Hello, it's been a while! How are you doing? The Chinese market has officially returned to working mode since last week. Although some downstream manufacturers were still on holiday, the stainless steel prices still increased. Part of the reason for this, the cost of raw materials increased. Due to the environmental control during the Winter Olympics, some Chinese material producers are required to reduce production. Another reason that lit up the market relates to the lastest action of Indonesia—— the government suspends operations of more than 1,000 miners. The stainless steel prices are now on the increase, but it also faces resistance from the tightening macroeconomy. If you want to know more about the Stainless Steel Market Summary in China, please keep reading.

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

3,185 |

29 |

0.95% |

|

Foshan |

3,235 |

29 |

0.93% |

||

|

Hongwang |

Wuxi |

3,090 |

38 |

1.29% |

|

|

Foshan |

3,090 |

26 |

0.90% |

||

|

304/NO.1 |

ESS |

Wuxi |

3,105 |

26 |

0.97% |

|

Foshan |

3,100 |

24 |

0.81% |

||

|

316L/2B |

TISCO |

Wuxi |

4,640 |

41 |

0.93% |

|

Foshan |

4,680 |

32 |

0.71% |

||

|

316L/NO.1 |

ESS |

Wuxi |

4,550 |

91 |

2.11% |

|

Foshan |

4,575 |

71 |

1.63% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,920 |

14 |

0.80% |

|

Foshan |

1,900 |

- |

- |

||

|

J5/2B |

Hongwang |

Wuxi |

1,825 |

14 |

0.85% |

|

Foshan |

1,810 |

- |

- |

||

|

430/2B |

TISCO |

Wuxi |

1,595 |

14 |

0.98% |

|

Foshan |

1,640 |

13 |

0.85% |

Trend|| Production limit and product shortage boost the prices of spot and futures.

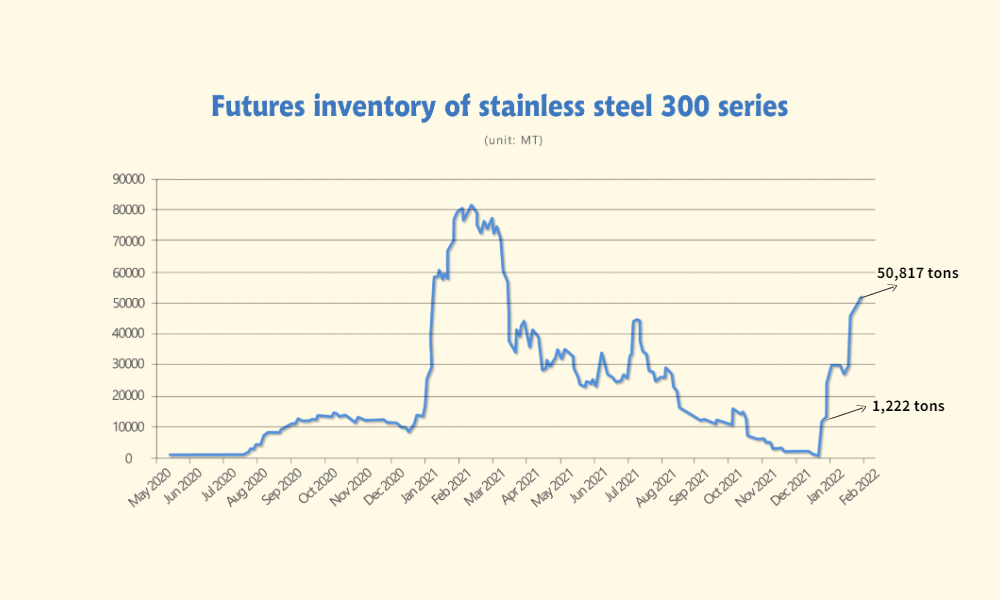

Last week, the prices of stainless steel increased stably. The market returned to work gradually and people are ambitious, boosting the prices of spot products to increase. Until February 11th, last Friday, the futures price of the stainless steel main contract rose by US$137/MT, to US$3,045/MT. In the meantime, the base price difference between futures and spot narrows down to US$106/MT.

300 series of stainless steel: Prices of futures and spot increased after the Spring holiday.

After the holiday, the stainless steel futures prices have gone all the way up. Though the ferrous and non-ferrous market decreased, only the prices of stainless steel remain to increase for 5 days. More warehouse receipts of stainless steel futures are registered. Until now, the futures inventory in Shanghai Futures Exchange increased by about 64,600 tons compared to the lowest point at the end of December 2021, rising to 65,800 tons. Because Tsingshan registered a large amount of futures warehouse receipts, the inventory of the spot product increased less. Influenced by the robust futures prices, it is predicted that the spot prices will also maintain high. Until last Friday, the closing price of the cold-rolled stainless steel 304 of 4 feet and mill edge was US$3,075/MT, which was US$80/MT higher than two weeks ago. As for the hot-rolled stainless steel 304, the price was quoted US$48/MT higher, increasing to US$3,125/MT. However, after the holiday, the prices continue to increase while some downstream manufacturers are yet to return to work. The domestic transaction can hardly heat up.

As you can notice, the prices of hot-rolled products are higher than that of cold-rolled products, one of the reasons is that the producing cost of the cold-rolled stainless steel 304 keeps increasing as the price of ferronickel rises.

200 series of stainless steel: Prices increase as it is facing a shortage.

In the first week of returning to work, people are vigorous. The prices increased significantly. But because not all downstream manufacturers are back to work, the domestic transaction was tepid. However, according to the market traders, there will be less arrival from steel mills in the future, so the market will face the risk of shortage. This gives a chance to the market to boost the prices. Typically, the hot-rolled 5-foot stainless steel 201 increased by US$183/MT last week, rising from US$1,810/MT to US$1,995/MT.

It is not common that the price grew more than US$150/MT in a week, but the product deserves the increase. Tracing back to pre-holiday, influenced by the LME nickel and stainless steel futures, the cold and hot rolling 201 both rose beyond US$1,715/MT. Meanwhile, the spot inventory of 200 series reduced to 2,600 tons and within, the hot-rolled products have taken the majority, which means that the inventory of the hot-rolled products has been scarce. Besides, some steel mills continue to reduce production in February, and thereby the future arrivals will also reduce. In a word, the shortage of the hot-rolled 5-foot stainless steel 201 will remain.

About the cold-rolled stainless steel 201, in Wuxi market, the base price of the mill-edge product grew by US$24/MT, to US$1,900/MT; as for J2 and J5, the base price increased to US$1,805/MT, which is US$24/MT higher compared to a week ago. The hot-rolled 5-foot products continue to rise. Until last Friday, the price rose to US$1,995/MT, which is US$183/MT higher. The hot-rolled product is still more expensive than the cold-rolled product, and the price difference gets wider. So far, the difference is around US$190/MT.

400 series of stainless steel: The market becomes vibrant after the holiday. Sellers keep boosting the prices.

In the Wuxi market, the 430/2B of TISCO and JISCO was quoted at US$1,635/MT which was US$40/MT higher compared to the price before the long holiday. The trade becomes vibrant, which supports the prices to keep increasing. Secondly, the cost of raw materials increases. The price of high chrome increases as the price of chrome ore rises. Moreover, because the COVID-19 breaks out in Guangxi Province which is one of the major chrome production areas, the high chrome factories stay firm on the increasing price. Except for the raw materials, the increasing prices of the stainless steel 300 series also give confidence to the stainless steel 400 series makers to allow the prices of the 400 series to step up. It is predicted that the price of stainless steel 430/2B will keep rising.

Summary:

300 series of stainless steel:

The supply of ferronickel is tight and steel mills purchase it proactively. The increase in the raw material prices lifts the cost of stainless steel 304, making the price maintain high. During the holiday, the arrival volume was low, and thus the steel mills and traders support the prices to grow. However, this week, contract 02 (futures in February) will enter the settlement. When the warehouse receipts turn to the spot market, the prices of stainless steel might suffer the risk of a sharp drop.

200 series of stainless steel:

The shortage has lasted for a long time. To avoid its expanse, some sellers tend to limit the delivery volume and in a meantime, they push up the spot prices. More downstream manufacturers are getting back to work, the domestic transaction will warm up. It is predicted that the price of stainless steel 201 will keep growing.

400 series of stainless steel:

Steel mills support the prices to increase. It is predicted that the price of 430/2B will rise by US$15/MT ~ US$32/MT, to US$1,650/MT~ US$1,665/MT.

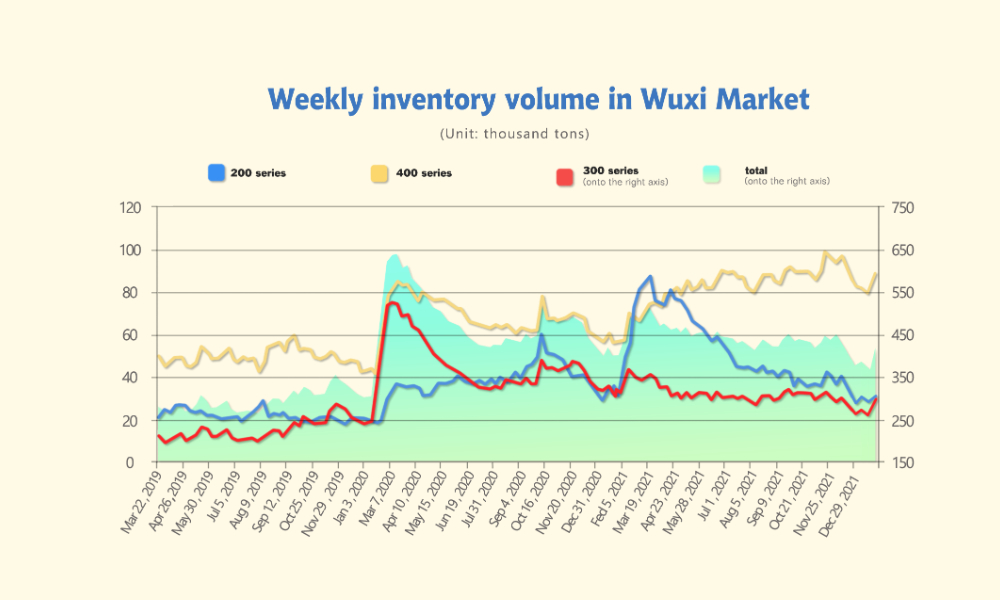

INVENTORY|| The inventory of 300 series rises by 100,000 tons.

| Inventory in Wuxi sample warehouse (Unit: thousand tons) | 200 series | 300 series | 400 series | Total |

| February 7th ~ February 11th | 29.7 | 392.8 | 88.1 | 410.6 |

| January 17th ~ January 20th | 26.3 | 256.0 | 78.0 | 360.3 |

| Difference | 3.4 | 3.7 | 10.10 | 50.3 |

Last week, the inventory volume in the Wuxi sample warehouse increased by 50,300 tons, to 410,600 tons. 200 series inventory rose by 3,400 tons, to 29,700 tons; 300 series went up by 36,800 tons, to 292,800 tons; 400 series increases by 10,100 tons to 88,100 tons.

200 series of stainless steel: Market is yet to be wakened. Inventory increases slightly.

Last week, the spot inventory of stainless steel 201 slightly rose by 3,400 tons compared to that before the holiday (January, 20th). On the one hand, since January 20th, the whole industry gradually began their holiday and the transaction weakened. When the consumption went down, the inventory stacks up naturally. On the other hand, although the National holiday ended, many manufacturers have a longer holiday, which also weakens the domestic transaction. Lastly, Baosteel Desheng keeps shipping more new products to the Wuxi market.

300 series of stainless steel: High pressure over the inventory because both of the inventory of futures and spot increase.

The inventory of 300 series went up by 36,800 tons, to 292,800 tons last week. The major reason it increased so much is the cold-rolled stainless steel 304. Even during the Spring Festival holiday, the steel mills kept sending products to the market. TISCO and Delong delivered a large amount of cold-rolled resources. But compared to the same period of last year, the inventory volume of this year is lower.

The inventory of stainless steel 300 series is facing high pressure. On the futures inventory side, Tsingshan recently registered a large quantity of the warehouse receipts in Shanghai futures Exchange, making the futures inventory add by more than 50,000 tons in one month. The contract in February is close to the settlement. At the moment, the futures resources of January and February will enter the spot inventory. The 100,000 tons of increase of the 300 series inventory causes great pressure on 300 series.

400 series of stainless steel: Steel mills enlarge the production.

In January, although a steel mill in Northwest China enlarged its production by almost 30,000 tons, the total production of stainless steel 400 series reduces more than expected, which dropped by 101,600 tons. However, during the holiday, steel mills still shipped their resources out. Last week, the inventory increased by 10,100 tons to 88,100 tons.

Raw Materials|| Products of nickel and chrome both increase in prices.

Influenced by low inventory, the price of SFE nickel (Shanghai Futures Exchange nickel)remains high, but because of the tightening macroeconomy, the price increase is limited. Therefore, it is predicted that the SFE nickel will stay high and fluctuated. Due to the Winter Olympics, the production limit is affecting the supply of ferrochrome and ferronickel. The cost of stainless steel rise, supporting the prices to go up.

Chrome & ferrochrome:

The price of ferrochrome remained as the prices before the holiday. However, the supply of high chrome tightens up. Because of the outbreak of COVID-19 in Tianjin and the environmental control, the production of Inner Mongolia and Shanxi reduces. Besides, some factories are still on holiday, which will slow down the production of high chrome in February.

Nickel & ferronickel:

During the first week to work, the high nickel-iron was bullish. The mainstream EXW quotation increased by US$6/nickel, to US$233/nickel.

The purchasing prices kept increasing as the market warmed up. A steel mill in Southern China has risen the purchasing price of high nickel iron to US$238/nickel (tax inclusive, deliver to the factory) and the trading volume was up to more than 10,000 tons.

A major reason leading to the increasing high nickel iron price is the tight supply after the holiday. Besides, due to the Winter Olympics and environmental protection, the production limit is again back on the stage. The ferronickel producers in Shandong Province are demanded to cut down 50% of the production, and the ferronickel producers in Liaoning Province also reduce the output. But in Fujian Province, the production goes down is out of the unfinished maintenance of the production line.

Turning the eyes on the global market, the nickel inventory has been consuming quickly. The inventory dropped down to 84,400 tons and the supply gets tighter. However, the macroeconomy will increase the resistance on the nonferrous market. According to an announcement last Thursday, U.S. inflation again increased, which will bring up the interest rate in March.

To sum up, influenced by low inventory and high nickel price, the prices of nickel ore and ferronickel will remain high. However, because of the tightening financial policies globally, the nickel prices abroad and in China will fluctuate at high. Moreover, the rising stainless steel prices will also boost the raw material industry. Lastly, it is predicted that the production limit will last to March.

Tsingshan Indonesia to expand high-grade nickel matte production.

The high-grade nickel matte products in Morowali Park continue to be delivered to Zhongwei and GEM from Tsingshan Indonesia. The production is vigorously accelerating to provide new energy materials for more customers. It is expected that the market competitiveness of nickel smelting production will be improved, and the supply and demand relationship of raw materials in the downstream new energy industry chain will also undergo fundamental changes.

Indonesia Morowali Industrial Park (IMIP)

1. Review of Tsingshan high-grade nickel matte:

- In July 2020, Tsingshan started to try to produce high-grade nickel(with nickel content of 75% and above), and until the end of 2020, the product was made successfully. Before that, except for Vale, the high-grade nickel matte was produced from nickel sulfide ore, and most of them were used to produce electrolytic nickel with high nickel content.

- On March 3, 2021, Tsingshan signed an agreement with Huayou and Zhongwei for the annual supply of 75,000 tons of nickel matte. The supply period is from October 2021 to October 2022. The conversion from high-grade NPI into high-grade nickel matte caused a sensation in the market. The nickel and stainless steel futures contracts’ hitting the limit down

- On December 8, 2021, the molten low-grade nickel matte was steadily added to the #1 converter in the Tsingshan Industrial Park in Indonesia. After more than 7 hours of blowing, the converter yielded the output of qualified molten high-grade nickel matte. It marked the start of the journey of formal high production in the Tsingshan Industrial Park in Indonesia, and accelerated the pace of Tsingshan’s advancement in the industry.

- On January 24, 2022, the first batch of high-grade nickel matte was shipped to China from Tsingshan Indonesia, which is about 500 tons. For now, 3 production lines have been completed in Tsingshan’s Morowali Park and the output is as high as 3,000 tons per month.

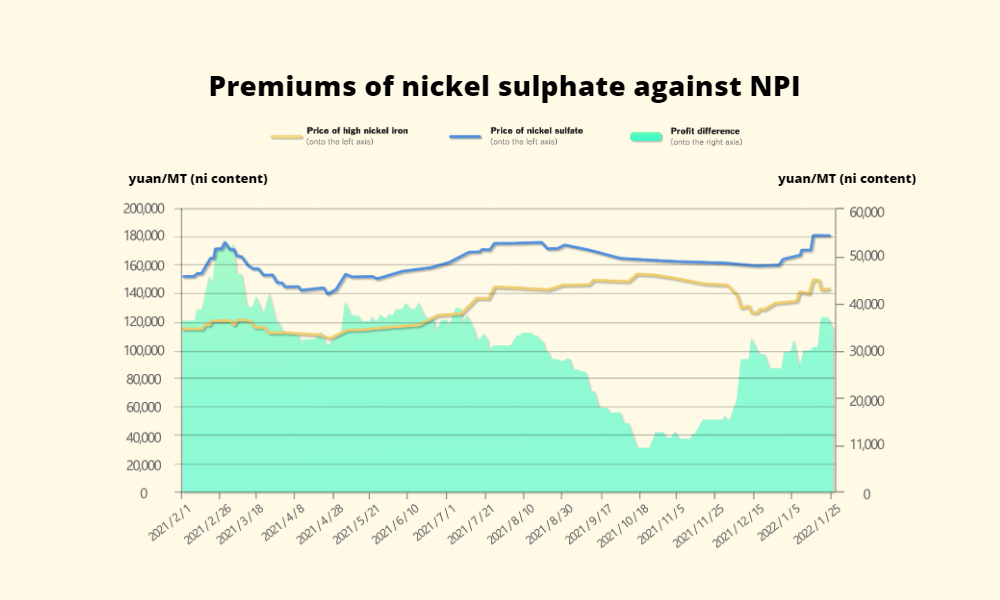

2. The driven force of producing high-grade nickel matte by (nickel pig iron) NPI.

The driven force lies in profit premium. Through the mathematic theory, when t the price difference between nickel sulfate and ferronickel is higher than 30,000 yuan /MT, it is profitable to produce high-grade nickel matte by NPI.

It is predicted that in the second half of this year, the supply of ferronickel might be surplus. With the higher demand for nickel due to the development of electric cars, and the increasing capability of high-grade nickel matte, the output of high-grade nickel matte will be expanded.

Latest: Indonesia suspends operations of more than 1,000 miners.

The prices of stainless steel keep increasing.

Indonesia has suspended the operations of more than 1,000 miners of coal, tin and other minerals due to a failure to submit their 2022 work plans, according to a document issued by the Minerals and Coal Directorate General of the mining ministry.

The Southeast Asian country has been seeking to improve the oversight of its rich resources sector and President Joko Widodo last month revoked the permits of more than 2,000 companies due to poor compliance.

Sony Heru Prasetyo, an official at the minerals and coal directorate, said on Friday that before the temporary suspension of operations was imposed the companies had been given a warning but had failed to submit their 2022 work plans.

The document, which was verified by Sony, showed the suspended miners included around 80 coal companies, more than a dozen tin miners and several nickel miners. Three bauxite miners in West Kalimantan were also suspended, as well as some gold and manganese companies.

The miners have 60 days to submit their 2022 work plans.

“If within that period the companies still have not submitted their work plan then they will be given a strict sanction of permit revocation,” Sony said.

The official said he did not have an estimate of how much the companies typically produced annually.

Indonesia is the world’s top exporter of thermal coal and a major producer of nickel metals, copper and refined tin.

The country rattled global energy markets in January when it banned exports of coal to shore up supply for domestic power generators.