Last week, the weekly average price of all grades of stainless steel remained to drop. Generally, the industry mostly holds a negative view towards the future stainless market since the two major contradictories—— supply is over demand and the continuous decreasing price is close to the production cost, can be hardly solved in a short time. Vale3.SA expects that the iron ore price to increase after February, the end of the Beijing Wither Olympics. News reported that Indonesia is considering stopping allowing the export of tin and copper ore in 2024 and 2023 respectively. The Philippines also has a similar action, whose bureau handed a proposal about restricting the export of raw ore. For more about the stainless steel market summary in China, just keep going:

Stainless steel average prices of last week

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 3,280 | -106 | -3.28% |

| Foshan | 3,330 | -106 | -3.23% | ||

| Hongwang | Wuxi | 3,080 | -83 | -2.73% | |

| Foshan | 3,070 | -54 | -1.81% | ||

| 304/NO.1 | ESS | Wuxi | 3,015 | -79 | -2.69% |

| Foshan | 3,040 | -79 | -2.66% | ||

| 316L/2B | TISCO | Wuxi | 4,650 | -114 | -2.48% |

| Foshan | 4,700 | -114 | -2.45% | ||

| 316L/NO.1 | ESS | Wuxi | 4,435 | -133 | -3.02% |

| Foshan | 4,480 | -133 | -2.99% | ||

| 201J1/2B | Hongwang | Wuxi | 1,940 | -92 | -4.85% |

| Foshan | 1,915 | -86 | -4.58% | ||

| J5/2B | Hongwang | Wuxi | 1,825 | -79 | -4.47% |

| Foshan | 1,825 | -79 | -4.47% | ||

| 430/2B | TISCO | Wuxi | 1,710 | -48 | -2.92% |

| Foshan | 1,710 | -48 | -2.92% |

TREND|| The rising supply accelerates the price dropping.

Last week, the price of stainless steel remains to drop. Early last week, the increasing price of nickel boosted the stainless steel futures stock as well as the spot market. Some steel mills tried to raise the spot prices and thereby the prices increased slightly. However, the large number of orders was beyond the delivery capability of steel mills. The price of the spot again started to fall. With more products supplied to the market, the futures prices also went down. Until November 26th, the base price of the cold-rolled stainless steel 304 from the private-owned mills in Wuxi market declined by US$48/MT, falling to US$3,030/MT.

300 series of stainless steel: The futures price lacked of motivation and the spot price declined.

Last week, the futures prices increased and fluctuated to decrease. The fluctuation between the peak height and peak low was over US$275. Until November 26th, the main contract of the stainless steel futures increased by about US$9/MT, to US$2,890/MT compared to November 19th. The spot price of SS304 remains the declining tendency. Until 26th, the base price of the cold-rolled stainless steel 304 by the private-owned mills in Wuxi market dropped by US$48/MT, declining to US$3,030/MT. The prices remained to drop however the steel mills tried to boost them up. The price difference between spot and futures ramped up to around US$210/MT.

From the perspective of production cost, the EXW price of the high-nickel iron fell by US$5/nickel to US$232/nickel. The price of ferrochrome decreased by US$48 to US$1,492/50 base ton. Theoretically, the production cost of CR SS304 is US$1,492/MT. Based on the current raw material cost, the profit of SS304 per ton is in deficit. For now, the scrap of SS304 in Foshan is around US$2,048/MT, while the production cost by scrap production is about US$2,847. The profit is evaluated at around US$42/MT. The profit earned by metallurgy production declined sharply, which makes scrap production more profitable.

The inventory volume in Wuxi’s sample warehouse decreased by 4,600 tons, to 303,700 tons. Although the and prices and trading once increased, on Friday, the market cooled down and the prices start to decrease.

200 series of stainless steel: The trading warms up.

The prices of 200 series stainless steel continued to drop last week. Until November 26th, the cold-rolled and mill-edge stainless steel 201 J1 in Wuxi market dropped by US$48/MT, and the average price of last week is US$1,825/MT which is about US$80/MT lower compared to November 19th. 5-foot hot-rolled stainless steel 201J1 reduced by US$110/MT, averaged US$1,640/MT. On Friday, the prices of hot rolled products continued to decline and the price difference between cold rolling and hot rolling widened last week, at around US$278/MT.

The trading from last Monday to Tuesday was bland. News conveyed in Tuesday saying that the mills to boost the prices. On Wednesday, Tsingshan and Yongjin increased the opening prices of cold-rolled and hot-rolled stainless steel 304. The market prices followed suit and stainless steel 201 was influenced and stopped decreasing. The trading heated up on Wednesday and Thursday. But on Friday, the prices returned to fall, so did the trading.

400 series of stainless steel: High chrome will face the unstable reason.

The changes of high chrome is the major reason influencing the prices of 400 series. In winter, the heating demand and electricity usage increase, and smog (the polluted air) arises. The local government of Shandong, Shanxi, Sichuan, and others has successively issued pollution warnings. Some areas such as Yuncheng of Shanxi, Leshan of Sichuan announced that the high chrome factories have to cut 50% of the production, and thereby the production volume starts to decrease slightly. But the reduction won’t affect the high chrome supply in a short term. The Chinese Spring Festival and Winter Olympics will fall in February 2022, the production limit and environmental protection policy will be published in the Beijing-nearing area.

It can be foreseen that traffic control, staggering production, production cuts, and even production suspensions may repeat in the future due to environmental regulations. In the future two months, it is predicted that the relevant environmental and production policy will be strictly carried out, such as the policy limit. The supply of high chrome will tighten up. It can be estimated that the downstream buyers will focus on stocking up in December. Meanwhile, the price of high chrome will have the opportunity to stabilize and increase.

Chinese demand: The shipbuilding industry is booming. Next year, it is expected to run weakly.

In 2021, global sea freight spike, and the container ship and gas carrier shipbuilding industry develop prosperously. From January to October 2021, China's new shipbuilding orders maintained high growth. During the period, China accepted 61.49 million deadweight tons of new ship orders, 210.5% over the same period of last year; 32.01 million deadweight tons of shipbuilding were completed within China, YoY increasing by 5.0%.

However, the bloom of the ship-making business meets the spiking raw material prices. Therefore, the profit margin of ship makers is squeezed.

Because of the sharp increase in 2021, it is expected that the increasing rate can hardly remain to next year.

Summary of the stainless steel prices:

There are currently two major contradictions in the stainless steel market. One is that the contradiction between supply and demand has intensified. The stainless steel market enters the slack season, and the demand is significantly weaker than the previous period, while the supply increased significantly in November and December because the power supply is no longer in shortage. In recent days, the supply is over demand.

The second contradiction lies between price and cost. The prices of stainless steel have continued to decrease significantly, which reduces the profit of steel mills. But the raw material prices do not decrease as much as the stainless steel prices.

These two contradictories won’t be fixed in a short term. The market prices will remain to decrease.

Although many people hold negative to the market in a short term, Brazil's Vale3.SA expects iron ore prices to rise after the Beijing Winter Olympics, because China may allow more steel producers to restore production capacity. Luciano Siani, vice president of strategy for Vale, predicts that once the Winter Olympics are over, China's industrial production will grow.

300 series of stainless steel:

The sufficient supply of stainless steel will maintain and the market inventory will keep increasing. The latest discovered variant of the coronavirus, Omicron caused a market panic. The futures prices fell sharply. It is predicted that the cold-rolled stainless steel prices from the private-owned mills will keep decreasing. The base price will be close to US$2,995/MT.

200 series of stainless steel:

So far, there is no factor in increasing the stainless steel prices, resulting in the low-pressure sentiment in the market. It is predicted that the price will remain reducing.

400 series of stainless steel:

Last week, the price of high chrome decreased by US$48/50 base ton. The lower cost further reduces the price of 430/2B. The current price of 430/2B is close to the production cost. Because the supply is over demand, it is predicted that the prices of 400 series will reduce to US$1,635/MT~US$1,650/MT.

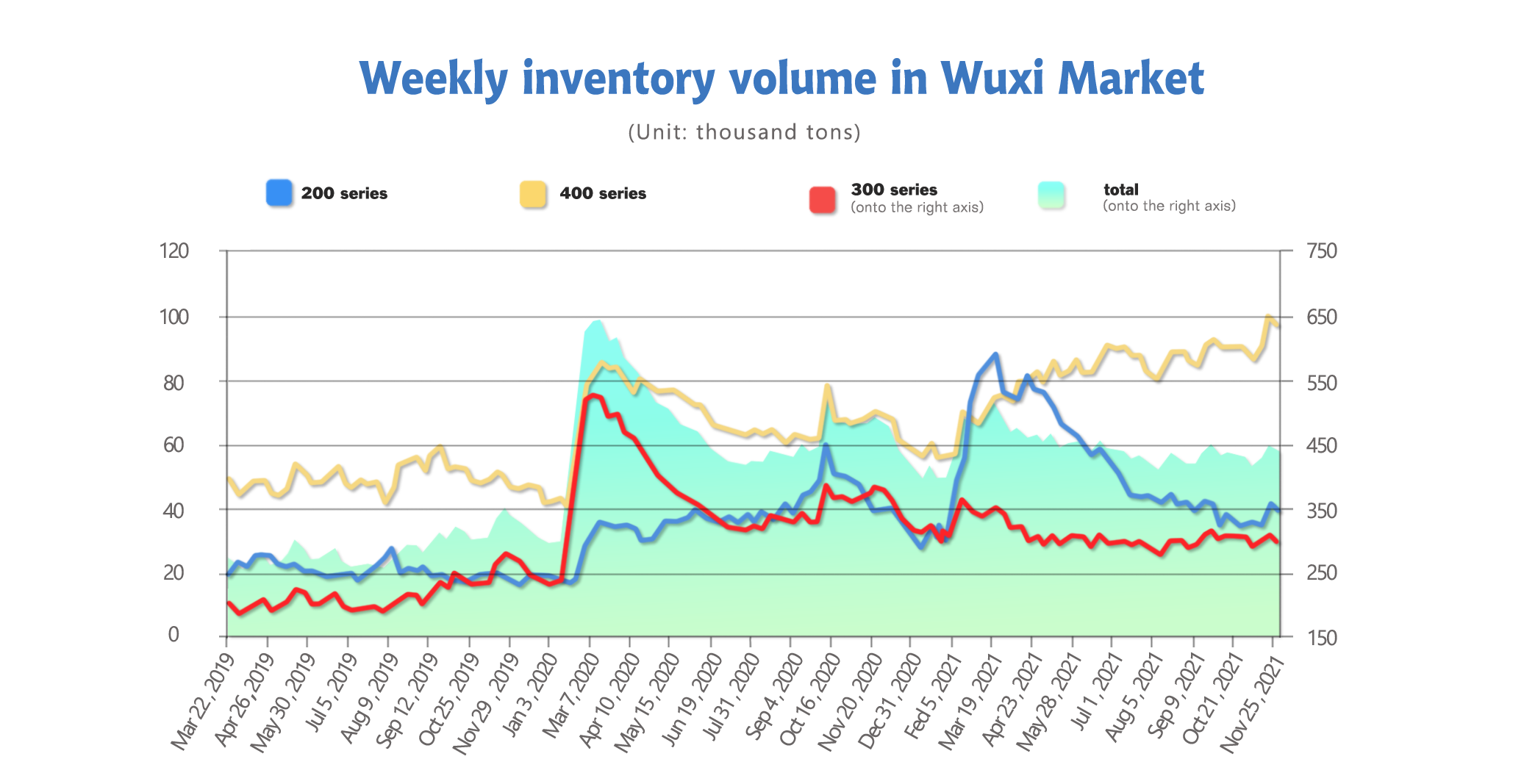

INVENTORY|| Inventory of last week reduces by 8,600 tons.

The total volume of the Wuxi sample warehouse decreases by 8,600 tons, to 440,800 tons. 200 series inventory reduces by 1,900 tons, to 39,700 tons; 300 series down by 4,600 tons, to 303,700 tons; 400 series decreases by 2,100 tons to 97,400 tons.

| Inventory in Wuxi sample warehouse (Unit: thousand tons) | 200 series | 300 series | 400 series | Total |

| November 22th ~ November 26th | 39.7 | 303.7 | 97.4 | 440.8 |

| November 15th ~ November 19th | 41.6 | 308.3 | 99.5 | 449.4 |

| Difference | -1.9 | -4.6 | -2.1 | -8.6 |

200 series of stainless steel:

The trading volume increased, and the inventory of stainless steel 201 decreased by around 2,000 tons last week. Before last Wednesday, the market tended to be gloomy and the prices decreased. Last Wednesday, steel mills boosted the market. Influenced by the increasing price of 304, the price of 201 increased as well. With the sentiment becoming positive, the transaction turned better. Whereas, traders are more negative about the future market because there will be more products shipped to the market this week. It is predicted that the prices will go down.

300 series of stainless steel:

Last week, the price of stainless steel 304 stopped decreasing because Tsingshan tuned up the quotation price on Wednesday, which also brought up the market trading and the inventory reduced. With the price higher, more buyers began to stock up. For the future prices, the new arrivals and the transaction sentiment shall be paid close attention to.

400 series of stainless steel:

Agents have to pick up the specific volume of products to complete the signed quota with the mills.

The inventory of 400 series stainless steel slightly decreased due to the pickup by the agents of the state-owned steel mills. To acquire the selling certification, agents have to sign with steel mills to pick up a certain volume of products every month.

RAW MATERIALS|| Same old trick: three large mines will stop exporting from 2022 to 2024.

In January 2020, Indonesia stopped allowing exports of nickel (Article: Indonesian Mining Ban, How Did it Control the Lifeblood of Nickel Price in 2019?). According to Reuters, Indonesia may stop tin exports in 2024 as part of efforts to attract investment into the resource processing industry and improve the country's external balance, President Joko Widodo said on Wednesday. Moreover, the president also reiterated the government may stop allowing exports of bauxite next year and copper ore in 2023.

The president has been making similar remarks during his recent public appearances, arguing that Southeast Asia's largest economy has for too long sold raw commodities, which deprives the country of bigger export earnings and jobs in the manufacturing industry.

Since the first time in 2014 Indonesia stopped allowing the export of nickel ore, the country has received a large amount of investment. The nickel industry has been developed and boosted infrastructure construction and local employment.

It is the benefit driving the export ban. More and more countries join in the actions of carbon neutral and carbon peak, which is a large opportunity for Indonesia that owns rich raw metal material resources.

Copper is a key component of electric vehicles, wind turbines and other technological advancements. These technologies can reduce the consumption of fossil fuels and are conducive to alternative and renewable energy sources.

It is reported that the United States has just passed an infrastructure reconstruction plan, and it is expected that the demand for copper will increase significantly in the next few years. In addition, the state bank stated that if copper supply is not increased, decarbonization cannot be achieved.

Industry analysts believe that Indonesia's export restrictions may have three effects: one is to stimulate the rise of commodity prices in the short term, the second is to reshape the global supply chain, and the third is to bring about demonstration effects.

The demonstration of Indonesia has taken effect. On November 18, 2021, the Philippine Bureau of Minerals and Geosciences (MGB) proposed to promote a policy of gradually restricting the export of raw ore, paving the way for mineral processing and value-added in the country’s mining industry. Currently awaiting a decision by Congress.

After Indonesia's exporting ban of metal ore, the Philippines became China's largest importer of nickel ore. From January to October this year, the total nickel ore exports to China were 37.707 million tons, YoY increasing by 16.23%. And nickel ore imported from the Philippines reached 34.172 million tons, 90.87% of the total imports of nickel ore.

It is worth mentioning that after Indonesia's ban on exporting nickel ore, it cut off an important source of Chinese nickel ore supply. Chinese companies have to invest huge sums of money to build factories in Indonesia.