Trend|| Futures and spots both increased.

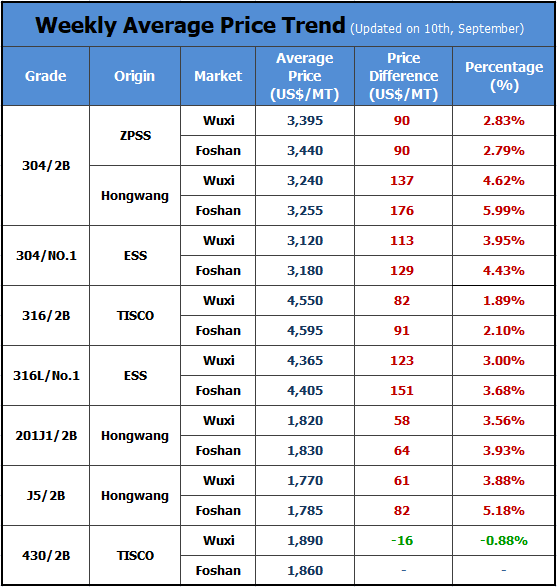

Last week, the stainless steel futures and spots both increased. Until the closing on Friday (September 10th), contract 2110 increased by US$129/MT, hitting US$3,210/MT. As for the spot market, CR 304 of the private-owned mills in Wuxi market rose by US$157/MT. The base price of the CR 4-foot mill-edge product by the private-owned mills went up to US$3,205/MT.

304: Price will fluctuate due to the mixed influences.

The production limit is still the most influential reason for the increasing price. It is reported that in response to the low energy consumption and production limit policy, the high furnaces of Guangqing and other production lines have been stopped running since last week. At present, the idling period is planned to be 10 days, and more than 100,000 tons of output will be affected, of which stainless steel 304 will take most of the account.

Besides, rumor has it that a document by the environment monitoring department in Jiangsu Province will be carried out in September. To the stainless steel industry, ferronickel is influenced the most by the document. It is said that a mill in Jiangsu will have to cut down 20% of the ferronickel output. If it comes true, the stainless steel output will decline accordingly.

From the perspective of the futures market, for now, the resources of warehouse warrant are keep reducing. The position of contract 2110 is about 45,000 plots. The demand of delivery is large while the register warehouse warrant volume is 12,700 tons. Affected by the festival in September and National Day in October, the register of the contract for October will be tight. If the supply of the warehouse warrant is insufficient, the futures prices will rise.

What is uncertain?

1. From the perspective of the futures market, for now, the resources of warehouse warrants are kept reducing. The position of contract 2110 is about 45,000 plots. The demand for delivery is large while the registered warehouse warrant volume is 12,700 tons. Affected by the festival in September and National Day in October, the register of the contract for October will be tight. If the supply of the warehouse warrant is insufficient, the futures prices will rise.

2. Futures stock prices failed to surpass the price of US$3,200/MT. The price difference between futures and spot maintains at US$80/MT, which is rather low. In a short term, the futures stock price might drop, which will influence the sentiment in the spot market.

3. Last week, the stainless steel 304 was bullish. The production profit of steel mills recovers thanks to the lower prices of raw materials. From the perspective of raw materials, the price of ferronickel maintains stability and high, while high carbon ferrochrome decreased a bit. It is said that the production of 300 series in Indonesia will reduce. At that time, the ferronickel imported to China will increase and the price of ferronickel will get weaker.

200 series: Supply is falling, and prices stay boosted.

Last week, the inventory of 200 series dropped by 1,400 tons in a week, totally leaving 40,100 tons. Due to the production limit, the prices of 200 series rose greatly. Until Friday, the base price of CR 201J2 in Wuxi market rose by US$71/MT, reaching US$1,755/MT.

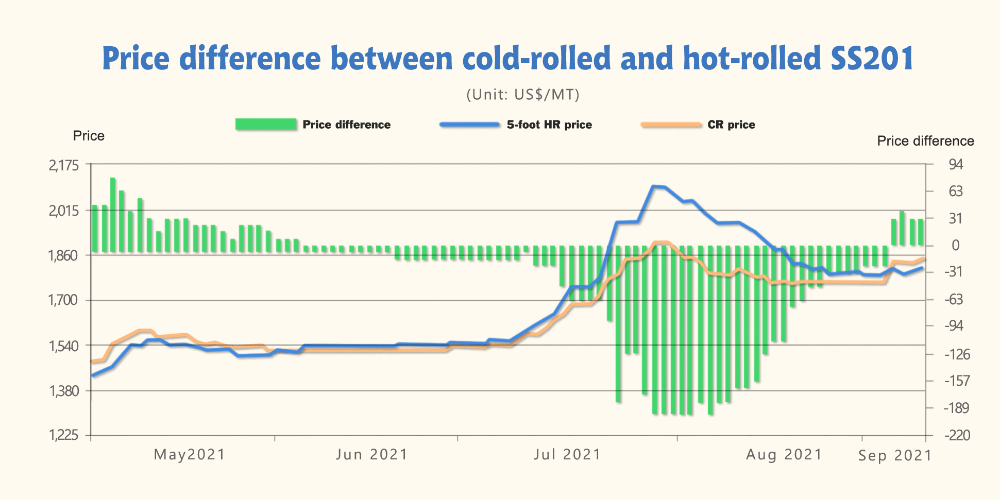

The production of CR 201J2 dropped significantly in August, while HR products are realized from the previous OOS. Thereby, the price difference gets back to normal now, CR prices are higher than the HR prices. The price difference gets back to US$30/MT. In a short term, influenced by energy controls and environmental inspection, steel mills are executing the production restriction policy, Baosteel Desheng, Guangqing, SY, Baogang New Materials, HNJH, and other steel mills are reducing the 200 series production. It is predicted that the crude steel production of 200 series will reduce by 150,000-170,000 tons. The supply for 200 series is facing a decline. It is possible that the inventory will be clearing. Both the prices of CR and HR products will increase because of the production limit. The prices will fluctuate and rise. The base price will increase by US$15/MT-US$30/MT.

400 series: Inventory stacks up and the prices tend to be weak.

From the raw material side, last week, the high chrome factories in Guangxi Province were closed. Moreover, the production limit gets stricter in Sichuan Province. For now, the supply for high chrome declines, so factories will sell at higher prices.

In the spot market, the production in August increased slightly by 10,900 tons, up to 533,300 tons. As for the inventory, the volume was 85,200 tons, reduced by 1,000 tons. The inventory volume is still high, the selling pressure falls on both steel mills and traders.

Summary:

304: Due to the production limit, the price of 304 will maintain increasing. However, the market sentiments are not bullish enough, influencing the prices to fluctuate.

201: Production limit and low inventory will boost the price. It is predicted that the base price will rise by US$15/MT ~ US$30/MT.

430: Large inventory and weak transactions affect the price to decrease. It is predicted that the price will fall by US$8/MT~US$15/MT. The mainstream transaction price of TISCO and JISCO in Wuxi market might be around US$1,825/MT~US%1,840/MT.

INVENTORY|| The production of 200 series fell by 160,000 tons. Price difference between CR and HR will enlarge.

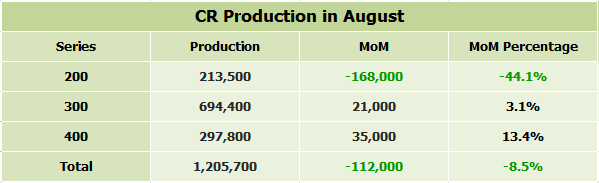

According to the total production data in August, the CR production by Chinese steel mills above-designated size(All industrial enterprises with annual main business income of RMB 20 million and above) is 1,205,700 tons, which is 112,300 tons lower than last month, and the declining percentage is 8.52%. Among, the production volume of 200 series is 213,500 tons; as for 300 series, the production volume goes up to 694,400 tons, MoM increasing by 21,000 tons, and the rising percentage is 3.1%; the production of 400 series also rises. Compared to last month, it increases by 35,200 tons that are 13.4%, reaching 297,800 tons in total.

From the statistic, the production volume of cold-rolled 200 series decreases the most.

200 series: Electric power rationing and high furnace shut down in Guangxi drag down the production volume.

The biggest factor in the decreasing production volume is the policy. In Guangxi Province, due to the electric power rationing policy, steel mills take the steel billet and hot-rolled steel into producing priority, and the crude steel production decreases. Therefore, the production materials of cold-rolled products are insufficient. The cold-rolled production line firstly stops running.

Besides, influenced by the controls of energy consumption and environment, some high furnaces are required to stop and overhaul. Thereby, the cold-rolled materials postpone the delivery.

Except for the policy, the high inventory of cold-rolled stainless steel also leads to the declining production of CR 201. In July, the CR production volume increased by 60,000 tons compared to that in June, making the HR steel prices kept rising over the CR steel prices. Considering the profit, steel mills choose to produce more HR products.

The price difference between CR and HR did not turn normal until recent days. It is believed that the CR production volume will hopefully rise in September. But considering the production limit, the total inventory volume of 200 series will keep clearing. In September, the crude steel of 200 series is planned to produce 830,000 tons which keep decreasing. Compared to the data in August, the production in September is 70,000 tons lower. Because of the low production, the price difference between CR and HR will keep enlarging.

300 series: Production volume will keep increasing.

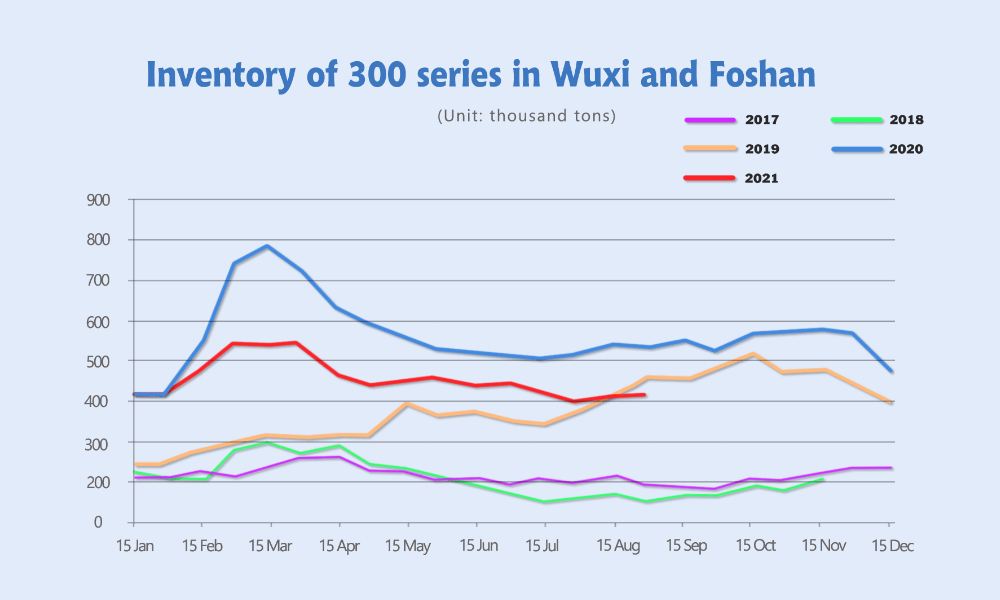

The production limit does not affect much on the 300 series output, and even it increases. Compared to July, the output increases by 53,600 tons, rising to 1,114,000 tons. The production of CR wide plates increases by 21,000 tons and to 694,400 tons. Until late August, the inventory of 300 series in Wuxi and Foshan increases by 18,600 tons compared to late July, reaching 416,300 tons. As for CR inventory, it rises by 8,000 tons and increases to 226,100 tons. And the HR inventory is 190,200 tons, which is 10,600 tons higher than July.

More steel mills implement production limits in September. The stainless steel futures prices begin to rise and the spots follow suit. Right now, two large private-owned steel mills, Delong and Tsingshan are reducing the production, causing a great effect on the futures and spot market and boosting the prices.

It is reported that energy consumption is the biggest reason for the requirement of Delong's reduction in production. While other mills’ production is limited because of the raw material shortage. Last week, the prices went up, bringing the production profit of 304 up to more than US$150/MT. Facing this high profit, steel mills tend to arrange more production of 304. Delong, one of the biggest private-owned steel mills, due to the power rationing on the submerged arc furnaces, the ferronickel is in shortage, forcing the steel milling production lines to hold on working. To release the pressure on raw material supply, more ferronickel are imported and steel mills are purchasing more stainless steel metal scrap. It is expected that the production volume will be around 150,000 tons, which is 40,000 tons ~ 50,000 tons lower compared to the normal production.

It should be noticed that the production of 300 series might fail to decline that much as expected because of the high production cost of 200 series and the high profit of 300 series.

400 series: The price of ferrochrome declines, whereas the price of 400 series remains high.

It is contradictory. When facing backlogs and weak demand, steel mills are unwilling to decrease the price. In August, the production of the 400 series crude steel is533,300 tons, which is 10,900 tons higher than in July. The CR inventory is 297,800 tons, which is 35,000 tons more than in July.

Different from the steel mills that producing 200 series or 300 series, 400 series mostly are produced by the state-owned mills. TISCO and JISCO have the ratio for carbon steel that can be deployed, so the production of 400 series is not influenced much by the production limit policy and its output maintain stable.

In late August, the electric power supply has gradually recovered and the production of ferrochrome increases. It is predicted that in September, the production of high chrome will maintain the increasing trend. Thanks to this, the price of high chrome falls, from US$1,824/MT in late July to now US$1,570/MT. Although the cost drops, the quotation does not. The production profit of steel mills remains high, so except for the steel mills that are influenced by the production control, other steel mills actually are producing more 400 series. As for demand, the downstream manufacturers are tepid in purchasing. For example, with the shortage of chips in the automobile industry, and the weak demand in the home appliances industry, the purchasing need for stainless steel declines. The supply for 400 series is beyond the demand, and the inventory is stacking up. Therefore, it is predicted that the prices tend to fall.

In summary, the crude steel production volume in August does not reduce as expected and the production of 300 series increases the most. However, both domestic and export demand are weak under such a high price. If the power recovers or enforcement of the production limit weakens, the future supply will go higher than expected. It should be aware of the sudden drop in the stock market.

Forecast:

Recently, there is news saying that Delong and Guangqing will reduce production. In response to lowering the energy consumption, the high furnace and other production lines of Guangqing have all shut down for 10 days but the ending day is yet to confirm. It is predicted that more than 100,000 tons, and 304 is influenced the most, then is 201. It is said that Delong has to reduce 30% of the production, beginning from September and lasting to the end of 2021. The future supply must be reduced, and it is predicted that the inventory will be clearing in the future market.

COMMODITY|| Inflation is soaring, and the price of industrial metals like stainless steel has reached a new high!

The metal price rebound is accelerating, and concerns about supply and strong demand have pushed prices to their highest levels in years.

In the past week, LME Aluminum hit a 13-year high, and LME Nickel increased to the highest level since 2014. Both of the metals benefit from the bullish prospects because of their role in the clean energy transition and China's crackdown on emissions from energy-intensive industries.

An analyst said: "Nickel prices have been hovering, waiting to find a way to break through US$20,110. China's suppression of energy-intensive industries is spreading from aluminum to stainless steel and nickel pig iron."

The soaring commodity prices, increasing transportation costs and imbalanced economic recovery have been putting pressure on global consumer prices. Data released last week showed that China's producer price index (PPI) accelerated to a 13-year high, and the US CPI has risen by more than 5%.

Nickel jumped by 2.8% in the previous cycle to US$20,255 per ton, the highest since 2014.

Meanwhile, the surge in China's stainless steel production is driving nickel demand to increase. Stainless steel futures rose by up to 2.7% in the past week (September 6-September 11), and steel rebar climbed by more than 4%.

Stainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in China