Stainless steel prices of last week faced a decline and it is estimated that the prices will continue to decrease as the output and delivery will expand in March. There was a highlight in the nickel market, due to the intense situation of Russia and Ukraine. On February 24, the price rose by 4.3% from $24,575/MT to $25,625MT, the highest nickel price in the past three months in LME.

Besides, the inventory of LME is still reducing. It is afraid that the LME nickel price will remain high. The war also appeals to concerns about sea freight because right begun the war, the oil price surged. To the shopping industry, the immediate concern is the impact of the crisis on the price of oil. With the increased operating cost of marine transportation, is it becoming less possible for sea freight to fall? About more details of the stainless steel market summary in China, just keep reading.

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

3,300 |

-18 |

-0.55% |

|

Foshan |

3,345 |

-18 |

-0.54% |

||

|

Hongwang |

Wuxi |

3,160 |

-57 |

-1.87% |

|

|

Foshan |

3,145 |

-41 |

-0.36% |

||

|

304/NO.1 |

ESS |

Wuxi |

3,175 |

-62 |

-2.01% |

|

Foshan |

3,170 |

-29 |

-0.94% |

||

|

316L/2B |

TISCO |

Wuxi |

4,765 |

24 |

0.52% |

|

Foshan |

4,830 |

26 |

0.55% |

||

|

316L/NO.1 |

ESS |

Wuxi |

4,695 |

-19 |

-0.42% |

|

Foshan |

4,730 |

13 |

0.28% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,960 |

-14 |

-0.78% |

|

Foshan |

1,925 |

-24 |

-1.31% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,850 |

-30 |

-1.73% |

|

Foshan |

1,665 |

-29 |

-1.65% |

||

|

430/2B |

TISCO |

Wuxi |

1,665 |

24 |

1.58% |

|

Foshan |

1,665 |

-16 |

-1.03% |

TREND||Stainless steel supply is enlarging. Prices tend to fall.

Last week, the price of stainless steel tended to decline as the supply continues to increase. Buyers are more cautious and the transaction is going light because of fewer supports to the high price. Until February 25th, the main contract of stainless steel futures dropped by US$1,020/MT to US$3,000/MT, which declined by 5.41%.

300 series of stainless steel: Prices are weakening.

Earlier last week, due to the intense Russia-Ukraine situation, the price of nickel surged, supporting the stainless steel futures price to increase a bit while the spot prices remained the same. Later in the week, with more warehouse receipts settled into the spot market, and steel mills recovered from production limit or suspense, the supply is expected to increase. Therefore, the prices of stainless steel futures and spot, both declined. For the cold-rolled stainless steel 304, the base price of the private-owned mills was decreased by US$64/MT to US$3,105/MT. As for the hot-rolled stainless steel 304, it dropped by US$80/MT, lowering to US$3,170/MT. In addition to last Thursday, the trade remained light during the week. Facing the high prices, most buyers are on the fence.

From the perspective of cost, the EXW price of high nickel iron was US$2/nickel higher compared to the price on February 18th, to US$247/nickel; the price of ferrochrome rose by US$16 to US$1,384/MT (with 50% of chromium content). In theory, the production cost of the cold-rolled stainless steel 304 increased by US$19/MT to US$3,130/MT. Based on the cost of metallurgical production, the cold-rolled stainless steel 304 is currently in a deficit of about US$25/MT. For now, the price of hot-rolled stainless steel is still higher than that of cold rolling, so the hot rolling production is more profitable to the producers.

200 series of stainless steel: It is estimated that the market will be weakened due to oversupply in a short term.

Last week, the price of stainless steel 201 in Wuxi market went down. People thought the prices to decline, making the market sluggish. Earlier in the week, the COVID in Wuxi blocked the supply chain, resulting in less order and demand. After the winter Olympics, the steel mills has returned to produce from the previous production limit and suspension. It is estimated that in March, more resources will be supplied to the market. Afraid of oversupply, the market sentiment is pessimistic and more voices for the falling prices.

Last week, the price of cold-rolled stainless steel 201 with mill edge in Wuxi market dropped by US$32/MT, to US$1,925/MT; for mill-edge J2 and J5, the prices declined by US$64/MT, quoting at US$1,795/MT. As for the hot-rolled 5-foot stainless steel 201, the price kept reducing. Last week, it dropped by US$64/MT, to US$1,960/MT. The hot-rolled stainless steel is still more expensive than the cold-rolled products, but the price difference has narrowed.

Similar to the stainless steel 300 series, buyers of the 200 series are also reluctant to current high prices when the supply continues to enlarge. Most people are now waiting for a more compatible price when the prices are way down. The transaction is light.

400 series of stainless steel: Lower volume trading on the market; prices reduce.

Last week, the stainless steel 430 increased slightly. Until February 24th, the cold-rolled stainless steel 430 in Wuxi market was US$1,675/MT which increased by US$16/MT compared to the average price two weeks ago. The guidance price of TISCO increased as well, from US$15/MT to US$1,750/MT. Steel mills of 400 series are also back to produce. The production in February maintained low though, the arrivals will gradually increase and it is expected that the inventory of stainless steel 400 series will rise.

From the perspective of the high chrome supply, it does not fully recover after the holiday. The output of high chrome gradually increase slightly in Shanxi Province after the Olympics, but in Inner Mongolia and Shanxi Province, the COVID broke out and the transportation is influenced in recent days. It is predicted that the output of high chrome in February will decrease largely compared to January.

Summary:

300 series of stainless steel: the production suspension in January and February was a strong boost to the stainless steel price, but now steel mills recover and the high prices lose support. The current large profit margin improves steel mills’ productivity. However, the transaction did not maintain long after the holiday, which starts to diminish. In addition, the nickel price was one of the great supports of the stainless steel prices, but the nickel price fails to remain high during the conflict breaks out in Ukraine. It is estimated that the price of stainless steel will remain weak in the short term, and the base price of the cold-rolled stainless steel 304 by the private-owned mills will reduce by US$48/MT, declining to US$3,060/MT.

200 series of stainless steel: The market was light last week. The trading volume and prices declined. Recently, the hot-rolled 5-foot stainless steel 201 dropped by nearly 50%. In a short term, more resources will be sent to the market. It is predicted that the stainless steel 201 will tend to fall.

400 series of stainless steel: The price of chrome ore and coke also increase, making the cost of high chrome increase. In March, steel mills’ purchasing bid will begin and it is predicted that the purchasing price of high chrome will MoM increase by US$48/MT. Therefore, the production cost of 400 series will increase as estimated. The stainless steel mills stayed firm on the prices of 400 series last week, but the transaction was light. It is predicted that the price of stainless steel 430/2B will keep declining to around US$1,650/MT~ US$1,665/MT.

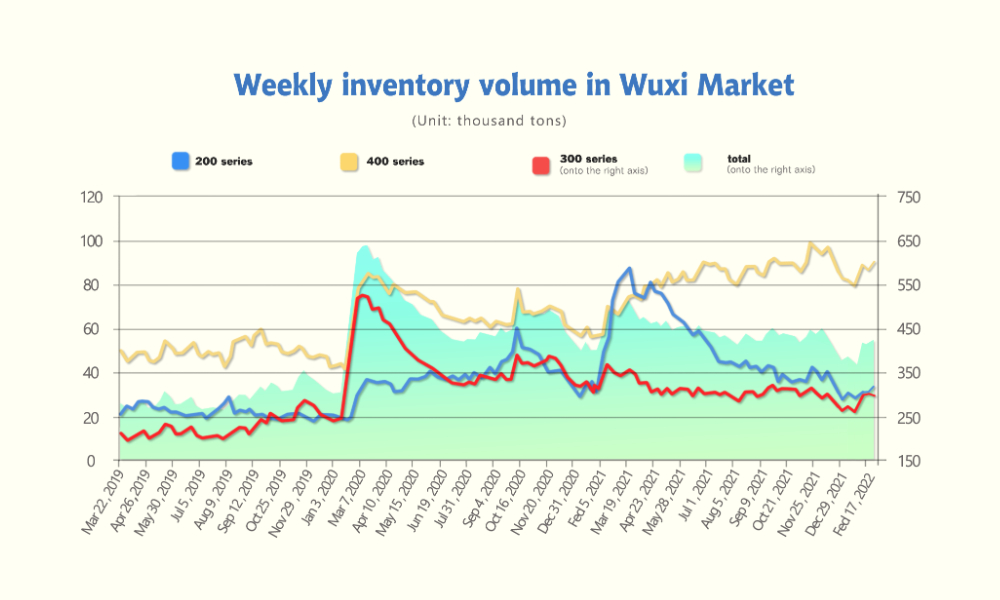

INVENTORY|| The total inventory rose by 7,700 tons. Pressure over inventory is increasing.

| Inventory in Wuxi sample warehouse (Unit: thousand tons) | 200 series | 300 series | 400 series | Total |

| February 21st ~ February 25th | 33.2 | 297.7 | 898 | 420.7 |

| February 14th ~ February 18th | 30.8 | 295.6 | 866 | 413 |

| Difference | 2.4 | 2.1 | 3.2 | 7.7 |

Last week, the inventory volume in the Wuxi sample warehouse increased by 7,700 tons, to 420,700 tons. 200 series inventory rose by 2,400 tons, to 33,200 tons; 300 series went up by 2,100 tons, to 297,700 tons; 400 series increases by 3,200 tons to 89,800 tons.

200 series of stainless steel: Pressure over market inventory will increase in March.

Stainless steel 200 series inventory increased by about 2,400 tons, and cold-rolled materials take the major proportion. Most of the resources are from Baosteel Desheng and Baogang New Materials. Besides, Ansteel LISCO and Tsingshan also delivered the hot-rolled 5-foot stainless steel to Wuxi market, which relieves the shortage of hot-rolled products. According to the traders, the market is still short on the hot-rolled 5-foot resource (with a thickness of 4.0 mm).

Influenced by the pandemic in Wuxi, the order volume in China decreases. But with the steel mill back to produce, it is predicted that in March a large number of resources will be sent to the market, which will increase the market inventory pressure.

300 series of stainless steel: Supply chain was insufficient.

Last week, the inventory of the stainless steel 300 series increased slightly. Recently, the steel mills did not deliver any materials to the market. Delong, a steel mill sent their products to Foshan instead of Wuxi where there was no more than 10,000 tons of stainless steel after the Chinese new year. As for another giant, Tsingshan, puts more effort into registering warehouse receipts in Shanghai Future Exchange. After the settlement of the stainless steel contract for February, the warehouse receipts keep turning into the market. Compared to the highest point of stainless steel inventory in the previous two weeks, the current inventory volume fell by about 10,000 tons. Meanwhile, the pandemic in Wuxi influenced the delivery to be sent sufficiently. It is predicted that in a short term the inventory in Wuxi will maintain, but in a long term, the inventory pressure will increase as steel mills recover to produce.

400 series of stainless steel: The volume of arrivals will rise.

In January 2022, the output of stainless steel 400 series reduced by 101,600 tons, to 451,000 tons which is far lower than expected. Last week, the inventory of 400 series in Wuxi increased significantly to 89,800 tons which were 3,200 tons more than two weeks ago.

Influenced by the previous production limit and suspension, the steel mills that stopped producing are back to work. Although the production in February remained low, the arrivals have started to rise. It is predicted that the inventory of stainless steel 400 series will rise slightly.

RAW MATERIALS|| The inventory of LME continues to reduce.

Ferromolybdenum: Price drops by US$160/MT, breaking the continuous increase for 3 months.

The price of ferromolybdenum increased for three months and on February 24th, the EXW price dropped by US$159/MT (with 60% of molybdenum content), to around US$27,273/ MT (with 60% of molybdenum content). Since November of 2021, the price of ferromolybdenum (with 60% of molybdenum content) has kept increasing. Until last week, the price peaked at US$27,432/MT, which rose by US$6,858/MT compared to that three months ago. The sharp rise of the ferromolybdenum price also brings up the price of the molybdenum concentration ore. The ore with 47% of the molybdenum content ramped by US$96/MTin the past three months.

After the Chinese New Year Holiday, the purchase of ferromolybdenum expanded but lately, the market sentiment starts to go down. Besides, as the pandemics are controlled in Liaoning and Henan which are the major production areas of molybdenum, the output is to enlarge also because of the recovery of the producing activities after the Winter Olympics. Therefore, the buyers are getting more fastidious to the high price. It is predicted that the price of ferromolybdenum will remain weak in the short term.

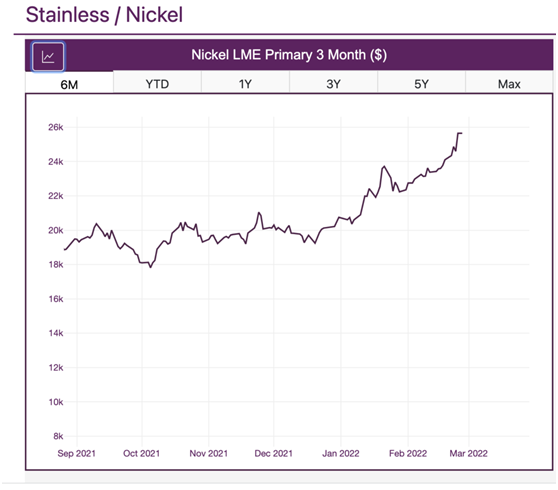

NICKEL: The price of nickel soars. The inventory of LME continues to reduce.

Influenced by the Russia-Ukraine situation, the nickel price of LME soared on February 25th, increasing by more than US$1,000/MT. On February 24, the price rose by 4.3% from $24,575/MT to $25,625MT, the highest nickel price in the past three months in LME.

Source: Metal Mining Insights

The price is expected to continue higher as Russia's Norilsk Nickel is a major supplier of nickel to the global market. Russia provides more than 7% of global nickel production. Norilsk's sales in 2021 were 193,000 tons, which was 18% less than the production in 2020, 235,709 tons.

Besides, according to Westmetall, metal inventories in LME warehouses fell to 96,308 tons in January, which was 61.3% less than 248,962 tons in the same period in 2021.

Although the high demand for nickel from Europe makes it unlikely that the company will be directly sanctioned, some analysts believe that measures to reduce Russia's access to Western markets will further push up global nickel prices. That, in turn, would delay the company's projects. Another option could prompt Norilsk to seek financing from China. This could transit into a buyout agreement as a form of payment. It might make the company more reluctant to sell to other markets.

Freight forecast: It will get more fluctuated due to the war.

To the shopping industry, the immediate concern is the impact of the crisis on the price of oil.

Russia is one of the world's leading energy producers and exporters. Until the end of 2020, Russia's proven oil reserves were about 107.08 billion barrels, about 6.22% of global reserves.

In 2020, Russia exported 910 million barrels of oil. In the same period, the global oil export volume was 10.16 billion barrels, with a total export value of about US$72.6. Russia is second only to Saudi Arabia in the world.

Right begun the war, the oil price surged.

According to data released by Societe Generale Investments on February 25, as of the close in the U.S., U.S. crude oil futures for April ended up $1.94 at $94.72 per barrel. The May futures of Brent crude oil closed up $1.12 at $95.80/barrel. The intraday high touched $102.19/barrel and the lowest fell to $94.05/barrel.

Changes in oil prices have also caused concern in the shipping industry because the price of marine fuel oil usually paces with the trend of crude oil. For the container shipping industry, the oil price trend affected by the current conflict may relate to the current freight trend. On the one hand, the price of marine fuel oil is directly linked to the international crude oil price; on the other hand, in the operating costs of liner companies, the cost of fuel oil fluctuates with the changes in market oil prices. Generally, it will not be lower than 20%.

In 2021, the container shipping industry earned higher than expected. Meanwhile, liner companies are also facing higher operating costs, including rising ship rents, rising crew wages, and pandemic prevention costs. Oil price is no exception. As the global economy recovers and oil prices rise again, average fuel costs increase by more than 50% in 2021.

Consultancy Alphatanker also said in October 2021 when the fuel price hit the highest since October 2014 that bunker fuel prices are surging and dampening growth in tanker earnings. Therefore, from the second half of 2020 to the end of 2021, most liner companies have adjusted fuel surcharges or increased freight rates according to the difference in fuel consumption in different shipping areas.

Although the fluctuation of freight rates mainly depends on supply and demand and fuel surcharges account for a relatively low proportion of the entire freight rate, at present, a lower surcharge is somehow what we all look forward to reducing the cost.