China is now facing the severest COVID-19 since 2020. Huge cities like Shanghai and Shenzhen have been in half-lockdown, where there are major ports for exports. Some key lines of logistics went slowly because of quarantine, making the stainless steel delivery and transaction insufficient. The domestic demand of last week was tepid due to the pandemics. The stainless steel spot prices fell following the drop of stainless steel futures. However, sources said the decrease can't last long due to the high raw material cost. It is predicted that the stainless steel price will struggle to remain stable amid the volatility. LME nickel is currently going lower than ShFE nickel. On March 22nd, LME nickel closed at US$31,380, which is still on the way down, while ShFE closed at RMB 206,420 (about US$32,921). More about the Stainless Steel Market Summary in China, please keep reading.

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

3,610 |

-174 |

-5.02% |

|

Foshan |

3,660 |

-174 |

-4.95% |

||

|

Hongwang |

Wuxi |

3,395 |

-64 |

-1.96% |

|

|

Foshan |

3,360 |

-27 |

-0.84% |

||

|

304/NO.1 |

ESS |

Wuxi |

3,405 |

-134 |

-4.11% |

|

Foshan |

3,385 |

-80 |

-2.46% |

||

|

316L/2B |

TISCO |

Wuxi |

5,335 |

-179 |

-3.45% |

|

Foshan |

5,320 |

-134 |

-2.60% |

||

|

316L/NO.1 |

ESS |

Wuxi |

5,025 |

-54 |

-1.11% |

|

Foshan |

5,050 |

-48 |

-0.98% |

||

|

201J1/2B |

Hongwang |

Wuxi |

2,000 |

-51 |

-2.73% |

|

Foshan |

1,985 |

-13 |

-0.69% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,900 |

-65 |

-3.69% |

|

Foshan |

1,890 |

-21 |

-1.18% |

||

|

430/2B |

TISCO |

Wuxi |

1,685 |

14 |

0.92% |

|

Foshan |

1,665 |

11 |

0.73% |

TREND|| Stainless steel prices are finding a balance amid the volatility.

Last week, the stainless steel spot prices fluctuated with the stainless steel futures, showing various tendencies in price. Influenced by the latest pandemics in China, the transaction was weakened. Until March 18th, the most-traded contract of stainless steel futures increased by US$127/MT to US$3,330/MT, rising by 4.16%. The price difference between spot and futures remains at US$37/MT.

300 series of stainless steel: Steel mills take a pause facing the rising raw material costs.

Last week, the spot price of stainless steel 304 fluctuated to rise. Earlier last week, the futures price increased significantly, but later it reversed down. Due to the high production cost, steel mills and traders insist on supporting the stainless steel prices. Until March 18th, last Friday, the base price of the cold-rolled stainless steel 304 raised by US$127/MT, to US$3,290/MT; as for the hot-rolled stainless steel, the price increased to US$3,260/MT, US$79/MT higher than the price on March 11th.

Lately, the COVID-19 breaks out in China, and it is the severest after 2020. The quarantine policy is escalated, which hinders the logistic system to go smoothly. Purchase slows down. The domestic transactions mostly were the circulation between traders, according to a source who knows the market. The pandemics also hinder the steel mills to produce as normal. As we know, because the raw materials were not delivered to the factory as arranged, Jiangsu Delong has to reduce half of its production. It is predicted that about 20,000 tons of stainless steel 304 will be pushed off.

With the price of LME nickel and ShFE nickel cool down, the EXW price of high-grade ferronickel decreased by US$6/ni to US$272/ni, and the price of ferrochromium remains at US$1,413/MT(with 50% of chromium content)as two weeks ago. For now, in theory, the production cost of the cold-rolled stainless steel 304 fell by US$51/MT to US$3,199/MT. With the price of ferronickel going down, fewer transactions were dealt at a high price. Most steel mills choose to wait to see the price tendency to decide when to purchase.

200 series of stainless steel: Pandemics blocked the logistics.

Last week, the trading of stainless steel 201 was weak due to the pandemics in China. There is more than 260,000 case reported until March 21st. To quarantine, the local government of Wuxi holds strict measures to the mobility of transportation and people. Thereby, the logistic system is seriously affected, and it also reduced a large number of the trading. Except for Wednesday, when the price of stainless steel 304 increased greatly, which stimulated buyers, the transaction was weak during most of the time.

The price of stainless steel 201 changed as the stainless steel 304 spot price which is related to the stainless steel futures prices. Last Wednesday, boosted by the increasing stainless steel futures price, traders of stainless steel 201 seized the chance to promote.

On March 17th, the cold-rolled stainless steel 201 in Wuxi market quoted US$1,910/MT; cold-rolled stainless steel 201J2 increased slightly by US$8/MT, to US$1,805/MT last Thursday. As for the hot-rolled 5-foot stainless steel, it was more expensive than the CR, though it dropped by US$16/MT last week, to US$1,910/MT.

400 series of stainless steel: Prices to increase due to the high cost of raw materials. The price of cold-rolled stainless steel 430 remained stable last week.

JISCO and TISCO quoted US$1,700/MT on stainless steel 430/2B, which remained as two weeks ago. The transaction was not as active as two weeks ago. But influenced by the rising price of stainless steel 304, the quotation of the 400 series was maintained. Besides, the prices of chromium ore and coke increased, supporting the cost of high chromium to grow. Although the transport was insufficient, the high chromium factories did not stop producing. It is predicted that the output of high chromium will increase by 50,000 tons.

Summary:

The most-traded contract of stainless steel futures fluctuated to rise last week, going above US$3,320/MT. The position volume increased and the stock market is getting stable. It is predicted that the stainless steel futures will remain steady, and the reasons are below:

1. Resources are tightened up in the market. The breakout of COVID-19 in China slows down the logistic system, partly blocking the supply chain, which results in fewer arrivals to the market. Due to the low inventory of traders, people stand firm in the current price.

2. The cost is increasing. Although LME nickel keeps dropping to limit down, as the nickel industry tends to enter new energy, to stainless steel, the cost for nickel remains high. Besides, the supply of chromium ore maintains tight, pushing the price of ferrochromium to grow.

3. More expectations are for the future output of stainless steel to reduce. Tsingshan will expand its input in nickel matte, which in turn will threaten the capability of ferronickel production. Thereby, the import volume of ferronickel and stainless steel from Indonesia will reduce, intensifying the tight supply of ferronickel in China. Probably, it will lead to a cut in production because of the lack of raw material.

Another opinion has it that the nickel supply chain will be favorable to the new energy industry, which will make it harder for stainless steel to reduce the cost. In short, it is predicted the stainless steel price will maintain and climb up steadily.

300 series of stainless steel: The short squeeze of nickel is easing, and the LME nickel is fixing the gap between ShFE nickel. However, the cost of raw materials, such as nickel ore and ferronickel, stays high, supporting the stainless steel price to rise. Steel mills’ purchase of ferronickel will be the key in the stainless steel price trend.

200 series of stainless steel: Due to the quarantine, traders lost many orders, forcing them to decrease the price last week. It is predicted that the price will keep going down in a short time. The cold-rolled stainless steel 201/J1 will be around US$1,895/MT and 201J2 and J5 will be about US$1,780/MT. As for the hot-rolled 5-foot, stainless steel 201 will remain as before, at US$1,910/MT.

400 series of stainless steel: Steel mills’ purchasing price of high chromium in March is far lower than the current quotation. It is predicted that the high chromium purchasing price for April will increase. Though the production cost of stainless steel will keep increasing, because of the low trading volume in recent days, it is predicted that the price of stainless steel 430/2B will remain at US$1,700/MT.

INVENTORY|| China’s inventory increases amid COVID-19 lockdown.

| Inventory in Wuxi sample warehouse (Unit: thousand tons) | 200 series | 300 series | 400 series | Total |

| March 14th ~ March 18th | 39.1 | 301.4 | 84.3 | 424.8 |

| March 7th ~ March 11th | 34.8 | 300.1 | 83.6 | 418.5 |

| Difference | 4.3 | 1.3 | 0.7 | 6.3 |

Last week, the inventory volume in the Wuxi sample warehouse increased by 6,300 tons, to 424,800 tons. 200 series inventory rose by 4,300 tons, to 39,100 tons; 300 series went up by 1,300 tons, to 301,400 tons; 400 series decreases by 700 tons to 8,430 tons.

200 series of stainless steel: Transaction comes to a halt, stacking up the stock.

Market fluctuates. People focus much on the LME nickel and the stainless steel futures price instead of trading. The COVID-19 disturbs the market and delivery. Wuxi government holds strict against transportation, seriously affecting the logistic system. The trading vibe turns down.

Low trading volume decelerates the consumption of inventory. Last week, Baosteel Desheng and Beigang New Materials kept delivering products. Therefore, the spot inventory increased slightly by 4,300 tons.

300 series of stainless steel: Futures delivery and quarantine increase the inventory.

Last week, the stainless steel futures contract for March settled last week. The volume is up to 25,000 tons, which will enter the market physically recently. For now, the stainless steel inventory of ShFE is 75,544 tons, very close to the highest level of last year.

The increase of inventory last week is out of that steel mills shifted to sea delivery because the highways were blocked seriously, making the inventory of a port in Wuxi increased greatly. It is predicted that if the pandemics can be controlled down, the resources will soon flood into the market.

400 series of stainless steel: Delivery was stable.

As for the inventory, the stainless steel 400 series is stable because the delivery from steel mills to Wuxi is through railway majorly, which was not influenced by the pandemics much. It is predicted that the inventory of the stainless steel 400 series will fluctuate slightly.

The output of the stainless steel 400 series in March is expected to increase by more than 90,000 tons compared to February, and the total amount will surpass 550,000 tons.

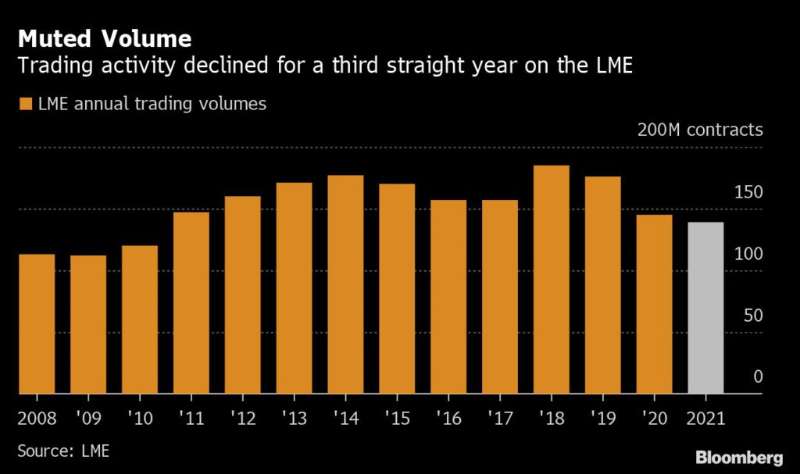

RAW MATERIALS|| Is LME losing its credit?

Nickel: LME boots nickel trading limit for three times, to 15%.

On March 16th, LME restarted the nickel trading, minutes later, it fell to limit down, reported that the LMW electronic system had faults, when the trading limit was 5% for nickel. On the next day, 17th, LME raised the price limit for the first time, to 8%. However, nickel quickly dropped to its limit down again. Last Friday, 18th, LME again increased the price limit to 12%, but for a third session in a row it hit limit down, quoting US$36,915, which was close to the highest point in 2008, US$34,225/MT. Some people thought that it would be a key battleground, but nickel keeps falling.

On March 21st, LME boosted trading limit to 15%.

The consequent changes and volatility hit down people’s faith just as the falling nickel price.

Now many of those same financial investors say they may abandon the LME. Some are working on lawsuits in the U.S. and the U.K., according to people familiar with the matter.

A portfolio manager at one large macro hedge fund says he has already stopped trading any LME contract for his relative value book, that bets on price differences between commodities, equities and currencies. Alex Gerko, founder of XTX Markets, a large quantitative trading firm, has dubbed the LME the “Soviet Metal Exchange”.

CHROMIUM: The price of high chromium raises as the supply remains strong.

The production cost of ferrochromium keeps increasing. On one hand, the cost of chromium continues to rise, partly because the mining and delivery of chromium ore in South Africa are controlled by the government. Besides, the Zimbabwe government has currently banned the export of chrome ore, and the ban on chrome ore and chrome concentrate follows a Cabinet resolution in August 2021 and will come into effect in July 2022.

On the other hand, the price of coke has increased for the fourth time in March. The highest was up to US$127/MT.

As chrome ore and coke prices continue to rise, supporting the price of ferrochrome. Since March, the mainstream EXW price of high chromium has increased by US$64/MT (of 50% chromium content) and is currently running over US$1,431/MT.

Thanks to the growing price, more ferrochrome factories return to produce. It is predicted that at the end of March, the output will be released. With the increasing stainless steel production, the demand for high chromium will raise. Closing to April, many steel mills will start the bid of ferrochrome. It is predicted that the high chromium will stay high in price.