Trend|| Recovering from output reduction does not equal to mass production.

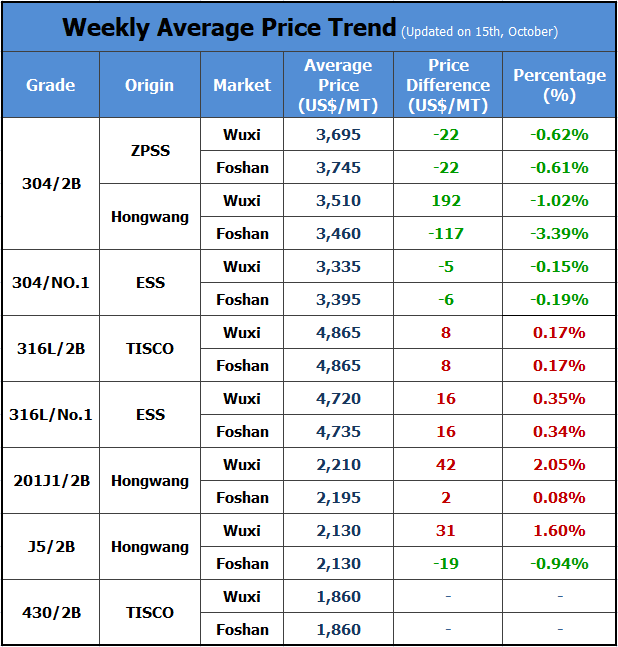

Thanks to the heat trading volumes after the holiday, more products arrived on the market, turning down the market transaction. On October 15th, the main futures contract closed at US$3,415/MT which is US$38/MT higher than the price on October 8th. As for the base price of the private-owned CR 304, the quotation was US$3,435/MT, which dropped by US$47/MT compared to two weeks ago. The price difference between spot and futures narrowed down. Besides, it is reported that a steel mill in Southeast China is getting back to work this week. Before this, all of its production lines were shut down.

300 series: Production limit maintains, bringing up the prices.

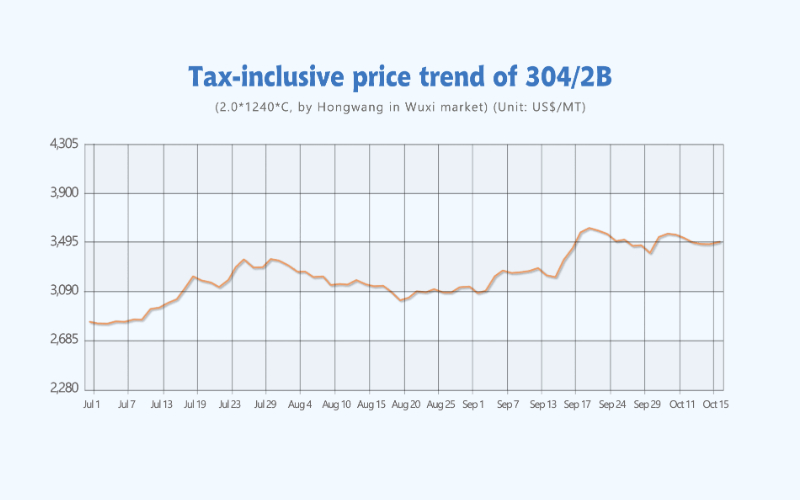

From the perspective of the stainless steel spot market, earlier in the last week, the spot prices dropped as the declining futures prices.Buyers were conservative facing the decreasing trend. However, in the latter part, the prices stopped falling, and people regained their purchasing faith. Overall, the transaction turns better in October compared to last month. On October 18th, the base price of 4-foot CR 304 by the private-owned mills in Wuxi market was quoted at US$3,450/MT which increased by US$15/MT compared to the price on October 15th.

About the futures, until the 15th, the price of the futures contract closed at US$3,415/MT, US$38/MT higher compared to October 8th. The price difference between spot and futures narrowed down to US$93/MT. The contract for October has entered the settlement. For now, the warehouse receipt volume is 15,657 tons and the settlement volume for this time is 13,740 tons. Besides in a short time, it is predicted that the price of nickel will stay high.

As for the inventory, after the holiday, the volume increased a bit. Last week, the total inventory volume in Wuxi sample warehouse increased by 4,900 tons, rising to 438,500 tons. Among, the inventory of 300 series increased by 2,100 tons, reaching 309,600 tons. The productivity of some steel mills has begun to recover thanks to the laxer limit on electric power use. The stainless steel produced during the long National holiday has been delivered to the market. For example, Delong has delivered more than 20,000 tons to Wuxi market. Tsingshan and Beigang New Materials also have resources arriving. But the new arrivals won’t cause burdens to the market inventory because the transaction situation work sufficiently in a short time.

The production limit remains important to steel mills. At the end of September, the production limit was stricter. Guangqing, ZPSS, Baosteel Desheng, Beigang New Material closed all of the production lines. During September, in China, the production volume of 300 series is 1,314,500 tons, MoM reduced by 265,900 tons. Within, the output of the wide plate crude steel MoM fell by 240,000 tons; the strip and billet also decreased slightly. A steel mill located in Southern China has stopped producing since September 6th, which cause a reduction in 300 series production, and this week, it is said that it will return to work.

Shortly, because of the high cost, and tight supply, the prices of stainless steel will remain increasing. However, in a long term, the supply side will improve while the demand side will be restricted and controlled. Be cautious, if you chase for increasing prices in the stock.

200 series: Transaction cools down.

According to the statistic, until mid-October, the inventory of 200 series in Wuxi market is 38,400 tons. Influenced by the new arrivals after the holiday, compared to late September, the market inventory reduced by 18,500 tons, lowering to 123,200 tons. Last week, the price of 200 series in Wuxi market maintained high. Until October 15th, Friday, the base price of the mill-edge CR 201J2 in Wuxi market was quoted at US$2,090/MT which was US$55/MT higher than two weeks before. For now, the price difference between CR and HR is as high as US$170/MT.

However, still affected the dual control policy, some downstream manufacturers have to produce and work at different times of the day. What’s worst, because of the expensive raw material cost, the transaction slows down. In a short time, influenced by dual control, environmental inspection and other irresistible reasons, steel mills are carrying out their reduction plan in production. The prices keep increasing. Some steel mills have recovered from shut down, but high furnaces like Guangqing are still closed down. The reason is that a high furnace consumes much power and energy, and thus the production is still limited. The prices of 200 series will increase. But downstream buyers are now tired of such high prices, it is believed that the price might go down this week.

400 series: The price of 430 might be tuned down.

The good news for 400 series is that the high chrome cost reduces, thanks to the power shortage is coming to an end in the main production areas. The future production will increase, typically the output in Inner Mongolia will regain the most. However, in the southwest of Inner Mongolia, Tsinghai Province has started electric power rationing since October 10th, resulting in a large decrease of high chrome production in the local factories.

From the perspective of supply, TISCO, Tsingshan Fujian and other steel mills have plans for a large-scale reduction in output. The supply for 400 series will tighten up. But the inventory volume, for now, is still high, at around 90,500 tons. Traders tell that the trading volume was better after the holiday, but it fails to maintain.

After the holiday, the prices of 400 series once increased, but it soon went down to the prices before the holiday. The cost of ferrochrome keeps reducing, which is influenced by the low purchasing prices given by the steel mills. Moreover, the output of high chrome is recovering in Inner Mongolia.

Summary:

300 series: Some steel mills recover from the dual controls, while some begin to carry it out. It is predicted that the reduction in the previous day will present in the market recently. The inventory maintains low in a short time and the prices will remain high and fluctuate.

200 series: The prices of 200 series have increasing tendency due to the production being limited by the shutdown of high furnaces which are energy-oriented processes. But downstream buyers are now tired of such high prices, it is believed that the price might go down this week.

400 series: Considering the output reduction in October, it is predicted that the price of 430/2B will remain stable, at around US$1,830/MT~US$1,845/MT.

Production|| About the production of stainless steel flat products in September and October.

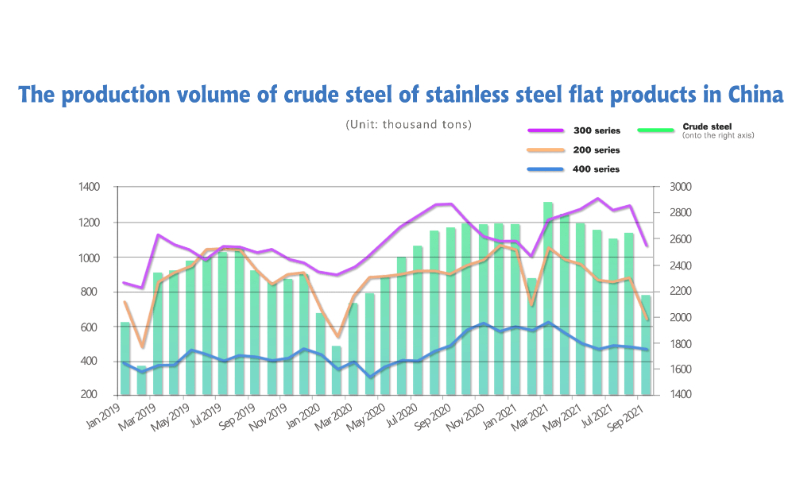

In September 2021, China’s production of stainless steel flat products and crude steel was 2,167,300 tons, MoM decreasing by 480,000 tons, 18% lower.

According to statistics, in September 2021, China’s stainless steel enterprises above the designated size produced 2,167,300 tons of flat steel crude steel, reducing by 481,800 tons, 18.19% compared to August, and YoY decreasing by 518,200 tons, 19.3%. The reduction is mainly due to the low production of 200 series and 300 series.

In details:

The 200 series fell by 233,600 tons (a decrease of 26.69%) from the previous month to 641,700 tons, YoY decreasing by 258,000 tons, 28.68%.

The 300 series dropped by 230,300 tons (a decrease of 17.8%) from the previous month to 1,063,500 tons; 239,800 tons lower than the same period of last year, which is 18.4% less.

The 400 series decreased by 17,900 tons (down by 3.72%) from the previous month to 462,100 tons; YoY decreasing by 20,400 tons, 4.23%.

In October 2021, the domestic planned volume of stainless steel flat products is about 2.14 million tons, down by 1.26% from the previous month.

In October, the planned volume of Chinese stainless steel flat products is about 2.14 million tons, 27,300 tons lower from the previous month, decreasing by 1.26%; and YoY fall by 585,700 tons, 21.49%:

The 200 series will increase by 9,800 tons, 1.53% from the previous month, reaching 651,500 tons, and YoY decreasing by 295,600 tons, 31.21% lower.

The 300 series will increase by 19,500 tons from the previous month, closing to 1.083 million tons, increasing by 1.83%, and YoY decreasing by 127,000 tons, 10.5% less from the same period of last year.

The 400 series will drop by 56,600 tons, 1.25% less from the previous month, reducing to 405,500 tons; YoY decreasing by 163,000 tons, cutting down 28.67%.

In the rest days of 2021, the output of the steel industry has to continue to reduce by at least 1.5 million tons.

Entering September, due to the shortage of power supply in various provinces and cities, many steel mills were subject to dual control, and several large-scale production enterprises stopped production at the end of September. After the National holiday, the companies that had previously stopped production gradually resume production, but some steel mills still have to reduce production after they return to normal work. The frequent policy changes keep challenging the sensitive nerves of the steel market.

In the first three quarters of 2021, China's stainless steel crude steel output was 27.21 million tons, which is 2.69 million tons, 11% over the same period of last year. If this year is to maintain the same output as last year, the crude steel production will still have to reduce by 2.69 million tons in the 4th quarter. Considering that some giant steel mills like TISCO and JISCO can sacrifice the production quotation of carbon steel to produce stainless steel, in the 4th quarter, it is reasonable that the output shall be reduced by 1.5 million tons.

People should pay more attention to the reduction policy. If it is right to reduce by 1.5 million tons of production, on average, the production should decrease by 500,000 tons every month in the 4th quarter. According to the calculation, the average crude steel output is 2.6 million tons every month from October to December, which is higher than the 2.52 million tons in September. From this angle, the limit in production will be relieved a bit.

However, rumor has it that some local governments require the goal should be completed in advance before November. It means that the time will be shortened to 2 months. At the moment, the reduction will be 750,000 tons respectively in October and November. In this situation, the stress over output reduction will become heavier than in September. It is necessary to focus on the downstream manufacturers as well. They will be greatly affected and even stop producing because of the shortage of power supply. On September 29, relevant departments responded to the issue of energy supply in winter and spring. In order to ensure a stable supply of heating coal, they will resolutely curb unreasonable demand in high-energy-consuming projects and promote coal saving and coal restriction.

Generally, because the steel industry has to remain the output same as last year, whenever the goal shall be completed, the tight supply won’t change in a short time. Because of the shortage of coal and electricity power, in the future, the electricity use limit will remain in the energy-oriented enterprises. The production schedule of steel mills will suffer from the policy. We predict that the tight supply will keep raising the stainless steel high.

RAW MATERIALS|| China’s high nickel-iron MoM drops by 115,400 tons, and the drop will extend to October.

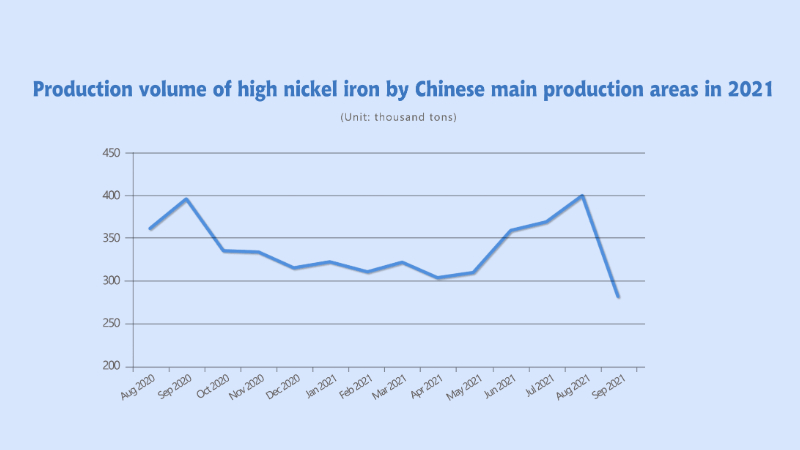

The rising spot price of stainless steel boosts the ferronickel market. In September, the ex-factory price of high-ferronickel increased by US$5/nickel, and the average ex-factory price has reached US$232/nickel so far.

Dual control disturb the regular production:

Affected by the increasing price, ferronickel plants have been proactively producing. However, the dual control has disrupted the regular production of steel mills, resulting in a significant decline in the output of ferronickel.

In September 2021, the overall output of high-ferronickel produced by Chinese major ferronickel manufacturers and steel mills totaled approximately 282,100 tons, dropping by 115,400 tons from the previous month.

From the perspective of different production areas, Inner Mongolia continued to increase the capacity, and the output increased significantly this month; the output in Shandong decreased slightly; the impact of dual control in Jiangsu and Liaoning provinces was severe, and the output of high-nickel iron decreased significantly. In other regions, the production has also dropped significantly. In September, steel mills' self-produced ferronickel output also fell sharply.

There were also sudden power outages abroad, and the supply of nickel and iron was tightened.

It is reported that the second phase of the ferronickel project of a steel mill in Indonesia caused the shutdown of some ferronickel production lines due to the malfunction of the power plant in September.

However, due to the recent decline in both supply and demand in the high-nickel iron market, the transaction price can hardly increase.

A steel mill purchased a batch of high-nickel iron raw materials in the Chinese market last week, at about US$230/nickel (tax inclusive, deliver to the factory).

And another steel mill also purchased from the Chinese market. The purchase price was US$232/nickel (tax inclusive, deliver to the factory in cash), which was about US$2 higher than the purchase price last week.

The dual control is continuing. At the end of October, the Philippines will enter the long rainy season. Factories are actively preparing for ore backup. However, influenced by the rainy season, the import volume of nickel ore will drop sharply, and the cost will gradually rise. In the fourth quarter, steel mills are expected to reduce production significantly. To guarantee profits, ferronickel factories may reduce their output. It is expected that the output of high ferronickel in October may decline slightly.

In the global market, overseas inventories continued to decline significantly. LME nickel inventory falls to 146,000 tons. In terms of macroeconomics, the United States has relatively high inflationary pressures but the economic data shows weak. The financial policy will maintain loose in the short term, causing the US dollar index to fall, weakening the impact of the previous reduction in debt purchase.

To sum up, the supply and demand of nickel and ferronickel continue to be weak. The power shortage has been conveyed to the raw material suppliers, and the price has begun to rise. As for pure nickel, overseas inventory volume continues to fall, and prices may still go up to new highs.

On the 18th, the mainstream ex-factory quotations of high-nickel iron rose sharply to around US$236/nickel, which was US$3/nickel higher compared to last weekend.

Judging from the price trend of stainless steel in the past month, the prices maintain high and fluctuate. Facing the dual control policy, the supply of stainless steel in the future will still be tight, and the large fluctuations in raw material prices will also affect the stainless steel market.

Stainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in China