ShFE nickel rushed high for several times, which led the stainless steel prices up. However, it lacks of steady momentum, and thereby the prices always have a way to do down. In July, the production of chromium priducts and stainless steel both are predicted to rise. During the muddy situation, with low demand, market worries much about it. Competition is getting harsh. Many steel mill giants around the world are also adjusting their selling prices to cope with the sluggish needs. If you want to know more about Stainless Steel Market Summary in China, please roll down and keep reading.

TREND|| Market performance was troubled by the industry's off-season.

The future price of stainless steel last week continued to remain choppy and eventually closed with a further drop. The stainless steel market is now praying for the silver lining while the supply is inevitably surpassing the demand.

The overall price trend of stainless steel 304 and stainless steel 430 remains weak; stainless steel 201 carried a sluggish trend from the beginning to the end. The mainstream contract price of stainless steel had an insignificant rose of US$3.5/MT and closed at US$2205/MT.

Stainless steel 300 series: Inventory rose but spot trading faced down.

The market price of stainless steel 304 was volatile last week:

The mainstream base price of both cold-rolled 4-foot mill-edge stainless steel 304 and hot-rolled stainless 304 fell from US$21 to US$US$2185/MT and US$2125/MT.

The future price of the stainless steel 300 series slightly extended the upward momentum from the previous week while the spot price went in different directions. There was also a slight rebound on the cold-rolled stainless steel and hot-rolled stainless steel.

Stainless steel 200 series: Frequent response from the steel mill to save the market.

The spot price of stainless steel 201 extended the losses in the previous week: until last Friday, the mainstream base price of cold-roll stainless steel 201 dropped US$56 to US$1350/MT, 201J2 had a US$42 fall and closed at US$1265/MT, the 5-foot hot-rolled stainless steel reported a US$28 descend and reported as US$1300/MT.

Transaction remained sluggish throughout last week, and the off-season is starting to spread the negative sentiment to the stainless-steel market. Beigang new material suspended trading for stainless steel 200 series and 300 series last Wednesday, then announced a production cut which disclosed its strong will of holding the price. However, the market did not show recognition on the price display, the spot price had nose dive to reach a record low in recent years.

Stainless steel 400 series: Remain unmoved like a statue.

400 series performance continued to poop out, the mainstream quote price remains steady at between US$1260/MT- US$1250/MT. The guidance price quoted by JISCO and TISCO was reported as US$1395/MT and US$1495/MT respectively.

Summary:

300 Series: Currently, the inventory of stainless steel spot market has shifted from a decline to an increase. Demand remains in the low season cycle, and downstream purchasing activity is sluggish. At the same time, the prices of nickel and chromium iron have experienced a downward trend, weakening the cost support. In the short term, private cold-rolled stainless steel prices are expected to exhibit weak and fluctuating trends within the range of US$2170/MT-US$2240/MT.

200 Series: Throughout last week, there have been a series of actions such as steel mills leading the decline at the opening and closing. Faced with the game played by steel mills and the uncertainty of the market, traders have chosen to adopt a wait-and-see approach. Currently, the market is in the low season of demand, and a short-term recovery in market transactions is unlikely. Future attention will be focused on the actions of steel mills. It is expected that the spot prices for 201 series will remain stable with a slightly weak tone next week, with J2/J5 cold-rolled prices fluctuating in the range of US$1230/MT-US$1255/MT.

400 Series: The mainstream ex-factory prices for high-chromium stainless steel remained stable this week. There has been no significant improvement in market transactions for the 400 series stainless steel market. The price of high-chromium raw material steel for Taiyuan Iron and Steel in July has declined by US$27.9/MT. The 400 series stainless steel market lacks positive factors, and it is anticipated that prices will remain stable with a slightly weak tone next week.

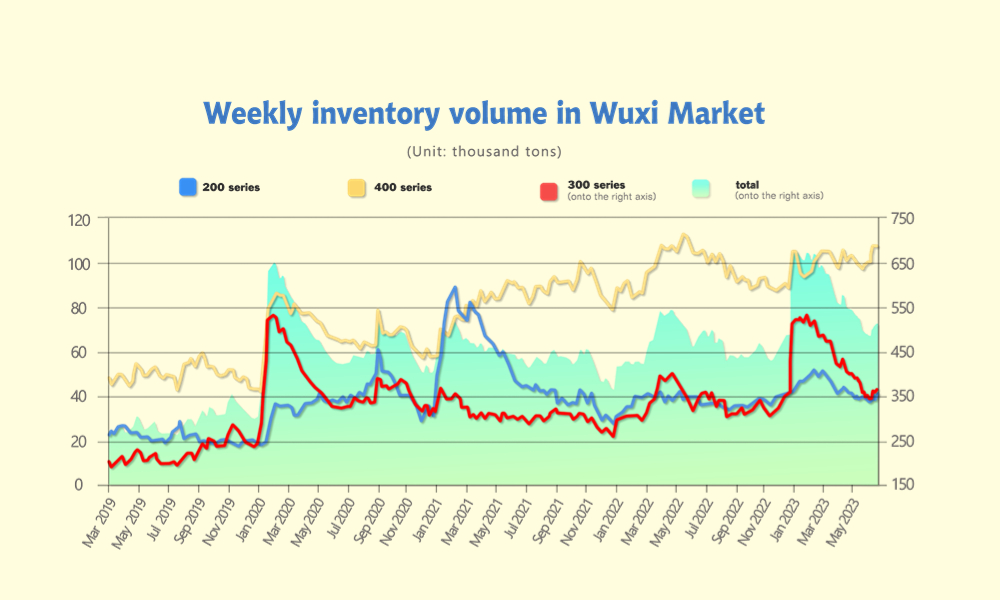

INVENTORY|| Steel mill taking big risk to maintain high production in off season.

The total inventory at the Wuxi sample warehouse rose by 8,350 tons to 512,581 tons (as of 6th July).

the breakdown is as followed:

200 series: 1,904 tons went up to 40,713 tons

300 Series: 6,059 tons went up to 364,436 tons

400 series: 387 tons went up to 107,432 tons

Stainless steel 300 series: Production resumed, and inventory continued to jump.

Delong’s steel mill in Jiangsu continued to water the supply to the market while another base in Xiangsui fired up its production capacity. Besides, other supply channels such as Tsingshan and Hongwang (Indonesia) keep dispensing resources to Wuxi. Nevertheless, traders and end users remained discretion in making procurement decisions.

Stainless steel 200 series: Weakening transaction.

The inventory last week remained steady growth despite some resources still en route. Certain specifications were running short.

Stainless steel 400 series: slight increase recorded

The market performance of the 400 series last week remained dull, though JISCO and Fuxin conducted maintenance, the destocking accelerated.

Hence, TISCO recently released the procurement price of High chrome steel in July, it had a US$27.9/MT(50% chromium) drop from June. Steel mills are still facing gigantic pressure in sales since the market is lack positive stimuli.

Raw Material|| Raw material failed to be the long-term pivot of stainless steel price.

Nickel: Ferronickel dived deeper

ShFE nickel remained strong until last Friday at US$23370/MT, recorded a US$839/MT (or 3.77% ).

Here are the reasons why Nickel surged in the bearish market:

- The hiking US dollar diminished the import volume

- Low level of LME nickel inventory

- The boosting market share of Electric vehicle accelerate the demand for Nickel

The manufacturing PMI is dropping synchronously across different regions while the output of China’s refined nickel is growing steadily. The price of nickel is expected to be volatile in the short term. The price of the high-grade ferronickel slid to US$255/MT with a US$2.8/nickel unit.

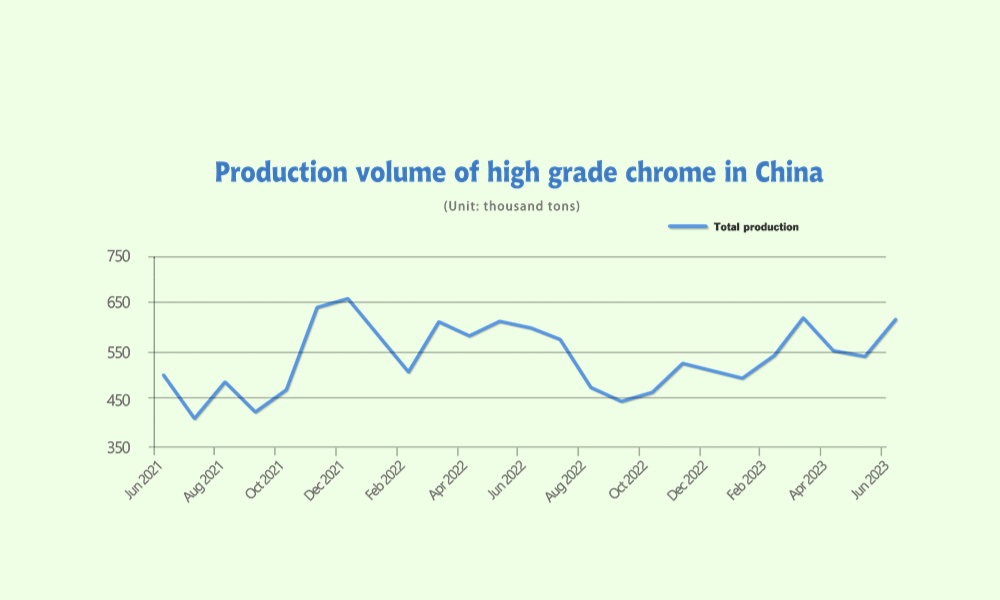

Chrome: The price stood firm as 80,000 tons of output hit the market

This week, the mainstream ex-factory prices for high-chromium stainless steel have remained stable, ranging from US$1315 to US$1345/MT (50%chromium), unchanged from the previous week. The prices of chromium ore and coke have also remained stable, and there have been no significant changes in the overall production costs of high-chromium stainless steel.

According to statistics, the production of high-carbon ferrochrome in June increased significantly, reaching nearly 620,000 tons, an increase of nearly 80,000 tons or 14.68% compared to the previous month. The market supply pressure has increased, but the prices of high-chromium stainless steel have not continued to decline and have gradually stabilized.

On the one hand, the increase in high-chromium production has led to strong demand for chromium ore, providing support to prices. On the other hand, the recent depreciation of the Chinese yuan has increased import costs, keeping the ore prices relatively firm. The significant reduction in the room for cost pressure in high-chromium production has contributed to the stability of prices in the short term.

As the hot weather continues, there has been an increase in unexpected incidents. Recently, power shortages have occurred in the main high-chromium production areas in Sichuan. On July 3rd, the Ebian power grid in Sichuan issued a temporary plan to restrict power supply, which will be in effect from July 3rd to July 21st.

Due to the power restrictions, local high-energy-consuming enterprises are experiencing production limitations, which are expected to affect the high-chromium production by around 7,000 tons in July.

Sea Freight|| Freight rate growth was reversed.

China’s Containerized Freight market was overall stabilized, but the demand recovery hit a bottleneck. On 7th July, the Shanghai Containerized Freight Index fell by 2.3% to 931.73.

Europe/ Mediterranean:

High-interest rates, high inflation rates, and consumption decline indicate a gloomy economic outlook.

Until 7th July, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$740/TEU, which fell by 3%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1413/TEU, which fell by 3.6%

North America:

The economic activity in the US manufacturing sector continued to contract at an accelerating pace in June, with the ISM Manufacturing PMI dropping to 46 from 46.9 in May. This reading came in worse than the market expectation of 47.2.

Until 7th July, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1404/FEU and US$2368/FEU, reporting a 0.3 growth and 0% change accordingly.

The Persian Gulf and the Red Sea:

Until 7th July, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 6.6% from last week's posted US$1145/TEU.

Australia/ New Zealand:

Until 7th July, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$49/TEU, a 4.2% slide from the previous week.

South America:

The freight market had a slight rebound. on 7th July, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2616/TEU, an 3.3% growth from the previous week.