TREND|| Out of expectation, the prices bounce back to increase.

Last week, the general prices began with a decreasing trend. Because the futures price was much lower than the spot price, the spot market was weak earlier last week. But stimulating by the nickel and stainless steel futures, people's attitude turns positive, and the prices gradually increase.

304: The increase in the spot market will maintain.

From a macro view, the news says that US President Joe Biden plans to spend US$6 trillion in budget funds for infrastructure, education, and healthcare in the fiscal year of 2022. The plan requires the federal government to spend $6 trillion in the fiscal year 2022 and by 2031, it will increase to $8.2 trillion.

Although the plan is yet to know, shortly it gains much faith to the market. The bulk commodities are all boosted globally when the news spreads ——the increase in nickel and stainless steel futures will support the spot market to maintain the increasing trend.

As for inventory and futures, on one hand, last week in the Wuxi market, the inventory of 300 series rose by 1,100 tons, reaching 307.4 thousand tons. The increase mainly arises from the pre-stock of a state-owned steel mill. Resources from mainstream steel mills are of small amount, and some specifications are even out of stock. Overall, the spot inventory remains low.

On the other hand, the futures market is bearish. After the futures rose significantly, the futures agio narrows down—— the agio of Contract 2107 is about US$143/MT, Contract 2108 is about US$195/MT, Contract 2109 is about US$238/MT; the backwardation of forward contracts are mostly deep.

201: Steel mills change production. The pressure of inventory is little.

Last week, new resources arrived in the Wuxi market, which is mainly from Baosteel Desheng and Chengde.

Because of the bounce-back price, the transaction of 201 turns better, and traders are proactively delivering. From the perspective of inventory, 201 keeps reducing to 194.9 thousand tons, falling by 7,200 tons last week. The market inventory is consumed.

For now, there are some uncertainties in the market, such as the invisible inventory of steel mills, pre-stock, and future profitable stocks. These are the reasons that are strong supports to the market prices.

However, to the hot-rolled products, steel mills change the production to plain carbon steel and meanwhile maintain the production of cold-rolled stainless steel, so the hot-rolled 201 production is reduced lately, making the price remain high.

430: Good and bad news both appear. The price might be stable in a short time.

From the perspective of raw materials, in June, TISCO's high-chromium steel bidding price fell slightly by US$8/50 basis ton to US$1,149/50 basis ton, which was better than expected. In addition, the electricity price of production companies in Inner Mongolia increased by ¥0.02/kWh which brings up the cost of high chromium plants by about US$8-12 /50 basis tons. The increase in new energy allocation may affect the stability of production. It is expected that the price of high chromium will be high in the future.

However, the bad news is the high inventory of 400 series. Last week, the inventory in the Wuxi market rose to 85,600 tons, increasing by 2,500 tons. Under the increasing pressure of the high inventory, it is more difficult to increase the price.

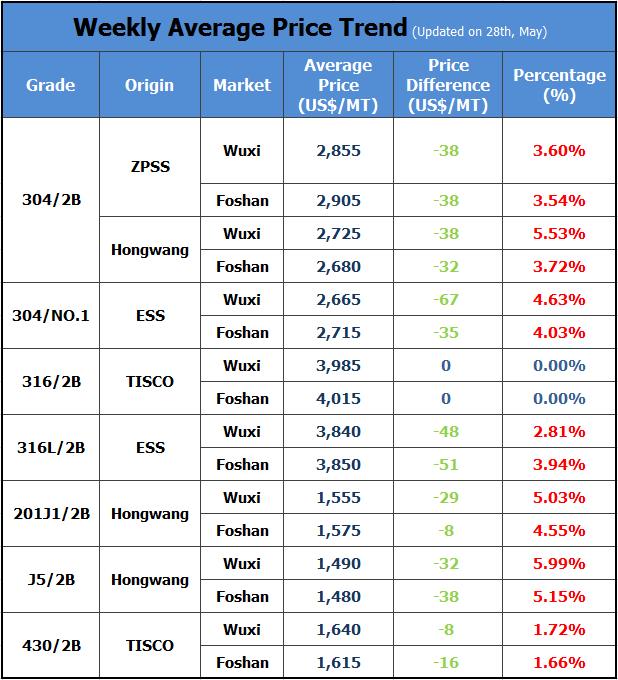

It is forecasted that this week, the spot product of 304 will slightly increase by US$16/MT. The base price of Hongwang cold-rolled 304 in the Wuxi market will fall around US$2,705/MT. Form the long term, the market is volatile. No matter it is in China or other regions and countries, both the political and economic environment is uncertain. If the new capability in China is released, the price will face the risk of a decrease.

ANALYSIS|| Stainless steel market is rising.

On 27th May, Thursday of last week, the stainless steel market met its reversal of trend, turning the decrease to increase.

In the night, the bulk commodities all sharply increased. At the close of the evening, HRB futures rose by 4.81%, iron ore increased by 4.11%, and coke futures was 3.01% higher; LME copper rose by 3.37%, and LME nickel increased by US$725 (4.19%) to US$18,035/MT. Stainless steel futures contract 2107 increased by US$75/MT to US$2,585/MT in the evening.

LME Nickel candlestick

The increase owns by the latest $6 trillion stimulus package plan by President Joe Biden.

Meanwhile, East China Stainless Steel Cold Rolling Exchange Conference was held on the same day. During the meeting, experts share their views about the future stainless steel trend.

Reasons why they think the prices will be rise:

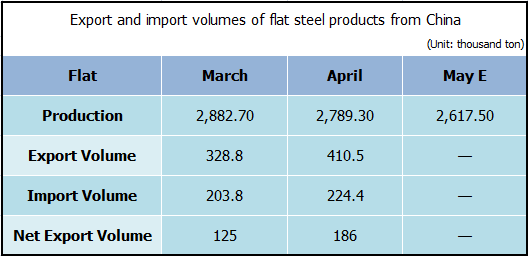

1. The out-of-stock situation will last. It is a little bit strange because the steel mills ran normally in May and many steel mills even enlarge their production in 304. However, the market shows that it is still out of stock. According to the above table, in recent months, the production of stainless steel has kept decreasing. The participants said that the export in May and June are still hot. Steel mills and exporters are all rush producing and delivering to avoid the imposition of export tax.

Under the circumstance of the decreasing stainless steel production, part of the volume is largely consumed by the abroad market. Therefore, in June, it is little possibility that the market will decline. Moreover, steel mills hold many undone orders in hand, so they are unwilling to reduce the price.

2. Some steel mills hold their plain carbon steel production unchanged in June. From later May to early June, some steel mills begin maintenance, and thereby the overall production of stainless steel in June may decrease.

3. New capability may be postponed. Baosteel Desheng will put the new products on the ground on 28th June, while the new project of Delong will be delayed. Therefore, the total output of stainless steel won’t largely increase in a short term. What’s more, for now, steel mills stopped purchasing raw materials in June, and thus it is a lack of force to reduce the price. The profit margin of steel mills may maintain in a normal range.

4. More constructions in the State bring up the demand. The increase in prices is caused by the highly rising demand, which also influences the export prices and lifts the abroad raw materials prices.

5. The Dual Controls policy: in Guangdong, Guangxi, Yunnan, and other provinces, because of power ratio, the production is limited not only in the downstream industry but also the raw material and stainless steel supply.

A guest said,” Due to the increase in electricity load in summer and the rise in coal prices, the cost of power supply companies has been higher than their profit. What’s worst, there have been power cuts in many places. Inner Mongolia Wumeng, Guangxi Baise, and other high chromium production areas have recently stopped production due to power cuts.”

Meanwhile, the import volume of ferrochrome is expected to reduce as well, because from June to August, South Africa is in winter, the overall electricity supply is insufficient; in India, the pandemic breaks out again, which cuts down the production and export volume. For now, because China’s mainstream steel mills are yet to confirm the purchasing price of high chrome, the market is leaving uncertain.

Reasons why they think the prices will be rise:

1. There is "invisible inventory" in the market. For example, the hot-rolled 304 by a large private-owned steel mill in southern China was poured into the market, and the amount of entering the market has increased. In addition, the current price of cold-rolled 304 is lower than that of hot-rolled 304, so steel mills prefer producing hot-rolled 304, which will enlarge the production volume in the future.

2. In present days, plain carbon steel has decreased largely in price, squeezing the profit margin, which will reduce people’s interest in producing carbon steel to replace stainless steel. In June, 200 series will probably maintain the production volume like May. It is reported that there has a sufficient cold-rolled 200 series output by Baosteel Desheng. Besides, there are much invisible inventory in 200 series. In some steel mills, the equipment and machines are exclusive to producing 200 series. Therefore, the guests hold an optimistic view towards the future prices of 200 series. As for 400 series, influenced by the update of emission control regulations, the production and consumption were already released last year, influencing the present and future demand to turn weak.

3. In terms of futures, for now, the forward contract of stainless steel is of large backwardation. The market is rather pessimistic about the future trend. The recent increase owns to the decreasing amount of warehouse receipts as well as the macro factors are beneficial to the price. However, the spot price will possibly get down to the futures price.

4. Besides, the recent appreciation of the RMB is conducive to hedging the upward pressure on commodities. If the RMB continues to appreciate in the future, it will weaken the export advantage of domestic commodity and stainless steel.

Stainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in China