possible to anchor between US$$1450-$1480/MT.

400 series of stainless steel: The price of 430/2B had a noticeable growth last week. The purchasing price of high chromium is descending in September compared with July’s figure. The price of 430/2B predictably landed between US$1280-$1325/MT.

INVENTORY|| Prices rise, inventory drops. Time for the peak season.

The inventory level at the Wuxi sample warehouse was downed from 7,245 tons to 469,200 tons.

Here is the breakdown:

200 series: 228 tons down to 34,700 tons

300 Series: 3,162 tons down to 335,200 tons

400 series: 3,855 tons down to 99,300 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| August 25th | 34,891 | 338,415 | 103,113 | 476,419 |

| September 1st | 34,663 | 335,253 | 99,258 | 469,174 |

| Difference | -228 | -3,162 | -3,855 | -7,245 |

200 series of stainless steel: Steel mills control the delivery volume, and thereby and the social inventory reduces.

The inventory level only had an insignificant difference from last week, the hot-rolled 5-foot stainless steel had a fraction down and cold-rolled stainless steel had a slight up. 200 Series inventory had created a new low record since March this year, but the shortage was not in severe condition even though the spot market was bearish looking. Driving by the increasing 304 stainless future and spot price, the spot price of 201 stainless steel were also turning green, both cold rolled and hot rolled stainless steel price closed at US$1445/MT level.

300 series of stainless steel: During the peak season, demand is recovering.

The inventory level of the preposition warehouse was volatilizing while there is an obvious reduction in social inventory. Agencies of state-owned mills made settlements at the end of the month also resulting in the decreasing inventory level. The inventory of Delong had a significant growth after recruiting agencies. The market transaction has improved a little, and the inventory shortage of the small and medium-sized traders is somewhat relieved, although the majority of the inventory is still condensing in the mills' agencies and large traders.

In summary, the price of stainless steel is likely to renounce in the coming “hot sales” period in China due to the awakened demand from the terminal customer on the market.

400 series of stainless steel: The inventory reduces as the production continues to reduce.

The production of 400 series in JISCO in September is expected to increase slightly after it was halved to 40,000 tons in August. Taishan Steel has changed its production line to plain carbon steel, TISCO is still on production halt and other mills also had low production rates due to the pressure on costs. There is no major issue to address with the supply of the 400 series.

Raw material|| Production cost keeps reducing.

Nickel: Price remains gloomy as demand and macroeconomy are sluggish.

The most-traded contract of ShFE nickel fluctuated to decrease last week and broke down below ¥160,000 (about US$23,529) because the demand and macroeconomy are weak.

The price of ferronickel decreased slightly to US$185/Ni in China. Fearing that Indonesia put a tax on nickel product exports, Chinese imports of nickel products are increasing. The lower-cost products from Indonesia are suppressing the domestic market. In addition, as the profit margin of stainless steel production gets smaller and steel mills reduce production, the supply of high-nickel iron goes above the need.

Although the supply of nickel ore is decreasing, influenced by the current weak situation for ferronickel, the nickel ore price did not change and tends to be weaker in a short term.

About the refine nickel, the decreasing price has attracted some buyers to reach out. However, it was not enough to form a solid and consistent force for the price to rebound. LME nickel inventory dropped down to 54,400 tons, but the low inventory now has less impact on propping up the nickel price. Besides, as the Fed interest rate hike is tending to rise and the US dollar index maintains strong, the prices of non-ferrous metals are more likely to fall.

Broadly speaking, the nickel market is to remain weak.

Chromium: High chromium drops by US$88/MT and the range of production cut increases.

The bidding price of high chromium (September) was released and it dropped significantly. TISCO reduced the purchasing price to US$1,059/MT(with 50% of chromium content) (tax inclusive, delivered to factory) which was reduced by US$235 compared to the price of July. TSINGSHAN and Baosteel Desheng both decrease the purchasing price of high carbon ferronickel price to US$US$1,088/MT(with 50% of chromium content) (tax inclusive, delivered to factory). Compared to August, Tsingshan’s price is US$88 lower. Baosteel Desheng reduced by US$235 compared to July.

Steel mills not only reduce the price but also the trading volume. Such as TISCO, the bidding volume in September was only set for one month. Due to the low price and deficit, high chromium factories are unwilling to sell.

After a fortnight of suspension of production, on August 29th, the power supply finally returned to normal in Sichuan and high chromium producers have gotten back to work. The power-off period was longer than it was announced which was said to be ended on August 15th. It was predicted that the power-off will cut down 20,000 tons of high chromium production. When the power supply gets stable, some people think that more factories will return to producing, while other people believe that the current low price of high chromium will push the factories to remain the production seized.

The shrinking need for chromium products in Europe has made the export from South Africa increase to China. The lower-cost products further threaten China's domestic prices. Deep down to the root of the low price, is the tepid demand for stainless steel.

MACRO: Western interest rate hikes accelerate the decrease of commodity prices.

Powell said at the annual meeting of global central banks that the size of the U.S. interest rate hike in September depends on the overall data, and emphasized that the priority is to reduce inflation to 2%. The Fed insists on being hawkish in monetary policy. The expectation of a rate hike of 75BP in September is getting stronger, which has boosted the US dollar index to increase rapidly and once hit 109.48. The interest rate hike suppresses the non-ferrous commodity and the nickel price dropped firstly.

Commodity prices will accelerate to drop globally.

According to the market, the bullish commodity market that started in 2020 might have come to an end. From a longer view, the Fed maintains the interest rate high which restraints global demand. But in a short term, due to the political and financial outbreaks such as the Russia-Ukraine war and the broad-based inflation, the commodity is getting scarce and unstable, which makes it hard to decrease in price directly. The commodity prices will more likely to be fluctuating to decline when the policies start to make an effect on the market. But lately, the aggressive interest rate hikes have made the effects obvious. The prices of the commodity are fluctuating and the decline in price is speeding up.

When global liquidity is getting more confined, the influence on the economy will be increasingly greater. The Fed’s interest rate hikes will continue to put pressure on the global commodity price. Based on all signs of the economic indicators, the western economy is stuck in stagnation and the demand will be further prohibited.

Geopolitics is an important factor that decides how fast the commodity price declines.

The rise and fall of commodity prices are related to the changes on the supply side. Currently, the Russia-Ukraine war remains a vital variety. Europe has been stuck in a shortage of energy. According to Bloomberg, surging European power costs are hurting energy-intensive metal producers on the continent, forcing some to halt output entirely. Previously steelmakers have succeeded in offsetting them through surcharges and price increases, but that may become more difficult if the crisis causes demand to falter. The conflict will continue to affect the market sentiment and prices.

Beijing continues to provide more support to the market.

China's PMI remains below 50% in August.

In August, the Caixin China Manufacturing Purchasing Managers Index (PMI) recorded 49.5, down 0.9 percentage points from July, and fell below the line of prosperity and decline, indicating that the manufacturing industry has returned to contraction after two months of expansion.

It is opposite to China’s official tendency which was recorded at 49.4%, 0.4% higher than that of the previous month, showing that the manufacturing industry was recovering.

The PMI in August was still in the contraction range, indicating that Chinese enterprises are facing more difficulties in running their businesses during the sluggish time. Among the surveyed enterprises, 54% reported insufficient market demand, and 48% reported high raw material costs.

China: More economic support in policy will be declared during the first half of September.

On August 31, Prime minister Li Keqiang emphasized strengthening policy support in early September, focusing on expanding effective demand, and consolidating the foundation for economic recovery, including expanding policy-based development financial tools to support areas, and introducing support for manufacturing enterprises, vocational colleges, and other equipment upgrades The policy of guiding commercial banks to provide medium and long-term loans for the construction of key projects and equipment renovation, support rigid and improved housing demand, and promote large-scale consumption such as automobiles.

By providing the preferences, China’s domestic demand for the metal will increase. Hopefully, the domestic needs will activate the steel prices. Besides, as the temperature cools down a bit in China, the power supply is getting stable and most steel factories have returned to work. Although the price of deformed steel bars fell from high, stainless steel prices did not follow suit because the warehouse receipt volume of stainless steel is only over 1,000 tons.

SEA FREIGHT OUTLOOK: The liner companies will reduce the shipping capacity to maintain the freight.

The SCFI on September 2nd slightly decreased to2847.62, declining by 9.7% on-week basis.

Europe/ Mediterranean: CPI of August in Eurozone YoY increases by 9.1% breaking new record high. The Central Bank has to raise the interest rate to constraint the policy On September 2nd, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European base port market was US$4,252/TEU, down by 4.3% from last week. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean base port market was US$4,774/TEU, down by 5.9% from the previous week.

North America: The Employment released by ADP increased by 132,000 but it is still lower than expected. Inflation remains high and the Fed will stay hawkish in the monetary policy. On September 2nd, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East base ports were US$3,959/FEU and US$8,318/FEU, respectively, down by 22.9% and 5.5% from the previous week.

The Persian Gulf and the Red Sea: It lost the rising momentum in demand side. On September 2nd, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the basic port of the Persian Gulf was US$1,767/TEU, decreasing by 14.1% from the last week.

Australia/ New Zealand: On September 2nd, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the basic ports of Australia and New Zealand was US$2,662TEU, down by 4.8% from the previous week.

South America: Sea shipping is now in the end of the traditional peak season. On September 2nd, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American base ports was US$7,981/TEU, decreasing by 9.6% from the previous week.

In the second half of 2022, the macro-economy is getting more complex. The Russia-Ukraine war will continue to crash down the energy and food supply. The stagnation is expanding. The monetary policy in Eurozone, the US and other western countries will remain contractionary. Influenced by the downward economy, such as the tepid consumption, tight energy and food supply, and the changing trading environment, the demand for sea shipping is weakening and the sea freights are fluctuating.

In the international container transportation market, the sluggish global economy will inhibit transportation demand. To maintain the profit margin, the liner companies reduce their transportation capacity to keep the freight rate. In this way, the price won’t fall too quickly. The sea freight is decreasing, but it is still higher than that before the pandemic.

From the perspective of the international dry bulk shipping market, the Russia and Ukraine war still threatens the energy supply. Europe and India have an increasing demand for ore and crude oil. Meanwhile, as China continues to invest in infrastructure, the demand for imported iron ore will increase. Therefore, the bulk shipping demand will maintain stability and it is possible that the sea freight will rise.