Two weeks ago, 6 steel mills united to resist the continuously decreasing prices of stainless steel by cutting down the production and setting the lowest prices limit. Last week, the prices of most grades of stainless steel increased slightly. Perhaps it is a good sign for the stainless steel market in the new year. Last month, China’s stainless steel export volume is 394,100 tons, 23.92% higher than last month, and increasing by 13.26% compared to November of 2020. The total export volume from January to November is 4,018,000 tons, 32.30% higher than the same period of last year. The low prices did attract more buying from abroad. Did you make a contribution to the increase of China's export? More about the Stainless Steel Market Summary in China, keep reading.

Stainless steel average prices of last week

Prices gradually increase.

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

2,920 |

29 |

1.04% |

|

Foshan |

2,970 |

29 |

1.02% |

||

|

Hongwang |

Wuxi |

2,810 |

46 |

1.75% |

|

|

Foshan |

2,780 |

25 |

0.97% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,790 |

63 |

2.45% |

|

Foshan |

2,780 |

32 |

1.22% |

||

|

316L/2B |

TISCO |

Wuxi |

4,340 |

-6 |

-0.15% |

|

Foshan |

4,375 |

-3 |

-0.08% |

||

|

316L/NO.1 |

ESS |

Wuxi |

4,195 |

5 |

0.12% |

|

Foshan |

4,245 |

3 |

0.08% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,815 |

29 |

1.72% |

|

Foshan |

1,795 |

24 |

1.45% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,705 |

40 |

2.58% |

|

Foshan |

1,705 |

22 |

1.43% |

||

|

430/2B |

TISCO |

Wuxi |

1,570 |

10 |

0.66% |

|

Foshan |

1,555 |

-3 |

-0.22% |

Trend|| Stainless steel prices increase.

Last week, the prices of stainless steel started to increase gradually on Thursday. Tsingshan’s opening price of stainless steel 304 increased and boosted the futures stock prices as well as the market trade. The market warms up, the prices of stainless steel 200 series and 300 series increased. Until last Friday, December 24th, the main contract of stainless steel futures grew by US$140/MT, to US$2,815/MT.

300 series of stainless steel: Prices increase.

Last week, the prices of stainless steel increased slightly. The downstream manufacturers start to stock up before the holiday. Besides, the inventory of stainless steel 300 series reduced quickly, stimulating the buyers to stock up. The prices of cold and hot rolled stainless steel both rose. Until last Friday, the base price of the cold-rolled stainless steel 304 of the private-owned mills in Wuxi market increased by US$48/MT, to US$2,905/MT. As for the hot-rolled stainless steel, the price rose by US$79/MT, to US$2,835. Lately, the prices of hot-rolled products are higher than the cold-rolled products because the hot-rolled resources are in shortage, and thereby the traders stay firm at the current prices. From the perspective of the futures, the stock fluctuated earlier in the week. Until Thursday, the stock prices increased as the ferrous stock prices rose. Until last Friday, the price of stainless steel futures main contract was US$140/MT higher, growing to US$2,815/MT. The price of spot products also increases slightly. The price difference between spot and futures narrowed down to US$62/MT. Last week, the Shanghai Futures Exchange's stainless steel warehouse receipts canceled 1,088 tons, leaving 1,521 tons, which is very low.

About the production cost, last week the price of raw material decreased and the theoretical production cost of cold-rolled stainless steel 304 went down toUS$2,649/MT. Meanwhile, due to the spot price increasing slightly, the metallurgy production is now profitable, which has been at a loss before.

200 series of stainless steel: Trading warms up.

The price of stainless steel 201 was maintained last week. From Monday to Wednesday, the quotation of cold-rolled stainless steel 201 J1 was US$1,780/MT, J2 and J5 quoted US$1,665/MT, and the 5-foot hot-rolled product was US$1,650/MT. However, last Thursday and Friday, Tsingshan, Hongwang continuously increased the opening prices, stimulating the market prices to increase, rising by US$15~US$30/MT.

The shortage of hot-rolled 5-foot products even boosts the prices higher. Some sellers proactively stock up from steel mills because they are lacking some specifications, which hinders their orders be settled down. The trading volume increased still, so did the actual transaction price. The price difference between cold-rolled and hot-rolled stainless steel keeps reducing. Compared to the hot-rolled market, cold-rolled stainless steel is a bit bland. The spot inventory is low but the trading was less rich.

400 series of stainless steel: Both trading volume and prices are increasing stably.

The supply of high chrome is ample, although the central environmental protection investigation team has stayed in Inner Mongolia for two weeks, which reduces the production of high chrome. It is predicted that the high chrome production in December will decrease.

Summary:

300 series of stainless steel:

Last week, the price of ferronickel decreased and then remained, making the prices of stainless steel materials remain as well. What’s more, many buyers start to stock up before the Chinese New Year Holiday, boosting the prices to keep increasing. The inventory volume of Wuxi market continues to reduce, and it is predicted that the cold-rolled stainless steel prices of the private-owned mills will fluctuate to increase.

200 series of stainless steel:

Influenced by the price limit policy and the stock prices, and the low inventory, the market prices of stainless steel will not decrease. It is predicted that the prices will remain in a short term.

400 series of stainless steel:

Last week, the transaction of the stainless steel 400 series turned better, and the inventory volume continue to decrease. Besides, steel mills reduce production, so the selling pressure will be alleviated. The new year is coming, and more people will wait for a new tendency of future prices, and thereby the transaction will be held on for a while. It is predicted that the stainless steel 430/2B of TISCO and JISCO in Wuxi market will maintain at US$1,555/MT.

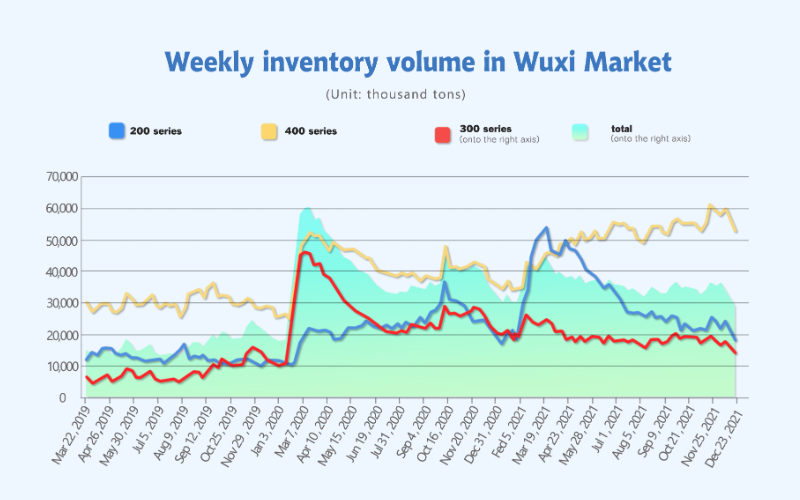

INVENTORY|| Inventory keeps reducing.

Last week, the total volume of the Wuxi sample warehouse decreases by 25,200 tons, to 389,100 tons. 200 series inventory reduces by 3,600 tons, to 30,900 tons; 300 series down by 15,100 tons, to 272,400 tons; 400 series decreases by 6,500 tons to 85,800 tons.

| Inventory in Wuxi sample warehouse (Unit: thousand tons) | 200 series | 300 series | 400 series | Total |

| December 20th ~ December 24th | 30.9 | 272.4 | 85.8 | 389.1 |

| December 13th ~ December 17th | 34.5 | 287.5 | 92.3 | 414.3 |

| Difference | -3.6 | -15.1 | -6.5 | -25.2 |

200 series of stainless steel: Less supply and stable transaction reduce the stock volume.

Last week, Baosteel Desheng and Beigang New Materials delivered a small number of materials. Though the steel mill union to stop the decrease in prices gradually fades out, the price limit is still effective. Therefore, the price of spot stainless steel 201 remains. Last week, the inventory of stainless steel 200 series will decrease slightly by 3,600 tons, to 30,900 tons. Less stainless steel materials are supplied to the market, and the current spot inventory volume of 201 has been low within the year.

300 series: Inventory has dropped significantly for two weeks.

It was the second week that the inventory of stainless steel inventory dropped significantly. Almost 30,000 tons of inventory were consumed in recent two weeks. Lately, hot-rolled stainless steel 304 is in shortage, typically the materials from Tsingshan. The transaction of last week was not good as two weeks ago. The stainless steel prices decreased greatly before, and the market was tepid, resulting in a large cut of arrivals. Some factories are so stressed by the heavy backlog of their inventory. At the end of the year, traders are proactively selling to barter for cash. The trend of stainless steel is still unclear, and traders are also on the fence. Fortunately, the decreasing inventory shows that the demand is actually better than people thought. It is estimated that the inventory will keep declining.

400 series of stainless steel: Steel mills reduce production. The high inventory volume is alleviated a bit.

In December, the production of stainless steel 400 series of TISCO has reduced by 40,000 tons and JISCO cut down 20,000 tons of stainless steel 400 series. Last week, the inventory volume declined by 6,500 tons to 85,800 tons. The decreasing rate continues to speed up.

Because of the less product arrival in the market, though the transaction of cold-rolled stainless steel 430 was tepid, the inventory decreased greatly. In December, two steel mills will reduce the production of 400 series. Currently, the inventory of stainless steel 400 series remains high, and it is alleviated thanks to the destocking in the past two weeks.

MARKET|| Abroad demand is wakened. The net import of stainless steel MoM increase by 100,000 tons.

1. Stainless steel imports fall while the exports rise.

The Chinese stainless steel import volume in November 2021 is 237,900 tons, which is 9.33% lower compared to October; and 2.02% lower compared to the same period of 2020. From January to November, the total import volume is 2,657,000 tons, YoY increasing by 67.35%. As for the exports, China’s stainless steel export volume in November is 394,100 tons, 23.92% higher than last month, and increasing by 13.26% compared to November of 2020. The total export volume from January to November is 4,018,000 tons, 32.30% higher than the same period of last year.

The decrease in stainless steel import majorly comes from declining Indonesian ingot imports. According to the news, a fire broke out in a ferronickel plant in Indonesia in October. Three furnaces were severely damaged. Each ferronickel production line can produce 650 nickel tons/month. The accident has influenced the production of semi-finished stainless steel products and steel ingots.

As for the exports, more countries have become bigger buyers to China in November. Turkey imported 51,700 tons from China, which is 64.02% higher than October, and YoY increased by 189.21% and it takes 13.12% of China’s total stainless steel export volume in November. Some countries recovered imports, such as Korea. The decrease in export to Korea lasted for 4 months and in November, it begins to increase. China exports 20,500 tons of stainless steel to Korea, MoM increasing by 47.23%.

During the 4th quarter, the price of China’s stainless steel fell significantly from the high level, which earns a lot advantage for the exporting business. For now, the export trade has turned much better than the previous time. Imports fell and exports rose in November, resulting in a significant increase in stainless steel net export volume. It increased by 156,200 tons which is 100,000 tons more than October. The increase in export relieved the oversupply in China to a certain extent.

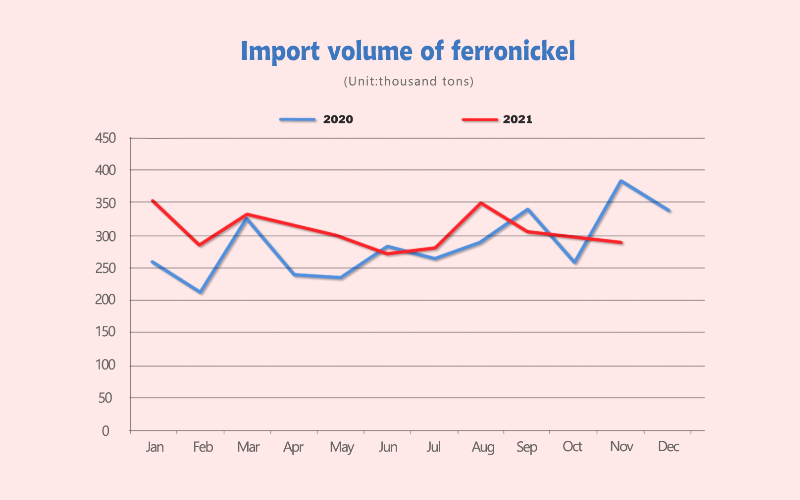

2.The import of ferronickel comes to a low point in 2021.

In November, China’s import volume of ferronickel was 290,300 tons, MoM decreasing by 2.88% and YoY cutting by 36.63%. The import volume of ferronickel from Indonesia was 231,000 tons, 7.03% lower than last month and 43.25% lower than November of 2020.

The amount of ferronickel imported from Indonesia continues to remain low, and China's stainless steel raw materials supply is tight. Until the end of November, the price of stainless steel 304 fell by US$587/MT from the high, US$3,555/MT in October, decreasing by 17%. Meanwhile, nickel, the main raw material of stainless steel, its price is very strong. LME Nickel remains at a high price of US$20,000, and the price of ferronickel has only fallen by 5%. Many steel mills that produce stainless steel 304 have lost significantly during the nickel-iron steelmaking process.

Moreover, it is said that after October, the ferronickel production lines of Indonesian Delong and Tsingshan will expand. The ferronickel production will increase and ferronickel imports to China are expected to rebound in December.

3. Imports of ferrochrome hit a record low, relieving the oversupply in China.

In November, China’s ferrochrome imports were 109,500 tons, decreasing by 47% from last month and reducing by 44.77% compared to the same period of last year; among, the import of ferrochrome from South Africa was 22,900 tons, MoM falling by 74.01% and YoY decreasing by 65.60%. South Africa is the main ferrochrome supplier to China. However, the import of ferrochrome from South Africa in November was only 22,900 tons, 74.01% lower than the previous month. This was mainly due to the shortage of power supply throughout South Africa in November. With the outbreak of Omicron lately, the export of ferrochrome in South Africa has dropped sharply.

In November, China's major high chromium production areas and other 100 large and medium-sized high-carbon ferrochromium factories had a total output of about 644,500 tons, increasing by 175,000 tons from October,rising by 37.27%. Among, the output increase in Inner Mongolia was the largest; the output increase in Guizhou was the second, and the output of high chromium in Guangxi and other areas also grew significantly, while the output in Shanxi decreased slightly. At present, China's ferrochrome production is rapidly increasing, the price competition is fierce, and the reduction in ferrochrome imports has effectively alleviated the pressure of China's oversupply.