Generally, the stainless steel prices had an increasing tendency in September and October, but the rises were too weak to last. Based on the current situation, the whole market is rather pessimistic about the future. An expert who is related to the Chinese steel market predicts that the steel price will continue to fall in November unless there will have really good policy support, but don’t pin the hope on it. More about Stainless Steel Market Summary in China, please keep reading.

WEEKLY AVERAGE PRICE

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

2,635 |

-43 |

-1.70% |

|

Foshan |

2,680 |

-43 |

-1.67% |

||

|

Hongwang |

Wuxi |

2,520 |

-63 |

-2.56% |

|

|

Foshan |

2,535 |

-70 |

-2.82% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,435 |

-67 |

-2.82% |

|

Foshan |

2,485 |

-42 |

-1.75% |

||

|

316L/2B |

TISCO |

Wuxi |

4,220 |

-31 |

-0.75% |

|

Foshan |

4,270 |

-36 |

-0.87% |

||

|

316L/NO.1 |

ESS |

Wuxi |

4,070 |

-48 |

-1.20% |

|

Foshan |

4,110 |

-42 |

-1.05% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,555 |

-3 |

-0.19% |

|

Foshan |

1,505 |

-17 |

-1.20% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,485 |

-8 |

-0.61% |

|

Foshan |

1,440 |

-20 |

-1.46% |

||

|

430/2B |

TISCO |

Wuxi |

1,250 |

3 |

0.25% |

|

Foshan |

1,240 |

3 |

0.25% |

TREND|| Bearish market is hinting the crisis

The spot price of stainless steel at Wuxi had a nosedive last week. Stainless steel 201 was falling after stabilizing while stainless steel 304 was fluctuating downward. The price of the most traded contract had a US$6 drop to US$2470/MT until last Friday.

Stainless steel 300 series: Weakening spot price

The spot price of stainless steel 304 was facing downward last week, with the decreasing pace of the stainless steel futures. The base price of cold-rolled 4-foot stainless steel 304 is quoted at US$2470/MT with a $49 drop while the hot-rolled 5-foot stainless steel drop by US$56 to US$2420.

As for production cost, the price of ferronickel dropped from US$14 to US$1305/MT. The theoretical production cost of cold rolled stainless steel 304 drop US$11 to US$2540/MT.

Stainless Steel 200 series: Increased supply to drag the spot price down

The spot price of the stainless steel 200 series was falling from Thursday to Friday. Both the base price of cold rolled stainless steel 201J2 and cold rolled stainless steel 201 had dropped by US$21, closing at US$1440/MT and US$1510/MT accordingly. Hot rolled 5-foot stainless steel closed at US$1465 with a US$14 drop.

Stainless steel 400 series: Sluggish transaction to constrain the price growth.

The quoted price of stainless steel 430/2B was stabilized between US$1250-1255/MT, and the demand level downstream was staying low. The guidance purchase price of 430/2B by JISCO maintains at US$1290/MT were the same level as last week.

Stainless steel Futures:

The most traded contract price of Stainless steel was lackluster, maintaining slightly below US$2505. The positions reduced obviously compared to a week ago.

In the short term, the up raising price of raw materials and the sluggish demand were constraining the growth of the future price. Yet, in the long term, the future price may be falling, due to:

1. The production cost in November is settled down by the mills and the decent figure on the order placed by traders, the mills, therefore, are not likely to downsize the production.

2. The gloomy atmosphere at downstream and the limited growth in end product price might force the Mills to seek profit margin further through raw materials.

Summary:

Stainless steel 300 Series: The increment in production and the newly operated production line directly fill up the inventory. The peak season is closing to the end, people are generally pessimistic about the future market. The declining demand might shift the price curve down to US$2435/MT in later times.

Stainless steel 200 series: The spot price had declined slightly and the transaction was sluggish. The price of stainless steel 201 is projected to face down, as the supply from the mills is back to normal.

Stainless steel 400 series:The inventory level of stainless steel 400 was continuing to drop. The newly released purchase price of high-chromium from TISCO and JISCO had a US$112/MT(50% chromium) spike. The weakening demand might drag the price down slightly after last week.

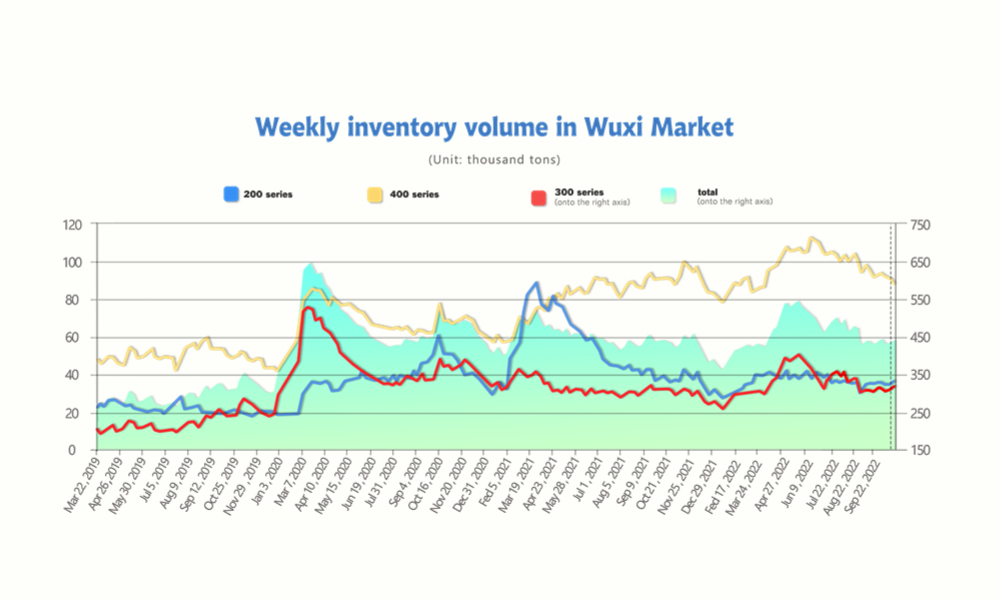

INVENTORY|| Steel mills enlarges the resources to the market

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| October 27th | 34,690 | 311,638 | 90,405 | 436,733 |

| November 3rd | 36,430 | 317,283 | 86,967 | 400,680 |

| Difference | 1,740 | 5,645 | -3,438 | 3,947 |

The inventory level at the Wuxi sample warehouse was rose by 3,947 tons to 440,680 tons (as of 3rd November).

the breakdown is as followed:

200 series: 1,740 tons up to 36,430 tons

300 Series: 5,645 tons up to 317,283 tons

400 series: 3,438 tons down to 86,967 tons

Stainless steel 200 series: resupply ease off the inventory shortage

The slight increment in the inventory had eased off the shortage last week and Baosteel and Beigang New Material took up a major part of the resupply. The bearish market is likely to maintain as the transaction was powerless and slowed inventory digestion. It causes greater increase in the spot inventory compared to last month.

Stainless steel 300 series: Inventory went up slightly

The transaction was also in a gloomy atmosphere as the spot price faced downward. A slight decrease in inventory in the preposition warehouse of the mills results from the agency lading. A small accumulation of hot rolled stainless steel inventory of market warehouses as the new production line and pickling line was in production recently at Delong. It is predicted that the delivery of spot products will keep rising in the future.

Stainless steel 400 series: Inventory went down but the price was stabilized

The inventory was down by 3,400 tons to 87,000 tons, and there was no further update noted last week despite the lackluster demand on downstream.

RAWMATERIAL|| Tax on Indonesian nickel and ferronickel export is stressed again

On 3rd November, The Minister of Finance of Indonesia Sri Mulyani Indrawati addressed the implementation of the export tax on Nickel which aims to ban the nickel export in the future to aid the downstream industries in Indonesia. While the implementation of the export tax is looming, the import volume of Nickel skyrocketed in the Second half of 2022. Accumulating 4,142,200 tons so far, the Nickel import rose by 47.94% compared to the same period last year. 61.14% of the 4 million tons were contributed by Indonesia. Mills in China began to stack up the ferronickel from Indonesia in response to the export tax.

SEA FREIGHT: Price index keeps down for 20 weeks

The sluggish situation of China's container transportation market was continuing as the demand was still laying low. freight rate on multiple sea routes continued to drop. Until 4th November, the Shanghai Containerized Freight Index was downed by 7% to 1579.21.

Europe/ Mediterranean: According to Eurostat, The Harmonised Index of Consumer Prices had a 10.7% hike, which is higher than the market expectation and the highest record since the Eurozone is found. Euro central bank keeps increasing the interest rate in dealing with the high-standing inflation rate, despite the side effect of slowed economic growth.

On 4th November, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$1763/TEU, an 16.1% decrease. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$2,222/TEU, down by 5.2%.

North America: According to Institute for Supply Management (ISM), “the October Manufacturing PMI registered 50.2 per cent, 0.7 percentage point lower than the 50.9 per cent recorded in September…… the lowest since May 2020”

On 4th November, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1681/FEU and US$4890/FEU, 11.6% and 8.0% fall accordingly.

The Persian Gulf and the Red Sea: The market was showing decent performance, freight rate continues to rise. On 4th November, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had a 4.9% growth from last week's posted US$1812/TEU.

Australia/ New Zealand: The freight rate continued to drop. On 4th November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1,200/TEU, down by 11.4% from the previous week.

South America: The supply-demand curve was imbalanced and drag the freight rate down. On 4th November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$3816/TEU, down by 16% from the previous week.

OPINION:Domestic and abroad demands remain sluggish, prices to go weaker.

Everyone knows the reason of the downward price. For the past six months, the market has become softer when the world is getting volatile and the inflation spreads. Based on the macro side, in China, many people expected that the quarantine policy would get loose, but after the national congress, Beijing’s attitude gives a strike on the market. The pessimistic sentiment is increasing over the world when the inflation remains and gets greater. The demand keeps shrinking, which worsens the oversupply.

In November, the stress of downward economy will continue to influence the steel market. Only when the price goes low enough, will the production and supply be reduced to the rational range, so as to make some space for the price to rebound. Without solid support from the government, the steel price will keep shifting down. Cited from some who are optimistic, the demand will be released because the downstream manufacturers start to stock up and projects are hurried to complete in the end of the year. They think there is chance for the price to meet a small highlight.