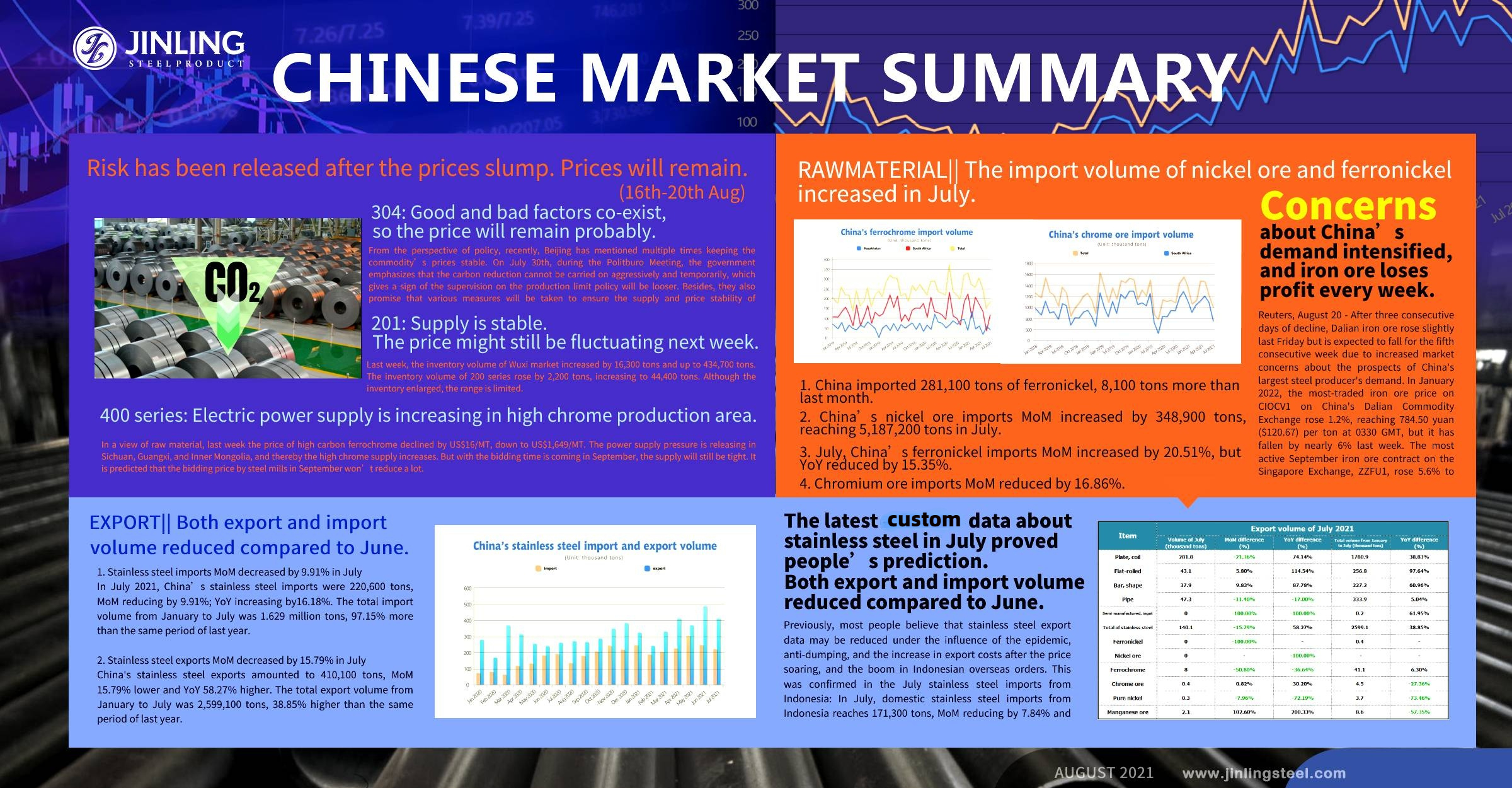

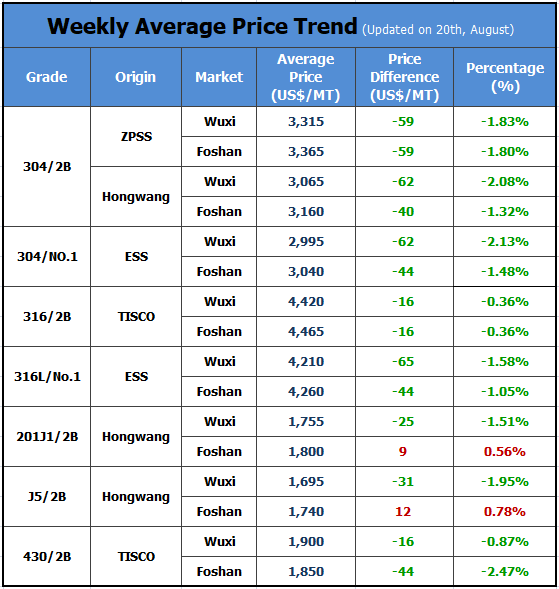

Trend|| Risk has been released after the prices slump.

304: Good and bad factors co-exist, so the price will remain probably.

From the perspective of policy, recently, Beijing has mentioned multiple times keeping the commodity’s prices stable. On July 30th, during the Politburo Meeting, the government emphasizes that the carbon reduction cannot be carried on aggressively and temporarily, which gives a sign of the supervision on the production limit policy will be looser. Besides, they also promise that various measures will be taken to ensure the supply and price stability of commodities.

On the FED side, July’s meeting tends to be pessimistic. Most of the participating committee members expect to slow down the pace of debt purchases starting this year. Although slowing down the pace of bond purchases does not directly raise interest rates, it generally signals that monetary policy has begun to shift, which means that interest rate hikes will also come soon. The tightening of dollar liquidity will undoubtedly bring about There is an obvious negative effect.

About the spot inventory of stainless steel, last week, there were nearly 10,000 tons of new arrivals of 300 series in Wuxi market, which is the consecutive second increase. Lately, there have been new resources supplied to the market. Tsingshan delivers about 20,000 tons of SS304; Beigang New Materials will also have 10,000 tons of SS304 arrivals and Delong will have a delivery volume of 20,000 tons. Moreover, in the large logistic industrial park, the resources of state-owned steel mills take a major place. However, because of the declining price trend, agents hesitate to take delivery, resulting in the stacking inventory. When the demand turns weak, the stock begins to get heavy.

As for the futures stock, on Thursday (August 19th), the stock was sold into corrections, breaking down below ¥18,000 (US$2,935). In a short period, the declining trend seems to maintain. It is possible that the bearish market will remain with the guide of capitals, which will affect the spot market sentiment.

Of course, after the prices dropped significantly, there are many good factors that affect the prices to increase.

1. The prices of raw materials keep rising and the mainstream transaction price of high ferrochrome remains high. Lately, a steel mill in Southern China purchased thousand of tons of high ferronickel at US$221/nickel. The factory reflects that the circulation sources are tight and the price is increasing. The abroad supply is lower than expected. According to customs data, in July, China’s ferronickel import volume increased by 2.95% compared to last month, rising to 281,100 tons. As for the imports from Indonesia, the volume decreased to 229,900 tons, 0.21% lower than last month, which has decreased for consecutive three months. The ferronickel supply in China is tight.

2. The scrap metal of SS304 circulation volume remains low. Last week, the purchasing prices of the scrap metal of SS304 by a steel mill were US$2,031/MT and US$1,984/MT. However, the resource is tight and so the price of SS304 scrap metal will remain high in the short term.

3. Raw material cost is high. Based on the current prices of ferronickel and ferrochrome, the cost of the hot-rolled 304 by private-owned mills is around US$2,703/MT. Compared with the current market price, the profit is greatly suppressed. Steel mills have a strong willingness to lift the price or they will reduce the production to maintain the profit high.

201: Supply is stable. The price might still be fluctuating next week.

Last week, the inventory volume of Wuxi market increased by 16,300 tons and up to 434,700 tons. The inventory volume of 200 series rose by 2,200 tons, increasing to 44,400 tons. Although the inventory enlarged, the range is limited.

Under the declining price trend, last week, downstream buyers hesitated in stocking up. Last week, Baosteel Desheng delivered 5,000~6,000 tons of resources, and a small volume of Tsingshan’s hot-rolled products also arrived. The market is gradually stacked.

It is reported that the power rationing policy in Guangxi Province was getting looser. Lately, the electric power supply has been improved thanks to the more rainfalls. Therefore, steel mills and ferrochrome factories are expected to get their work back on track, but it takes time to bring the result to the market. Temporarily, the supply will remain stable and the price will be fluctuating.

400 series: Electric power supply is increasing in high chrome production area.

In a view of raw material, last week the price of high carbon ferrochrome declined by US$16/MT, down to US$1,649/MT. The power supply pressure is releasing in Sichuan, Guangxi, and Inner Mongolia, and thereby the high chrome supply increases. But with the bidding time is coming in September, the supply will still be tight. It is predicted that the bidding price by steel mills in September won’t reduce a lot.

As for 400 series, in August, the stainless steel production volume reduced a lot. In Shandong province only, it dropped by almost 40,000 tons. But the transaction was gloomy. The price given by traders is far lower than steel mills’ guidance price.

The inventory of 400 series has been facing stacking up. Last week, the inventory stack up by 5,000 tons, reaching 88,300 tons in Wuxi market, which takes the high ground within the year.

Summary:

304: Good and bad factors coexist in the spot market. The risk of price drop is degraded after the price trend is maintained low. It is predicted that the price will be stable.

201: For now, the overall supply stress is little and the inventory volume is low, which maintains the price high and it is predicted that the price will stay stable.

430: The transaction price of 430/2B of TISCO and JISCO will stay at the current price of around US$1,855~US$1,885/MT.

RAWMATERIAL|| The import volume of nickel ore and ferronickel increased in July.

China imported 281,100 tons of ferronickel, 8,100 tons more than last month.

In July 2021, China’s imports of ferronickel were 281,100 tons, increasing by 2.98% MoM and 5.25%YoY. Among them, the import volume of ferronickel from Indonesia was 229,900 tons, 0.21% MoM lower and 13.90% YoY higher. From January to July 2021, the total domestic import of ferronickel was 2,143,600 tons, YoY increasing by 17.40%. Among them, 1.8043 million tons of ferronickel were imported from Indonesia, YoY rose by 22.36%.

Based on the import data in July, the import volume of ferronickel from Indonesia continues to decline. It has been declining for three consecutive months. The performance of ferronickel imports continues to fall short of expectations, and the supply of ferronickel is still insufficient in China.

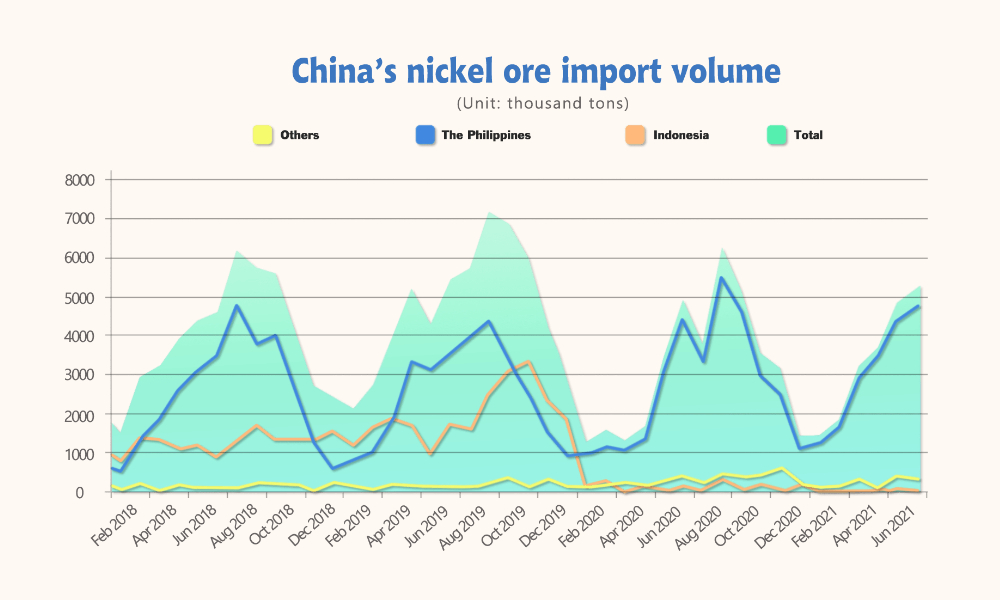

China’s nickel ore imports MoM increased by 348,900 tons, reaching 5,187,200 tons in July.

In July 2021, domestic imports of nickel ore amounted to 5.1872 million tons, MoM rising by 7.21% and YoY 5.79%. Among them, 4.7745 million tons of nickel ore were imported from the Philippines, 9.60% more than last month and 8.65% higher than last July. From January to July 2021, the total imports of nickel ore totaled 21.669 million tons in China, increasing by 25.24% YoY. Among them, the import of nickel ore from the Philippines was 19.553 million tons, which increases by 49.73% compared to the same period of last year.

According to past trends, China’s nickel ore imports in the third quarter maintained the highest level of the year. The current domestic nickel-iron factories have good production profits. China's output has grown steadily in the past two months. The demand for nickel ore has performed well. Moreover, due to the influence of the rainy season in the fourth quarter, most factories are actively stocking up, and nickel ore prices will keep rising.

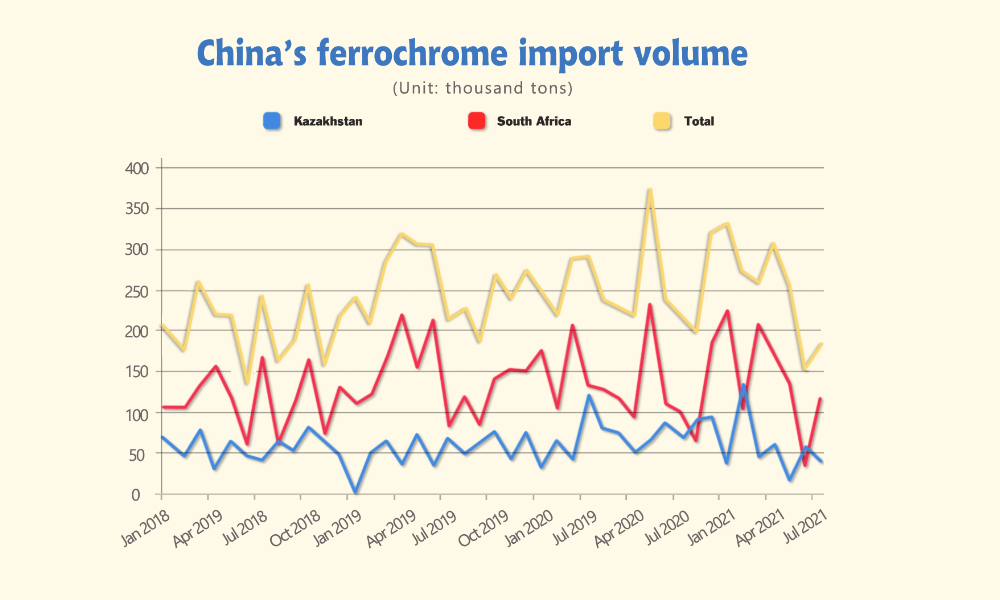

July, China’s ferronickel imports MoM increased by 20.51%, but YoY reduced by 15.35%.

In July 2021, China imported 183,700 tons of ferrochrome, MoM increasing by 20.51% but YoY reducing by 15.35%; within, ferrochrome imported from South Africa was 115,300 tons, 219.82% higher than last month and 21.32% more than July 2020. From January to July 2021, the total imports of ferrochromium were 1,753,400 tons, rising by 1.43% compared to the same period of last year; of which, about 989,100 tons of ferrochrome were imported from South Africa, YoY increasing by 3.31%.

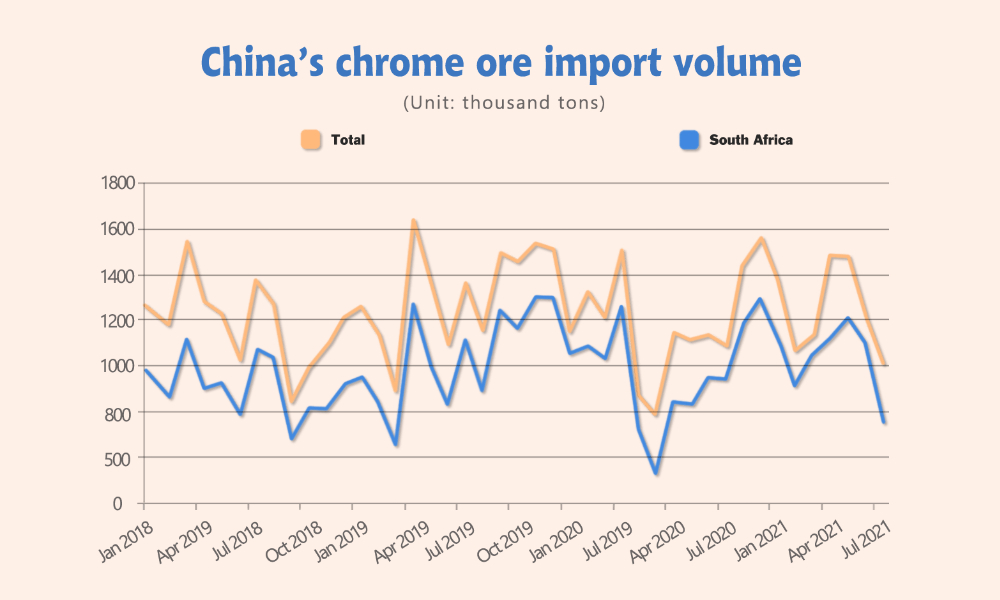

Chromium ore imports MoM reduced by 16.86%.

In July 2021, China’s import volume of chromium ore was 1.0181 million tons, reducing by 16.86% from the previous month and decreasing by 10.63% from the same period last year. Among them, the amount of chromium ore imported from South Africa was about 763,900 tons, MoM decreasing by 30.24%; YoY decreasing by 8.78%.

From January to July, the total amount of imports of chrome ore was about 8,790,400 tons, YoY 1.43% higher. Among them, the total amount of chrome ore imported from South Africa was 7,266,700 tons, YoY rising by 11.02%.

Concerns about China’s demand intensified, and iron ore loses profit every week.

The price drop is related to weak steel demand in China's real estate and infrastructure industries. The demand situation in these two key industries has weakened.

Reuters, August 20 - After three consecutive days of decline, Dalian iron ore rose slightly last Friday but is expected to fall for the fifth consecutive week due to increased market concerns about the prospects of China's largest steel producer's demand. In January 2022, the most-traded iron ore price on CIOCV1 on China's Dalian Commodity Exchange rose 1.2%, reaching 784.50 yuan ($120.67) per ton at 0330 GMT, but it has fallen by nearly 6% last week. The most active September iron ore contract on the Singapore Exchange, ZZFU1, rose 5.6% to US$137.85 per ton. It hit a six-month low last Thursday, but it will also experience a weekly decline.

August will be the most sluggish month for the iron ore market in two years, especially for the Dalian benchmark index, which fell more than 30% from its record peak in May. The price of spot iron ore delivered to ChinaSH-CCN-IRNOR62 fell below US$150 this week, the lowest level since December. ChinaSH-CCN-IRNOR62 reached a record high of US$232.50 per ton in May.

Commonwealth Bank Commodity Analyst Vivek Dhar said,

“The price drop is related to weak steel demand in China's real estate and infrastructure industries. The demand situation in these two key industries has weakened, which once again shows the market's concern about the inevitable reduction of China's steel production in the second half of 2021. "

Rebar on the Shanghai Futures Exchange rose 1.5%, and hot-rolled coil HCCV1 rose 1.3%, but these two varieties will also experience weekly declines. Stainless steel fell by 1.2%. Dalian coking coal was almost flat, while coking coal fell 1%. The Dalian Stock Exchange will increase transaction fees for some coking coal and coke contracts starting August 24.

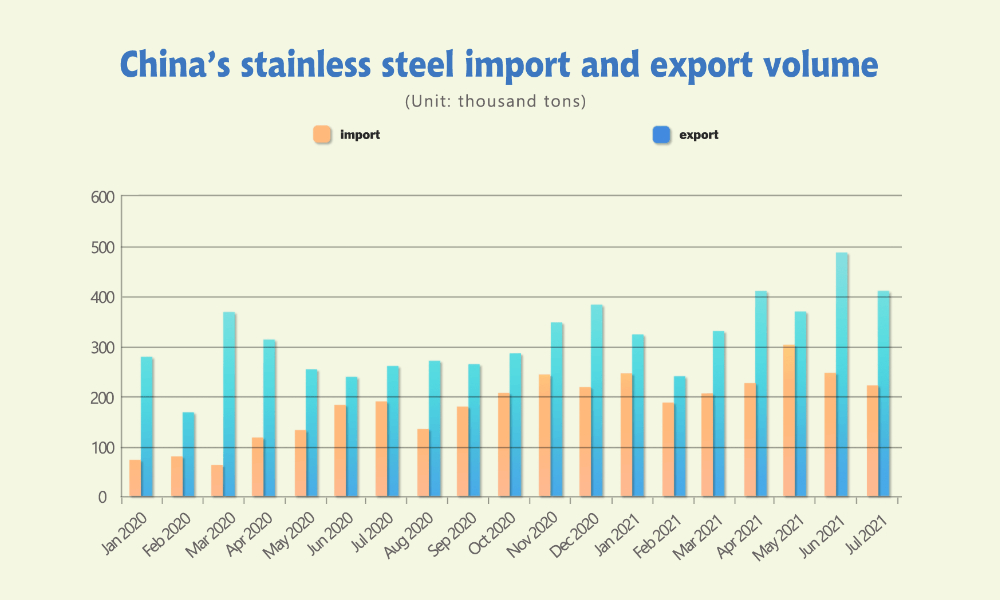

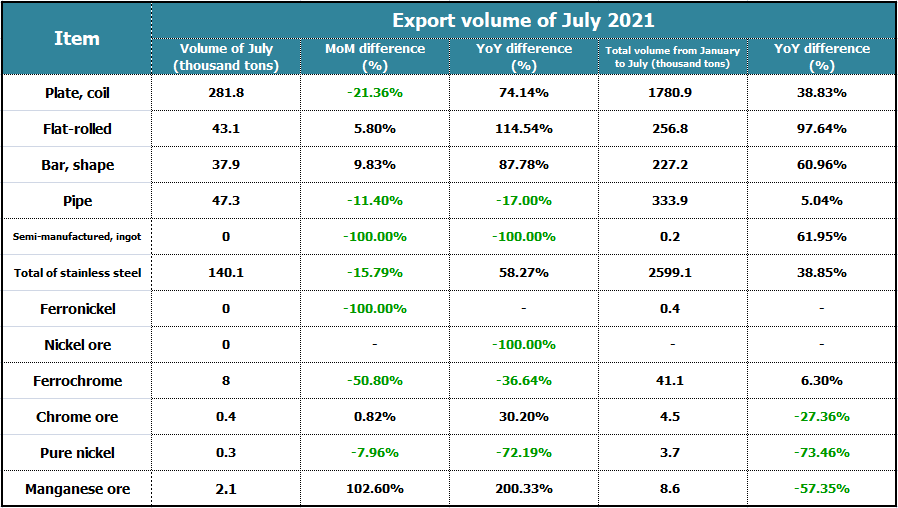

EXPORT|| Both export and import volume reduced compared to June.

The latest custom data about stainless steel in July proved people’s prediction. Both export and import volume reduced compared to June.

1. Stainless steel imports MoM decreased by 9.91% in July

In July 2021, China’s stainless steel imports were 220,600 tons, MoM reducing by 9.91%; YoY increasing by16.18%. The total import volume from January to July was 1.629 million tons, 97.15% more than the same period of last year.

2. Stainless steel exports MoM decreased by 15.79% in July

China's stainless steel exports amounted to 410,100 tons, MoM 15.79% lower and YoY 58.27% higher. The total export volume from January to July was 2,599,100 tons, 38.85% higher than the same period of last year.

Previously, most people believe that stainless steel export data may be reduced under the influence of the epidemic, anti-dumping, and the increase in export costs after the price soaring, and the boom in Indonesian overseas orders. This was confirmed in the July stainless steel imports from Indonesia: In July, domestic stainless steel imports from Indonesia reaches 171,300 tons, MoM reducing by 7.84% and YoY increasing by 21.54%.

Summary:

Before the latest data was published, many of us have predicted that the export volume would decrease. But another sound thought that because of the future export tax imposition, everyone would hurry delivery and the export volume would not drop too much.

However, if the exports did not fall, it might be a force of future tax imposition. As a Chinese exporter, we believe most of our peers and clients share the same mixed feelings about the market.

Stainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in China