In summary, the stainless steel market in China is currently experiencing prolonged price declines. The prices of different grades have varied, with stainless steel 201 falling, stainless steel 304 rising after a fall, and stainless steel 430 remaining flat. The inventory levels have decreased, especially in the 300 series, while the 400 series saw a slight improvement in trading. The production of stainless steel is facing power rationing, and the prices of nickel and chrome raw materials have been unstable. China's stainless steel exports have reached a new record high, while the manufacturing PMI continues to decline. Sea freight rates have stabilized on various routes. If you need specific analysis, please keep reading Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,375 | -27 | -1.20% |

| Foshan | 2,415 | -27 | -1.18% | ||

| Hongwang | Wuxi | 2,285 | -36 | -1.63% | |

| Foshan | 2,300 | -30 | -1.36% | ||

| 304/NO.1 | ESS | Wuxi | 2,200 | -27 | -1.29% |

| Foshan | 2,240 | -34 | -1.60% | ||

| 316L/2B | TISCO | Wuxi | 3,995 | -17 | -0.44% |

| Foshan | 4,055 | -9 | -0.22% | ||

| 316L/NO.1 | ESS | Wuxi | 3,790 | -29 | -0.78% |

| Foshan | 3,850 | -40 | -1.07% | ||

| 201J1/2B | Hongwang | Wuxi | 1,490 | -1 | -0.10% |

| Foshan | 1,580 | -13 | -0.94% | ||

| J5/2B | Hongwang | Wuxi | 1,415 | -3 | -0.22% |

| Foshan | 1,405 | -11 | -0.88% | ||

| 430/2B | TISCO | Wuxi | 1,225 | 0 | 0% |

| Foshan | 1,225 | 0 | 0% |

Trend|| Prolonged price declines

The price trend of stainless steel series went for different direction. Stainless steel 201 fell after stabilized while stainless steel 304 rose after a fall, and 430 remained flat. The mainstream contract price of stainless steel fell US$12/MT to US$2260/MT.

Stainless steel 300 series: Prices dropped slightly.

Until Friday, the mainstream base price of cold-rolled 4-foot mill-edge stainless steel 304 quoted US$2240/MT with a US22/MT fall; hot-rolled stainless steel fell US$7/MT and closed at US$2210.

The future price trend has been rallying during last week, it regained the losses on Friday.

Stainless steel 200 series: Steel mills to worsen the price decline.

The spot price of stainless steel 201 remained flat: the mainstream base price of cold rolled stainless steel 201 was untouchable at US$1465/MT; 201J2 fell US$7/MT to US$1380/MT; 5-foot hot rolled also dropped US$22/MT to US$1395/MT.

The future price of 201J2 in June which was recently quoted by Tsingshan, pinned at US$1365/MT.

Stainless steel 400 series: Price curve was flatten

The guidance price of stainless steel 430/2B quoted by TISCO and JISCO stayed still at US$1380/MT and US$1475/MT respectively.

The spot price in Wuxi market was commonly anchored between US$1235/MT and US$1235/MT.

Summary:

The transaction remains gloomy in Chinese stainless steel market, but the high scheduled production causes great pressure on the future supply side. The downstream demand shows no sign to revert. Marketers are pessimistic to the future trades. Generally, the stainless steel market will maintain weak and fluctuating.

300 series: Due to limited arrivals in the market and proactive destocking by traders, inventory continued to decrease last week. Steel mills raised their opening prices, and after destocking, the limited supply allowed spot and futures prices to stabilize. However, with weak demand and fluctuations in raw material prices, the focus of stainless steel prices is trending downward. In the short term, the base price for private cold-rolled 300 series in the Wuxi region is expected to remain weak and stable around US$2205/MT to US$2230/MT.

200 series: The inventory of 200 series stainless steel in the Wuxi market continued to decrease last week, but downstream demand remains sluggish, resulting in sustained weak market transactions. Combined with steel mills leading the price decline, it is anticipated that next week, the spot prices of 201 series stainless steel will primarily decrease, while the base price for 201J2/J5 cold-rolled stainless steel will fluctuate in the range of US$1350/MT to US$1380/MT. Attention should be given to downstream restocking activities.

400 series: The chromium ore prices remained stable last week, and the mainstream price for 430/2B stainless steel in the Wuxi market maintained a steady state. However, TISCO and Tsingshan Group increased their purchase prices for high-chromium raw materials by US$29/MT (50% chromium) in June, leading to an increase in the production cost of 400 series stainless steel. Considering the lack of significant improvement in market transactions, it is expected that the price of 430/2B stainless steel will continue to remain stable this week.

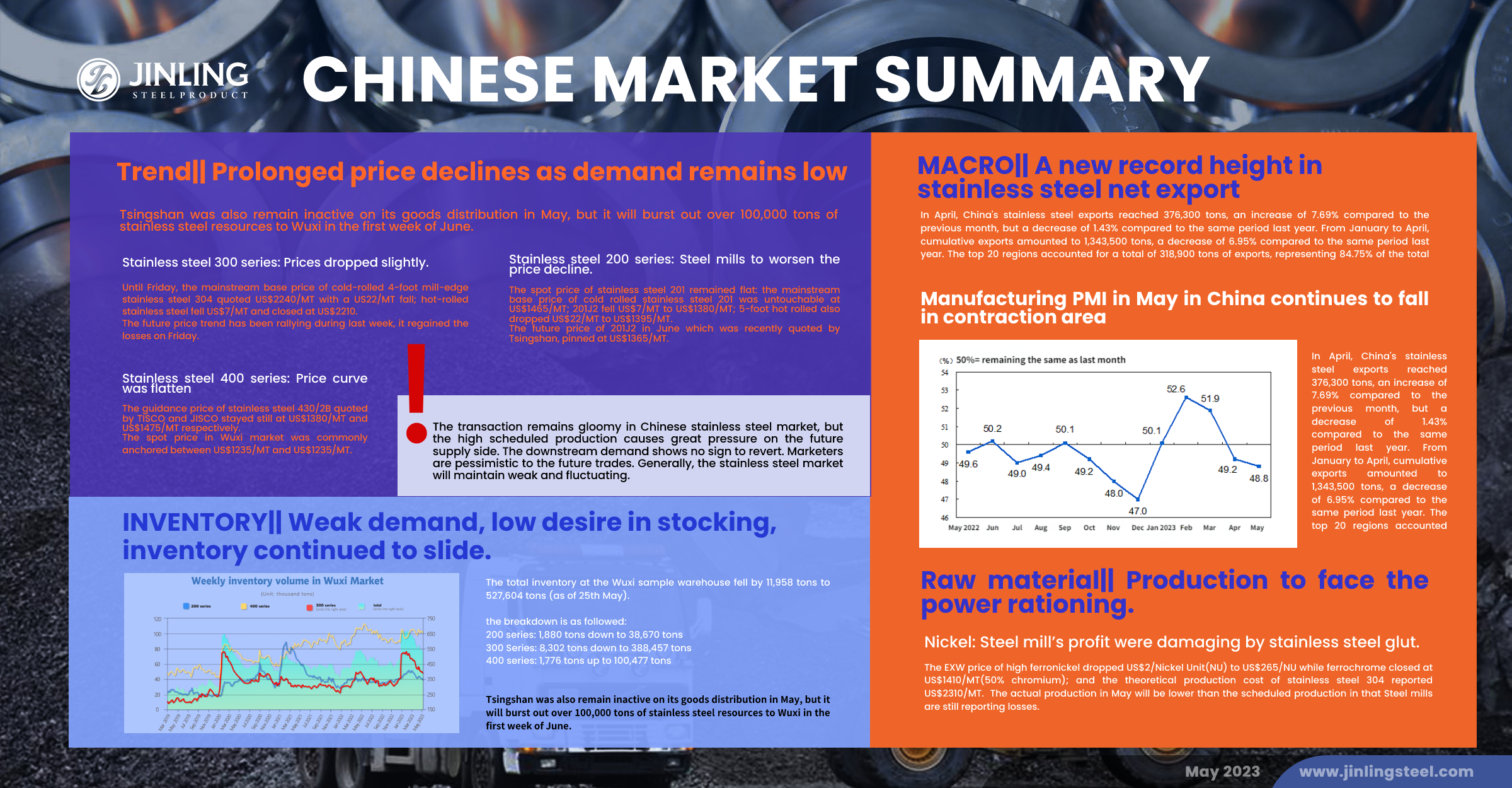

INVENTORY|| Inventory continued to slide.

The total inventory at the Wuxi sample warehouse fell by 11,958 tons to 527,604 tons (as of 25th May).

the breakdown is as followed:

200 series: 1,880 tons down to 38,670 tons

300 Series: 8,302 tons down to 388,457 tons

400 series: 1,776 tons up to 100,477 tons

Stainless steel 300 series: Late arriving good result in the inventory decline

The rapidly drop spot price of stainless steel 304 in May stimulated considerable market transaction, the hot-rolled resources took the majority of the inventory consumption. It is believed that Delong had suspended the production line in Liyang and cut 20% of the goods distribution.

Tsingshan was also remain inactive on its goods distribution in May, but it will burst out over 100,000 tons of stainless steel resources to Wuxi in the first week of June.

Stainless steel 200 series: Slight drop in inventory

The sluggish demand of 200 series continues, and the slight dropping inventory last week was notable, but it only contributed by few buyers. The arriving goods mostly belongs to Bao Steel and there is more enroute.

Stainless steel 400 series: An obvious drop in inventory.

The turnover was slightly improved last week, wiping about 1800 tons of inventory off last week. The market for 400 series stainless steel saw a slight improvement in trading. TISCO, in June, the procurement price rose US$29/MT(50% chromium). Considering the continued sales pressure on manufacturers, shipments have been relatively active. It is expected that there will be a slight decrease in spot inventory this week.

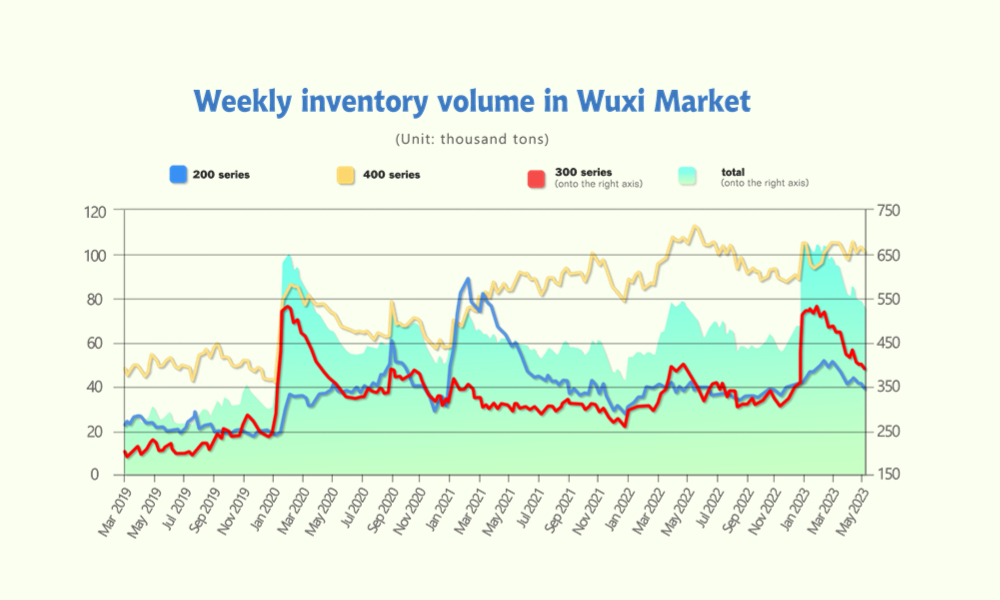

Raw material|| Production to face the power rationing.

Nickel: Steel mill’s profit were damaging by stainless steel glut.

The EXW price of high ferronickel dropped US$2/Nickel Unit(NU) to US$265/NU while ferrochrome closed at US$1410/MT(50% chromium); and the theoretical production cost of stainless steel 304 reported US$2310/MT. The actual production in May will be lower than the scheduled production in that Steel mills are still reporting losses.

The importation of ferronickel in April was recorded 669,900 tons, with 27.36% increase from March and 59.86% growth from last year, and there was about 10% of the ferronickel sent from Indonesia, marked another historical high. But the oversupply in the market will constrain the price growth.

Chrome: Stable Supply in the Chinese High Chrome Market

Last week, mainstream EXW prices for high chrome remained relatively stable but slightly weak, falling to around US$1410-US$1435/MT(50% chromium), a decrease of US$14/MT compared to the end of last week. The spot price of chrome ore remained stable.

Since May, the electricity load in southern China has been steadily increasing. On May 22nd, the peak load of the Southern Power Grid exceeded 200 million kilowatts for the first time this year. It is predicted that in May, there will be a significant increase in electricity load and consumption in five southern provinces and regions, including Guangxi and Guizhou, the main high chrome production areas. With the increase in hot summer weather, there is a higher possibility of production limitations due to power restrictions in the major high chrome-producing regions in southern China.

Recently, the Durban area of South Africa experienced heavy rainfall. The South African Meteorological Service issued a level 10 warning for severe storms, floods, and mudslides in some coastal areas. The extreme weather has raised concerns about the transportation of chrome ore in South Africa.

According to statistics from China Custom, China's total chromium ore imports in April 2023 reached 1.474 million tons, an increase of 26.87% compared to the previous month and 11.89% compared to the same period last year.

Overall, the recent supply of chromium raw materials in the market is relatively sufficient. However, due to the persistently high price of chrome ore and the difficulty in reducing the production cost of ferrochrome, combined with increased expectations of power shortages both domestically and internationally, there is an increased possibility of disruptions to the supply of high chrome in the third quarter due to uncertain factors.

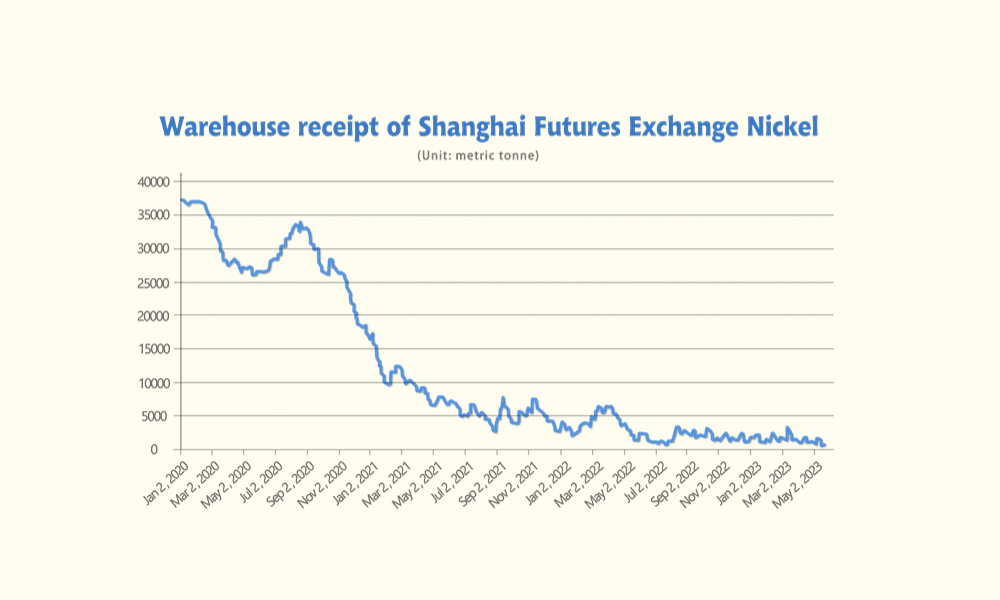

MACRO|| A new record height in stainless steel net export

In April, China's stainless steel exports reached 376,300 tons, an increase of 7.69% compared to the previous month, but a decrease of 1.43% compared to the same period last year. From January to April, cumulative exports amounted to 1,343,500 tons, a decrease of 6.95% compared to the same period last year. The top 20 regions accounted for a total of 318,900 tons of exports, representing 84.75% of the total exports.

Looking at specific countries, the largest increase in exports among the top ten regions in mainland China was mainly seen in South Korea (a 65% year-on-year increase), India (a 53.7% year-on-year increase), Russia (a 41.0% year-on-year increase), and the United Arab Emirates (a 21.5% year-on-year increase). In April, exports to South Korea, Vietnam, Indonesia, and other countries decreased compared to the previous month.

In April 2023, China's stainless steel imports reached 122,100 tons, a decrease of 1.02% compared to the previous month and a decrease of 48.93% compared to the same period last year. The import volume reached a new low in nearly three years. Due to low import levels and increased exports, the net stainless steel exports in April exceeded 250,000 tons, a 78% year-on-year increase. From January to April, the cumulative net exports reached 760,000 tons, an increase of 1.93 times compared to the same period last year, alleviating the pressure of domestic stainless steel oversupply.

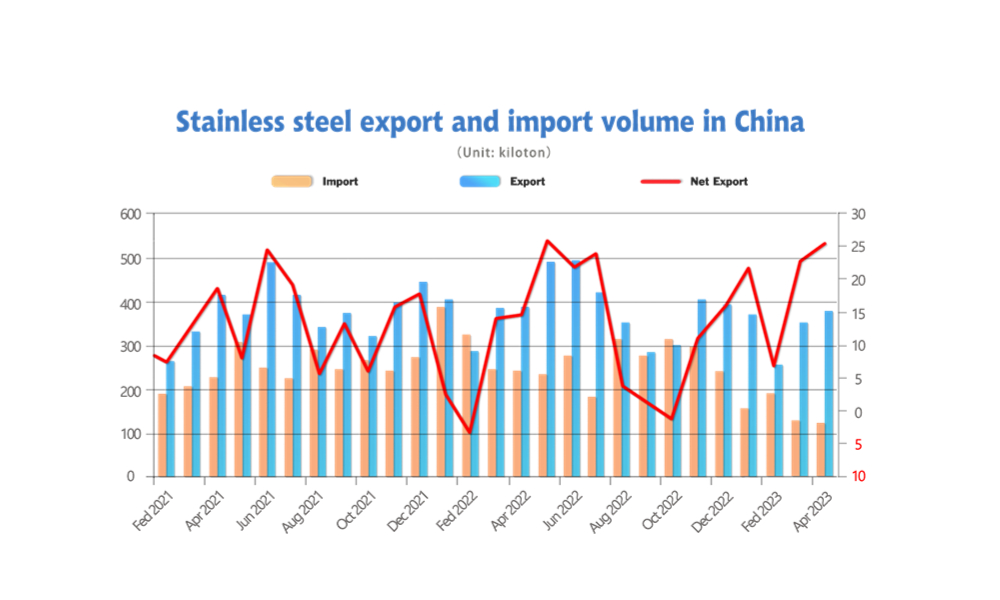

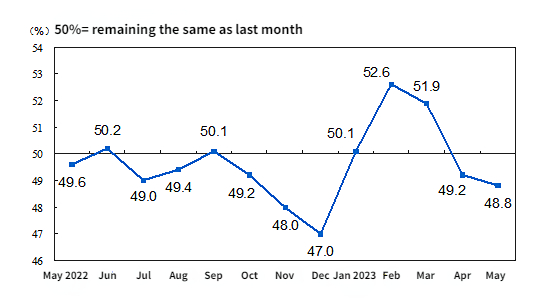

Manufacturing PMI: China manufacturing PMI in May keeps falling

In May, the manufacturing PMI continued to fall below the contraction zone, at 48.8 from 49.2 last month declining for the third consecutive month. Both production and demand slowed down. The production index and new order index were 49.6% and 48.3% respectively, down 0.6 and 0.5 percentage points from the previous month, both below 50. Among the 21 indices surveyed, 10 are in the contraction zone.

The purchase price index of major raw materials fell sharply by 5.6 percentage points to 40.8%, indicating that the producer price index (PPI) may further weaken. Finished product inventories and ex-factory prices continued to drop, reflecting that companies are still actively reducing prices to destock.

In May, the new order index fell by 0.5 percentage points to 48.3%, and the new export orders fell by 0.4 percentage points to 47.2%, pointing to the further increase of the drag on domestic demand and external demand. Under the suppression of demand, the production index fell by 0.6 percentage points to 49.6%, and entered the contraction range again; the upstream industries—— chemical industry, non-metallic minerals, and ferrous metal smelting were in the pessimistic low level below 45%.

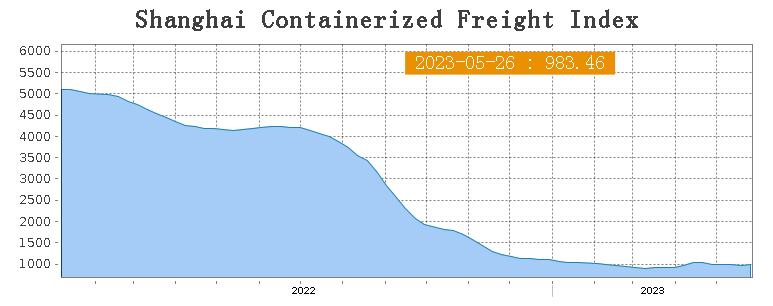

Sea Freight|| Sea freight market stabilized

Freight rates overall on multiple sea routes varied differently last week. On 26th May, the Shanghai Containerized Freight Index rose by 1.1% to 983.46.

Europe/ Mediterranean:

The Composite PMI - which rebalances the data to give a better assessment of broader economic performance - read at 53.3 in May, below consensus expectations for 53.7 and below April's 54.1. The Eurozone Manufacturing Purchasing Managers Index (PMI) arrived at 44.6 in May, lower than the 46.2 expected by markets and below the 45.8 registered in April. The index reached a three-year low.

Until 26th May, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$859/TEU, which fell by 1.2%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1651/TEU, which rose by 1.4%

North America:

S&P Global said on Tuesday its flash U.S. Composite PMI Output Index, which tracks the manufacturing and services sectors, rose to a reading of 54.5 this month. That was the highest level since April 2022 and followed a final reading of 53.4 in April. It was the fourth straight month that the PMI remained above 50, indicating growth in the private sector.

Until 26th May, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1,398/FEU and US$2,374/FEU, 5.2% and 0.4% growth accordingly.

The Persian Gulf and the Red Sea:

Until 26th May, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had a 1.2% increase from last week's and posted US$1276/TEU.

Australia/ New Zealand:

Until 26th May, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$261/TEU, a 6.5% fall from the previous week.

South America:

The freight market had a slight rebound. on 26th May, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2073/TEU, an 3.2% growth from the previous week.