Haven't seen a rebound in China's stainless steel prices for a long time. Last week, the average price of stainless steel 201 J1 and J5 increased and stainless steel 304 also rebounded. This is a good sign for the market. Besides, some steel mills will maintain their production strategy in July, that is to reduce the output to resist the bearish market and prices. There is more good news. One is China's manufacturing PMI in June increased, indicating the recovery of the manufacturing activities. Second is that the case for commodities going forward remains strong, as conditions of acute scarcity continue to persist across commodities, according to JP Morgan. If you want to go deep, please keep reading Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

2,890 |

-19 |

-0.70% |

|

Foshan |

2,935 |

-19 |

-0.69% |

||

|

Hongwang |

Wuxi |

2,750 |

-15 |

-0.57% |

|

|

Foshan |

2,735 |

-15 |

-0.57% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,635 |

-54 |

-2.11% |

|

Foshan |

2,695 |

-30 |

-1.16% |

||

|

316L/2B |

TISCO |

Wuxi |

4,470 |

-25 |

-0.59% |

|

Foshan |

4,510 |

-18 |

-0.41% |

||

|

316L/NO.1 |

ESS |

Wuxi |

4,175 |

-66 |

-1.61% |

|

Foshan |

4,210 |

-63 |

-1.52% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,560 |

36 |

2.56% |

|

Foshan |

1,535 |

-1 |

-0.11% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,440 |

22 |

1.73% |

|

Foshan |

1,445 |

-6 |

-0.45% |

||

|

430/2B |

TISCO |

Wuxi |

1,380 |

-51 |

-4.07% |

|

Foshan |

1,420 |

-58 |

-4.54% |

TREND|| Expecting the market to warm up after the reduction in output.

From July 4th to July 8th, the prices of stainless steel spot in Wuxi had various trends in terms of different grades. As for stainless steel 201, the cold-rolled resource was stable in price while the hot-rolled 5-foot resource slightly decreased; the price of the cold-rolled stainless steel 304 remained stable firstly and then increased, but the hot-rolled resource was weak; the stainless steel 430 went all the way down. During last week, the futures price stopped decreasing and started to rise in price. Until July 8th, compared to a week ago, the most-traded contract of stainless steel futures increased by US$82/MT to US$2,670/MT.

300 series of stainless steel: Prices stopped falling and maintained stable.

Until July 8th, the cold-rolled 4-foot stainless steel 304 of private-owned mills in Wuxi was US$2,725/MT which increased by US$15/MT higher than July 1st, while the hot-rolled resource declined by US$30/MT to US$2,620/MT. The pandemic arises in Wuxi recently, the major stainless steel trading centers are now under strict control, which influences the delivery. Some specifications of stainless steel 304 are out of stock. The prices of stainless steel futures and spots remained and the trading volume increased.

200 series of stainless steel: Pandemic returns, and the market tends stable.

In Wuxi, the cold-rolled stainless steel 201 price was stable last week, but the hot-rolled 5-foot stainless steel price dropped a bit. Until July 8th, the mainstream base price of cold-rolled stainless steel 201 remained at US$1,530/MT; stainless steel J2 and J5 also maintained at US$1,410/MT; the hot-rolled 5-foot stainless steel 201 dropped by US$30/MT to US$1,440/MT.

400 series of stainless steel: Pandemic drags down transaction.

Last week, the cold-rolled stainless steel 430 operated weakly. Until July 7th, the cold-rolled stainless steel 430 in Wuxi dropped to US$1,325/MT which was reduced by US$15/MT. The stainless steel 430/2B of TISCO and JISCO continued to decline, which was around US$1,295/MT ~ US$1,305/MT, and it was US$45/MT lower than the price on July 1st. Influenced by the recent pandemic, the transaction was hit and reduced last week.

Summary:

The most-traded contract of stainless steel futures fluctuated and rebounded slightly, closing to US$2,680/MT but generally the declining trend lasted from April and is hard to be pivoted. Although the price increased a bit, the tendency is not optimistic in a short term. What leads to the rebound in price is that steel mills have kept enlarging the reduction of stainless steel output, which to a certain extent, relieves the oversupply in the market. Another reason is the necessary demand increases after the stainless steel prices have dropped low enough. However, the rebound in price can hardly remain, we believe, because of the weak and unstable consumption.

300 series of stainless steel: In June, the production of 300 series decreased sharply and the reduction will remain to July. But the demand is recovering, meanwhile, the inventory in Wuxi has decreased for consecutive seven weeks. It is predicted that the price of cold-rolled stainless steel 304 of the private-owned mills will keep trying to rebound in a short term.

200 series of stainless steel: The pandemic in Wuxi will probably remain for a while. As the transaction goes weak, traders will suffer more pressure when propping up the prices. The prices of 200 series will probably decrease. The price of cold-rolled stainless steel 201J2 (coil) will stay above US$1,395/MT.

400 series of stainless steel: The cost of raw materials will continue to drop, it is assumed that. Under the pandemics, the stainless steel transaction will get weaker. It is predicted that the price of stainless steel 430/2B will remain to decline, between US$1,245/MT and US$1,275/MT.

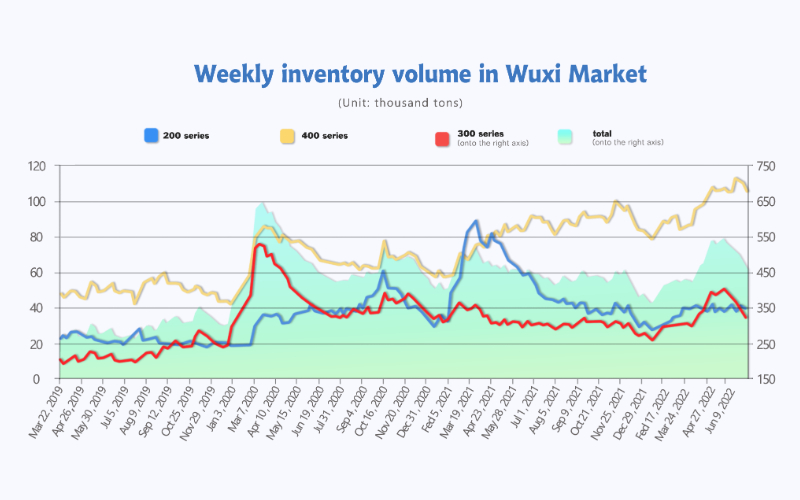

Inventory|| Output reduction remains. The inventory of 300 series has decreased for consecutive seven weeks.

Last week, the inventory volume in the Wuxi sample warehouse continued to decrease by 20,000 tons to 455,700 tons. 200 series inventory decreased by 500 tons, to 38,500 tons; 300 series decreased by 14,900 tons, to 313,500 tons; 400 series decreases by 4,600 tons to 103,700 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| June 30th | 38,973 | 328,360 | 108,349 | 475,682 |

| July 7th | 38,473 | 313,459 | 103,700 | 455,632 |

| Difference | -500 | -14,901 | -4,649 | -20,050 |

200 series of stainless steel: Wuxi again faces COVID, slowing down the digestion of inventory.

COVID strikes Wuxi. Most stainless steel trading markets have to shut down and the transportation is insufficient, resulting in delays in the steel mills’ delivery. Therefore, the inventory of stainless steel 200 series decreased slightly, only by 500 tons, declining to 38,500 tons. Facing the continuous drops in the past three months, now Chinese traders are standing firm to support stainless steel prices.

300 series of stainless steel: Steel mills keep reducing the output.

The inventory of stainless steel 300 series in Wuxi decreased obviously last week. Due to the shutdown of the trading markets, and the stable stainless steel prices, the transaction gets better. The inventory of stainless steel 300 series has declined for consecutive seven weeks. In June, the crude steel of stainless steel 300 series was 1.27 million tons, YoY reduced by 180,000 tons. The decrease of crude steel affects and drags the delivery of stainless steel. For now, the inventory has turned down to the level in Mid-April. The production reduction will remain until July according to the steel mills. It is predicted that the inventory will continue to drop.

400 series of stainless steel: Supply will be reduced again, as steel mills plan to cut down production.

In June, the production of 400 series decreased by 118,200 tons to 485,400 tons. The inventory of stainless steel 400 series in Wuxi was reduced slightly. Although JISCO has completed the maintenance, it plans to reduce production in July. As for TISCO, it has turned to plain carbon steel, which limits the supply of 400 series. The inventory has fallen down from high.

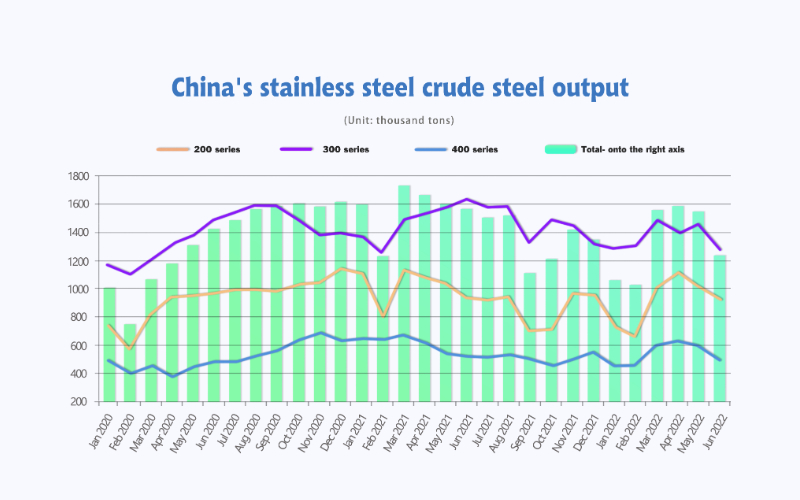

Crude steel of stainless steel: Production decreases by over 400,000 tons. The bearish market might be boosted.

According to the data for June of the crude steel production of stainless steel, the output of all grades dropped significantly. The crude steel production by the stainless steel enterprises (above designated scale) was 2,689,900 tons, MoM decreased by 385,400 tons, the declining range was 12.53%; YoY reduced by 415,200 tons and the percentage was 13.37%. In June, the stainless steel, whatever grades, was cut down in output, particularly the stainless steel 300 series.

In details:

The output of stainless steel 200 series was 929,800 tons, MoM reduced by 91,600 tons is 8.96%; YoY decreased by 12,500 tons and the declining percentage was 1.32%.

The output of stainless steel 300 series was 1,274,600 tons, MoM reduced by 175,600 tons is 12.11%; YoY decreased by 362,700 tons and the decreasing percentage was 22.15%.

The output of stainless steel 400 series was 485,400 tons, MoM reduced by 118,200 tons is 19.58%; YoY decreased by 118,200 tons and the declining percentage was 7.61%.

From the chart above, since the second quarter, crude steel production has declined by month. Influenced by the pandemic, the demand of end-users remains gloomy. Steel mills could not reach orders under the downward price trend. However, the raw material prices did not decrease simultaneously when the stainless steel selling prices started to drop. The time gap, as well as the cost gap, resulted in a sharp decrease in the profit of steel mills and even a large loss in certain types of stainless steel. Therefore, steel mills had to bring out maintenance to reduce production.

The production of the 200 series caused the greatest loss. As early as May, many mills reduced the production of 200 series and enlarged the production of 300 series. In June, the output of 200 series dropped further.

From the perspective of 300 series, Delong faces the stacking inventory which is consumed slowly, it suspends the production of two new producing basements. Another steel giant, Tsingshan, due to the bearish market and increasing cost, some production lines were stopped and started maintenance in June. Other steel mills also reduced their output. This results in a steep decline in output in June. Compared to the data of May, the production in June decreased by almost 180,000 tons and less by over 360,000 tons compared to the same time of last year.

400 series of stainless steel decreased in output is also decreased due to the poor market. In China, the downstream buyers such as the home appliances makers were not active in production. The bearish domestic demand leads to the increasingly high 400 series inventory. To deal with it, JISCO started the maintenance during May and June, and other mills also reduced their output.

So far, steel mills have released plans of reducing output in July. It won’t be a surprise that China’s stainless steel output will maintain a low level. When China’s domestic demand recovers gradually which we have noticed the signs, the social inventory of stainless steel keeps decreasing, we can expect stainless steel prices will increase.

RAW MATERIAL||Costs keep reducing.

NICKEL: Steel mills continue to hit down the purchasing price, down to US$190/Ni.

Last week, the high nickel-iron decreased to US$190/Ni which was US$8/Ni lower compared to the price on June 30th. As for the low nickel-iron (1.6%≤Ni≤1.8%), the price remains at US$710/MT.

ShFE (Shanghai Futures Exchange) nickel fluctuated to drop. Until July 7th, the most traded contract of ShFE nickel closed at CNY¥164,230/MT (about US$24,808/MT), which dropped by CNY¥11,860/MT (about US$1,792/MT), the declining percentage is 6.74%. The price of nickel once went down below CNY¥160,000, but influenced by the sanction on Russian nickel, the price rebounded. However, the declining tendency remains.

Accordingly, steel mills continue to reduce the purchasing price. Two mills decreased the price to US$196/Ni which was US$6/Ni lower than the last given price. Following the trend, some ferronickel factories reduced the EXW price significantly, the lowest went down to US$190/Ni which breaks below the lowest cos of some iron factories. In response to the sharp decrease in the ferronickel price, some iron factories reduce output and bring maintenance forward.

About the refine nickel, the consistently decreasing nickel price activates the trade of spot. But the buying momentum is limited because the demand majorly is for replenishing the stock. The LME nickel inventory declined to 65,700 tons. The low inventory volume will have some pushup to the price in a short term. The American austerity is expected to remain, which will hit the nickel price. Generally, the declining tendency will continue.

Indonesian export tax on nickel products will be carried out next month earliest, the source says.

After Indonesia banned the export of nickel ore in 2019, the Indonesian government has repeatedly mentioned restrictions on the export of nickel products since this year, saying that it will impose a progressive tax on nickel export products. Nickel products are subject to a 2% tax rate, mainly involving raw materials with a nickel content of less than 70%.

It is reported that the increase in export tariffs on Indonesian nickel products will be introduced as soon as next month, but there are different views on the rate. The tariff increase rate may reach up to about 20%, which is much higher than the 2% levy rate mentioned at the beginning of the year.

Chromium: High chromium production to drop in July.

Recently, the EXW quotation of high chromium has been stable, at around US$1,360/MT (with 50% of chromium content). It is predicted that the latest purchasing price of high chromium will be reduced to US$1,329/MT (with 50% of chromium content) nearby.

In July, steel mills cut down the high chromium purchasing price sharply by US$98/ MT (with 50% of chromium content). To reduce the cost, the high chromium factories in Inner Mongolia mostly work to avoid the electric power consumption peak when the bill is charged higher. But this will reduce the output by 20,000 tons ~ 30,000 tons.

So far, the production cost is higher than the selling price because the chromium ore was expensive. There might be more factories forced to reduce production in July. As the supply reduces, the price of high chromium will climb stably.

MACRO||Commodities going forward remains strong, says JP Morgan.

Source from JP MORGAN

Commodities are on pace to deliver a third consecutive year of significant positive returns, up 30% year-to-date. Despite this strong performance, the case for commodities going forward remains strong, as conditions of acute scarcity continue to persist across commodities. Summertime is the traditional peak of demand season, but current inventories are 19% below historical norms and lack of an inventory buffer is leaving the market vulnerable to unplanned supply outages.

“In our view, almost the entire complex remains a buy,” said Natasha Kaneva, Head of the Global Commodities Strategy team at J.P. Morgan.

In oil markets, Russian crude is flowing, but global crude markets have tightened considerably, as transit times get longer. Tightness in Liquid Natural Gas (LNG) supply suggests higher prices for longer is the continued theme for the European natural gas market. In agriculture, apart from soybeans, balances continue to show draws in inventories through 2022/23 across the board and stock-to-use ratios across tradeable inventories remain historically tight.

Turning to base metals, while there are sizeable risks that zero-COVID policies could continue to hamper economic activity in China, a rebound in Chinese demand could further stress low inventory levels, driving a 2H22 price recovery. Finally, precious metals remain the more bearish outlier. While firmer inflation may seem bullish for prices, it is now being quickly counteracted by more aggressive pricing for a policy response from the Fed and other central banks, likely keeping prices constrained.

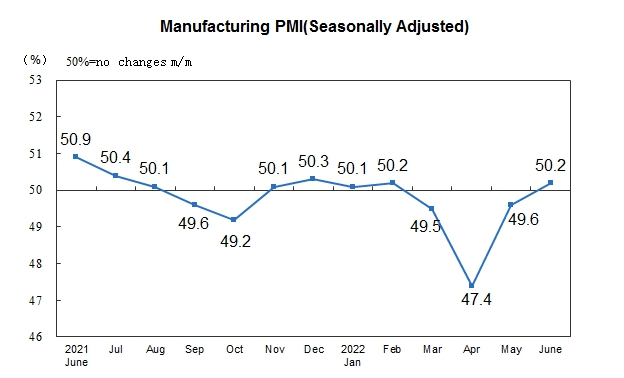

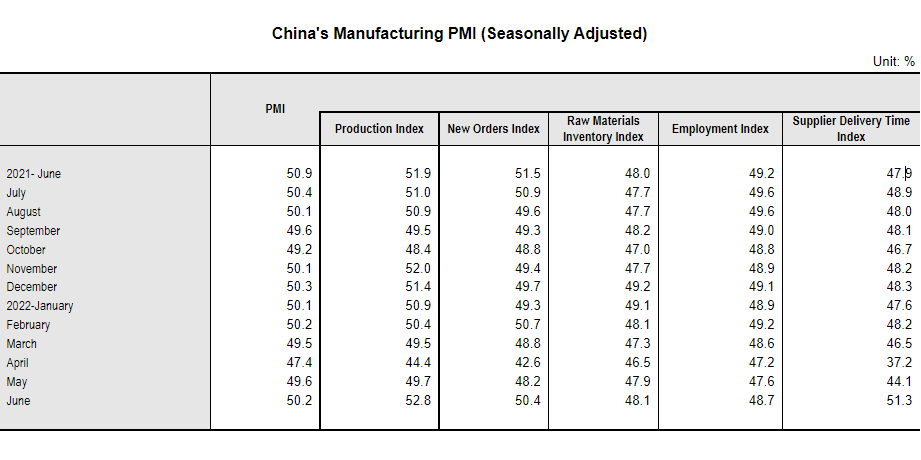

China's manufacturing PMI increases, indicating a positive warm-up of the economy.

In June, the Purchasing Manager Index (PMI) of China's manufacturing industry was 50.2 percent, up 0.6 percentage point from the previous month, returning to above the threshold, and the manufacturing industry recovered and expanded.

Economic activity has sped up in June since various COVID lockdowns have been rolled back as COVID-19 cases fell, with a range of support measures unveiled by the State Council in late May to stabilise growth gradually kicking in.

Generally, from the sub-indexes, the production index, new order index and supplier delivery time index were all above the threshold, and the raw material inventory index and employee index were all below the threshold.

FREIGHT|| Sea freight to South America continues to increase.

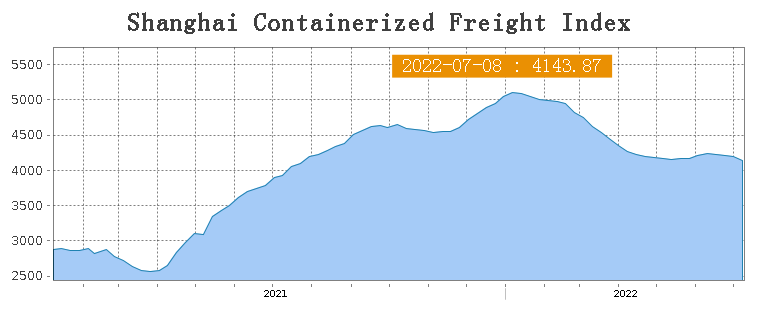

Compared to the previous week, the SCFI on July 8th slightly decreased by 1.4% to 4143.87.

Europe/ Mediterranean: Last week, the transportation market remained stable, and the market freight rate fell slightly. On July 8th, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European base port market was US$5,697/TEU, down by 0.6% from last week. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean base port market was US$6,335/TEU, down by 1.0% from the previous week.

North America: According to data released by the Institute for Supply Management (ISM), the U.S. national factory activity index fell to 53.0 in June, the lowest value since June 2020, indicating that future economic growth in the United States will slow down sharply. In addition, in order to control inflation, the Federal Reserve is forced to continue to raise interest rates, and the US economy may face a situation of stagflation in the future. On July 8th, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East base ports were US$7,116/FEU and US$9,602/FEU, respectively, down by 3.0% and 0.8% from the previous week.

The Persian Gulf and the Red Sea: On July 8th, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the basic port of the Persian Gulf was US$3,309/TEU, decreasing by 4.7% from the last week.

Australia/ New Zealand: On July 8th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the basic ports of Australia and New Zealand was US$3,309/TEU, down by 0.3% from the previous week.

South America: This service is now in the traditional peak season. The spot market booking price continued to rise. On July 8th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American base ports was US$8,954/TEU, up by 6.8% from the previous week.