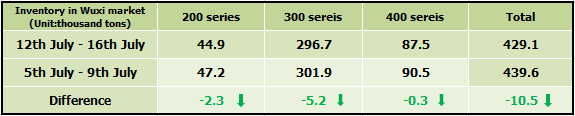

INVENTORY|| Stainless steel inventory reduces by 10,000 tons a week.

Based on the inventory data, last week, the inventory volume of the sample warehouses in Wuxi market was reduced by 10,500 tons, decreased to 429,100 tons. The inventory volume of 200 series is 44,900 tons, 2,300 tons less than a week before; 300 series reduced by 5,200 tons, decreasing to 296,700 tons; 400 series is 3,000 tons less, lowering to 87,500 tons. (The warehouse receipts resources registered in Shanghai Futures Stocks are excluded in the sample warehouse.)

200 series: The inventory comes to the consecutive fourth decrease.

From the latest market feedback, the resources of 200 series are not abundant, and now the inventory has come to its consecutive decrease. There is news saying that there is no resource from SDSY this week. Besides, NHJH and BGXC do not release any information about new resources.

People hold an optimistic attitude towards the market. It is said that the new cold-rolled 201 resources volume of a mill in Eastern China will again reduce. Tsingshan also stops providing cold-rolled 201 temporarily. LISCO may plan to reduce the production volume recently. Besides, the production limit of crude steel will probably influence the supply of 200 series in the future, if the limit is taken action because steel mills will firstly guarantee the production of 300 series. 200 series is facing a decrease in production volume and it will result in stocking out in the future.

300 series: The inventory volume still reduces even though prices increase significantly.

Last week, the inventory of 300 series was reduced by 5,200 tons and left 296,700 tons. The total inventory volume remains at a low level during a recent year. Some large traders actively reduce the inventory and Tsingshan also reduces the new arrivals. Last week SS304 was in a crazy upward trend, breaking the new highest of futures stock and pushing the market price up to a record high.

In the market, it is said that some specifications of 304 are out of stock. Delong outputs 2,000-3,000 tons of 304, but the demand still surpasses supply, while Tsingshan put more resources in the downstream manufacturers.

In the next week, the settlement resources of contract 2107 will be sent to the spot market, which will release the OOS in the spot market, but be cautious about the production limit policy. Once it is carried out, the future supply will sharply fall, and OOS will get more severe.

400 series: Inventory volume maintains high because demand is weak.

Last week, the high inventory volume of 400 series reduced little, which mostly are TISCO. Influenced by the sharply increasing price of 300 series and ferrochrome, SS430 also begins to rise in price. With the increasing trend and the lack of thick products, the transaction turns better. However, overall, the inventory of 400 series is large.

Summary:

200 series is in a status of inventory reduction, and the market is lacking spot products that keep up the price. As for 300 series, due to the hype of the production limit, the prices increase greatly and people mostly think the price will keep rising. But it all depends on how severe the implementation will be.

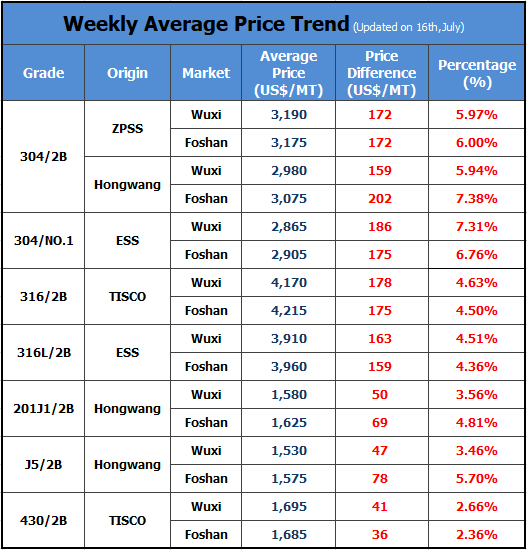

TREND|| Increasing by US$234/MT in a week. Will the concern of production limit continue?

Last week, we all witness how crazy the market can be. The futures, contract 2108 increased by almost US$219/MT and the SS304 spot in Wuxi market rose by over US$234/MT. The cold-rolled 304 base price of private-owned mills even went up to around US$3,045/MT.

201: Inventory is decreasing, which boosts the price to rise.

Influenced by the large increase of the SS304 price, the price of 200 series also rose last week. 201J2 in Wuxi market was US$86/MT higher than a week before, going up to US$1,570/MT.

According to the market transaction, it heated up compared to the past week. Although the price of the coil is more expensive than that of the sheet, downstream still has greater demand for the coil.

Analyzed from the current inventory, the volume of Wuxi and Foshan markets both keeps reducing. Until mid-July, the total inventory of 200 series in Wuxi and Foshan was 183,100 tons, 39,800 tons lower than that at the end of June, and the declining percentage is 18%. The effect of earlier production reduction has gradually presented. The spot volume keeps declining in the market.

Thanks to the increasing price, the producing profit is recovering, but it remains around the break-even point. Because of the possibility of production limit, low-profit 200 series production will be cut down. It is reported that Baosteel Desheng and Ansteel LISCO have begun to cut down the production of 200 series. The declining production of 200 series will bring up the price in the future.

304: Hyping production limit, the price might keep rising.

The significant increase last week owns to the news of the production limit. Lately, there is continuous news about the production limit to steel mills by the local governments. In Jiangsu, Anhui, and Gansu provinces, the requirement is that the crude steel production volume of this year shall not surpass that of last year.

As for the stainless steel industry, the same requirement is sent to some state-owned enterprises, such as Tsingshan, Delong, and other 10 stainless steel mills. But for now, the official document is yet to bring to practice. Most of the stainless steel production is not affected. According to the market news, Baosteel Desheng plans to cut down 20,000 tons of production this month, but it is in the range of SS201. Besides, Ansteel LISCO will also reduce production. However, most of the mainstream steel mill giants do not reveal their plans for output reduction yet. Because of the production limit news, the market price tends to increase.

Second, the inventory volume remains low. As we mentioned above, the inventory of 300 series only dropped down by 5,200 tons, but actually, it might decrease more, because some products have been sold on their way to warehouses. Besides, the hot-rolled resources of Tsingshan did not arrive, and even the agents of Tsingshan bought from the market. Overall, the resources in the market are insufficient. The biggest uncertainty is that whether the production limit will carry out and how strict will the enforcement be. If the enforcement is lower than expected, the recent increase will risk a turndown. What’s more, the Ministry of Industry and Information Technology said on Friday that it will ensure the supply of bulk commodities and stabilize prices and resolutely combat price bidding, which will also affect market sentiment to a certain extent.

400 series: Lacking electric power, raw material cost is increasing.

From the perspective of raw material, the lack of electric power is getting more serious in the high chrome main production areas. In June, the production of high chrome was 500,700 tons but in July it is predicted there will have 40,000-50,000 tons of decrease due to the power rationing policy.

The price of high chrome maintains the increasing trend. Last week, the price increased by US$31/50 base ton, quoting at around US$1,344/50 base ton. Influenced by the increasing price of raw material and 300 series, SS430 also increased. The 430/2B guidance price of TISCO and JISCO increased to US$1,735/MT. From the feedbacks of market merchants, the overall transactions are turning good, and the inventory volume decreased by 3,000 tons.

Considering that the output production will become the tone of steel mills in the rest half year, it is of large uncertainty whether the high furnace of Baosteel Desheng will be put into production. Therefore, the supply might reduce, which will boost the price of SS430.

Price forecast:

304: The cold-rolled 304 of private-owned mills will have an increase of US$63/MT. Be cautious that the enforcement of the production limit policy.

201: It is predicted to increase, by about US$16-31/MT. Also concerning the production limit, if the enforcement is loose, the price of 201 will meet a reduction.

430: Influenced by the high price of raw material and 304, the price of state-owned steel mills 430/2B will go up to US$1,750-US$1,770/MT, increasing by US$31/MT.

ANALYSIS|| Why the prices are increasing?

The price of high chrome has kept increasing significantly. In June, the price increased by 13.51%, reaching US$1,313-1,328/50 base tons, and the factories have kept raising the price. In early July, Tsingshan confirmed its new purchasing price which is US$1,312/50 base ton (tax inclusive, deliver to the factory), which is US$148 higher than last month.

Behind the insane increase are the continuous accidents.

1. On July 9, 2021, South Africa, China's most important source of chrome ore and ferrochrome imports, began riots, causing the terminal to fail to operate normally, which has affected the delivery of chrome ore and ferrochrome.

South African state-owned transportation company Transnet announced on the 12th local time that the following terminals cannot continue to operate:

a. Durban Container Terminal No. 1 and No. 2 Berths;

b. Durban Ro-Ro and Multi-Purpose Terminal;

c. Richards Bay Multi-Purpose and Bulk Cargo Terminal;

d. Durban Port Maiden Bulk Cargo Terminal.

The above-mentioned port resumption time has not been announced. Shipment of chrome ore may be blocked in the short term.

What’s worse, South African President Ramaphosa announced on the evening of the 11th local time that the current four-level "blockade order" is extended to July 25.

2. Also on the 9th, the Inner Mongolia Electric Power Dispatching Center issued a red warning for orderly power consumption on July 10th, 11th, and 12th. It shows that there was a power balance gap of 5.42 million kilowatts on July 10, a power gap of 5.02 million kilowatts on July 11, and a power gap of 5.02 million kilowatts on July 12.

3. Due to the COVID-19 pandemic, the Suez Canal crisis, and China's Yantian port epidemic prevention, the container industry continues to be tense, causing serious congestion in Indian ports. The Federation of Indian Export Organizations (FIEO) recently emphasized the urgent need to release nearly 50,000 containers stranded in different ports in India.

Either inside China or outside China, there are factors affecting the chromium price to keep increasing in a short term.

DISCUSS|| Will the commodity prices cool down when China uses the reserve?

China has taken a multi-pronged approach to curb the continuous rise in commodity prices, which has brought China, the world's largest buyer of many major resources, and its unique economic intervention policies into a game with global market forces. The prices of commodities show that this is a tough battle.

However, relevant Chinese authorities have not given up. They said they plan to increase the measures introduced in recent months in the short term to cool down the bulk commodity market boosted by the global economic recovery. In addition to inspections of pricing platforms and widespread warnings of market speculation, the Chinese government auctioned off national reserves of copper, aluminum and zinc in early July to increase supply. The State Reserve Agency stated that it plans to release more national reserves.

The National Development and Reform Commission, China's highest economic planning agency responsible for overseeing commodity reserves, stated on July 6 that in order to ensure the stable operation of the market, it will continue to organize the release of national reserves in the near future.

Beijing began investigating the iron ore trading platform last month and said it will also investigate coal prices, thereby escalating its months-long campaign to curb high iron ore prices. The prices of these two commodities have remained near record levels. Chinese leaders pointed out that the commodity market is one reason for the high producer price inflation in the world’s second-largest economy. They worry that this may harm China’s economic recovery, while economists say it may help the United States and others. Increase in prices for foreign consumers.

Despite China’s measures to calm the market down, iron ore prices are still hovering near their 10-year high.

Strong global demand in the construction and infrastructure industries has not helped Beijing's actions. Commerzbank said in a report last week that stainless steel producers-many of which are located in China-are still setting the highest prices for Europe since 2016, and most of their production has been sold out domestically.

Wood Mackenzie Senior Economist Zhou Yanting said:

“We do see the risk that (Chinese) consumer price inflation will continue to rise in the next few months. The prices of household appliances and automobiles continue to rise.”

On July 13, container transport at a port in Zhejiang Province.

Chinese leaders regard the commodity market as the main cause of high inflation in downstream manufacturing production costs.

Stainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in China