TREND|| The market is weakening.

Last week, the price of stainless steel remains the decreasing trend. Under the gloomy trend, people are reserved in buying. The more new products supplied to the market, the heavier pressure brought to the inventory, which drags down the price trend. Until Friday, November 19th, the price of stainless steel futures increased by over US$30/MT, up to US$2,885/MT.

300 series: The price of spot products decreases. The price difference between futures and spots narrows.

The price of stainless steel futures maintained stable last week. Until November 19th, the main contract increased by US$31/MT compared to that on November 12th, up to US$2,885/MT. Whereas the spot price of 304 was fluctuated to decline, down by US$95/MT. The CR 304 by private-owned mills in Wuxi market was reduced to US$3,075/MT. The price of HR products also went weak during the week because there were new arrivals in the market. The price was reduced to US$3,045/MT which was US$110/MT lower than the price on November 12th. The price difference between futures and spot narrowed compared to last week, but it is still over the average level. The futures contract prices are getting higher while the spot prices are getting lower, resulting in a larger volume of the warehouse receipts. Until November 19th, the warehouse receipt from Shanghai Futures Exchange left 3,461 tons which are 1,393 tons less than November 12th, hitting a new record low since the last settlement.

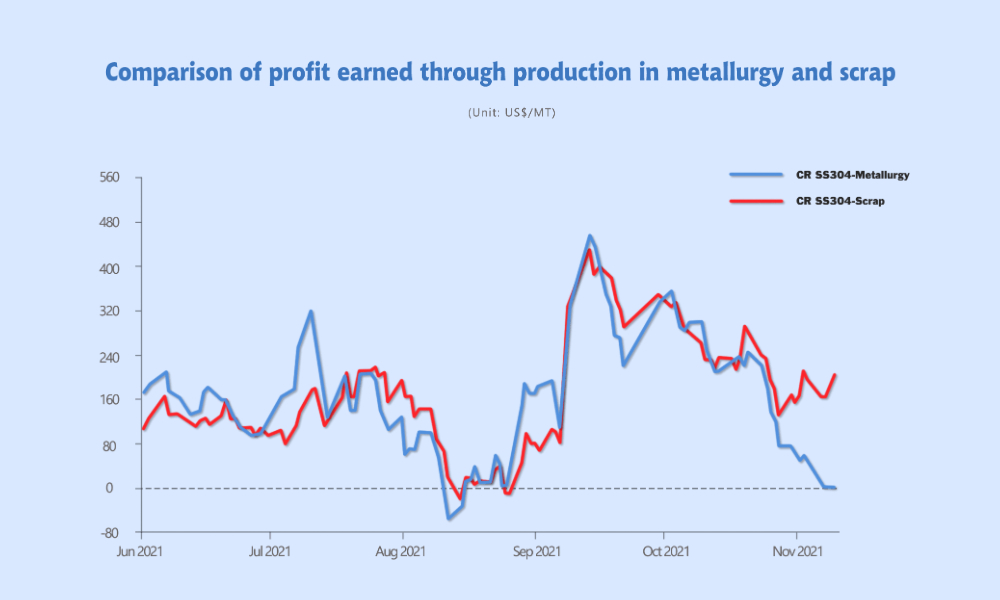

From the raw material side, the EXW price of the high nickel-iron reduced to US$237/nickel, ferrochrome down to US$1,540/50 base tons, decreasing by almost US$65/50 base tons. For now, theoretically, the production cost of cold-rolled stainless steel 304 is around US$2,954/MT. The profit per ton is in deficit. Currently, the SS304 scrap is US$1,984/MT, and the processing cost of the scrap is US$2,766/MT which is much lower than the metallurgical production cost, which means that the profit margin is larger. Besides, steel mills have greater dominance in purchasing steel scrap.

Last week, the price of 200 series dropped significantly in Wuxi market. Until November 19th, the coil of CR mill-edge 201J2 decreased by US$87/MT and the average price of last week was US$1,905/MT which was US$86/MT lower than the last weekly average price. As for the 5-foot HR J1, the price dropped by US$127/MT in a week the weekly average price down to US$1,765/MT which was US$108/MT lower than the last average price. The price difference between CR and HR widened to US$2446/MT.

Influenced by the continuously decreasing price trend, the market opened low. Last Monday, unlike the usual beginning of the week, the market was bland in a transaction. On Tuesday, the trade seemed to heat up, but in the noon, Tsingshan Hongwang opened a lower price on both HR and CR products, resulting in a further decrease in the prices in the next days. The market price dropped in consecutive 5 days. To boost the transaction, traders keep adjusting the prices to lower. It was like the trading volume is low because the price is not low enough. Therefore, in only 5 days, the price of a 5-foot HR product was cut down by US$127/MT. With the backlogs of the 200 series inventory, the price is facing a further decrease.

400 series: The demand is still tepid.

The production of high chrome regains since the electric bills are leveled up and the shortage of power supply has become a history for now. The supply keeps increasing.

Steel mills have recovered from the previous maintenance, and thereby the 400 series production has risen. The inventory broke the record high, up to 99,500 tons.

Mainland demand: It is weakening for now, but will recover.

On one hand, the 14th 5-year plan incorporates the elevator construction for the old apartments in many cities and provinces, including Jiangsu Province, Zhejiang Province, Shanghai, Guangdong, etc. It is predicted that in the future five years, the plan will appeal to the investment of 4 trillion RMB or more.

On the other hand, the intelligent elevator has attracted more market margin. In the commercial market, the intelligent elevator has taken 55.02% of the margin. In 2021, the market value of the intelligent elevator increases to 21.56 billion yuan and it is possible that in 2027, it will break through 41.485 billion yuan.

Summary:

Last week, the main contract of stainless steel futures fluctuated to decline. Under the low-pressure atmosphere over the spot market, it is also a lack of motivation for the stock market to increase.

The difference between the near delivery price and the forward delivery price widens. Prices of the contract of December are more than US$160/MT lower than the contract January, due to the futures price drops faster than the spot price, making the contract December prices get closer to the spot prices. Meanwhile, the volume of the warehouse receipt is extremely low and thereby the contract December is near to the spot price. On the other hand, the industry senses the cost cut in the raw materials such as ferrochrome and ferronickel. Currently, the prices of chrome and nickel have started to reduce.

Demand is weak because the stainless steel market is now in the slack season. But on the supply side, the production in November and September recover and increase compared to the third quarter. With the power supply recovering, the production will keep increasing and it is possible that the inventory will be larger.

As a result, the supply will remain stronger than the demand, and the spot prices will further decrease nearing the futures prices.

Price forecast:

300 series: The loosened production limit expands the supply stream and also suppresses the profit margin of steel mills. It is predicted that the prices of CR products of the private-owned mills will maintain the decreasing trend, and the base price may get to US$2,995/MT~US$3,030/MT.

200 series: So far, the trading is light in the stainless steel market. No bullish news is released in both the steel mills and the buyers. Similarly, it is predicted that the prices of 200 series, no matter it is CR or HR, will keep reducing.

400 series: The trading price of high chrome continued to decline. Last week, it decreased by US$48/MT~US$63/MT. Demand is still gloomy. Therefore, it is predicted that the price of 400 series will go down to around US$1,555/MT.

INVENTORY|| Total volume rises by 23,500 tons, which further cuts down the prices.

The total volume of the Wuxi sample warehouse increases by 23,500 tons, to 449,400 tons. 200 series inventory rises by 5,900 tons, reaching 41,600 tons; 300 series up by 8,700 tons, to 308,300 tons; 400 series increases by 5,900 tons to 99,500 tons.

200 series: Trading is weakening, supply is enlarging and the inventory is going higher.

Last week, the increase of the 200 series inventory is more than usual. Two reasons lead to the situation:

1. Baosteel Desheng, Beigang New Materials and Tsingshan all had arrivals to the market.

2. The trading has been light in the market. Even on the traditionally better Monday, no sign indicated the market was wakened.

As the futures market of the contract December fell on Tuesday, one more straw falls on the inventory. The slow consumption gradually stacks up the inventory.

300 series: The inventory keeps stacking up.

Tsingshan delivered about 11,000 tons of stainless steel 304 to the market; Beigang New Materials delivered 6,000 tons of HR SS304; SY sent 8,000 tons of HR products. Most of the new resources were sent to Wuxi market.

However, the demand remains weak. Although the prices kept decreasing, the trading failed to warm up.

400 series: Inventory increases.

The inventory of 430 also increases and the HR 430 increases the most. A steel mill in eastern China produced 50,000 tons of HR 400 series in October. Currently, the profit margin per ton of 430 is more beneficial than 201 and 304. In future production, steel mills will reallocate the production schedule, to arrange more effort in producing 430. It is predicted that the 400 series inventory will stack up.

RAW MATERIALS|| Ferromolybdenum price decreases by 14%.

On November 18th, the EXW price of ferromolybdenum has fallen to US$20,476/60 base tons in the past month. Since November, it has reduced by more than US$3,330/60 base tons, cutting down by 14%.

The main reason for the sharp drop, as the expert analyzed, it is the result of the decreasing production of the stainless steel 316L, which brought down the demand for ferromolybdenum.

Since November, molybdenum has dropped by US$45/MT. The price of 47% of the main grade of molybdenum fell from US$152/MT to US$306/MT, decreasing by 13.06%.

Although with the decline in prices, steel mills have recently enlarged their purchases, they have stronger bargaining power.

Recently, Tsingshan Group of China and Indonesia both bid for ferromolybdenum in China. The purchase price is US$20,279/60 basis tons (tax inclusive in cash); POSCO Zhangjiagang gave the latest bid price for ferromolybdenum in November was lowered to US$20,159/ 60 basis tons (half acceptance and half cash).

After the price of ferromolybdenum fell sharply, factories and traders became more reluctant to sell. Recently, the bulk cargo transaction has improved, and it is expected that the steel mills currently on the sidelines will enter the bidding at a later stage. As the trading volume continues to increase, the price of ferromolybdenum is expected to rebound.

Nickel: The inventory of LME nickel keeps decreasing.

The price of Shanghai nickel was sluggish at the beginning of last week, which fluctuated to fall to around US$22,220, but soon increased to US$23,490.

Nickel ore:

The price was stable last week. The nickel ore also enter the slack season, and it is predicted that the falling nickel price will drag down the price of nickel ore.

Ferronickel: Last week, the price was reduced slightly. One of the factors is the continuous declining prices of stainless steel. The nickel market is less competitive compared to the steel scrap in steel production, which strikes the ferronickel price in China. Since the market is sluggish, it is predicted that the ferronickel price will fall in a short term.

Refined nickel:

Chinese purchasers are sensitive to the prices. Earlier in the last week, the price was low, attracting more buyers to make a deal. With the demand side gradually heating up, the price of refined nickel increased significantly. Buyers were reserved. The stock prices again faced a decreasing risk. About the LME nickel, the inventory continued to drop to 123,400 tons. Generally, refined nickel will remain stable.

NEWS||A submerged arc furnace exploded. 2,500 tons of high nickel iron will be influenced.

On the 16th, a submerged arc furnace in the Delong stainless steel project in Indonesia exploded and the iron hole burned through. If it needs to be overhauled after inspection, it may take more than 3 months.

The shutdown of this furnace is expected to affect the high-ferronickel production in November by 2,500 tons. It is reported that the ferronickel produced in the Delong Stainless Steel Park is used for red steelmaking, which will not affect the supply for now in China.

But there is also news that the explosion may affect three nickel-iron production lines, but one of them is the most serious.

Stainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in China