Merry Christmas in advance. But Chinese stainless steel market is still far from the holiday mood. The prices of stainless steel have dropped for about six weeks and finally last week, steel mills couldn't bear the uncontrollable prices anymore. On December 14th, six steel mill giants announced production cuts and price limits would carry out on the stainless steel 200 series. Stimulated by the announcement, prices of stainless steel 200 series increased and other grades of stainless steel also rose meanwhile. The transaction warmed up for several days, but soon on Thursday and Friday, the market began to cool down. The prices of the stainless steel 200 series remain at the same level. Will it be a flash in the pan? Can we meet an inflection point in the rest days of 2021? More about the stainless steel market summary in China, keep reading.

Stainless steel average prices of last week

Decrease starts to slow down.| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,890 | -111 | -3.88% |

| Foshan | 2,940 | -111 | -3.81% | ||

| Hongwang | Wuxi | 2,760 | -40 | -1.49% | |

| Foshan | 2,755 | -19 | -0.72% | ||

| 304/NO.1 | ESS | Wuxi | 2,725 | -32 | -1.21% |

| Foshan | 2,745 | -38 | -1.44% | ||

| 316L/2B | TISCO | Wuxi | 4,350 | -92 | -2.15% |

| Foshan | 4,375 | -92 | -2.13% | ||

| 316L/NO.1 | ESS | Wuxi | 4,195 | -41 | -1.01% |

| Foshan | 4,240 | -43 | -1.04% | ||

| 201J1/2B | Hongwang | Wuxi | 1,785 | 16 | 0.97% |

| Foshan | 1,770 | 16 | 0.98% | ||

| J5/2B | Hongwang | Wuxi | 1,665 | 17 | 1.15% |

| Foshan | 1,680 | 21 | 1.95% | ||

| 430/2B | TISCO | Wuxi | 1,560 | -51 | -3.42% |

| Foshan | 1,560 | -30 | -2.06% |

Production cut of stainless steel 200 series|| 45,000 tons to be reduced in the next three months.

On December 14th, six steel mill giants, including Tsingshan, Baosteel Desheng, Beigang New Materials, LISCO, Huale Hejin and Chende, jointly announced production cuts and limits on prices of stainless steel 200 series in response to the continuously decreasing stainless steel prices.

Tsingshan: To protect and regulate the market, the production of stainless steel 200 series will be cut off more than 60% until March of 2022.

Baosteel Desheng: Until March 2022, the production of stainless steel 200 series will be reduced by over 60%. Only one high furnace will be worked for 200 series. Meanwhile, there will be strict regulations on the agents against the prices and quotations. For, example, since January 2022, about the price of 200 series, the weekly guidance price will be replaced by a daily updated guidance price.

Beigang New Materials: To maintain the price of stainless steel 201, the maintenance plan has begun and the production will be ceased.

…

It is estimated that in the next three months, China's 200 series stainless steel output will decrease by 450,000 tons.

Trend|| The total inventory reduces more than 20,000 tons and the heat of production cut gradually fades.

Last week, six major steel mills united and announced a production cut on stainless steel 200 series to control and regulate the collapsing prices. The announcements instantly turned on the market transactions and the stainless steel prices. The spot prices of stainless steel stopped decreasing and started to rise. Until December 17th, the major contract of stainless steel futures increased by US$29/MT, to US$2,675/MT.

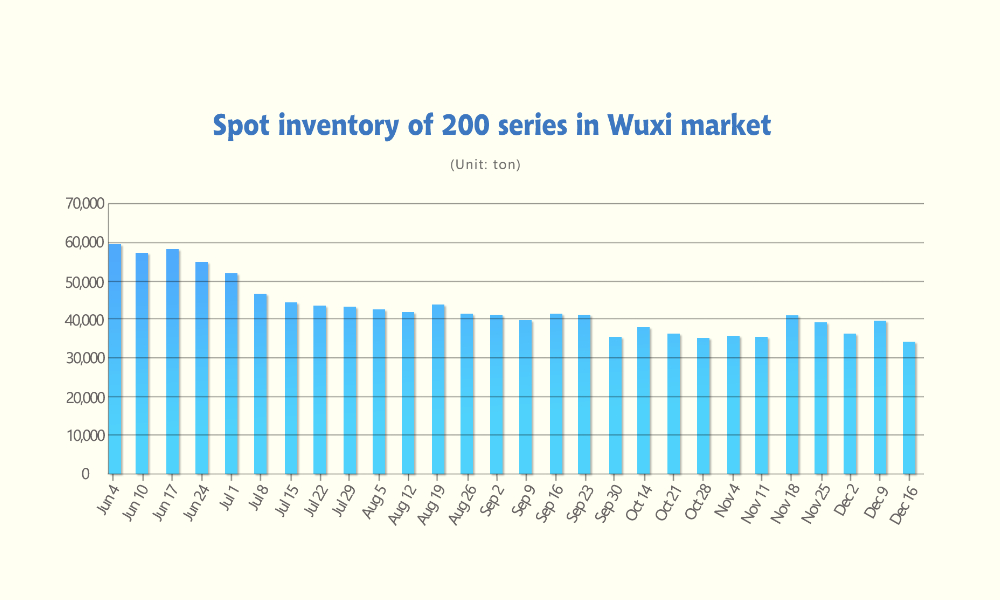

As for the inventory, the total volume of the Wuxi sample warehouse decreases by 22,800 tons, to 413,800 tons. 200 series inventory reduces by 5,700 tons, to 34,500 tons; 300 series down by 12,200 tons, to 287,500 tons; 400 series decreases by 4,400 tons to 92,300 tons.

| Inventory in Wuxi sample warehouse (Unit: thousand tons) | 200 series | 300 series | 400 series | Total |

| December 13th ~ December 17th | 34.5 | 287.5 | 92.3 | 414.3 |

| December 6th ~ December 10th | 40.2 | 299.7 | 96.7 | 436.6 |

| Difference | -5.7 | -12.2 | -4.4 | -22.4 |

300 series of stainless steel: Influenced by the production cuts, the trading got better.

Although the production cuts are majorly taken on stainless steel 200 series, it also boosts the trading in the spot market. The prices instantly increased and people rushed buying. After Thursday, the market started to cool down because most demands have been filled. Until last Friday, the base price of the cold-rolled stainless steel 304 of the private-owned steel mills in Wuxi market increased by US$95/MT to US$2,755/MT; as for the hot-rolled stainless steel, it rose to US$2,675/MT which was US$29/MT higher than the price on December 10th; the major contract of stainless steel futures increased by US$29/MT, to US$2,675/MT. Both of the prices of stainless steel spot and futures rose slightly. But influenced by the macroeconomy, the increase can hardly remain.

Pushed by the steel mills, the raw material cost fell quickly last week. The theoretical production cost of cold-rolled 304 has been moved down to US$2,680/MT, and the loss per ton is US$60/MT, which is less than before. At present, the price of stainless steel 304 scrap in Foshan is US$1,937/MT, the cost of cold-rolled stainless steel 304 scrap is US$2,712/MT, and the loss per ton is US$93/MT.

200 series of stainless steel: The heat of production cut gradually fades and the prices lost their driven force.

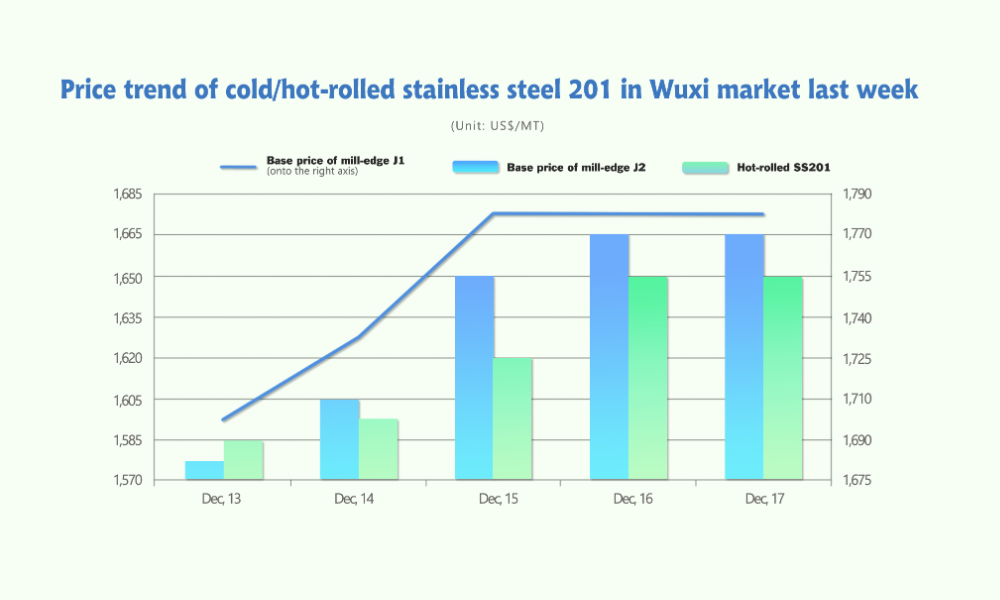

Last week, the price of stainless steel 201 stopped falling and began to rise due to the production reduction. Before the announcement, the hot-rolled 5-foot stainless steel remained its positive trading tendency. After the six steel mills announced their plans on Tuesday, the trading and prices of stainless steel 201 increased. Within only two days, the price of stainless steel 201 rose by US$35/MT. However, it seems that the boost did not last long. Last Thursday, the transactions started to weaken. Last Friday, December 17th, the prices stopped rising and remain stable. Transaction keeps weakening. So far, without any outside factor, the price of stainless steel 201 is difficult to increase.

400 series of stainless steel: Transactions heat up. The decreasing trend is weakening and the prices get stable.

The supply of high chrome remains large. Some factories even complained that it is difficult to sell. Since December 5th, the Central environmental protection team has been in Guizhou Province and some factories have been influenced.

In December, a steel mill in Northern China starts hauling, which will influence about 40,000 tons of production of stainless steel 400 series. Another steel mill in northwestern China announced that about 20,000 tons of stainless steel 400 series will be cut down in December. The decrease in supply will alleviate the pressure of large inventory.

Summary:

300 series of stainless steel:

The raw materials cost is declining and the price of stainless steel 300 series tend to be stable and stopped falling, which is fixing the production deficit of steel mills. It is predicted that the base price of the cold-rolled stainless steel 300 series of the private-owned mills will fluctuate around US$2,755/MT.200 series of stainless steel:

Stainless steel did make a breakthrough last week, but it failed to maintain. The prices can hardly keep increasing but can remain at the current level thanks to steel mills’ price regulations. It is predicted that the prices will maintain in a short time.400 series of stainless steel:

The inventory volume is large but two steel mills said they will cut down the supply, which speeds up the consumption. The winter Olympics is around the corner. Most people believe that the government will take stricter policy against the industry and the supply will tighten up. Therefore, the prices of the stainless steel 400 series will go higher in the future. It is predicted that the stainless steel 430/2B of TISCO and JISCO will remain at US$1,555/MT.The legacy of production cut of stainless steel 200 series: Does it really work?

Last week, steel mills ignited the stainless steel 200 series market with an announcement about a production cut. It is estimated that in the next three months, China's 200 series stainless steel output will decrease by 450,000 tons. The prices of the stainless steel 200 series increased by more than US$60/MT within a week. It seems that the price battle was to be turned around.

1. Prices rose.

Last week, the stainless steel 201 market was significantly better. Firstly, from the perspective of price, the union of the six major steel mills boosted the prices of 200 series successfully, enlarging the price difference between the cold-rolled and hot-rolled materials to over US$85/MT. Until Dec 17th, the cold-rolled stainless steel 201 in Wuxi market increased by US$48/MT, quoting at US$1,780/MT; as for the J2 and J5, the price rose by US$63/MT, to US$1,665/MT; hot-rolled and 5-foot stainless steel 201 grew to US$1,650/MT, which was US$63/MT higher.

Secondly, about the inventory and stock shortage, the shortage of some specifications remain. Typically, the hot-rolled 5-foot stainless steel 201 thinner than 5.0mm have been in shortage and the supply of thickness of 3.0 mm is even severely short; but the supply of cold-rolled products is more stable and sufficient except for the thin materials that have been in shortage for a long time.

2. Timeline.

Monday, December 13, 2021

The hot-rolled 5-foot stainless steel 201 has remained its substantial trading volume. The transaction of cold-rolled products was kind of bland but it soon recovered in the afternoon. Some merchants even increased the price slightly by US$8/MT.

Tuesday, December 14, 2021

It was a memorable day. The prices of stainless steel spots increased. Leading by Baosteel Desheng, the production cut and price limit about stainless steel 200 series were announced, and Beigang New Materials, Huale Hejin, Henan Jinhu, Tsingshan, LISCO followed suit. The market instantly becomes lively. The processing orders of the hot-rolled materials were arranged till the weekend and the trading volume of cold-rolled stainless steel reached its peak recently.

Wednesday, December 15, 2021

The market kept warming up. The transaction of the hot-rolled 5-foot stainless steel 201 was hot still and the price was adjusted to rising for two times in the day. In the afternoon, the price was US$30~50/MT higher than the price in the morning. As for the cold-rolled stainless steel 201, it was no less prosperous. Although the trading was weaker in the morning compared to Tuesday, Tsingshan soon gave a hand in the afternoon by increasing the price by US$16/MT. The rise again attracted more transactions, and the trading volume grew to a new high in the afternoon.

Thursday, December 16, 2021

The increase of stainless steel 201 started to slow down. The price of cold-rolled stainless steel 201J1 stopped increasing and remained stable; the cold-rolled J2 and J5 were still on a rise, about US$15/MT higher than yesterday but people did not buy it. The transaction was weakening. Some traders think it is because, on Tuesday and Wednesday, the necessary demand has finished purchasing. The enthusiasm for buying hot-rolled 5-foot materials also started to fade. The transaction cooled down a little bit compared to the previous two days.

Friday, December 17, 2021

All specifications of stainless steel 201 remained the same price as yesterday on Friday. The transaction volume was maintained on Thursday. The influence of the production cut by the steel mills gradually dispensed. However, the price limit is still effective to regulate and maintain the prices. It is predicted that the prices of stainless steel 201 won’t drop significantly.

3. Inventory reduced.

Last week, the inventory of 200 series was reduced to 34,500 tons.

The current inventory volume is the lowest level after February 2021. Influenced by the action of the six steel mills, the reading volume was several times of the previous weeks. Some traders said they were out of stock thanks to steel mills’ sudden decision. Moreover, last week the new arrivals to the market were also less than usual, and thereby the spot inventory reduced significantly.

4. Forecast.

Based on the market performance on Thursday and Friday, though the market did make a breakthrough, the influence fails to maintain and extend. The prices to rise are still facing some pretty significant headwinds. However, the price limit is still effective to regulate and maintain the prices. It is predicted that the prices of stainless steel 201 won’t drop too much.

5. Raw material: Manganese industry is under pressure.

Market participants predict that the production cuts of Chinese stainless steel producers will put pressure on the manganese market in the short term. Manganese metal is mainly used in the production of 200 series stainless steel.

Manganese producers also announced production cuts before

Right before Chinese steel mills announced the production cut, Chinese major manganese producers planned for reducing the output.

From December 4th to 5th, manganese flake manufacturers held an industry alliance meeting. The largest manufacturer in China stated that it will stop production equipment for maintenance for two months until March 15th, 1,500-1600 tons of productivity will be influenced.

At the meeting, a plan for major Chinese manganese producers to suspend production for 195 days within 6 months was also formulated next year. According to reports, China’s manganese output is expected to drop by half to 500,000-600,000 tons by 2022, and this year’s output is estimated to be about 750,000-900,000 tons.

Manganese production reduction plan boosts the confidence of manganese producers.

The production discipline plan boosted the confidence of the producers because the price stopped weakening before the alliance meeting on November 25.

On December 13, the EXW price of manganese flakes rose slightly to US$6,270/MT~ US$6,667/MT and maintained to December 19.

People hold different views on the prospects. Some people expect the price of manganese flakes to fall in the short term. Many manufacturers may reduce prices to attract orders and create cash for year-end accounting purposes while steel production is reduced. Others expect the market to remain at current levels, as major producers’ reduction plans will offset the decline in stainless steel production.