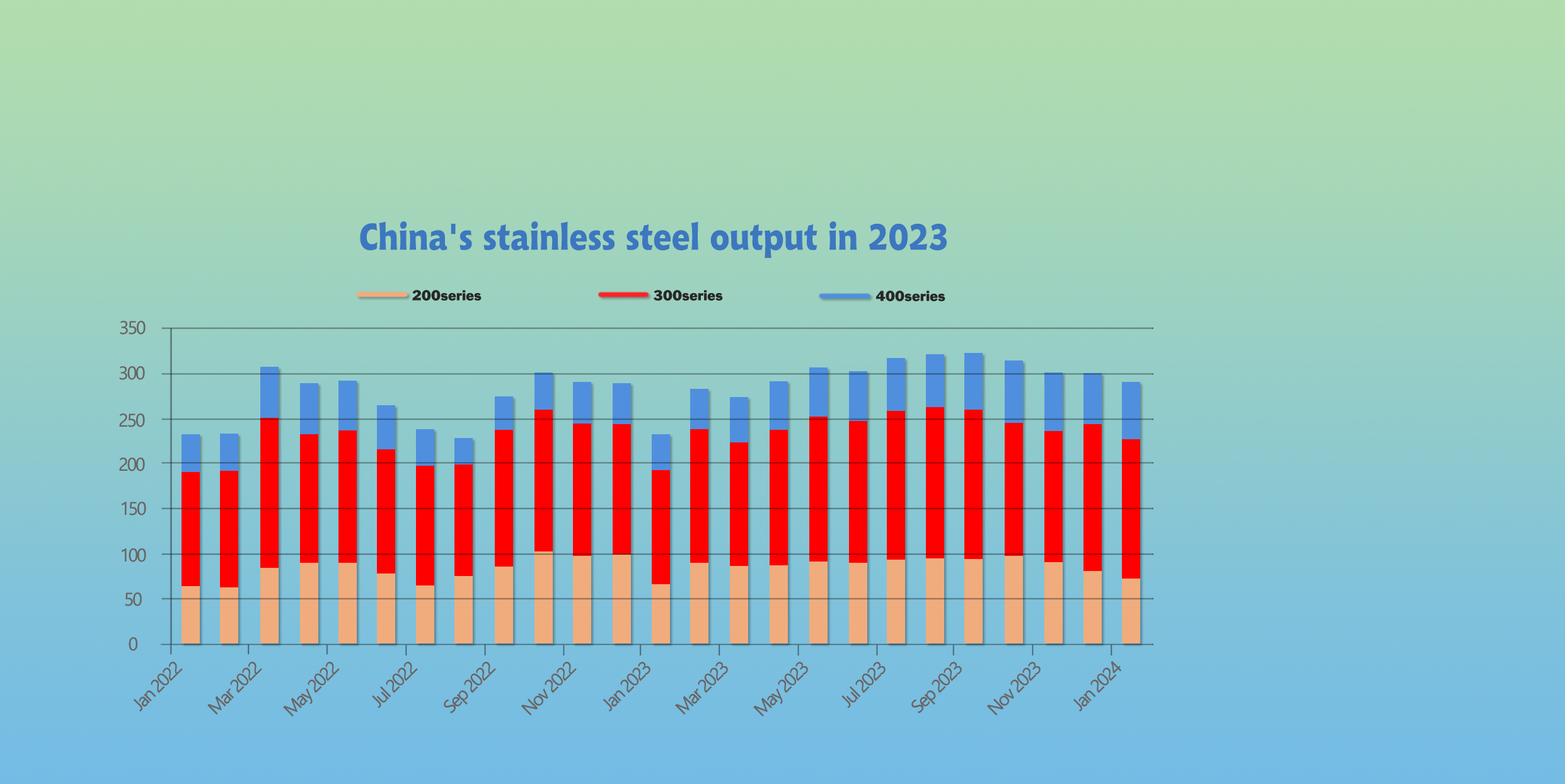

The escalating conflict in the Red Sea is so concerning. Over 400 vessels were rerouted to avoid the risky region, pushing the insurance fee, and freight rate. Other routes are also affected due to the spilling-out vessel arrangement. Besides, in the Americas, the Panama Canal has been suffering from extreme drought, and the capability of the Canal keeps decreasing and also raising the sea freight. Fortunately, the stainless steel market is more peaceful before the Chinese New Year Holiday. Prices remained stable last week, inventory was reduced, and trading worked smoothly. According to the statistics, in December 2023, the crude stainless steel increased to over 3 million tons. Last year, while the major production countries and regions reduced the output of stainless steel, China still owned an over 10% rise from 2022. It is an underlying risk to us, for the oversupply problem which does no good to the market. If you want to know the prices in detail, please keep reading our Stainless Steel Market Summary in China. We hope the world be peaceful soon.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,145 | 0 | 0.00% |

| Foshan | 2,190 | 0 | 0.00% | ||

| Hongwang | Wuxi | 2,055 | -4 | -0.18% | |

| Foshan | 2,060 | 1 | 0.06% | ||

| 304/NO.1 | ESS | Wuxi | 1,975 | -4 | -0.19% |

| Foshan | 1,995 | 1 | 0.06% | ||

| 316L/2B | TISCO | Wuxi | 3,605 | 16 | 0.45% |

| Foshan | 3,710 | 10 | 0.27% | ||

| 316L/NO.1 | ESS | Wuxi | 3,585 | 14 | 0.42% |

| Foshan | 3,510 | 10 | 0.29% | ||

| 201J1/2B | Hongwang | Wuxi | 1,390 | -4 | -0.34% |

| Foshan | 1,395 | -3 | -0.21% | ||

| J5/2B | Hongwang | Wuxi | 1,310 | -1 | -0.11% |

| Foshan | 1,305 | -3 | -0.23% | ||

| 430/2B | TISCO | Wuxi | 1,255 | 5 | 0.40% |

| Foshan | 1,255 | 0 | 0.00% |

TREND|| Future price rebounded.

The spot price of stainless steel 304 and 430 in the Wuxi market rose after stabilizing, and 201 remained steady. The future price closed at a hesitant result after exceeding US$2095/MT. The most traded contract price had a US$45/MT month-on-month growth to US2085/MT.

Stainless steel 300 series: Future price hiked; spot price followed suit.

The market price of stainless steel 304 fluctuated last week: the most traded base price of cold-rolled 4-foot mill-edge stainless steel 304 and hot-rolled stainless steel 304 reached US$2015/MT and US$1975/MT respectively, both concluded a US$7/MT increase. Last week, the spot price of the 300 series ran hesitantly until Thursday, then it had a rebound at the end of last week. It is worth mentioning that hot-rolled stainless steel had a better trade volume than cold-rolled stainless steel which led to a stock shortage in hot-rolled stainless steel.

Stainless steel 200 series: destock continued.

Until last Thursday, the most traded base price of both cold-rolled stainless steel 201J1 and 201J2/J5 recorded a US$7/MT growth and closed at US$1365/MT and US$1285/MT; 5-foot hot-rolled stainless steel 201J1 remained steady at US$1305/MT.

Stainless steel 400 series: Prices climb up.

The most traded base price of cold-rolled stainless steel 430 produced by state steel mills was landed between US$1265/MT to US$1270/MT which both rose by US$14/MT. Hot rolled stainless steel 430 remained unchanged at US$1150/MT.

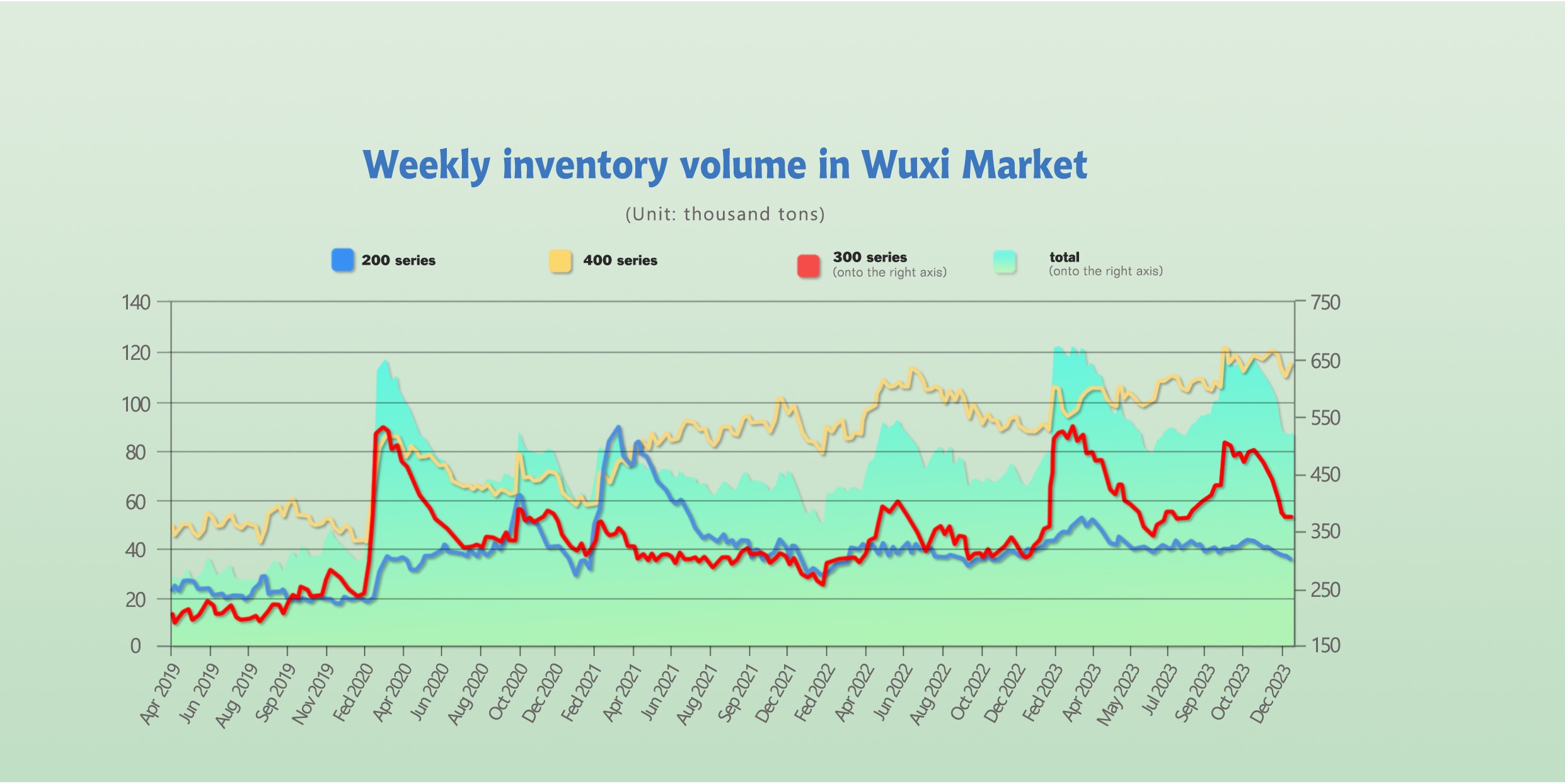

INVENTORY|| Destocking record of 200 series continues.

The total inventory at the Wuxi sample warehouse downed by 2,596 tons to 519,546 tons (as of 11th January).

the breakdown is as followed:

200 series: 955 tons down to 34,704 tons

300 Series: 1,785 tons down to 370,370 tons

400 series: 5,336 tons up to 114,472 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| January 4th | 35,659 | 372,155 | 109,136 | 516,950 |

| January 10th | 34,704 | 370,370 | 114,472 | 519,546 |

| Difference | -955 | -1,785 | 5,336 | 2,596 |

Stainless steel 300 series: Cold-rolled inventory increase.

Another batch of cold-rolled stainless-steel resources produced by Tsingshan arrived in Wuxi last week. The market performance, however, received a cold reception as the social inventory of cold-rolled stainless steel concluded the ten-week destocking record.

Stainless steel 200 series: Inventory downed for 10 weeks in a row.

Affected by the furnace maintenance of a major steel mill in South China, the supply was greatly cut last week. While the social inventory has been downsizing for ten weeks, Tsingshan is sustaining its price limits on its stainless steel products to keep the price trend steady.

Stainless steel 400 series: Supply pressure relieved.

The overall market atmosphere showed a slight improvement last week as most stainless-steel businesses received a decent volume of orders. It is understood that the production of crude steel in December reached 500,050 tons with 10,120 tons (or 2.18%) descent and the supply in January will be back to stable.

RAW Material|| Ferronickel hit the lowest level since 2021

The mainstream EXW price of high-carbon ferronickel rose US$1 to US$235/nickel point, and it is landing at the lowest position since 2021. Steel mill’s procurement price reached around US$240/Nickel point.

The price of ferromolybdenum harvested a solid gain from US$26,545/MT to US$31,660/MT (60%Mo).

The mainstream EXW price of ferrochrome stabilized at between US$1315/MT-US$1340/MT (50% chromium).

When it comes to the market supply, the production of high-carbon ferrochrome slid by 39,000 tons to 642,200 tons in December 2023 which pulled up the average volume of the annual production.

Summary|| The supply is likely to be lifted.

The downstream consumption has shown average performance towards the end of the year. Social inventories have seen a slight increase, while traders maintain low levels of stock. The future market anticipates continued pressure on goods arrivals, and there is a cautious attitude towards the market's outlook.

300 Series: After the long and continuous destocking, the current pressure on circulating inventory is limited. Some specifications are experiencing shortages, and there is a strong willingness for spot prices to rise when futures pull up. With demand for pre-holiday stocking, short-term prices are expected to range between US$2010/MT and US$2065/MT.

200 Series: Currently, due to steel mill maintenance, there is a reduction in arrivals at steel mills, and traders have limited inventory. The consecutive price limits imposed by Tsingshan, along with multiple positive factors, are boosting the development of the market. In the short term, it is expected that 201 prices will remain stabl.

400 Series: Last week, the Wuxi market's transaction atmosphere has improved. Throughout the week, steel mills in North China and Northwest China have had arrivals, addressing shortages in specifications that were lacking in the previous spot market. The production of steel mills is expected to remain stable in January, with an anticipated increase in market supply to ease pressure. Expectations are that downstream industries will release orders for Spring Festival stocking, and the price of 430 cold-rolled steel is expected to stabilize and rise.

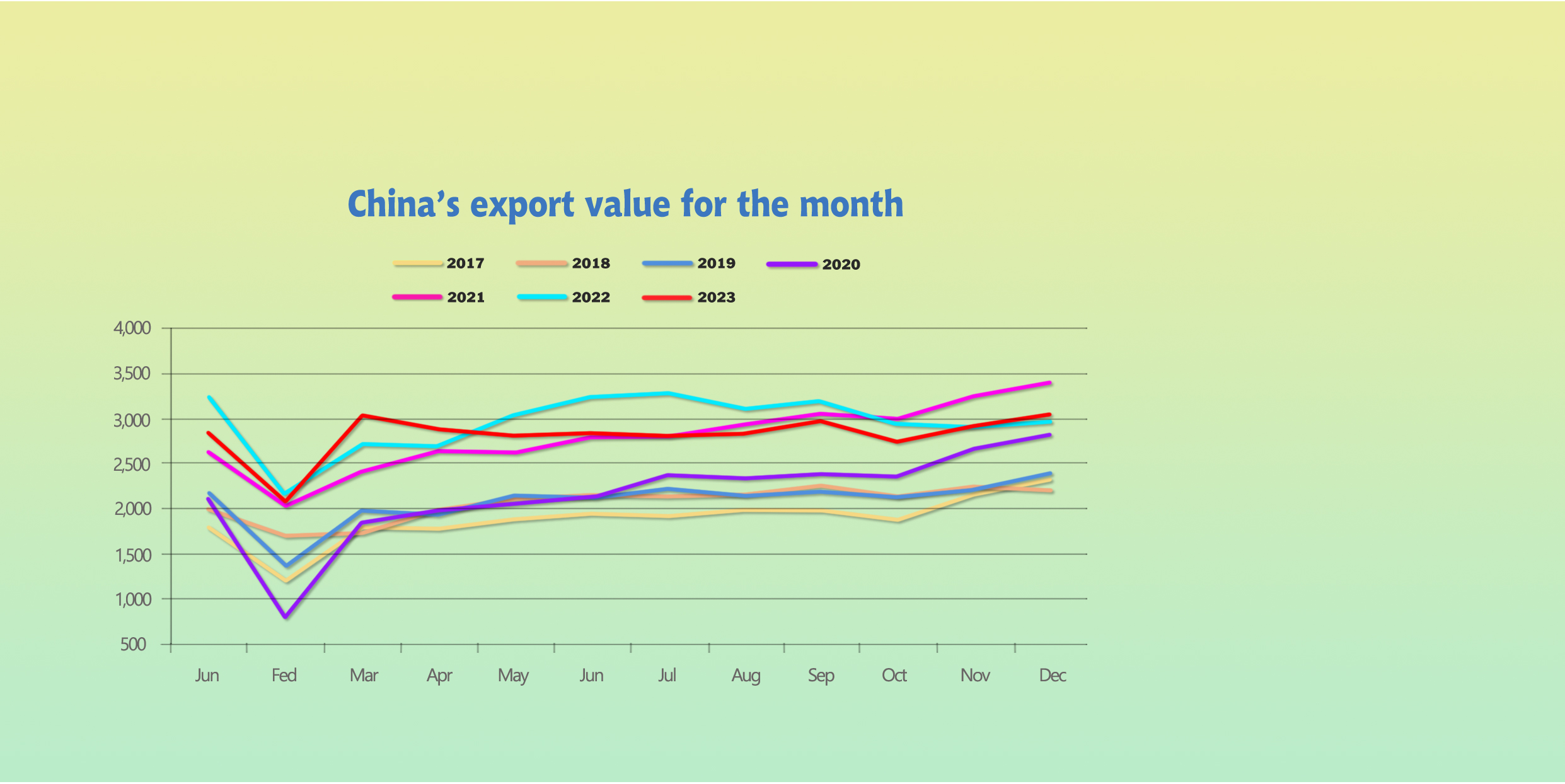

Macro|| China’s export volume

China’s exports grew slightly for a second consecutive month in December even as deflationary pressures persisted, according to official data released Friday that underscored the uneven nature of the country’s economic recovery from the pandemic. Exports rose 2.3% year-on-year in December to $11.7 billion. The improvement is a sign that demand may be picking up after months of decline earlier in the year. However, Vietnam, South Korea, and Taiwan China had at least 11.8% higher than China in terms of export.

The Global Manufacture PMI fell to 49.0 in December from 49.3 the previous month. China’s weak external demand also remained a major drag on factory activity, with new export orders index registering 45.8 in December, contracting for the ninth straight month.

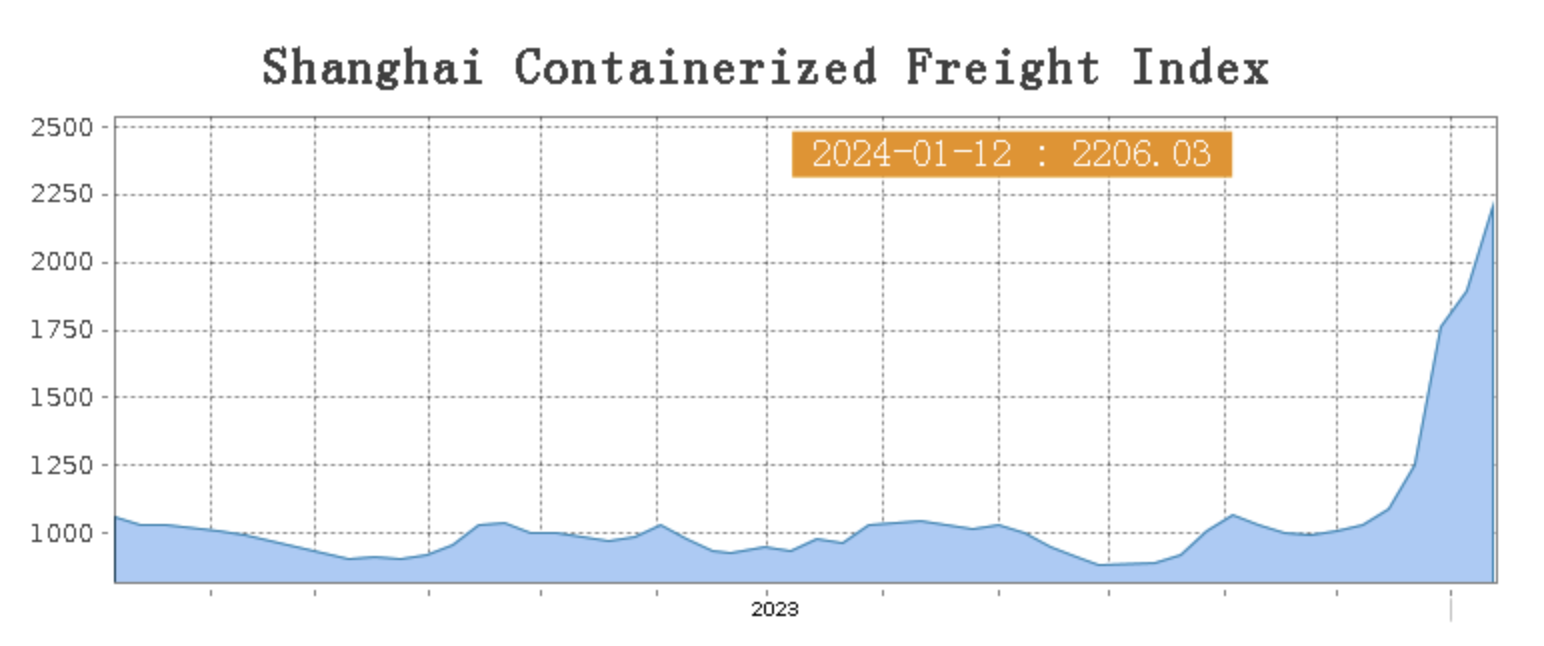

Sea Freight|| Unsolved complication in Red Sea continues.

China’s Containerized Freight market continued to be interrupted by the regional fluctuation. On 12th Janurary, the Shanghai Containerized Freight Index rose by 16.3% to 2206.03.

The U.S. military carried out new strikes in Yemen on Tuesday against anti-ship ballistic missiles in a Houthi-controlled part of the country as a missile struck a Greek-owned vessel in the Red Sea.

Attacks by the Iran-allied Houthi militia on ships in the region since November have affected companies and alarmed major powers - an escalation of Israel's more than three-month-old war with Palestinian Hamas militants in Gaza. The Houthis say they are acting in solidarity with Palestinians and have threatened to expand attacks to include U.S. ships in response to American and British strikes on their sites in Yemen.

Two heads of international banking groups attending the World Economic Forum said privately that they were worried the crisis might cause inflationary pressures that could ultimately delay or reverse interest rate cuts and jeopardize hopes for a economic soft landing.

Europe/ Mediterranean:

The freight rate of European freight line hiked unsurprisingly as the rumble continued.

On 12th Janurary, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$3103/TEU, which rose by 8.1%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$4037/TEU, which surged by 11.5%

North America:

The U.S. economy added 216,000 jobs in December, above November’s 199,000 new jobs, the Bureau of Labor Statistics reported. The number of jobs surged past economists' expectations that employers would hire just 170,000 new workers during the month. It marks another strong month for a labor market that never produced the layoffs economists expected in 2023.

On 12th January, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$3974/FEU and US$5813/FEU, reporting a 43.2% and 47.9% spike accordingly.

The Persian Gulf and the Red Sea:

On 12th January, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 4.9% from last week's posted US$2224/TEU.

Australia/ New Zealand:

On 12th January, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1211/TEU, a 11.7% jump from the previous week.

South America:

On 12th January, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2874/TEU, an 0.9% slide from the previous week.