Looks like stainless steel grade 400 has a brighter future. Thanks to the ore costs, stainless steel prices again stopped falling last week. The inventory of 400 and 200 seires accelerated in destocking, helping to boost the prices. However, stainless steel 300 seires looks tepid this time. The invnetory has stacked for four consecutive weeks, showing a less prominent trend compared to the others. But the increasing production cost save it from cutting sellng prices down. An opinion holds that, the current stainless steel prices are relatively low compared to the cost. He believes that there are chances for the stainless steel prices to rise during September and October at least, which are traditionally the peak time. From the perspective of the export volume, we can also see the enlarging trade of series 200 and 400. These two grades will keep surprising us in the following time. If you would like to know more about the marker, please keep reading Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,375 | 11 | 0.50% |

| Foshan | 2,415 | 11 | 0.49% | ||

| Hongwang | Wuxi | 2,305 | 21 | 0.96% | |

| Foshan | 2,300 | 11 | 0.51% | ||

| 304/NO.1 | ESS | Wuxi | 2,225 | 24 | 1.14% |

| Foshan | 2,240 | 11 | 0.53% | ||

| 316L/2B | TISCO | Wuxi | 4,100 | 22 | 0.56% |

| Foshan | 4,135 | -8 | -0.21% | ||

| 316L/NO.1 | ESS | Wuxi | 3,950 | 3 | 0.07% |

| Foshan | 3,945 | -1 | -0.04% | ||

| 201J1/2B | Hongwang | Wuxi | 1,405 | -1 | -0.11% |

| Foshan | 1,415 | 10 | 0.75% | ||

| J5/2B | Hongwang | Wuxi | 1,335 | 10 | 0.80% |

| Foshan | 1,330 | 3 | 0.23% | ||

| 430/2B | TISCO | Wuxi | 1,295 | 7 | 0.59% |

| Foshan | 1,275 | 14 | 1.21% |

TREND|| The Price of the stainless steel 400 series is expected to rise.

There was no significant change in the trading volume of stainless steel last week, the future price of stainless steel last week had a plunge: the mainstream contract price fell 1.99% and closed at US$2280/MT.

Stainless steel 300 series: Raw material showing strong support on stainless steel prices.

The market price of stainless steel 304 was volatized: the mainstream base price of cold-rolled 4-foot mill-edge stainless steel 304 and hot-rolled stainless steel rose by US$14 to US$2255/MT and US$2210/MT respectively.

The stainless steel market opened with a decent performance last week but then turned modest, and the spot price dropped to US$2230/MT. Tsingshan announced the price floor of US$US$2260/MT for cold-rolled stainless steel coil.

Stainless steel 200 series: Prices dived as supply-demand was weakening

Until Friday, the mainstream base price of cold-rolled stainless steel 201 and 5-foot hot-rolled stainless steel remained unchanged at US$1380/MT and US$1335/MT respectively. Cold-rolled stainless steel 201J1 rose by US$14 to US$1310/MT.

Seemingly the market trend of the 200 series ran counter to the traditional peak season: the spot price only had a slight increase last Monday and then it ran at a sedate pace. The tightened supply was shifting the inventory level downward for 3 weeks in a row.

Stainless steel 400 series: The upward price trend is answering the call of the peak season.

The guidance price of stainless steel 430/2B quoted by TISCO had a US$21 jump to US$1420/MT, while JISCO lifted US$14 to US$1320/MT.

The mainstream quoted price of 430/2B in the Wuxi market was roaming at between US$1295MT-US$1300/MT last week and recorded a US$7 growth. Stainless steel 430/No.1 remained unchanged at US$1140/MT.

Summary: expected 'Golden September and Silver October.’

Currently, the situation of loose supply continues, and the performance during the 'Golden September' is relatively average. As time goes on, the weaker-than-expected downstream consumption will gradually erode market confidence. The market is re-balancing between expectations and reality and is generally maintaining a wait-and-see attitude, all in anticipation of the expected 'Golden September and Silver October.’

300 Series: Overall, commodities have experienced an earlier rise and are now in a period of volatile adjustment, with futures and spot prices showing a weak trend. Meanwhile, raw material prices were strong, and steel production costs were high, leading steel mills to maintain the prices.

200 Series: In recent times, the supply of the 200 series from various steel mills has generally decreased. On one hand, the 200 series has seen low profits, leading many steel mills to shift their production to other series. On the other hand, recent typhoon impacts have disrupted shipments from some steel mills in southern China. Due to these factors, the spot market is in a situation of weak supply and demand, with prices holding but a lack of buyers. Market expectations for the peak season have diminished, and there is a growing chorus of bearish voices in the market. It is expected that next week, the overall operation of 201 will be stable with a slightly weaker bias.

400 Series: The primary raw material, high-chromium, has a weak but stable EXW price. Currently, stainless steel production costs at some steel mills are relatively high, leading to losses for some. There is a strong determination to support prices. Last week, there has been a significant reduction in the inventory of the 400 series. The price of 430 stainless steel is supported and has been strengthening. With the traditional peak season expected to arrive, downstream customers are beginning to stock up, and demand is expected to improve. In the short term, the price of 430 stainless steel is expected to be stable with a slight upward bias. In the medium to long term, as the accumulated inventory is reduced and production costs are supported, the price of 430 stainless steel may strengthen.

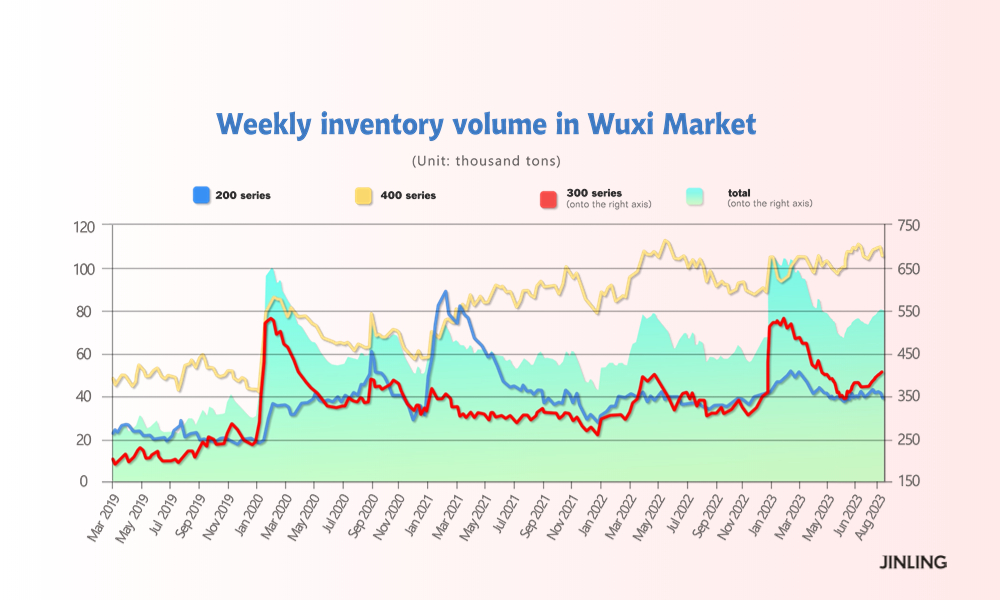

INVENTORY|| Stainless steel 300 series continued to stack up

The total inventory at the Wuxi sample warehouse rose by US$1,078 tons to 547,941 tons (as of 7th September).

the breakdown is as follows:

200 series: 1,709 tons down to 38,383 tons

300 Series: 6,403 tons up to 404,686 tons

400 series: 3,616 tons down to 104,872 tons

Stainless steel 300 series: The cold-rolled stainless steel industry recorded a 4 consecutive growth.

The inventory increment last week was mainly owned by Delong and Indonesia Yongwang. Steel mills in South China delayed the shipment of the resources due to the extreme weather. The inventory is likely to sit at a high level in the short term as the production has also remained high recently.

Stainless steel 200 series: Supply-demand shifted left as spot good digested a little.

Beigang New material took a major part of the resource's arrival last week while the short supply still kept market inventory tightened.

Stainless steel 400 series: Acceleration in destocking.

The slight improvement in market transactions boosted the destocking last week. The demand for the 400 series is estimated to improve in the peak season. The spot inventory will remain stable in the short term.

RAW Material|| Clouds are gathering above the Indonesian nickel market.

The EXW price of high-graded ferrochrome lifted by US$1.34 to US$270/Nickel point. The price of ferrochrome fell from US$7 to US$1370/MT.

Due to concerns about mining-induced pollution along the Sagea River, on Monday, the provincial Environmental Bureau advised PT Weda Bay Nickel, PT Halmahera Sukses Mineral, PT Tekino Energi, PT First Pacific Mining and PT Karunia Sagea Mineral to halt mining activities pending the completion of an investigation and the subsequent release of evaluation results, according to Provincial authorities in Indonesia’s mining hub of North Maluku province.

Indonesia’s mining quota distribution has been delayed having reverted to an older approval process due to an ongoing investigation into illegal mining, a senior official said on Monday, assuring there was sufficient nickel ore for smelters.

“The simplified approval process was considered problematic … Rather than causing more problems, we reverted to the (old) regulation,” Muhammad Wafid, a senior official at the Energy and Mineral Resources Ministry, told reporters.

Under the old system, 27 factors need to be reviewed for a quota to be approved, compared to nine under the relaxed process, and it takes at least a month time, Wafid said.

Earlier on 5th September, the mainstream EXW price of high-grade ferronickel was quoted at US$270/MT with an 11% growth. While the whole stainless steel industry is in peak season, the supply of ferronickel unfortunately is currently in a problematic situation. The price of ferronickel is likely to remain strong in the short term.

MACRO|| China’s Export narrowed the gap in August

China's exports and imports extended declines in August as the twin pressures of sagging overseas demand and weak consumer spending at home squeezed businesses in the world's second-largest economy, although the falls were slower than expected.

China Customs data released Thursday showed exports for August slumped 8.8% to $284.87 billion in the fourth straight month of decline. Imports slid 7.3% to $216.51 billion.

China’s total import and export until August 2023 amounts to US$3.89 trillion, making a 6.5% descent YoY:

the amount of import were concluded as US$2.22 trillion with a 5.6% decrease, the export also slumped 7.6% to US$1.67 trillion. The trade surplus is 5.534 trillion.

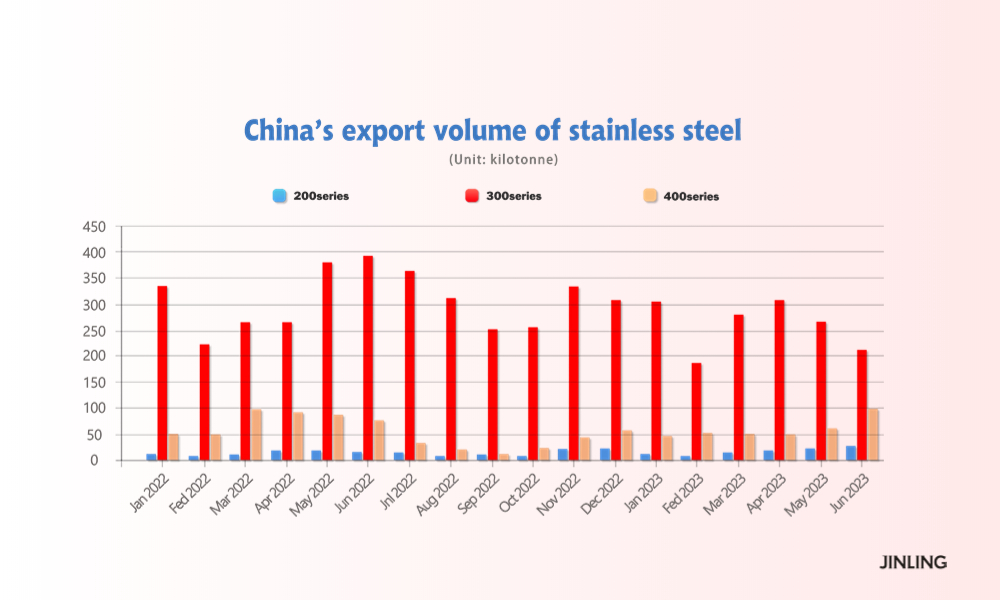

A huge plunge was caused in stainless steel import and export, and it is owing to the supply reduction in Indonesia and unreasonable trade barriers: there were approximately 1.19 million tons of stainless steel net exports made between January and June 2023.

It is understood that the acceleration in import and export was slowed, and the demand for stainless teel 200 and 300 series are the same as 2022’s level. The overall demand went up steadily quarter by quarter.

Sea Freight|| Freight rate fell as the demand was powerless

China’s exports fell by 8.8% in August year-on-year, while imports contracted 7.3%, customs data showed on Thursday,

China’s Containerized Freight market was overall stabilized, but the demand recovery hit a bottleneck. On 8th September, the Shanghai Containerized Freight Index fell by 3.3% to 999.25.

Europe/ Mediterranean:

China’s exports and imports with EU recorded a19.6% contraction in August, and it is giving pressure to the freight market.

Until 8th September, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$714/TEU, which fell by 7%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1308/TEU, which fell by 4.1%

North America:

Until 8th September, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$2037/FEU and US$2869/FEU, reporting a 4.6% and 8.4% decline accordingly.

The Persian Gulf and the Red Sea:

Until 8th September, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 1.5% from last week's posted US$948/TEU.

Australia/ New Zealand:

Until 8th September, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$630/TEU, a 7.1% jump from the previous week.

South America:

The freight market had a slight rebound. on 8th September, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$1924/TEU, an 6.4% fall from the previous week.