Some people think that China's stainless steel market is getting hopeful now because more steel mills are taking action against the stacking inventory and sluggish demand by seizing or reducing production. Somehow, the latest prices did rebound for some moments. The increase was just a blink under the irresistible interest rate hike of the US Fed and the gloomy global economy. The good news is that the sea freight is going down, except for the service to South America. The commodity market is closely related to and can give instant feedback from the global economy. What's your view on the future market? For more detailed analysis, please roll down and read the Stainless Steel Market Summary in China of last week.

WEEKLY AVERAGE PRICES

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

2,935 |

-80 |

-2.78% |

|

Foshan |

2,980 |

-80 |

-2.74% |

||

|

Hongwang |

Wuxi |

2,785 |

-112 |

-4.04% |

|

|

Foshan |

2,775 |

-103 |

-3.74% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,710 |

-139 |

-5.11% |

|

Foshan |

2,745 |

-118 |

-4.31% |

||

|

316L/2B |

TISCO |

Wuxi |

4,530 |

-91 |

-2.02% |

|

Foshan |

4,560 |

-91 |

-2.01% |

||

|

316L/NO.1 |

ESS |

Wuxi |

4,270 |

-88 |

-2.08% |

|

Foshan |

4,310 |

-69 |

-1.64% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,535 |

-39 |

-2.70% |

|

Foshan |

1,550 |

-41 |

-2.78% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,430 |

-35 |

-2.59% |

|

Foshan |

1,465 |

-29 |

-2.09% |

||

|

430/2B |

TISCO |

Wuxi |

1,380 |

-48 |

-3.69% |

|

Foshan |

1,420 |

-38 |

-2.83% |

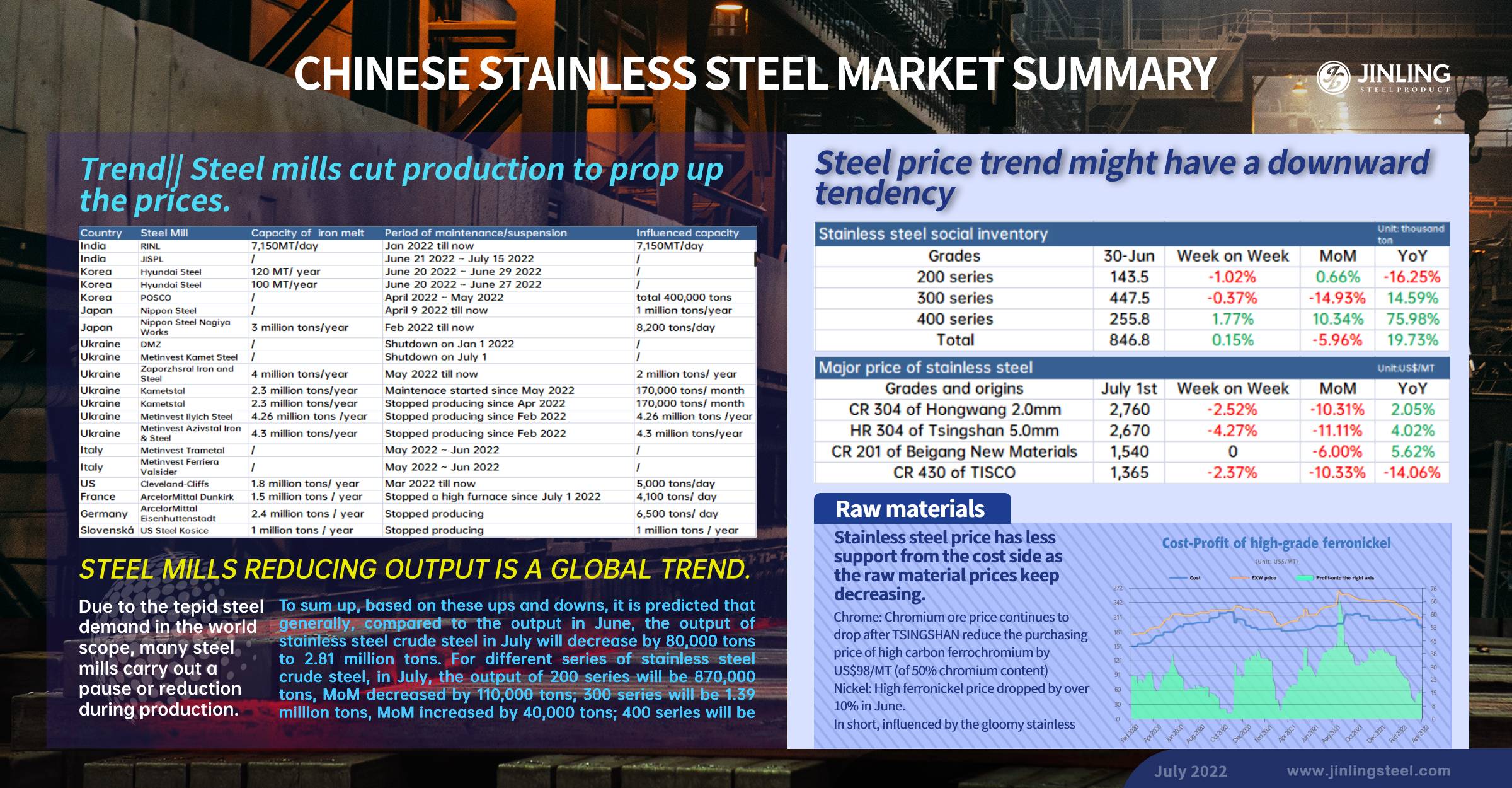

Trend|| Steel mills cut production to prop up the prices.

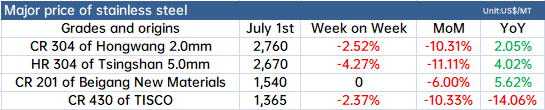

From June 27th to July 1st, the transaction was bland. The price of stainless steel 304 and 430 was generally weak while the price of stainless steel 201 had a slight increase in the latter part of the week. Some steel mills have plans for cutting down the production of the 200 series, which boosted the spot price of stainless steel 201. Until July 1st, the most-traded contract of stainless steel futures dropped by US$66/MT to US$2,605/MT compared to the price on June 24th.

300 series of stainless steel: Prices remain gloomy.

Last week, the spot price of stainless steel 304 kept decreasing. The base price of the cold-rolled stainless steel 304 of private-owned mills was decreased to US$2,730/MT which was US$106/MT lower than a week ago. The hot-rolled resources also fell in price, reducing to US$2,670/MT which was US$181/MT lower compared to June 24th. From last Monday to Wednesday, the spot prices dropped greatly and the market transaction was weak, on last Tuesday and Friday, the price tend to remain and the transaction turned up a bit. However, due to the weakening price of raw materials, the price of stainless steel futures continued to drop.

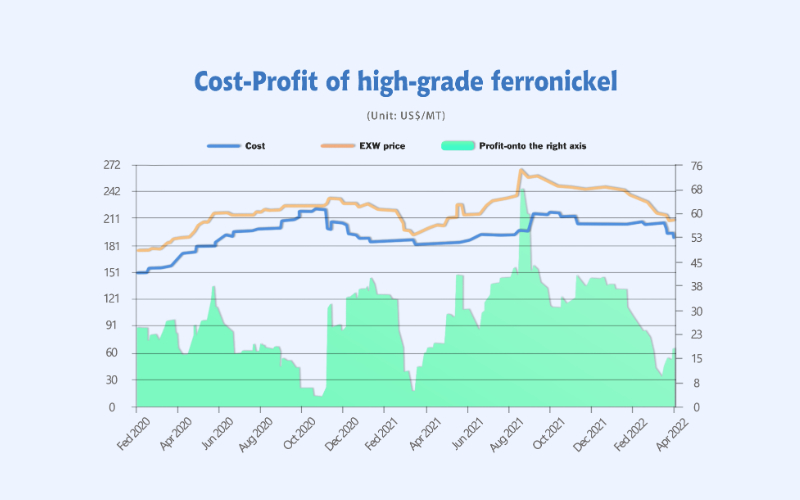

From the perspective of cost, the price of major raw materials of stainless steel 304 remained weak. The EXW price of high-graded ferronickel declined by US$10/Ni to US$200/Ni. The price of ferrochromium was reduced by US$45/MT (with 50% of chromium content) to US$1,360/ MT (with 50% of chromium content). The cost of production of cold-rolled stainless steel 304 has dropped by US$95/MT in theory.

200 series of stainless steel: Steel mills boosted the price and the prices rebound.

Last week, the price of stainless steel 201 in Wuxi has been weak. On Thursday, three steel mill giants united to prop up the price and the spot price of stainless steel 201 rebounded by US$75/MT~ US$90/MT. The base price of the cold-rolled stainless steel 201 in Wuxi increased by US$45/MT to US$1,540/MT; the cold-rolled stainless steel 201J2 rose by US$15/MT to US$1,420/MT; the major price of the hot-rolled 5-foot stainless steel fell by US$30/MT to US$1,480/MT.

The trading was weak, although steel mills stimulated the market by propping up the prices. The trading heat soon faded.

400 series of stainless steel: Demand remains stagnated and the price continued to fall.

Last week, the price of cold-rolled stainless steel 430 kept decreasing. Until June 30th, the quotation of cold-rolled stainless steel 430 in Wuxi was US$1,365/MT, down by US$45/MT. In June, JISCO’s stainless steel 430/2B continued to decrease and the price was cut down by US$45/MT.

Summary:

300 series of stainless steel: Recently, the price of ferronickel fluctuated to go down and the price of ferrochromium slumped, which reduces the support of the stainless steel 304 price. Besides, COVID again breaks out in Wuxi, which might stall the delivery of stainless steel. It is predicted that in a short term, the price will keep lowering and the price of the cold-rolled stainless steel 304 of private-owned mills will be no lower than US$2,625/MT.

200 series of stainless steel: The price rebounded due to steel mills’ action but the market did not accept this offer. The weak demand will remain the major factor in the price. It is predicted that the price will be fluctuating and the cold-rolled mill-edge stainless steel 201J2 will fluctuate between US$1,360/MT and US$1,405/MT.

400 series of stainless steel: In Wuxi, the stainless steel 430/2B of TISCO and JISCO declined to US$1,350/MT which dropped by US$60/MT from June 24th. TSINGSHAN Group released the purchasing price of high chromium in July which is US$1,359/MT (with 50% of chromium content) (tax inclusive to factory),U and it was sharply decreased by US$98/MT (with 50% of chromium content) compared to the price of June. The cost of the stainless steel 400 series dropped significantly but the deficit in profit was hard to get rid of. The demand tends to be weak, it is predicted that the price of stainless steel 430/2B will remain decreasing, staying above US$1,330/MT.

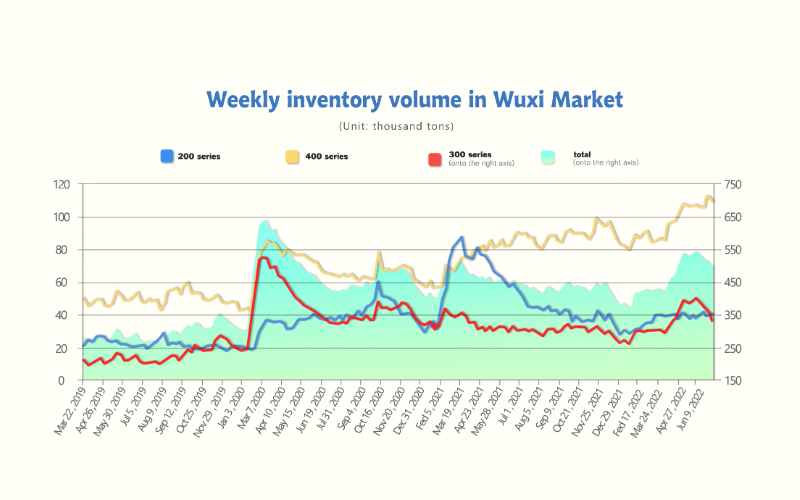

INVENTORY|| The spot inventory decreased for consecutive 6 weeks.

Last week, the inventory volume in the Wuxi sample warehouse continued to decrease by 21,900 tons to 475,700 tons. 200 series inventory decreased by 1,100 tons, to 39,000 tons; 300 series decreased by 18,700 tons, to 328,400 tons; 400 series decreases by 2,100 tons to 108,300 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| June 23rd | 40,081 | 347,041 | 110,488 | 497,610 |

| June 30th | 38,973 | 328,360 | 108,349 | 475,682 |

| Difference | -1,108 | -18,681 | -2,139 | -21,928 |

200 series of stainless steel: Inventory slightly drops as steel mills delivery was postponed.

The inventory of stainless steel 200 series in Wuxi was slightly reduced by 1,100 tons to 39,000 tons, and the majority was the cold-rolled resources. Baosteel Desheng maintained its delivery volume at 2 cargo ships per week while some resources of other steel mills were on the road. Therefore, the inventory of stainless steel 200 series was reduced slightly. A source said that Beigang New Materials is going to reduce 200 series production by 70,000 tons because of the overhaul of the high furnace. In the meantime, some steel mills also express the intention of a reduction in output. It is predicted that the volume of stainless steel 200 series will drop.

300 series of stainless steel: Steel mills cut output and the inventory has decreased for consecutive six weeks.

The inventory of 300 series stainless steel in Wuxi declined by 18,700 tons compared to a week ago, and it was reduced to 328,400 tons. Since June, influenced by the weak demand and the high cost, some steel mills chose to cut down the production of the 300 series and reduce the delivery volume to market. Some production reductions are to extend to July. Although, previously we have mentioned that there will be 4.5 million of capacity newly thrown to the market, considering the current stagnation of demand, the actual production volume will be greatly limited.

400 series of stainless steel: Supply recovers as steel mills complete maintenance.

JISCO finished the maintenance and recovered to produce in the later June and so the production increased gradually. The inventory of stainless steel 400 series decreased by 2,100 tons to 108,300 tons last week, because at the end of the month the agents had to pick up the designated volume from steel mills.

Maintenance and production cut to remain in July, and the output of 200 series will be limited.

Since June, the price of stainless steel has kept decreasing. The price of raw materials dropped as well, but many steel mills were still in deficit. Due to the tepid demand, many steel mills have to arrange maintenance or reduce the output spontaneously.

In July, due to a continuous deficit, some steel mills carry out an overhaul plan. In the meantime, some steel mills recover their production from maintenance as well as the new capabilities will be taken into practice. Therefore, in July, the production arrangement is various.

JISCO: The annual maintenance was finished in mid-June and it has recovered to produce. In July, the output of stainless steel 300 series and 400 series will recover and increase by 20,000 tons to 30,000 tons compared to the output in June.

Delong: Many branches of the steel mills located in different areas suffered constant pause in production activities during early June. In July, the production of stainless steel 300 series will recover and increase as the new production lines also begin to work in later June. It is predicted that in July, the output of the stainless steel 300 series will increase by 50,000 tons compared to June.

Baosteel: Since June 28th, the steel mill has started the maintenance for the high furnaces, which will last for over one month. About 70,000 tons of stainless steel 200 series will be influenced as well as the production of 30,000 tons of stainless steel 300 series.

TISCO: The steel mill will produce just as the ordering volume. It is predicted that in July the production of stainless steel 400 series will be reduced by 60,000 tons from last month.

LISCO: Due to the high production cost and stalling trade, LISCO plans to reduce the production of stainless steel 201 to around 10,000 tons, which is about 10,000 tons ~20,000 tons lower than its normal output.

Many other steel mills in China have the same intention to reduce the output in July. One will reduce the stainless steel 400 series production in July by 25,000 tons ~ 30,000 tons because of the low demand. Another two steel mills will decrease the output through maintenance in July, which will bring drops in stainless steel 200 series, and 300 series, respectively down by over 20,000 tons ~ 30,000 tons, and 30,000 tons.

To sum up, based on these ups and downs, it is predicted that generally, compared to the output in June, the output of stainless steel crude steel in July will decrease by 80,000 tons to 2.81 million tons. For different series of stainless steel crude steel, in July, the output of 200 series will be 870,000 tons, MoM decreased by 110,000 tons; 300 series will be 1.39 million tons, MoM increased by 40,000 tons; 400 series will be 560,000 tons, MoM dropped by 10,000 tons.

Steel mills reducing output is a global tendency.

Due to the tepid steel demand in the world scope, many steel mills carry out a pause or reduction during production.

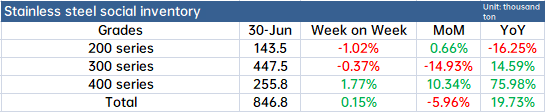

Steel price trend might have a downward tendency

Last week, the steel comprehensive price index increased by 41 point. Steel scrap price index rose by 25 point, coke comprehensive price index dropped by 24 point. In China, if there is no huge positive factor, the price of steel will keep going down. One reason is that although China’s domestic macro economy is working toward stability, globally, inflation is increasing and signs of a recession intensify. Second, the five major sample inventories will remain to drop, but some inventories are still high, which fails to provide a fundamentally good factor. Moreover, as the raw material cost decreases, the production cost of steel reduces but facing a huge deficit, steel mills will continue to lower the raw material prices.

Since March, China’s supply of stainless steel has reduced, but the spot resources are abundant and demand has been tepid. The demand recovered shortly and discontinuously. The pathetic vibe is still lingering in the market and the end demand is hard to see a rebound in a near future. More focus shall be put on the practice of output reduction and the consumption of spot inventory. In a short term, the stainless steel spot will be difficult to get rid of the gloomy trend, and it is predicted that the price trend will be fluctuated and be weak.

Raw material|| Stainless steel price has less support from the cost side as the raw material prices keep decreasing.

Chrome: Chromium ore price continues to drop after TSINGSHAN reduce the purchasing price of high carbon ferrochromium by US$98/MT (of 50% chromium content)

Last week, TSINGSHAN Group announced the latest purchasing price of high carbon ferrochromium in July which dropped by US$98/MT (of 50% chromium content) for July. Instantly, several chromium ore giants closed the quotation. The price of chromium ore was maintained for two days. On June 30th, the price decreased.

The dilemma that the chromium industry is facing is the weak demand for stainless steel, high cost, and production shutdown due to the increasing bill of electricity. Although the chromium ore price slightly dropped, it is still too small for the high chromium producers to relieve the deficit. More high chromium factories choose to reduce and even stop production. Not to mention the sharp decrease in steel mills’ purchasing price, the productivity even goes lower. A high chromium factory in Sichuan has shut down two high furnaces, and over 3,000 tons of high chromium will be reduced in July. In Hunan province, suffering from the increasing electric bill in summer, more factories have reduced production.

In a short term, as the supply of high chromium decreases, the price will get stable.

Nickel: High ferronickel price dropped by over 10% in June.

ShFE nickel contract declined earlier last week and rebounded to around CNY¥180,000 (US$27,190) but generally, the decrease remained and it kept to fall to CNY¥165,000 (US$24,924).

From the perspective of nickel ore, the price decreased last week. Due to the continuously falling price of ferronickel, the price of nickel ore had to go down as well. Besides, the supply of nickel ore is going to increase. In a short term, the price of nickel ore will remain weak. The price of ferronickel remained on the downside. The trading price dropped below US$204/Ni, which offsets the increase during this year and the price went back to the level in January this year. The low price of ferronickel has caused a deficit in some ferronickel factories. However, the inventory of stainless steel is large and steel mills are expanding the cut-down in output. The price of ferronickel is still facing downward pressure.

Regarding the refined nickel, the decrease in nickel price improves the trades but it is rational. After the replenishment of stock, the demand is limited. The supply of refined nickel will increase. About the LME nickel, the inventory declined to 66,500 tons, which prevents the nickel price to fall sharply. The US Fed will probably continue to increase the interest rate, which will maintain the gloomy vibe over the market.

In short, influenced by the gloomy stainless steel market, the price of nickel ore and ferronickel will remain weak. In a short period, the Shanghai Futures Exchange nickel will remain to fluctuate.

The production cost of ferronickel decrease significantly and the profit margin recovers, which provides space for the price to reduce.

Markets|| India's steel export YoY reduces by 42% in May.

According to an Indian source, India’s steel export seriously crashed down in May, decreasing by 42% compared to the same period of last year. And the finished steel product was about 682,000 tons, remaining the same as May of last year. They assume that the decrease owes to the weak Asian demand and the competitive Chinese products.

In April and May, exports fell 35% year-on-year to 1.358 million tons. Actually, the export has begun to reduce in March. Before March, the orders were mostly from Europe but after March, India’s major buyer in Asia, Vietnam, has been weak in demand.

The flat products take about 75% ~ 80% of the total steel export, which was 1,188,300 tons and it was down by 31%. For the non-flat products, the demand dropped the most. The export decreased by 48%, to 170,000 tons.

The export further decreased in June because Europe imposes taxes. Indian products are at least 10% more expensive than Chinese, according to an exporter.

The export tax will continue to influence the orders in July.

It is understood that the average monthly steel production in India is about 10 million tons, which fell to 6 million tons in May, and the inventory of steel mills is still increasing, indicating that domestic demand is sluggish. Steel exports in May were estimated at 750,000 tons, compared with 1.24 million tons in May 2021, the decline is expected to be steeper in June due to the imposition of export taxes.

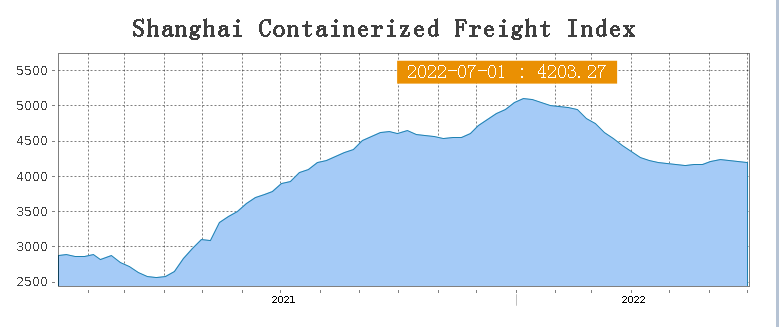

FREIGHT|| Sea freight to South America continues to increase.

The SCFI on July 1st slightly decreased by 0.3% to 4203.27.

Europe/ Mediterranean: Last week, the transportation market remain stable, and the market freight rate fell slightly. On July 1st, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European base port market was US$5,731/TEU, down by 0.6% from last week. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean base port market was US$6,418/TEU, down by 0.1% from the previous week.

North America: On July 1st, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East base ports were US$7,334/FEU and US$9,684/FEU, respectively, down by 0.6% and 1.2% from the previous week.

The Persian Gulf and the Red Sea: On July 1st, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the basic port of the Persian Gulf was US$3,473/TEU, decreasing by 1.9% from the last week.

Australia/ New Zealand: On July 1st, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the basic ports of Australia and New Zealand was US$3,320/TEU, down by 2.3% from the previous week.

South America: This service has entered the peak season in recent three months. The spot market booking price continued to rise. On July 1st, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American base ports was US$8,384/TEU, up by 6.3% from the previous week.