Any space for the market to struggle? The market is struggling. Steel mills and traders think that there is no space for the stainless steel prices to drop further. However, the downstream manufacturers are not confident about the future consumption. Steel mills have to continue to reduce production in November as the demand stays bearish and the stainless steel prices are lower than the cost. No one wants to do a losing trade, but completely halting the work is impossible for the mills. For one, it is a business morale when facing a large group of employees. Besides, to restart the production line is a billion-dollar deal. Thereby, according to the scheduled production in November, steel giants will cut down the output of stainless steel crude steel by 307,700 tons from October. Will this help them to go through the slack season? The good news is that the ore cost decreased, which can fix the loss to a certain extent. This year is approaching to an end. Can the stainless steel market get back to the motivation it used to be? Any opinion, share it with us. For more details, please roll up to the full content of the Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,240 | -6 | -0.26% |

| Foshan | 2,280 | -6 | -0.26% | ||

| Hongwang | Wuxi | 2,160 | -10 | -0.47% | |

| Foshan | 2,165 | -4 | -0.20% | ||

| 304/NO.1 | ESS | Wuxi | 2,065 | -12 | -0.64% |

| Foshan | 2,085 | -14 | -0.70% | ||

| 316L/2B | TISCO | Wuxi | 3,730 | -58 | -1.59% |

| Foshan | 3,810 | -50 | -1.34% | ||

| 316L/NO.1 | ESS | Wuxi | 3,540 | -50 | -1.44% |

| Foshan | 3,595 | -30 | -0.87% | ||

| 201J1/2B | Hongwang | Wuxi | 1,365 | 0 | 0.0% |

| Foshan | 1,365 | 0 | 0.0% | ||

| J5/2B | Hongwang | Wuxi | 1,270 | -4 | -0.36% |

| Foshan | 1,280 | 0 | 0.0% | ||

| 430/2B | TISCO | Wuxi | 1,280 | 0 | 0.0% |

| Foshan | 1,255 | -6 | -0.48% |

TREND|| Stainless steel price found a hard way to touch down.

The trend of spot price of stainless steel last week showed little variation between series and most of the series had explored a new level of cycling around: Stainless steel 201 and 430 were overall stable, but stainless steel 304 slid down a little. Until last Friday, the mainstream contract price of stainless steel fell by US$21/MT to US$2115/MT.

Stainless Steel 300 series: Struggling at the bottom of the price chart.

The market price of Stainless steel 304 sank to the bottom last week: the mainstream base price of cold-rolled 4-foot mill-edge stainless steel 304 fell US$7/MT to US$2120/MT while the hot-rolled stainless steel was quoted as US$2055/MT. Most of the sellers were forced to undersell the products with great inventory pressure in the off-season.

Stainless steel 200 series: The price is in fear of decline as demand turned sluggish.

The price of stainless steel 201 ran smoothly until last Friday: The mainstream base price of cold-rolled stainless steel 201J1, 201J2/J5, and 5-foot hot-rolled stainless steel remained stable, and quoted as US$1340/MT, US$1240/MT, and US$1275/MT respectively.

The weekly average settlement price of BN1D4 from Baosteel Desheng Stainless Steel was US$1245/MT, Beigang new material settled stainless Steel 201J5/2B at US$1240/MT and Tsingshan’s 201J2/2B was quoted as US$1245/MT.

Stainless steel 400 series: The price trend of 430 might be shaken by the weak demand.

The market guidance price quoted by TISCO and JISCO remained untouchable last week and closed at US$1420/MT and US$1525/MT respectively.

The quotation of stainless steel 430/2B sustained a weak trend and the mainstream quotation was hung approximately at US$1290/MT. Stainless steel 430/NO.1 remained flat at US$1135/MT.

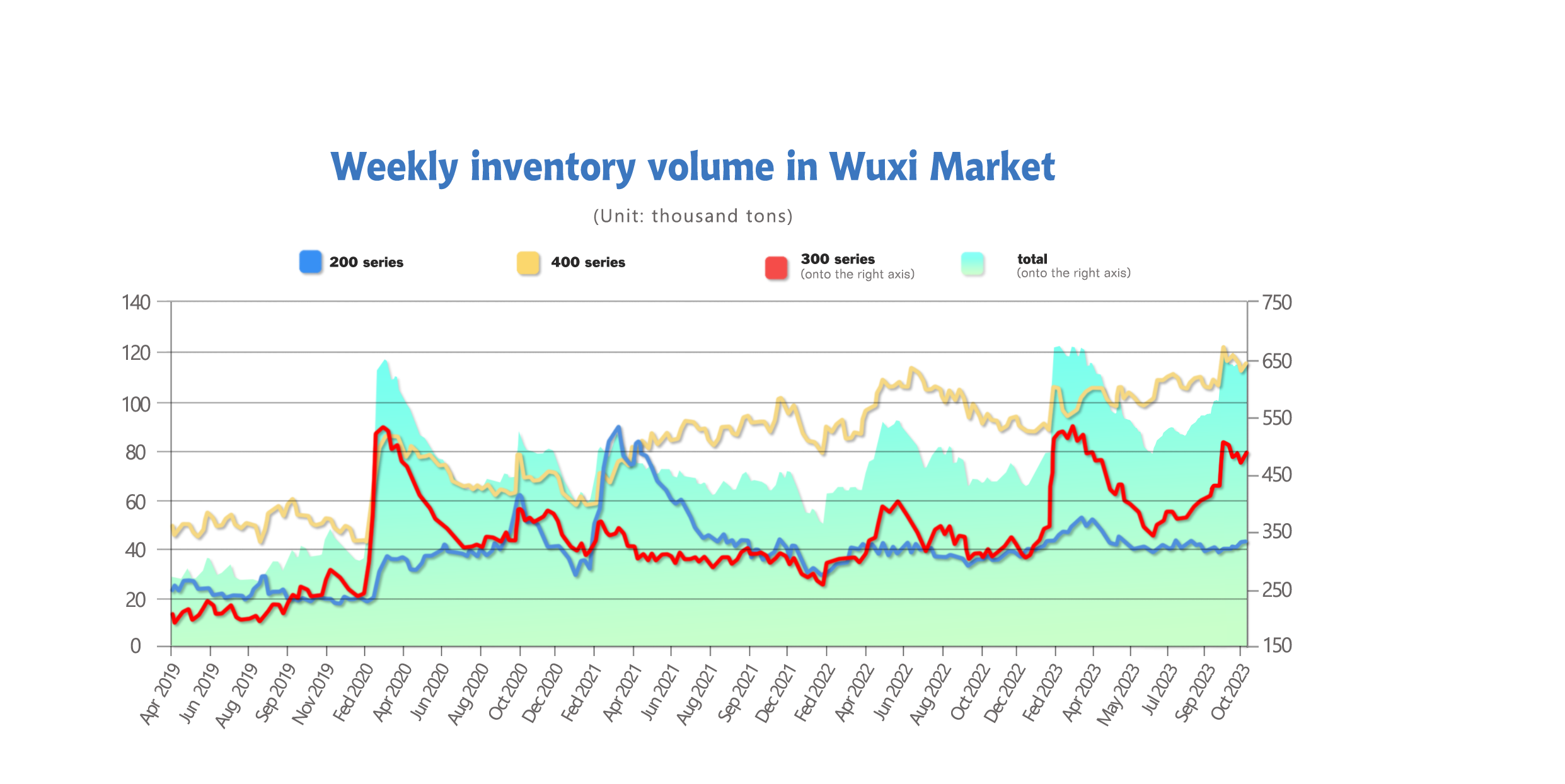

INVENTORY|| Inventory surged as the stainless-steel market received a cold reception.

The total inventory at the Wuxi sample warehouse increased by 20,782 tons to 643,240 tons (as of 9th November).

the breakdown is as followed:

200 series: 953 tons up to 42,549 tons

300 Series: 16,730 tons down to 485,903 tons

400 series: 3,099 tons down to 114,788 tons

|

Inventory in Wuxi sample warehouse (Unit: tons) |

200 series |

300 series |

400 series |

Total |

|

November 2nd |

41,596 |

469,173 |

111,689 |

622,458 |

|

November 9th |

42,549 |

485,903 |

114,788 |

643,240 |

|

Difference |

953 |

16730 |

3099 |

20,782 |

Stainless steel 300 series: warehouses were crowded with the latest resources.

The hot-rolled stainless steel was the biggest driver in last week’s inventory increment.

The spot price of the stainless steel 300 series landed deeper last week as the market had few mentionable transactions. The backwash of the production cut is now gradually kicking in the stainless steel market lately received fewer resources than usual.

Major steel mills in south China, however, stood out among others with a high production volume and bursting sone of the preposition warehouses.

Stainless steel 200 series: Oversupply boosts the inventory.

The 1.13 million tons of 200 series crude steel production in October hinted that the supply of 200 series in October has been shifted rightward. But the gloomy atmosphere decelerates the destocking and the future price.

Stainless steel 400 series: weak demand shaped the cumulative stock.

The was an obvious shrink in resources arriving from steel mills such as Tsinshan and JISCO, the inventory level somehow rose a little. It is understood that the planned production of 400 series in November will be 275,500 tons with 5.96% short month on month, and the spot inventory level is likely to rally in the short term.

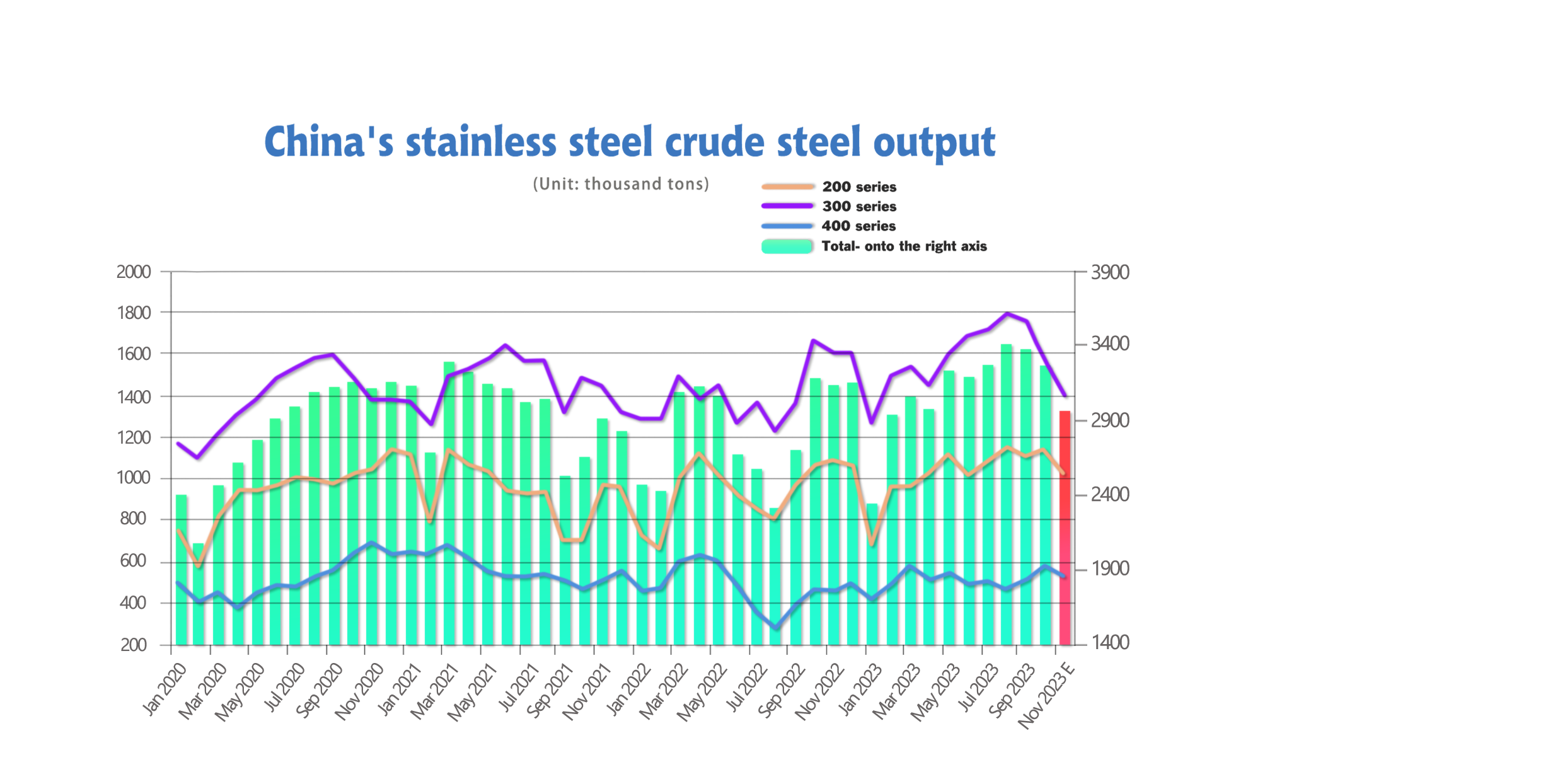

Production: November output continues to drop, 300 series to reduce by 161,500 tons

The total production of crude stainless steel in October was 3.27 million tons, which concluded a 3.44% (or 116,300 tons) shrink MoM, and 2.83% (or 90,000 tons) increase YoY.

Here is the breakdown:

Series 200:

Production: 1,132,900 tons, a 1.94% (or 21,600 tons) lift MoM, a 7% (or 74,100 tons) lift YoY

Series 300:

Production: 1,566,500 tons, a 11.11% (or 195,800 tons) drop MoM, a 5.34% (or 88,300 tons) decrease YoY.

Series 400:

Production: 567,300 tons, 11.37% (or 57,900 tons) lift MoM, a 22.51% (or 104,200 tons) lift YoY

High inventory volume, low demand, and heavy output costs are now forcing steel mills to put production on hold. According to statistics, there are about 370,000 tons (out of 620,000 tons in total) of stainless steel 300 series have been wiped out from production since October. Hence, some of the steel mills gave up production quota of series 300 to series 200 and series 400 in October, consequently boosting their output to 1.13 million tons and 570,000 tons.

It is estimated that the total production of crude stainless steel in November will be 2.96 million tons, which is a 9.42% (or 307,700 tons) shrink MoM, and a 5.88% (or 184,800 tons) increase YoY.

Here is the breakdown:

Series 200:

Production: 1,022,000 tons, a 9.79% (or 110,900 tons) drop MoM, a 6.31% (or 63,100 tons) drop YoY

Series 300:

Production: 1,405,000 tons, a 10.31% (or 161,500 tons) drop MoM, a 12.23% (or 195,800 tons) decrease YoY.

Series 400:

Production: 532,000 tons, 6.23% (or 35,300 tons) drop MoM, a 16.18% (or 74,100 tons) lift YoY

RAW Material|| Cheaper input cost heals steel mill’s losses.

The mainstream quote price of high-carbon ferronickel extended the downtrend from last week and closed at US$250/Nickel point with a US$4.1 slide; the high-carbon ferrochrome fell US$14/MT to US$1260/MT (50% Chromium).

Nickel: Production continued to dive.

Closing at US$250/nickel point, the EXW price of high-carbon ferronickel is likely to reclaim its position in the short term, because the raw material purchasing is increasing lately.

The overall output of high-carbon ferronickel from state-owned and private steel mills in October was 272,300 tons, about 6,100 tons less than in September. State-owned steel mills took up about 28.7% of total output and private steel mills claimed the big chunk of 71.3%

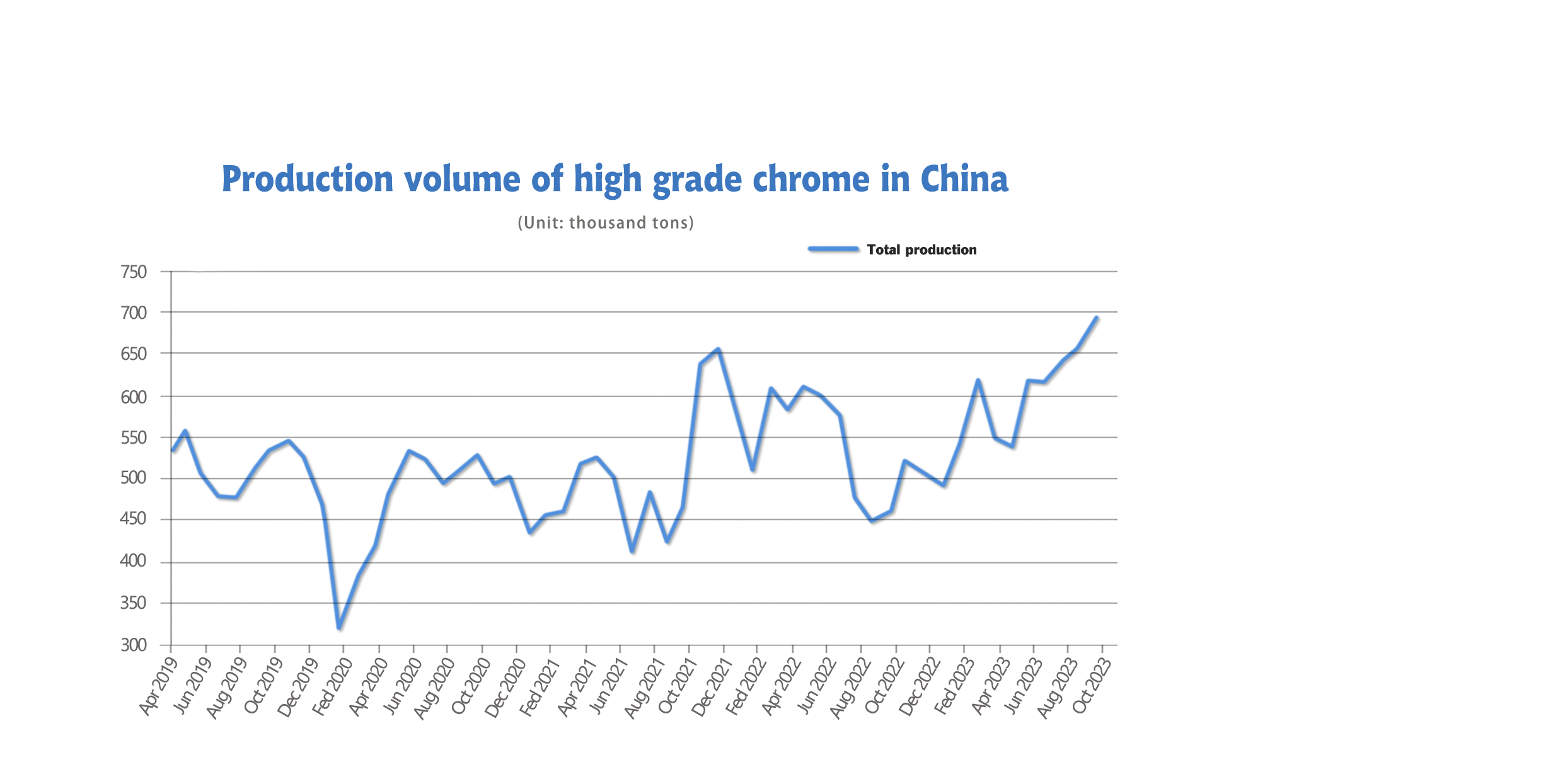

Chrome: Weak trend extended.

The EXW price of high-carbon ferrochrome continued to slide to US$1260/MT, concluding a US$21/MT drop from the previous week. It is believed that the increasing pressure of supply is the main reason for the ongoing price diving.

The production of high-carbon ferrochrome reached 698,700 tons in October this year with a 5.53% (or 36,600 tons) month-on-month increase.

Moreover, the ferrochrome import is recording a 3-month winning streak. About 588,300 tons of chrome were imported from August to September this year, and it has a 25.99% jump from the same period last year. Although the current import data for ferrochrome has not been published, based on the import volume of 259,900 tons of ferrochrome in October 2022, the import volume of high-carbon ferrochrome in this October remains at a relatively high level.

Besides, more and more stainless steel producers cutting their production due to the weak trending stainless steel price. It is believed that the price of chrome products will be stabilized until the next tendering process.

Summary:

Stainless steel prices experienced weak fluctuations this week, with no driving force for inventory replenishment in the market. Steel mills reduced production to alleviate their inventory pressures. However, the extent of the production cuts is not sufficient to boost market conditions, and prices continue to decline. It is expected that the supply side will continue to proactively reduce production capacity to alleviate supply and demand imbalances. The stainless steel market is anticipated to continue weak and oscillating.

300 Series: Affected by steel mill maintenance and production cuts in October and November, prices of raw materials such as nickel-iron continue to decline, reducing the cost support for stainless steel. The market has been oscillating and testing the bottom after the rebound earlier last week. Limited transactions occurred amid a bearish atmosphere, and the destocking of stainless steel inventory did not meet expectations. Short-term stainless steel prices are expected to maintain a weak and oscillating trend.

200 Series: Overall, with current cost reductions and no significant improvement in downstream demand, the supply from steel mills is expected to be tightened in November. Prices remained stable throughout last week, and the mindset of some midstream merchants has quietly changed. They believe that the current prices may have reached the bottom, with limited downward space. Considering the current willingness of steel mills to support prices, the short-term base price of 201J2/5 cold-rolled stainless steel is expected to continue oscillating in the range of US$1225/MT-US$1255/MT.

400 Series: Main raw material prices in the high-carbon ferrochrome market were weak, with reduced cost support, and downstream consumer confidence was further weakened. In the market, although prices did not rise or fall last week, some businesses offered discounts for destocking. With the reduction in production, supply pressures will ease. However, due to high current inventories and limited demand release, the spot prices of the 400 series are expected to be weak and stable.

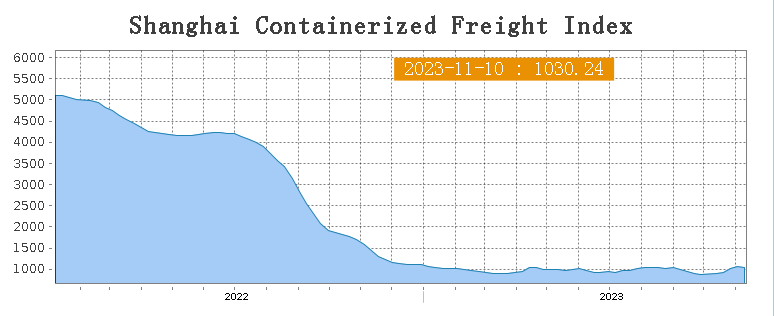

Sea Freight|| Freight rate dropped in main freight line.

China’s Containerized Freight market was overall stabilized and harvested mix result, On 10th November, the Shanghai Containerized Freight Index fell by 3.5% to 1030.24.

Europe/ Mediterranean:

The demand of European freight line was still laying low, there was no significant stimulus to boost the current economic conditions, and freight rate continued to slide.

Until 10th November, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$722/TEU, which fell by 4.5%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1184/TEU, which fell by 3.8%

North America:

The load rate in west freight line to US slid to 90% last week, while the east freight line stabilized. The booking fee of US freight line fell after a lift last week.

Until 10th November, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1843/FEU and US$2356/FEU, reporting a 12.3% and 3.3% decline accordingly.

The Persian Gulf and the Red Sea:

Until 10th November, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf lifted by 3.5% from last week's posted US$1313/TEU.

Australia/ New Zealand:

Until 13th October, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$911/TEU, an 8.7% jump from the previous week.

South America:

The freight market had a slight rebound. on 13th October, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2767/TEU, an 4% increment from the previous week.