Some small steel mills, particularly those that majorly produced stainless steel 400 series said that they might face bankruptcy as they are in great deficit. We think that it is time for the market to give a shuffle to eliminate the weaks. The market competition is cruel to a certain extent. The one who smiles at the end might win the future market. As you can see in the later parts of Stainless Steel Market Summary in China of last week, there is not much good news that can revoke the sluggish market. Anyway, we are not going anywhere but will keep providing you with the authentic news and resources and help you make the best decision.

WEEKLY AVERAGE PRICES

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

2,655 |

-63 |

-2.42% |

|

Foshan |

2,700 |

-63 |

-2.38% |

||

|

Hongwang |

Wuxi |

2,515 |

-86 |

-3.49% |

|

|

Foshan |

2,515 |

-86 |

-3.49% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,450 |

-72 |

-2.91% |

|

Foshan |

2,470 |

-45 |

-1.89% |

||

|

316L/2B |

TISCO |

Wuxi |

4,090 |

-92 |

-2.29% |

|

Foshan |

4,165 |

-86 |

-2.10% |

||

|

316L/NO.1 |

ESS |

Wuxi |

3,835 |

-45 |

-1.20% |

|

Foshan |

3,880 |

-51 |

-1.34% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,520 |

7 |

0.53% |

|

Foshan |

1,510 |

-7 |

-0.53% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,455 |

13 |

1.02% |

|

Foshan |

1,440 |

-6 |

-0.45% |

||

|

430/2B |

TISCO |

Wuxi |

1,260 |

18 |

1.59% |

|

Foshan |

1,260 |

19 |

1.73% |

TREND || Steel mills are stuck in price competition. Prices are running lower.

The series of the spot price of stainless steel at Wuxi were diversified. Last week, 201 stainless steel and 403 stainless steel were stabilized after growth, 304 stainless steel, on the other hand, were diminishing. The contract price for stainless steel closed at US$2470/MT last Friday, with a US$94 drop.

Stainless steel series 300: Steel mills knock down the opening price. Futures price again rocks bottom.

Tsingshan Holding and Delong Limited made a stunning entrance with low quotes price to bring the spot price of 304 stainless prices down.

The market was quiet as Indonesia scheduled a 100,000-ton stainless steel roll shipment to China in August, price curve was laid down for three days in a row while the supply curve is going up.

The US inflation rate cooled and CPI Climbed up inversely through July, Nickel stainless steel rose as the spot price stabilized on Wednesday night. 304 cold-rolled 4-foot stainless steel was quoted at US$2,465/MT, US$75 drop from last week, hot-rolled stainless steel has a $30 drop and closed at US2,450/MT.

Stainless steel series 200: Being short of some specifications. Prices rose then become steady.

Series 200 remained steady after a slight ascent. Until 12nd August, the price of 201 cold-rolled stainless steel had $7 raise to US$1500/MT, a $15 increase for 201J2 and closed at US$1430/MT.

Both hot-rolled 5-foot stainless steel and 201J2 gained a $15 increase, closed at US$1430/MT and US$1440/MT correspondingly.

The transaction of 201 stainless steel on the Wuxi market was futureless, turning up at the beginning and turning down in the latter days. The spot price for stainless steel sheets closed at US$1410/MT.

The stock-out had worsened the market transaction, not to mention the stainless-steel market was forced to close down due to the rolling blackout at Dongbei tang Wuxi.

Stainless steel series 400: SS430 price remains stable.

Cold rolled 430 stainless steel remained stable at the level of US$1265-1270/MT, while 430 hot rolled stainless steel closed at US$1330/MT.

The industry hint that the Inventory of series 400 has downed 4,200 tons which are majorly owned by the market traders.

Some specifications of 430/2B such as 0.37-0.41 mm and 2.0 mm were running out of stock.

The industry also pointed out, that the low inventory of the market was led by the negative correlation between the guidance price of 430 cold-rolled stainless steel from the mills and the market price, and also the unwillingness on the trader side to replenish. On the other hand, the major cut on production will, and transaction volume was closely attached to the inventory consumption.

the price of 430/2B was stabilized. The purchase price could be noteworthy in the coming weeks, as the strong correlation between ferrochrome and the production cost of series 400 products.

The spot price of chromium products was downward dropping continually.

Summary:

Series 300: Although US inflation dipped down while Tsingshan Holding and Delong Limited undersold the product last week, the price level is expected to linger at a low level near US$2375, affected by the arrival of Indonesian shipment.

Series 200: Wuxi market was still experiencing the hardship of out stoking that cause by the production reduction, supply shortage could be long lasting on the market. the price of 201 stainless steel next week is expected to be stabilized, 201J2/J5 cold-rolled 4-foot stainless steel will be volatile at the level of US$1455/MT-US$1470/MT.

Series 400:JISCO and TISCO stabilized their piece of 430/2B stainless steel at between US$1265 - US$1270, merely a US$7 raise compare to last week. The purchase price for high chromium has not yet been released by JG and TG, but the bid price was downed to US$1255/MT. The production cost of Series 400 is shifting low, but the mills are still bleeding. The price of 430/2B is expected to be stabilized at a medium-low level that might spread between US$1240/MT-US$1270/MT.

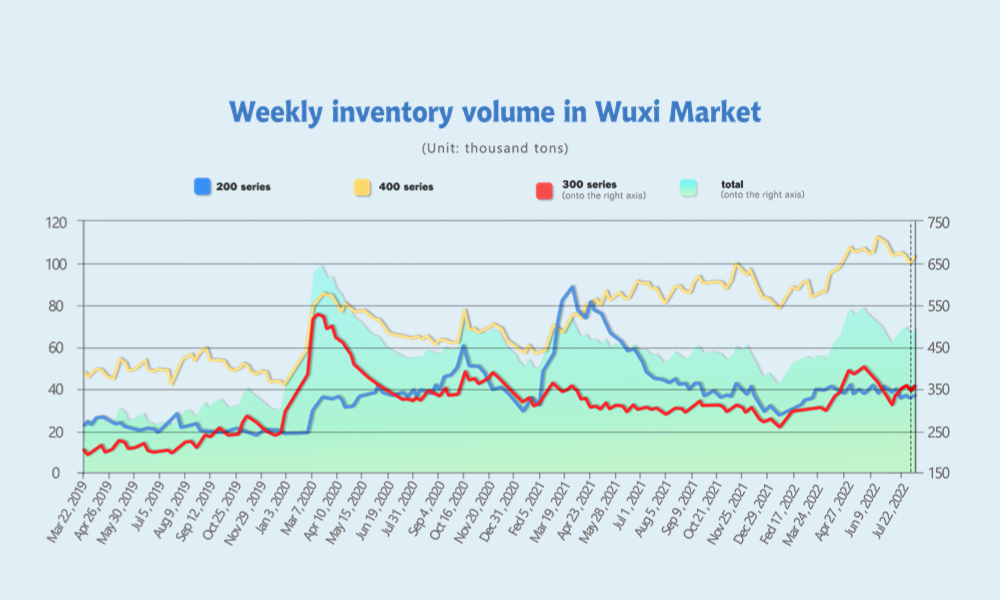

INVENTORY || It raises by over 20,000 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| August 4th | 35,296 | 343,538 | 99,002 | 477,836 |

| August 11th | 36,436 | 355,700 | 102,832 | 494,968 |

| Difference | 1,140 | 12,162 | 3,830 | 17,132 |

The inventory level at the Wuxi sample warehouse went by 17,100 tons, Series 300 taken up 71% with 17,100 tons, Series 400 occupied 22% with 10,280 tons, Series 200

the total volume closed at 495,000 tons.

Series 200: Steel mills cut down the delivery volume. Spots reduce.

Inventory volume of 201 in the Wuxi market was running low last week, Beigang New Material still taking up a major proportion of the stock, and a certain amount of the stock from Baosteel Desheng Stainless Steel Co. is still en route. Both transaction volume and demand of series 200 were laid down at the bottom of the Wuxi market, underselling could commonly seem.

Series 300: Transaction is weak still and the inventory increases.

The inventory of series 300 at Wuxi jumped up to 356,000 tons with a 120,000 increase, but the major volume is held by the mills and traders.

A dramatic twist occurred after Delong’s agreement with agencies at Wuxi, some agencies abandoned the ship as Delong required a larger volume on the agreement which was signed earlier this month. Meanwhile, Baosteel begs to differ with Tsingshan & Delong’s action on underselling.

Indonesia Ruipu Nickel and Chrome Alloy (IRNC)’s 304/2B shipment finally arrived at Jiangyin port on 7th August and it is circulating in the market.

The 700,000 tons stainless steel cold rolling project in Indonesia, which cooperates with Aoyama holdings, is planned to have a trial production on 15th August. There are will be at least 120,000 tons supply to ship China estimated.

As a whole, Series 300 had a rebound in supply, but the consumption was still seemingly low.

Series 400: Inventory drops promisingly as the mills cut their production.

The market transaction was calm last week, the inventory of series 400 has a 40,000 tons increase to 103,000 tons JTISCO and TISCO halved their production. Taishan Steel has changed its production line to plain carbon steel while other mills had an unappealing figure on their production.

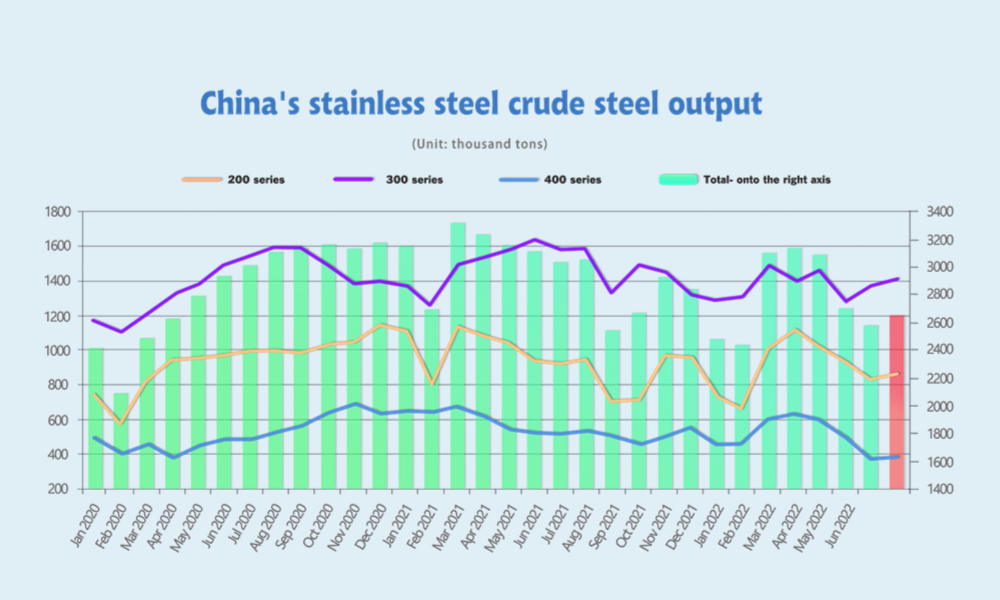

HIGHLIGHT: Stainless steel 300 series output increased by over 90,000 tons MoM.

In the past few months, the price of stainless steel has been falling all the way, down nearly 30% from the high price in March and April. However, the price of raw materials has not fallen significantly, the production profits of steel mills have continued to be sluggish, and even some steel types have been in a state of substantial losses, and the output of stainless steel crude steel has shown a downward trend month by month.

in July 2022, stainless steel enterprises above the designated size, (referring to all industrial enterprises with an annual income of the main business reaching US$3 million and above) produced about 2,569,400 tons of crude steel, MoM reduced by 120,500 tons, about 4.48% lower; YoY dropped by 449,200 tons, down by 14.88%. 300 series production increased while 200 series and 400 series production decreased in July.

The output of the 200 series was 831,800 tons, a decrease of 98,000 tons or 10.54% month-on-month, and a year-on-year decrease of 92,000 tons, a decrease of 9.96%.

The output of the 300 series was 1,369,200 tons, an increase of 94,500 tons or 7.42% month-on-month, and a year-on-year decrease of 203,200 tons, a decrease of 12.92%.

The output of the 400 series was 368,400 tons, a decrease of 117,000 tons or 24.1% month-on-month, and a year-on-year decrease of 154,000 tons, a decrease of 29.47%.

200 series and 400 series production losses are more serious. As early as May, many steel mills had begun to reduce the production schedule of the 200 series and switched to the 300 series, resulting in a further decline in the production of the 200 series in July. Among them, the most prominent reduction is Baosteel. The steel plant started maintenance at the end of June, affecting the production of 200-series and 300-series steelmaking. In addition, due to cost pressure, the 200-series output of many other steel mills has shrunk to varying degrees.

In terms of the 300 series, Delong urgently needs to produce steel products due to the high inventory of raw materials. At the same time, the scale of sales will be expanded. After the new project is put into operation, the output of the steel plant will be released quickly. As most steel mills switched to the 300 series, the output of the 300 series in July increased by nearly 100,000 tons from the previous month. Affected by the rebound in supply, many steel mills have cut prices to accept orders, and the market price has continued to fall. The price of 304 rebounded and fell, approaching US$2,365/MT.

In terms of 400 series, due to the continued low price of 430 stainless steel, the production loss per ton of 430 cold rolling once exceeded US$180/MT. JISCO announced that the production of 400 series will be halved from July to August, and TISCO will reduce the production of 400 series and increase the production of 300 series. In addition, some steel mills switched to ordinary carbon steel, so that the output of 400 series in July was only 370,000 tons, which was far lower than the output in the same period of the past years. Driven by the production cuts of various steel mills, the price of 430 bottomed out.

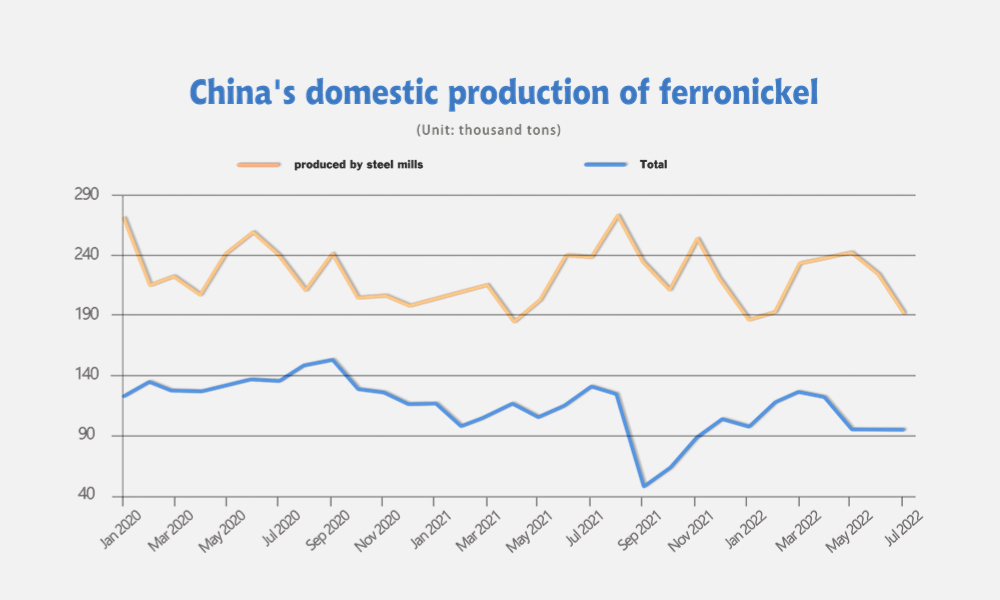

Raw materials|| Production cut remains.

Last week, the EXW price of high-grade ferronickel remained at US$190/Ni, while the price of ferrochromium dropped by US$30/MT (with 50% of chromium content) to US$1,138/MT (with 50% of chromium content). Based on these major materials of stainless steel, the production cost of stainless steel 304 decreased by US$11/MT.

Nickel: LME futures increased. Whereas in production, high-grade ferronickel continued to lose money.

On August 11, the United States announced inflation data. In July, the nominal CPI increased by 8.5% year-on-year, compared with the expected 8.7% and the previous value of 9.1%. The CPI data finally ushered in an inflection point and came in below expectations, laying the groundwork for the Fed to slow rate hikes.

LME nickel, ShFE nickel, and stainless steel futures prices surged right the way. Until the closing of August 11th, the price of the most-traded contract of ShFE nickel rose by 5.59% to US$26,500/MT (CNY¥177,020/MT); the price of the most-traded contract of stainless steel increased to 0.77% to US$2,470/MT which rebounded by US$45/MT from the lowest price on August 10th.

The stainless steel market has been sluggish, which forces the steel mills to bargain the raw material prices. Most of the iron mills are losing money and begin to cut down or suspense the production to resist the price drop. Moreover, the Indonesian imports of ferronickel maintain high, causing oversupply in China’s domestic market, and thereby the price keeps reducing.

The Indonesian imports have further suppressed Chinese ferronickel production. In July, the total production of high-graded ferronickel (produced by major ferronickel producers and stainless steel mills) was 288,600 tons which were reduced by 33,800 tons to 322,400 tons from June. The high-graded ferronickel produced by steel mills was about 95,500 tons, MoM decreased by 2,700 tons; that produced by ferronickel factories was 193,100 tons, MoM decreased by 31,100 tons.

Chrome: Price drops the freezing point. More factories have to further reduce or suspense the production.

The trading price of the chromium ore futures from South Africa’s ore mountain slumped. The concentrated ore (40%~42%) futures fell greatly to US$220/MT which was US$40/MT lower on-week basis and the delivery date is around mid-October.

Influenced by the drop, the overseas chromium ore price also fell and down by US$10 ~US$15/MT. The drop in ore price will lead to the decreasing cost of future high chromium production and there might probably reduce further.

But based on the current production, what the factories are using right now is the expensive material bought before when the chromium ore was at a high price. Therefore, it means that the recent drop in cost does nothing to offset their deficit now.

In China, the production of high-carbon ferrochromium continues to decrease in July. The high-carbon ferrochromium reduced to 576,800 tons in July which was 25,300 tons less than June and the declining percentage is 4.20%.

Meanwhile, steel mills tune down the purchasing price of high-carbon ferrochromium in August. Tsingshan reduce it to US$1,197/MT (with 50% of chromium content) (tax inclusive, delivered to factory) which cuts down by US$150 from last month. The price will continue to drop as some steel mills stop or reduce buying the high chromium. In August, the price has fallen by US$45/MT (with 50% of chromium content).

The coke price rebounded by US$30/MT. The production cost of high chromium remains high. As we know, in August, there are more factories reducing the production of high chromium. It is predicted that the price will get stronger support.

Freight|| Sea freight keeps decreasing.

The SCFI on August 5th slightly decreased to 3562.67, declining by 4.7% on-week basis.

Europe/ Mediterranean: According to the latest data released by Eurostat, retail sales in the eurozone fell by 3.7% year-on-year in June, and the decline in consumption data showed that the prospects for economic recovery were poor. On August 12th, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European base port market was US$4,917/TEU, down by 3.8% from last week. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean base port market was US$5,633/TEU, down by 3.7% from the previous week.

North America: According to data released by the U.S. Department of Labor, the number of unemployed people in the United States reached 262,000 on August 6, rising for the second consecutive week and approaching the highest level since November 2021. Meanwhile, inflation remains high. On August 12th, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East base ports were US$6,153/FEU and US$9,106/FEU, respectively, down by 5.3% and 2.4% from the previous week.

The Persian Gulf and the Red Sea: On August 12th, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the basic port of the Persian Gulf was US$2,372/TEU, decreasing by 8.8% from the last week.

Australia/ New Zealand: On August 12th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the basic ports of Australia and New Zealand was US$2,372/TEU, down by 8.8% from the previous week.

South America: Sea shipping is now in the traditional peak season but approaching the end. The spot market booking price continued to rise. On August 12th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American base ports was US$9,214/TEU, decreasing by 3.3% from the previous week.