From June 2nd to June 5th, it was the Dragon Boat Festival and most businesses took three days off. It means that last week, there were only 4 trading days for the Chinese market. But it did not appeal to stock up and more purchasing behaviors because the prices kept decreasing. At the end of the month, the inventory was reduced as usual since steel mills' agents have to complete the designated delivery volume. The Chinese stainless steel market seems to need more time to recover. On the other side of the earth, the US is raising interest rates to cool down inflation. As you can feel in your daily that the gasoline is extremely expensive right now. Commodity prices have been climbing globally, except for Chinese stainless steel prices. As we know, among the same quality products, Chinese stainless steel is now very competitive. Back to the Fed, throwing back to the past Fed rate hikes, Chinese commodity prices tend to rise. For the detailed analysis of the Stainless Steel Market Summary in China, keep rolling down.

WEEKLY AVERAGE PRICES

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

3,170 |

-33 |

-1.06% |

|

Foshan |

3,215 |

-33 |

-1.05% |

||

|

Hongwang |

Wuxi |

3,075 |

-48 |

-1.62% |

|

|

Foshan |

3,050 |

-47 |

-1.58% |

||

|

304/NO.1 |

ESS |

Wuxi |

3,005 |

-35 |

-1.20% |

|

Foshan |

3,035 |

-41 |

-1.39% |

||

|

316L/2B |

TISCO |

Wuxi |

4,830 |

-33 |

-0.71% |

|

Foshan |

4,850 |

-27 |

-0.56% |

||

|

316L/NO.1 |

ESS |

Wuxi |

4,535 |

-29 |

-0.65% |

|

Foshan |

4,585 |

-28 |

-0.63% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,665 |

-39 |

-2.47% |

|

Foshan |

1,640 |

-42 |

-2.72% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,540 |

-51 |

-3.48% |

|

Foshan |

1,545 |

-43 |

-2.92% |

||

|

430/2B |

TISCO |

Wuxi |

1,545 |

-15 |

-1.05% |

|

Foshan |

1,520 |

-17 |

-1.23% |

TREND|| PRICES keep down.

On June 2nd, before Dragon Boat Festival, a Chinese holiday, LME nickel decreased by US$25/MT and closed at US$28,270/MT; as for the contract for July of stainless steel futures, the price increased by US$4/MT to US$2,910/MT. Before the holiday, the market was stable.

From May 30th to June 2nd, the spot price of stainless steel 201 in Wuxi dropped all the way down. Until June 2nd, the base price of cold-rolled stainless steel 201 has decreased by US$30/MT to US$1,625/MT. The base price of cold-rolled 201J2 also declined by US$30/MT, to US$1,500/MT; the hot-rolled 5-foot even dropped much, by U$S38/MT to US$1,655/MT. From the point of transaction, the trading of stainless steel 201 in Wuxi was weak. Last week, steel mills kept reducing their prices. Last Tuesday, Tsingshan cut both CR and HR 201 down by US$76/MT. What’s more, another steel mill even quoted lower to US$1,640/MT.

The price of stainless steel 304 also continued to decline. Until June 2nd, the cold-rolled 4-foot stainless steel 304 by the private-owned mills in Wuxi was quoted at US$3,185/MT which was US$48/MT lower than the average price of two weeks ago. About the hot-rolled stainless steel 304 by the private-own mills, it decreased by US$16/MT in one week, which was US$3,170/MT.

Stainless steel 430 is no exception. The cold-rolled stainless steel 430 in Wuxi decreased by US$15/MT, to US$1,540/MT. TISCO and JISCO also reduced the guidance price of the cold-rolled stainless steel 430 by US$15/MT, quoting US$1,685/MT.

INVENTORY|| Domestic traders stocked up under low prices and market inventory was reduced.

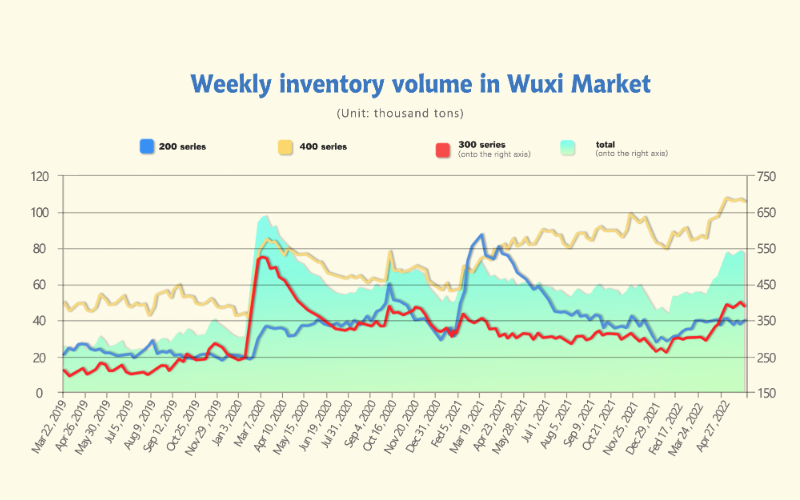

Last week, the inventory volume in the Wuxi sample warehouse decreased by 14,000 tons to 527,500 tons after several weeks of increase in the spot inventory volume.

200 series inventory decreased by 1,600 tons, to 39,000 tons; 300 series decreased by 14,000 tons, to 383,700 tons; 400 series reduces by 1,500 tons to 10,480 tons.

200 series: Transaction was tepid and the inventory increased slightly.

Led by the steel mills who firstly cracked down on the prices of stainless steel 201, making worsened the market trading. The stainless steel 200 series of Wuxi slightly increased by 1,600 tons, to 39,000 tons. The majority of the increase came from the hot-rolled resources by Beigang New Materials while the cold-rolled stainless steel inventory was reduced a bit. The tepid demand and the weak transaction remained, and thus the inventory stays high.

300 series of stainless steel: Inventory decreased because agents have to complete the designated delivery.

To complete the delivery portion that is signed with steel mills, the agents proactively take the delivery, which has consumed a lot from the on-way inventory. The opening price of Delong once went down to US$3,015/MT which was lower than the market price. Traders’ orders that count for more than 10 thousand tons, flooded into steel mills. Earlier last week, the stainless steel futures prices increased greatly, heating up the transaction vibe. On May 31st, Tsingshan opened again and the prices of cold and hot rolled stainless steel decreased by US$45/MT~US$76/MT. Meanwhile, the stainless steel futures turned down, cooling down the short market fever. The prices were decreasing and the quotation of cold-rolled stainless steel even dropped below US$3,185/MT. Under the downward trend, buyers hesitated, leaving the market quietly.

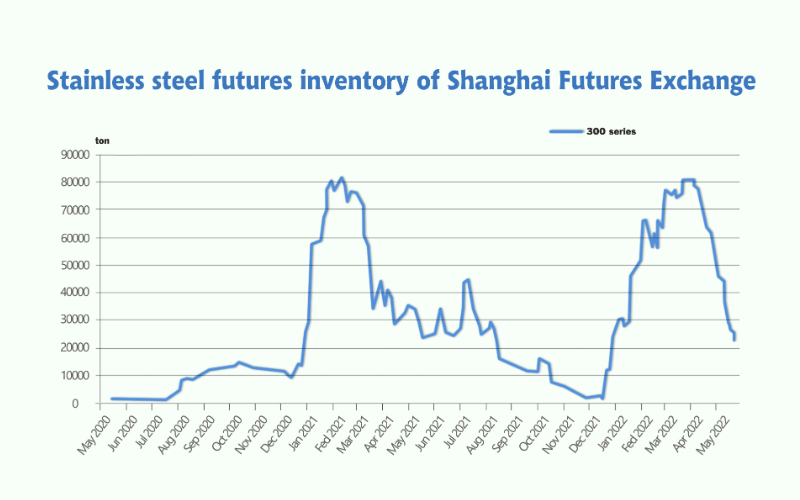

The price difference between spot and futures highest widened to US$232/MT. It is more advantageous to buy the warehouse receipt. According to the data from Shanghai Futures Exchange, until June 1st, the stainless steel futures inventory was 22,400 tons which have fallen back to the level of January. A source said that Tsingshan will probably not enter settlement in June, which will lead to a continuous decrease in the inventory of warehouse receipts.

400 series of stainless steel: Overhaul of steel mills reduces the inventory.

Last week, the inventory of stainless steel 400 series in Wuxi sample warehouse reduced slightly. JISCO is having the maintenance of the machines, which influences the delivery and production of the products. Although the transaction was boosted under the influence of the rising stainless steel 304 prices, the stacking inventory is still under high pressure.

Raw materials|| Chromium products might be reduced in June.

The price of high chromium finally gets stable after weeks of fluctuations because of high cost and low demand. Since late May, the price of high chromium maintained between US$1,439~ US$1,470/MT (with 50% of chromium content). After May, the high chromium price has cut down by US$45/ MT (with 50% of chromium content). On one hand, in May, more high chromium factories were back to work after the environmental investigation, which raised the supply to the market. On the other hand, many steel mills have begun maintenance and reduced production to deal with the sluggish market and declining prices. The demand for chromium products decreased and naturally the price of high chromium fell. However, the price of chromium ore remains high, which stressed the high chromium producers.

Facing the difficulty, accidentally, some manufacturers have to overhaul. In Inner Mongolia, the electricity bills rise slightly, forcing some producers to reduce their production. In Sichuan, two high chromium producers shut down the high furnaces, and 4,000 tons of production will be influenced. In Shanxi, there is also one high carbon ferrochrome producer, repairing a 36000KVA submerged arc furnace, which will last for half a month due to equipment failure. The domestic supply will decrease in June based on this current situation. But the stainless steel production will start to increase in June because the steel mills that have stopped producing will recover in this month, which will appeal to higher demand for chromium products.

It is predicted that the oversupply of high chromium will stop in June. As the stainless steel market is fixed, the price of ferrochrome will remain stable and rise gradually.

Negative buying sentiment in India, ferrochrome prices fall

The price of ferrochrome, a key raw material for making stainless steel, fell 2%-5% in various auctions in India, fluctuating in the range of 114,000 rupees/MT (about US$1,467.5/MT).

The main reason for the decline in ferrochromium

The main reason is weak buying sentiment in India and delays in purchases due to production cuts by stainless steel makers. High inventories and weak demand in export markets also contributed to the fall in ferrochromium prices, and the lower demand in China and logistical bottlenecks drag down demand.

Imported raw materials are the best choice

Besides, India's imposition of export duties has also reduced export transactions, and for stainless steel producers, importing raw materials now seems to be a cheaper option ——low-cost stainless steel products imported from Indonesia are taking a growing share of the local market.

India's steelmaking output was estimated to have reached 1.1 million tons in the first quarter of this year, but it could come under pressure in subsequent quarters. The market expects prices will continue to fall after Vedanta's auction ends on June 4.

Market sentiment is starting to improve

However, as Shanghai returns to normal, it is expected that the overall demand will soon return to normal. The realization rate of ferrochrome is expected to increase to around 125,000 rupees/MT (about US$1,608/MT).

What’s more, data show that global stainless steel production may grow by 4% to 58.6 million tons in 2022.

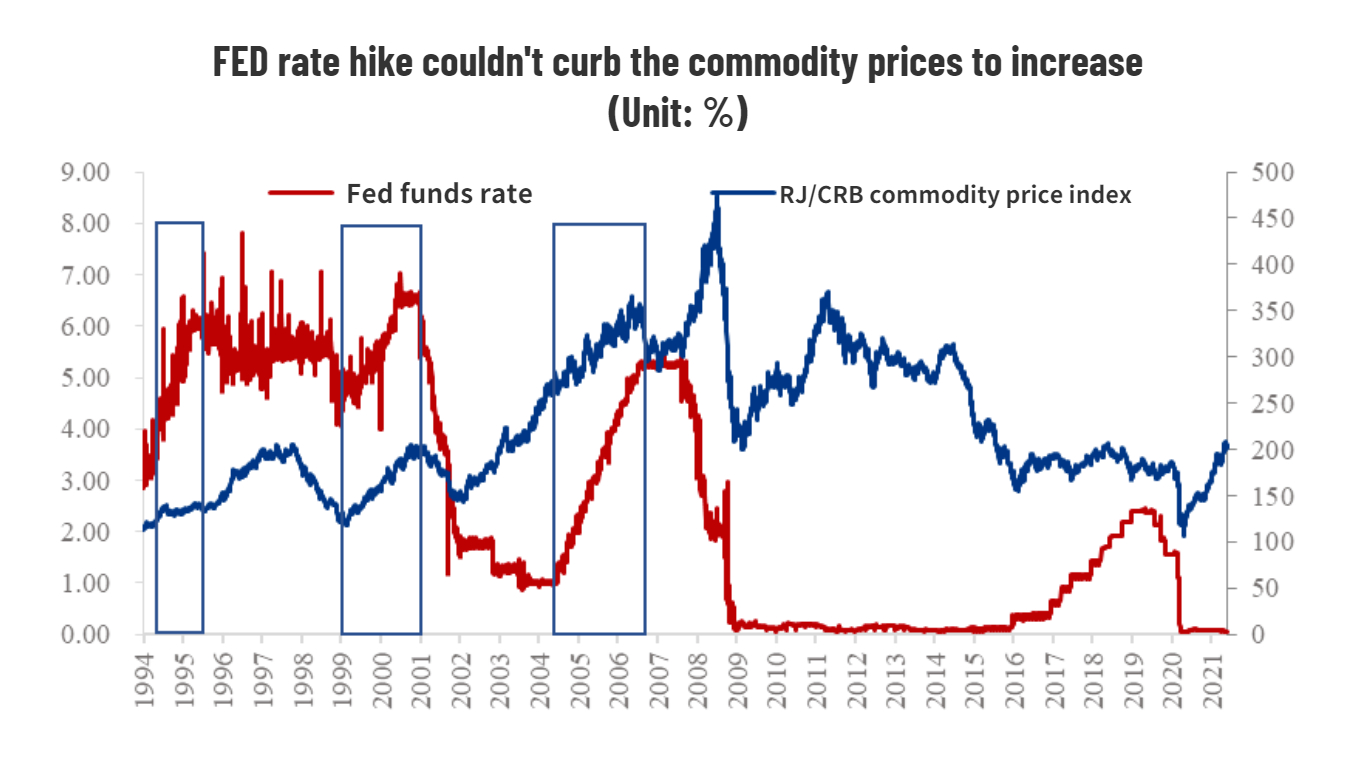

MACRO|| Commodity prices likely to rise during Fed rate hike period.

Since 1980, the Fed has completed six rounds of the interest rate hike. The main reason for raising the interest rate is to curb inflation or prevent the economy from overheating. In each interest rate hike cycle, regardless of the various economic environment, commodity prices mostly show a rising tendency, more or less. It is because the effect won’t respond to the interest hike immediately, though it reduces the demand for commodities.

According to traditional investment theory, when inflation runs high, the investment still keeps rushing into the commodities and thus the commodity prices will remain increasing.

About this latest round of rate hike, in a long term, it will curb the global demand for commodities. The inflation in the US boosts the real estate industry, and the demand for housing products spurs. Part of the needs is imported from China. While the US raises the rate, the cost of real estate will increase, which will reduce the demand for houses and the following needs for the relevant products.

But in a shorter view, the inflation, the Russia-Ukraine war, and the unstable supply chain are making the commodity price difficult to fall. On one hand, the market has already prepared for the rate hike, and current commodity prices have taken the increasing rate into consideration. Therefore, the hike might not strike down the prices but in return, the bad news will be out of the market. On the other hand, while some evidence points to a peak in U.S. core PCE, monetary policy tools cannot mitigate supply shocks, and their role is to reduce demand, which has a greater impact on core inflation and might be helpless on the inflation caused by the supply side. In the near future, the economy will still suffer from inflation due to the war and the unstable global supply chain.

Throwing back to the past Fed rate hikes, Chinese commodity prices tend to rise. Studies have shown that frequent adjustment of US interest rates will affect China's domestic commodity prices through currency and exchange rate fluctuations. From the perspective of the impact on prices, the rise in interest rates has caused the prices of all commodities of production means to rise. And the prices of oilseeds and oils will be influenced directly. In terms of price volatility, the rise in U.S. interest rates has increased the volatility of commodity prices of all means of production. According to the degree of influence, they are ore, metal, steel, rubber and energy.