Rarely can we see the prices green again, though it did not last long. The stagnant market both in China and abroad remains the biggest anti-force for the price to rise. The stainless steel prices last week actually show a tepid tendency after Monday and finally fell on Friday. But the weekly average price was still higher than before. According to the manufacturing PMI in July, China's manufacturing industry remains under the threshold. Besides, we think it might be a red flag to the stainless steel industry, that in the first half of 2023, the total crude steel output is 5.8% higher than the same period of last year. We are afraid that the market does not have the ability to digest such a rise in stock, as we can see an obvious cut in export volume in H1, which is YoY 381,600 tons lower. Morgan Stanley forecasts that global GDP will stay lackluster in 2024. The industry should upgrade its plans to prepare for future risks. If you want to go deep into our Stainless Steel Market Summary in China, please keep reading.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,355 | 63 | 2.92% |

| Foshan | 2,400 | 63 | 2.85% | ||

| Hongwang | Wuxi | 2,290 | 62 | 2.94% | |

| Foshan | 2,285 | 59 | 2.81% | ||

| 304/NO.1 | ESS | Wuxi | 2,185 | 69 | 3.46% |

| Foshan | 2,200 | 59 | 2.93% | ||

| 316L/2B | TISCO | Wuxi | 4,025 | 54 | 1.40% |

| Foshan | 4,050 | 45 | 1.17% | ||

| 316L/NO.1 | ESS | Wuxi | 3,880 | 68 | 1.84% |

| Foshan | 3,900 | 79 | 2.14% | ||

| 201J1/2B | Hongwang | Wuxi | 1,400 | 34 | 2.70% |

| Foshan | 1,395 | 32 | 2.60% | ||

| J5/2B | Hongwang | Wuxi | 1,310 | 34 | 2.91% |

| Foshan | 1,310 | 31 | 2.66% | ||

| 430/2B | TISCO | Wuxi | 1,265 | 4 | 0.37% |

| Foshan | 1,230 | 1 | 0.13% |

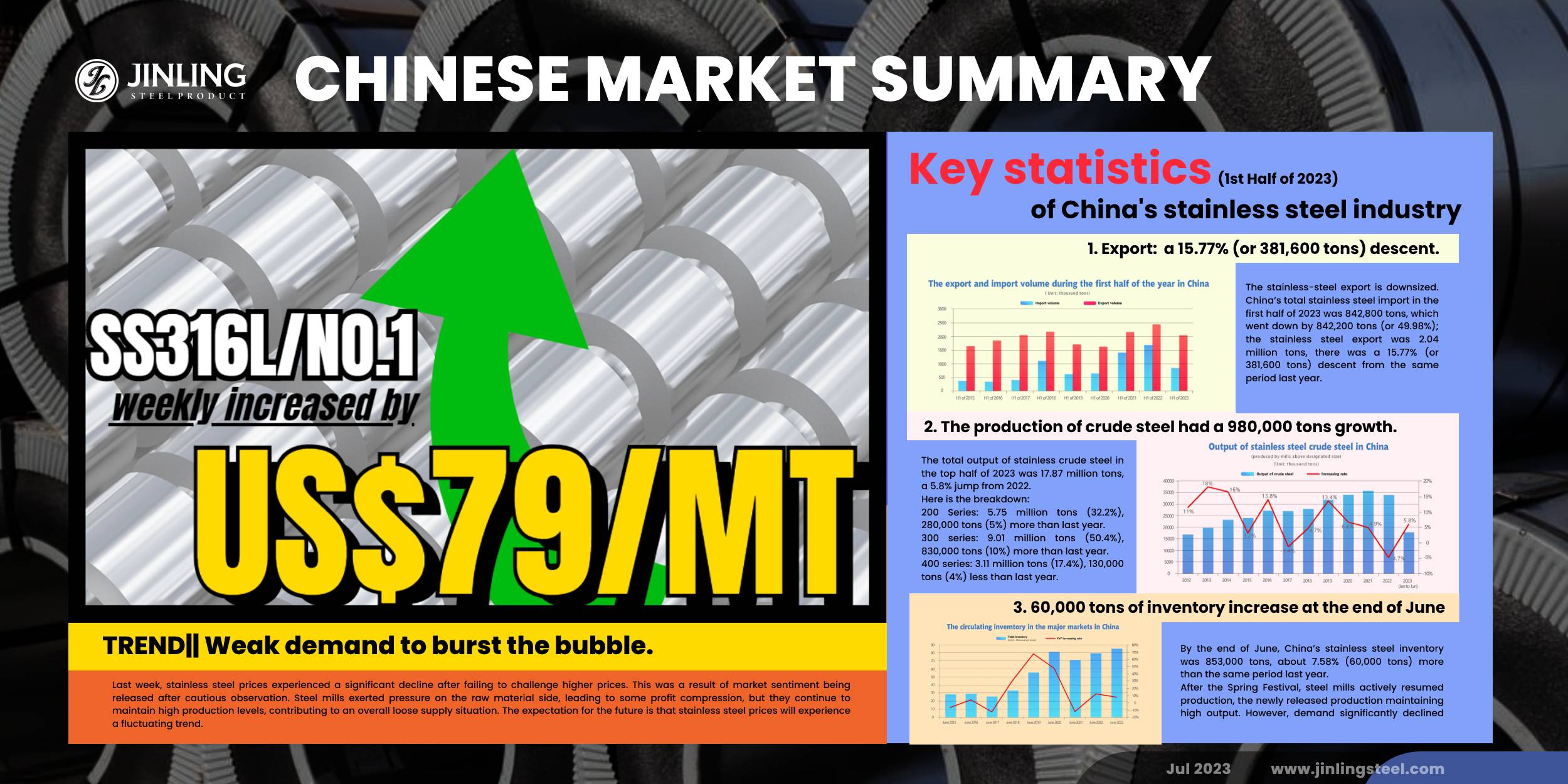

TREND|| Weak demand to burst the bubble.

The stainless-steel price lost the upward momentum halfway through last week despite the weekly average price illuminating the green color. Eventually, the bullish trend of stainless steel 304 and 201 was short-lived due to the imbalance supply-demand, but stainless steel 430 remains strong somehow.

The mainstream contract price fell US$21 to US$2260/MT on Friday.

Stainless steel 300 series: Transaction declined

The market price of the stainless steel 304 series fell after a raise last week: the mainstream price of cold-rolled 4-foot mill-edge stainless steel 304 concluded at US$2225/MT with a US$14 rose; the hot rolled 304 also reported a US$100 growth to US$2165/MT. The spot price of cold and hot roll stainless steel loses support as the future price of stainless steel weakens.

There were numerous traders in the cold-rolled stainless steel market downsizing their sales volume when the price went up in the early week. The spot price then headed down as the transaction was weakened.

Stainless steel 200 series: market turned down sharply last week.

Similar to the price trend of the stainless steel 300 series, the spot price of 201 fell after an increase during the mainstream base price of the cold-rolled stainless steel 201J1, 201J2, and 5-foot hot-rolled stainless steel concluded a US$14 increment, reported US$1370/MT, US$1275/MT and US$1310/MT respectively.

At the beginning of the week, spot prices maintained an upward trend from the previous week. However, downstream demand was unable to keep up, and market transactions lacked significant momentum. On Tuesday, the growth visibly diminished, and on Wednesday and Thursday, prices remained stable, but market transactions continued to be weak. By Friday, spot prices showed signs of decline, indicating an overall unfavorable situation.

Stainless steel 400 series: Standing out in the sluggish market.

The guidance price of 430/2B quoted by TISCO had a US$7 rose to US$1395/MT, while JISCO’s guidance price was lifted from US$21 to US$1510/MT.

The market price of 430/2B in Wuxi rose slightly from the previous week, it was quoted as US$1270/MT-US1275/MT on 26th July; 430/No.1 remains unchanged at US$1140/MT.

Due to maintenance at some steel mills, it is expected that the cold-rolled 400 series stainless steel arrival volume in the Wuxi market will decrease in August. Last week, Wuxi market prices saw a slight increase in 430 cold-rolled prices due to higher mill prices. However, downstream demand remained insufficient, resulting in sluggish transactions and a slight reduction in spot inventories.

Summary:

Last week, stainless steel prices experienced a significant decline after failing to challenge higher prices. This was a result of market sentiment being released after cautious observation. Steel mills exerted pressure on the raw material side, leading to some profit compression, but they continue to maintain high production levels, contributing to an overall loose supply situation. The expectation for the future is that stainless steel prices will experience a fluctuating trend.

300 series:

Overall, after a significant rise in stainless steel futures prices, demand downstream has not shown clear signs of improvement, leading to a generally sluggish market with low overall transactions. The spot price of 304 stainless steel has declined, and there is still pressure from supply sources. It is expected that stainless steel prices will remain weak in the short term but will fluctuate. However, the market still anticipates the traditional peak season for stainless steel and continues to monitor changes in downstream demand and market arrivals.

200 series:

The market remained weak throughout the last week. The prices have already stopped rising and started to decline, resulting in increased resistance to market transactions. Additionally, the recent reduction in steel mill deliveries has led to relatively tight spot inventories. The expectation for the next week is that the overall market will continue to operate weakly, with mainstream prices of 201J2 cold-rolled fluctuating in the range of US$1240/MT-US$ 1270/MT.

400 series:

Last week, both northern and southern steel mills announced a decrease of US$14/MT (50% of Chromium) in their bids for high-chromium materials for August, weakening the support for 430 stainless steel costs. This week, the inventory of 400 series stainless steel spot saw a slight decline, but manufacturers are still facing considerable sales pressure. In the short term, the stainless steel 430 price trend is expected to be weak and stable. In the medium to long term, due to maintenance at some steel mills this month, it is predicted that the arrival volume for August will decrease, potentially leading to stronger price support.

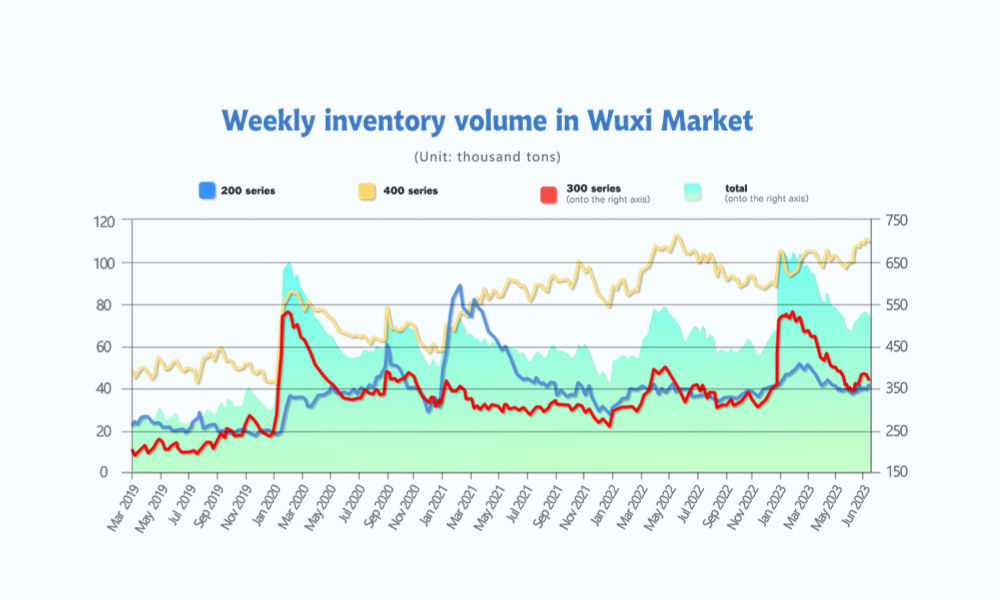

INVENTORY|| Slight decrease in inventory.

The total inventory at the Wuxi sample warehouse fell by 7,878 tons to 520,424 tons (as of 27th July).

the breakdown is as followed:

200 series: 1,967 tons went up to 41,687 tons

300 Series: 8,842 tons went down to 370,150 tons

400 series: 1,003 tons went down to 108,587 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| July 20th | 39,720 | 378,992 | 109,590 | 528,302 |

| July 27th | 41,687 | 370,150 | 108,587 | 520,424 |

| Difference | 1,967 | -8,842 | -1,003 | -7,878 |

Stainless steel 300 series: Temporary price hike relieved the pressure on stock

The recent price increase has stimulated transactions, leading to active buying behavior in some markets. Additionally, due to the steel mills' requirement for agents to concentrate on taking deliveries at the end of the month, their inventory in the preposition warehouse has significantly decreased, mainly in hot-rolled resources.

Currently, steel production has resumed at Delong’s Xiangshui base, and the Liyang steel project has started production. Furthermore, Tsingshan's Indonesian resources have gradually arrived in Wuxi, and with warehouse resources gradually entering the market after July delivery, there is pressure on the supply of goods. It is important to monitor the continued strength of market purchases.

Stainless steel 200 series: Continue to stack up.

Beigang’s resources took the majority part of the arriving goods in Wuxi and some of the stainless-steel resources are en route. Some certain specifications still running short although the inventory level was lifted last week.

Stainless steel 400 series: A small bit of destocking.

The market for stainless steel 400 series is desperate for the element of surprise and the destocking is likely to happen in early August.

RAW Material|| The weak demand limited the growth of production costs.

Nickel: Indonesia performs a stricter government on Nickel refineries.

The mainstream EXW price of high-grade ferronickel reported a US$2.8 rose to US$260/Nickel point, while the ferrochrome jump US$7 to US$1320/MT.

According to Taiwan’s media: the recent price hike of LME Nickel and China stainless steel pushed Tsinghsan(Indonesia) to lift their quote price in export. The stainless steel price in Taiwan might reach a higher level due to the increasing cost of raw materials which primarily rely on imports.

Chrome: Tensive drama of power supply continued

There are 3 high chromium plants in Chengdu that recently has to give way to the World University Games and called off up to 5000 tons of production.

The 24th of July marked South Arica’s 1,176th hour of blackouts – equivalent to 49 days, cumulatively. It is estimated that the hour of blackout will climb to 2112 in the remaining time of 2023.

The peaking production cost and the shrinking supply were the main reason for the steady performance of high chromium prices, not to mention the decent output of stainless steel in July. But there are voices in the industry that rebuts that the price of high chromium will be powerless in growth as the new production project initiating in August.

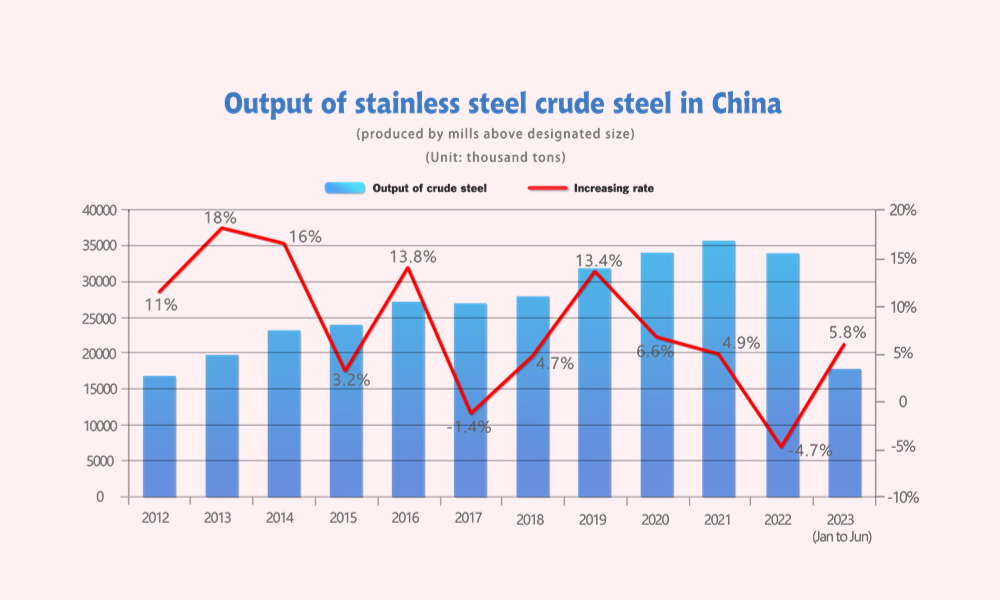

MARCO|| Key statistics of China's stainless steel industry (1st Half of 2023)

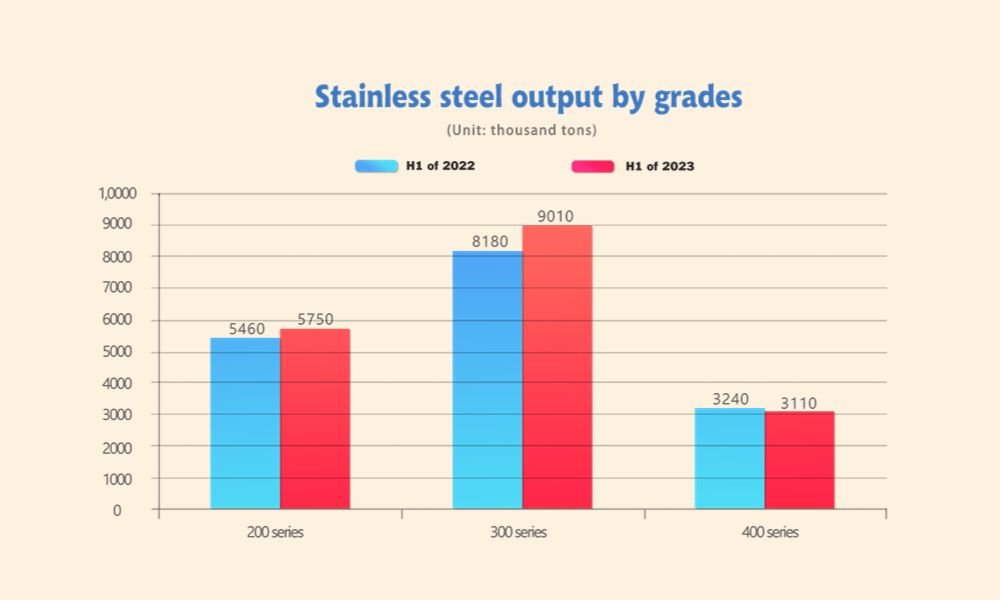

1. The production of crude steel had a 980,000 tons growth.

The total output of stainless crude steel in the top half of 2023 was 17.87 million tons, a 5.8% jump from 2022.

Here is the breakdown:

200 Series: 5.75 million tons (32.2%), 280,000 tons (5%) more than last year.

300 series: 9.01 million tons (50.4%), 830,000 tons (10%) more than last year.

400 series: 3.11 million tons (17.4%), 130,000 tons (4%) less than last year.

2. The stainless steel export is downsized.

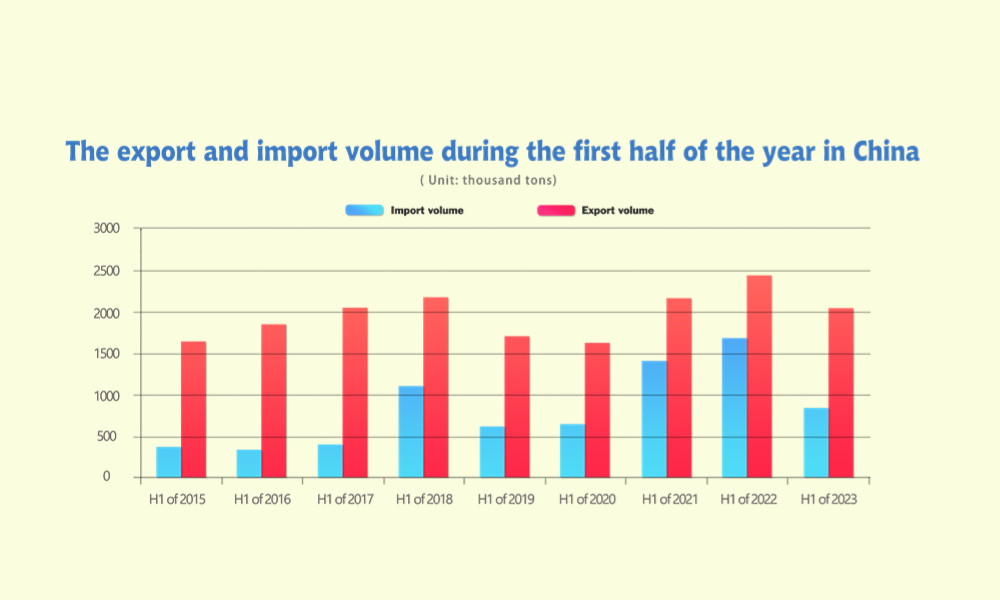

China’s total stainless steel import in the first half of 2023 was 842,800 tons, which went down by 842,200 tons (or 49.98%); the stainless steel export was 2.04 million tons, there was a 15.77% (or 381,600 tons) descent from the same period last year.

3. 60,000 tons of inventory increase at the end of June

By the end of June, China’s stainless steel inventory was 853,000 tons, about 7.58% (60,000 tons) more than the same period last year.

After the Spring Festival, steel mills actively resumed production, the newly released production maintaining high output. However, demand significantly declined due to the long Chinese New Year holiday period. Post-holiday inventories quickly soared to historical highs. Under the pressure of high inventory levels, some agents held a pessimistic outlook for the future and proactively reduced their stockpiles. Following continuous destocking from March to June, inventory levels at the end of the second quarter were close to the three-year average level.

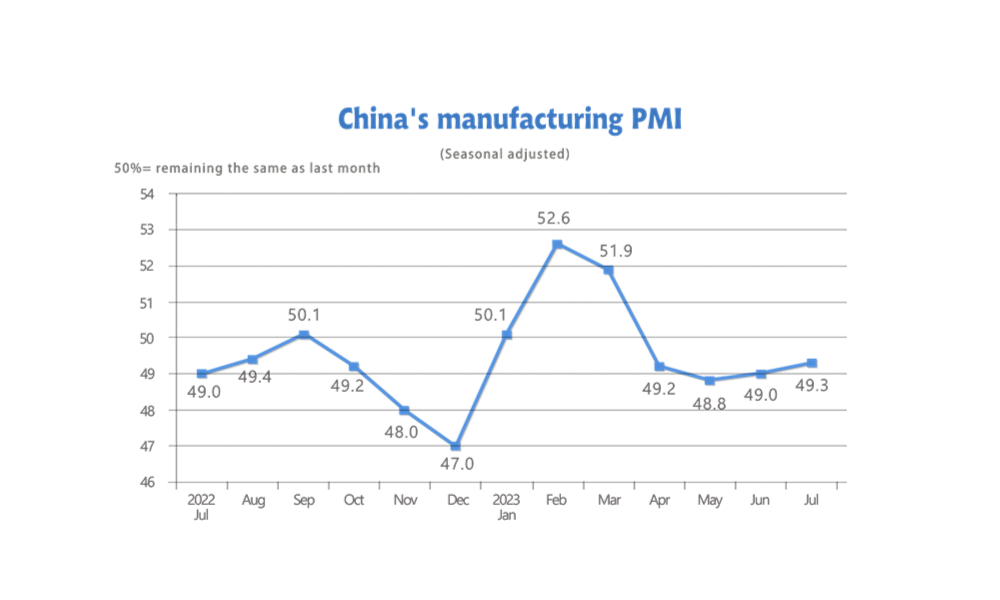

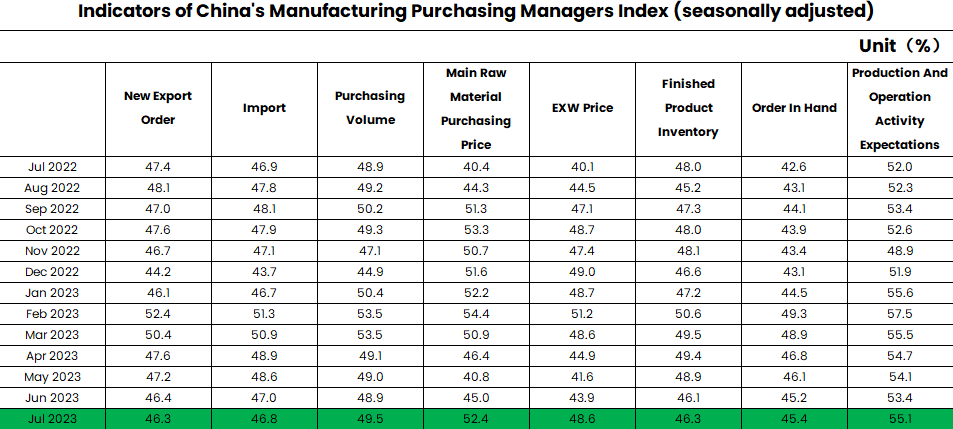

4. China's factory activity swung to a contraction in July

The Caixin/S&P Global manufacturing purchasing managers' index (PMI) fell to 49.2 in July from 50.5 in June, missing analysts' forecasts of 50.3 and marking the first decline in activity since April. The 50-point index mark separates growth from contraction.

Summarizing at 46.3% and 46.8% respectively, the new export orders and the import index contracted at the steepest pace since September 2022 amid weakening global demand.

During The Politburo of the Chinese Communist Party Meeting, China’s top leaders signaled more support for the troubled real estate sector alongside pledges to boost consumption and resolve local government debt, though fell short of announcing large-scale stimulus to support the slowing economic recovery.

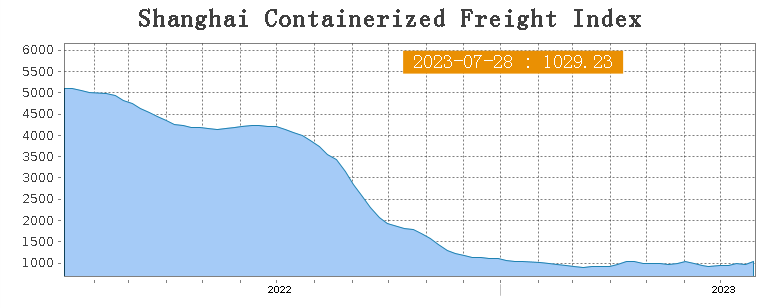

Sea Freight|| Freight rate of western countries rebound.

China’s export volume had a 3.7% growth in the first half of 2023.

On 28th July, the Shanghai Containerized Freight Index rose by 6.5% to 1029.23.

Europe/ Mediterranean:

The June composite PMI stood at 49.9, broadly signalling stagnation, but in July the PMI dropped to 48.9, indicating contraction.

Until 28th July, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$975/TEU, which surge by 31.4%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1503/TEU, which rose by 6.8%

North America:

The world’s largest economy grew 2.4 per cent on an annualized basis between April and June, according to preliminary figures released by the Department of Commerce on last Thursday.

Until 28th July, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1943/FEU and US$2853/FEU, reporting a 10.1% and 6.6% growth accordingly.

The Persian Gulf and the Red Sea:

Until 28th July, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 10.6% from last week's posted US$839/TEU.

Australia/ New Zealand:

Until 28th July, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$318/TEU, a 23.7% spike from the previous week.

South America:

The freight market had a slight rebound. on 28th July, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2513/TEU, an 2.6% slide from the previous week.