Some opinions are getting optimistic. Stainless steel spot inventory decreased and stainless steel mills plan to reduce the output in October. Typically, the stainless steel 300 series will be cut down by about 140,000 tons, which had risen for consecutive seven weeks. Therefore, the potential drop in stainless steel production leads to the decreasing prices of ores, such as ferrochrome and ferronickel. This can possibly partly fix the losses of stainless steel mills that have suffered losses in profit for a long time. If you want to know more about the market, please keep reading the Stainless Steel Market Summary in China

TREND|| Stainless steel price will bottom out and rise through the improved transaction?

The stainless-steel price extended the downtrend from the previous week: stainless steel 201 was overall weakening; stainless steel rose after a decrease and stainless steel 430 remained untouchable.

The mainstream contract price of stainless steel had a slight fall of US$3.5/MT (or 0.1%) to US$2160/MT.

Stainless steel 300 series: The downstream cut loose on purchase after the holiday.

The market price of stainless steel 304 had a faced down last week. Until last Friday, the mainstream base price of cold-rolled 4-foot mill-edge stainless steel 304 closed at US$2150/MT with a US$14/MT decrease, and privately produced hot roll stainless steel fell by US$7 to US$2115/MT.

Stainless steel 200 series: transaction remained sluggish, and spot inventory went up slightly.

The overall price trend of stainless steel 201 remained weak last week: The mainstream base price of stainless steel 201J1accumulated a US$21/MT slide and closed at US$1350/MT; cold-rolled stainless steel J2/J5 dropped by US$28/MT to US$1250/MT; The five-foot hot rolled stainless steel dip slightly by US$7/MT to US$1285/MT.

Last week, the overall market transactions showed weakness. After the holiday, the market did not see the usual strong start. On the first trading day of the futures market, there was a sharp decline in the opening, and spot prices for 304 stainless steel plummeted rapidly. This led to a collapse in trader sentiment, with most of the early week dominated by sales and destocking. With futures turning positive on Thursday, the market's trading atmosphere improved, and the willingness of traders to sell at lower prices weakened and led to a decent recovery of transaction activity.

Stainless steel 400 series: Grade 430 is keeping a steady price trend

The guidance price of 430/2B quoted by TISCO was US$1420/MT, while JISCO quoted it as US$1525/MT.

Lingbo Baoxin quoted the EXW price for cold rolled stainless steel 430 for US$1595/MT, and they are leaving the price of cold rolled stainless steel 304 open for negotiation.

The mainstream quote price of stainless steel 430/2B remained stable at between US$1285/MT-US$1295/MT.

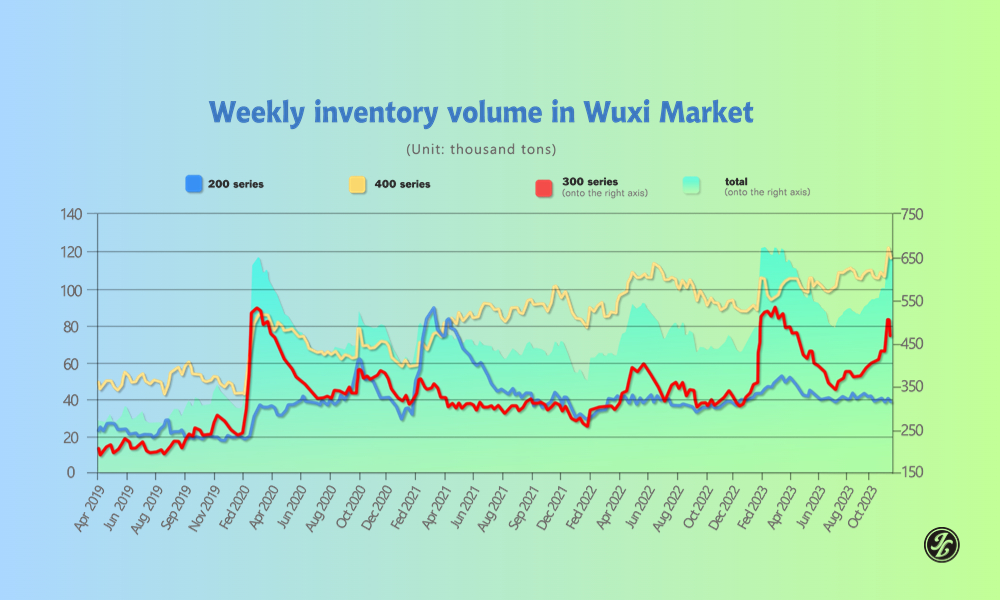

INVENTORY|| Steel mills are cutting production to relieve the inventory pressure.

The total inventory at the Wuxi sample warehouse was downed by US$10,090 tons to 651,883 tons (as of 12th October).

the breakdown is as followed:

200 series: 749 tons up to 39,701 tons

300 Series: 4,923 tons down to 497,015 tons

400 series: 5,916 tons down to 115,167 tons

Stainless steel 300 series: Inventory went up a bit

The preposition warehouses recorded a significant change in inventory as traders started picking up goods after the long holiday, but the agency inventory had gone up slightly. It is understood that the scheduled production for the stainless steel 300 series will go down by 140,000 tons to 1.62 million tons.

Stainless steel 200 series: transaction remained sluggish, and spot inventory went up slightly.

Tsingshan took up the majority of resource arrivals last week, as usual. Hence, the downstream clients are holding a strong “wait and see attitude” attitude as the demand for the 200 series remains sluggish, and the inventory is expected to remain at a high level.

Stainless steel 400 series: Inventory drops due to pre-holiday orders

There was a significant destocking in TISCO’s resources last week. Deals were struck less than the pre-holiday and the destocking was owed to the pre-holiday order.

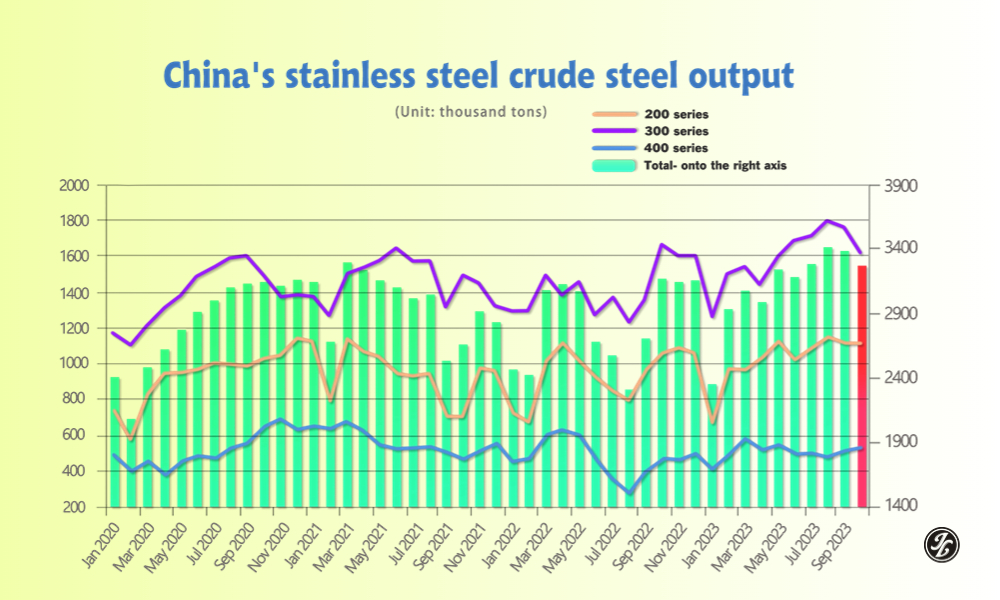

Steel mills: 140,000 tons of production cut

September production: 30,000 tons less than August

The total production of crude stainless steel in September was 3.38 million tons, which concluded a 0.77% (or 26,100 tons) shrink MoM, and 24.96% (or 675,800 tons) YoY.

Here is the breakdown:

Series 200:

Production: 1,111,300 tons, a 3.1% (or 35,500 tons) drop MoM, a 15.79% (or 151,500 tons) lift YoY

Series 300:

Production: 1,762,300 tons, a 1.53% (or 27,300 tons) drop MoM, a 30.04% (or 407,100 tons) lift YoY

Series 400:

Production: 509,400 tons, 7.78% (or 36,800 tons) drop MoM, a 29.88% (or 117,200 tons) lift YoY

Production of October: Steel mills reduce the output

Major steel mills were cutting their production in October as they are suffering losses from production, other producers also postponed their purchase plans. It is estimated that the high level in inventory will be relieved by the low production in October.

The Scheduled production of October will be 3.27 million tons, about 3.35% (or 113,500 tons) decrease MoM, and 2.92% (or 92,800 tons):

Series 200:

Production: 1,119,000 tons, a 0.69% (or 35,500 tons) lift MoM, a 15.79% (or 151,500 tons) lift YoY

Series 300:

Production: 1,623,000 tons, a 7.9% (or 139,300 tons) drop MoM, a 1.92% (or 31,800 tons) drop YoY

Series 400:

Production: 527,500 tons, 3.55% (or 18,100 tons) lift MoM, a 13.91% (or 117,200 tons) lift YoY

Affecting by the high production cost and high inventory, most of the steel mills announced production cuts. It is believed that Tsingshan will uphold the reduction to about 60,000 tonnes. Hence, Delong had already proceeded with production cut before the Chinese National Holiday, and there will be cutting of 3,500-4,000 tons per day.

RAW Material|| Stainless steel further compresses the ore price.

The EXW price of high ferronickel remained flat at US$265/nickel point, the ferrochrome fell US$21/MT to US$1330/MT (50% chromium). The EXW price of high ferrochrome was weakening at between US$1330/MT-US$1345/MT(50% chromium), with a US$21/MT decrease.

Chrome: Production hit 2-year high.

Recently, high-chromium production has remained at relatively high levels. According to statistics, the production in September exceeded 660,000 tons, reaching a new high within the past two years. Additionally, there has been a significant increase in recent imports of ferrochrome, contributing to a relatively ample supply in the high-chromium market.

However, the demand for high-chromium has shown signs of weakening. This is due to the fact that stainless steel production costs remain high, but stainless steel prices have been continuously declining, causing prices to fall below production costs. Moreover, extensive production by steel mills in the past has led to abundant stainless steel inventories. In the Wuxi market, inventories of 300-series stainless steel are approaching the highest point of the year, prompting major steel mills to announce maintenance and production reduction plans in October. It is expected that the demand for high-chromium will decrease around November.

Anticipating increased supply and decreased demand for high-chromium, price support has weakened slightly. However, production costs remain an important factor affecting the price trend of high-chromium. Given the significant losses in the high-chromium sector, there is limited downward price movement in the short term. If stainless steel production reductions continue to increase, this might exert pressure on ferrochrome and chromite ore prices.

Stainless price trend summary: stainless steel prices continued their previous downward trend this week.

Stainless steel has been influenced by steel mill pricing policies, intensifying price competition, and shifting the focus of transactions downward. The competitive market has led to a quicker release of market sentiment. Currently, the main source of pressure is on steel mills, as traders' inventories are relatively low and there is a demand for replenishment. Market transaction atmospheres have also been affected by pricing policies. Prices are currently at a low level, with active transactions primarily aimed at replenishing inventories at these lower prices. Steel mill production costs are still in an inverted state, and continuous losses have prompted some steel mills to arrange production cuts, alleviating the issue of oversupply. The focus will remain on further news about steel mill production plans. It is expected that stainless steel will continue to fluctuate in the future.

300 Series: Currently, there's a tight supply of nickel ore resources, and raw material prices remain robust. This cost support has strengthened the willingness of some steel mills to raise prices, leading to measures such as price limits and maintenance. During the week, inventories fell from their high levels, ending an eight-week consecutive increase. This has driven a rebound in both futures and spot prices, with market sentiment gradually improving. In the short term, stainless steel prices are expected to fluctuate and trend slightly stronger.

200 Series: From mid-September to the present, 201 spot prices have generally been weak. The expectations for downstream purchases before and after the Mid-Autumn Festival and National Day have not been met. Additionally, during the holiday season, various steel mills made concentrated deliveries, resulting in inventory accumulation and weakening support for spot prices. The market is still dominated by pessimism, and it is anticipated that 201 prices will trend slightly weaker in November. 201J2/J5 cold-rolled base prices are expected to fluctuate in the range of US$1205/MT-US$1275/MT.

400 Series: In October, the high-chromium tender prices at steel mills remained unchanged compared to the previous month. Production costs are still high, supporting the prices of 430 stainless steel. In October, various steel mills resumed production, increasing the supply. During the holiday, a large amount of 400 Series spot stainless steel entered the Wuxi market. Due to slow sales during the holiday, there was an inventory buildup. While there has been an increase in downstream inquiries after the holiday, transactions have not met expectations, and inventory digestion has slowed. In the short term, 430/2B prices are expected to trend slightly weaker in the range of US$1275/MT-US$1285/MT.

Sea Freight|| Supply-Demand is smoothly recovering.

China’s Containerized Freight market was overall stabilized, On 13th October, the Shanghai Containerized Freight Index rose by 0.5% to 891.55.

Europe/ Mediterranean:

The demand of European freight line was still laying low, there was no significant change in the supply-demand, and freight rate continued to slided.

Until 13th October, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$562/TEU, which fell by 6.2%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1112/TEU, which fell by 4.6%

North America:

Due to the volatility of recent political affairs and China’s long holiday, the economic outlook could be taking more risk than it can afford. The loading rate in the North American Freight line had hit below 95% last week.

Until 13th October, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1735/FEU and US$2230/FEU, reporting a 0.3% growth and 0.8% decline accordingly.

The Persian Gulf and the Red Sea:

Until 13th October, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf lifted by 6.5% from last week's posted US$841/TEU.

Australia/ New Zealand:

Until 13th October, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$662/TEU, a 10.3% jump from the previous week.

South America:

The freight market had a slight rebound. on 13th October, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$1922/TEU, an 9.5% increment from the previous week.