It sets a troubled start for the stainless steel industry in 2023. On January 4th, Taiwan bans a series of products exported to Russia and Belarus, and stainless steel plate of No. 304 and No. 316 are included. Also on the same day, the nickel market gets volatile. The nickel price climbed high but as Tsingshan's Electrolytic Nickel project began smoothly on January 4th, which vastly increases the production of nickel, the ShFE nickel keeps going down until January 9th. Until January 6th, the ShFE nickel has reduced by over 10% last week. The declining nickel price dragged down the stainless steel prices after Wednesday. As for the production, in January, it predicts that the crude stainless steel will drop by 360,000 tons on month basis due to the high cost, low demand, and holiday. More about the Stainless Steel Market Summary in China, please keep reading.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,770 | 20 | 0.77% |

| Foshan | 2,815 | 20 | 0.76% | ||

| Hongwang | Wuxi | 2,675 | 12 | 0.46% | |

| Foshan | 2,680 | 15 | 0.57% | ||

| 304/NO.1 | ESS | Wuxi | 2,615 | 31 | 1.28% |

| Foshan | 2,640 | 14 | 0.57% | ||

| 316L/2B | TISCO | Wuxi | 4,740 | 128 | 2.86% |

| Foshan | 4,830 | 104 | 2.27% | ||

| 316L/NO.1 | ESS | Wuxi | 4,610 | 119 | 2.75% |

| Foshan | 4,680 | 143 | 3.25% | ||

| 201J1/2B | Hongwang | Wuxi | 1,605 | 0 | 0.00% |

| Foshan | 1,575 | 0 | 0.00% | ||

| J5/2B | Hongwang | Wuxi | 1,510 | 0 | 0.00% |

| Foshan | 1,510 | 1 | 0.11% | ||

| 430/2B | TISCO | Wuxi | 1,370 | 34 | 2.76% |

| Foshan | 1,360 | 34 | 2.78% |

TREND|| Spot prices are growing steadily

The spot price of the stainless-steel series went in different ways. Stainless steel 201 was barely moved as stainless steel 304 fell after the increase. Stainless steel rose two days in a row last week and remained a strong trend. The traded contract price had fallen by US$17 to US$2625/MT.

Stainless steel 300 series: Inventory went up for four consecutive weeks

The most traded base price of both cold-rolled (4-foot mill-edge) and hot-rolled stainless steel 304 was quoted at US$2625/MT, while the latter rose by US$30 during the week. The future price rebounded earlier last week but trended downward soon after the nickel price had a nosedive.

Stainless steel 200 series: Transaction heated up slightly.

All specifications of 200 series had little price movement last week. The most traded base price of cold rolled stainless steel 201 was quoted at US$1575/MT, stainless steel 201J2 remained at US$1480/MT and hot rolled 5-foot stainless steel closed at US$1525/MT.

Stainless steel 400 series: High production cost appreciated the value

The guidance price of 430/2B rose by US$22 to US$1485 quoted by TISCO, while JISCO quoted US$1465/MT with a US$7 increase. The price in the Wuxi market was quoted between US$1380-US$1390/MT.

Summary:

Stainless steel 300 series: The price of nickel had been shaken by the Electrolytic Nickel program set up by Tsingshan, and the growing space is limited as the Chinese New Year is weakening the supply and demand. The base price of cold rolled stainless steel 304 is expected to hover between US$2545-US$2615/MT.

Stainless steel 200 series: The market is gradually quite down as almost all the downstream producers are already taking the Chinese New Year holiday, and spot good transactions will be suspended for a while. The price of stainless steel 201 is likely to be stabilized and J2/J5 will be lingering between US$1435/MT to US$1465/MT.

Stainless steel 400 series: The most traded price of high chromium chromite remained at a strong trend last week, then the high standing production costs forced the stainless-steel producers and stainless steel handrail suppliers to sell high on their products. The purchasing activities are diminishing as the Chinese New year is drawing near, price movement is very likely to stand still.

INVENTORY|| There will be 360,000 tons short on production in January

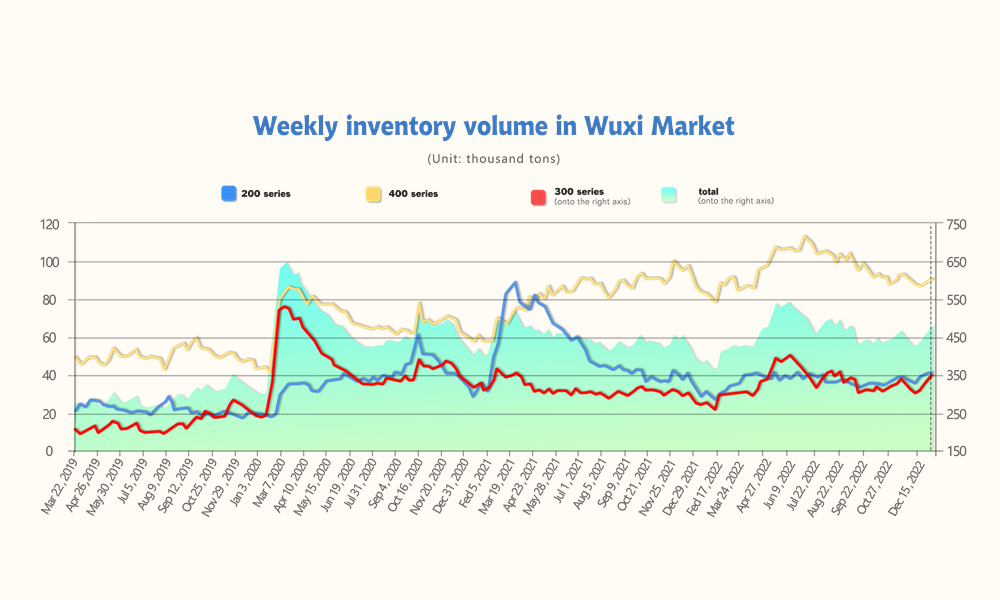

The inventory level at the Wuxi sample warehouse rose by 19,096 tons to 479,711 tons (as of 5th January).

the breakdown is as followed:

200 series: 530 tons up to 40,200 tons

300 Series: 17,181 tons up to 349,328 tons

400 series: 1,385 tons up to 89,653 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| December 29th | 40,200 | 332,147 | 88,268 | 460,615 |

| January 5th | 40,730 | 349,328 | 89,653 | 479,711 |

| Difference | 530 | 17,181 | 1,385 | 19,096 |

Stainless steel 300: Inventory went up for four consecutive weeks.

The increment in inventory mainly took up by the preposition warehouse and agency warehouse. The stainless steel market is now having a “lean season” due to the approaching Chinese New Year and the spiking COVID pandemic. Surprisingly production volume rose slightly by 6000 tons in December, affected by the soaring production cost, the scheduled production in January however had reduced by 200,000 tons.

Stainless steel 200 series: Transaction was growing weak

The slight increment in inventory last week was mainly owned by Beigang New Material, the digestion of inventory gradually turning slow as the Chinese New Year draws near. Similar to the week before last week, the downstream producers had heated the transaction in the early week to stock up on materials, but then the transaction cooled down in the second half of last week.

Series 400 series: Price and inventory hiked synchronously

Most of the traders were piling up goods in preparation for the market to reopen after the Chinese New Year, resulting in a slight ascend in inventory last week. The digestion of inventory is projected to slow down before the Chinese New Year.

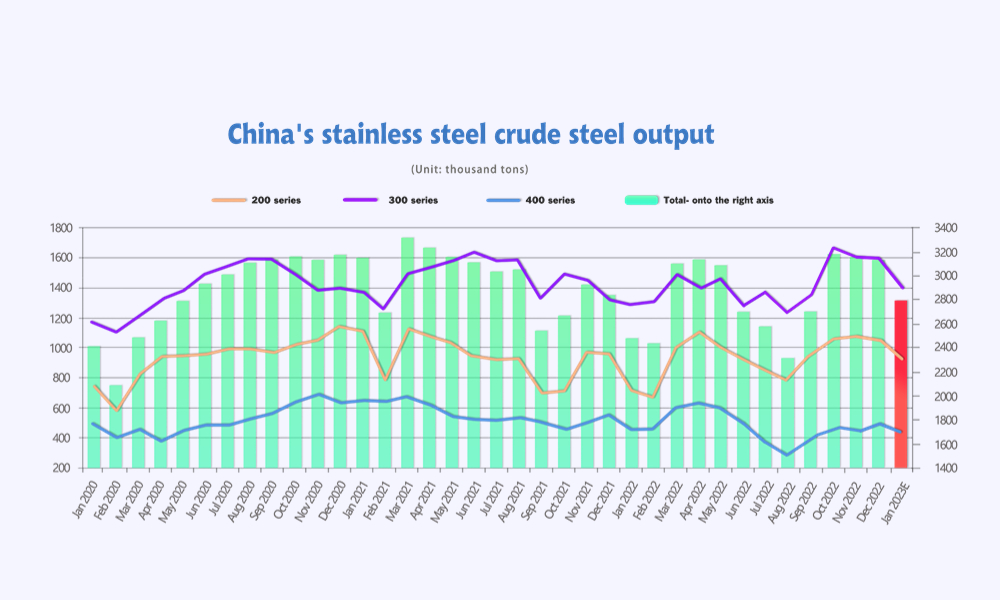

December Reviews: Surprising outcome in production.

According to statistics, there was 3,161,100 tons of stainless crude steel were produced by the “Enterprises above designated size” ( enterprises with annual main business revenue of 3 million US dollars or more) in China in December, approximately 0.55% lift from November and 11.76% growth compared to the same time last year.

Here is the breakdown:

Stainless Steel Series 200 Production: 1,060,500 tons, 20,100 (1.85%) tons less than last month, 106,600 tons (11.13%) more than the same period last year.

Stainless Steel Series 300 Production: 1,606,700 tons, 5,900 (0.37%) tons more than last month, 289,000 tons (21.93%) more than the same period last year.

Stainless Steel Series 400 Production: 489,500 tons, 31,600 (6.89%) tons more than last month, 63,100 tons (11.42%) lesser than the same period last year.

More and more organizations were gradually back to normal as China had announced policies to ease off the COVID restriction. Hence, most of the steel mills fired up their production in December since the production statistic in 2022 is closely related to the KPI formulation in 2023.

The midstream and downstream in the stainless steel industry were severely disrupted by the spiking COVID infection rate in early December, transaction volume dropped nearly 20%. The inventory level, on the other hand, kept increasing throughout December.

The latest production scheduling hints that the production volume in January is estimated to have a significant cutback. It is believed that the Chinese New Year holiday and the high standing production cost were the main reasons to owe to.

According to the statistic, approximately 360,000 tons of stainless crude steel production will be cut, it is estimated that: the 300 series will have a 200,000 tons reduction, the 200 series will have 120,000 tons lesser than December and the 400 series will have 40,000 tons short in production.

RAW MATERIALS|| The smooth opening Electrolytic Nickel project strikes down the nickel price

Last Friday, the price of ShFE Nickel once hit the lowest level at US$31355/MT then closed at US$31740/MT amid growing nickel matte supply from Tsingshan Group. The output from the Electrolytic Nickel project set up by Tsingshan will soon hit the market in January, it is believed that it will substantially increase the nickel supply in the market.

The most traded contract price of stainless steel, yet it held the position firmly at US$2625/MT.

About the Electrolytic Nickel plating (Electrodeposition Nickel)

Electrolytic plating can be made with 100% nickel, The plating process can also be performed with other metal materials, and can create higher production volumes with the shorter turnaround, which makes the process slightly more productive. The common usages are: production of stainless steel, high nickel alloy, nickel plating, cast steel, alloy steel, copper, catalyst, battery and other products.

MACRO|| Taiwan bans certain stainless steel plate exports to Russia and Belarus

Taiwan's Ministry of Economic Affairs (MOEA) on Wednesday announced the expansion of its sanctions against Russia and its ally Belarus, effective immediately, in a bid to prevent the two countries from using Taiwan-made high-tech items for military purposes in the wake of the Russian invasion of Ukraine on Feb. 24, 2022.

In a statement, the MOEA said the items barred from being exported to Russia and Belarus in the expanded sanctions include chemicals such as ricin, conotoxin, botulinum toxin, nitrogen trifluoride, ammonium nitrate, tributyl phosphate and nitric acid, as well as stainless steel No. 304 and No. 316.

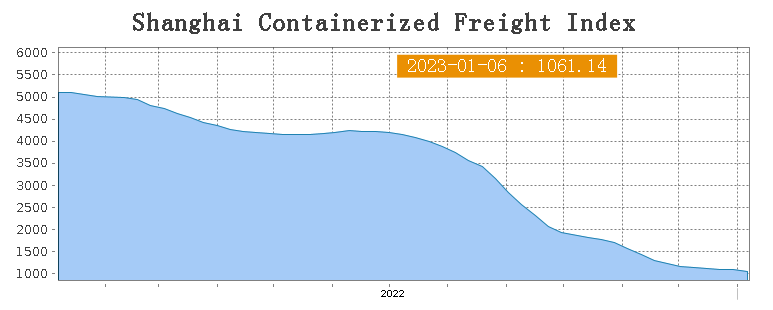

SEAFREIGHT|| Shipping market is recovering slowly

China's container transportation market is stabilizing. Freight rates on multiple sea routes had different movements last week. Until 6th January, the Shanghai Containerized Freight Index was downed by 4.2% to 1061.14.

Europe/ Mediterranean: According to S&P Global, the PMI was at 47.8 in December, up from 47.1 in November, but still lower than the threshold which is a strong indicator of the recession in manufacturing industries. Until 6th January, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$1050/TEU, an 2.6% increase. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1855/TEU, up by 0.3%

North America: Business activity in the US manufacturing sector contracted for the second straight month in December with ISM's Manufacturing PMI declining to 48.4 from 49 in November. This reading came in slightly below the market expectation of 48.5.

On 6th January, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1,414/FEU and US$2,845/FEU, 0.6% and 7.2% fall accordingly.

The Persian Gulf and the Red Sea: The freight rate dropped last week. On 16th December, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had an 11.4% fall from last week's posted US$1039/TEU.

Australia/ New Zealand: The freight rate had bounced back. On 16th December, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$589/TEU, which went up by 14.9% from the previous week.

South America: The imbalanced supply-demand curve and high inflation rate dragged the freight rate down. On 11th November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$1,231/TEU, down by 14.1% from the previous week.