Stainless steel futures and spot prices declined last week, because of the macroeconomic concerns. Besides, during the previous time when the stainless steel price tended to rise, steel mills expanded the production, which is gradually flowing to the market and thereby the spot inventory stacked. The new arrivals will continue to add up the inventory, suppressing the prices. In May, the output of the stainless steel 300 series hits a record high, reaching 1.81 million tons. For June, steel mills currently have no significant maintenance plans, raw material prices are fluctuating upwards, and cost pressures are increasing. It seems that currently, the ore cost is the only driver of stainless steel prices. Chromium and nickel-iron kept rising, although recently LME nickel has decreased. Nickel spot prices on June 6 were $18,300 per ton, down from $21,300 per ton on May 20, marking a decrease of $3,000 per ton, or 14% over two weeks. Well, the surging sea freight has earned a great sum of money for the linear giants like it was during the pandemic era, getting them rid of the sluggish transportation market. The cost of shipping around the world stably goes up. In the coming second half of the year, some important elections are going to reshape the world. The world is swiftly changing and the only way to adapt to the transient situation is to get used to the changes, right? So, stay on track with the dynamics, and keep an eye on our Stainless Steel Market Summary in China to make the just right decision.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,180 | -7 | -0.34% |

| Foshan | 2,225 | -7 | -0.33% | ||

| Hongwang | Wuxi | 2,080 | -10 | -0.50% | |

| Foshan | 2,080 | -14 | -0.71% | ||

| 304/NO.1 | ESS | Wuxi | 2,005 | -11 | -0.59% |

| Foshan | 2,005 | -11 | -0.59% | ||

| 316L/2B | TISCO | Wuxi | 3,680 | 25 | 0.71% |

| Foshan | 3,750 | -6 | -0.15% | ||

| 316L/NO.1 | ESS | Wuxi | 3,530 | 3 | 0.08% |

| Foshan | 3,545 | 8 | 0.25% | ||

| 201J1/2B | Hongwang | Wuxi | 1,410 | 0 | 0.00% |

| Foshan | 1,405 | -4 | -0.32% | ||

| J5/2B | Hongwang | Wuxi | 1,310 | 0 | 0.00% |

| Foshan | 1,305 | -4 | -0.35% | ||

| 430/2B | TISCO | Wuxi | 1,235 | 0 | 0.00% |

| Foshan | 1,240 | 6 | 0.50% |

TREND|| Stainless Steel Prices Decline After High Production in the Early Period.

Wuxi's stainless steel spot market witnessed a week of stability tinged with slight price drops across all three series. While 300 series prices mirrored the market's downward fluctuations, 200 and 400 series prices held steady. Last week's market decline coincided with the gradual fading of macroeconomic concerns, leading to sluggish spot trading activity. Traders' quotes mirrored market movements, with arrivals increasing and causing a minor inventory rise. By Friday, the main stainless steel contract price had fallen US$51.5/MT compared to the previous Friday, settling at US$2105/MT, a decrease of 0.26%.

300 Series: High Output Effects Gradually Released, Spot and Futures Prices Enter a Downward Channel.

304 market prices began to decline last week. As of Friday, the mainstream base price of cold-rolled 4-foot mill-edge stainless steel 304 in Wuxi region was reported to be US$2025/MT, down US$21/MT from last Friday; the price of hot-rolled 300 series products was reported to be US$2000/MT, down US$14/MT from previous Friday. Stainless steel prices fluctuated downwards last week, and Tsingshan released a balanced distribution. Costs remained high, steel mills had a strong willingness to hold prices, spot prices remained firm, and the market procurement atmosphere was not good. With the continuous decline of futures prices, the willingness of traders to hold prices has loosened, and market prices have been lowered. Under weak demand, merchants shipped slowly and transactions were poor for days. At present, the market arrivals have increased, which is not as expected as digestion, and the pressure on inventory and warrants is high. Hence, the decline of futures prices has intensified. The steel mills' opening prices on Thursday have fallen. The wait-and-see sentiment of merchants is relatively strong. Trading performance is relatively weak during last week, and most of them are traded at a discount.

200 Series: Steel Mill Prices Remain Stable, 201 Trading Light.

Last week, the spot price of 201 in the Wuxi market was mainly stable. As of Friday, the mainstream base price of cold-rolled 201J1 in the Wuxi market was US$1380/MT, the mainstream base price of J2/J5 cold-rolled was US$1285/MT, and the mainstream base price of five-foot hot-rolled 201J1 was US$1335/MT, all of which were the same as the price of last Friday.

400 Series: Inventory Continues to Destock, Supply Pressure Eases.

As of Friday, the guidance price for TISCO cold-rolled 430 was US$1475/MT, an increase of US$7/MT from the previous week. JISCO's cold-rolled 430 guidance price was US$1605/MT, up US$14/MT from the previous week. Last week, in the Wuxi market, the spot price for state-owned cold-rolled 430 was US$1235/MT to US$1240/MT, up US$4.1/MT from the previous week. The state-owned hot-rolled stainless steel 430 price remained stable at around US$1130/MT, unchanged from the previous week.

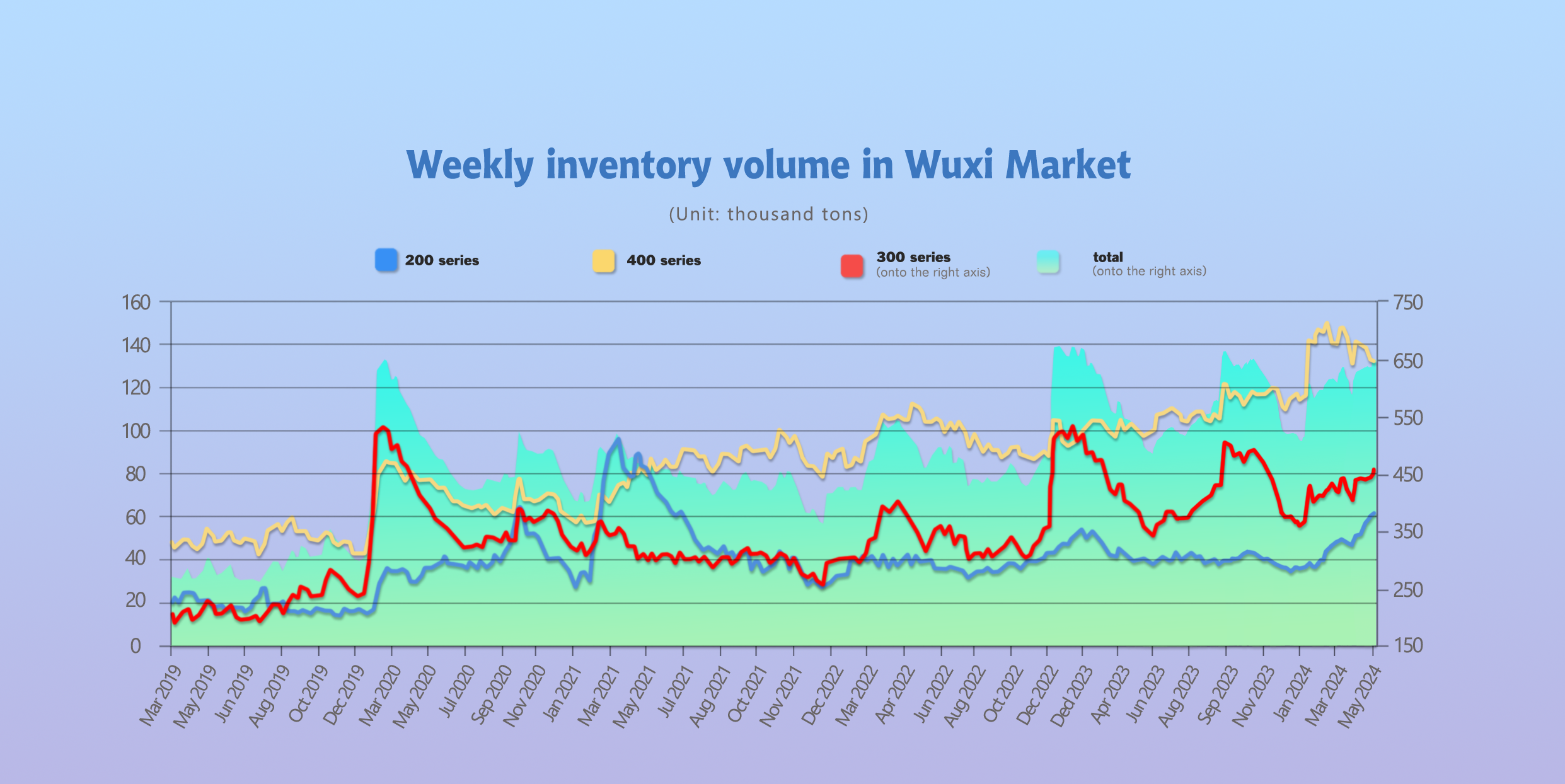

INVENTORY|| Inventory Increases by 15,100 Tons.

The total inventory at the Wuxi sample warehouse up by 15,094 tons to 648,007 tons (as of 6th June).

the breakdown is as followed:

200 series: 1,825 tons up to 61,437 tons,

300 Series: 14,642 tons up to 455,516 tons,

400 series: 1,373 tons down to 131,054 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| May 30th | 59,612 | 440,874 | 132,427 | 632,193 |

| Jun 6th | 61,437 | 455,516 | 131,054 | 648,007 |

| Difference | 1,825 | 14,642 | -1,373 | 15,094 |

300 Series: Warrants Remain High, Inventory Continues to Accumulate!

Despite falling futures prices and a firm stance on holding prices by spot steel mills last week, normal market arrivals and continued high production resulted in slightly increased inventory for both cold and hot rolled 300 series stainless steel in Wuxi. Year-on-year, warrant levels remained high with ongoing registration, reflecting weak downstream confidence in the future market. With current raw material prices causing slight losses for steel mills and off-season demand being relatively weak, production is expected to remain high, potentially leading to a further slight increase in inventory next week. Continued monitoring of steel mill production and market transactions is crucial. (Note: Including warrants, Wuxi's total inventory of cold-rolled and hot-rolled 300 series last week reached 384,400 tons, a 3.31% increase of 12,300 tons from the prior week and a significant 82.50% increase, or 173,800 tons, compared to the same period last year.)

200 Series: Prices Remain Stable.

Last week, Tsingshan Hongwang's guidance price remained stable, and the spot price of 201 continued to stabilize. Baosteel Desheng and Hongwang continued to arrive, and downstream customers mainly making just-in-time purchases. The supply exceeds demand pattern has not changed, leading to an increase in inventory. It is expected that the spot price of 201 will mainly fluctuate and weaken in the short term.

400 Series: Monthly Pickup Increases, Inventory Continues to Destock!

Last week saw a decrease in 400 series inventory thanks to a confluence of factors. Steel mills delivered on prior orders, a surge in end-of-month agent pickups occurred, and some mills planned stoppages for May-end maintenance, all leading to a decline in available market resources. This, coupled with rising raw material costs pushing steel mills further into loss territory, resulted in a US$14/MT increase in their guidance prices, reflecting a strong resolve to raise prices for 400 series. Despite the reduction in current inventory and planned high output for June, the market faces ongoing supply pressure due to the weak off-season demand. As a result, 430 series prices are expected to remain stable in the short term, albeit at a subdued level. We will continue to monitor inventory changes and market transactions for further developments.

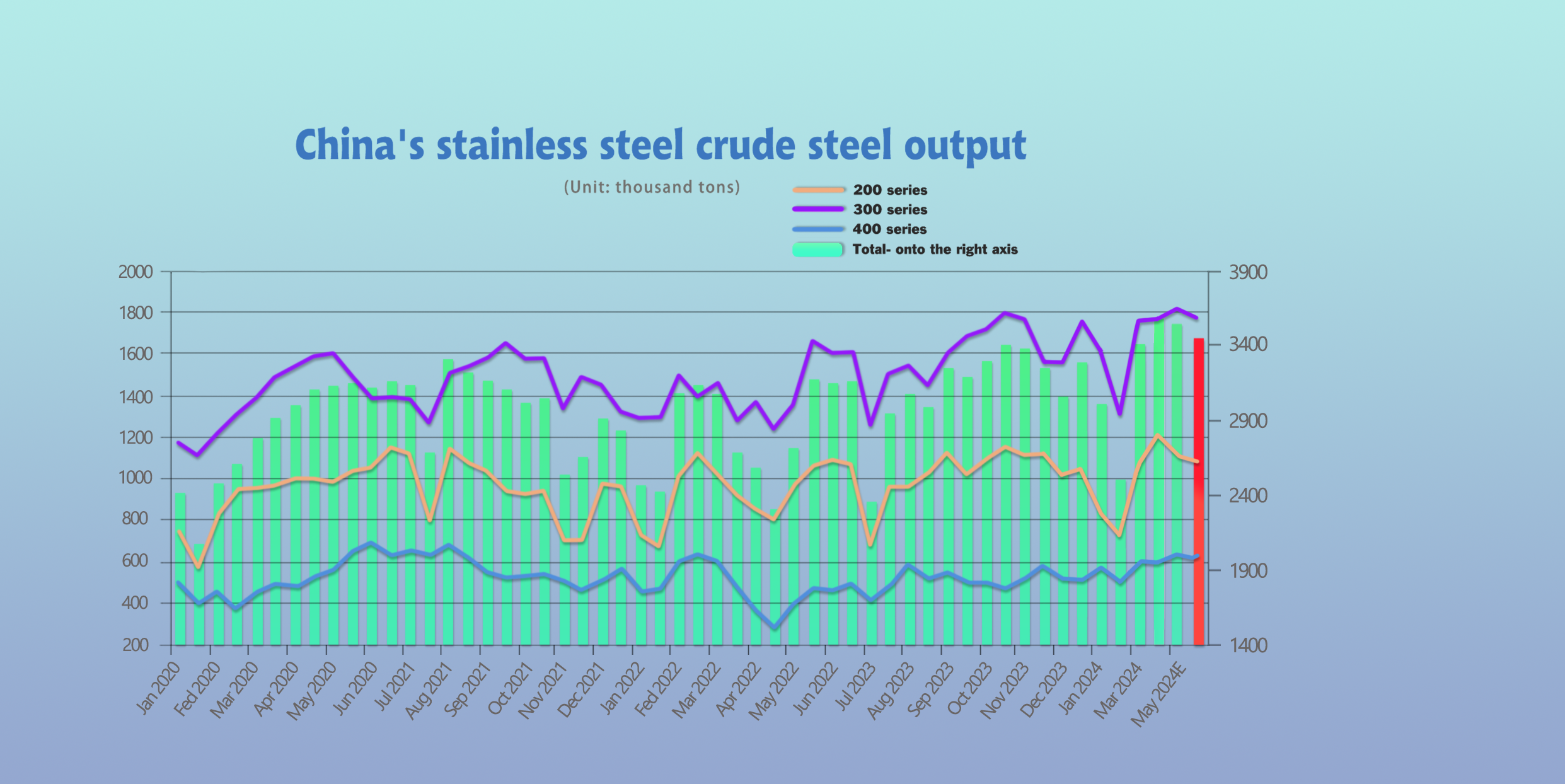

Production|| 300 Series Output Hits Record High of 1.81 Million Tons in May.

In May, prices first fell and then rose, reaching a new high for the year, driving up the enthusiasm for production among steel mills. The 300 series output reached a record high of 1.81 million tons. The spot market transactions gradually improved with the price increase, but still primarily consisted of just-in-time purchases, with social inventory shifting from increase to decrease by the end of the month.

According to statistics, the crude steel output of large and above-scale domestic stainless steel enterprises in May 2024 was 3.5453 million tons, a decrease of 24.1 thousand tons or 0.68% month-on-month, but an increase of 297.3 thousand tons or 9.15% year-on-year.

The changes in output by series in May were as follows:

200 Series: Output was 1.1069 million tons, a decrease of 95.3 thousand tons or 7.93% month-on-month, and a decrease of 8.6 thousand tons or 0.77% year-on-year.

300 Series: Output was 1.8124 million tons, an increase of 44.2 thousand tons or 2.5% month-on-month, and an increase of 220 thousand tons or 13.82% year-on-year.

400 Series: Output was 626 thousand tons, an increase of 26.9 thousand tons or 4.5% month-on-month, and an increase of 85.8 thousand tons or 15.88% year-on-year.

For June, steel mills currently have no significant maintenance plans, raw material prices are fluctuating upwards, and cost pressures are increasing. Downstream demand in the off-season has not shown significant improvement, and terminal enterprises are making just-in-time purchases, leading to a slight decline in steel mill output. According to research and statistics, the estimated production for June is as follows:

200 Series: 1.075 million tons,

300 Series: 1.7685 million tons,

400 Series: 611 thousand tons.

The total production is expected to be around 3.4545 million tons, a decrease of 2.56% month-on-month but still an increase of 8.25% year-on-year.

In summary, steel mill output remained high in May. In June, the order volume from steel mills declined, and production plans were adjusted downwards month-on-month, but still showed an increase compared to previous years. With prices peaking and then falling, combined with insufficient demand in the off-season, the supply-demand imbalance has not been resolved. It is expected that inventory levels may continue to increase in June, with spot prices fluctuating in the range of US$1811-US$1950. Continuous attention should be paid to the recovery strength of market demand and the production situation of steel mills.

RAW MATERIALS|| Stable Raw Material Prices Become Major Support for Future Stainless Steel.

The mainstream EXW price of high carbon ferronickel ranged between $1355 and $1370 per 50 reference tons, remaining unchanged from the previous week. Recently, chrome ore prices have continued to rise, coke prices remain stable, and the overall cost of high chromium continues to increase. Due to the stable prices of high carbon ferrochrome in June, which exceeded market expectations, market activity remains high. Additionally, with the expectation of increased hydropower in the main production areas in the south, a small part of the capacity is expected to be released, leading to an anticipated increase in high chromium production in June, though at a slower pace. Short-term high chromium prices are expected to remain stable.

After continuous increases since early 2024, nickel ore prices have recently declined. As of June 9, the 3-month nickel futures on the London Metal Exchange (LME) had slipped to around $18,500 per ton, down approximately 14% over the past two weeks. Additionally, news from Indonesia's Tsingshan suggests a downward revision in export quotes, resulting in cooling buying interest. The market believes that without significant bullish stimuli and with sufficient downstream inventory, short-term market performance will be relatively subdued.

In early February, nickel prices were below $16,000 per ton but continued to rise, reaching a high of over $21,000 per ton in late May, driving up stainless steel prices. Stainless steel manufacturers like YUSCO, Tang Eng, and Walsin Lihwa have been adjusting their prices upwards. However, since late May, nickel prices have started to decline. On June 5, 3-month nickel on the LME fell below $18,500 per ton to $18,200 per ton, rebounding slightly to $18,500 per ton on June 6. Nickel spot prices on June 6 were $18,300 per ton, down from $21,300 per ton on May 20, marking a decrease of $3,000 per ton, or 14% over two weeks.

Stainless steel manufacturers noted a recent decrease in downstream inquiry intentions. With raw material prices declining and downstream inquiries cooling, especially in the domestic market, previous price increases led some customers to restock early, resulting in a noticeable wait-and-see attitude now.

Summary|| Downstream Demand Suppresses Prices.

Stainless steel prices trended weakly last week, with trading volume declining. Downstream pre-holiday inventory replenishment was cautious, social inventory continued to accumulate, and raw material prices remained firm, supporting stainless steel prices. Steel mill profits were marginal, and production remained high.

300 Series: Currently, steel mill cost support is relatively strong, but downstream demand is not keeping up, and high market inventory is suppressing the upward space for prices. Futures prices have continued to decline after reaching a high and then falling back, spot prices have fallen, and steel mills have suffered increased losses. After the concentrated procurement in the terminal period, the terminal will maintain rigid demand procurement, and the subsequent attention should be paid to the improvement of terminal demand and the arrival of the market.

200 Series: The continuous decline of futures has affected the trading atmosphere of the spot market. Steel mills might continue to maintain high production in June. Downstream customers will maintain rigid demand procurement before the Dragon Boat Festival. Inventory will continue to accumulate. It is expected that the price of 201 will still be mainly volatile and weak in the short term.

400 Series: At present, the production schedule of steel mills in June is still maintained at a high level, and the supply pressure in the market will not be reduced in the later period. The weak downstream demand situation has not shown any significant signs of improvement, limiting the upward space for prices. The subsequent focus will be on inventory changes and market trading conditions.

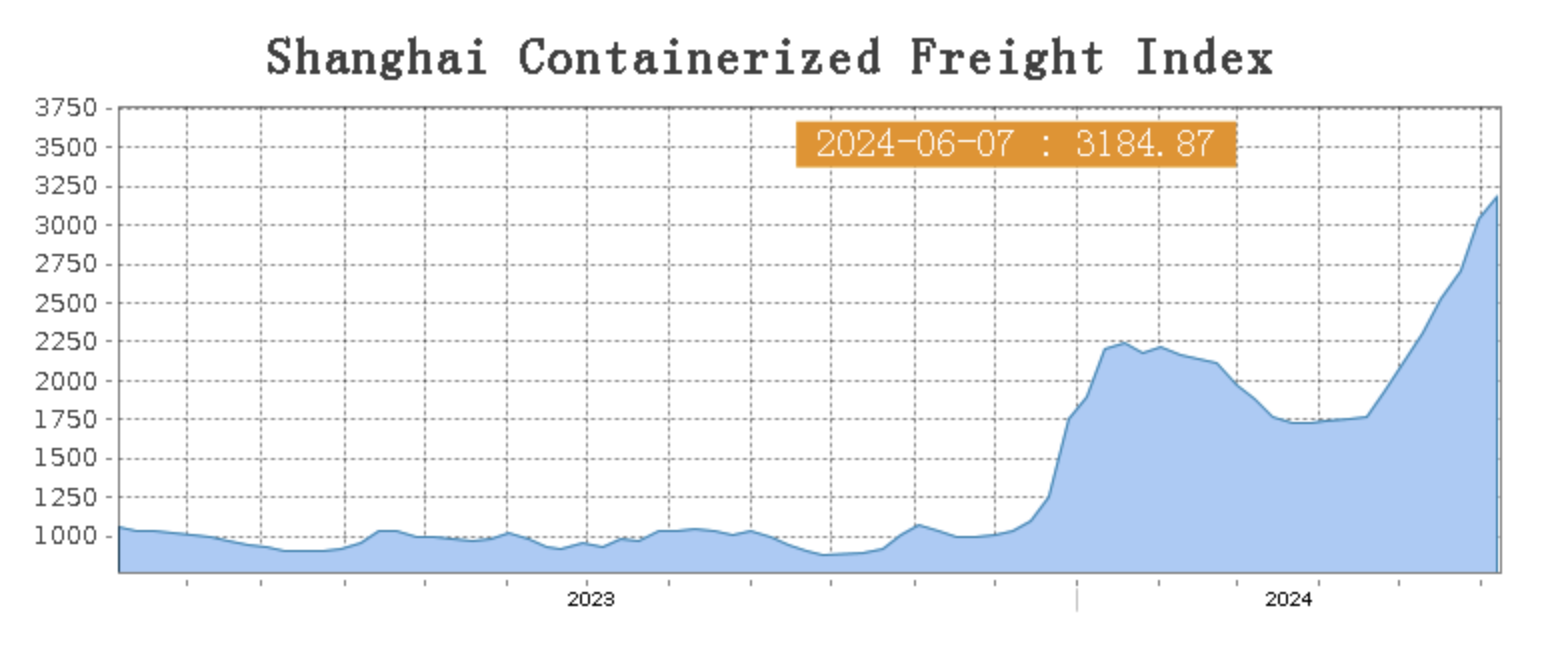

Sea Freight|| Composite Index Continues to Rise.

Last week, China's export container transportation market continued to maintain a generally positive trend. Transportation demand remained strong, and the supply-demand fundamentals were stable. The Growing freight rates is driving the composite index further upward. According to data released by the General Administration of Customs, China's exports in May 2024 increased by 7.6% year-on-year in dollar terms, with export growth continuing to accelerate.

China’s Containerized Freight market continued to be interrupted by the regional fluctuation. On 7th June, the Shanghai Containerized Freight Index rose by 4.6% to 3184.87.

Europe/ Mediterranean:

According to data released by Eurostat, the unemployment rate in the Eurozone fell to 6.4% in April, a historic low. This week, transportation demand performed well, and the tight supply of capacity continued to push up market freight rates.

On 7th June, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$3949/TEU, which rose by 5.6%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$4784/TEU, which surged by 1.4%

North America:

Data from the General Administration of Customs of China show that in the first five months of 2024, the total value of trade between China and the United States was US$260.44 billion, an increase of 2%. Among this, exports to the United States were US$193.59 billion, an increase of 3.6%, and the trade surplus with the United States was US$126.90 billion, an expansion of 7.2%. The stable growth of Sino-US trade is beneficial for the long-term stability of the North American route transportation market. This week, transportation demand remained at a high level, the supply-demand fundamentals were stable, and market freight rates continued to rise, though the rate of increase has slowed.

China’s Containerized Freight market continued to be interrupted by the regional fluctuation. On 7th June, the Shanghai Containerized Freight Index rose by 12.63% to 3044.77.

On 7th June, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$6209FEU and US$7447/FEU, reporting a 0.7% and 3.3% lift accordingly.

The Persian Gulf and the Red Sea:

On 7th June, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf lifted by 12.3% from last week's posted US$2855/TEU.

Australia/ New Zealand:

On 7th June, the freight rate (shipping and shipping surc-harges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1440/TEU, a 7.3% jump from the previous week.

South America:

On 7th June, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$7936/TEU, an 7.1% growth from the previous week.