We heard that some of you are worrying about the shipping becasue of the intense situation in the Taiwan Strait. According to the Shanghai Container Futures Index (SCFI) from August 1st to August 5th, the sea freight remained steady. As for the stainless steel prices, 200 series and 400 series had an upward tendency but soon returned stable. Because the prices of chromium and nickel products are falling in the sluggish market, the support for stainless steel prices remains loose. In a short term, the stainless steel prices will probably remain steady and weak. More about the stainless steel insights, keep reading Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

2,730 |

-33 |

-1.25% |

|

Foshan |

2,775 |

-33 |

-1.23% |

||

|

Hongwang |

Wuxi |

2,615 |

-31 |

-1.25% |

|

|

Foshan |

2,595 |

-3 |

-0.12% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,505 |

-27 |

-1.12% |

|

Foshan |

2,550 |

-15 |

-0.61% |

||

|

316L/2B |

TISCO |

Wuxi |

4,200 |

-63 |

-1.53% |

|

Foshan |

4,270 |

-39 |

-0.93% |

||

|

316L/NO.1 |

ESS |

Wuxi |

3,895 |

-57 |

-1.49% |

|

Foshan |

3,945 |

-51 |

-1.32% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,520 |

7 |

0.54% |

|

Foshan |

1,525 |

16 |

1.19% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,445 |

7 |

0.57% |

|

Foshan |

1,455 |

16 |

1.25% |

||

|

430/2B |

TISCO |

Wuxi |

1,245 |

40 |

3.72% |

|

Foshan |

1,245 |

52 |

4.88% |

TREND|| The prices for stainless steel 201 and 304 showed an overturn

The prices for stainless steel 201 and 304 showed an overturn, stainless steel 430 series maintaining a firmly raise during the last week. The most-traded contract of stainless steel futures went up $75/MT to US$2565/MT.

300 series of stainless steel: Price rebound as underselling is underway.

The spot price market had a positive trend under the influence of the future’s upward creeping. Tsingshan Holding and Delong Limited, however, went for the underselling surprisingly. Until August 5th, both cold-rolled 4-foot stainless steel and hot-rolled stainless steel have a US$45/MT decent, quoted US$2540/MT and US$2480/MT.

On Monday, Cold-rolled stainless steel reached US$2555/MT and hot-rolled stainless steel at US$2495/MT, as quoted by Delong Limited. While the agency receives approximately $15/MT commission, Delong signed up a 30,000-ton 304 cold-rolled stainless steel agreement with agencies at Wuxi.

200 Series of stainless steel: Prices to remain steady

Last week, the price curve of Cold-rolled stainless steel was flatted after ascending, reported US$1490/MT. Accumulated US$115/ during this week, 201J2 cold-rolled stainless steel quoted US$1415/MT and the hot-rolled 5-foot stainless steel increased and quoted US$1425/MT.

200 series on the trading market experienced a price rise before the inhibition. Market transactions turning optimistic, some processing orders are even scheduled till the weekend. Yet, the demand was largely increased, sales and transactions were gradually gone downward.

400 series of stainless steel: Prices keep rising as inventory decreases

Under the circumstance of production reduction, the spot price of 430/2B was surging up at US$1270/MT.

430 stainless steel climbed up to US$1250/MT, a US$37 increase compared to last week. JISCO and TISCO quoted US$1560/MT until Friday.

However, the price ascend ceased during the days of last week, TISCO quoted US$1520/MT and JISCO quoted US$1560/MT with US7$ raise.

Stainless steel futures: No more room for the price to rebound

Constraining by the bearish market, the stainless future maintain at US$2525/MT.

The modest rebound for the stainless steel market could be owed to the firmly standing production cost of the mills in a short period, and the huge price differences of the settlement could bring the bright side to the market.

Hence, there is limited room for the stainless steel future to increase, a small downturn is possible in short term. It is because

-

The weak consumption of stainless steel, and the market sounds quiet, at the moment.

-

The low digestion of the inventory.

-

The mills might rearrange the settlement for the future to hedge the risk caused by the large inventory and gloomy consumption and it might be tightening short the market. The previous drops in prices are gradually recovering, benefiting the steel mills to tune on the settlement. If the settlement volume reaches a certain large amount, the discount will again raise.

To sum up, the stainless steel futures price will hardly increase largely, and continue to face pressure that is mainly due to the tepid demand. If the steel mills enter settlement in the stock, it is predicted that the stainless steel will be weak and the discount range will get wider.

Summary:

300 series of stainless steel: The future price was volatile as the Steel mill’s underselling and expected to stabilize at US$2565/MT roundabout next week.

200 Series of stainless steel: The transaction for 201 this week was plain after the price ascended at the first week of August and spot trading has been hyped up by the market trader. Still, the demand curve was at the same level as the mills remain silent on the quotation.

201J2/J5 cold-rolled 4-foot stainless steel struggling at US$1440~1470/MT.

400 series of stainless steel: TISCO and JISCO quote on 430/2B keep increased to US$1265/MT with a US$45 increase.

The purchasing price for high chromium is still not yet released, but the latest quote from Tsingshan Holding and Delong Limited could forecast the US$150/MT (with 50% of high chromium) downturn for the price. The cost of production for the 400 series is decreasing as the price for Iron ore had a rebound, with about a US$30-36 increase.

The price of 430/2B will be expected to be stable and settle between US$1240~1270/MT this week, but US$1315/MT might be the ceiling.

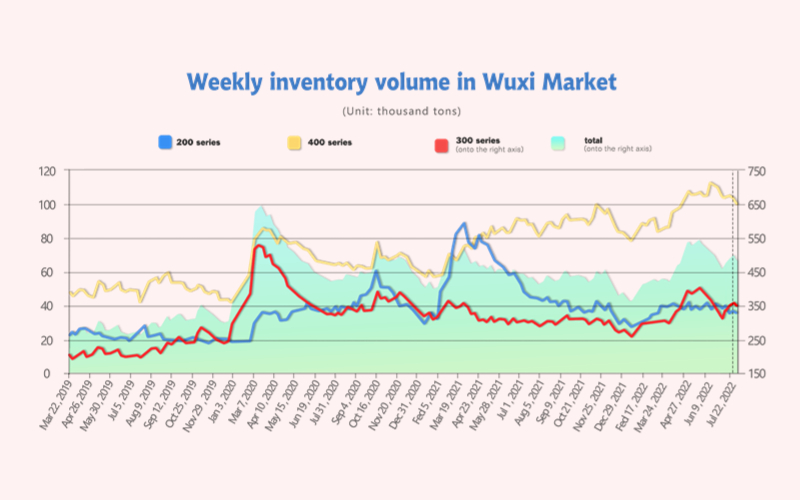

INVENTORY||Market warms up, inventory is decreasing.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| July 28th | 35,548 | 355,970 | 103,189 | 494,707 |

| August 4th | 35,296 | 343,538 | 99,002 | 477,836 |

| Difference | -252 | -12,432 | -4,187 | -16,871 |

The inventory level at the Wuxi sample warehouse was lowered by 16,690 tons to 470,780 tons. Series 200 stainless steel decreased by 300 tons closed at 35,300 tons, Series 200 stainless steel closed at 34,350 tons with 12,400 reductions, and Series 400 stainless steel closed at 99,000 tons with 4,200 reductions.

200 series of stainless steel: Market warming up, inventory reducing slightly

The inventory level of 200 series had a slight decrease to 35,300 tons, cold-rolled stainless steel takes up a major part. the inventory of hot-rolled 5-foot stainless steel went up slightly. Baosteel Desheng Stainless Steel Co and BG New Material took up the main proportion in AOG despite it having a slight reduction.

The transaction was turning positive, the sales for cold and hot-rolled stainless steel sheets were the most popular choice as the processing order piled up.

The reduction in production from the mills is still ongoing while the trader does not seem willing to cut the price down, the overall market is improved compared to July.

300 Series of stainless steel: First decrease in a month’s time, while pressure is still on

Inventory volume was lowered for the first time in a month, closed at 34,400 tons with a 12,000-ton reduction. The future price for stainless steel was back to bland in the mid-week after the upward soaring in the early week. Some of the mills have changed their production plan to series 300 which will stack up the arrival of goods, further updates on inventory will be given in the later days.

400 Series of stainless steel: Mill’s production cut relieves inventory pressure

The reduction in inventory level was obvious, descending under 100,000-ton level (99,000tons) after a quarter with a 4,000-ton drop.

Jiuquan Iron And Steel Group halved their production in 400 series to 40,000 tons since last month, and other manufacturers followed the step on production cut due to the cost pressure. The tension on the supply of 400 series has been relieved this month.

RAW MATERIALS|| Prices can’t help decreasing.

Chrome: Deficit is worsening in August, which appeals to a production cut.

From August 1st to 5th, the spot price of the major grades of chromium ore continued to decline, totally decreasing by US$1/MTU, and the cost of metallurgical coke rose by US$30/MT ~ US$36/MT. What these reflect on the high chromium is that the production cost dropped by US$22/MT (including 50% of chromium content). The output of high chromium in July was 576,800 tons, MoM decreased by 25,300 tons. The trading price of the concentrated ore (40%~42%) from South Africa dipped down to US$220/MT

Whereas, the price of coke kept rising by US$15/MT. When it comes to production, the cost was reduced by US$20/MT (with 50% of chromium content).

However, since August, the EXW price of high chromium has dropped by US$45/MT (with 50% of high chromium). The drop in high chromium price was much larger than the decrease in cost, which has caused a bigger deficit for the high chromium producers.

So far, the quotation of the high chromium factories locates around the purchasing prices given by the major steel mills which are around US$1,168/MT (with 50% of high chromium) and US$1,198/MT (with 50% of high chromium).

Some opinions about the future market have that the high chromium price is close to rock bottom and will be hindered from falling continuously. That is because on one hand, due to the deficit worsening in August, more small and medium size of factories have to seize and even stop producing, which will gradually relieve the supply pressure in the future. On the other hand, although the giants have long-term clients, their suppliers of the ore materials are also their long-term partners. The ore prices did not fall until not long before, and thereby the production cost is rather high.

But how come the drop in high chrome price that started from quarter 2 this year does not smooth out but accelerates instead?

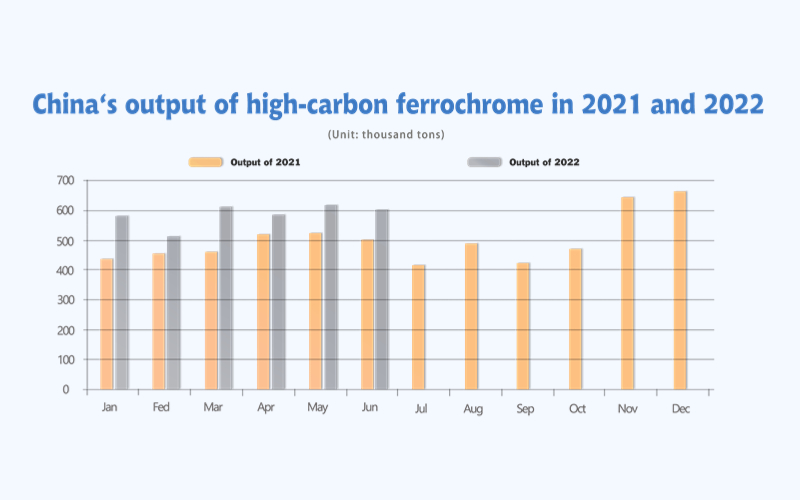

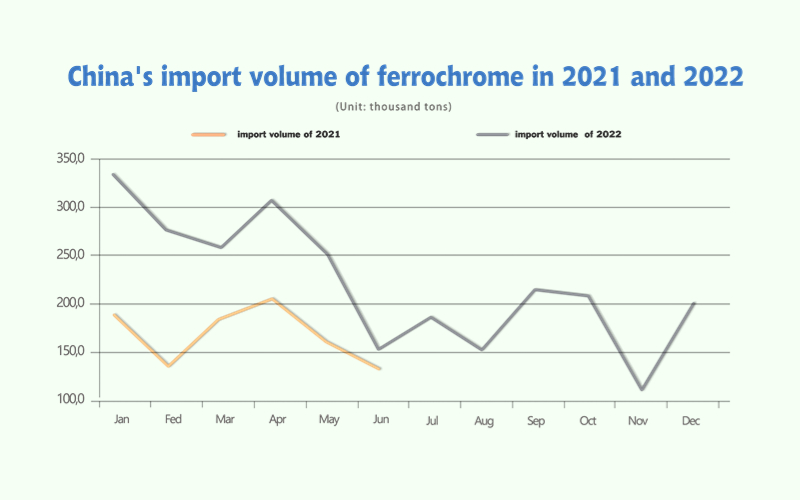

The supply of high-carbon ferrochromium increases.

From January to June this year, China’s domestic production volume of high-carbon ferrochromium amounted to 3.505 million tons, increasing by about 660,300 tons compared to the same period in 2021.

The monthly production of high chrome peaked in May during H1 of this year, reaching up to 613,400 tons. The production peak of 2021 also happened in May, when it was 528,800 tons. It means that the former is 16% over the latter and significantly increases by 84,600 tons.

Together with the domestic and abroad supply of ferrochromium from January to June, the total supply was about 4.5 million tons.

Mathematically, there shall be a shortage of high chromium in H1 2022. From January to June, the crude steel production by China’s major stainless steel producers, which was 16.9 million tons, plus the production of the special steel, the demand for high chromium to meet the production would be 4.54 million tons. That is to say, the supply of high chromium should have lacked 40,000 tons.

But as the matter of fact, the supply has deviated from the production demand. The stainless steel production peaked at 3,134,900 tons in April during H1 of 2022. It continued to fall in the latter three months, and thereby the demand for high chromium decreased.

The shortage of high chromium mainly emerged from February to April. As it rose in May and June and meanwhile the stainless steel industry began to reduce production to resist the sluggish market, and the situation remains in July, but the problem is that the high chromium factories fail to maintain the same pace as the decrease in stainless steel production. What’s worse, in August, some steel mills suspended the purchase plans of high chromium. The oversupply of high chromium is put under the spotlight, leading to unstoppable decreases in price.

NICKEL: In August, the Indonesian domestic trade base price of nickel mines fell for four consecutive months.

According to the Indonesian Ministry of Energy and Mineral Resources(ESDM), the domestic trade base price(MC 30%)of nickel mines continued to decrease on an on-month basis. The price is closely related to the price of LME nickel but which is two months ago. Since the LME nickel spiked in March, the LME nickel price has gone all the way down and bottomed at US$18,230/MT which dropped by 66.85% from the peak of US$55,000/MT. Influenced by the diving price, the price of Indonesian nickel ore slumped as well. Currently, the price of Ni 1.8% (MC30%) decreased to US$53.88/MT which is US$32.29 lower than the peaking price in April, and the declining percentage is 37.47%. The fastly decreasing price of nickel ore wins more profit for the Indonesian ferronickel factories because the price of ferronickel did not drop more slowly. Therefore, the increase in profit drives the Indonesian ferronickel suppliers to expand their production. The export to China will increase.

However, in China, the supply of ferronickel is surplus. In August, steel mills remain to cut down the production of stainless steel 200 series and 400 series, but raise the output of stainless steel 300 series, which increases the demand for ferronickel. As we mentioned above, the import of ferronickel will maintain high. The oversupply of ferronickel will remain, and the ore price will keep declining as well. It is predicted that the price of ferronickel in August will remain stable and have a slightly weak tendency.

As for the refined nickel, the transaction was plain last week because the price was high. The spot price is rising weakly. Previously, out of actual need, some buyers have bought at a lower price and now people tend to wait. From the perspective of the LME, the nickel inventory increased slightly to 57,900 tons. The inventory home and abroad both hit the bottom at the stage. However, the increase in non-ferrous metal prices might face a hit, as the US dollar index goes up based on the negative non-farm payrolls which may lead to another interest rate hike.

To sum up, the price of nickel ore and ferronickel will remain steady in a short term, but it is lacking increasing force due to the gloomy downstream market. The refined nickel price will slow down the rising pace because its previous increase weakens buyers’ purchasing desire. Thereby, the inventory will rebound and the price of ShFE nickel will tend to be weakened.

FREIGHT|| Sea freight keeps cooling down.

The SCFI on August 5th slightly decreased to 3739.72, declining by 3.8% on-week basis.

Europe/ Mediterranean: Health systems and geopolitical struggles in the European region are at risk, dragging on Europe's economic recovery. A number of recent economic data point to a poor economic outlook. On August 5th, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European base port market was US$5,166/TEU, down by 4.6% from last week. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean base port market was US$5,852/TEU, down by 2.0% from the previous week.

North America: Worrying that the US will be stuck in the recession as data shows the new low of ISM manufacturing index after June of 2020. Besides, the high inflation also brings continuous interest rate hikes. On August 5th, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East base ports were US$6,499/FEU and US$9,330/FEU, respectively, down by 2.9% and 0.2% from the previous week.

The Persian Gulf and the Red Sea: On August 5th, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the basic port of the Persian Gulf was US$2,601/TEU, decreasing by 6.7% from the last week.

Australia/ New Zealand: On August 5th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the basic ports of Australia and New Zealand was US$2,988/TEU, down by 0.3% from the previous week.

South America: Influenced by the Fed rate hike, the local economy has been fluctuating. Sea shipping is now in the traditional peak season. The spot market booking price continued to rise. On August 5th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American base ports was US$9,531/TEU, rising by 1.0% from the previous week.