Back from the CNY holiday and immediately present the latest report about the Chinese market for you. Although the spot inventory has been stacked in the past two months because of the infection peak of COVID and the Chinese New Year holiday, the stainless steel prices are going up as people hold a positive prospect for the market. On the other hand, steel mills will reduce 750,000 tons of production to offset the current large inventory in the market. Overall, in the past five years, according to our survey, stainless steel prices tend to increase after the CNY holiday. More about the market dynamics and forecast, please keep reading Stainless Steel Market Summary in China.

PRICE||Price comparison of stainless steel before and after the Spring Festival in recent years

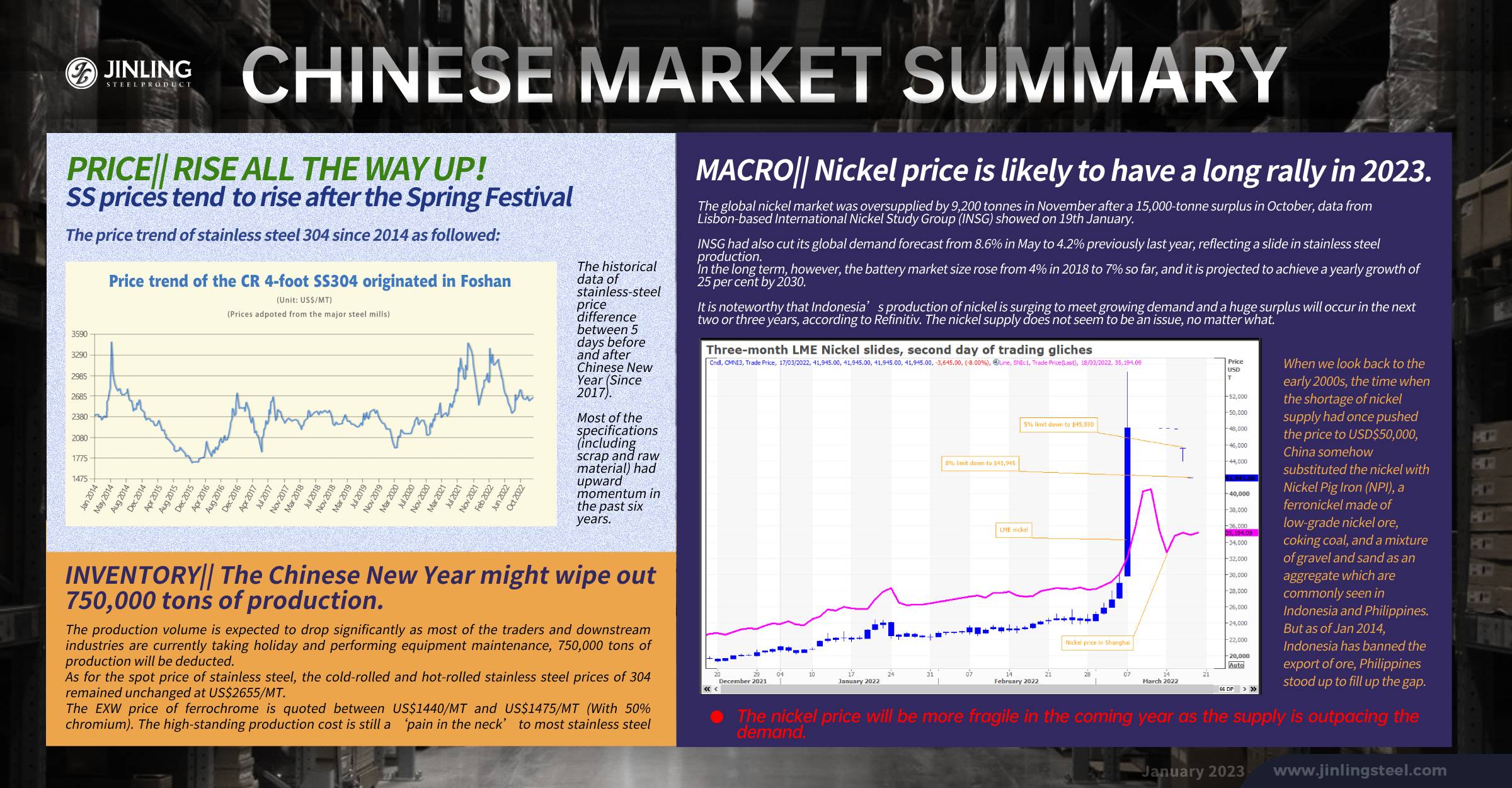

The price trend of stainless steel 304 since 2014 as followed:

The historical data of stainless-steel price difference between 5 days before and after Chinese New Year (Since 2017).

| 304/2B | 5 days Before CNY | 5 days after CNY | |

| 2.0*1240 | Average price (US$/MT) | Average price (US$/MT) | difference (US$/MT) |

| 2017 | 2495 | 2485 | -2 |

| 2018 | 2350 | 2350 | 0 |

| 2019 | 2290 | 2335 | 7 |

| 2020 | 2230 | 2230 | 0 |

| 2021 | 2390 | 2460 | 11 |

| 2022 | 2890 | 2925 | 5 |

| 2023 | 2700 | - | - |

| 201J1/2B | 5 days Before CNY | 5 days after CNY | |

| 1.0*1240 | Average price (US$/MT) | Average price (US$/MT) | difference (US$/MT) |

| 2017 | 1615 | 1615 | 0 |

| 2018 | 1510 | 1510 | 0 |

| 2019 | 1410 | 1415 | 1 |

| 2020 | 1270 | 1270 | 0 |

| 2021 | 1440 | 1465 | 4 |

| 2022 | 1775 | 1790 | 2 |

| 2023 | 1585 | - | - |

| 430/2B | 5 days Before CNY | 5 days after CNY | |

| 2.0*1219 | Average price (US$/MT) | Average price (US$/MT) | difference (US$/MT) |

| 2017 | 1520 | 1510 | -2 |

| 2018 | 1570 | 1570 | 0 |

| 2019 | 1335 | 1335 | 0 |

| 2020 | 1320 | 1320 | 0 |

| 2021 | 1655 | 1675 | 3 |

| 2022 | 1495 | 1515 | 3 |

| 2023 | 1405 | - | - |

Most of the specifications (including scrap and raw material) had upward momentum in the past six years.

On January 30th, the price of cold-rolled stainless steel 304 by the private-owned mills in Wuxi has risen for consecutive two days and increased to US$1,685/MT. Even the base price of mill-edge coil grew to US$1,685/MT as well. Stainless steel 316L price rose even faster, by US$90/MT in the past two days.

INVENTORY|| The Chinese New Year might wipe out 750,000 tons of production.

The production volume is expected to drop significantly as most of the traders and downstream industries are currently taking holiday and performing equipment maintenance, 750,000 tons of production will be deducted.

As for the spot price of stainless steel, the cold-rolled and hot-rolled stainless steel prices of 304 remained unchanged at US$2655/MT.

The EXW price of ferrochrome is quoted between US$1440/MT and US$1475/MT (With 50% chromium). The high-standing production cost is still a ‘pain in the neck’ to most stainless steel 304 producers, as the production cost of cold rolled alloy reached US$2715/MT while the production cost of stainless-steel scrap landed at US$2745/MT.

The market in Eastern China received the latest batch of stainless steel resources during Chinese New Year which escalated the inventory pressure. Meanwhile, the demand of the downstream industries remained low as most of the mills chose to keep down their storage level before CNY. However, the stainless price is estimated to pump up by the recovering demand the downstream after the CNY holiday.

MACRO|| Nickel price is likely to have a long rally in 2023.

In 2022, China's gross domestic product (GDP) will reach 121,020.7 billion yuan, a year-on-year increase of 3%. China's GDP target for 2023 is set at 5.0%.World output growth is projected to decelerate from an estimated 3.0 percent in 2022 to 1.9 percent in 2023, while China's economic growth is forecast to accelerate to 4.8 percent this year, according to a UN report launched on last Wednesday.

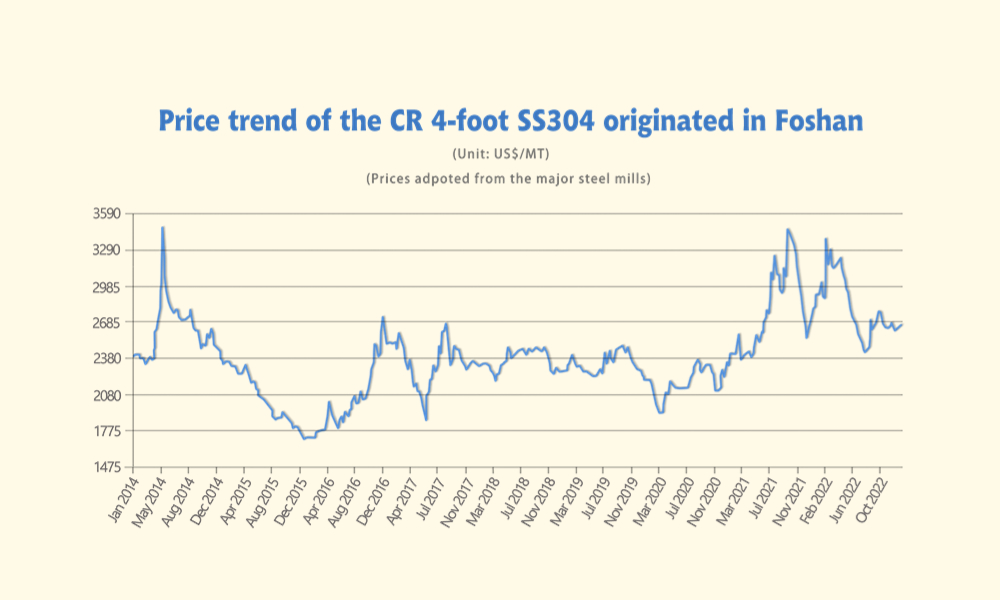

The global nickel market was oversupplied by 9,200 tonnes in November after a 15,000-tonne surplus in October, data from Lisbon-based International Nickel Study Group (INSG) showed on 19th January.

INSG had also cut its global demand forecast from 8.6% in May to 4.2% previously last year, reflecting a slide in stainless steel production.

In the long term, however, the battery market size rose from 4% in 2018 to 7% so far, and it is projected to achieve a yearly growth of 25 per cent by 2030.

It is noteworthy that Indonesia’s production of nickel is surging to meet growing demand and a huge surplus will occur in the next two or three years, according to Refinitiv. The nickel supply does not seem to be an issue, no matter what.

When we look back to the early 2000s, the time when the shortage of nickel supply had once pushed the price to USD$50,000, China somehow substituted the nickel with Nickel Pig Iron (NPI), a ferronickel made of low-grade nickel ore, coking coal, and a mixture of gravel and sand as an aggregate which are commonly seen in Indonesia and Philippines. But as of Jan 2014, Indonesia has banned the export of ore, Philippines stood up to fill up the gap.

The nickel price will be more fragile in the coming year as the supply is outpacing the demand.