Some of you might be having holidays, and hope that you are enjoying your time. Chinese producers are also very close to Spring and New Year holidays and probably, and they will come earlier than we expected before because the first tide of COVID-19 is spreading very fast in China. We have already seen some restaurants or small businesses close this week. Many businesses have to face this urgent situation, so fewer people can work as usual. The real estate industry is more hopeful to turn better as Beijing keeps giving support, and thereby, the stainless steel industry also gets encouraged. Prices of stainless steel increased significantly last week before the US Fed announced the new and slower raise in interest rates. Besides, seemingly, sea freight is getting stable in some regions. More about the Stainless Steel Market Summary in China, please keep reading.

WEEKLY AVERAGE PRICES

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

2,720 |

46 |

1.03% |

|

Foshan |

2,765 |

46 |

1.02% |

||

|

Hongwang |

Wuxi |

2,655 |

45 |

1.30% |

|

|

Foshan |

2,620 |

9 |

1.42% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,560 |

43 |

1.73% |

|

Foshan |

2,575 |

30 |

0.85% |

||

|

316L/2B |

TISCO |

Wuxi |

4,415 |

90 |

0.84% |

|

Foshan |

4,490 |

87 |

0.68% |

||

|

316L/NO.1 |

ESS |

Wuxi |

4,330 |

157 |

0.87% |

|

Foshan |

4,345 |

128 |

0.50% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,580 |

42 |

0.00% |

|

Foshan |

1,550 |

28 |

1.57% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,485 |

42 |

0.00% |

|

Foshan |

1,480 |

25 |

1.77% |

||

|

430/2B |

TISCO |

Wuxi |

1,255 |

13 |

-0.77% |

|

Foshan |

1,250 |

6 |

-0.13% |

TREND|| Spot price continue to climb up a week before Christmas

The spot price of stainless 201 and 304 volatized synchronously last week, both rose on Monday but lost what they had gained on Friday, while the price of stainless steel 430 remained strong. The most traded contract price fell from US$35 to US$2625/MT.

Stainless Steel Series 300: Future price heading down to cool off the market

Until last Friday, cold-rolled 4-foot mill-edge stainless steel 304 closed at US$2600/MT, hot rolled stainless steel 304 closed at US$2545/MT at US$29/MT. The theoretical production cost of cold rolled 304 rose by US$55 to US$2635/MT.

There was about a 4,439 tons increment in the inventory of the stainless steel 300 series, closed at 306,300 tons. The demand downstream is gradually recovering despite the COVID infection rate spiking as the loosening restriction in China. Notably, the stainless steel inventory of the 300 series in eastern China is recently increasing, owing to Delong’s distribution of stainless steel being back to a normal level.

Stainless steel 200 series: Stabilized after rising.

The most traded base price of cold rolled stainless steel 201 and 201J2 rose by US$36 to US$1545/MT and US$1450/MT respectively. The most traded price of hot rolled 5-foot stainless steel rose US$43 to US$1490/MT.

The increment in inventory last week was mostly taken up by Beigang New Material and Baosteel. However, as the spring festival is drawing close and downstream industries taking holidays early, the transaction is getting sluggish which is piling up the stainless-steel spot goods in the market.

Stainless steel 400 series: sound market performance to boost the price up

The guidance price of 430/2B remained at US$1380/MT quoted by TISCO, while JISCO quoted US$1350/MT with a US$14 rise.

The quote prices of 430/2B trended upward at the Wuxi market last week, located at between US$1270-US$1275/MT, about a US$29 rise.

The production cost of high chrome is surging. The EXW price of high chromium chromite (50% chromium) spiked between US$1365/MT-US$1395/MT last week, a US$75 increase from the week before.

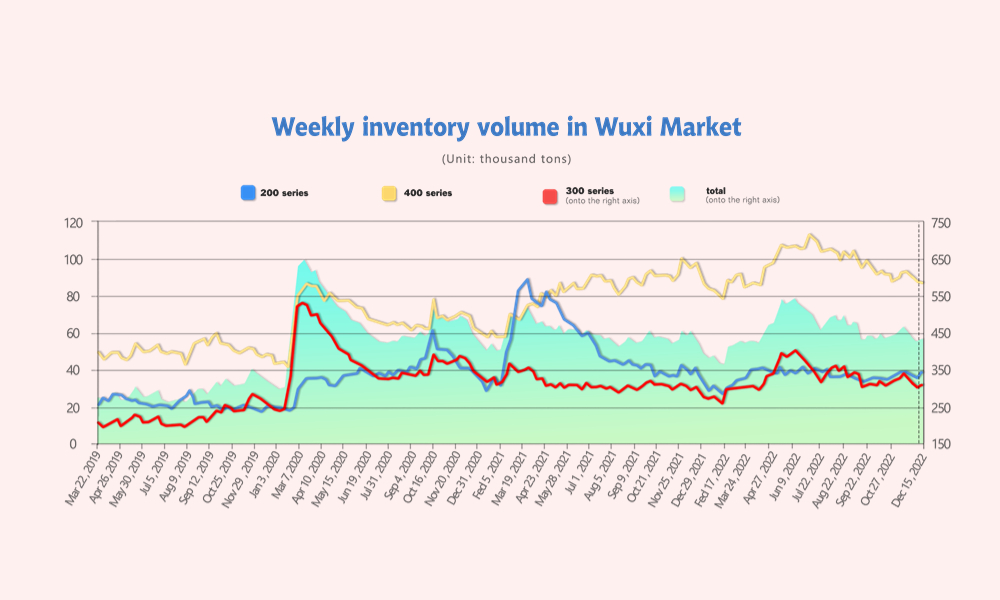

INVENTORY|| Price surge, inventory level goes different direction

The inventory level at the Wuxi sample warehouse rose by 6,606 tons to 431,222 tons (as of 15th December).

the breakdown is as followed:

200 series: 3,000 tons up to 38,450 tons

300 Series: 4,439 tons up to 306,254 tons

400 series: 833 tons down to 86,518 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| December 8th | 35,450 | 301,815 | 87,351 | 424,616 |

| December 15th | 38,450 | 306,254 | 86,518 | 431,222 |

| Difference | 3,000 | 4,439 | -833 | 6,606 |

Stainless steel 200 series: weak transactions lead to the slight increment

Cold-rolled stainless steel took a major part of the slight boost last week. More and more downstream industries and market traders are taking holiday early in response to the rapidly growing infection rate of COVID and sluggish demand in the market.

Stainless steel 300 series: More orders taken; inventory went up.

In the early December, the 10 new COVID-easing steps boosted the demand a little, smoothing the digestion and resupply of the resources. The general distribution in eastern China had back to normal and more resources from Indonesia are arriving in Wuxi.

Stainless steel 400 series: spot goods inventory was downed, and the price went up

The production had dropped as expectedly as JISCO and TISCO planned, easing off the imbalance of supply and demand. The upraising raw material price had also prompted up the stainless-steel price. The inventory level is likely to drop this week.

Stainless Steel Crude Steel Production:

The 34 major cold-rolled stainless steel mills contributed 1,222,700 tons of stainless-steel production in November, about 4.86% lesser than last month, and 2.91% more compared to the same period last year. A Series of stimulus policies on real estate industries will boost the actual production volume way more than expected.

Here is the breakdown:

Series 200 Production: 416,700 tons, 4.83% tons more than last month, and 23.61% more than the same period last year.

Series 300 Production: 626,000 tons, 5.72% lesser than last month, and 5.69% lesser than the same period last year.

Series 400 Production: 180,000 tons, 19.54% lesser than last month, and 3.85% lesser than the same period last year.

RAW MATERIALS|| Cost is increasing

Nickel: Indonesia Won’t Rush to Impose Nickel Tax to Stay Competitive

The most traded contract of ShFE Nickel continued to rush high last week right after the 50 base point added to the US interest rate, then ShFE Nickel and LME Nickel were trending downward on Friday, closed at US$31605/MT with US$214 (0.68%) drops last Friday.

Influenced by a series of global financial movements, the valuation of Nickel price has seemingly been overstated lately. The Nickel price is likely to fluctuate as uncertainty remains over the direction of the COVID pandemic in China and the supply of nickel is tightening at the moment.

Indonesia is still studying whether to impose a tax on nickel exports and isn’t looking to impose the levy immediately as it could hurt investors, said Coordinating Minister for Investment and Maritime Affairs Luhut Panjaitan.

Chrome: Power rationing halted the production

The high chromium production volume slumped down as seasonal power rationing is underway across China, most of the industries chose to suspend production as they received a jaw-dropping power bill, tightening the supply of the high chromium. The EXW price of high chromium chromite(50%) rose US$14 to US$1395/MT, the purchase price reached US$1420/MT.

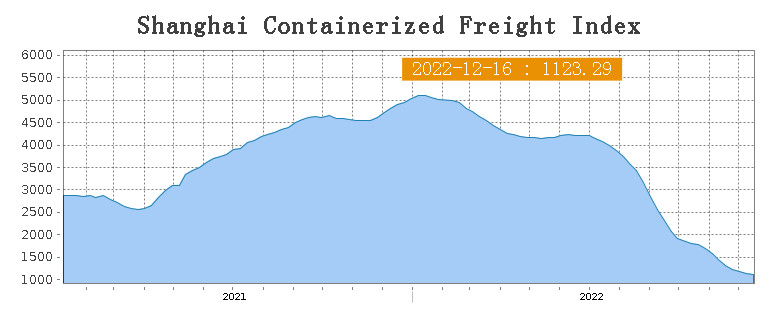

SEAFREIGHT|| Shipping market stopped bleeding

China's container transportation market is stabilizing. Freight rates on multiple sea routes had different movements last week. Until 16th December, the Shanghai Containerized Freight Index was downed by 1.3% to 1123.29.

Europe/ Mediterranean: The ZEW Indicator of Economic Sentiment for the Euro Area "improved" to -23.6 in December from -38.7 in the prior month, better than the expected reading of -25.7. Similar to the findings for Germany, the December Euro Area reading was also the highest since February.

Until 16th December, the freight rate had a U-turn from decline, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$1050/TEU, an 0.3% increase. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1851/TEU, up by 0.5%

North America: Retail sales for the month declined 0.6%, even worse than the Dow Jones estimate for a 0.3% drop. The number is not adjusted for inflation as gauged by the Labor Department’s consumer price index, which increased 0.1% in November, which also was below expectations. Spending declined in some areas, including categories like motor vehicles, furniture, consumer electronics, clothing and sporting goods.

On 16th December, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1,423/FEU and US$3,169/FEU, 0.5% and 3.7% fall accordingly.

The Persian Gulf and the Red Sea: The freight rate dropped last week. On 16th December, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had a 1.5% fall from last week's posted US$1153/TEU.

Australia/ New Zealand: The freight rate had bounced back. On 16th December, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$738/TEU, which went up by 4.7% from the previous week.