Heard that some of you are having a holiday already?! If that is so the market is legitimately getting more quite. Last week, stainless steel prices remained weak. On December 8th, Wednesday, both spot and futures prices hit record-low prices. The new pricing scheme for Indonesian nickel failed to provide consistent support to the market. The value of raw materials did not recover. The price of ferronickel might run down to US$127/Ni. In the short term, the stainless steel prices will tend to remain at the bottom. From the perspective of production and inventory, in November, steel mills reducced by about 300,000 tons of production. But in December, as steel mills are back from maintenance, the overall production will increase to 3,100,000 tons and it is predicted that the output of the 400 series will expand by 50,000 tons to around 560,000 tons. Is tomorrow a better day? At least we hope it will be a better day after the holiday! For more information on the industry, please keep reading the Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,110 | -28 | -1.40% |

| Foshan | 2,150 | -28 | -1.37% | ||

| Hongwang | Wuxi | 2,030 | -37 | -1.88% | |

| Foshan | 2,025 | -39 | -2.03% | ||

| 304/NO.1 | ESS | Wuxi | 1,930 | -32 | -1.76% |

| Foshan | 1,955 | -35 | -1.88% | ||

| 316L/2B | TISCO | Wuxi | 3,505 | 11 | 0.33% |

| Foshan | 3,585 | -14 | -0.41% | ||

| 316L/NO.1 | ESS | Wuxi | 3,400 | 65 | 2.02% |

| Foshan | 3,380 | -3 | -0.09% | ||

| 201J1/2B | Hongwang | Wuxi | 1,360 | -6 | -0.45% |

| Foshan | 1,355 | -6 | -0.45% | ||

| J5/2B | Hongwang | Wuxi | 1,260 | -6 | -0.49% |

| Foshan | 1,270 | -10 | -0.85% | ||

| 430/2B | TISCO | Wuxi | 1,270 | -4 | -0.36% |

| Foshan | 1,260 | 0 | 0.00% |

TREND|| New pricing mechanism in Nickel has proven false alarm.

Last week, the spot price of stainless steel in the Wuxi market gained what it had lost in early weeks: the price trend shaped a “fishhook structure” affected by the overall bearish market sentiment. Until last Friday, the most traded contract price of stainless steel fell by US$38.8/MT to US$2005/MT.

Stainless steel 300 series: Silver lining in the downbeat days.

The misfortune of stainless steel price came doubly last week, the market price of stainless steel 304 sank to the bottom, again, after the bearish trend in the previous week. Until Friday, the mainstream base price of cold-rolled 4-foot stainless steel 304 closed at US$1970/MT with a US$64/MT fall, and the hot-rolled stainless steel 304 dropped by US$49/MT to US$1920/MT.

The new pricing mechanism for nickel seemingly failed to lift the price of nickel up since it just recorded a new low last week, but a decent spot transaction was recorded during the week.

Stainless steel 200 series: Seesawing at the bottom for the rebound.

The spot prices of stainless steel 201 were mostly walking on a downslope last week: the mainstream base price of cold-rolled stainless steel 201J1 and 201J2/J5 fell US$7/MT to US$1330/MT and US$1230/MT, hot-rolled 5-foot stainless steel also recorded a US7/MT decrease to US$1280/MT.

The price of stainless steel 201 had a smooth start at the beginning of last week and hovered around US$1265/MT until 4th December. However, the slump in future price and price of stainless steel 304 forced stainless steel 201 to follow suit last Tuesday with the lowest price reported as US$1230/MT.

Stainless steel 400 series: supply pressure up, demand remained weak.

TISCO and JISCO remained steady on their market guidance price of stainless steel 430/2B at US$1445/MT and US$1550/MT respectively.

Ningbo Baoxin remained open for negotiations of the EXW price of cold-rolled stainless steel 304, while they quoted cold-rolled stainless steel 430 for US$1595/MT with a US$28/MT drop.

The quoted price of cold-rolled stainless steel 430 in the Wuxi market was weakening at US$1270/MT with a US$7/MT fall; the hot-rolled stainless steel 430 remained flat at US$1135/MT.

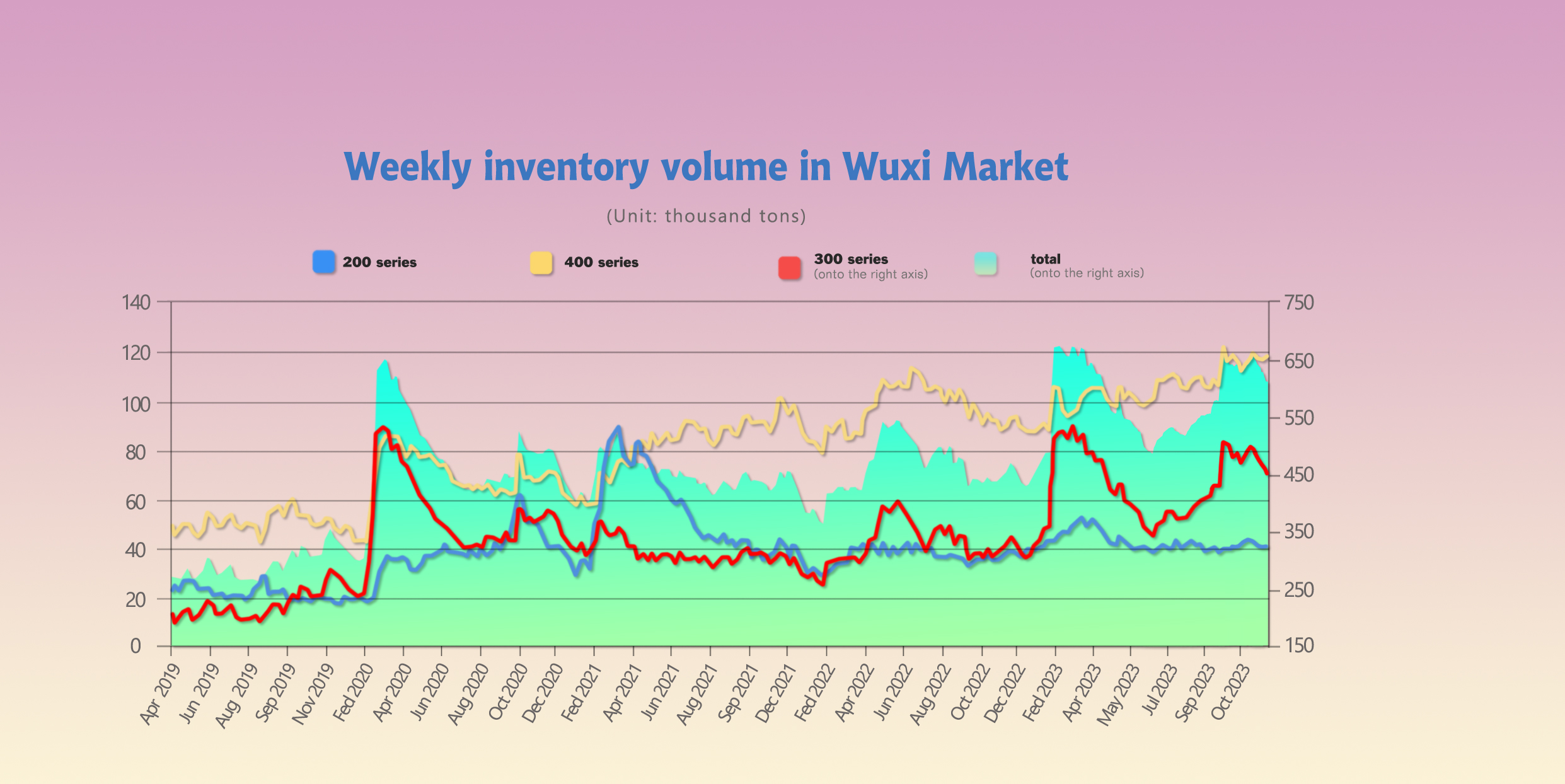

INVENTORY|| Downscaled output in 300 series led to a successful destocking.

The total inventory at the Wuxi sample warehouse downed by 13,939 tons to 608,294 tons (as of 7th December).

the breakdown is as followed:

200 series: 269 tons down to 39,649 tons

300 Series: 14,712 tons down to 451,414 tons

400 series: 1,042 tons up to 117,231 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| November 30th | 39,918 | 466,126 | 116,189 | 622,233 |

| December 7th | 39,649 | 451,414 | 117,231 | 608,294 |

| Difference | -269 | -14,712 | 1,042 | -13,939 |

Stainless steel 300 series: Destocking continues.

During this inventory cycle, The spot price continued to hit rock bottom. Within this inventory period. The prices of futures and spot goods fluctuated and explored new lows for the year, with robust transactions on some working days but generally average for most days. The earlier price rebound led to "hot" transactions, but recently there has been a gradual destocking. This has resulted in destocking in both upstream steel mill inventories and the inventories of many traders. According to statistics, in the fourth quarter, steel mills in the 300 series have maintained reduced production levels, with monthly output fluctuating around 1.55 million tons, a decrease of 200,000 tons compared to production in August and September. This reduction in production may contribute to maintaining destocking trends.

Stainless steel 200 series: Significant decrease in hot-rolled inventory.

The resources of the 200 series arrived at the warehouse regularly. Influenced by the bearish market sentiment and the approaching of the year-end, most of the downstream producers of stainless steel had already taken a holiday early.

Stainless steel 400 series: Weak demand is setting a hurdle for destocking.

It is understood that some of the specifications of the hot-rolled 400 series were in shortage, while the cold-rolled resources stacked up little. Some of the traders undersold products to reduce the inventory level. Hence, hot-rolled stainless steel 430 was quoted differently in the market last week, some of the specifications in shortage rose slightly by US$7/MT. Meanwhile, the supply was narrowed in November, the demand had no sign of rebound.

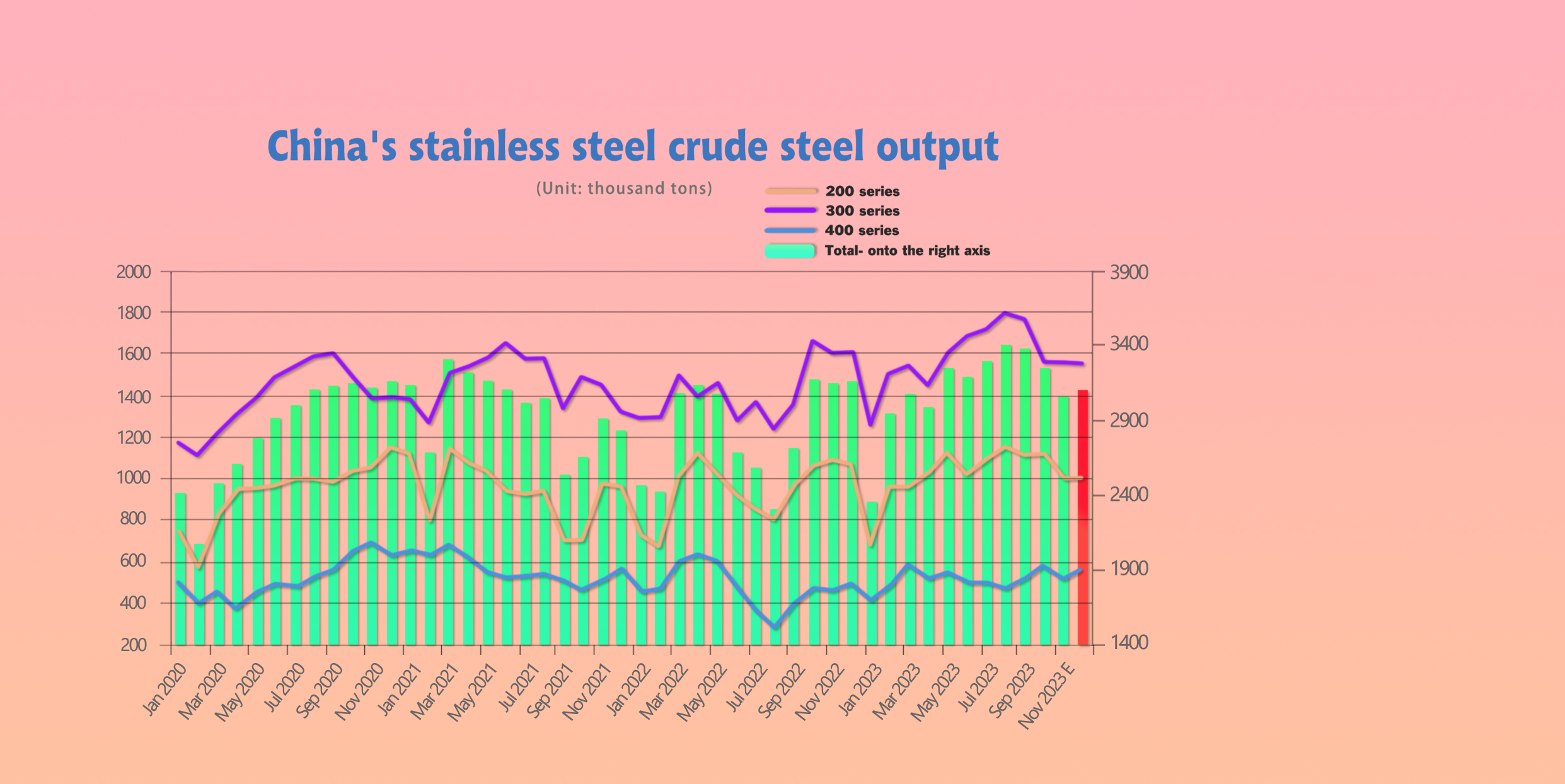

Production: Output recovered in December.

Production in November shrank greatly, making a 300,000 difference from the peak this year in aid of the destocking. It is expected that the total stainless steel production in December will be around 3.1 million tons.

The oversupply in ferronickel and the slumping stainless steel price had not only brought down the price of ferronickel, but also the mining cost of the raw material.

RAW Material|| Nickel future dived 45% since the start of 2023

Nickel: High ferronickel hit the new low

The mainstream EXW price of Chinese high-carbon ferronickel was quoted as US$240/Nickel point, reaching its lowest position since 2020 alongside with stainless steel, The steel mills once again had to swallow a biter fruit of the sales loss.

Nickel's Rollercoaster Ride: Prices Plummet 45%, but Electric Vehicle Boom Sparks Hope for a 2024 Rebound

According to Kedia Advisory, Nickel futures witness a staggering 45% drop since the year's inception, driven by oversupply from major producers and global economic slowdown. Despite this, optimism for 2024 emerges as the electric vehicle industry's growing appetite for nickel and a stainless-steel sector revival promise a potential turnaround.

Nickel Price Decline: Nickel futures have experienced a significant decline, reaching around $16,500/MT. This marks a 45% decrease since the beginning of 2023.

Supply Surpassing Demand: The International Nickel Study Group forecasts that nickel supply will exceed demand by 223,000 metric tons in 2023, following a surplus of 104,000 metric tons in 2022. The surplus is expected to widen further to 239,000 metric tons in 2024.

Leading Producers and Supply Dynamics: The decline in nickel prices is attributed to robust supply from major producers, namely Indonesia and China. This oversupply situation is influenced by factors such as a global economic slowdown and a fragile recovery in China.

Global Economic Conditions: Subdued use of nickel is noted due to a global economic slowdown, with specific emphasis on the fragile recovery in China. Moody's recent credit rating cut for China adds to the challenges faced by the nickel market.

Hopes for 2024: Despite the current challenges, there is optimism for 2024, with hopes of stronger demand (projected at 3.47 million tons compared to 3.20 million in 2023). This optimism is linked to the increasing usage of nickel in electric vehicle batteries and the revival of the stainless-steel sector.

Electric Vehicle Batteries: The anticipated growth in demand for nickel is associated with its increased usage in electric vehicle batteries, reflecting the ongoing trend toward electric vehicles in the automotive industry.

Stainless-Steel Sector Revival: The revival of the stainless-steel sector is mentioned as a contributing factor to the expected increase in nickel demand in 2024.

Factors Affecting China's Recovery: The fragile recovery of China is highlighted as a key factor influencing the current state of the nickel market, with potential impacts on both supply and demand dynamics.

Credit Rating Cut by Moody's: The recent cut in China's credit rating by Moody's is cited as a factor contributing to the challenges faced by the nickel market.

Long-Term Outlook: Despite the current downturn, there is an indication that the nickel market may experience some relief in prices due to expectations of stronger demand in the future, especially driven by the electric vehicle industry and stainless-steel sector.

Summary:It’s harder to solve the imbalanced supply-demand than the Gordian Knot.

Stainless steel prices experienced a significant dive last week, with a sharp drop in prices at the beginning of last week.

Downstream demand has not shown a significant improvement. Social inventories have seen some reduction in relieving pressure on steel mills. However, recent procurement of raw materials and increased production by steel mills could lead to significant pressure on future arrivals, contributing to a mismatch between supply and demand that is difficult to alleviate. It is expected that the subsequent developments will depend on steel mill policies, production plans, and inventory destocking.

In the 300 series: Approaching the end of the year, the market's sentiment is turning prudent. Despite there was a rebound in futures prices due to a reduction in costs, spot prices have been relatively weak. Steel mills are maintaining reduced production levels in November and December, and inventory may continue to destock. Short-term prices are expected to remain in a fluctuating and exploratory bottoming trend.

In the 200 series: Last week, prices in the 201 market primarily declined. However, overall, the inventory of 201 continues to decrease. Traders believe that the current prices are in the bottom range, and the market will likely experience fluctuation and bottoming.

In the 400 series: Quotations in the main raw material, high-chromium market, show signs of stabilization. Last week, the quoted price for 430 cold-rolled products decreased by US$7/MT, indicating an active destocking phase. With increased production planned by steel mills in December, the supply is very likely to rise. Hence, market spot inventories remain high, and purchases are mainly driven by immediate needs. The forecast for the 430 cold-rolled market suggests weak stability in prices.

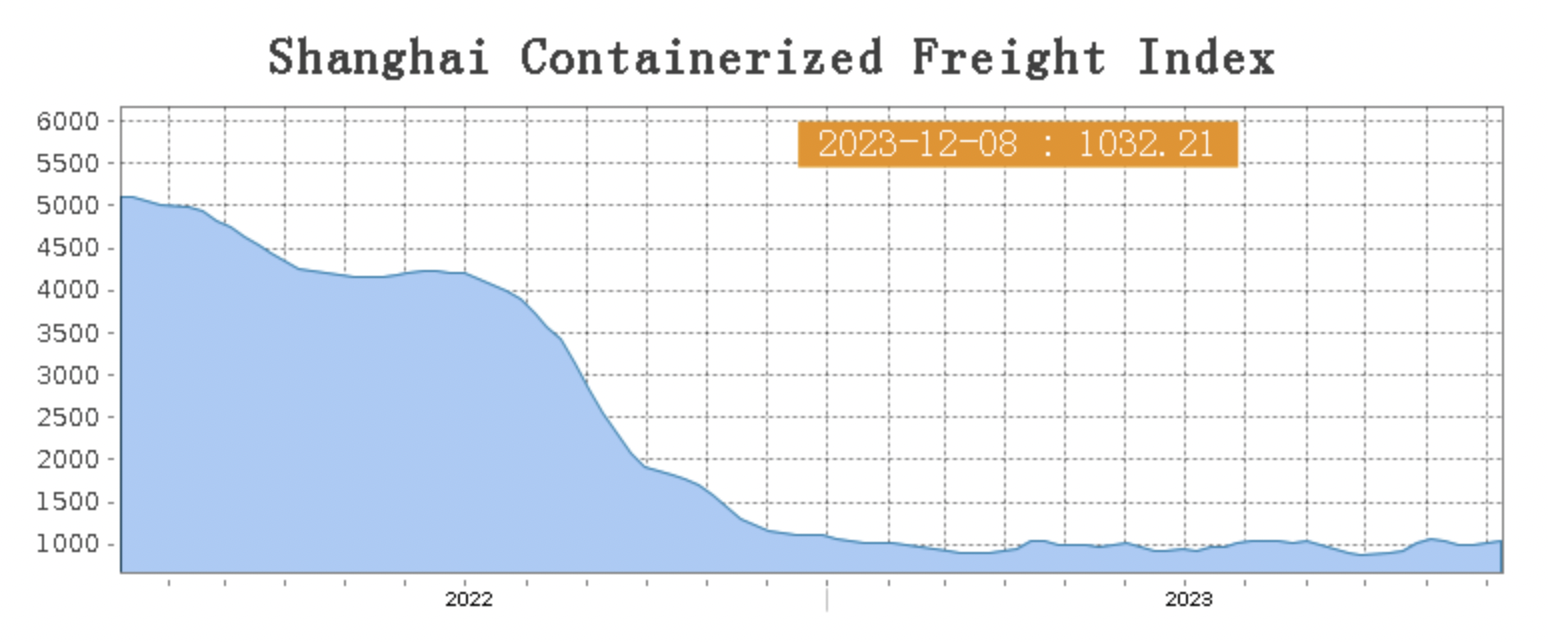

Sea Freight|| Mixed results on multiple freight shipping routes.

China’s Containerized Freight market was overall stabilized, On 8th December, the Shanghai Containerized Freight Index rose by 2.1% to 1032.21.

Europe/ Mediterranean:

The seasonally adjusted HCOB Eurozone Composite PMI Output Index, recorded a sub-50.0 reading for a sixth successive month in November, signaling another month-on-month reduction in private sector output levels across the eurozone. While the latest reading of 47.6 was up from October’s 35-month low of 46.5 and the highest since July, it was still indicative of a solid deterioration in economic conditions.

The demand of European freight shipping line was stabilized, thefreight rate continued to jump.

Until 8th December, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$925/TEU, which rose by 8.7%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1387/TEU, which lifted by 10.1%

North America:

Until 8th December, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1669/FEU and US$2441/FEU, reporting a 1.4% growth and 0.2% decline accordingly.

The Persian Gulf and the Red Sea:

Until 8th December, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf lifted by 0.3% from last week's posted US$1156/TEU.

Australia/ New Zealand:

Until 8th December, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$915/TEU, a 0.5% drop from the previous week.

South America:

On 8th December, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2483/TEU, an 3.7% reduction from the previous week.