China promises to provide more support for private enterprises. Manufacturing PMI in August fixed by 0.4% but remains in the contraction zone. It is the consecutive fifth month the data falling below 50%. CPI and PPI in China both turns down in July, which indicates the economy is probably falling into deflation. Demand and consumption are downsizing almost over the world. Though the market loses demand, the cost keeps increasing due to the robust ore market. Nickel, chrome, molybdenum continuous to rising, pushing up the stainless steel prices high. In a short term, it is predicted that the stainless steel prices will remain the upward tendency. If you want to go deep into the weekly report, please keep reading Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,380 | 25 | 1.12% |

| Foshan | 2,415 | 25 | 1.10% | ||

| Hongwang | Wuxi | 2,310 | 29 | 1.35% | |

| Foshan | 2,310 | 19 | 0.90% | ||

| 304/NO.1 | ESS | Wuxi | 2,220 | 28 | 1.34% |

| Foshan | 2,250 | 29 | 1.39% | ||

| 316L/2B | TISCO | Wuxi | 4,085 | -6 | -0.14% |

| Foshan | 4,165 | 0 | 0.00% | ||

| 316L/NO.1 | ESS | Wuxi | 3,975 | -11 | -0.29% |

| Foshan | 3,965 | -28 | -0.27% | ||

| 201J1/2B | Hongwang | Wuxi | 1,410 | 18 | 1.41% |

| Foshan | 1,405 | 11 | 0.87% | ||

| J5/2B | Hongwang | Wuxi | 1,335 | 24 | 1.95% |

| Foshan | 1,330 | 14 | 1.15% | ||

| 430/2B | TISCO | Wuxi | 1,285 | 7 | 0.60% |

| Foshan | 1,260 | 6 | 0.49% |

TREND|| Traders to hold the horses while the stainless steel price grows wild.

The price trend of stainless steel last week had a decent start and harvested a mixed performance: stainless steel 201 stabilized after an increase; stainless steel 304 declined after a rise and stainless steel 430 remained strong.

Last week, the price of raw materials continued to exert an influence on stainless steel prices. The future price, however, dragged down the spot price. The digestibility in the downstream will be seriously tested under the circumstance that the production in August was maintained at a high level.

Stainless steel 300 series: Price climbing up while bearing pressure.

Until 24 August, the market price of stainless steel 304 fluctuated and continued to rise: the mainstream base price of cold-rolled 4-foot mill-edge stainless steel 304 rose by US$28 to US$2275/MT, the price of private-produced hot-rolled stainless steel had a US$42 jump and closed at US$2240/MT.

There was an obvious increase in cold-rolled stainless steel while hot-rolled stainless steel dropped slightly. The future price of stainless steel succeeded in the upward momentum from the previous week and touched US$2375/MT.

Stainless Steel 200 series: Trading turns sluggish again.

The spot price of stainless steel 201 remains a strong trend from the previous week: the mainstream base price of cold-rolled stainless steel 201 closed at US$1385/MT with a US$21 growth from last week, cold-rolled stainless steel 201J2 closed at US$1310/MT and reported a US$21 increment; the 5-foot hot-rolled stainless steel reached US$1340/MT with a US$7 increase.

The downstream buyers clearly cannot agree with the peaked spot price last week which led to an inactive market trend. However, the inventory of spot goods received a lesser supply than usual and it became the only destocking series among others.

Stainless steel 400 series: High ore costs and maintenance will support to prices.

TISCO made no change to their guidance price of stainless steel 430/2B and quoted US$1400/MT. JISCO on the other hand, decided to add US$7 more and quoted US$1520/MT.

The mainstream quote price of 430/2B in the Wuxi market rose US$7 to a range of US$1290/MT- US$1295/MT. The quoted price of 430/NO.1 has been standing still at US$1130/MT since 14th July.

Summary:

300 Series: Improved order acceptance by steel mills has maintained high production rates in August. The strong performance of nickel-iron and ferrochrome prices has resulted in strong support for stainless steel costs. However, the buying enthusiasm downstream has not matched the increase in steel mill supply, leading to a slight accumulation of inventory in the market and putting pressure on prices. In the short term, maintaining high prices requires new positive factors from the industry.

200 Series: Since mid-August, the price of 201 stainless steel has remained relatively strong, but the recent market has become quieter, with a slight shortage in the spot market. Currently, a downtrend is emerging in the market, with a predominantly wait-and-see attitude in the downstream. However, recent supply reductions by steel mills have made spot market inventories slightly tight, providing some support for prices. Combined with the traditional peak season of September, it is expected that 201 will not see a significant decline in the short term and will operate stably with a slight weakness overall.

400 Series: The main raw material of stainless steel, high chromium, has seen firm EXW prices, and steel mills have higher costs and a strong willingness to raise prices. According to the statistics, due to steel mill maintenance, the supply of 400 series stainless steel in August has remained low. Although there has been a slight accumulation of inventory during the week, downstream inquiries have gradually increased. While procurement remains on-demand, it is expected that demand will improve with the advent of the traditional peak season. In the short term, the quotation for 430 stainless steel will remain stable. In the medium to long term, due to supply contraction and cost support, the quotation for 430 stainless steel may strengthen.

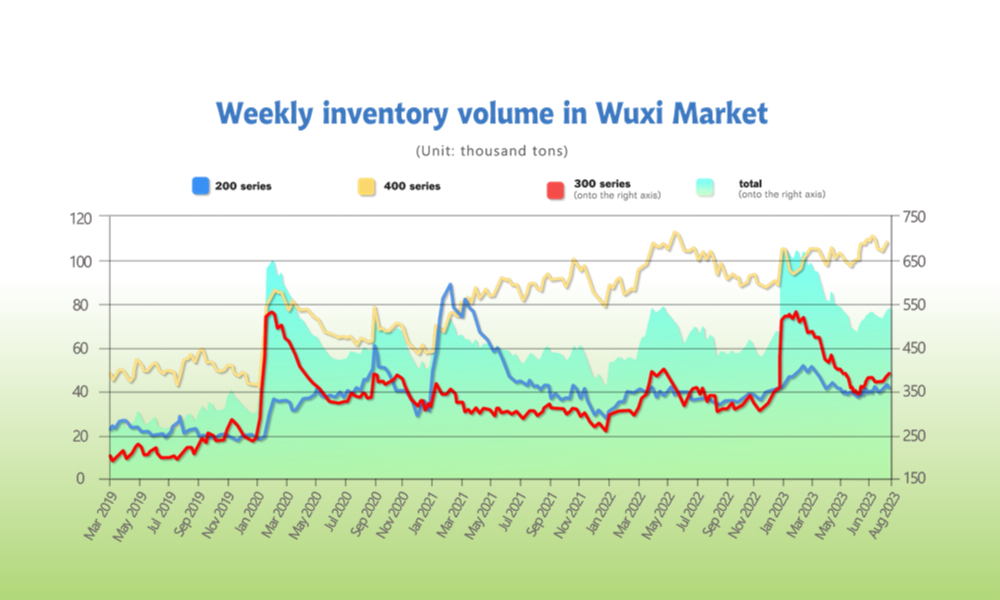

INVENTORY|| Increasing pressure in inventory

The total inventory at the Wuxi sample warehouse rose by US$8,381 tons to 538,235tons (as of 24th August).

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| August 17th | 41,940 | 381,121 | 106,793 | 529,854 |

| August 24th | 40,762 | 389,527 | 107,946 | 538,235 |

| Difference | -1,178 | 8,406 | 1,153 | 8,381 |

the breakdown is as followed:

200 series1,178 tons down to 40,762 tons

300 Series: 8,406 tons up to 389,527 tons

400 series: 1,153 tons up to 107,946 tons

Stainless steel 300 series: 8000 tons of Cold-rolled stainless steel added to inventory

The hot-rolled stainless-steel inventory had a slight drop last week while the cold-rolled stainless steel inventory was waited to consume. Tsingshan and Delong claimed the largest share of the stainless-steel resources in the warehouse last week.

Stainless steel 200 series: Narrowed supply to drop the inventory

The arriving resources in Wuxi last week were mainly owned by Hongwang and Beigang New Material. The destocking was decelerated regardless of the hype of spot price, and the weak demands were still the culprit to point the finger at.

Stainless steel 400 series: Price trend remained stable

While the spot goods were lining up for sales, the supply of 400 series seemingly had a plunge due to the maintenance of steel mills. The inventory level had a small increase as the trading atmosphere turned warm. It is estimated that the peak season will improve the demand to a certain extent, and most of the downstream business will boost sales.

RAW Material|| The price hike of Chrome and Molybdenum caused a knock-on effect on stainless steel.

The EXW price of high-carbon ferrochrome has already reached between US$US$1395/MT-US$1415/MT(50% Chromium), and it is concluding a US$85 increment since August.

The price of molybdenum also accumulated a US$3894 surge, reaching at US$40045/MT(60% molybdenum).

The upward price trend of chrome and molybdenum recently has been pushing the price of raw materials sky-high.

In response to the peaked production cost, this is how stainless steel producers across the globe react:

The Taiwanese steel maker Feng Hsin Steel has lifted their product prices; major steel mills in China increased their quoted price for July and August on Stainless steel 316, and US steel mills are adding additional charges on stainless steel alloy. Hence, major stainless-steel producers in Taiwan to reportedly increased the price of the stainless steel 300 series in September, especially, since a board-lifted price of grade 316L is expected.

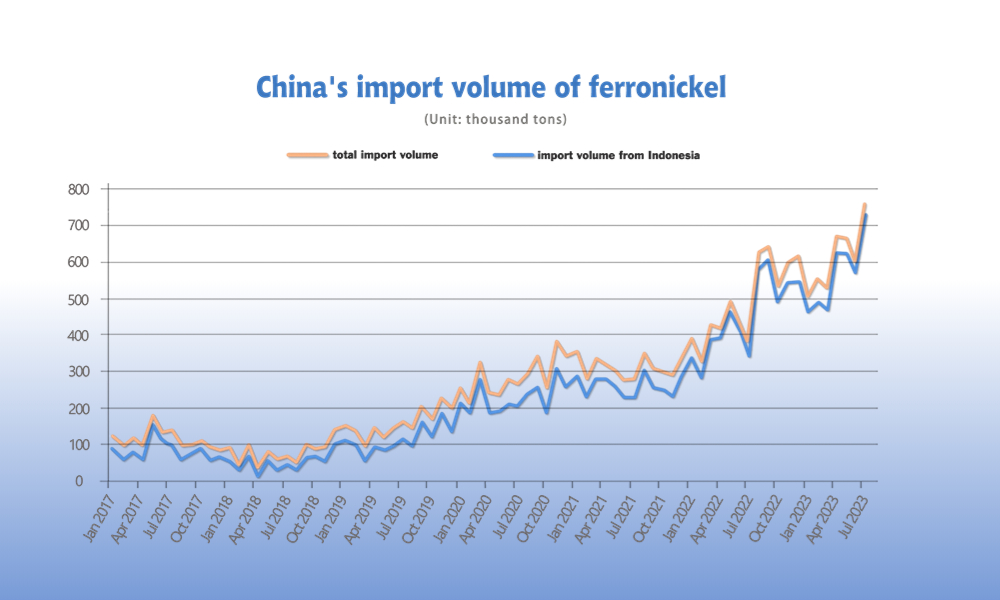

Nickel: Indonesia nickel prices soar about 10% on anti-corruption storm, mining approval probe

Indonesia’s mining quota distribution has been delayed having reverted to an older approval process due to an ongoing investigation into illegal mining, a senior official said on Monday, assuring there was sufficient nickel ore for smelters. Prices of nickel ore in top global producer Indonesia have surged about 10% in recent weeks, local buyers say, with ore production affected by delayed quotas, known locally as RKAB.

Indonesia’s Attorney General’s Office is investigating a former senior mining official, alleging his easing of a quota approval process led to illegal activities that caused 5.7 trillion rupiah ($372.84 million) of state losses.

In the RKAB, Indonesian authorities allocate each miner’s production and sales quota every year, which can be revised when they need more.

Under the old system, 27 factors need to be reviewed for a quota to be approved, compared to nine under the relaxed process.

It is understood that there was no ore shortage for local smelters, adding the quotas approved so far this year should be enough for processing needs.

Dozens of nickel smelters in Indonesia have been rushing to stock up on ore fearing a shortage, pushing up prices of the material, according to a smelter manager, a nickel trader.

Some smelters are raising offers for ore by as much as 15%, said a Chinese trader who buys nickel pig iron from Indonesia. Indonesia banned nickel ore exports in 2020 to develop domestic processing industries and has successfully attracted investment into smelters producing nickel metals and nickel products used for batteries for electric vehicles.

According to the World Bureau of Metal Statistics, Indonesia produced 1.61 million tons of Nickel ore in 2022 which is half of the world's production.

For smelting into nickel pig iron and producing stainless steel locally, the Indonesian nickel ore will normally be exported to China.

The rising mining cost of nickel ore added 10% more to the price of nickel pig iron in August to US$161.22/Nickel point, which is the highest level since March. The average export price of Indonesian nickel also marked a new height since June with US$139/nickel point.

As the biggest nickel-consuming country, China imported 4.29 million tons of nickel pig iron in the first seven months of this year, and swallowed 93% of the total from Indonesia, according to China Customs.

Macro|| Industrial enterprises above designated size in China earn less by 15.5%

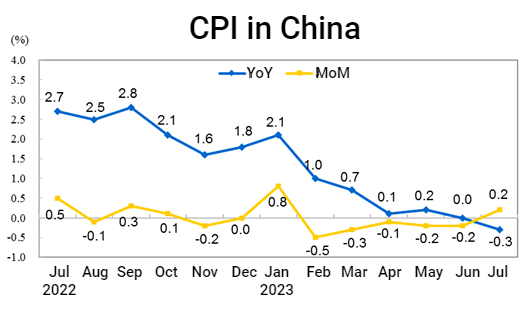

When CPI and PPI run in the negative zone at the same time, the era of deflation seems to be a certainty.

In China, from a month-on-month perspective, the CPI turned from a decrease of 0.2% in the previous month to an increase of 0.2%.

From a year-on-year perspective, the CPI changed from flat last month to a decrease of 0.3%

From a month-on-month perspective, the PPI fell by 0.2%, and the rate of decline narrowed by 0.6 percentage points from the previous month.

From a year-on-year perspective, PPI fell by 4.4%, and the rate of decline narrowed by 1.0 percentage points from the previous month.

CPI reflects the price of downstream consumer goods, and PPI reflects the price of upstream industrial products. Both CPI and PPI have dropped, that is, the prices of consumer goods and industrial products have both dropped. This is due to the continuous decline in the prices of bulk commodities such as coal and oil. However, the fundamental factors are insufficient consumption and insufficient innovation motivation of market players.

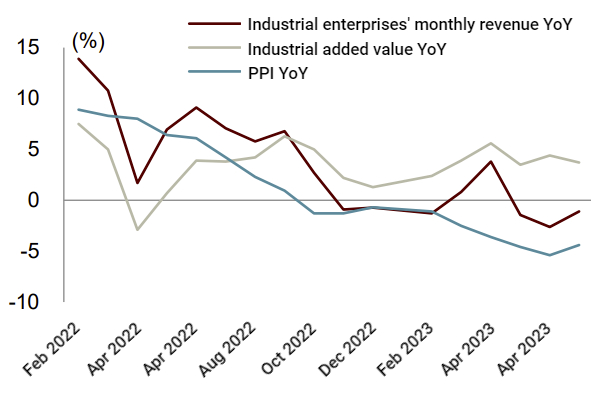

From January to July 2023, the profits of industrial enterprises above designated size fell by 15.5% year-on-year, a decrease of 1.3 percentage points from January to June.

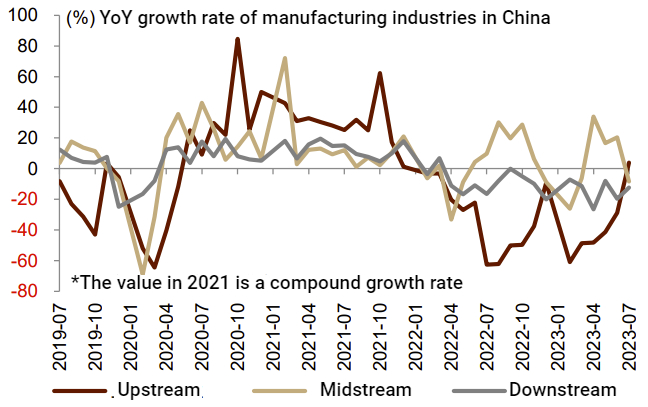

In July, the profits of manufacturing industries fluctuated greatly, and the year-on-year growth rate of upstream raw material manufacturing profits turned from negative to positive.

The profit growth rate of the upstream raw material manufacturing industry jumped from the previous value of -28.8% to 4.0%, mainly supported by the low base in the same period last year. From a month-on-month perspective, the month-on-month drop was 26.2%, which was one of the largest year-on-year drops since 2011, and the drop was only smaller than the same period last year.

Sea Freight|| The sluggish demand dragged down the Freight Index.

China’s Containerized Freight market was overall stabilized, but the demand recovery hit a bottleneck. On 25th August, the Shanghai Containerized Freight Index fell by 1.5% to 1013.78.

Europe/ Mediterranean:

As the peak season in the freight market is coming to the end, the mismatched supply-demand led to a further down of freight rate.

Until 25th August, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$852/TEU, which fell by 8%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1500/TEU, which fell by 0.5%

North America:

Retail sales rose a better-than-expected 0.7% in July from June, according to the Commerce Department’s report. Hence, the overall consumer prices rose 3.2% from a year earlier.

Until 25th August, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$2006/FEU and US$3052/FEU, reporting a 0.1% and 1.9% growth accordingly.

The Persian Gulf and the Red Sea:

Until 25th August, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf lifted by 0.7% from last week's posted US$914/TEU.

Australia/ New Zealand:

Until 25th August, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$520/TEU, a 14.8% jump from the previous week.

South America:

The freight market had a slight rebound. on 25th August, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2107/TEU, an 7.8% fall from the previous week.