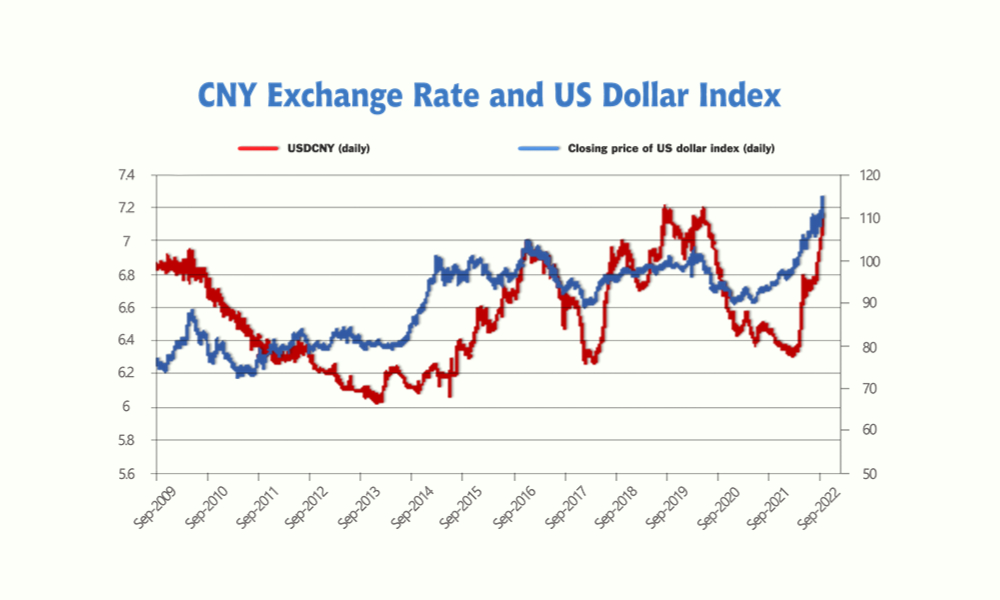

Can you feel the volatility either at the economic level or at the political level? As the Fed raised the interest rate, though it is well foreseen by many people, the nickel and stainless steel futures market fluctuated. The commodity market will continue to be under the dark cloud. The USD has risen against the CNYto a new high in two decades. The fluctuating currency rate also influences foreign trading and our stainless steel prices. The 20th Congress of CPC will be held on October 16th and this is to decide the future of China and the future development direction of the business. If you want to know more about the information, please keep reading the Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

2,635 |

-19 |

-0.75% |

|

Foshan |

2,675 |

-19 |

-0.73% |

||

|

Hongwang |

Wuxi |

2,550 |

-34 |

-1.39% |

|

|

Foshan |

2,540 |

-23 |

-0.93% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,455 |

-42 |

-1.77% |

|

Foshan |

2,500 |

-37 |

-1.47% |

||

|

316L/2B |

TISCO |

Wuxi |

4,015 |

40 |

1.04% |

|

Foshan |

4,065 |

42 |

1.08% |

||

|

316L/NO.1 |

ESS |

Wuxi |

3,955 |

77 |

2.05% |

|

Foshan |

3,940 |

63 |

1.67% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,535 |

1 |

0.05% |

|

Foshan |

1,520 |

-9 |

-0.63% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,470 |

-8 |

-0.57% |

|

Foshan |

1,460 |

-12 |

-0.87% |

||

|

430/2B |

TISCO |

Wuxi |

1,275 |

0 |

0% |

|

Foshan |

1,265 |

0 |

0% |

Trend || Chaotic scene before China National day

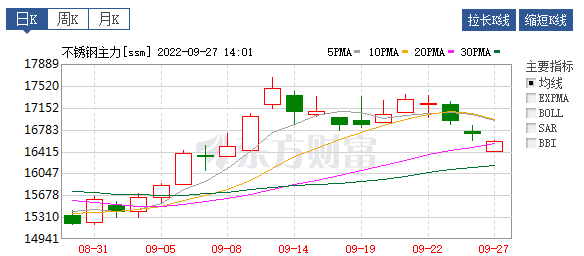

The spot price of 201 and 304 stainless steel was in plain, there was no significant movement occurring during last week. The most-traded contract of stainless steel futures had an $11 increase to $2350/MT until 23rd September.

Series 300: Roller-coaster riding

The price of 304 stainless steel was running downward slightly as the delayed shipment due to the typhoon had finally arrived in relieved of the shortage. The price of cold-rolled 4-foot mill-edge stainless steel 304 at Wuxi was quoted at US$2515/MT while Hot rolled 4-foot 304 stainless steel was quoted at US$2455/MT. The theoretical production cost went up by $11 to US$2480/MT.

Series 200: The mid-autumn had cold down the transaction

The price of hot rolled 5-foot stainless steel 201 was stabilized at US$1470/MT, while the price of cold rolled stainless steel had a little “hiccup”. Both the price of 201 and 201J2 cold rolled stainless steel totalling $7 rose to US$1510/MT and US$1445/MT correspondingly.

The transaction was featureless at the beginning of last week due to the stock outage, but the market was turning warm with the arrival of the shipment from the mills.

Series 400:Powerless growth on price

The price of 430/2B was remaining stable at US$1275 -$1280/MT, quoted by TISCO and JISCO.

As for the purchasing price of high chrome, Jiuquan Iron quoted US$1150/MT (with 50% of high chrome) and Taiyuan Iron quoted US$1140/MT (with 50% of high chrome).

The production cost of high chrome is continually shifting upward as the price the of coke had also climbed up. The power outage in Guizhou province is still halting production, the production level of high chrome in September is expected to drop.

Summary:

The most-traded contract price was volatile and trending downward,

Stainless steel futures price was slightly decreasing in the later part of last week.

It is because:

1. The increasing price and supply from the mills had lifted the profit margin, and the resumed production resulting the increment of the market resources.

2. The coming off-season might be slowing down the digestion of the inventory though there will be inventory in bulk shipping back to China. The price of stainless steel future is projected to slow down the growth and the volatility is foreseeable.

Series 300:

The inventory level at Wuxi and Foshan was still laying low, as well as the warehouse receipt. The digestion of the market inventory was slowed down due to the import from Indonesia and the resume of production. The base price of cold rolled stainless steel 304 was maintaining at between US$2470-US$2545/MT.

Series 200:

The transaction of stainless steel 201 was dull and it is hard to have a huge change in the short term, but the China National day could be a minuscule stimulus for the market in the coming week. The price of 201J2 cold-rolled stainless steel is likely to hover between US$1470-US$1495/MT next week.

Series 400:

Mills are recovering from the production losses, and the traders are increasing the shipment. The price of 430/2B is projected to prop up at a lower level at US$1255-US$1280/MT approximately.

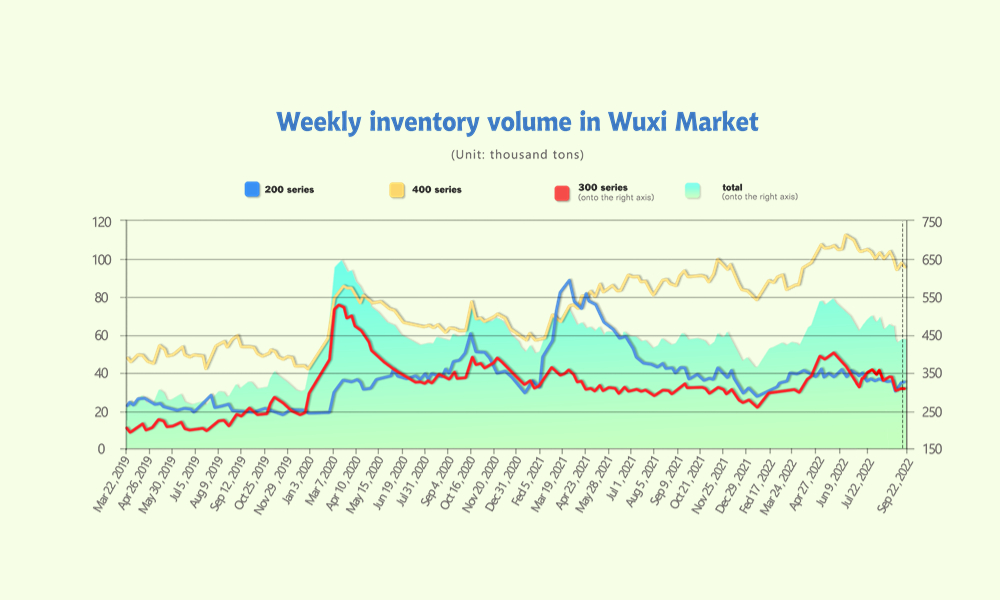

Inventory || Domestic inventory decreases on a-week basis; Export volume slumps in August.

The inventory level at the Wuxi sample warehouse was downed by 1,834 tons to 436,245 tons (as of 22nd September).

the breakdown is as followed:

200 series: 1,150tons up to 34,800 tons

300 Series: 479 tons up to 307,317 tons

400 series: 3,463 tons down to 94,128 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| September 15th | 33,650 | 306,838 | 97,591 | 438,079 |

| September 22nd | 34,800 | 307,317 | 94,128 | 436,245 |

| Difference | 1,150 | 479 | -3,463 | -1,834 |

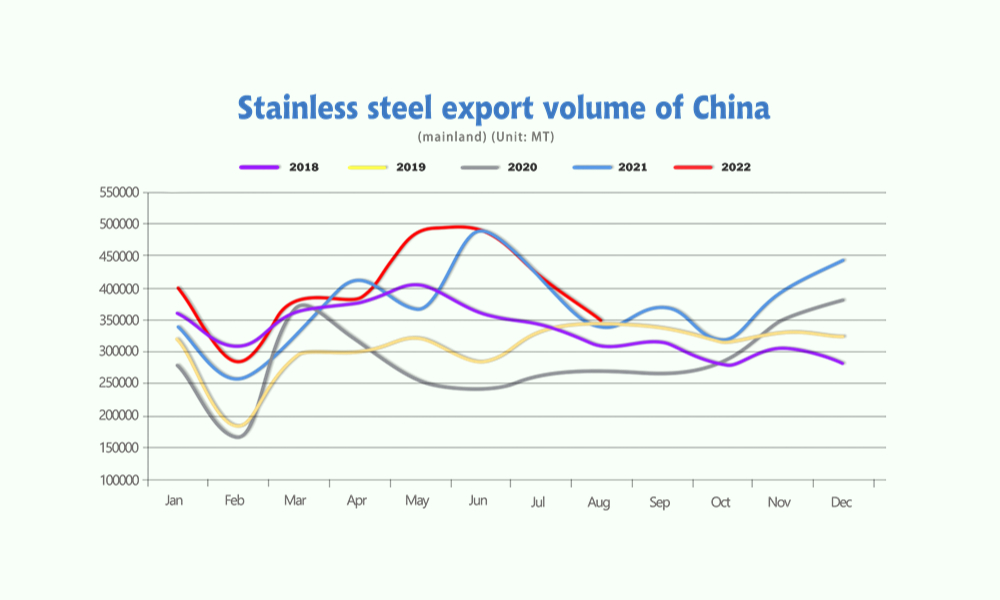

According to China Custom, the stainless-steel export amount in August was 36,700 tons, a 200,000-decrease compared to July. Accounting for 2,050,000 tons of stainless-steel consumption in August, it had a 3% drop from last month and a 25% decent compare with the same period last year. The low consumption could result from the dropping demand for export and the backflowing Indonesian shipment. However, the consumption could hit 2,300,000 tons due to the low inventory level and September, as known as China traditional commodity sales high season.

Series 200: plain performance in transaction

The AOG was creeping up a little compared to last month. The slight increase in social inventory was mainly taken up by Baosteel and Beigang new material, some thickness varieties in series 200 were out of stock.

Series 300: Inventory in, Inventory out

The AOG was increasing after the interruption of the typhoon, and the inventory level at Wuxi and Foshan was stabilized but still considered as low level. The resources in bulk from Delong Steel will be arriving at Wuxi at the end of September allegedly, the inventory level is projected to go up.

Series 400: Inventory downed

The transaction was in fair performance and the reduction in inventory level was notable as the production had recovered. The 7-days holidays of China National day might prompt the trader to reduce the selling price.

RAWMATERIALS|| The US interest rate hike suppresses the prices.

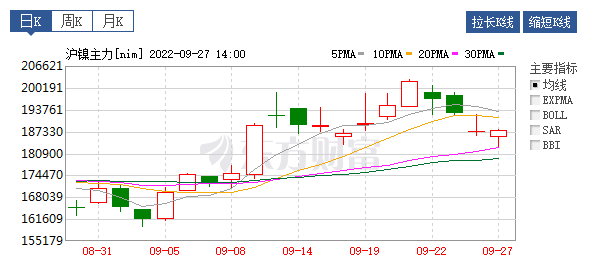

Nickel: ShFE nickel could head down after peak while ferronickel standing strong

ShFE nickel was hyping up above US$28,780 at the beginning of last week but soon dropped below US$27,345 after the US Federal Reserve increased the interest rate, again.

ShFE nickel price fluctuated as the Fed raised the interest rate.

The price of nickel ore was increasing affected by the chain reaction of the typhoon. The miners, on the other hand, might not give way to cutting the selling price. Hence, the off-season of shipping in the Philippine is drawing near, and the price of nickel ore will be estimated to stand firmly.

As for the price of ferronickel, it had a small step up and does not seems to be easily shifted by the mills. The mills in downstream, however, had stocked up in the earlier stage and were discreet about the lump-sum purchase. According to China Custom, in August, the import volume of ferronickel totalled 625,400 tons and hit a historic high with approximately a 78.85% increase from the same period last year, the import from Indonesia taking up to 93% of the total volume.

The price of the refined nickel maintained at a high-level last month and the buyers at downstream were pessimistic about the upraising price. The LME nickel had bounced back to 52,500 tons at the oversea inventory though the inventory level was still considered low. Under the impact of increasing US interest rates and the US Dollar Index, the price of the nickel is likely to be suppressed in a short term.

In summary, the price of nickel ore and ferronickel was gradually reaching upward, but the high-standing price might slump down as it is closely affected by the ascending US interest rate.

Chrome: The demand for chromium ore reduces becasue of the production cut of high chrome.

The spot price of chrome ore was slowing down the pace of upraising. The trading price of the concentrated ore (40%~42%) from South Africa was stabilized. The price of chrome is not likely to increase in the short term. It is because the market demand is dropping as high chrome factories are cutting production.

According to the China custom, the import volume of Chrome ore reached 1,156,400 tons in August, and South Africa accounts for 1,010,600 tons (87%) of the total amounts last month. The total import volume of chrome ore until August accumulated around 10,084,900 tons.

The high standing production cost of high chrome could be led by the increasing price of raw material, coke, electricity fare and freight rate. Hence, the high chrome mills still suffer from losses, and the price of chrome is not likely to ascend in the short term.

MACRO|| Major economic entities are facing important policy changes.

The global market is still volatile no matter the financial or political range. The S&P 500 (.SPX) fell to its lowest level in almost two years on September 27th on worries about super aggressive Federal Reserve policy tightening, trading under its June trough, and leaving investors appraising how much further stocks would have to fall before stabilizing. Britain is also making a path to stabilizing the economy and launching a new economic strategy, generally, by reducing interest rates. As in China, the 20th National Congress of CPC will be the most important determinant of almost everything in the future. The Congress is to be held on October 16th and last for about one week.

US: Lifting up 75bp interest rate, the dollar remains strong.

On September 22, the Federal Reserve’s Monetary Policy Committee announced that it would raise the benchmark interest rate by 75 basis points to a range of 3.00%-3.25%, and it has raised interest rates by 75 basis points three times in a row. Basically, the action is in line with market expectations, but the higher rate hike still makes the capital market sentiment cautious. After the rate hike was implemented, the U.S. dollar index continued to rise, hitting a two-decade high, while the three major stock indexes closed down collectively. The domestic Shanghai Composite Index ran under pressure during the day, and commodity market prices were relatively firm.

Britain’s new government outlined plans to cut taxes and boost spending

Prime Minister Liz Truss, who took office less than three weeks ago, is racing to combat inflation, which is at a nearly 40-year high of 9.9 percent, and head off a prolonged recession. Facing a general election in two years, she needs to deliver results quickly.

China: The Congress will largely decide the future from all angles.

The Chinese government continues to boost foreign trade by prolonging the tax payment term, reducing the service fee, and breaking the invisible threshold.

More importantly, the world is focusing on the approaching Congress.

The Congress is held every five years, and it is the dominant indicator for the future five years and even the future of China because it decides the next leader and the base of the political as well as economical direction. Particularly, when the world is now full of uncertainties, more and more governments, and enterprises will reconsider their global strategies.

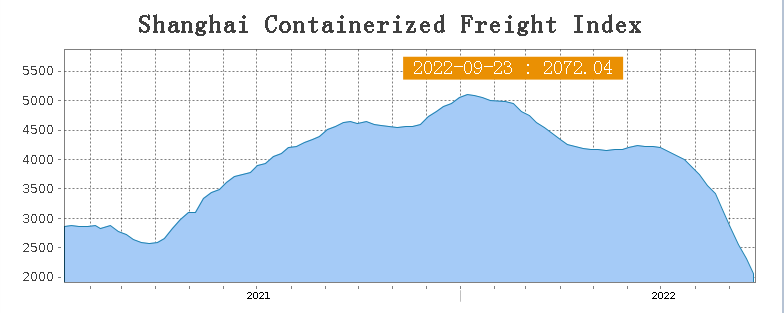

SEAFREIGHT|| Demand and freight collapse.

Recently, the transportation market maintains sluggish, and transportation demand is losing its growth momentum. From September 19th to September 23rd, the market freight rates of ocean routes continued to decrease. On September 23, the Shanghai Export Containerized Freight Index released by the Shanghai Shipping Exchange was 2,072.04, down by 10.4% from the previous week.

On September 23, the SCFI was 2,072.04.

Europe/ Mediterranean: Consumer confidence index continues to reduce in Eurozone to -28.8, breaking historic low which is far lower than the market expected. Winter is approaching, and it will escalate the energy crisis and inflation, hitting consumers’ sentiment. Thereby, the demand is shrinking and it reduces the demand for transportation. On September 23rd, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European base port market was US$3,163/TEU, down by 10.8 % from last week. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean base port market was US$3,249 /TEU, down by14% from the previous week.

North America: Inflation remains high. The Fed has taken an aggressive measure to fight back by increasing the interest rate, disturbing the financial market. The continuous contraction moves pull back the recovery of economy and employment. On September 23rd, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East base ports were US$2,684 /FEU and US$6,538 /FEU, respectively, down by 12% and 8.9% from the previous week.

The Persian Gulf and the Red Sea: Demand continues to drop in the local market. On September 23rd, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the basic port of the Persian Gulf was US$988/TEU, decreasing by 19.8% from the last week.

Australia/ New Zealand: Demand shows a declining tendency. On September 23rd, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the basic ports of Australia and New Zealand was US$1,956 /TEU, down by 13.5% from the previous week.

South America: Some economic entities have great debts. Influenced by the Fed interest rate hikes, the local financial market is volatile. On September 23rd, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American base ports was US$5,479/TEU, decreasing by 13.6% from the previous week.