Back to work and happy new year. Stainless steel prices last week remained steady and rose a bit as the New Year holiday is approaching and people are stocking up for future work after the new year holiday. As a matter of fact, many downstream manufacturers in China are having their holidays now. Recently, all Chinese have been busy dealing with COVID rather than having the new year vibe. In December, many businesses had to close and what reflects on the data is the slump of PMI in December, which hits a three-year low. It is such a concerning signal. However, experts predict that the low ebb is in the past December as the first tide of infection will soon come to an end and economy will start to recover in January. In the first market insights in 2023, we are going to rewind the key prices in the industry, and have an outlook to the market. Please keep reading the Stainless Steel Market Summary in China.

TREND|| The last-minute growth on the spot price

Stainless steel 201: spot price was featureless.

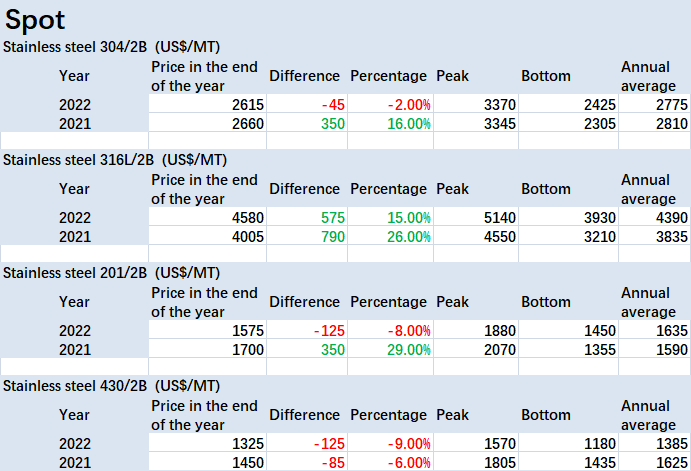

The spot price stabilized last week. The base price of cold rolled stainless steel 201 stabilized at US$1545/MT while cold rolled stainless steel 201J2 remain unchanged at US$1450/MT. The most traded price of hot rolled 5-foot stainless steel rose US$7 to US$1495/MT.

Stainless steel 304: distribution drops but inventory keep going up.

Seemingly the market was preparing for the new year holiday in advance. Last Friday, the most traded base price of both cold-rolled 4-foot stainless steel 304 and hot-rolled stainless steel 304 had a US$15 increase, closed at US$2575/MT and US$2545/MT.

Delong released the settlement price last Friday, hot rolled stainless steel was marked US$2560/MT and cold rolled stainless steel closed at US$2575/MT.

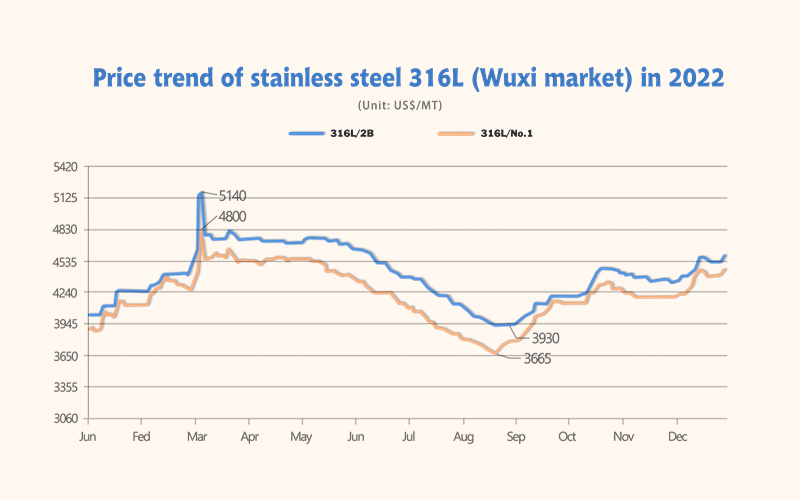

Stainless steel 316L: Bull market in raw material

The material in making stainless steel 316L, ferromolybdenum, just had a dramatic surge in quoted price last month, pumping the price of stainless steel 316L in Wuxi to US$4580/MT(cold rolled) and US$4460/MT (hot rolled). Foshan, another major stainless-steel market, the quoted price recorded US$4520/MT.

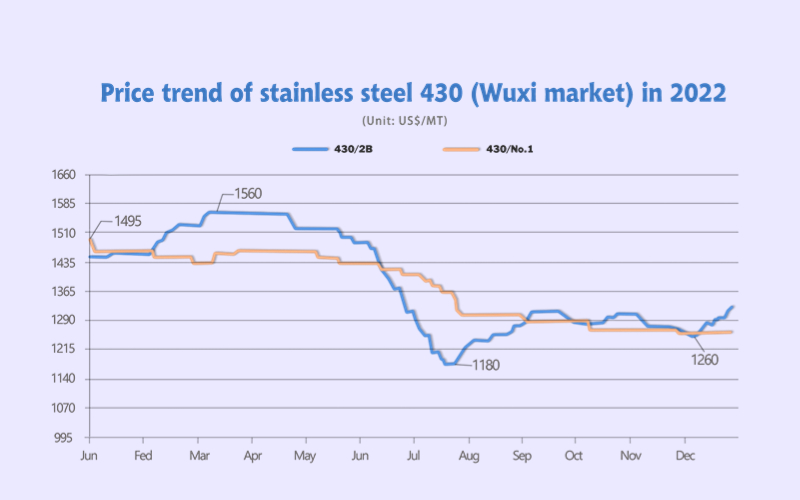

Stainless steel 430: costly input prompting the price to go up

Similar to stainless steel 316L, the price of stainless steel 430 was also affected by the price movement of raw materials last week, and the supply pressure is reduced as the production volume of the stainless steel 400 series dropped.

The tendering-base purchase price of high chromium had a significant increment which sparked the rising price of the stainless steel 400 series. Last Thursday, the most traded price of cold rolled stainless steel 430 was quoted at US$1480 with a US$15 increase from the week before. The guidance price of stainless steel 430/2B touched US$1435/MT.

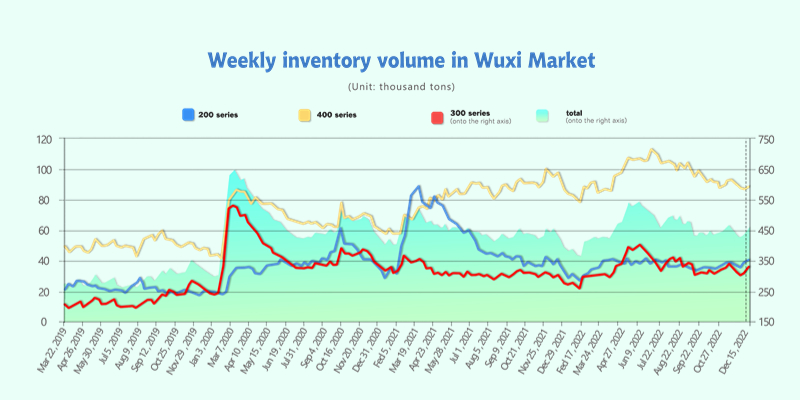

INVENTORY|| Totaling 460,000 tons inventory level rose three weeks in a row

The inventory level at the Wuxi sample warehouse rose by 13,447 tons to 460,615 tons (as of 29th December).

the breakdown is as followed:

200 series: 900 tons up to 40,200 tons

300 Series: 10,819 tons up to 332,147 tons

400 series: 1,728 tons down to 88,268 tons

Stainless steel 200 series: transaction was weakening during last week

The inventory level of the 200 series had gone up for three consecutive weeks, but transaction was growing weakly in the very last week before New Year’s Day. Most of the traders in the market were “panic selling” to fasten the cash inflow as their clients downstream are very likely to take a spring festival holiday early.

Stainless steel 300 series:

The storage service of stainless steel had once brought down by the spiking infection rate of COVID in early December, now it is gradually back to normal. However, the transaction does not seem to be normalized and the inventory is still piling up.

Stainless steel 400 series: downed demand and digestion

The poor demand remained downstream and the digestion of inventory is expected to slow down before the Spring festival.

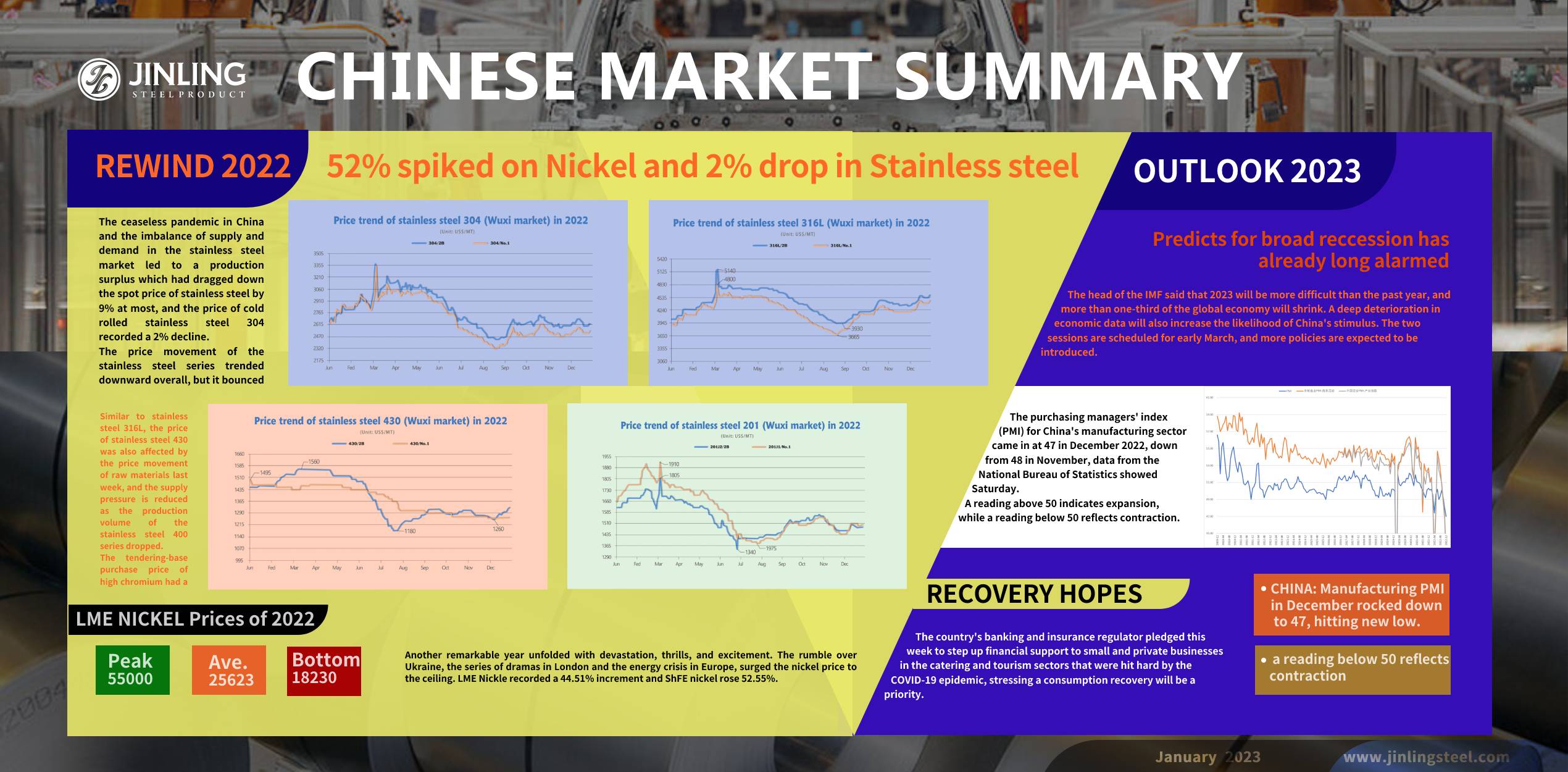

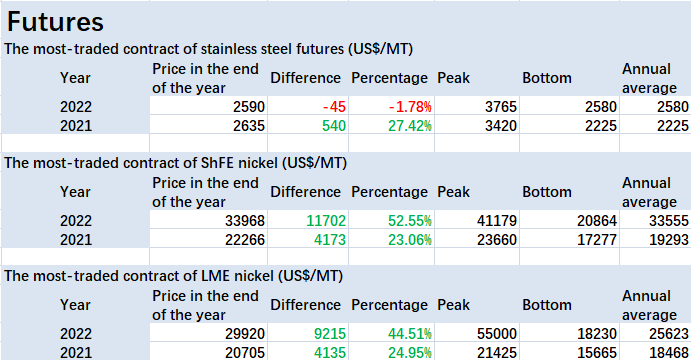

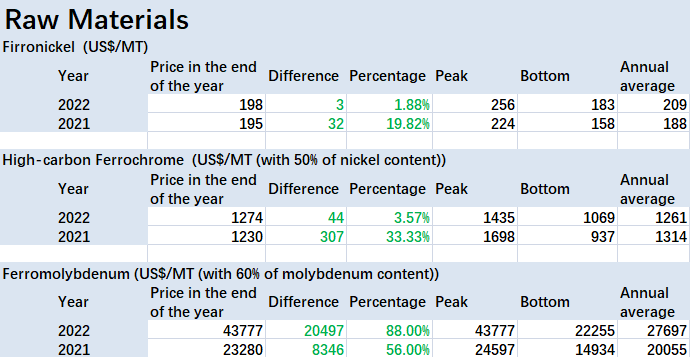

2022 Rewind: 52% spiked on Nickel and 2% drop in Stainless steel

Another remarkable year unfolded with devastation, thrills, and excitement. The rumble over Ukraine, the series of dramas in London and the energy crisis in Europe, surged the nickel price to the ceiling. LME Nickle recorded a 44.51% increment and ShFE nickel rose 52.55%.

The ceaseless pandemic in China and the imbalance of supply and demand in the stainless steel market led to a production surplus which had dragged down the spot price of stainless steel by 9% at most, and the price of cold rolled stainless steel 304 recorded a 2% decline.

The price movement of the stainless steel series trended downward overall, but it bounced back slightly in the second half of 2022 while the highest point landed in the first half.

OUTLOOK 2023|| Economic bottom might have passed as the first tide of infection is to end

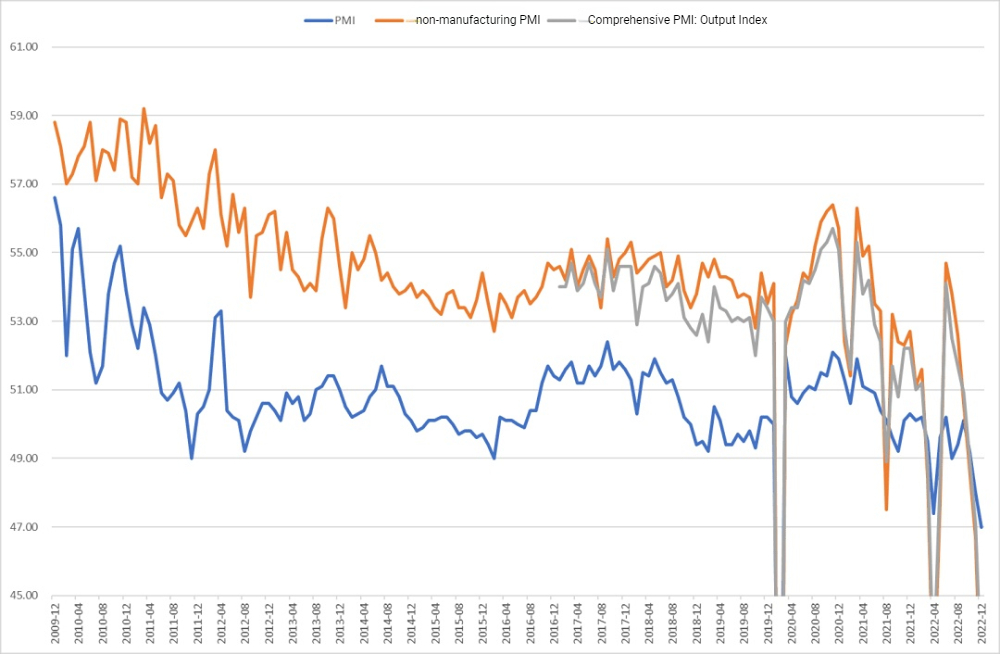

CHINA: Manufacturing PMI in December rocked down to 47, hitting new low.

The purchasing managers' index (PMI) for China's manufacturing sector came in at 47 in December 2022, down from 48 in November, data from the National Bureau of Statistics showed Saturday.

A reading above 50 indicates expansion, while a reading below 50 reflects contraction.

The head of the IMF said that 2023 will be more difficult than the past year, and more than one-third of the global economy will shrink. A deep deterioration in economic data will also increase the likelihood of China's stimulus. The two sessions are scheduled for early March, and more policies are expected to be introduced.

RECOVERY HOPE: More governmental supports and the first tide of infection is closed to the end.

The PMI data for December showed that the impact of the first wave of infection on the economy was greater than that of Shanghai's lockdown in April. The annual report data is expected to be poor. It is necessary to be alert to the risk of pre-loss in the annual report of many companies. However, the wave of infection in economically developed areas will pass after New Year's Day, and the impact of the wave of infection in rural areas during the Spring Festival on the economy will weaken. And this year's Spring Festival started as early as January, and February has already entered the peak season of economic activities. It is expected that there will be a significant rebound in the Q1 quarter of 2023, which means that the bottom of the economy may be in December.

"While (the factory PMI) was lower than expected, it is actually hard for analysts to provide a reasonable forecast given the virus uncertainties over the past month," said Zhou Hao, chief economist at brokerage house Guotai Junan International.

"In general, we believe that the worst for the Chinese economy is behind us, and a strong economic recovery is ahead."

The country's banking and insurance regulator pledged this week to step up financial support to small and private businesses in the catering and tourism sectors that were hit hard by the COVID-19 epidemic, stressing a consumption recovery will be a priority.

The non-manufacturing PMI, which looks at services sector activity, fell to 41.6 from 46.7 in November, the NBS data showed, also marking the lowest reading since February 2020.

"The weeks before Chinese New Year are going to remain challenging for the service sector as people won't want to go out and spend more than necessary for fear of catching an infection," said Mark Williams, Chief Asia Economist at Capital Economics.

"But the outlook should brighten around the time that people return from the Chinese New Year holiday – infections will have dropped back and a large share of people will have recently had COVID and feel they have a degree of immunity."