Trend||Demand is tipid.

Last week, the prices of stainless steel performed stably, except for the prices of 300 series which were greatly influenced by the fluctuations of the futures market. The Development and Reform Commission issued regulations against the hype of bulk commodities. The carbon products declined to the limit down and the prices of HRB fell with the trend. As for stainless steel futures, the price tended to be weakening, which dropped by US$82/MT in a week, decreasing to US$3,340/MT.

300 series: Prices fluctuated, because of the back and forth of production policy.

Last week, the general trend of the stainless steel market decreased from a high opening price. Prices fluctuated because some steel mills were back to work from the production limit while some others just began to carry out the limit. Until October 22nd, the stainless steel main contract was closed at US$3,340/MT which was US$82/MT lower. During last week, the Development and Reform Commission lays much emphasis on the bulk commodity hype.

However, compared to the futures market, the spot market develops in its own way. When the futures prices went up, traders actively sent out products; when the futures prices fell, the spot prices did not drop due to the low market inventory volume. Therefore, until October 22nd, the base price of the CR stainless steel from the private-owned mills fell by US$32/MT, closing at US$3,415/MT. About the inventory, last week, the volume decreased by 3,000 tons, going down to 306,500 tons. It is said that 9,000 tons of HR products are on the way to Wuxi market, which mainly are 3.0 mm in thickness, though it is predicted that the supply of HR 304/3.0 will remain sufficient.

Currently, the EXW price of high nickel-iron is quoted as high as US$242/MT. Steel mills expanded their purchasing volume. Delong, Beigang New Materials and ZPSS bought ferronickel last week. Last week, earlier, Delong purchased 2,000 tons of the high nickel-iron at US$237/nickel (tax inclusive, cash to the factory), which was US$6/MT higher than the last deal. Following this, other mills also purchased ferronickel, and thereby the price of ferronickel increased. Besides, because of dual control, Chinese ferronickel production was reduced. To ensure the steel milling, Delong even again closed down the ferronickel production line.

In September, Chinese ferronickel output reduced by 115,400 tons compared to August, declining to around 282,100 tons. The ferronickel imported from Indonesia is also reduced. Based on the data of September, the import volume of ferronickel was 306,500 tons, MoM decreasing by 12.34%. It is predicted that the import volume is to remain in October because the ferronickel production lines in Indonesia were shut down due to the electricity supply error in October. The low production volume home and abroad will maintain the supply tight.

200 series: The inventory volume reduces, and transaction warms up.

Last week, the inventory of 200 series reduced by 1,600 tons, declining to 36,800 tons in Wuxi market. Because there were not many new arrivals, the inventory was 434,000 tons which is 4,500 tons lower compared to mid-October. The price of 200 series was rather stable last week. Until October 22nd, CR mill-edge 201J2 was quoted at US$2,105/MT while the average price was US$2,135/MT which is US$2/MT lower than two weeks ago. So far, the price difference between CR and HR maintains at around US$115/MT.

Until October 22nd, the base price of the mill-edge CR 201J1 was US2,200/MT; J2 and J5 were around US$2,105/MT; as for the 5-foot HR product was US$2,010/MT. Earlier last week, the transaction began to warm up, and the spot inventory was tightening up. Therefore, the price of 201 increased. On October 21st, the futures price increase. 201 follows suit but the transaction cooled down. The production of 200 series has not recovered, neither the downstream demand. Therefore the price will remain next week.

400 series: A sharp cut in chrome production did not lift up the price of 430 because of the weak demand.

In October, steel mills like Taishan Steel, Tisngshan, LISCO have a production plan in reduction of 400 series. The inventory of 400 series remains high ad even kept increasing by 300 tons, reaching 90,800 tons totally.

The high chrome producers in Hunan Province all close down. The limit of power usage in Tsinghai province remains. Although the production volume in Inner Mongolia is recovering, the actual output is still lower than expected. However, thanks to the import might be expended, the shortage of high chrome will be eased.

As for the high chrome, last week, TISCO, JISCO, and Baosteel Desheng have settled down the purchase price which is US$6/MT higher compared to last month. The purchasing price is far lower than expected. The high chrome output is influenced by the power usage limit, and thus the production is low, but the price did not rise thereby.

Summary:

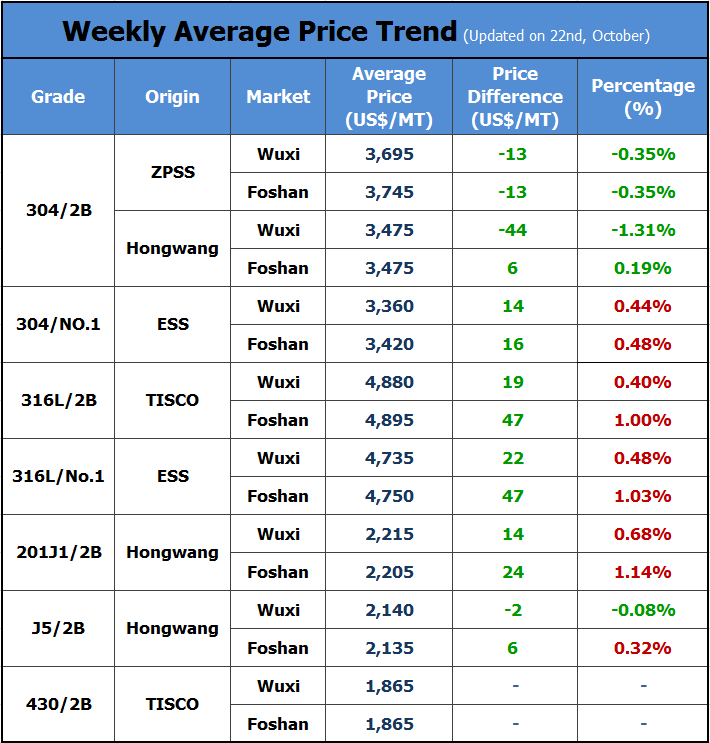

300 series: Overall, the back and forth of the production policy result in prices fluctuating. It is necessary to keep the eyes on the policy dynamics in Jiangsu and Guangdong provinces. It is predicted that the CR product price from the private-owned mills will fluctuate between US$3,380/MT- US$3,460/MT.

200 series: So far, the production limit continues. The market inventory is decreasing. Last week, the transaction of 201 turned better. It is predicted that the price of 201J1 is around US$2,200/MT ~ US$2,215/MT; J2 and J5 will be around US$2,105/MT~ US$2,140/MT; the 5-foot HR product will be about US$2,025/MT.

400 series: Considering that the steel mill reduce the production of 400 series in October, which is good news to the price of 430/2B. It is predicted that the price will remain around US$1,838/MT~US$1.850/MT.

Stainless steel futures have entered a stalemate, mainly due to the contradiction between high producing costs and weakened consumption expectations in a long term:

In the short term, from the perspective of cost, the Chinese supply of ferronickel and ferrochromium is tight, and the prices continue to stay high and the rising trend remains. The power limit policy has a greater impact on raw materials, which intensifies the lack of raw materials.

In the long term, from the perspective of demand, the inventory in the stainless steel industry is not stacked up, which can hold up the prices.

At last, the weak consumption expectation is the main reason that suppresses the stock prices. The export volume is decreasing. When the power limit gets loose, the total supply will recover. Stainless steel prices will be difficult to rise. Next week, the prices will remain fluctuating.

RAWMATERIAL|| Supply tightens up.

The rainy season is here. The supply of nickel ore reduces by 90,000 tons.

On one hand, the local production of ferronickel decreases in China. On the other hand, it also reduces abroad.

According to the data, in September, the Chinese import of ferronickel and nickel ore both reduces. The ferronickel import YoY decreases by 43,200 tons; the nickel iron import volume fell by 92,800 tons.

This month, the rainy season starts in The Philippines and it will last until March next year. As The Philippines is the major nickel ore supplier to China, Chinese ferronickel factories have stocked up in advance.

From the perspective of nickel ore import volume, from July to September 2021, Chinese nickel ore imports totaled 16.6486 million tons, increasing by 1.7906 million tons compared with the third quarter of 2020, rising by 12.05%. In the third quarter of this year, the import volume of nickel ore was more than 5 million tons each month, and in August it reached a high of 5,777,100 tons.

However, with the approach of the rainy season in The Philippines, the reduction of nickel ore imports begins earlier than in the past years. In September 2021, the total imports of nickel ore are 5.6843 million tons, MoM reduced by 1.61% and YoY fell by 8.45%. Those imported from The Philippines are 5.1949 million tons, which is 4.02% lower than the imports in August, and 5.34% less compared to the same period of last year.

Last year, September is the peak time importing nickel ore, when it was as high as 6.209 million tons, among which, 5.4882 million tons of nickel ore were from The Philippines. Except for the pandemic and the insufficient marine shipping, the unusual rains are also a crucial factor to the earlier end of importing.

The nickel production volume might reduce due to the bad weather in The Philippines.

On October 21st, Dante Bravo, chairman of the Philippine Nickel Industry Association and chairman of Global Ferronickel Holdings Inc, the country's second-largest ore producer, said: "The output is likely to decline because we have experienced a lot of rain this year compared to previous years."

Affected by the rainy season, mining operations and ore transportation at the Nickel Center in the Caraga region in the southern Philippines usually stop in the third or fourth quarter of each year, but Bravo said this year's downpour is particularly destructive.

Data from the Bureau of Minerals and Geology of the Philippines shows that from January to June this year, the country's nickel production increased to 151,646 tons, which is 39% higher than the same period in 2020. The president of the Philippine Nickel Industry Association insists that the decline in nickel production may be concentrated in the second half of the year, especially in the fourth quarter when the rain hits harder.

Nickel price surged and plunged.

On October 21, 2021, LME nickel rose by US$1,000 and then fell back by US$1,000. Between the peak and bottom, the fluctuation was more than US$2,000 in one day. In the evening, LME nickel continued to fall, once fell by more than 1,000, and plunged below US$20,000/MT, lowest to US$19,870/MT.

Influenced by the dramatic nickel market, the stainless steel futures stock would not be in peace. The contract SS2111 increased by more than US$125/MT earlier in the day but also fell as the nickel in the night, by over US$110/MT.

For now, in the Foshan market, people seem to hold a neutral point of view, showing no tendency in the price changes whether it is to increase or decrease. What really matters to them currently, is to deliver the products on time. After all, such a sharp change, won’t last long.

China curbs the coal price to increase.

In the case of coal prices soaring, the country has strengthened supervision and investigations, promised to crack down on irregularities that disrupt market order, and will take measures to prevent coal companies from making excessive profits to bring coal prices back to a reasonable range.

China's ferrous metal futures fell sharply on October 22nd, and both steel and steelmaking raw materials fell sharply as the Chinese government stepped up its efforts to control the rise in coal prices.

On October 24,the Emergency Management Department of Shanxi Province, which is the biggest coal mining province in China, issued a notice to request that within safety, the local jurisdictions shall ensure safe production during the production increase and guarantee supply period; strictly implement the investigation of potential hazards in coal mines. The notice lists six types of unqualified mine operations.

Previously, the China Development and Reform Commission stated that the current global energy prices are rising and the situation is severe. Therefore, Shanxi and Inner Mongolia are required to release advanced production capacity as soon as possible under the premise of ensuring safe production.

The government is urging for a more stable power supply amid the dual control policy. On the evening of the 24th, the Central Committee of the Communist Party of China and the State Council issued an opinion on carbon peaking and carbon neutrality. This document emphasizes the security of relations between all parties in the process of reducing carbon emissions. It points out that the relationship between pollution reduction and carbon reduction and energy supply, producing chain and supply chain, food, and the life of people should be properly dealt with. Meanwhile, prevent overreaction.

Macro|| The supply lack for stainless steel and other metals might be extended to 2022.

“There are several factors that may cause precious metals to continue to face supply constraints in 2022, the most important of which is demand——we have never seen such a strong demand before. Manufacturers also struggle to keep up with demand, partly because people are working from home and order consumer durables online.” Colin Hamilton, Managing Director of Commodity Research at Bank of Montreal Capital Markets, said in an online speech on October 12. He added: “This is a real, demand-driven deficit.”

1. Energy crisis influences the supply of metal.

The global energy crisis contributes to the difficulty of supply lack.

“We are striving to deliver more calories to the world. The reason behind the energy crisis is the heating requirement for every space is larger rather than blaming it on the energy structure transformation ”, Hamilton said.

There have some solutions to the situation. Improving construction can be helpful to the heating requirement because it accounts for 30% of the global energy usage. For example, the smart metal facade of the building will allow for better temperature control. At the same time, improving ventilation based on the COVID-19 will benefit zinc and copper.

2. Dual control in China.

Power outages in China are also affecting industrial activities. After an informal ban in 2020, the country has now gradually resumed coal shipments from Australia.

Australia used to be China's second-largest coal supplier, of which about 60% is thermal coal, used in power generation and cement industries, and about 40% is coking coal, used to make steel.

According to China Customs statistics, coal imports in September YoY increased by 76% which is 32.9 million tons in total. Natural gas imports increased from 8.61 million tons to 10.6 million tons, by 23%. Therefore, Hamilton predicts that the metal supply will decline in the rest of 2021.

European News reported that after the outbreak of the pandemic, China's economy recovers, and 2020/2021 winter was longer. Coupled with competition from East Asian companies, European natural gas prices have increased several times.

3. Logistics restructuring

The unusual recovering methods, geometrically and departmentally, caused serious destruction in the logistics. The quarantine and restriction policies in the ports line up the cargo ships, causing congestion. In some cases, raw metal is transported in bulk rather than in containers. Hamilton warned that people get desperate in metal demand, which means a potentially high premium.

“If possible, you want more inventory because you know the fact that sometimes it is hard to get these materials in time.”

4. Strong demand for nickel

Due to the very high demand for stainless steel, global nickel demand may increase by 15% YoY in 2021.

The production cost of nickel pig iron is at the highest level since 2014 because of the increase in energy costs and logistics costs for ore transportation.

Although the People's Bank of China said it will no longer provide funding for any coal-burning nickel plants, the battery and stainless steel industries still keep Hamilton optimistic about the prospects of this precious metal.

He said,” Battery recycling will continue to grow in the next decade. This will also be a source of nickel supply units”.

All these factors are driving the structural growth of energy demand, and we may not be well-prepared yet.

Stainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in China