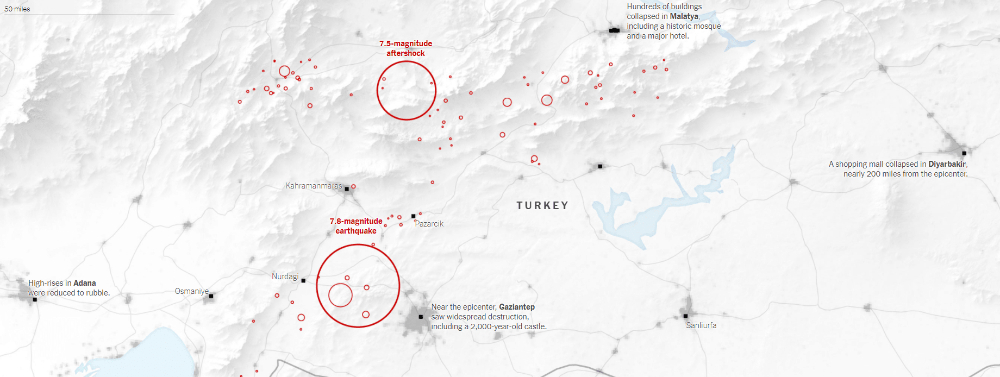

We are deeply sad about the disaster in Turkey and Syria. From the perspective of the stainless steel market, the earthquake has greatly damaged production and transportation in southern Turkey, the main chrome ore-producing area, Adana Province. In a short term, this will support the price of chromium products to remain high. Regarding the stainless steel prices, stainless steel 316L highest rose by US$291/MT on a weekly basis. However, it seems that the market demand fails to keep up with people's expectations. The increasing momentum of stainless steel prices is losing. If you want to know more about the market, please keep rolling to Stainless Steel Market Summary in China

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,800 | 0 | 0% |

| Foshan | 2,845 | 0 | 0% | ||

| Hongwang | Wuxi | 2,705 | -13 | -0.52% | |

| Foshan | 2,700 | -12 | -0.46% | ||

| 304/NO.1 | ESS | Wuxi | 2,665 | -9 | -0.35% |

| Foshan | 2,665 | -15 | -0.59% | ||

| 316L/2B | TISCO | Wuxi | 5,355 | 264 | 5.34% |

| Foshan | 5,420 | 291 | 5.84% | ||

| 316L/NO.1 | ESS | Wuxi | 5,160 | 201 | 4.18% |

| Foshan | 5,150 | 201 | 4.19% | ||

| 201J1/2B | Hongwang | Wuxi | 1,630 | 9 | 0.60% |

| Foshan | 1,605 | 6 | 0.41% | ||

| J5/2B | Hongwang | Wuxi | 1,530 | 7 | 0.54% |

| Foshan | 1,530 | 3 | 0.21% | ||

| 430/2B | TISCO | Wuxi | 1,420 | 3 | 0.23% |

| Foshan | 1,410 | 3 | 0.23% |

TREND|| A robust price trend is shaped by decreasing supply.

The price trend of the stainless-steel series went in different directions: stainless steel 201 and 304 fell after rose while 430 remain steady growth. The most traded contract price fell by US$43 to US$2590/MT.

Stainless steel 300 series: production shrank to relieve the inventory pressure.

Prices were stabilized as the downstream industries back to operation after the holiday. The most traded price cold-rolled 4-foot mill-edge stainless steel 304 quoted US$2615/MT and hot rolled quoted US$2630/MT. The digestion of inventory is ostensibly back to normal, but the weak transaction could not “give an extra hand” to relieve the inventory pressure.

Stainless steel 200 series: Transaction stays sluggish

The spot price of stainless steel 201 laid low after a lift last week. The most traded base price of cold rolled stainless steel 201 closed at US$1580/MT with a US$7 increase; cold rolled stainless steel 201J2 volatilized and finalized at US$1475/MT and hot rolled 5-foot stainless steel quoted at US$1520.

Stainless steel 400: Inventory drop, price stands firmly.

TISCO quoted their guidance price of 430/2B at US$1535/MT while JISCO quoted US$1510/MT which is US$15 more valuable than a week before.

The EXW price of cold rolled stainless 430 closed at US$1675/MT (quoted by Baoxin), a US$44 increase from the average price of January.

The prices in the Wuxi market, however, are quoted between US$1400MT-US$1405/MT. The social inventory level had dropped significantly as the market transaction turned warm.

The most traded EXW price of high chromium chromite stabilized between US$1465/MT-US$ 1495/MT(with 50% chromium). The price of spot goods also remain steady and the coke (ore) went up slightly.

Summary:

300 series: The current market inventory remains high, and prices are under pressure. Private cold-rolled base prices are likely to roam around US$2570/MT. Until there is a significant easing of raw material supply, the loose supply and demand pattern will gradually ease due to the reduction in steel mill supply and the gradual recovery of downstream demand, which will drive a long-term positive trend.

200 series: The recovery of downstream demand is slower than market expectation, and transactions remained sluggish. March could be the turning point

400 series: The EXW price of high chrome remained steady last week, and Chrome Crude Ore South African (Cr2O3 40-42%) rose to US$8/MT; the most traded quoted price 430/2B stabilized at between US$1400/MT-US$1405/MT.

The inventory level had a slide last week while the tendering-base purchase price surged in February, the price of stainless steel 430/2B is likely to be stabilized.

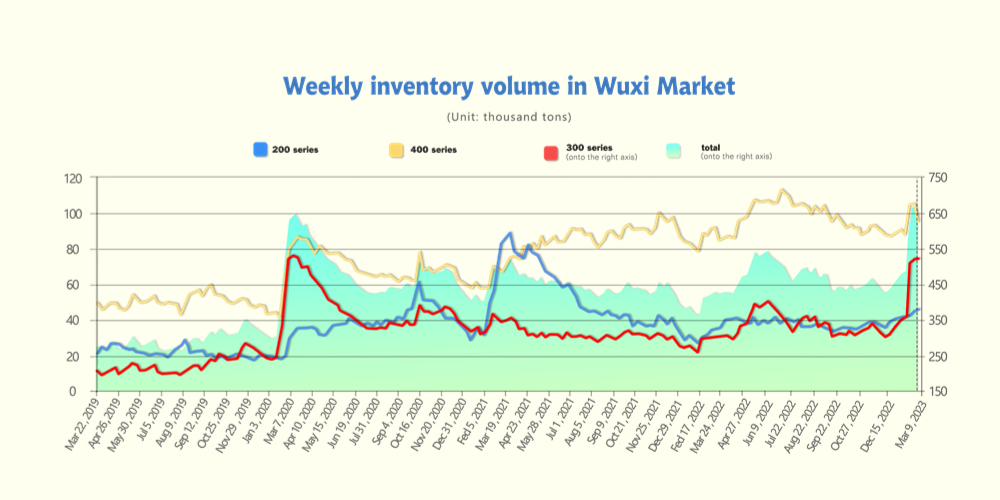

Inventory|| production dropped, as well as the spot goods inventory

The inventory level at the Wuxi sample warehouse fell by 5,938 tons to 661,201 tons (as of 9th February).

the breakdown is as followed:

200 series: 1,307 tons up to 45,615 tons

300 Series: 2,322 tons up to 521,114 tons

400 series: 9,567 tons down to 9,567 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| February 2nd | 44,308 | 518,792 | 104,039 | 667,139 |

| February 9th | 45,615 | 521,114 | 94,472 | 661,201 |

| Difference | 1,307 | 2,322 | -9,567 | -5,938 |

Stainless steel 200 series: Inventory is still stacking up high.

The inventory of 200 series is now recorded the 8 consecutive weeks of increment, and it is still mainly owned by the arriving resources from Beigang New Material and Bao Steel. Cold rolled stainless steel resources.

Stainless steel 300 series: a turning point in increment.

The growth in the 300 series inventory seemingly slowed, and cold-rolled resources had a certain amount of decrease although the inventory level of hot-rolled stays high. Delong suspended their distribution last Thursday and Friday as the inventory level of the preposition warehouse was nearly topped up.

Besides, the production volume of stainless steel 200 and 300 series had a significant drop in January due to plant maintenance. The production scheduled in February will improve the figure a bit, but it is not likely to surpass the production volume of the 4th quarter of 2022.

Stainless steel 400 series: Consumption speeded up; price stabilized.

There was a significant drop in 400 series inventory last week, the nearly 10% of the inventory reduction reflected the activeness of the 400 series market after the Lantern Festival.

The supply so far seemingly could not keep up with the inventory consumption and the rush is likely to ease off for the time being.

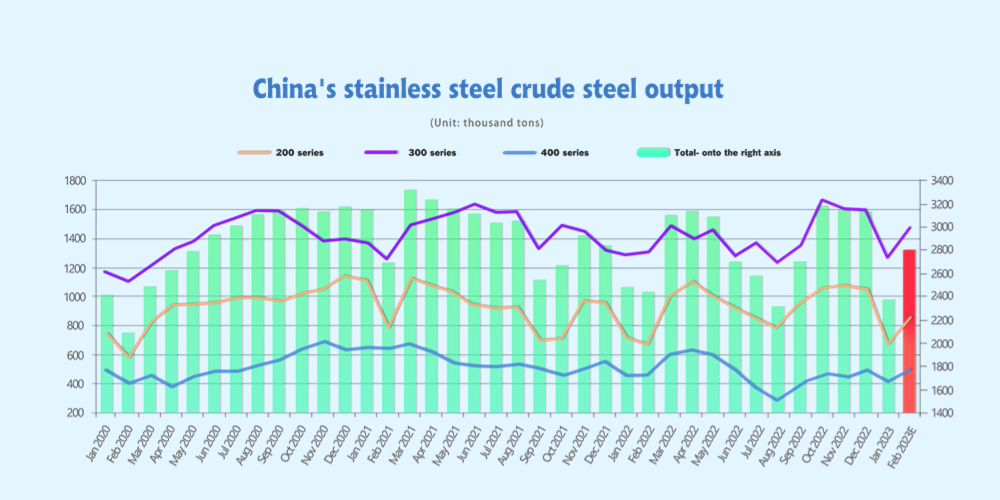

Production: A small recovery in production volume

The production of crude stainless steel in January recorded 2,385,000 tons, 776,000 tons (24.6%) lesser than last month, 87,000 tons (3.5%) increment compared to the same period last year.

Here is the breakdown:

Series 200: Production: 682,000 tons, 383,000 (36%) tons less than last month, 50,000 tons (6.8%) less than the same period last year.

Series 300: Production: 1,270,000 tons, 337,000 (21%) tons less than last month, 19,000 tons (1.5%) less than the same period last year.

Series 400: Production: 433,000 tons, 56,000 (11.5%) tons less than last month, 18,000 tons (3.9%) less than the same period last year.

As steel mills in China are gradually resuming production after the spring festival, the total scheduled production of crude stainless steel is lifted from 420,000 tons to 2,810,000 tons, a difference from January. (300 series: 210,000 tons up 200 series: 160,000 tons up 400 series:50,000 tons up)

It is noteworthy that the tendency of production is rather low due to the tight supply and high-pitched inventory at Wuxi and Foshan. The total production volume in February is estimated to be lower than the average number for the 4th quarter of 2022.

Thus, there is limited room for stainless steel prices to grow in the short term due to the high inventory level and high production cost.

RAW MATERIALS|| Chrome: High production cost of chrome shortens the supply.

The price of major varieties of chromite continue surging:

Chrome Crude Ore South African (Cr2O3 40-42%) rose to US$8/MT

Chrome Lump Turkey (Cr2O3 40-42%) rose to US$9/MT

While the price of coke ore reached US$15/MT, pushing adding US$30 more to the production cost of high chrome.

The steel mills' enthusiasm for production is running low and the supply of high chrome is likely to be tightened.

In the early hours of February 6 (local time), a massive earthquake hit southern Turkey and northern Syria. Turkey's main chrome ore-producing area, Adana Province in the south, was greatly stricken by the earthquake. Many ports in south-eastern Turkey also suffered serious damage, causing delays and even suspension. It is expected that the country's exports of chrome ore will be affected.

With South Africa enduring daily power outages of up to 10 hours, President Cyril Ramaphosa declared a nationwide “state of disaster” on Thursday (9th February) to address an electricity crisis. The electricity crunch has been years in the making, a product of corruption in the chrome-supply.

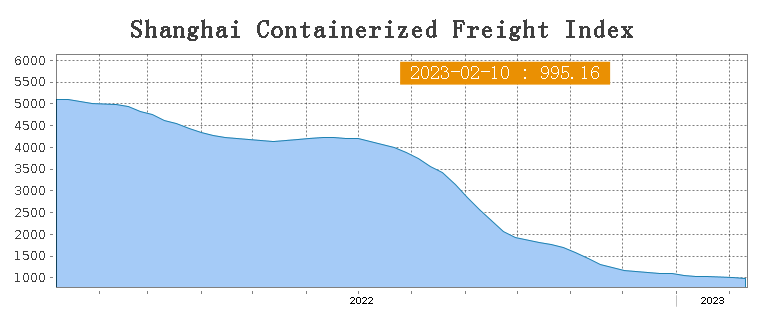

SEA FREIGHT|| Slow recovery in sea freight decelerates the freight rate.

China's container transportation market is weakening as recovery is slower than the market expected. Freight rates on multiple sea routes continued to dip last week. 10th February, the Shanghai Containerized Freight Index was downed by 1.2% to 995.16.

Europe/ Mediterranean:Until 10th February, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$925/TEU, an 3.7% decrease. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1724/TEU, down by 1.7%

North America: Until 10th February, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1,293/FEU and US$2,553/FEU, 5.1% and 5.7% fall accordingly.

The Persian Gulf and the Red Sea: The freight rate rebounded as the economy stabilized. Until 10th February, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had an 8.8% rose from last week's posted US$1132/TEU.

Australia/ New Zealand: Until 3rd February, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$414/TEU, which was downed by 6.1% from the previous week.

South America: The imbalanced supply-demand situation is greatly relieved, freight rate starts to rebound. On 3rd February, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$1522/TEU, which rose by 5.6% from the previous week.