Can we see demand recover in 2024? ShFE Nickel hiked for three days in a row, pushing up stainless steel futures prices. Until last Friday, stainless steel futures contract 2405 raised by 3.15%. Besides, as we also mentioned in the last report the social inventory was accumulated less than expected during the Spring Festival. The low inventory gives another boost to the stainless steel prices. Back to the topic of nickel, the Indonesian presidential election has ended. There are obvious differences between former President Jokowi and current President Prabowo in the development of "nickel". President Prabowo's economic policies are more nationalistic, and future nickel export policies need to be closely followed. Other than Indonesia, based on the recent news, the global nickel output will tend to reduce. If you want to know more about the stainless steel dynamics, please keep reading our Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,150 | -11 | -0.55% |

| Foshan | 2,195 | -11 | -0.54% | ||

| Hongwang | Wuxi | 2,070 | 1 | 0.07% | |

| Foshan | 2,070 | -13 | -0.64% | ||

| 304/NO.1 | ESS | Wuxi | 2,000 | 7 | 0.37% |

| Foshan | 2,015 | -13 | -0.66% | ||

| 316L/2B | TISCO | Wuxi | 3,655 | 0 | 0.00% |

| Foshan | 3,755 | -22 | -0.62% | ||

| 316L/NO.1 | ESS | Wuxi | 3,525 | -70 | -2.02% |

| Foshan | 3,550 | -6 | -0.16% | ||

| 201J1/2B | Hongwang | Wuxi | 1,425 | 7 | 0.54% |

| Foshan | 1,420 | 7 | 0.54% | ||

| J5/2B | Hongwang | Wuxi | 1,340 | 6 | 0.46% |

| Foshan | 1,335 | 7 | 0.58% | ||

| 430/2B | TISCO | Wuxi | 1,255 | 0 | 0.00% |

| Foshan | 1,255 | 7 | 0.62% |

TREND|| ShFE nickel hikes for three days in a row

Last week, the spot prices of stainless steel in the Wuxi market saw a slight increase compared to the pre-holiday period, with strong upward momentum from steel mills. Benefiting from reduced production due to maintenance before and after the Spring Festival, the overall decline compared to last year was significant. The upward trend in the market continued, driving spot prices upward. As of this Friday, the main contract price of stainless-steel rose by US$60/MT to US$2095/MT compared to before the holiday, an increase of 3.15%. ShFE Nickle opened with an uptrend, reaching a high of US$19,164/MT during trading, the highest in nearly three months. Shanghai nickel has risen for three consecutive sessions, up US$1430/MT from before the holiday, an increase of 7.42%.

300 series: Inventory is lower than expected, and futures are strong.

The price of stainless steel 304 in the market increased last week. As of Friday, the mainstream base price of cold rolled 4-foot stainless steel 304 in the Wuxi area was reported at US$2040/MT, an increase of US$7/MT compared to before the holiday; the private produced hot-rolled stainless steel price was reported at US$2040/MT, an increase of US$35/MT compared to before the holiday. After the Chinese New Year holiday, the inventory level in the market was lower than expected, and most spot prices remained stable. Futures performed strongly in the middle of last week, with market quotations rising slightly, and the trading atmosphere was generally good.

200 series: Good news for 201 at the start of the new year.

Last week, the spot price of 201 in the Wuxi market mainly showed a stable upward trend. As of last Friday, the mainstream base price of cold-rolled stainless steel 201J1 in the Wuxi market increased by US$14/MT compared to the previous week, reaching US$1405/MT; cold rolled stainless steel J2/J5 increased by US$14/MT and reaching US1320/MT; the mainstream price of five-foot hot-rolled stainless steel increased by US$14/MT closed at US$1365/MT. In the first week of the new year, the price of 201 showed a stable upward trend. Since the opening of the market, Hongwang has issued a new price guidance for 201 cold-rolled, followed by agents issuing price adjustment for 201(Hongwang March futures J2-US$1320/MT; J1-US$1405/MT (specification 0.55mm and below will add US$28/MT)). Boosted by the news, traders in the market have successively raised their quotations, and the overall trading volume has been good throughout the week.

400 series: Inventory increases, demand is gradually released, and 430 prices remain stable!

This week, the guide price for 430 cold-rolled stainless steel from TISCO was US$1455/MT, and from JISCO was US$1575/MT, both up US$7/MT from previous week. The mainstream quotation for state-owned 430 cold-rolled stainless steel in the Wuxi market last week was US$1255/MT to US$1265/MT, and the price of 430 hot-rolled was around US$1145/MT, both unchanged from last week. Due to the support of raw material costs, both TISCO and JISCO raised their guide prices for 430 cold-rolled stainless steel, and there was a strong willingness from steel mills to increase prices.

INVENTORY|| Stock piles lower than expected during the Spring Festival

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| January 18th | 36,317 | 365,312 | 114,658 | 516,287 |

| January 25th | 37,633 | 425,144 | 141,318 | 604,095 |

| Difference | 1,316 | 59,832 | 26,660 | 87,808 |

300 Series: Inventory of the 300 series in the Wuxi market accumulated to 425,100 tons (excluding warehouse receipts), with both cold and hot rolling inventory showing significant accumulation. Spot market transactions stagnated last week, and the accumulation of inventory was routine due to the impact of the long holiday and the adverse weather affecting the transportation of some goods, resulting in reduced arrivals. The overall inventory accumulation this time was lower than the same period last year (during the 2023 Spring Festival, the inventory accumulation of the 300 series in the Wuxi area was nearly 150,000 tons). It is reported that due to limited shipments during the holiday, most resources from some steel mills are still in transit, leading to continued pressure on inventory accumulation in the Wuxi area this week.

200 Series: In terms of inventory, with the concentrated maintenance and production reduction of 200 series steel mills before and after the Spring Festival, the pressure on recent arrivals is limited. The steel mill B in South China, which was shut down for maintenance, officially resumed production on January 28th. It is expected that the supply of the 200 series will gradually loosen in the later period.

400 Series: During the Spring Festival, the inventory of the 400 series accumulated to 141,300 tons, with both cold and hot rolling inventory showing significant accumulation. This was mainly due to the stagnation of transactions during the Spring Festival, with all steel mills having arrival resources, resulting in a significant increase in pre-stock inventory at steel mills.

RAW MATERIAL|| It is worth betting on the Ores.

Nickle: Indonesia's restrictions on new capacity and the issuance of new licenses are expected to lead to an 8% reduction in nickel production capacity Since last year, the global nickel market has been experiencing increasing oversupply, causing nickel prices to decline continuously.

To alleviate the oversupply situation, Indonesia, the world's largest producer of primary nickel, has explicitly stated that it will not issue licenses for nickel metal smelting, and some operators with non-competitive costs have also gradually closed their production capacity. It is expected that the overall capacity of sulfide nickel production will decrease by approximately 8% in the future. Indonesia possesses the world's largest nickel reserves.

According to analysis by Huaxin, local governments are limiting the development of new mining and the issuance of new licenses to avoid overexploitation. It is unlikely that the new Indonesian government will change this policy.

Additionally, this approach also aims to encourage the industry to shift downstream towards stainless steel and electronic materials in the future. Furthermore, internationally, sulfide nickel production capacity in Australia and some parts of Russia is being phased out, and closures are expected to continue, which could potentially reduce overall supply by about 8%. The oversupply pressure in the global nickel market has not been alleviated so far. Nickel pig iron prices were as high as US$270/nickel point in October last year but dropped to US$240/nickel point in December. In January this year, it fell further to only US$235/nickel point. Although it has now rebounded back to US$240/nickel point, overall prices are still at a low level. With the slump in both volume and price, the profits of many international miners have also greatly diminished.

Huaxin believes that the resource industry is still experiencing oversupply overall. Combined with the continuous decline in nickel prices since October last year, prices are still at a low level. It is expected that the first quarter will still be at the bottom, and profits may be even lower than in the fourth quarter of last year. Expectations are for gradual growth in overall nickel demand, supported by demand from batteries and stainless steel, despite the international policies and the replacement of old and new capacity.

Chrome: From December 2023 to February 2024, the price of high-carbon ferrochrome has remained stable for over two months, maintaining at around US1305/MT and US$1355/MT(50% Chrome). Despite the active resumption of work by factories after the Spring Festival, there are still quite a few who are waiting and observing for the right opportunity. One major reason for factories to adopt a wait-and-see attitude is the significant cost pressure. After the holiday, the price of chromite ore remains high, with signs of further increases. Recently, domestic chromite ore spot prices have remained relatively firm, with prices of 40-42% South African fines rising to around US$8/MT. On one hand, this is due to the high operating rates of high-chromium smelters, which have a large demand for this type of ore in China. On the other hand, the situation in the Red Sea region continues to affect market sentiment.

SUMMARY || Nickel Price Boosts Stainless Steel

Stainless steel prices showed slight strength and fluctuation this week, driven by the rise in nickel prices. Spot prices also saw a boost, with the general market trading atmosphere. Post-holiday downstream markets have not fully recovered, with social inventories remaining high. Raw material prices remained firm, leading to shrinking profits for steel mills. Currently, the arrival of spot resources in the market is limited, with ongoing attention on subsequent deliveries from steel mills. It is expected that stainless steel will experience a slightly strong and fluctuating trend in the future.

300 Series: With current raw material prices showing a slight increase and a positive macro atmosphere, market sentiment has improved. Post-holiday inventory pressure is still manageable, and with downstream resumption of work, demand is gradually releasing. It is anticipated that the base price of cold rolled 304 may fluctuate in the range of US$2015/MT and US$2085/MT, with subsequent attention on the intensity of demand release and resource arrival.

200 Series: In the first working week of the new year, both the new guidance prices from Tsingshan Hong Wang and the news of price support from steel mills have triggered reactions among stainless steel traders. The market was active throughout the week, with expectations that next week's price for cold-rolled stainless steel 201J2 will fluctuate in the range of US$1315/MT to US$1385/MT.

400 Series: The trading atmosphere in the Wuxi market gradually improved this week, with downstream demand gradually releasing. It is expected that the pressure on inventory in the spot market may ease in the short term. The price of 430 is expected to remain stable in the near term.

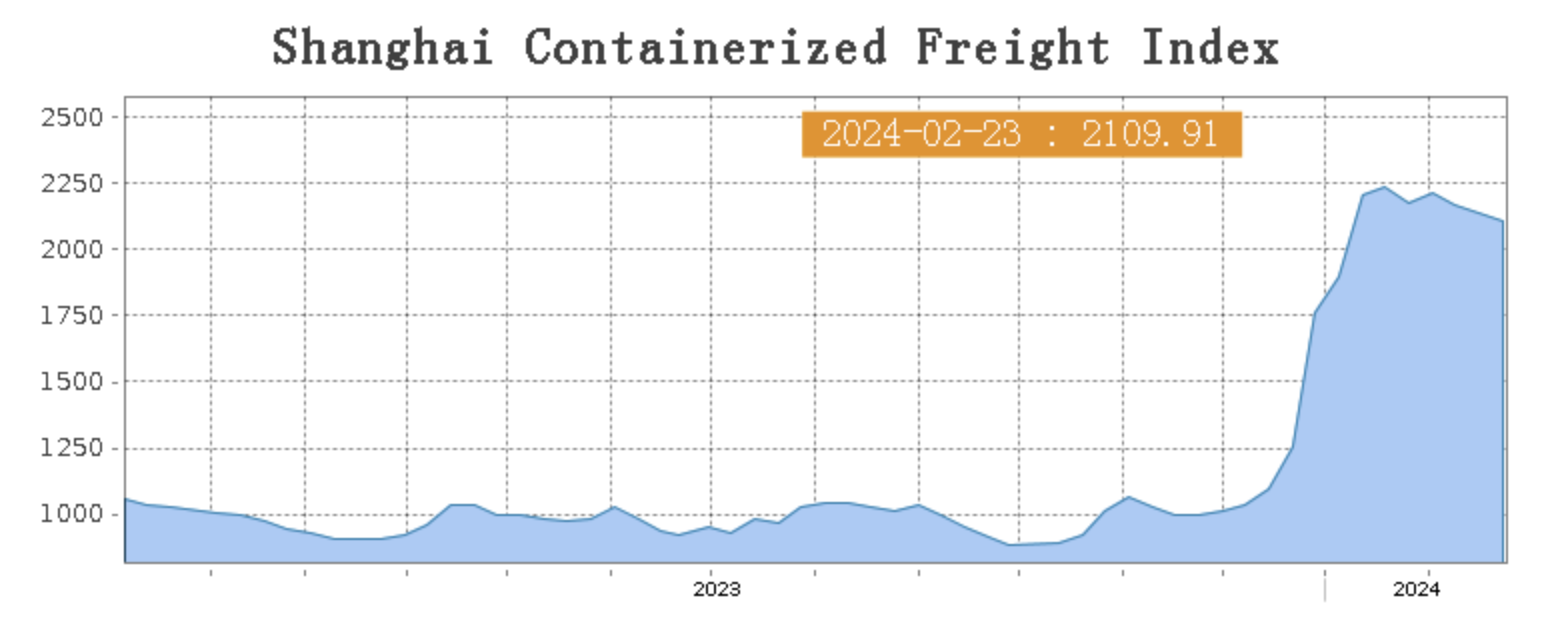

Sea Freight|| Freight market opened with a sluggish start.

After the 'Spring Festival' holiday, the Chinese export container shipping market is in a phase of recovery, but the recovery appears somewhat weak. Most route markets have far less cargo volume compared to before the holiday, and freight rates continue to decline, dragging down the composite index. On 23rd February, the Shanghai Containerized Freight Index dropped by 2.6% to 2109.91.

Europe/ Mediterranean:

The economic recovery in the European region will continue to face challenges in the future. Additionally, tensions in the Red Sea region remain unresolved, leading major shipping companies to continue bypassing the area. Post-holiday transportation demand has been average, and last week the market freight rates have continued to decline.

On 23rd February, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$2508/TEU, which decreased by 5.3%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$3465/TEU, which dropped by 6.5%

North America:

The market transportation demand has shown a slight and slow recovery after the holiday, with an imbalance in supply and demand. Freight rates in the market had risen significantly earlier, but continued to decline last week.

On 23rd February, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$4691/FEU and US$6127/FEU, reporting a 2.9% and 5% slide accordingly.

The Persian Gulf and the Red Sea:

On 23rd February, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf lifted by 9.7% from last week's posted US$1701/TEU.

Australia/ New Zealand:

On 23rd February, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1213/TEU, a 1.2% drop from the previous week.

South America:

On 23rd February, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2625/TEU, a 2.3% growth from the previous week.