Standing at the current point, the past two weeks seem like a dream to us. Last week, from April 17th to 21st, all major grades of stainless steel had risen in price. However, this week, the stainless steel market showed a downward tendency. It is not a surprise. We have kept mentioning that the low demand is the major trouble that leads to the continuous drop in price. Although some were optimistic, believing that there might be stock replenishment before the Labor Day holiday. It comes out as an illusion. During the sluggish time, many fluctuations were accounted to be a quasi-re-bounce played up by the steel mills. Maybe it has gone too far on the pessimistic side. There are still some exciting data that support our confidence in the global stainless steel market. Based on the latest export statistics, in March, China’s stainless steel export volume was 349,400 tons, MoM increasing by 38.15%, YoY increasing by 61.73%. This just gives us more motivation to explore and develop our business. If you want to know more about the Stainless Steel Market Summary in China, please keep reading.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,520 | 93 | 4.03% |

| Foshan | 2,565 | 93 | 3.95% | ||

| Hongwang | Wuxi | 2,440 | 84 | 3.76% | |

| Foshan | 2,425 | 90 | 4.06% | ||

| 304/NO.1 | ESS | Wuxi | 2,340 | 76 | 3.59% |

| Foshan | 2,370 | 68 | 3.11% | ||

| 316L/2B | TISCO | Wuxi | 3,995 | 9 | 0.23% |

| Foshan | 4,095 | 44 | 1.13% | ||

| 316L/NO.1 | ESS | Wuxi | 3,840 | 44 | 1.21% |

| Foshan | 3,900 | 53 | 1.43% | ||

| 201J1/2B | Hongwang | Wuxi | 1,535 | 22 | 1.58% |

| Foshan | 1,520 | 28 | 2.04% | ||

| J5/2B | Hongwang | Wuxi | 1,455 | 28 | 2.14% |

| Foshan | 1,445 | 26 | 2.04% | ||

| 430/2B | TISCO | Wuxi | 1,255 | 0 | 0% |

| Foshan | 1,245 | 0 | 0% |

Trend|| Stainless steel price trend shaped a “fishhook” structure.

The spot price of stainless steel series gained a positive trend last week. Grade 201 stabilized after raise and grade 304 closed at a stabilized price trend last Friday. The mainstream contract price closed at US$2375/MT with US$11/MT increase.

Stainless steel 300 series: a sound consumption in inventory owe to the price rebound.

Until last Thursday, the mainstream base price of cold-rolled 4-foot mill-edge stainless steel 304 was quoted US$2390/MT and hot-rolled quoted US$2330/MT, both harvested US$59/MT increment. A strong upward momentum in the stainless steel market continued to digest a large chunk of inventory in the first half of last week. After the price increase, however, the market transactions slowed down noticeably in the latter half of the week.

Stainless steel 200 series: “Recover mode” turned on

Last week, the spot price of 201 in Wuxi market first increased and then stabilized. As of Friday, the mainstream base price of 201 cold-rolled in Wuxi market reached US$1510/MT, while that of 201J2 cold-rolled reached US$1430/MT, and the mainstream price of five-foot hot-rolled reached US$1460/MT, all increasing by US$22/MT from last Friday.

The spot transaction performance of grade 201 last week was good overall, with the spot price rising strongly at the beginning of the week, stimulating downstream buyers to enter the market and stockpile, and the market transactions noticeably increasing. However, the market price turned from rising to falling on last Tuesday due to the decline in futures prices, leading to a subsequent weakening of transactions.

400 Series: Continuous inventory reduction and slight price increase

Last week, TISCO’s 430/2B market guidance price remained at US$1415/MT, unchanged from last weekend, while the guidance price of JISCO’s 430/2B remained at US$1495/MT, also unchanged from last weekend. The 430/2B quotation in Wuxi market remained stable but slightly strong, with the current quotation at around US$1255/MT-US$1265/MT, up US$7/MT from last weekend. Social inventory of spot goods in the Wuxi market continued to decrease during the week.

Summary:

The supply and demand relationship has not significantly improved and the demand still not considered recover.

The profit margin of steel mills may also lead to a slightly loose supply situation in the future. After the concentration of short-term demand is released, there is a risk of a second decline, and the market is expected to operate in a volatile manner in the future.

300 series: The pressure on steel mills and the market is gradually easing, and the prices of raw materials and finished products are rebounding simultaneously. Currently, the market's pessimistic sentiment has significantly improved, and increased transactions have led to a rapid depletion of inventory. It is expected that the price of stainless steel will fluctuate above US$2330/MT before the holiday. Pay attention to the arrival of market resources.

200 series: The spot market prices have been fluctuating frequently last week. Affected by the shortage of supply, the price of 201 has followed the increase and not the decrease, and has temporarily stabilized. Since April, with the reduction of steel mill production and downstream demand gradually recovering, the inventory of 201 spot goods has changed from pressure to "support", and the market has shown signs of warming up.

400 series: The mainstream offer for 430/2B in Wuxi market has increased by 50 yuan/ton to US$1255/MT-US$1265/MT. The spot inventory of 400 series stainless steel in the Wuxi market continues to decline. Transactions in the Wuxi market have slightly improved, and with the approach of the Labor Day holiday, downstream purchasing demand is expected to increase. It is expected that the price of 430/2B will run steadily and slightly stronger in the coming period.

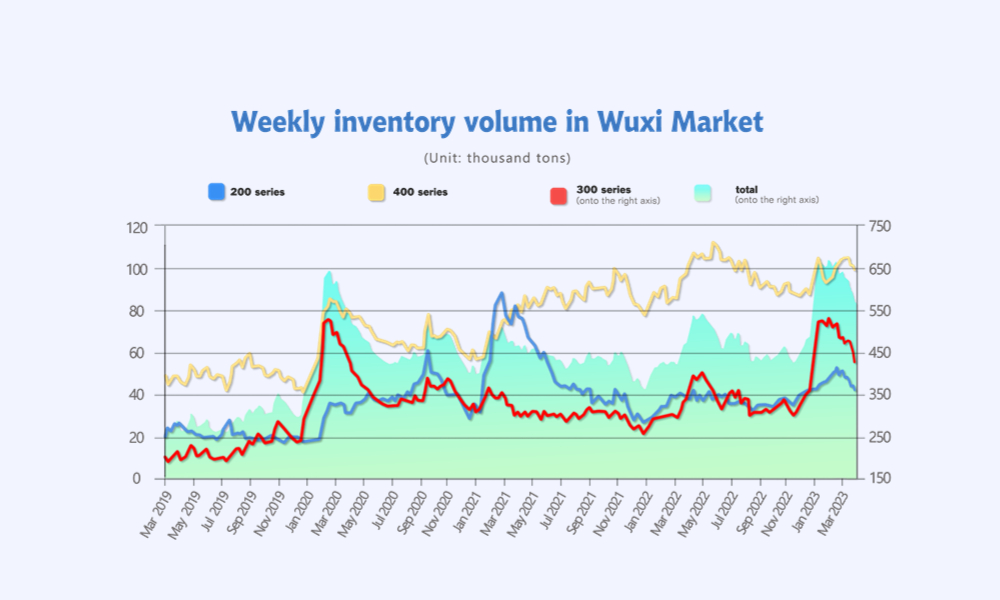

Inventyory|| Over 10% of 300 series Inventory vanished in a fortnight.

The inventory level at the Wuxi sample warehouse fell by 28,014 tons to 559,405 tons (as of 20th April).

the breakdown is as followed:

200 series: 2,100 tons down to 41,260 tons

300 Series: 23,123 tons down to 420,400 tons

400 series: 2,791 tons down to 97,745tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| April 13th | 43,360 | 443,523 | 100,536 | 587,419 |

| April 20th | 41,260 | 420,400 | 97,745 | 559,405 |

| Difference | -2,100 | -23,123 | -2,791 | -28,014 |

300 series: Rising prices drive transactions; inventory drops for four consecutive weeks.

The inventory of 300 series in the Wuxi market decreased by 23,100 tons to 420,400 tons last week. The pre-storage of steel mills and some trading company warehouses showed a significant reduction in inventory, with the reduction in hot-rolled inventory being better than that of cold-rolled. During this inventory cycle, the market prices maintained an upward trend. Active transactions at the end of last week and the beginning of this week led to an increase in recent outflows.

However, the reduction in production due to the previous maintenance of steel mills has limited the number of resources recently delivered. The inventory of the 300 series in the Wuxi area has decreased for four consecutive weeks. Currently, the inventory in the Wuxi area has reduced by nearly 100,000 tons since the high point after the Spring Festival, with a reduction rate of 19%. The inventory pressure has been significantly alleviated compared to the beginning of the year, and some steel mills have already experienced shortages of resources.

200 series: Transactions pick up, inventory continues to decrease

Last week, the resources delivered by steel mills have decreased, and some resources in transit have not yet arrived in Wuxi. The supply of market inventory is not timely enough, so the inventory of spot goods is still being reduced. Currently, there is still a shortage of 201 in the Wuxi market. However, due to frequent fluctuations in the market recently, traders mainly choose to reduce inventory to avoid risks. As of this week, the inventory of the 200 series in the Wuxi market has been decreasing for four consecutive weeks.

400 series: Continuous reduction of inventory boosts market confidence!

The inventory of 400 series stainless steel spot goods in the Wuxi area continued to decline to below 100,000 tons last week, a decrease of 0.28 million tons to 97,700 tons from the end of last week. The inventory of spot goods in the market is accelerating. This week, the demand for 400 series stainless steel spot goods was still good, and the weak price trend has changed. Some traders have increased their price. It is expected that the spot inventory will continue to decrease in the coming period.

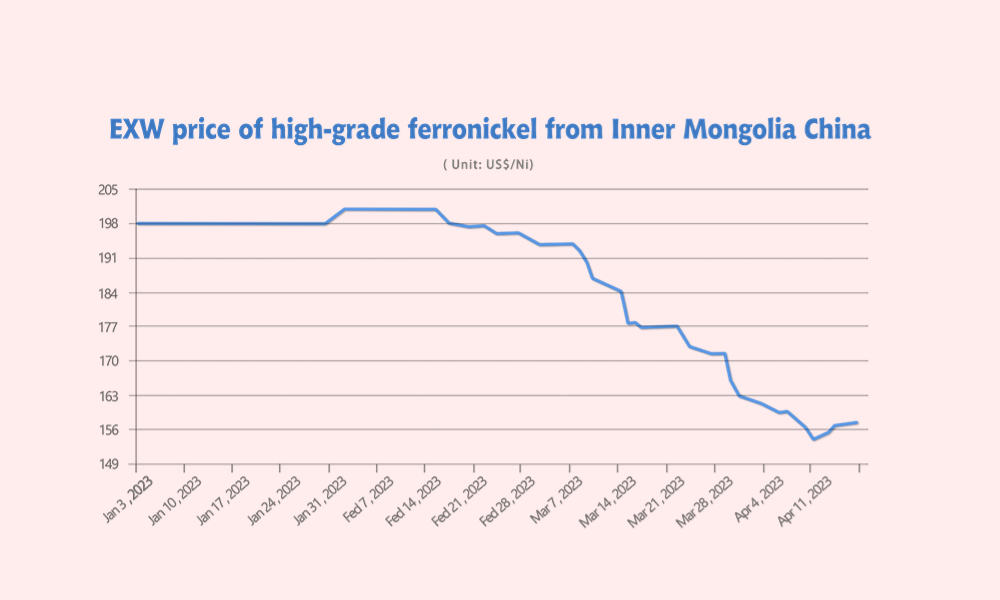

Raw Material|| Spot price rose along with the raw material.

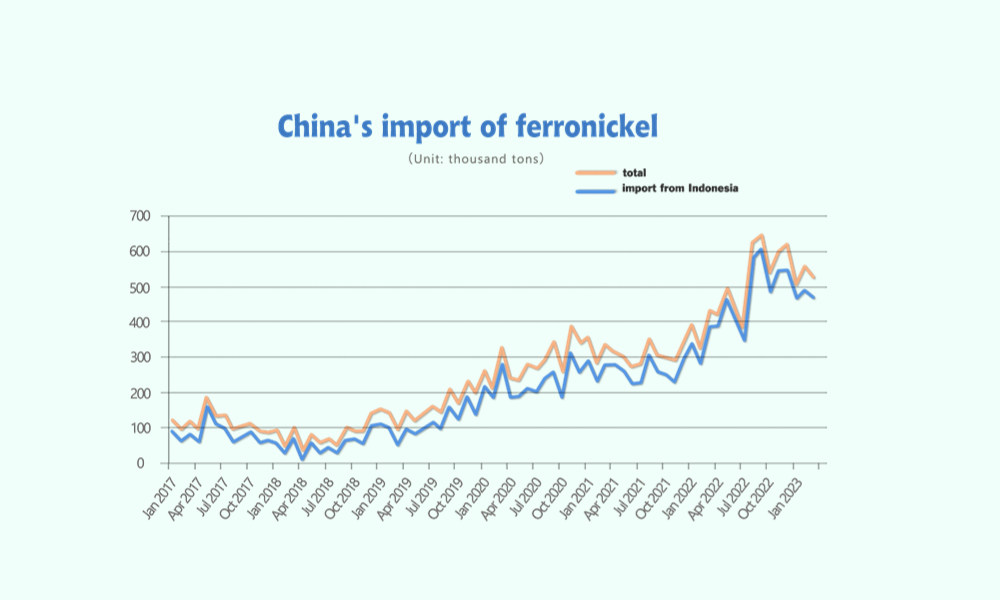

With the recent surge in stainless steel prices, market traders have increased prices multiple times and steel mills have seen an improvement in orders with demand for replenishing materials. After the Indonesian earthquake last Friday, nickel prices briefly surged, which was also somewhat beneficial for nickel-iron. In the long term, the excess supply of nickel-iron continues to be restrained by stainless steel prices. It is expected that nickel-iron prices will remain stable and slightly strong in the short term. In March, the nickel-iron import volume was slightly lower due to the sluggish market.

According to customs data, in March 2023, China's nickel-iron imports were 526,000 tons, a decrease of 5.57% month-on-month and an increase of 22.3% year-on-year. Among them, nickel-iron imports from Indonesia were 467,700 tons, a decrease of 4.15% month-on-month and an increase of 20.93% year-on-year.

Last week, the mainstream ex-factory price of high-chromium remained stable at around US$1385/MT-US$1415/MT(50% chromium), which was unchanged from the end of last week. The spot price of chrome ore remained stable, and the price of coke was weak and stable, with little change in the comprehensive production cost of high-chromium. It is expected within the industry that high-chromium production in April will decrease by around 80,000 MT compared to the previous month. However, with a decrease in stainless steel production expectations in April, the demand for high-chromium will also decrease. After the mainstream steel recruitment in April, the factory's production enthusiasm has significantly decreased, and the market supply has contracted, but with the expectation of reduced demand, the price of high-chromium is not strongly supported.

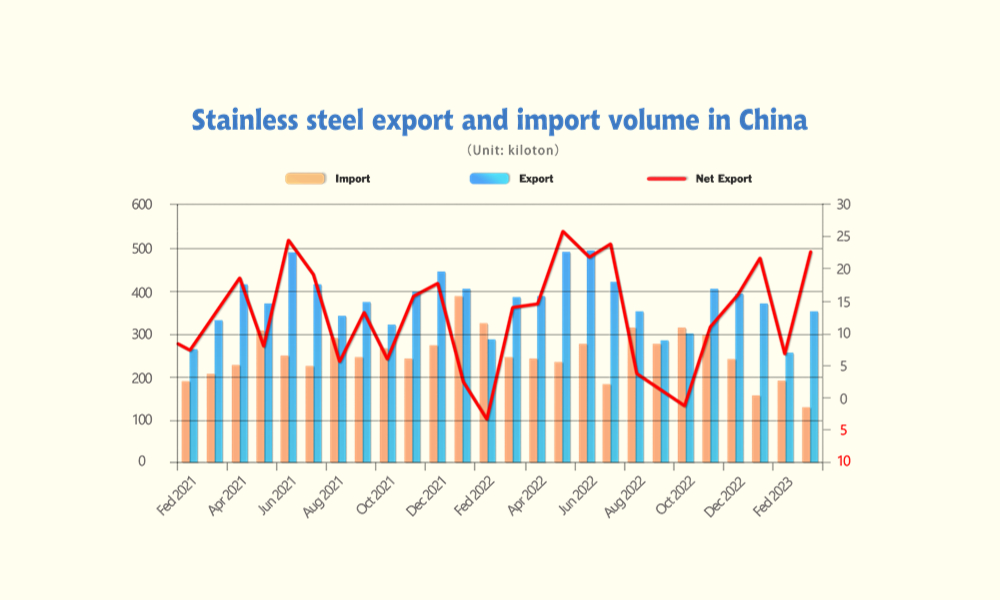

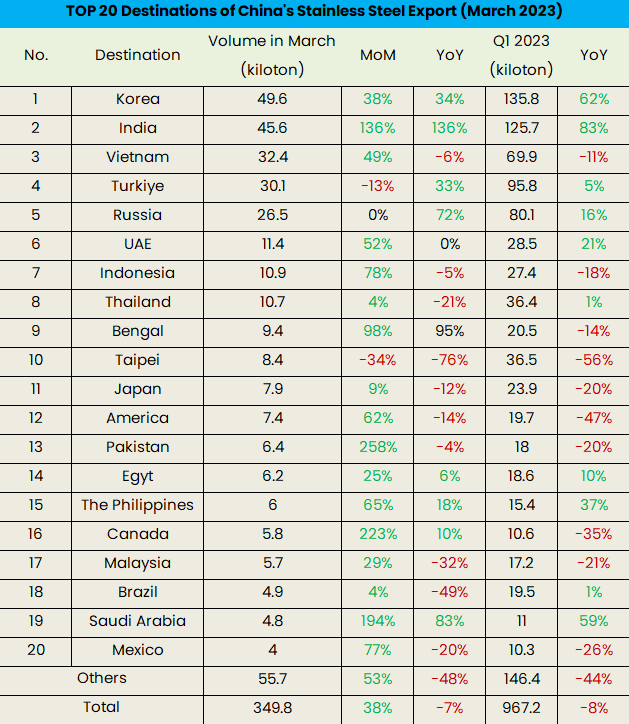

Export|| Surprising outcome in March’s export

In March, China’s stainless steel import volume was 123,300 tons, a decrease of 34.14% compared to the previous month, and a decrease 48.61% compared to the same period last year.

China’s stainless steel export volume on the other hand was 349,400 tons, an increase of 38.15% compared to the previous month, an increase of 61.73% compared to the same period last year.

The net export volume for March 226,100 tons, an increase of 244.32% from last month, and 61.73% more than compared to the same period last year.

It is noteworthy that the bearish market trend was the main reason of the significant rebound in stainless steel export. Recorded 135,800 tons of stainless steel export during January and March, South Korea had became the closest beneficiary.

But the stainless-steel import, on the other hand, experienced a new low. Delong’s refinery in Indonesia greatly suspended their production since January and recommenced at the end of March. It is believed that the 39.62% of decrease in import volume was the result of the supply shortage in Indonesia.

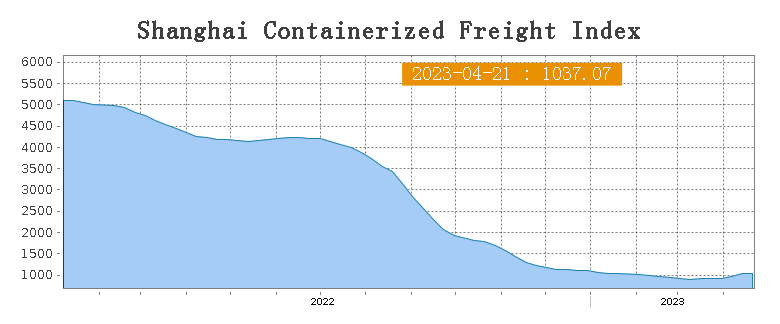

Sea Freight|| Freight rate stabilized for most routes.

Freight rates overall on multiple sea routes increased slightly last week. China’s GDP reported 4.5% growth in the first quarter of 2023, according to National Bureau of Statistics of China. On 21st April, the Shanghai Containerized Freight Index rose by 0.3% to 1037.07.

Europe/ Mediterranean:

According to Eurostat, The Harmonised Index of Consumer Prices recorded a 6.9% growth, Last week, transportation demand remained flat. Until 21st April, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$883/TEU, rose by 1.4%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1605/TEU, which fell by 0.8%.

North America:

The supply-demand was stabilized, and the shipping industry is making effort in controlling the shipping capacity.

Until 21st April, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1,633/FEU and US$2,510/FEU, 2.1% and 2.1% growth accordingly.

The Persian Gulf and the Red Sea:

Until 21st April, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had a 7.6% rise from last week's posted US$3114/TEU, despite of the tradition festival- Ramadan.

Australia/ New Zealand:

Until 21st April, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$238/TEU, which fell by 6.7% from the previous week.

South America:

The freight market had a significant rebound. on 21st April, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$1989/TEU, an 0.8% rose from the previous week.