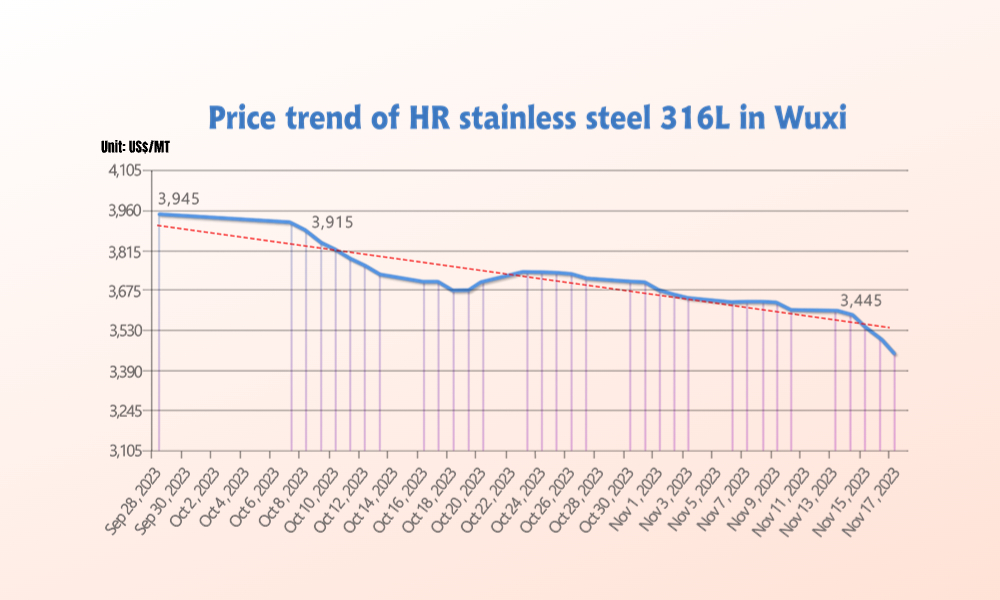

The cold windswept to China’s stainless steel market last week. The stainless steel prices remained low; last week, they just went even lower. The decrease of stainless steel 316L in price reached US$102/MT weekly. Other major grades of stainless steel were reduced as well. Demand plummets with the holiday season approaching. The last market report mentioned that the mills would cut their output in November due to the unbearable loss. However, as the raw material cost decreased, the profit margin of stainless steel fixed up a bit, which stimulated the mills to speed up their maintenance and end the suspension period in advance. This means that the supply of stainless steel will increase in the market in December and the coming 2024. Can you imagine, if the demand remains bearish? For more about the market, please roll up to the full report of our Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,240 | -45 | -2.09% |

| Foshan | 2,280 | -45 | -2.05% | ||

| Hongwang | Wuxi | 2,160 | -44 | -2.10% | |

| Foshan | 2,150 | -58 | -2.77% | ||

| 304/NO.1 | ESS | Wuxi | 2,065 | -44 | -2.20% |

| Foshan | 2,085 | -44 | -2.18% | ||

| 316L/2B | TISCO | Wuxi | 3,705 | -102 | -2.77% |

| Foshan | 3,790 | -102 | -2.71% | ||

| 316L/NO.1 | ESS | Wuxi | 3,525 | -88 | -2.51% |

| Foshan | 3,585 | -88 | -2.47% | ||

| 201J1/2B | Hongwang | Wuxi | 1,385 | -8 | -0.66% |

| Foshan | 1,385 | -10 | -0.77% | ||

| J5/2B | Hongwang | Wuxi | 1,285 | -8 | -0.72% |

| Foshan | 1,300 | -10 | -0.83% | ||

| 430/2B | TISCO | Wuxi | 1,300 | -8 | -0.71% |

| Foshan | 1,280 | -3 | -0.24% |

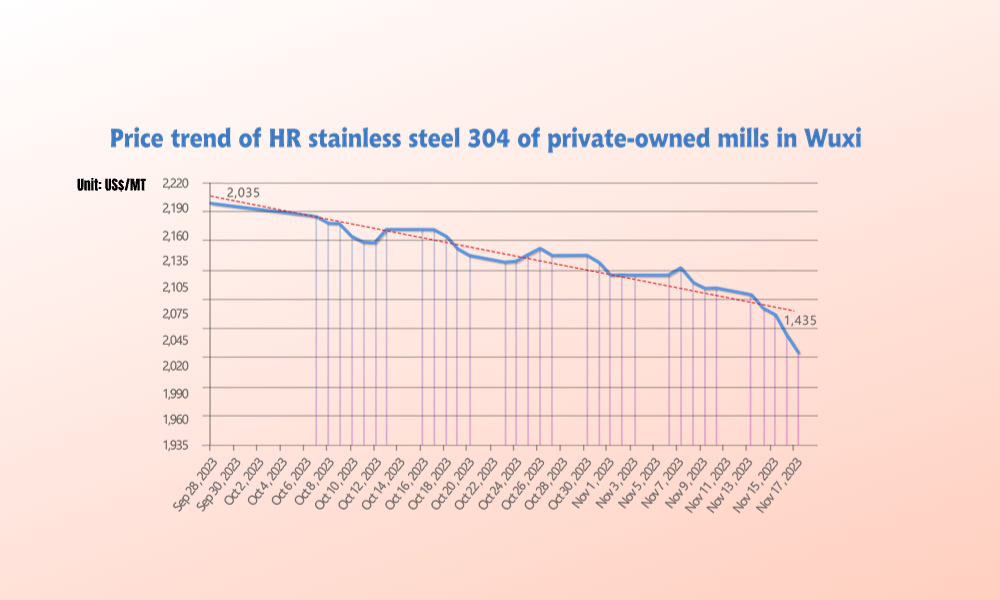

TREND|| Stainless steel price is on an expedition to a deeper end.

Affecting the “wait-and-see” sentiment on the market, the spot price of stainless steel dived through US$2100/MT. The mainstream contract price fell by US$71/MT to US$2085/MT.

Stainless steel 300 series: Market price continues to be exsanguinated.

The average market price of stainless steel had a tragic collapse last week. Until last Friday, the mainstream price of cold-rolled 4-foot mill-edge stainless steel 304 and hot-rolled stainless steel 304 plunged by US$70/MT to US$2085/MT and US$2025/MT respectively.

While the whole stainless steel market was in a sluggish state, agencies and traders were panic selling their goods.

Stainless steel 200 series: The price floor lifted, and the market could be shaken once again.

The spot price of stainless steel 201 maintained a downtrend until last Friday: the mainstream base price of cold rolled stainless steel 201J1 and 201J1/J5 fell US$14/MT to US$1350/MT and US$1250/MT accordingly. The five-foot hot-rolled stainless steel remains unchanged at US$1300/MT.

Quotation: Bao Steel Desheng’s guidance price was finalized at US$1260/MT with a US$14/MT drop; Beigang New Material downward adjusted their guidance price of stainless steel 201J5/2B to US$1260/MT and Tsingshan’s stainless steel 201J2/2B was quoted as US$1255/MT with a US$14/MT decrease.

Stainless steel 400 series: The price trend of 430 might be shaken by the weak demand

Both TISCO and JISCO unchanged their market guidance price of Stainless steel 430/2B last week, it was quoted as US$1450/MT and US$1555/MT.

Ningbo Baoxin remained open for negotiations of the EXW price of cold-rolled stainless steel 304, while they quoted cold-rolled stainless steel 430 for US$1630/MT.

The quotation of 430/2B in the Wuxi market was stable but slightly weak, the mainstream quote price fell by US$14/MT to US$1300/MT, and stainless steel 430/No.1 reached US$1160/MT.

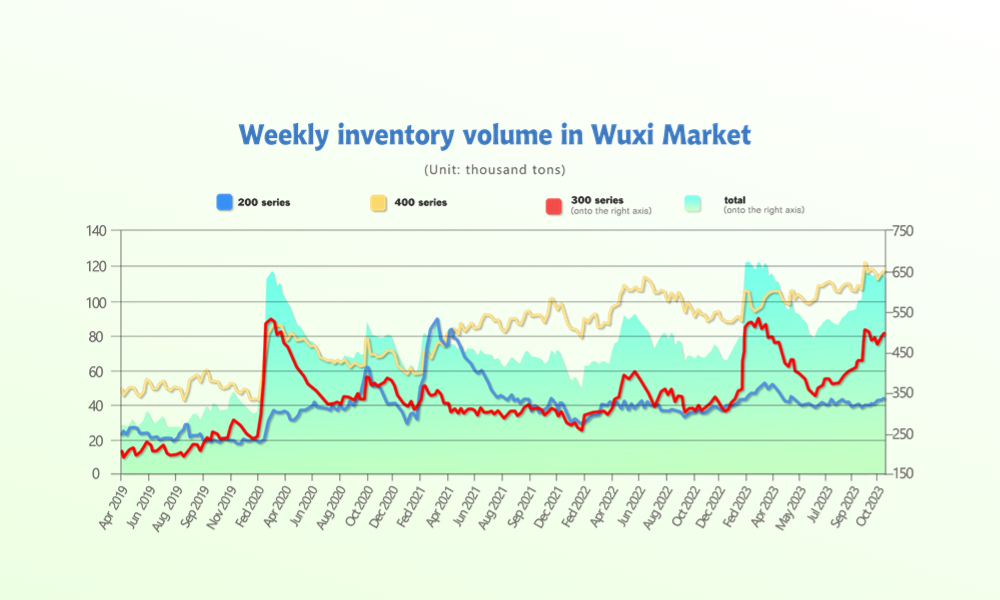

INVENTORY|| Supply had a slight rebound while prices was plummeted.

The total inventory at the Wuxi sample warehouse lifted by 5,654 tons to 648,894 tons (as of 16th November).

the breakdown is as followed:

200 series: 372 tons down to 42,177 tons

300 Series: 3,066 tons up to 488,969 tons

400 series: 2,960 tons up to 117,748 tons

Stainless steel 300 series: Inventory went up a bit.

The stainless-steel market has been going through some downbeat days recently while the spot price and future price of stainless steel were dropping together within the stocking period. Although steel mills and agencies are adopting underselling, the actual transaction has shown a disappointing result.

Stainless steel 200 series: A tiny bit of inventory was wiped out.

The market trend of the 200 series remains sedated except the future price experience a minor “hiccup”. There was no significant movement in the inventory last week as market demand remained weak.

Stainless steel 400 series: Prices were weakly stabilized.

The digestion of the 400 series inventory was slower than expected, and most of the traders greatly cut their quotations as possible as they could to facilitate purchases. It is estimated that the inventory of the 400 series will fluctuate slightly in the short term.

RAW Material|| Production cost continues to dive.

The price of high ferronickel extended the downtrend from the previous week: the mainstream EXW price was quoted as US$250/nickel point, and the ferrochrome remained unchanged at US$1285/MT (50% chromium).

Chrome: Cold season to snap down production.

The EXW price of high-carbon ferrochrome ceased the weak momentum and closed between US$1285/MT-US$ 1315/MT (50% chromium).

It is understood that the production cost of some ferrochrome producers in Southern China will peak due to a more expensive cost of electricity, and even some producers choose to halt production. Nonetheless, high-carbon Ferrochrome producers in inner Mongolia are pushing the production volume to a higher level at 450,000 tons. The price of high-carbon ferrochrome will remain “weak-stable” in the short term as the demand for stainless steel raw materials will slide.

Nickel: Indonesia attempts to limit nickel export by lifting the export duty.

Sizeable output cuts will help shore up nickel prices, which are likely to have reached a bottom after a year-long slide, but tighter supplies are not expected to eliminate surpluses.

Specifically, the cutbacks have affected nickel pig iron (NPI) and ferronickel, both used to make stainless steel, where prices at around $14,000 a metric ton have dropped more than 15% since the third quarter of 2022.

On the London Metal Exchange (LME), nickel prices trading below $18,000 a ton have plunged 45% since December, but as yet production cuts of LME grade material have not been seen. Macquarie analyst Jim Lennon estimates more than 100,000 tons nickel production, mostly ferronickel, has been cut so far.

“Using an LME price of $18,000, we estimate nearly one-third of the industry is cash flow negative,” Lennon said, adding further cuts were likely, particularly in Chinese NPI output.

“A fall in LME prices to below $15,000 would push another 35-40% of the industry into loss making territory, suggesting considerable support for prices well above $15,000 and probably in the $17,000-18,000 range.”

The average forecast in a recent Reuters survey was for a nickel market surplus of 200,000 tons this year and 205,000 tons in 2024. Global supplies are forecast to total around 3.3 million tons this year.

Surpluses are due to falling stainless steel production, weaker than expected demand from manufacturers of electric vehicle batteries and mounting supplies from top producer Indonesia, which accounts for nearly half of global mined production.

“With such a huge global dependency on supply from the country there is a risk this emboldens Indonesia to exercise its dominant position to behave like a de-facto swing producer,” Citi analysts said in a note.

“This risk increases in a lower price environment. Indonesian nickel supply also faces risks more broadly from ore grade depletion, regulatory actions, and pressure to address ESG issues.”

Indonesia earlier this year revoked more than 2,000 mining permits for various minerals including nickel, in an attempt to tighten governance in the sector.

Sources say the Indonesian government could attempt to help buttress nickel prices by trying to limit nickel ore shipments with higher export taxes.

Summary: Off-Season, Price Reduction and Destocking Are the Main Trends

Stainless steel prices continued to decline this week, with a significant increase in trading volume and open interest on the futures side. The bears actively initiated selling, leading to low market confidence. The atmosphere in the spot market was subdued due to the off-peak season and maintained high inventories at steel mills. The market, in general, focused on reducing inventory through price cuts, and the center of gravity for raw material prices continued to decline. Currently, the supply is relatively abundant, traders maintain low inventory, and spot sales are in a loss-making state, with downstream industries having little replenishment demand. It is expected that the supply side will continue to proactively reduce production capacity to alleviate supply and demand imbalances. Continuous attention is needed on steel mill production plans and destocking in the market. The stainless-steel market is anticipated to continue weak and oscillating.

300 Series: Raw material prices and cost support continued to decline, and under the high-pressure inventory, steel mills lifted price restrictions, leading to a significant drop in stainless steel spot prices, breaking through the US$2100 mark. After the price adjustment, transaction volumes improved on some working days. Short-term stainless steel prices are expected to maintain a weak trend under destocking pressure, with attention on the market's buying behavior after the price fall.

200 Series: This week, the 201 market mainly experienced a downward trend. From mid-October to now, the spot prices of 201 have been operating with an overall downward trend. Upstream steel mill supplies increased, and high production gradually entered the market. However, the downstream demand remained weak, resulting in a subdued atmosphere for spot transactions and slow destocking. Spot prices lacked support and slightly declined. The current market sentiment is pessimistic, and it is expected that 201 prices will continue to oscillate weakly in the short term. The 201J2/J5 cold-rolled base is expected to oscillate in the range of US$1245/MT-US$1265/MT.

400 Series: Main raw material prices in the high-chromium market were weak and stable, and the cost support for 430 stainless steel weakened. At the beginning of last week, the market price of 430 cold-rolled stainless steel was adjusted downward, with businesses offering discounts for destocking. According to statistics, the inventory of the 400 series increased slightly again this week. The market's spot inventory digestion is limited, and the demand is mainly for just-in-time orders. Due to the reduced production plan for the domestic 400 series in November, the supply pressure is expected to ease slightly. However, considering the current high inventory levels and the absence of specifications in short supply, downstream industries are purchasing on demand. The spot prices of the 400 series are expected to be weak and stable.

Sea Freight|| Freight rate dropped in main freight line.

China’s Containerized Freight market was overall stabilized, On 17th November, the Shanghai Containerized Freight Index rose by 2.9% to 999.92.

Europe/ Mediterranean:

European Central Bank President Christine Lagarde on Friday said Europe is now at a critical juncture, with deglobalization, demographics and decarbonization looming on the horizon.

“There are increasing signs that the global economy is fragmenting into competing blocs,” she said at the European Banking Congress, according to a transcript.

On 17th November, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$707/TEU, which fell by 2.1%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1147/TEU, which fell by 3.1%

North America:

The loading rate in North American Freight line rebound and maintained steady last week.

On 17th November, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1696/FEU and US$2351/FEU, reporting a 8% and 0.1% decline accordingly.

The Persian Gulf and the Red Sea:

On 17th November, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 3.2% from last week's posted US$1271/TEU.

Australia/ New Zealand:

On 17th November,the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$946/TEU, a 3.8% jump from the previous week.

South America:

The freight market had a slight rebound. On 17th November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2812/TEU, an 1.6% increment from the previous week.