The Chinese market fully returns and recovers quickly in February. The manufaturing PMI of China in January jumps by 3.1% to 50.1%, showing the srong momentum of the economy recovery in the post-pandemic era. The bright view of the future development boosts the stainless steel prices to increase steadily in these two weeks. The inventory of stainless steel remains large though, as more downstream manufacturers start to produce, the volume will soon be digested, people predict. Besides, from the perspective of raw materials, the cost tends to rise. The Philippines has plans to impose a tax on the nickel export just as Indonesia did to promote the industry. This act will definitely push the price of Chinese nickel products higher. As for the sea freight, the index generally declines but for the route to South America, the cost rose by 35% over the week. If you want to know more about the market, please keep swiping down to the Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,785 | 7 | 0.28% |

| Foshan | 2,830 | 7 | 0.28% | ||

| Hongwang | Wuxi | 2,705 | 16 | 0.64% | |

| Foshan | 2,695 | 9 | 0.35% | ||

| 304/NO.1 | ESS | Wuxi | 2,660 | 24 | 0.95% |

| Foshan | 2,665 | 15 | 0.59% | ||

| 316L/2B | TISCO | Wuxi | 5,060 | 177 | 3.75% |

| Foshan | 5,100 | 194 | 4.08% | ||

| 316L/NO.1 | ESS | Wuxi | 4,930 | 235 | 5.18% |

| Foshan | 4,920 | 209 | 4.58% | ||

| 201J1/2B | Hongwang | Wuxi | 1,610 | 6 | 0.40% |

| Foshan | 1,590 | 15 | 1.03% | ||

| J5/2B | Hongwang | Wuxi | 1,515 | 6 | 0.43% |

| Foshan | 1,520 | 13 | 0.97% | ||

| 430/2B | TISCO | Wuxi | 1,405 | 12 | 0.94% |

| Foshan | 1,400 | 19 | 1.54% |

TREND|| Stainless steel market awakens with a promising start.

The spot price of the stainless steel series varied last week. Stainless steel 304 fell after a lift, and stainless steel 201 and 430 remained a positive trend. The spot price of stainless steel overall was powerless to grow as the transaction was not fully recovered. The most traded contract price of stainless steel futures fell from US$46/MT to US$2650/MT.

Stainless steel 300 Series: Huge deposit in preparation for the market reopening.

Traders at Wuxi were back in business last week after the CNY holiday, but the down-stream business might reopen after 5th FEB. The demand, therefore, is remaining sluggish and pushing the inventory to a new record high.

The cold-rolled 4-foot mill-edge stainless steel 304 quoted US$2635/MT with a US$15 fall, and the hot-rolled stainless steel 304 rose US$15 to US$2650/MT.

Stainless steel 200 series: Price lifts a little

The movement of the most traded base price of stainless steel 201 was pretty much “synchronized”, all specifications had a US$7 increase last week.

Cold-rolled stainless steel 201 quoted US$1580/MT,

Cold-rolled stainless steel 201J2 quoted US$1485/MT,

Hot rolled 5-foot stainless steel closed at US$1530/MT.

The 4% increment in the inventory to some extent indicated the weak demand downstream.

Stainless steel 400 series: Prices rise steadily

Both TISCO and JISCO add US$30 more on the guidance price of 430/2B, quoted at US$1530/MT and US$1505/MT respectively.

The EXW price of cold rolled stainless 430 closed at US$1685/MT (quoted by Baoxin), a US$45 increase from the average price of January.

Meanwhile, the quoted prices of 430/2B in the Wuxi market increased by US$22 and rallied between US$1410/MT - 1415/MT.

Summary:

Stainless steel 300 series: The price of the stainless steel 300 series might find it challenging to grow in the short term as the market inventory is still hiking, but the high production cost might become the “X factor” to pump the price up.

Stainless steel 400 series: The most traded price of 430/2B rose as the EXW price of high chromium chromite and the spot price of chrome ore surged up. Inventory had a slight decrease owing to the warming up market transaction.

Stainless steel 200 series: The downstream industries are not fully resuming production before 6th February, the demand level is projected to rebound and the price of stainless steel 201 J2/J5 will be rallying between US$1475/MT – US$1505/MT.

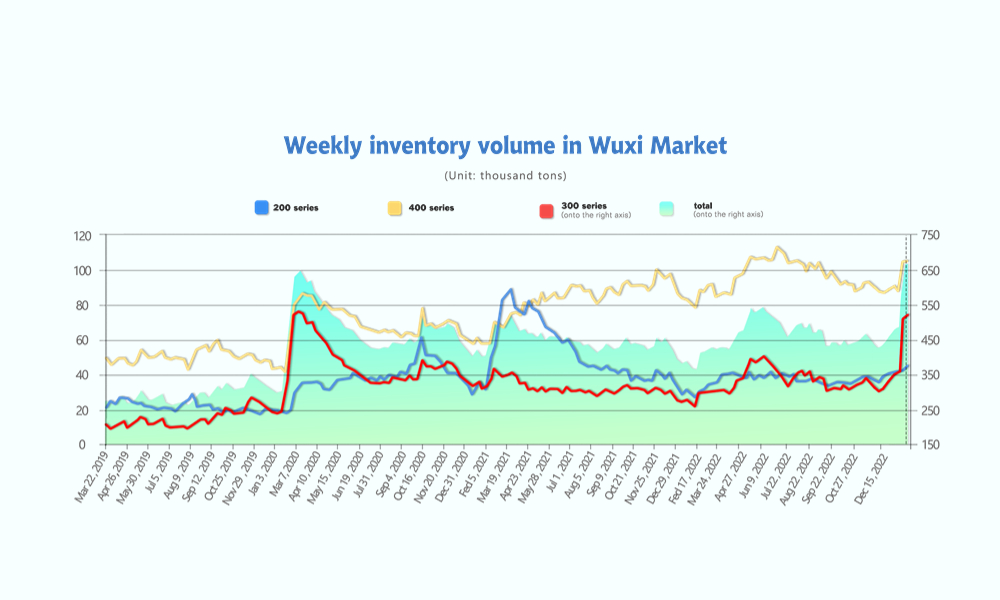

INVENTORY|| Oversupply led to a new inventory record.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| January 29th | 42,500 | 507,517 | 104,229 | 654,246 |

| February 2nd | 44,308 | 518,792 | 104,039 | 667,139 |

| Difference | 1,808 | 11,275 | -190 | 12,893 |

The inventory level at the Wuxi sample warehouse rose by 12,893 tons to 6667,139 tons (as of 2nd February).

the breakdown is as followed:

200 series: 1,808 tons up to 44,308 tons

300 Series: 11,275 tons up to 518,792 tons

400 series: 190 tons down to 104,039 tons

Stainless steel 200 series: inventory went up slightly.

The cold-rolled stainless steel resources in social inventory took up the major part of 4.25% of the inventory increment last week. The whole market still needs a bit of time to warm up and the end-users are very likely to turn active after the Lantern festival (5th February).

Stainless steel 300 series: over 500,000 tons awaited to be consumed.

Transactions currently in the market were mostly “trader to trader”. Delong distributed their cold-rolled products excessively which abounded the market deposit in the short term. 6th February is the return date for the downstream industries after CNY, it is predicted that the inventory level will start to slide in the coming week.

Stainless steel 400 series: The market is turning warm.

400 series had a great start in the market transaction after the Chinese New Year holiday, and inventory had digested a little as the demand recovered. A certain amount of the inventory is likely to be digested as the industry revives.

RAW MATERIAL|| Price of nickel surged in fear of export tax.

Nickel: Philippines may tax nickel exports to follow Indonesia’s success

The Philippines is considering taxing nickel ore exports among options to push miners in the world’s second-biggest supplier of the metal to invest in processing instead of just shipping raw minerals, a route that top nickel producer Indonesia has taken and succeeded in. Indonesia and the Philippines are the world’s biggest suppliers of nickel – used in making stainless steel and are key components in batteries for electric vehicles. But Indonesia banned exports of metal ores in 2020 and limited shipments to refined products, boosting China's nickel import from Philippines to 33.23 million tons in 2022 – 83% of total nickel import. The tax regime on nickel ore, overall, will greatly lift the production cost in China indefinitely.

The head of the Philippine nickel mining industry warned on Tuesday that the government’s plan to impose an up to 10% tax on nickel ore exports could force local producers to close up shop. “The initial proposal in the House of Representatives was 10%. That will kill the industry,” Dante Bravo, president of the Philippine Nickel Industry Association said.

So far, in the Philippine market, the price of Ni0.9%、AL7% quoted US$22/WMT, Nil.3% quoted US$46.5/WMT, Nil.5% quoted US$66-67/WMT.

In China market the price of Ni0.9%、AL7% quoted US$22/WMT, Nil.3% quoted US$46.5/WMT, Nil.5% quoted US$66-67/WMT.

If the tax regime is finalized, the 10% will eventually add up to the China Nickel trading price, and the profit margin of the industries is bound to drop steeply, and production could be ceased.

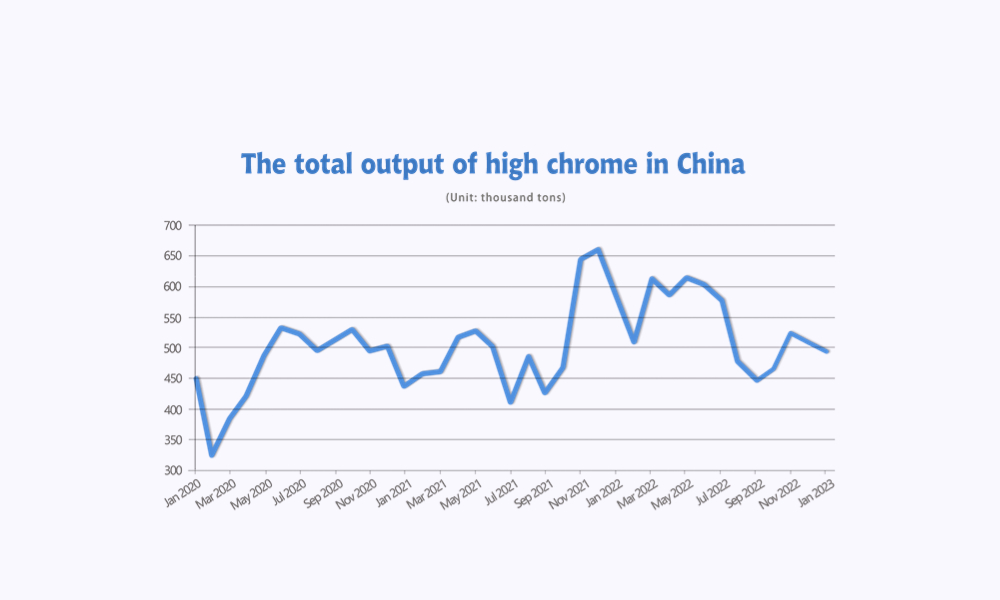

Chrome: Supply dropped while demand enlarges

The most traded retail price of chromium chromite continued to rise, accumulating US$45/MT

The production of high-carbon ferrochrome overall slid marginally in January, totalling 495,800 tons. 2.25% less than December 2022. Major production areas in Southern China had dragged down the average production for a bit while the production in northern China went up.

Meanwhile, the ferrochrome import significantly dropped lately, decreasing by 48.12% from last month, and 39.48% less than the same period last year. The import from South Africa even slipped by at least 50%.

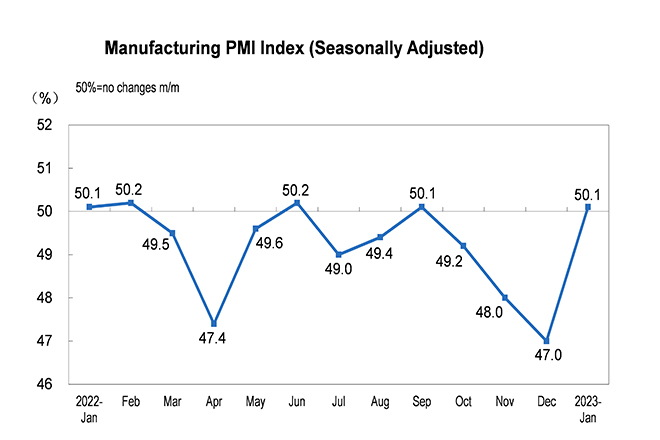

MACRO|| China's economy recovers quickly in January

CHINA: Manufacturing PMI increased by 3.1% to 50.1%.

In January, the Purchasing Manager Index (PMI) of China's manufacturing industry was 50.1 percent, increase 3.1 percentage points from the previous month, rising above the threshold, and the prosperity level of the manufacturing industry rose significantly.

Both supply and demand have recovered rapidly, and the improvement in production is lower than that of new orders or mainly due to seasonality, while the improvement of new orders is mainly driven by domestic demand. Expectations have also been further repaired. We expect that under the background of the optimization of epidemic prevention policies and the hedging of macro policies, work will start or resume soon after the holiday.

The US: The Rate hike trembled the nickel price

The Federal Reserve is hiking interest rates by 25 basis points. The rate increase was widely anticipated by markets, with analysts pricing the odds of a 25 basis points hike at 85%. This marks the eighth time the Fed has raised interest rates since the beginning of 2022. Affecting the US rate hikes, on 2nd February, ShFE nickel dropped US$739(2.21%) to US$33,045/MT, while LME Nickel fell 4.64% to US$29,000/MT.

SEAFREIGHT|| Slow recovery in sea freight decelerates the freight rate.

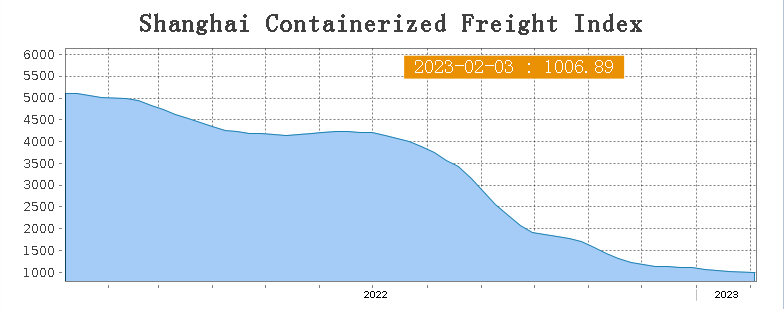

China's container transportation market is weakening as recovery is slower than the market expected. Freight rates on multiple sea routes trended down last week. 3rd February, the Shanghai Containerized Freight Index was downed by 2.2% to 1006.89.

Europe/ Mediterranean: According to S&P Global, the eurozone composite PMI continued to lay below the threshold, which indicates the unideal economy in Europe.

Until 3rd February, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$961/TEU, an 5.2% decrease. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1754/TEU, down by 3.4%.

North America: The tight monetary policy and the hiking rates keep influencing the freight rate.

Until 3rd February, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1,363/FEU and US$2706/FEU, 2.9% and 2.8% fall accordingly.

The Persian Gulf and the Red Sea: The freight rate dropped after the Chinese New Year. Until 3rd February, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had a 4% fall from last week's posted US$1040/TEU.

Australia/ New Zealand: The freight rate dropped significantly. Until 3rd February, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$441/TEU, which went up by 14.4% from the previous week.

South America: The imbalanced supply-demand situation is greatly relieved, freight rate starts to rebound. On 3rd February, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$1441/TEU, which rose by 35.3% from the previous week.