Officially in the dull off-season. Even during the peak season, the stainless steel transaction was disappointedly weak. Almost without a second thought, the market is meant to be bearish continuously. Facing the tepid demand and stacking up inventory, stainless steel mills maintain their strategy which is to cut off production to control the volume circulating in the market. Since October, about 520,000 tons of stainless steel output has been reduced until November, according to the statistics. The problem is not earning more, but losing less or more. Chinese stainless steel mills have been suffering losses because the selling price has stayed lower than the production cost. Perhaps, reducing production seems to be a long-term strategy to cope with the oversupply, the long-lasting pinpoint of the industry. Another big issue in the industry is the anti-circumvention investigation launched by Brazil on October 27th, regarding some valid stainless steel products imported from China. It is heard that the final decision will announced 6 months later. Such an allegation is a huge challenge to the bilateral trade between the two countries. What’s your opinion about it? Any thoughts, you are welcome to share with us and we would love to talk deep with you. For more about the market dynamics, please go through our Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,250 | -3 | -0.13% |

| Foshan | 2,285 | -3 | -0.13% | ||

| Hongwang | Wuxi | 2,175 | -8 | -0.40% | |

| Foshan | 2,175 | -15 | -0.74% | ||

| 304/NO.1 | ESS | Wuxi | 2,080 | -12 | -0.63% |

| Foshan | 2,105 | -10 | -0.49% | ||

| 316L/2B | TISCO | Wuxi | 3,795 | -47 | -1.27% |

| 3,870 | -25 | -0.66% | |||

| 316L/NO.1 | ESS | Wuxi | 3,600 | -54 | -1.53% |

| Foshan | 3,635 | -24 | -0.67% | ||

| 201J1/2B | Hongwang | Wuxi | 1,370 | -7 | -0.55% |

| Foshan | 1,370 | 0 | 0% | ||

| J5/2B | Hongwang | Wuxi | 1,275 | -3 | -0.24% |

| Foshan | 1,285 | 3 | 0.24% | ||

| 430/2B | TISCO | Wuxi | 1,285 | -6 | -0.47% |

| Foshan | 1,265 | -4 | -0.36% |

TREND|| The Stainless steel market is tested by contradictory trends.

Affecting by the hesitant atmosphere in the market, the price trend of the stainless-steel series traveled at the same pace and remained volatile at the bottom last week. The mainstream contract price of stainless steel rose slightly by US$2/MT to US$2145/MT.

Stainless steel 300 series: Production cut in aid of destocking.

The mainstream base price of cold-rolled 4-foot mill-edge stainless steel 304 fell US$7/MT to US$2130/MT; the privately produced hot-rolled stainless steel was quoted US$2075/MT with a US$21/MT drop. It is understood that the downstream is only making “Just-in-time” purchases as the industry is entering the off-season. Moreover, there will be about 370,000 tons (out of 670,000 tons in total) of 300 series crude stainless steel will be deducted from production in October and November due to the maintenance of steel mills. Stainless steel 200 series: Price trend sustains hesitant as winter approaches.

The mainstream base price of cold-rolled stainless steel 201J1 sustains a steady trend from the previous week at US$1340/MT; stainless steel 201J2/J5 and 5-foot hot-rolled stainless steel dropped US$7/MT to US$1245/MT and US$1280/MT accordingly.

Stainless steel 400 series: The price might be shaken by the decelerating Cost.

The guidance price of stainless steel 430/2B quoted by TISCO and JISCO were US$1425/MT and US$1530/MT correspondingly, both remained unchanged.

The mainstream quote price of 430/2B in the Wuxi market landed at US$1290/MT and 430/NO.1 was closed at US$1140/MT.

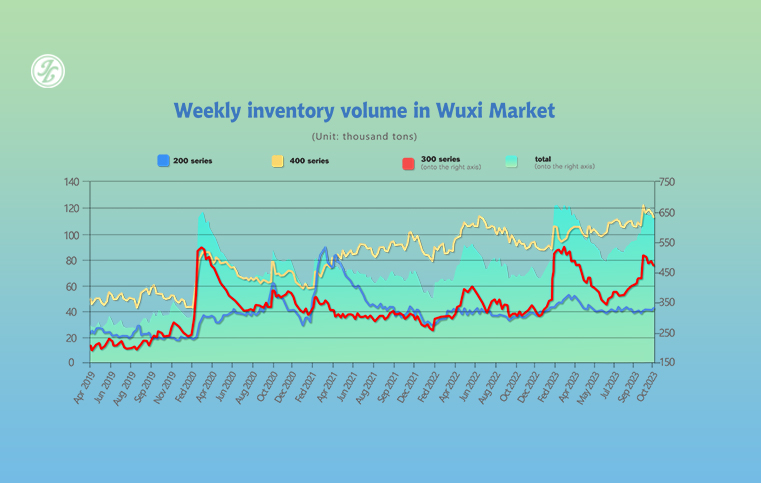

INVENTORY|| The inventory cannot be fulfilled by off-season demand.

The total inventory at the Wuxi sample warehouse downed by US$16,321 tons to 622,458 tons (as of 2nd November).

the breakdown is as followed:

200 series: 1,612 tons up to 39,701 tons

300 Series: 14,227 tons down to 469,173 tons

400 series: 3,706 tons down to 111,689 tons

|

Inventory in Wuxi sample warehouse (Unit: tons) |

200 series |

300 series |

400 series |

Total |

|

October 26th |

39,394 |

483,400 |

115,395 |

638,779 |

|

November 2nd |

41,596 |

469,173 |

111,689 |

622,458 |

|

Difference |

1,612 |

-14,277 |

-3,706 |

-16,321 |

The stainless-steel producers are announcing maintenance since they are already suffering losses from production. It is known that the 10-day great maintenance will affect the production line of steel furnacing, hot-rolled pickling, and cold-rolling, and approximately 100,000 tons of stainless steel output will be wiped out from the schedule.

Dongte Stainless Steels brought their maintenance forward for a week due to the electro-circuit examination which was originally planned for 3rd November, there will be 40,000 tons of 300 series output. Hence, 300 series producers in Shandong are executing a 5-day maintenance to cut 25,000 tons of stainless steel 304.

Stainless steel 300 series: Biggest destocking among other series.

The market performance last week was calm, again, fewer resources were arriving on the market than usual. Both cold-rolled and hot-rolled stainless steel had a significant dive in inventory last week while spot price and future price were rallying at the bottom of the price chart amid the stocktaking period.

Stainless steel 200 series: A slight increase.

The overall performance of stainless steel 201 was weak, stainless-steel 201/J2 was commonly sold between US$1235/MT and US$1250/MT in the market; 4-foot stainless steel roll 201/J2 was quoted as US$1255/MT. It is understood that the settlement might still fluctuate by US$7/MT from the original quotation boosting the market confidence. The 4% inventory increment at the turn of the month was mainly owed to Tsingshan’s cold-rolled resources.

Stainless steel 400 series: A slight decrease in inventory to shake the steady price.

The market harvested a decent improvement last week but seemingly the sellers had to give up part of their profit in trade of the sales volume. Meanwhile, it is estimated that the spot inventory will be violated in the short term as the supply is narrowing.

RAW Material|| A timely pause in production could save the price from a further decline.

The price of high-carbon ferronickel fell by US$4.85/nickel point to US$255/nickel point, The price of high-carbon ferrochrome was quoted as US$1280/MT(50% chromium), with a US$28/MT decrease; the theoretical production cost of cold-rolled stainless steel 304 had

a US$49/MT slide and it was marked as US$2165/MT.

Updates on high-carbon ferronickel supply:

In September, the major producers of ferronickel and high-carbon ferronickel had produced 2.784 million tons of ferronickel, about 5,400 tons less than in August. State-owned steel mills contributed 73% (or 200,300 tons ) out of the total production while private steel mills had the rest of 27%(or 78,100 tons).

Chrome: Production halt continues:

The average quotation for high-carbon chrome fell from US$28/MT to US$1305/MT(50% chromium). The tendering price dropped US$42/MT. The demand in the downstream dipped down a little despite the chrome supply having a significant boost.

High-chromium factories in the main production area of Sichuan began to implement flat-rate electricity prices recently, resulting in a significant lift in electricity costs in some areas. Industry insiders anticipate that more high-chromium production companies in the southern regions of China will reduce or halt production in November.

Currently, some high-chromium factories have already started implementing production reduction plans. In the E-bian area, a factory has directly suspended production on three furnaces, while other factories have indicated that they are adopting peak-avoidance production modes.

Last week, mainstream high-chromium prices stabilized with a weak trend, staying in the range of around US$1290/MT to US$1320/MT(50% chromium). The slowdown in the decline of high-chromium prices is largely influenced by high production costs.

As the winter deepens, unexpected events in the high-chromium market are expected to increase. On October 30th, some ferrochrome production companies in Fengzhen City, Inner Mongolia, received a notice that they would need to cooperate with a power system maintenance requiring a power outage from 8:00 on November 3, 2023, to 20:00 on November 8, 2023.

According to industry feedback, this mainly affects the East Park power supply in Fengzhen. It is expected that production in three ferrochrome enterprises in the park will be impacted, resulting in a reduction of several thousand tons of high-chromium production in the park for November.

Overall, the weak state of high-chromium prices in November has not been reversed. However, there will be a more noticeable reduction in domestic high-chromium production in November. With the continued implementation of production reductions, high-chromium prices are expected to stabilize shortly.

Summary: Stainless steel market will remain bearish during the off-season

Stainless steel prices weakened this week as the market entered the off-season. Demand was mediocre, and there was no motivation for restocking. Steel mills reduced production to alleviate their inventory pressure, while traders maintained low inventory levels. Market supply was abundant, and prices continued to decline. As the market is now in the off-season, without positive expectations, there is no initiative to restock, especially given the current unfavorable market conditions, which have undermined market confidence. It is expected that the producers will continue to reduce production capacity to ease supply-demand imbalances. The focus in the future will remain on production reductions and the reduction of social inventories. The outlook for stainless steel in the near term is a weak and fluctuating market.

300 Series: In October and November, many steel mills underwent maintenance and production reductions, which will significantly alleviate supply pressure, and inventories are expected to continue to decline. As the market gradually enters the off-season, coupled with declining cost support, it is anticipated that in the short term, the base price for private stainless steel cold rolling will fluctuate around US$2060/MT.

200 Series: The cost of production tended to decline as the raw material started to drop. However, steel mills reduced production, with crude steel production reaching 620,000 tons in October and November. Although most of the production cuts are for the 300/400 series, they may have a stimulating effect on the entire stainless steel industry. Hence, it is expected that the base price for 201J2/5 cold rolling will continue to fluctuate in the range of US$1255/MT-US$ 1290/MT.

400 Series: The primary raw material, high-chromium market prices, have been relatively weak. In November, steel mills all lowered their steel bidding prices in the tendering process.

Some businesses are actively reducing prices to offload inventory. According to inventory data, there was a slight reduction in 400 series sample inventory during last week. This is partly due to market digestion and partly due to some steel mills' production cuts in October and November, which are expected to reduce supply. It is anticipated that in the short term, 430/2B prices will be weak, ranging from US$1265/MT to US$1290/MT.

Brazil launches anti-circumvention investigation

On October 27, 2023, Brazil, in response to an application submitted by Aperam on July 27, 2023, imposed restrictions on some stainless steel products originating in China, and the government initiated an anti-circumvention investigation to examine whether the relevant product imports have circumvented the currently valid flat-rolled austenitic 304 (304, 304L and 304H) stainless steel and cold-rolled stainless steel 430 plate with thicknesses greater than or equal to 0.35 mm and less than or equal to 4.75 mm through slight changes.

Brazil's anti-dumping duties against Chinese stainless steel can be traced back to April 13, 2012, when the anti-dumping investigation was launched. On October 2, 2019, Brazil decided to continue to impose anti-dumping duties on stainless steel cold-rolled plates originating in mainland China and Taiwan China for five years.

The products involved are products under Mercosur’s customs codes 7219.32.00, 7219.33.00, 7219.34.00, 7219.35.00 and 7220.20.90.

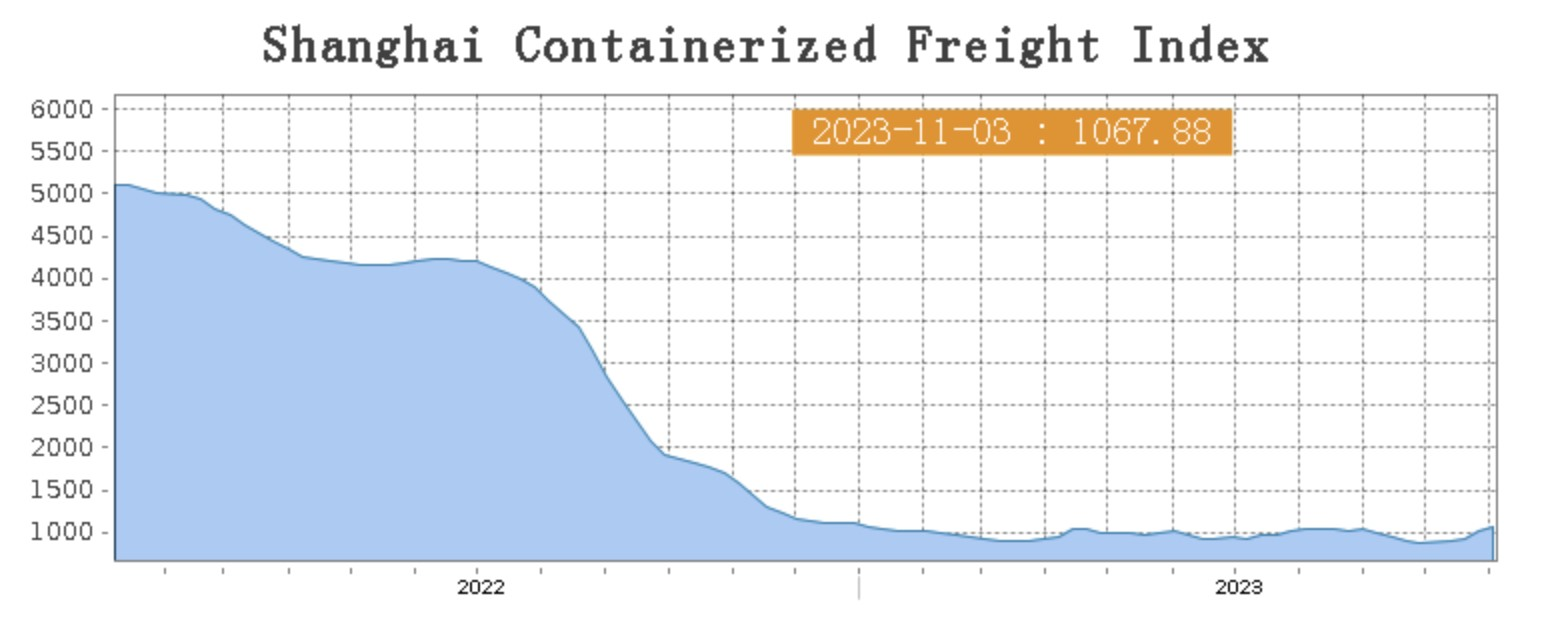

Sea Freight||Market supply accelerating the overall freight rate.

China’s Containerized Freight market was overall improved, On 3rd November, the Shanghai Containerized Freight Index rose by 5.5% to 11067.88.

Europe/ Mediterranean:

The loading rate in European freight line slide down a bit, although the freight rate had a short surge earlier last week.

Until 3rd November, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$756/TEU, which fell by 11.7%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1231/TEU, which rose by 0.8%.

North America:

The loading rate in North American Freight line (East and West) hit the ceiling last week as the freight demand was improved by the well recovered economy.

On 3rd November, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$2102/FEU and US$2434/FEU, reporting a 9.7% and 3.1% growth accordingly.

The Persian Gulf and the Red Sea:

On 3rd November, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf surged by 15.2% from last week's posted US$1268/TEU.

Australia/ New Zealand:

On 3rd November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$838/TEU, a 5.8% lift from the previous week.

South America:

The freight market had a slight rebound. on 13th October, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2660/TEU, an 9.7% increment from the previous week.