Can't believe it is already the last month of the first half of 2023! Stainless steel prices rebound slightly, yet it is not the time for the market to make a relief. The sluggish demand remains the biggest obstacle. However the cost increases, inventory reduces, it seems like all attempts made by the steel mills are in vain. Last week, from May 29th to June 2nd, grades like stainless steel 304, 316L, 430 had small increments in price. Although the inventory is low, and even some specifications are in shortage, the price of molybdenum has risen by over 8% since late May, people are still withholding their purcahse. Down to earth, it is because of the unbalance of China's economic recovery, which the third industry is fixing quickly, while the manufacturing industries are recovering weakly. If you are interested in stainless steel dynamics, please follow our Weekly Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,375 | -9 | -0.38% |

| Foshan | 2,415 | -9 | -0.38% | ||

| Hongwang | Wuxi | 2,285 | 6 | 0.27% | |

| Foshan | 2,300 | -3 | -0.13% | ||

| 304/NO.1 | ESS | Wuxi | 2,200 | 0 | 0.00% |

| Foshan | 2,240 | -7 | -0.34% | ||

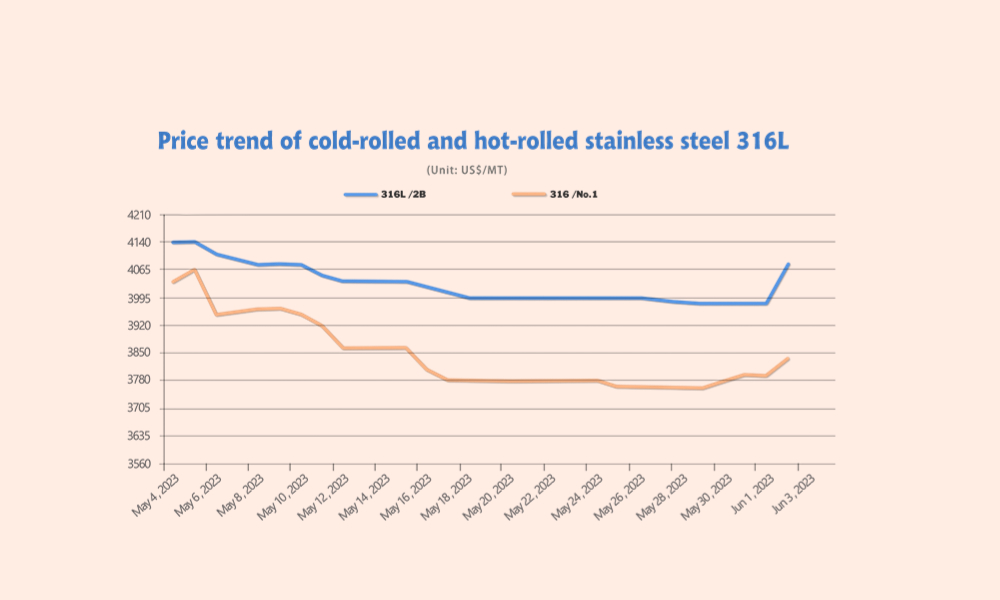

| 316L/2B | TISCO | Wuxi | 3,995 | 6 | 0.15% |

| Foshan | 4,055 | 6 | -0.15% | ||

| 316L/NO.1 | ESS | Wuxi | 3,790 | 20 | -0.55% |

| Foshan | 3,850 | 20 | -0.54% | ||

| 201J1/2B | Hongwang | Wuxi | 1,490 | -4 | -0.31% |

| Foshan | 1,580 | -11 | -0.84% | ||

| J5/2B | Hongwang | Wuxi | 1,415 | -17 | -1.33% |

| Foshan | 1,405 | -16 | -1.22% | ||

| 430/2B | TISCO | Wuxi | 1,225 | 7 | 0.65% |

| Foshan | 1,225 | 4 | 0.39% |

TREND|| A breathing space for the continuing price drop.

The spot price of stainless-steel series recorded less than 1% gained/loss last week, falling at the beginning of last week then the active market transaction triggered the rebound in the later week. Demand still remaining sluggish despite the spot price of stainless steel 304 and 430 ran robustly last week. The mainstream contract price rose US$46/MT to US$2290/MT until last Friday.

Stainless steel 300 series: Inventory dropped to stabilize the spot price.

The price of stiannless steel 304 had U-turn last week: cold-rolled 4-foot mill-edge stainless steel 304 quoted US$2250/MT with a gain of US$29/MT, and hot rolled stainless steel rose by US$14/MT to US$2210/MT. The future price of 300 series harvested a weakening performance while the spot trading turned hot.

Stainless steel 200 series: an opposite to 300 series.

The overall price trend of stainless steel 201 faced down slightly. The mainstream base price of cold-rolled 201 fell US$7/MT to US$1375/MT, 201J2 loss US$14/MT and reported US$1360/MT; hot rolled 5-foot stainless steel dropped US$7/MT to US$1380/MT.

Stainless steel 400 series: Prices remained stable, but production cost is hiking.

The guidance price of 430/2B quoted by TISCO remain unchanged at US$1375/MT while JISCO lifted US$14/MT to US$1480/MT.

The quote price of 430/2B in Wuxi market recorded around a US$21/MT growth and anchored between US$1240/MT-US$1245/MT. The social inventory continued to drop as the EXW price of high chromium slight to US$1415/MT(50% chromium).

Summary:

Last week, stainless steel prices have experienced a slight increase, but the transaction performance has been mediocre. Only during a rapid rebound in prices on Thursday did it stimulate trading enthusiasm. The market believes that there is significant pressure on prices, raising concerns about the sustainability of the price increase. Fundamentally, there haven't been any significant changes. Although social inventories have been slowly declining, demand has not improved. The sudden price increase can only temporarily stimulate traders' replenishment behavior and lacks sustainability. It is expected that stainless steel will continue to fluctuate in the future.

300 series: With the continuous reduction of spot inventories and futures warehouse receipts, the market's inventory pressure has been greatly relieved, and prices have stabilized after the decline. However, due to downward pressure on nickel prices, nickel-iron prices have weakened, and the cost support for stainless steel has become weaker. In the short term, private cold-rolling base prices in the Wuxi area mainly fluctuate around the cost line.

200 series: In the Wuxi market, the inventory of the 200 series ended its three-week consecutive decline and experienced a slight cumulative increase. However, the market's digestion capacity has not increased but rather decreased. Currently, steel mills continue to supply, but downstream demand shows little growth. It is expected that the spot price of 201 stainless steel will still operate on the weaker side. The base price for 201J2/J5 cold-rolled stainless steel will fluctuate in the range of US$1345/MT-US$1375/MT.

400 series: In the Wuxi market, the 400 series stainless steel market is mainly driven by essential demand. Spot inventory has declined significantly but remains at a relatively high level. Both the cost and sales pressures for the 400 series stainless steel are significant. After the price increase in the retail market, market transactions need to be observed. It is expected that the price of 430/2B stainless steel will stabilize mainly in short term.

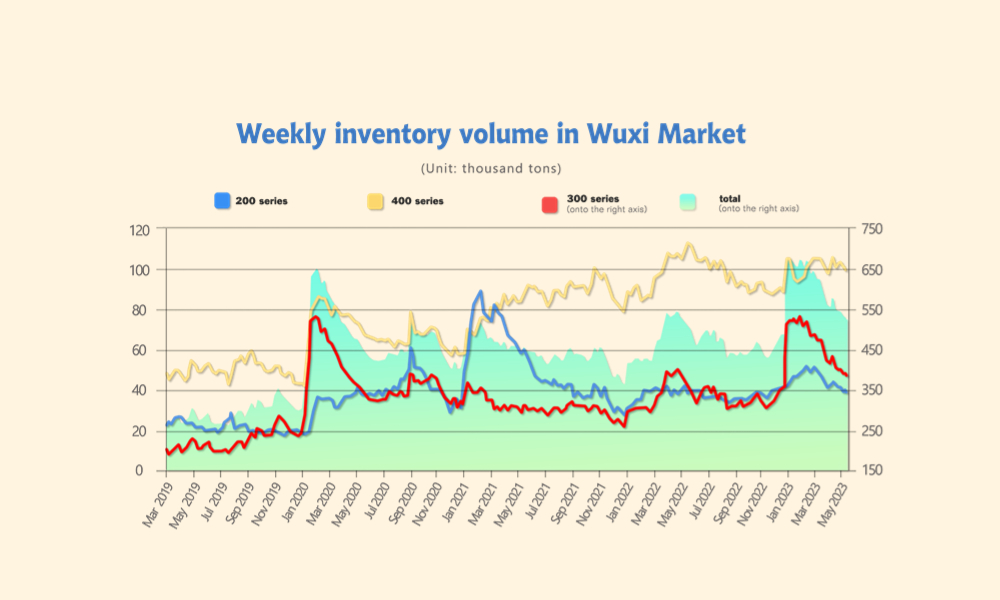

Inventory|| Four consecutive drop

The total inventory at the Wuxi sample warehouse fell by 9,148 tons to 518,456 tons (as of 1st June).

the breakdown is as followed:

200 series: 590 tons up to 39,260 tons

300 Series: 7,363 tons down to 381,094 tons

400 series: 2,375 tons down to 98,102 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| May 25 | 38,670 | 388,457 | 100,477 | 527,604 |

| June 1 | 39,260 | 381,094 | 98,102 | 518,456 |

| Difference | 590 | -7,363 | -2,375 | -9,148 |

300 series: Inventory decreases for the fourth consecutive week.

Steel mills and some traders' inventories have shown significant reduction, mainly in cold-rolled resources, while some agency warehouses have seen an increase in inventory. During this inventory cycle, market transactions have been lackluster, with emphasis on essential procurement. However, the goods deliveries have contracted as a large steel mills in Xiangshui East China was affected by fire drills, resulting in reduced production in hot-rolled and cold-rolled lines and limited production of four-foot cold-rolled, directly impacting the delivery process in the Wuxi area. During the week, resources from a steel mill in South China arrived in Wuxi, and there was a visible increase in inventory in some agency warehouses.

200 series: Weak supply and demand, slight increase in inventory

The increase in inventory was mainly in cold-rolled, while there were increases and decreases in social circulation inventories. Last week, Beigang New Materials resources accounted for most of the arrivals, while other steel mills also had resources arriving in Wuxi. Market transactions weakened further compared to the previous week, with continued sluggish downstream demand and low sales sentiment among traders. Overall outflow volume narrowed slightly, coupled with ongoing deliveries from steel mills, resulting in an accumulation of spot inventory.

400 series: Inventory continues to decline but remains at a relatively high level!

The overall market transactions for 400 series stainless steel were average. Tsingshan Group and TISCO both increased their purchase prices for high-chromium raw materials by US$29/MT(50% chromium) for June. The cost of 400 series stainless steel continues to rise, and inventory remains at a relatively high level. In the short term, manufacturers still face sales pressure, and due to the rising cost factors, there is a lack of willingness to sell at low prices. It is expected that spot inventory will slightly increase.

RAW MATERIAL|| Great maintenance in late June

The EXW price of high grade ferronickel fell US$0.71/Nickel unit(NU) to US$265/NU while ferrochrome dropped US$US$1390/MT(50% chromium); the theoretical production cost of cold-rolled stainless steel 304 was reported as US$2290/MT.

Following the downward price trend of the high grade ferrochrome, the spot price of concentrated ore (40%~42%) from South Africa US$8.57/MT last week; the coke ore loss US$7/MT.

The spot price of Ferromolybdenum on the other hand, kept spiking since the late May, approximately an US$2857/MT (or 8%) of increment.

It is going against the grain that the price of Stainless steel 430 remained stable lately, despite the hiking production cost, and steel mills suffered a heavier losses in production with around US$143/MT. A major steel mills in Northwest China will be suspended for maintenance from 25th June to 25th July, as the result, the supply of stainless steel 400 series is projected to reduce.

Marco|| Indonesia puts nickel export levy on hold to devise a price index first

Indonesia, the world’s top nickel producer, has put on hold plans to tax nickel product exports while it works on creating a price index to ease volatility tied to the London Metal Exchange (LME) benchmark, a senior government official said on Tuesday. The government plans to launch a nickel price index by the end of 2023 and needs it to be in place before going ahead with an export levy, Septian Hario Seto, a senior official with the investment coordinating ministry, told the SMM Indonesia Nickel-Cobalt conference in Jakarta. “By the end of the year, the index will be created. We are still asking for the proposal from each index provider. We will see who has the best,” he told reporters on the sidelines of the conference.

Sea Freight|| Sea freight market stabilized and started to recover.

Freight rates overall on multiple sea routes varied differently last week. On 2nd June, the Shanghai Containerized Freight Index rose by 4.6 % to 1028.7.

Europe/ Mediterranean:

The warfare between Russia and Ukraine continued bring a series of uncertainty to EU’s economy.

Until 2nd June, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$846/TEU, which fell by 1.5%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1638/TEU, which fell by 0.8%

North America:

About 278,000 workforce are added to US industries in May, ADP revealed last week, encouraging the recovery of US economy. The Demand-Supply was well fixed in sea freight market, boosting the booking price last week. Until 2nd June, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1,666/FEU and US$2,634/FEU, 19.2% and 11% growth accordingly.

The Persian Gulf and the Red Sea:

Until 2nd June, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had a 1.6% increase from last week's and posted US$1297/TEU.

Australia/ New Zealand:

Until 2nd June, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$254/TEU, a 2.7% fall from the previous week.

South America:

The freight market had a slight rebound. on 2nd June, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2236/TEU, an 7.9% growth from the previous week.