It seems that the bank giants are sliding into a crisis, which raises panic in the world economy. The stainless steel market also gets stuck in a miserable situation. All the weekly average prices of major grades of stainless steel fell and meanwhile, the inventory and future output both increases according to the survey. Although the raw material cost has to reduce because the demand is too weak, the drop in stainless steel price is way faster than the decrement in cost. As the stainless steel prices drop further, it just gives reason for the downstream manufacturers to hold their purchase plans, pushing the market to a more tepid circumstance. Chinese export volume from January to February YoY decreased, but it is a common risk confronted by most of the major economic entities. The global trading volume declines. The continuously downward sea freight can be a strong witness of it. To some Chinese exporters, one good news might count to Brazil's "ZERO TARIFF" on steel and aluminum materials. If you want to get the whole content of the market, just keep reading the Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,675 | -24 | -0.92% |

| Foshan | 2,720 | -24 | -0.90% | ||

| Hongwang | Wuxi | 2,580 | -35 | -1.42% | |

| Foshan | 2,570 | -44 | -1.78% | ||

| 304/NO.1 | ESS | Wuxi | 2,530 | -29 | -1.21% |

| Foshan | 2,550 | -40 | -1.61% | ||

| 316L/2B | TISCO | Wuxi | 4,985 | -38 | -0.79% |

| Foshan | 5,055 | -62 | -1.24% | ||

| 316L/NO.1 | ESS | Wuxi | 4,765 | -77 | -1.63% |

| Foshan | 4,795 | -77 | -1.62% | ||

| 201J1/2B | Hongwang | Wuxi | 1,575 | -4 | -0.30% |

| Foshan | 1,545 | -12 | -0.82% | ||

| J5/2B | Hongwang | Wuxi | 1,470 | -10 | -0.76% |

| Foshan | 1,475 | -10 | -0.75% | ||

| 430/2B | TISCO | Wuxi | 1,345 | -28 | -0.23% |

| Foshan | 1,340 | -28 | -0.24% |

TREND|| One present in price drop, 100% of dead stock.

The spot price of stainless steel performed poor last week.Stainless steel 201 was fluctuated, 304 and 430 was weak and trended down. The most traded contracted price fell by US$88 to US$2450/MT.

Stainless steel 300 Series: Miserable downfall

This week, the market prices have been running weakly. As of Friday, the mainstream base price for cold-rolled 4-foot mill-edge stainless steel 304 in the Wuxi area was reported at US$2505/MT, and the private hot-rolled price was reported at US$2500/MT, both down US$44/MT from last week. Stainless steel goods arrived in the market during the week, but with the declining future price, the transaction of warehouse receipt had a sound performance, while spot transactions were weak, and inventory remained high. A major steel mill in East China reportedly has started maintenance on its steelmaking production line, which is expected to result in reduced production until mid-to-late March, with an estimated daily output reduction of 2,600 tons, mainly for stainless steel 304. The reduction in production by steel mills has forced a decline in raw material prices, causing a resonance in the weakening of nickel-iron and stainless-steel prices.

Stainless steel 200 series: Rallied against the gloomy market.

200 series was sharing the same market performance as what 300 series. The most traded base price of cold-rolled stainless steel 201 and 201J2 held still at the level of US$1540/MT and US$1435/MT accordingly, while the hot-rolled 5-foot stainless steel fell US$7 to US$1495/MT.

Stainless steel 400 series: Price drop to trade with a better sale, hopefully.

TISCO dropped the guidance price of stainless steel 430/2B by US$7 to US$1510/MT, while JISCO remain unchanged at US$1535/MT.

The quoted price of 430/2B at the Wuxi market, however, had a steep drop to US$1335/MT with a US$44 decrease.

The EXW price of high chrome remained stable at US$1475/MT(With 50% chromium), and the spot price of coke rose slightly.

Baoxin (Ningbo) announced the EXW price of cold-rolled stainless steel products in March:

Cold-rolled stainless steel 430: US$1695/MT, a US$29 raise.

Cold-rolled stainless steel 304: Orders negotiated separately.

Summary:

Stainless steel 300 series: The downstream user is feeling less pressure to make purchases despite the storage of stainless steel 300 series being abundant. This is an obvious signal of a weak trend in stainless steel prices. However, it's important to note that the price of raw materials isn't dropping as quickly as the price of stainless steel, which is putting many steel mills in a difficult financial situation. As a result, they were producing less motivated steel production.

Stainless steel 200 series: The market for 200 series stainless steel in Wuxi has been fluctuating this week. the price of stainless steel 304 had a promising start at the beginning of last week then unexpectedly dropped, and this caused the price of 201 stainless steel to also decrease and made the buyers in the downstream more cautious.

Stainless steel 400 series: The prices for high-grade chrome have remained stable, and the price of chromium ore has gone up slightly. However, the price of 430/2B stainless steel in the Wuxi market has fallen by US$44, which is a significant drop. This is largely due to the sluggish market transactions, which have led to the spike in inventory. The price of stainless steel 430/2B is unlikely to fall significantly as the production cost is remaining high.

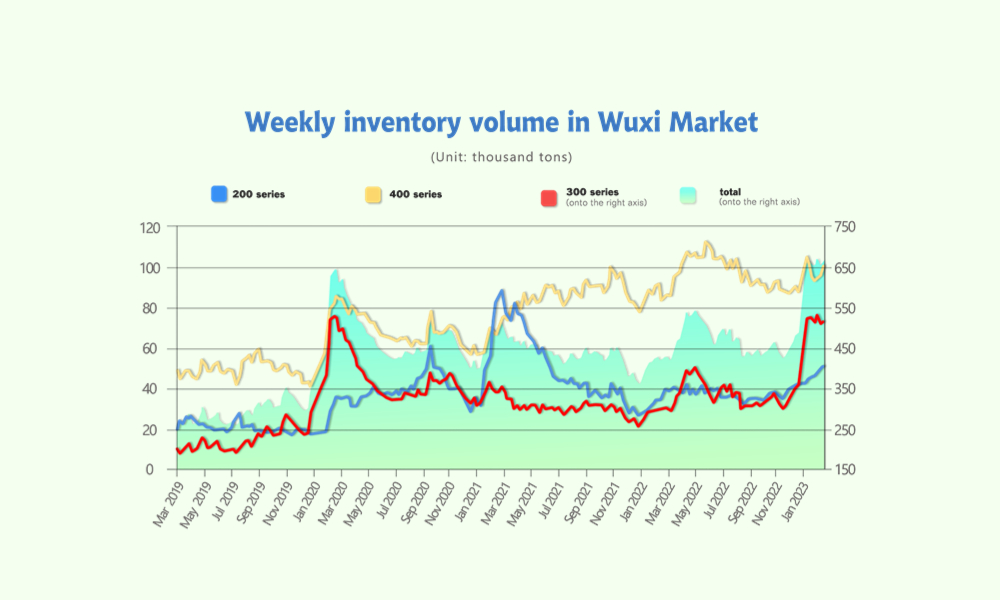

INVENTORY || Another 14,000 tons topped up to the inventory.

The inventory level at the Wuxi sample warehouse rose by 14,000 tons to 664,803 tons (as of 9th March).

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| March 3rd | 49,310 | 506,043 | 95,450 | 650,803 |

| March 9th | 51,160 | 513,743 | 99,900 | 664,803 |

| Difference | 1,850 | 7,700 | 4,450 | 14,000 |

the breakdown is as followed:

200 series: 1,850 tons up to 51,160 tons

300 Series: 7,700 tons up to 513,743 tons

400 series: 4,450 tons up to 99,900 tons

Stainless steel 300 series: Low price but no one seem to bother

The down-falling spot price had stimulated the transaction for a short while last week. However, the increment in inventory was still outpacing the consumption last week, making the storage level go up continuously.

Stainless steel 200 series: The accumulation continues.

The weak transaction slowed the inventory consumption down last week. But look it on the bright side, there is no shortage of any specification of the 200 series in the market, and no rain check is needed to be issued.

Stainless steel 400 series: Still no sign of overturn

There was no bright spot for the 400 series last week as the inventory level was still upward going, and the price on the other hand had dipped down but the high production cost prevented it from further sinking.

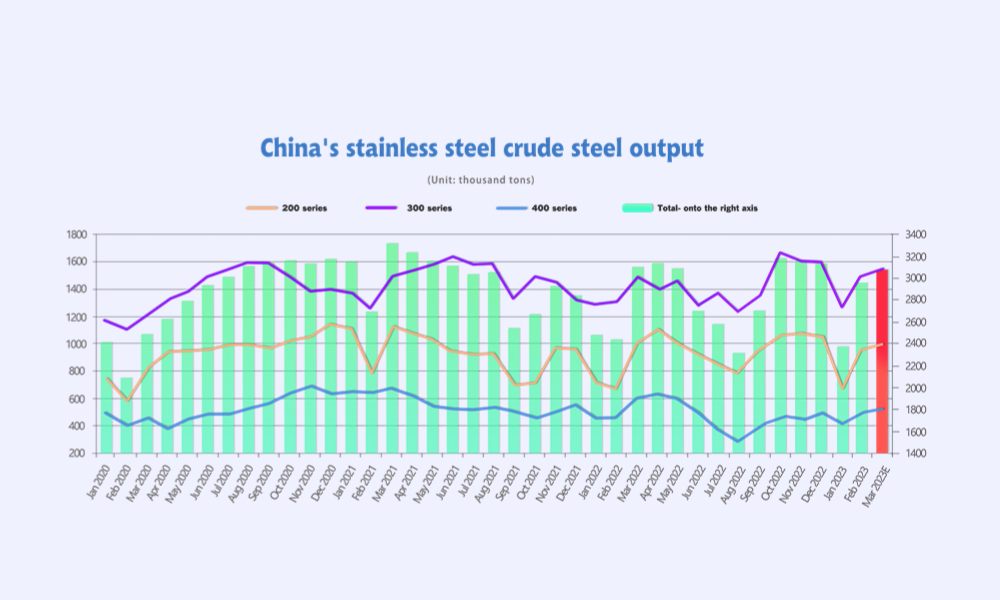

Production: Crude steel marked 600,000 tons of production

The production of crude stainless steel in February recorded 2,954,600 tons, 593,800 tons (25.15%) more than January, 528,100 tons (21.76%) increment compared to the same period last year.

Here is the breakdown:

Stainless steel Series 200 Production: 960,000 tons, 283,800 (41.98%) tons more than January, 294,300 tons (44.22%) more than the same period last year.

Stainless steel Series 300 Production: 1,497,000 tons, 236,600 (18.77%) tons more than January, 201,600 tons (15.57%) more than the same period last year.

Stainless steel Series 400 Production: 497,700 tons, 73,300 (17.27%) tons more than January, 32,100 tons (6.9%) more than the same period last year.

The industry is gradually returning to normal as the influence of the pandemic wears off, and production is now operating at a higher level (103%) compared to January.

In addition, most steel mills maintained normal production or slightly reduced production. The production in March will be slightly rebounded but is still lower than the average level in the fourth quarter of last year. It is estimated that the domestic crude stainless steel production increased by about 110,000 tons on a month-on-month basis to around 3.07 million tons in March.

Among them:

the scheduled production of the 300 series increases by 50,000 tons to 1.55 million tons on a month-on-month basis,

the scheduled production of the 200 series increases by 40,000 tons to 1 million tons on a month-on-month basis,

and the scheduled production of the 400 series increases by 25,000 tons to 520,000 tons on a month-on-month basis.

| Series | Jan-2022 | Feb-2022 | Mar-2022 | Jan-2023 | Feb-2023 | Mar-2023*E |

| 200 series | 0.73 | 0.67 | 1 | 0.68 | 0.96 | 1 |

| 300 series | 1.29 | 1.3 | 1.49 | 1.26 | 1.5 | 1.55 |

| 400 series | 0.49 | 0.47 | 0.6 | 0.42 | 0.5 | 0.52 |

| Total | 2.47 | 2.44 | 3.09 | 2.36 | 2.96 | 3.07 |

While the underreaction of the downstream industry is creating a bearish stainless steel market, over 6 million tons of the stainless steel inventory is sitting in the warehouse and waiting to be consumed.

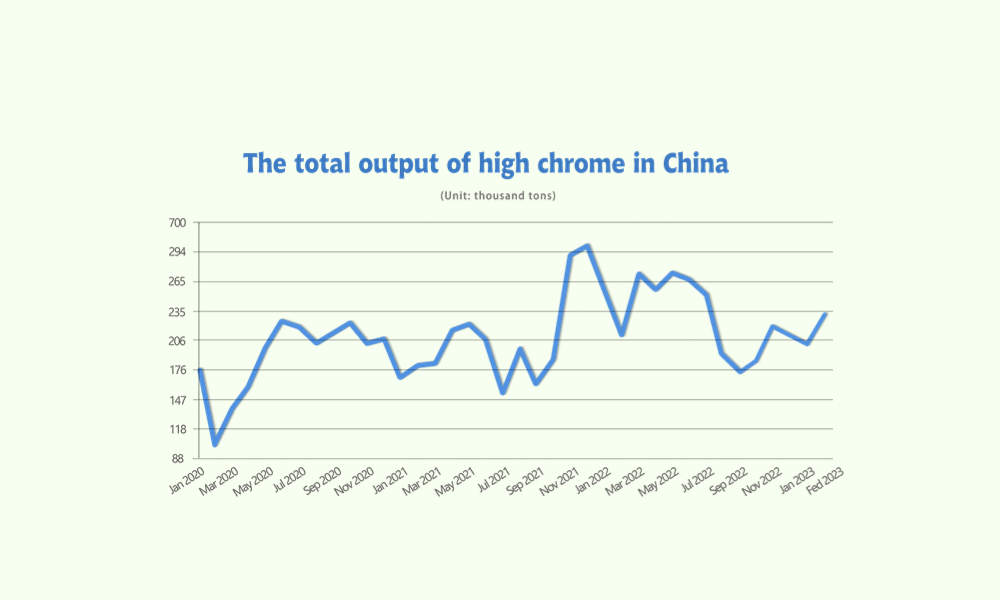

RAW MATERIALS|| Price trends went separate ways.

Chrome: a steady growth throughout the quarter.

The production of high carbon ferrochrome hiked significantly in February, it came to a total of 541,500 tons with a 45,700 (or 9.22%) tons increase.

The most traded tender price of high-grade chrome also maintains the upward momentum, rising US$37/MT in March, with approximately US$177 increment in 3 months.

Nickel: Price continued to slide

The EXW price of high-grade ferronickel continued to descend and closed at US$295/MTU. Hence, ShFE Nickel rallied and fell US$1015/MT from US$27,000 to US$26,785/MT last Friday.

It is noteworthy that steel mills are now suffering a more severe loss from production due to the sliding stainless steel price and the constant steel supply from Indonesia.

MACRO|| Global trading volume heads down

Brazil removes import tariffs on six types of goods

On March 10th, Geraldo Alckmin, Brazilian Vice President announced through social media that Brazil will remove import tariffs on six types of goods, including two different types of steel and aluminum plates. Alckmin stated that the import tariffs on the above goods were previously between 12% and 16%, and the government will implement a "zero tariff" policy for these categories of goods shortly.

Being China’s biggest and most favored trading partner in South America, Brazil built up US$152.9 billion economic exchange with China in 2022, taking up 27% and 23% of total export and import last year.

Global trading volume declines

China’s total imports and exports declined 0.8% (year-on-year) to 6.18 trillion yuan (US$890 billion) during the first two months of the year.

Exports increased 0.9% from a year earlier to 3.5 trillion yuan (US$504 billion) while imports declined 2.9% to 2.68 trillion yuan (US$386 billion) during the period, It is worth mentioning that the hiking inflation rate in the US had dragged the export amount down by 15.2 percent to US$71 billion.

As a matter of the fact, most of the countries which are weighed heavily on manufacturing production also suffered from a significant descend in the export of over 10%(Excluding the OPEC countries), China’s statistics listed above were merely “a drop in the bucket”.

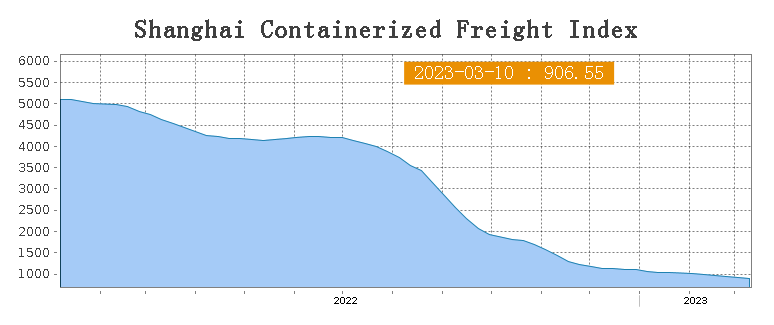

SEAFREIGHT|| Freight rate continues to decline.

Freight rates overall on multiple sea routes continued to dip last week as the market is still recovering. On 10th March, the Shanghai Containerized Freight Index was downed by 2.6% to 906.55.

Europe/ Mediterranean: Adding to the downbeat news, Sentix's index, a key indicator of investor morale, fell unexpectedly in March for the first time since October, dragged down by a decline in expectations. The index fell to -11.1 points from -8.0 in February, well under economists' expectations for a rise to -6.3.

Until 10th March, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$865/TEU, which remained unchanged from the week before last week. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1589/TEU, down by 0.7%.

North America: As it had mentioned above, the export volume from China to the US had downed by 15.2 percent to US$71 billion.

Until 10th March, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1,163/FEU and US$2,194/FEU, 3.1% and 5.5% fall accordingly.

The Persian Gulf and the Red Sea: Until 10th March, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had a 9% fall from last week's posted US$878/TEU.

Australia/ New Zealand: Until 10th March, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$280/TEU, which was downed by 16.2% from the previous week.

South America: The supply-demand in the freight market is now balanced, on 10th March, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$1378/TEU, a 7% drop from the previous week.