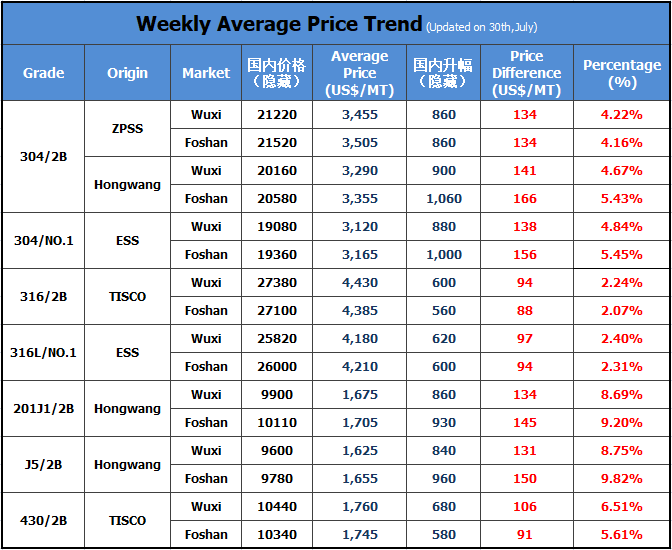

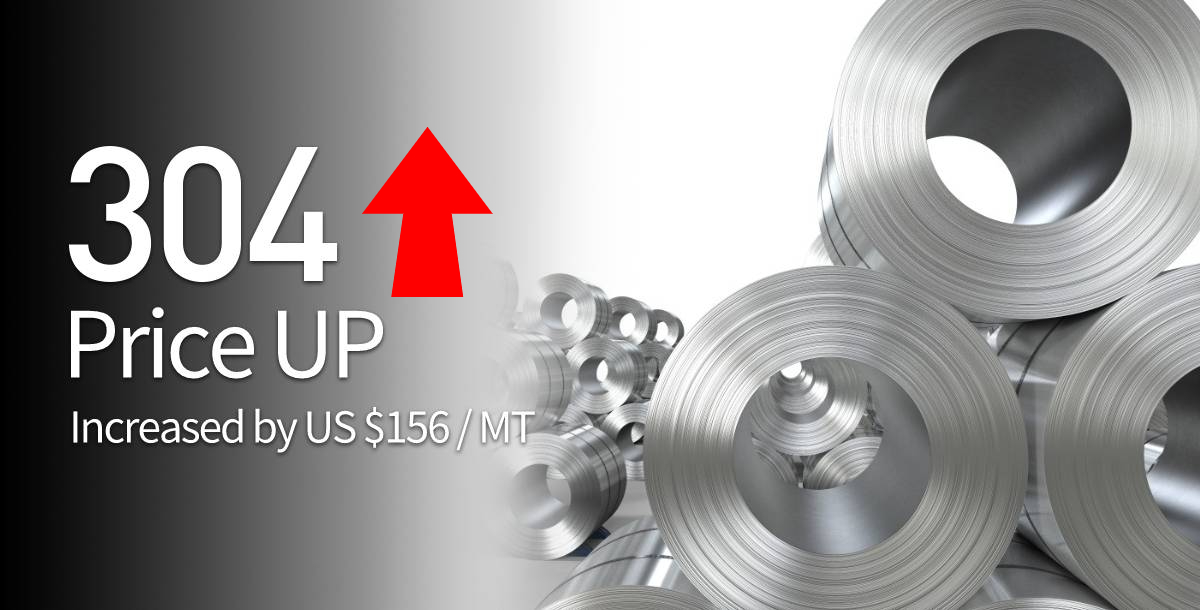

TREND||SS304 increases by more than US$156/MT in a week.

Last week, the prices of stainless steel kept increasing, Stainless steel futures contract 2109 once rose to US$3,295/MT and closed at US$3,265/MT on Friday, which increased by US$172/MT within the week. In Wuxi market, the cold-rolled 304 of private-owned mills increased by US$172/MT and the base price of cold-rolled stainless steel of 4 feet and mill edge grows to US$3,280/MT.

304: More factors conveying to boost the price.

Beginning from the macroeconomics and policy, FED maintains the low-interest rate. Besides, the European Central Bank said that it will not raise interest rates prematurely, which is conducive to financial and commodity market speculation.

For now, the rumor overwhelmed the market did not realize. stainless steel is not involved in China’s latest export tax policy. Therefore, it will bring certain positive effects to the stainless steel market.

From the perspective of the market, influenced by typhoons and storms, lately, the new resources from BG New Materials, Tsingshan, and TISCO are postponed. Moreover, with the production limit policy, electric power rationing, environment protection policy are getting stricter, the raw material supply is reducing, and steel mills stop production and begin overhaul. As a result, the production volume of BE New Materials and Delong will be shrunk down. In the future, it is predicted that the production volume will be reduced still. The market will remain consuming the inventory.

As for raw materials, last week, the price of high nickel-iron rose by US$9, reaching up to US$223/nickel. The purchasing price of steel mills is increasing, and some transaction price moves up to US$224/nickel. But now many factories quote US$227/nickel, and the price will tend to increase because the ferronickel imported from Indonesia reduced, and it lacks spot resources in the domestic market.

What is uncertain?

1. In the Central Politic Meeting, it is stressed to maintain the commodity prices stable. This brings negative effects to the market, and thereby on Friday night, ferrous commodities and stainless steel futures both fell.

2. The downstream manufacturers refuse the products of high price. For now, the coil prices are way higher than sheet prices.

200 series: The price will stay in the increasing trend, due to the electric power rationing and low inventory.

Until the latter July, the 200 series inventory in Wuxi and Foshan is 183,600 tons, which is 500 tons more than that in mid-July. The previous production reduction of steel mills is gradually presented. The overall inventory pressure decreases compared to the past period.

Based on the current production, Jinhui is now in overhaul because of storms. Other mills such as Shengyang and BG New Materials reduce production because of environmental inspection and power rationing policy. It is believed that there will be fewer resources arrived in the market. Supply is narrowing down.

Lately, the prices keep increasing. The profit of cold-rolled 201 recovered to US$63/MT. However, compared to the profit of 300 series and 400 series, it is low. The prices of the 200 series will still go up.

400 series: Prices are boosting after the cost increased significantly.

Raw material: The mainstream steel mills give their purchasing price of high chrome in August, which increased by about US$375/50 base tons. The reason is that the electric power rationing regions spread to Hunan and Guizhou provinces and the production volume of high chrome will further reduce. The price will increase.

Since August, the production of steel mills may be greatly affected by the regulatory policies, and the supply of stainless steel in the market may be subject to certain restrictions. In addition, driven by the sharp rise in high chromium, the cost of the 400 series has risen sharply, and steel mills will continue to increase prices. What’s more, the decline in inventory (the 400 series inventory in the Wuxi market decreased by 4,600 tons, leaving 83,200 tons this week), which further pushes up market prices.

Summary:

304: The price will remain high because of power rationing and production limit. It is predicted that in the next week, the cold-rolled 304 private-owned mills will increase by US$78/MT. However, It is necessary to prevent the risk that the implementation of the production restriction policy may not be as strong as expected.

201: Due to the raw material shortage, production reduction of steel mills and low inventory, it is predicted that the price will increase by US$31/MT.

430: Because of the continuously increasing price of high carbon ferrochrome, the cost of SS430 production rises significantly. It is predicted that TISCO and JISCO will increase the price of 430/2B to around US$1,925/MT ~ US$1,940/MT, US$31~US$47/MT higher.

Will stainless steel face obstacles on the way of increasing?

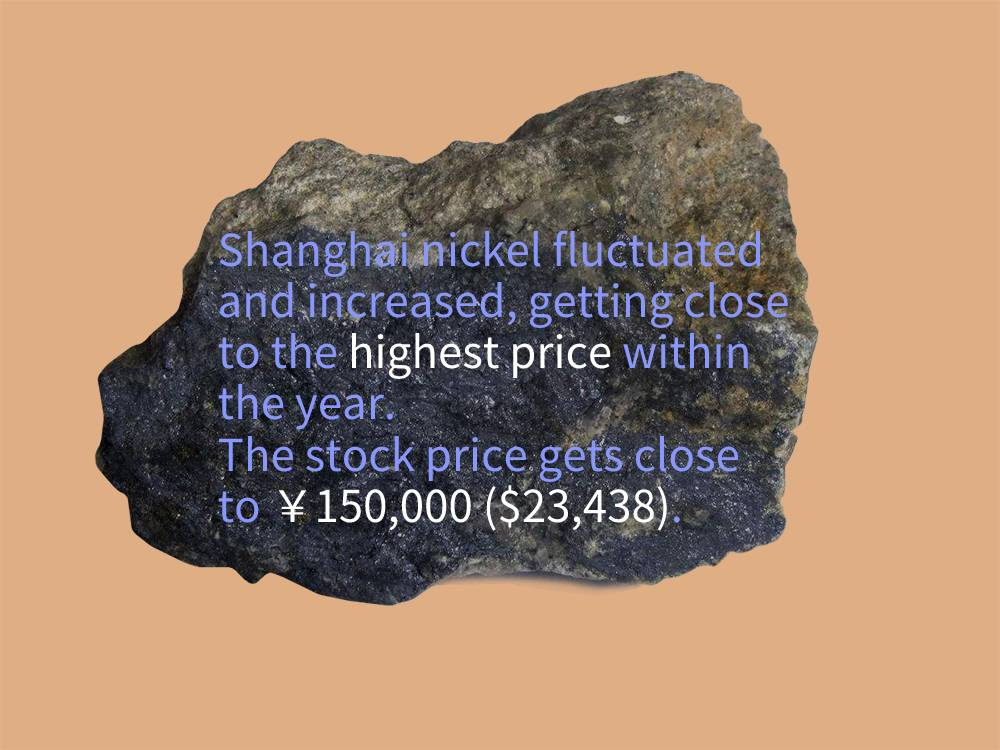

Shanghai nickel fluctuated and increased, getting close to the highest price within the year. The stock price gets close to ¥150,000 ($23,438). But it fails to go higher because the plots were reducing.

Nickel ore

Last week, influenced by typhoons, the delivery was postponed, so the supply reduces, raising the price. Moreover, thanks to the large profit margin of ferronickel, it is predicted that nickel ore will keep increasing.

Ferronickel

Last week, the price continued to rise, and the transaction price moved up to US$219/nickel. Because of the large production of 300 series in China, the demand for ferronickel is great. However, the nickel imported from Indonesia is lower than expected. Therefore, steel mills proactively purchase ferronickel within China. It is expected that the price of ferronickel will remain at a high level.

Refined nickel

Last week, stock prices rose sharply, while spot transactions were once again cool down. The downstream demand lacks purchasing force at higher prices, which brings certain resistance to price to increase. In terms of macroeconomics, the U.S. economic growth rate was less than expected in the second quarter, and it is possible that the loose monetary policy will maintain. When the U.S. dollar index turned down, this gave nickel prices a boost, while the LME continued its destocking trend. In terms of overseas demand, it stays positive.

OPINION|| The price of stainless steel will fluctuate and rise.

One on hand, the supply of nickel ore and ferronickel are tight and the demand is high, which gives strong support to the nickel price. On the other hand, from the perspective of investment sentiment, the fear from the Chinese demand-side hinders the price to increase further. It is believed that next week, the Shanghai nickel price will stay fluctuated and high.

The main contract price of stainless steel continued to rise last week. Due to the rumor of tariffs imposed on stainless steel exports in the middle of the week, it fell back to around ¥19,000(US$2,969). But since it did not realize, the price quickly grew to ¥20,000( US$3,125), breaking record high.

From the perspective of stainless steel stock, the increasing motivation maintains, because of the expensive raw materials—— ferronickel and ferrochrome both rose largely last week. Meanwhile, the demand is growing. In a longer view, stainless steel has stayed at a high price for long, continuous increase is not easy, and the reasons are:

1. The production of 300 series won’t reduce.

As soon as the production limit came out, the gloomy sentiment spreads in the stock market. Actually, the limit influences more on plain carbon steel. Some steel mills reduce producing plain carbon steel to ensure the production of stainless steel. Within stainless steel range, it is 200 series that suffers the most of reduction. Therefore, the limit policy affects little on 300 series stainless steel.

2. The possibility of tax imposition is large.

Based on the current export policy, reducing steel exports to achieve the goal of reducing steel production is in line with the current emission reduction requirement. Although stainless steel is not included in the tariff adjustment this time, it is still of large possibility to be on the list in the future.

3. The cost of downstream manufacturers is heavy.

The current high price of stainless steel brings a burden to the downstream manufacturers. PPI (Producer Price Index) has remained high, which will appeal to greater enforcement on the side of the policy.

RAW MATERIALS|| The enforcement of production limit is expected to be strong. Iron ore drops by US$16/MT.

On 30th July, iron ore closed at US$160/MT, which dropped by almost US$16/MT and the declining percentage was 8.14%. What leads to the drop is production limit, increasing supply and stacking inventory.

Insider A: Insufficient downstream demand caused by production limit is the main reason for the iron ore plummet. Many places across China have successively issued a production limit policy to reduce steel production capacity and have a greater negative impact on the downstream demand for iron ore. Earlier, the Ministry of Ecology and Environment stated that the reduction of crude steel production is a major adjustment of the iron and steel industry this year. Besides, typhoons and the recurrence of epidemics have also affected the operation of steel mills and restricted downstream demand.

Insider B: The negative effect brought by increased supply on iron ore prices is obvious. In China, the China Iron and Steel Association stated that it will accelerate the development of domestic iron ore resources, promote the construction of overseas iron ore projects. In other countries, Vale of Brazil stated that its annual iron ore production capacity reached 330 million tons, compared with the 75.69 million tons output in the second quarter, which reflects that the iron ore output will increase; What’s more, the delivery of a foreign mine enlarged, which has suppressed the current iron ore prices.

Insider C: Due to the demand for lump ore, the inventory has increased by nearly 1 million tons last week. The inventory of high-grade mines MMP has been increased for three consecutive weeks. The increase in inventories has also put pressure on the current iron ore prices.

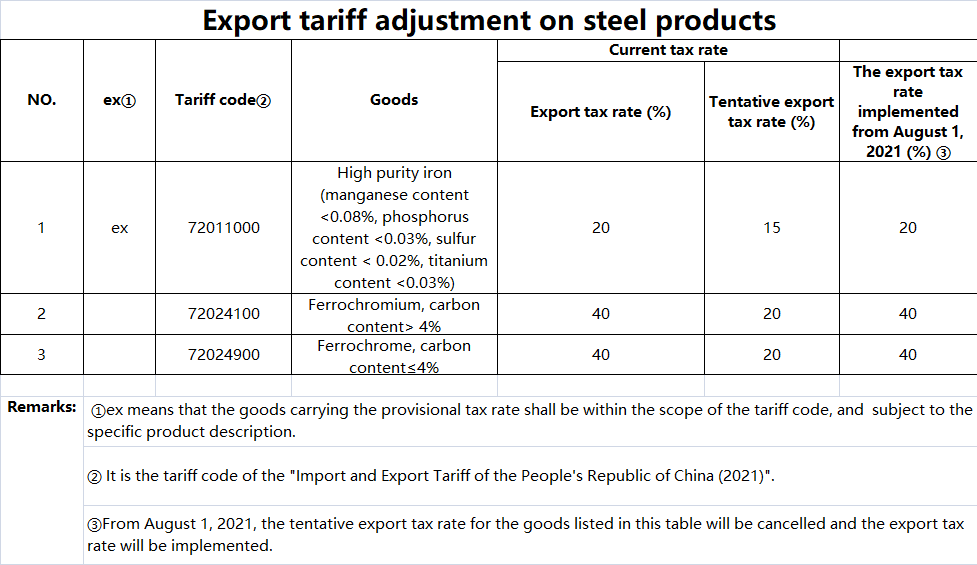

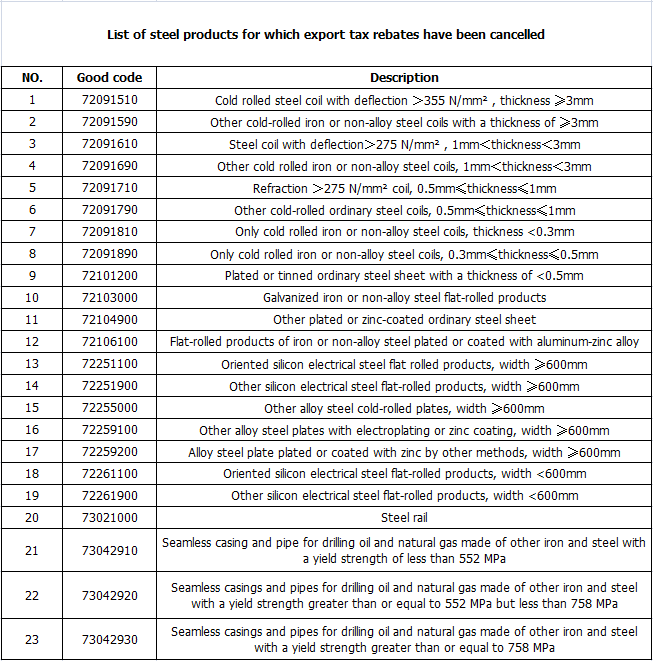

Export tariff imposition on steel product, it is settled.

China has stepped up its efforts to rectify the steel industry to curb soaring steel prices. It was reported on July 29 that Beijing would raise tariffs on some steel materials and cancel the tax rebates for cold-rolled products since August 1st.

1. The export tariff of ferrochrome, the main raw material for stainless steel production, will be raised from 20% to 40% from August 1.

2. The levy rate of high-purity iron will be increased from 15% to 20%.

3. Export tax rebates will be canceled from 23 items, including some cold-rolled coil products.

The Ministry of Commerce stated that these measures are to urge the industry to transform.

The world’s largest steel producers and exporters are transforming their industries to contain pollution, limit production and maintain more domestic supply.

China has already abolished export tax rebates in May and raised tariffs on some products.

Earlier this year, after the recovering demand pushed steel prices to record high, the export market may tighten. As the economy rebounded and we see a consumer boom in the global market.

Chinese authorities have implemented sporadic production cuts this year, but production has reached record levels amid high demand and high-profit margins.

A researcher from the China Iron and Steel Association said this week:

"The government will lower exports and inventories to offset the supply shortage in order to push production cuts in the second half of the year."

The country's measures to curb exports were not that effective as expected. After the effect of the previous taxation in May, the export volume falls by 30% and shipments in June increased by more than 20%.

The latest announcement includes the cancellation of export tax rebates for galvanized steel and electrical steel used in transformers, as well as some cold-rolled products.

Stainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in China