It is absolutely good news. On December 7th, Beijing further eases the COVID-19 restrictions, marking a significant step toward reopening. The most influential shall be that people can travel without showing a "green code" and the 24hrs or 48hrs certificate of Negative Nucleic Acid Test. But it is hard to say we are confident about the future economy as the global market is getting weaker. Poor market performance naturally leads to a contraction on the production side. To cope with the economic recession and sluggish demand worldwide, stainless steel producers have to cut output. All most all stainless steel producers around the world are reducing their output. Maybe this step would stimulate the market some days. According to a source related to the Chinese stainless steel industry, many domestic stainless steel producers stop distributing resources to their agents and reduce producing to withhold the ores for the production next year. It is predicted that the stainless steel inventory in China will keep decreasing until January. For more details of the market, please roll down to Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICE

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

2,640 |

0 |

0.00% |

|

Foshan |

2,685 |

0 |

0.00% |

||

|

Hongwang |

Wuxi |

2,570 |

4 |

0.18% |

|

|

Foshan |

2,570 |

-3 |

-0.12% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,465 |

14 |

0.62% |

|

Foshan |

2,515 |

-3 |

-0.12% |

||

|

316L/2B |

TISCO |

Wuxi |

4,275 |

-12 |

-0.28% |

|

Foshan |

4,360 |

0 |

0.00% |

||

|

316L/NO.1 |

ESS |

Wuxi |

4,125 |

0 |

0.00% |

|

Foshan |

4,185 |

0 |

0.00% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,535 |

0 |

0.00% |

|

Foshan |

1,500 |

1 |

0.10% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,440 |

-6 |

-0.44% |

|

Foshan |

1,425 |

9 |

0.67% |

||

|

430/2B |

TISCO |

Wuxi |

1,250 |

-9 |

-0.76% |

|

Foshan |

1,240 |

-9 |

-0.76% |

TREND|| Production cut shifted the supply and demand leftward

The average spot price of the stainless-steel series was stabilized last week. Stainless steel 201 and 304 were flatted while 430 dropped slightly. The most traded contract price rose by US$20 to US$2570/MT.

Stainless steel 300 series: spot price stabilized and promising digestion in inventory

The spot price of stainless steel 304 was levelling off, cold-rolled 4-foot mill-edge stainless steel was quoted at US$2525/MT and hot-rolled stainless steel 304 was quoted at US$2465/MT. More and more stainless-steel manufacturers are joining the line of production reduction recently as the peaking costs and weakening demand. On Saturday, the stainless steel 304 continue to rushing high, since that on December 2nd, LME nickel closed at US$28,150, US$840 higher than the previous day; ShFE Nickel followed suit and rose by US$1101 to US$30,248/MT. Stimulated by robust nickel market, China’s stainless steel futures of contract 2301 increased by US$57/MT and closed at US$2,620/MT. Meanwhile, the spot price of the cold-rolled stainless steel 304 generally rose to US$2,540/MT.

Stainless steel 200 series: Spot price was barely moved

The spot price of stainless steel 201 was in a weak trend last week. Both most traded spot prices of cold and hot-rolled stainless steel 201 were levelled off. The spot price of Cold rolled mill edge stainless steel J1 and 201J2 closed at US$1505/MT and US$1420MT accordingly. hot rolled 5-foot stainless steel reached US$1420/MT.

The sluggish performance of the stainless steel 201 transaction continues as the inventory of some specification were running low, traders, therefore, were unwilling to cut the price, the chain reaction of the rising price of stainless steel 304 had lifted the price of 201 a little on last Saturday.

Stainless steel 400 series: Digestion of inventory accelerated while weak spot price remain unchanged

The guidance price of 430/2B quoted by TISCO and JISCO remained at US$1375/MT and US$1330/MT respectively.

The quoted price of 430/2B had a weak trend last week, stabilized between US$1245-US$1250/MT, a US$15 drop. The EXW price of high chrome remained stable at US$1300/MT (with 50% chromium).

Stainless steel futures:

The most traded contract price of stainless steel had fluctuated and had a dramatic increase last Friday, peaking at US$2585/MT.

The stainless steel market was somewhat speculative in the short term as China had taken the first step in easing off the epidemic control, but the optimization has limited effect on the market in the short term due to the inactive purchase activities and the small increment in inventory.

In the long term, the term structure could be shifted to distant contango under the influence of the production reduction, narrowing price difference by month and the possibility of a heavy tax on nickel.

In summary

The stainless steel market had limited room for growth although it is bullish looking lately, the supply and demand were in a weak trend.

Stainless steel 300 series: production volume shrank, and the down-trending reserve requirement ratio encourages investment. The base price of cold rolled stainless steel 304 is projected to hover between US$2510-US$2555/MT.

Stainless steel 400 series: The EXW price of high chrome had a slight drop and the price of chrome ore faced down as the demand remain sluggish. It is estimated that the price of 430/2B will be in a weak trend.

Stainless steel 200 series: The production volume and market resource will be dropped in December as the production cut is on schedule.

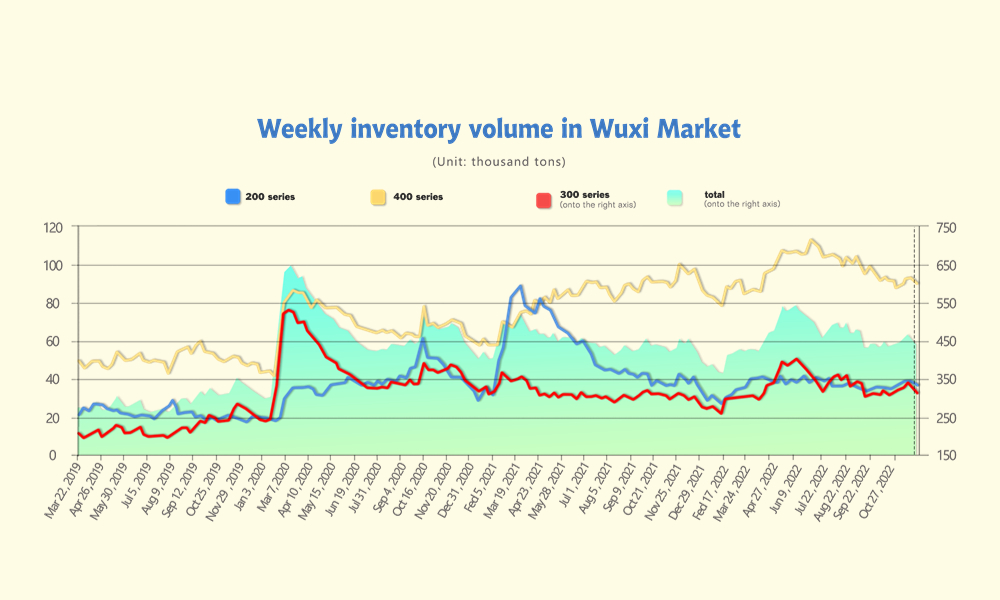

INVENTORY|| A noteworthy decline

The inventory level at the Wuxi sample warehouse fell by 19,534 tons to 434,595 tons (as of 1st December).

the breakdown is as followed:

200 series: 1,174 tons down to 36,328 tons

300 Series: 14,599 tons down to 309,597 tons

400 series: 3,761 tons down to 3,761 tons

Stainless steel 200 series: Slight decrease

The 1174 tons drop made the inventory level down to 36,328 tons which are likely to continue to drop in the second half of December. The new arrivals of last week mostly are delivered by Beigang New Material. The stainless steel 201 with thicker thicknesses are comparatively in short. But considering the production cut, next week, the spot inventory will reduce.

Stainless steel 300 series: Slight decrease

There was 14,600 tons inventory decrease in the 300 series, the preposition warehouse had the most reduction. Delong continues to reduce cold-rolled and hot-rolled resource distribution, 30-50% short of the normal amount. It seems that the Chinese stainless steel producers are preparing for the new year holiday. Recently Delong has begun to limit the pickup volume for the agents and withhold their ore materials as a reserve for the production next year. On the other hand, due to the continuous weak demand and increasing production cost, more and more steel mills cut down output to avoid profitless productions. It is believed that in December and January, the inventory will keep decreasing.

Stainless steel 400 series: Imbalance supply and demand

3,800 tons decrease in 400 series. The supply pressure was eased off, but the market demand remains sluggish. Although steel mills have decreased the purchasing price of high chromium in December, the profit margin of 400 series is narrow. A significant reduction in production volume can be forecasted in December as it is planned by TISCO and JISCO. The inventory is likely to have a modest scale of movement.

RAW MATERIAL|| Raw material market has a Gordian Knot to solve

Nickle: big frustration on Indonesia export tax

Indonesia's Government failed to reach an agreement with local ferronickel industries on nickel export tax, resulting the volatility in LME Nickel. Meanwhile, the price of raw materials stands still as the Philippines is currently in the rainy season.

Meanwhile, LME nickel soared US$840 up to US$28,150/MT last Friday, the price of the SHFE Nickel 2301 contract surged by US$1101 to US$30595/MT, Stainless steel future contract price 2301 rose by US$57 to US$2620/MT.

Federal Reserve Chairman Jerome Powell confirmed last Wednesday that smaller interest rate increases are likely ahead and could start in December. The nickel inventory is still located in historically low.

Chrome: The production cut could be a hurdle for the price to jump prior to the Spring Festival

The tendering-base purchase price is finalized at between US$1275-US$1315/MT(With 50% Chromium). There are different opinions on the trend of the high chromium market before the Spring festival. On one hand, production and logistic is heavily interrupted at the moment, and some reckon the price could face up right before the festival. On the other hand, some voices pointed out that the raw material has been refilled by the mill for their production plan prior to the Spring festival, seemingly the production cut had a limited effect on purchase volume. Therefore, the price of high chromium is more likely to fall before the Spring festival.

As a matter of the fact, the “supply-demand” is the key factor to solving the complexity. The market demand for high chromium will fall indubitably since the significant reduction in production from December to January is foreseeable, but the output from resuming production in November might lift the supply amount slightly higher than the expectation which is a bad omen for the price rebound.

SEAFREIGHT|| Freight rate dropped, but slower the pace down

The sluggish situation of China's container transportation market was continuing as the demand was still laying low. The decline of freight rate on multiple sea routes is slowed. Until 2nd December, the Shanghai Containerized Freight Index was downed by 4.8% to 1171.36.

Europe/ Mediterranean: The unemployment rate of Germany rose by 17,000 in November, more than economists had estimated, data Wednesday showed. That pushed the unemployment rate up to 5.6% from 5.5%. European economy continues to be haunted by the spiking energy price and high standing inflation rate. Until 2nd December, the freight rate slowed down the declining.

The freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$1085/TEU, an 1.4% decrease. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1827/TEU, down by 0.8%.

North America: According to the Institute for Supply Management’s manufacturing index, a key barometer of activity at American factories, fell to 49% in November, down from 50.2% in October, the 5th drop in half-years’ time and the first time to break through the threshold since Covid-19 pandemic.

On 2nd December, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1437/FEU and US$3437/FEU, 3.9% and 6.8% fall accordingly.

The Persian Gulf and the Red Sea: The freight rate dropped last week. On 2nd December, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had a 5.3% fall from last week's posted US$1184/TEU.

Australia/ New Zealand: The freight rate continued to drop. On 2nd December, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$602/TEU, down by 1.8% from the previous week.

South America: The imbalanced supply-demand curve and high inflation rate had dragged the freight rate down. On 11th November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2025/TEU, down by 11 % from the previous week.

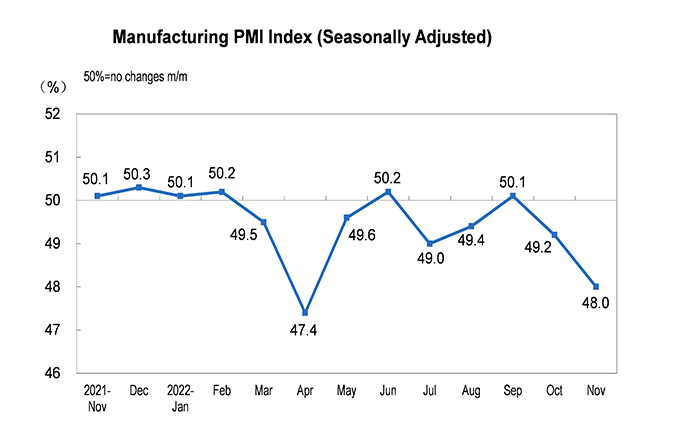

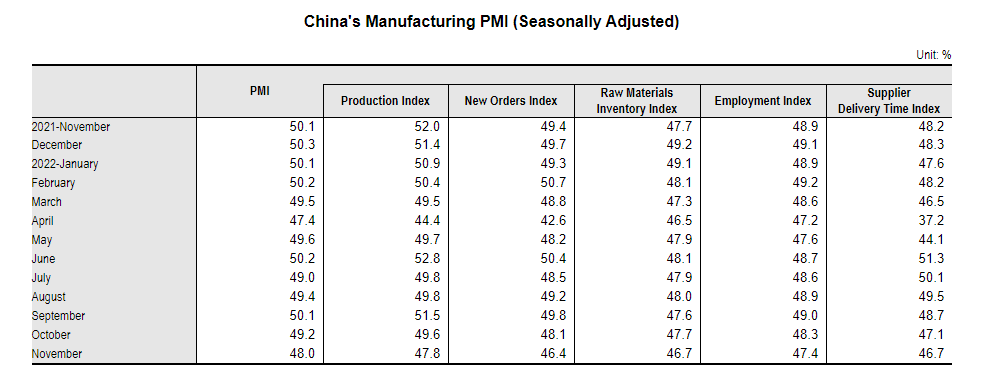

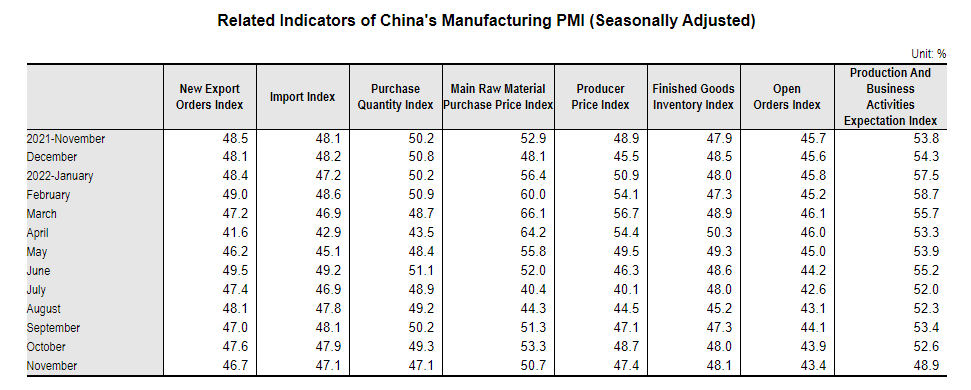

MACRO:China's Manufacturing PMI in November continues to fall and stainless steel producers reduce ouput globally.

China’s PMI in November continues to decrease

In November, the Purchasing Manager Index (PMI) of China's manufacturing industry was 48.0 percent, decrease by 1.2 percentage points from the previous month.

Other key and related indicators of China's Manufacturing PMI all fell and below the threshold.

The Chinese government has released three major real estate relaxation policies to provide systematic support to the real estate supply side from the perspectives of credit, bonds, and equity. Macroscopically, the price of finished products has been driven up, but terminal demand such as consumption and manufacturing investment has been suppressed again; on the other hand, the US Markit manufacturing PMI continued to fall by 2.8 percentage points to 47.6% in November, and the Eurozone manufacturing PMI rebounded slightly 0.9 percentage points to 47.3%. The overseas economic prosperity index is in a contraction trend, driving down exports and showing no signs of easing the plight of real estate.

Stainless steel producers cut output amid weak demand

Source: MEPS International

Many major steelmakers expect challenging market conditions in the fourth quarter. Consequently, MEPS has lowered its stainless steel production forecast, for 2022, to 56.5 million tonnes. The total outturn is projected to rebound to 60 million tonnes in 2023.

Worldstainless, the body representing the global stainless steel industry, expects consumption to recover, next year. However, energy costs, developments in the war in Ukraine, and measures adopted by governments to combat inflation provide substantial risks to the forecast.

Major European stainless steel mills began reducing their output in the middle of 2022, as energy costs soared. That trend is expected to continue, in the final three months of this year. Demand from local distributors is weak.

At the onset of the war in Ukraine, supply concerns caused stockists to place large orders. Their inventories are now inflated. Moreover, end-user consumption is falling. The Eurozone purchasing managers’ indices, for the manufacturing and construction sectors, are currently below 50. The figures indicate that activity in those segments is dropping. European producers are still contending with raised power expenditure. Attempts by regional flat product mills to introduce energy surcharges, to recoup those costs, are being rejected by local buyers. Consequently, domestic steelmakers are reducing their output to avoid unprofitable sales.

US market participants are adopting more positive economic outlooks than their counterparts in Europe. Nevertheless, underlying domestic steel demand is falling. Availability of material is good. Output in the fourth quarter is expected to decline, so that production meets the current market demand.

Asia

Chinese steelmaking is forecast to fall, in the second half of the year. Covid-19 lockdowns are supressing domestic manufacturing activity. Expectations that domestic steel consumption would increase after the Golden Week holidays proved to be unfounded. Furthermore, despite recently announced fiscal measures to support the Chinese property sector, underlying demand is weak. As a result, melting activity is forecast to decline, in the fourth quarter.

In South Korea, the estimated melting figures for the July/September period fell, quarter-on quarter, due to weather-related damage to POSCO’s steelmaking plants. Despite plans to rapidly bring those facilities back online, South Korean production is unlikely to recover significantly, in the final three months of this year.

Taiwanese melting activity is being weighed down by high domestic stockholder inventories and poor end-user demand. In contrast, Japanese output is expected to remain relatively stable. Mills in that country are reporting steady consumption by local customers and are likely to maintain their current output.

Indonesian steelmaking is estimated to have slipped in the July/September period, quarter-on-quarter. Market participants report shortages of nickel pig iron – a key raw material for stainless steel production in that country. Furthermore, demand in Southeast Asia is muted.