Perhaps China is facing the most urgent moment in the economic sector after 1978. Many data point to a pessimistic future. Although the demand for stainless steel remains weak globally, the prices have remained rising in the recent two weeks in China. Last week, the futures of nickel and stainless steel prices rose because the Indonesian government started to investigate the corruption case in the nickel industry, which will drag down the production and export of nickel products. In fear of the decline in future supply, and also because steel mills and traders all want to catch the chance to hype, the stainless steel prices keep going up. Except for the nickel, led by the ferromolybdenum ramped quickly, stainless steel 316L grade stood high and increased by over US$90/MT based on the weekly average price. The market is kind of miserably complicated in China these days. In July, domestic consumption, export, invest, the three most important driving forces of economic development, all declined. Besides, the unpaid debts of Country Garden which is the biggest private real estate group in China hit seriously the problematic housing industry. People are losing faith in the market. People are losing faith of the market. If you want to know more about the market, please keep reading our Stainless Steel Market Summary in China and also go to our YouTube channel Weekly market roundups for more relative news.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,320 | 3 | 0.13% |

| Foshan | 2,365 | 3 | 0.12% | ||

| Hongwang | Wuxi | 2,255 | 0 | 0.00% | |

| Foshan | 2,255 | 3 | 0.13% | ||

| 304/NO.1 | ESS | Wuxi | 2,160 | 1 | 0.07% |

| Foshan | 2,190 | 14 | 0.68% | ||

| 316L/2B | TISCO | Wuxi | 4,055 | 53 | 1.37% |

| Foshan | 4,105 | 70 | 1.79% | ||

| 316L/NO.1 | ESS | Wuxi | 3,945 | 98 | 2.64% |

| Foshan | 3,940 | 64 | 1.72% | ||

| 201J1/2B | Hongwang | Wuxi | 1,380 | 0 | 0.00% |

| Foshan | 1,380 | 4 | 0.33% | ||

| J5/2B | Hongwang | Wuxi | 1,300 | 7 | 0.59% |

| Foshan | 1,295 | 4 | 0.36% | ||

| 430/2B | TISCO | Wuxi | 1,275 | 11 | 0.97% |

| Foshan | 1,245 | 15 | 1.38% |

TREND|| Raw material pillared stainless steel price.

The stainless-steel price was in mix bag last week and the transaction volume had a slight contract. The price of raw material, however, ran the opposite way with stainless steel price and stopped the latter from a further drop. The mainstream contract price reported a US$30 rise and closed at US$2285/MT.

Stainless Steel 300 series: Stainless steel future warmed up the market.

The price trend of stainless steel 304 experienced volatility: the mainstream base price of cold-rolled 4-foot mill-edge stainless steel 304 and hot-rolled stainless steel 304 fell by US$7 to US$2210/MT and US$2180/MT accordingly.

The performance of the spot transaction was pretty much a reflection of the price trend: the spot price was volatile in the top half of last week, the stainless steel future was shaking above US$2225/MT and then wrapping up at US$2290/MT last Friday.

Stainless steel 200 series: The market remains bearish.

The spot price of stainless steel 201 was leveling off last week: The mainstream base price of cold-rolled stainless steel 201 remained unchanged at US$1350/MT, cold-rolled stainless steel 201J2 closed at US$1270/MT; 5-foot hot-rolled stainless steel reached US$1305/MT.

Wuxi market merely harvest “apparent growth” in the early week, and most of the buyers were holding a “wait and see” attitude. Due to the maintenance of Beigang New Material, the price of stainless steel 304 had a significant growth last Friday, cold rolled stainless steel 201J2 rose slightly by US$7 to US$1275/MT.

Stainless steel 400 series: Grade 430 remained steady.

The market price of 430/2B in Wuxi reported a US$14 rise and closed at between US$1280/MT-US$ 1290/MT. The quoted price of 430/NO.1 remained unchanged at US$1135MT.

TISCO lift their guidance price of 430/2B by US$7 to US$1420/MT and JISCO increased by US$14 to US$1520/MT.

Summary:

Steel mills maintain high production, leading to expectations of ample supply in the market. Current downstream demand is relatively weak, but the market has some confidence in the upcoming peak season, which is expected to support prices. In the future, market’s attention will still be focused on the arrival of stainless-steel resources, changes in steel mill production, and whether end-demand can match the supply pace. The expectation is for stainless steel prices to continue fluctuating.

300 Series: Current steel mill orders have improved, maintaining high production. The relatively strong trend in raw material prices provides a support for stainless steel costs. Supported by the expectation of strong demand in the September peak season, the market's purchasing sentiment is expected to improve. In the short term, the price of privately produced cold-rolled stainless steel is expected to run relatively strong within the range of US$2165/MT-US$US$2250/MT. In the medium to long term, the price trend is expected to rise.

200 Series: Spot prices operated with relative stability and weakness during the week, with overall sluggish trading. The market's sentiment is cautious due to the current weak market trend. Additionally, recent increases in steel mill supplies and gradual arrivals to the market could pose the risk of oversupply, weakening spot price support. It is anticipated that the 201 stainless steel price will have difficulty breaking through its range in the short term. The next week's market is expected to operate with overall stability and a slightly weaker bias, with the mainstream base price for 201J2 cold-rolled steel fluctuating between US$1245/MT-US$1275/MT.

400 Series: Last week, the main raw material's high chromium production cost remained high, resulting in continuous price increases, bolstered the stainless steel market. On the other hand, steel mill production costs are relatively high, leading to some steel mills operating 430 production at a loss. In the short term, the price of 430 stainless steel is expected to remain stable. In the medium to long term, due to decreased arrivals in the Wuxi market and supply contraction, the conditions are favorable for prices to strengthen.

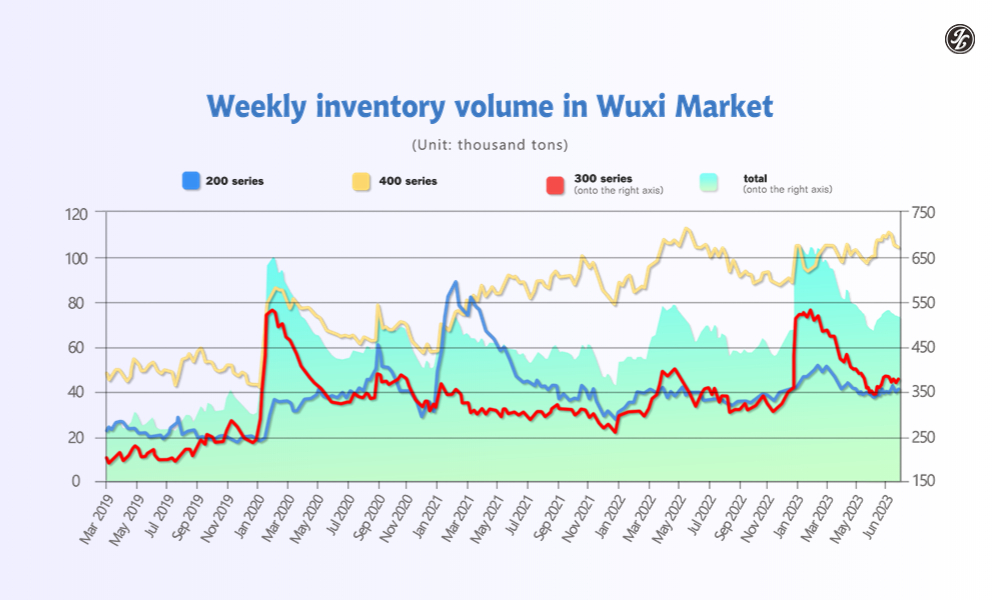

INVENTORY|| Inventory dived despite the late arrival of stainless steel resources.

The total inventory at the Wuxi sample warehouse fell by 2,555 tons to 513,561 tons (as of 10th August).

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| August 3rd | 39,728 | 372,009 | 104,379 | 516,116 |

| August 10th | 40,547 | 369,538 | 103,476 | 513,561 |

| Difference | 819 | -2,471 | -903 | -2,555 |

the breakdown is as followed:

200 series: 819 tons up to 40,547 tons

300 Series: 2,471 tons down to 369,538 tons

400 series: 903 tons down to 103,476 tons

Stainless steel 300 series: Slaight decrease amid volatility.

The spot price and future price had a slight fluctuation, the latter was hovering above US$2235/MT. Limited by the production capacity of acid treatment, one of the biggest steel mills in Jiangsu had cut their distribution of hot-rolled resources. Meanwhile, Tsingshan’s belated sources had finally arrived in Wuxi.

It is worth mentioning that the production of the stainless steel 300 series had just reached a historic high in July, and the production in August is very likely to add 20,000 tons more to around 1.73 million tons.

Stainless steel 200 series: Spot goods lined up for sales as supply resumed.

The spot inventory of stainless steel was running short as the logistics were heavily interrupted by the typhoon the previous week. The shortage was finally relieved last week but the thin trading environment could not accelerate the destocking.

Stainless steel 400 series: slight increase in price, a slight decrease in inventory.

The spot inventory of the 400 series went down due to the maintenance of steel mills. According to the latest statistics, the scheduled production of flat rolling crude steel 400 series will be 443,000 tons, about a 2.83% decrease from July.

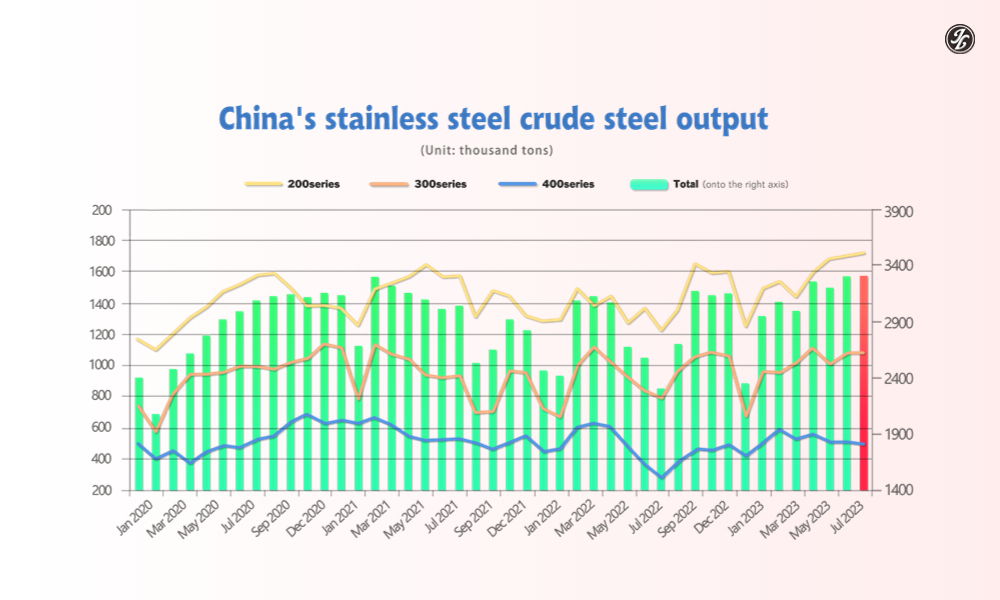

Production|| Crude steel production hit 3.3 million tons.

The production of crude stainless steel in July recorded 3,306,600 tons, 9.73% more than June, about a 28.11% (725,500 tons) spike compared to the same period last year.

Here is the breakdown:

Series 200:

Production: 1,085,200 tons, 6.56% (or 66,800 tons) more than June, 23.84% (or 238,400 tons) more than the same period last year.

Series 300:

Production: 1,711,300 tons, 1.9% (or 32,000 tons) more than June, 25.29% (or 345,4

00 tons) more than the same period last year.

Series 400:

Production: 510,100 tons, 0.28% (or 1,400 tons) less than June, 38.46% (or 141,700 tons) more than the same period last year.

In April 2023, the planned production volume of wide cold-rolled steel by China steel mills (large scale) is 1.035 million tons, an increase of 0.08% compared to the previous month, and a decrease of 23.19% year-on-year.

The break down as followed:

Series 200:

Production: 311,000 tons, 3.67% tons more than February, 26.49% less than the same period last year.

Series 300:

Production: 502,500 tons, 0.1% tons more than February, 22.88% less than the same period last year.

Series 400:

Production: 221,500 tons, 4.58% tons less than February, 18.79% less than the same period last year.

The production of crude steel in August is estimated to reach 3,310,000 tons: the goal of 1,730,000 tons is for 300 series to hit, 200 series likely to remain at 1,080,000 tons, and 400 series to reduce about 500,000 tons.

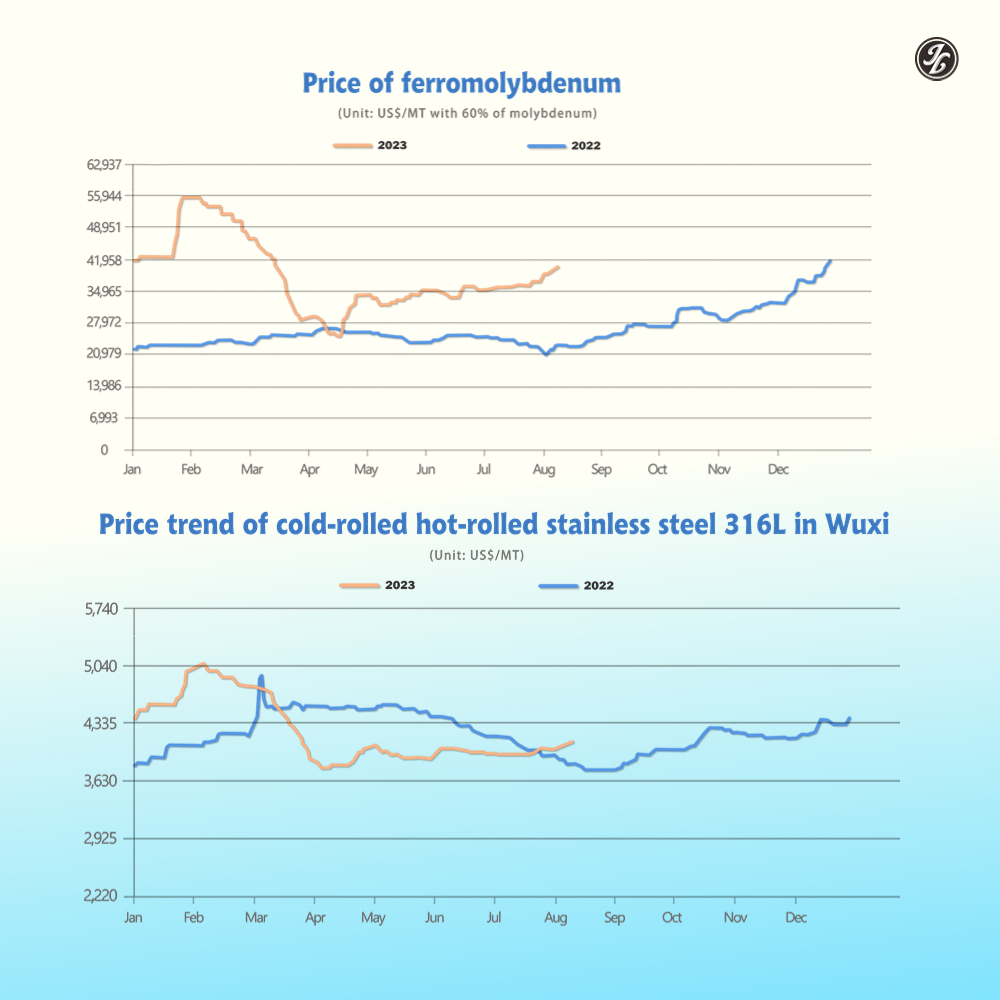

RAW Material|| Main raw materials are all on the uptrend

Molybdenum: a US$2,900 surge in nine trading days

Until 11th August, the price of molybdenum continued to climb to US$40555/MT (60% molybdenum). The upward momentum in Molybdenum price since August appreciates the mineral by US$2937MT.

The weak demand in the stainless steel market apparently flatten the price curve of stainless steel grade 316L, although similarities can be found in the price trend of 316L and Molybdenum.

Nickel: contradictory trends to shake the nickel price.

The nickel price has been walking downhill since late July, but the supply of nickel unfortunately is overrunning which is led by the surging production capacity.

Recently, Chinese regions will be encouraged to increase annual car purchase quotas and efforts will be made to support sales of electric vehicles. The stimulus undoubtedly can lift the demand for a nickel while the alloy producers downstream can precisely pinpoint their favorable price in purchasing raw materials.

The refined nickel inventory now is at a history low, but it could be altered by the import resources. Nickel prices are likely to be choppy in the short term.

Indonesia: anti-corruption in the nickel industry

On August 8th Southeast Sulawesi (Southeast Sulawesi) Attorney General’s Office investigators report the latest developments regarding the handling of PT Antam’s IUP mining corruption case in the Mandiodo Block, North Konawe.

PT Antam’s IUP mining

Among them are money denominated in dollars and rupiah worth IDR 75 billion. This tens of billions of dollars belonged to the suspect AA who is the CEO of PT KKP.

“Cash in the amount of IDR 75,000,000,000 (seventy-five billion rupiah) in rupiah, USD and SGD from the suspect with the initials AA as the CEO of PT. KKP and other suspects,” Dody explained in a press statement.

Not only money, the Southeast Sulawesi Prosecutor’s Office also disclosed several other pieces of evidence that were also confiscated, namely 161,740 MT of nickel ore from the stock field of PT. LAM is also involved in the PT Antam mining corruption case. As much as 50,000 MT of nickel ore from PT KKP’s stock field was also confiscated by the Southeast Sulawesi Attorney General’s Office.

PT Antam mining is now suspending.

Affected by this incident, Indonesia is currently conducting a large-scale anti-corruption investigation, and the issuance of nickel mine RKAB has been suspended.

The Rencana Kerja dan Anggaran Biaya (RKAB), or Work Plan and Budget, is a document that mining companies must prepare and submit annually for approval to the Ministry of Energy and Mineral Resources (ESDM) or an agency authorized by the Ministry of Energy and Mineral Resources. Approved RKAB document is very important for mining business license (IUP) / special (IUPK) owner as it is a Certificate of Legal Support for every mining activity from exploration, excavation-loading-transportation, processing-refining phase to marketing phase. Therefore, even though there are more than 300 nickel mining companies currently operating in Indonesia, without RKAB, it means that the mines cannot carry out production and trade.

As Indonesia's policy of banning illegal mines and quota approval continues to tighten, the supply of limonite that can be circulated in the market will decrease, which will increase the production cost of MHP. China is the world's largest producer of nickel sulfate, and MHP is its main raw material. Some companies will switch to pure nickel when the price difference is appropriate, which also means that the bottom cost of nickel will also increase to a certain extent.

Chrome: the price and production both increase

The price of high chrome has been hanging at a high level since the start of August and the EXW price even jumped to US$1375/MT on 10th August.

Also, the production is still at full blast in meeting the expectation: totaling 4 million tons so far in 2023 and bursting over 620,000 tons in the past two months.

Sailing downwind with the production, the price of chrome ore refuses to turn down: the concentrated ore (40%~42%) from South Africa quoted as USUS$8.3 /MT, the Chrome Lump Turkey (Cr2O3 40-42%) reported as US$9.01/MT.

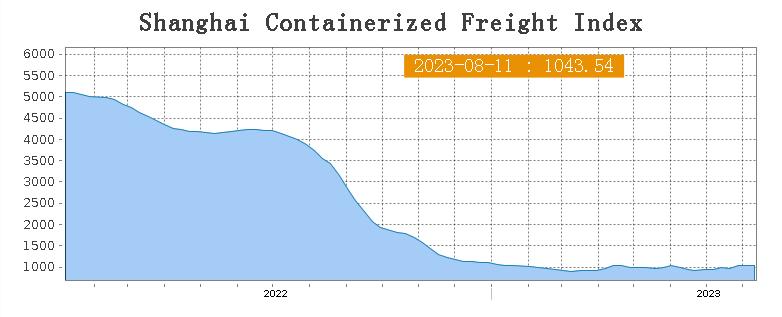

Sea Freight|| Demand remained steady.

According to the latest statistic from China Custom, the export value surprisingly dropped 14.5% and suffering a negative growth.

China’s Containerized Freight market was overall stabilized, but the demand recovery hit a bottleneck. On 11th August, the Shanghai Containerized Freight Index rose by 0.4 to 1043.54.

Europe/ Mediterranean:

Until 11th August, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$926/TEU, which fell by 2.2%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1507/TEU, which fell by 1.4%

North America:

Until 11th August, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$2017/FEU and US$3071/FEU, reporting a 0.7% and 1.9% growth accordingly.

The Persian Gulf and the Red Sea:

Until 11th August, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf rose by 5.4% from last week's and posted US$853/TEU.

Australia/ New Zealand:

Until 11th August, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$435/TEU, a 27.9% surge from the previous week.

South America:

The freight market had a slight rebound. on 11th August, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2444/TEU, an 0.3% slide from the previous week.